Download chart as a .gif file

Key Insights

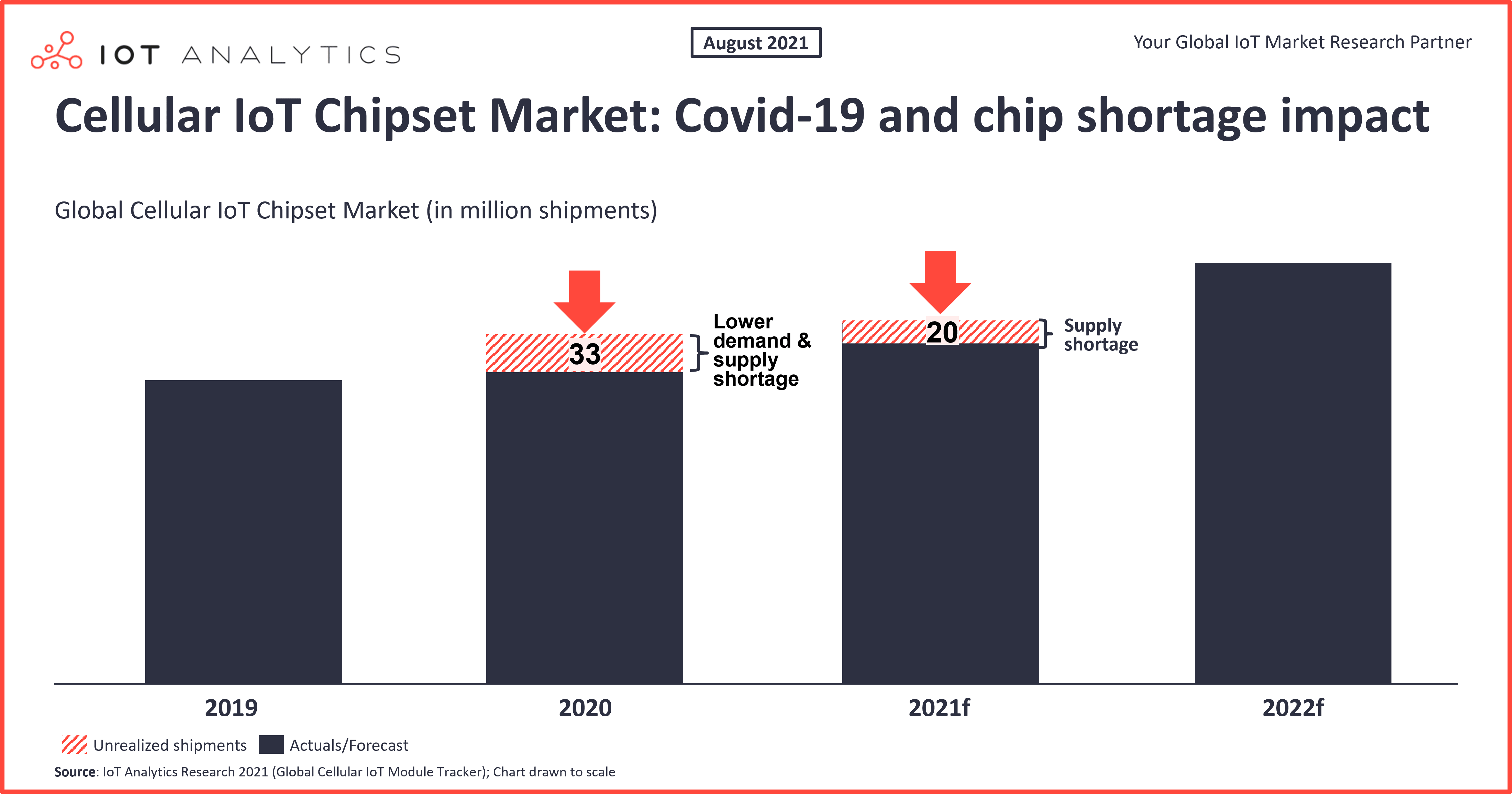

- Demand for 20 million cellular IoT chipsets will not be met in 2021 due to a supply shortage. According to IoT Analytics’ latest report on cellular IoT chipsets, the industry is expected to see a much lower than possible growth of 9% year-over-year (YoY) in 2021. At the same time, prices are expected to increase sharply.

- Qualcomm leads the global cellular IoT chipset market with a market share of 43% in 2020 (based on shipments).

Why it matters?

- Although cellular IoT is just a small portion of the global semiconductor market, the analysis indicates the overall impact of current supply issues.

- The cellular IoT chipset market insights and forecast will guide cellular/telco IoT players in mapping the trajectory of fast-growing connectivity technologies, most notably 5G and NB-IoT.

The cellular IoT chipset market: Overview

As part of IoT Analytics’ expanding market coverage of IoT markets, IoT Analytics this month launched an in-depth cellular IoT chipset market tracker that provides a quarterly look at the revenues and shipments of 13 companies providing cellular connectivity chipsets for IoT deployments. IoT Analytics expects the global cellular IoT chipset market to grow at a compound annual growth rate (CAGR) of 28% between 2021 and 2026, with significant impacts from supply issues in 2021.

What is a cellular IoT chipset?

Every connected IoT device that makes use of a cellular connection (e.g., 2G, 3G, 4G, 5G, LTE-M, and NB-IoT) uses a cellular IoT chipset. The chipset can be embedded directly into the device’s printed circuit board or into an IoT module that is placed in the device. The research presented in this article focuses on the larger of the two segments: cellular IoT chipsets embedded within an IoT module.

Current market environment: Impacted by the global chip shortage

In 2020, COVID-19 impacted both the demand and supply of chips. Supply was reduced, as production was halted at times, and supply chains and access to raw materials were not intact. In the first half of 2020, chip demand fell as uncertainty set in and budgets were frozen. In the second half of 2020, demand came back, but supply was often disrupted. This resulted in a supply shortage that first impacted the automotive industry and then extended to other segments, such as smartphones, TVs, gaming, and IoT. The lower demand in 2020 coupled with a shortage of supply at the end of the year led to a gap of 33 million cellular IoT chipsets that would have been shipped had everything gone smoothly.

In 2021, the chip shortage continues. Out of 3,000+ analyzed public companies, 11% mentioned “chip shortage” in their conference call in the second quarter (Q2) of 2021. IoT Analytics expects that there will be an additional shortage of 20 million cellular IoT chipsets due to limited production capacity and ongoing COVID-19 restrictions in some regions, which have resulted in severe supply chain issues, such as a lack of vessels and shipping containers and port congestion.

The market is expected to grow 9% YoY in 2021 but would have grown a lot more had there been no supply constraints.

According to market leaders TSMC and Qualcomm, the situation is likely to improve in early 2022:

“We are limited in our options until the beginning of 2022. Starting from the second half of that year, many investments will start to produce results, and the situation will improve,”

Akash Palkhiwala, CFO at Qualcomm

“Clients are preparing for a higher level of inventory to ensure supply stability due to uncertainties from geopolitics and the pandemic. As a result, our capacity will remain tight throughout the year 2021”

C. C Wei, Chief Executive Officer at TSMC

Cellular IoT chipset market : Qualcomm comfortably leading

Five players currently dominate the cellular IoT chipset market: Qualcomm, MediaTek, HiSilicon, Intel, and UNISOC. These five companies make up 93% of all 2020 global cellular IoT chipset shipments.

Qualcomm leads the market with a 43% market share (based on shipments) in 2020. Qualcomm’s share is higher on a revenue basis. In recent years, the key to the company’s market success has been its global scale and presence, its deep partnerships with module players, and its large number of carrier certifications. Qualcomm also keeps innovation cycles short, introducing new IoT chips regularly and often releasing upgrades to existing chips in cycles shorter than one year. 4G LTE IoT chipsets have driven Qualcomm’s volumes in the past, but the future is dependent on how quickly 5G takes off in the market. The IoT Analytics view is that demand for 5G is now ramping up and will be a key driver for the cellular IoT chipset market in the years to come.

In contrast to Qualcomm, volumes of MediaTek and HiSilicon are predominantly driven by NB-IoT chipsets.

Connectivity technology trends: NB-IoT, LTE-Cat 1, and 5G

The technology mix for cellular IoT connectivity remains very dynamic. In addition to the rise of 5G and the sharp decline of 2G and 3G, these are some current trends:

- NB-IoT. NB-IoT chipsets contributed to more than one-third of global cellular IoT chipset shipments in 2020.

- LTE-Cat 1. LTE-Cat 1 (a subset of 4G technology) grew 43% YoY in 2020. One chip in particular, the Qualcomm MDM9207-1 chipset, contributed majorly to the growth of LTE-Cat 1. Adoption of another chip, the UNISOC 8910DM, grew 300% in 2020 (YoY), driving the development of the newer LTE-Cat 1 bis subsegment, which now accounts for 23% of all LTE-Cat 1 shipments.

- 5G. The mass distribution of 5G chipsets is anticipated in 2021. IoT Analytics expects that 5G IoT chipsets will contribute to almost half of global cellular IoT chipset revenue in 2021, although the percentage is much smaller when looking at the market on a shipment level.

Industry adoption trends: Tracking applications and 5G in automotive

Cellular IoT connectivity technologies are present in nearly all verticals, ranging from asset tracking in the transportation, supply chain, and logistics industry to remote monitoring in the healthcare industry. Among others, our research shows two recent trends:

- Transportation and logistics use cases on the rise. The transportation, supply chain, and logistics vertical contributes to 30% of the global cellular IoT chipset shipment market. Within this segment, it was not the traditional automotive and telematics applications that grew in 2020 but rather tracking applications that helped companies locate goods in the supply chains. Shipments of chipsets for tracking applications grew 22% YoY in 2020, compared to an overall market growth of 3%.

- 5G adoption in automotive. In 2021, despite the ongoing chip shortage in the automotive sector, the adoption of 5G within the embedded automotive segment is expected to see more than 50% YoY growth.

Conclusion and outlook

With 30 billion IoT devices expected by 2025, chips are in high demand, contributing to the overall demand for IoT semiconductors. While cellular IoT makes up a small portion of those 30 billion devices, it is one of the most dynamic technology landscapes, with technology shifting toward NB-IoT and 5G and specific verticals, such as transportation, racing ahead on the adoption curve.

Due to the aforementioned disruptions, the market has seen structural changes in the last 1.5 years. Chipset vendors need to rethink their positioning regarding the technology they offer, the verticals they address, their dependencies on specific suppliers, and the sourcing of their production capacity.

In the broader scheme of things, with the market growing so much, the current supply challenges and the 20 million missing chips appear important today. However, they will matter less in a few years, when the disruptions have settled, and vendors have reacted to the structural changes. By then, 2020 and 2021 will look like a dent in the curve, nothing more.

More information and further reading

Are you interested in learning more about the global cellular IoT chipset market?

The Global Cellular IoT Chipset Tracker 2021 consists of four different nested databases:

- Database 1: Modules vs Chipset Shipments (2018–2020, quarterly)

- Database 2: Cellular IoT Chipsets Shipments, Revenues, and Wholesale Average Selling Price (ASP) (2018–2020, quarterly)—by cellular IoT chipset company, connectivity technology, and region

- Database 3: Cellular IoT Chipsets Shipments, Revenues, and Wholesale ASP (2018–2020, quarterly)—by cellular IoT chipset company, connectivity technology, and industry vertical

- Database 4: Cellular IoT Chipset Shipments, Revenues, and Wholesale ASP Forecast (2020–2026)

The Global Cellular IoT Chipset Tracker 2021 is part of IoT Analytics’ ongoing coverage of IoT connectivity and hardware (IoT Connectivity & Hardware Research Workstream).

This tracker represents the updated view of the cellular IoT chipset market for the 2018–2020 period, including a forecast for the 2020–2026 period. The forecast model considers historical growth, the effects of COVID-19, the effects of the current chip shortage, the total addressable market, saturation, and many other factors.

This tracker provides answers to the following questions (among others):

- What is the global cellular IoT chipset market size in terms of shipments and company revenue?

- Who are the leading players globally and in each region?

- What is the growth of the cellular low-power wide-area (LPWA) chipset market?

- What are the wholesale ASP trends in cellular connectivity by technology and by region?

- Which cellular connectivity technology is leading globally and in each region?

- How are LTE-Cat 1 chipsets performing in China and the rest of the world?

- Which region is leading the market in terms of growth or market share?

- Which companies are leading the market, and what are their market shares?

- Which industry vertical has the highest demand for cellular IoT connectivity chipsets, and which is growing the fastest?

- And more…

By downloading the sample of the tracker, you can view:

- The structure of the file

- Complete information about which data points are included

- The methodology

Related articles

You may be interested in the following recent articles:

- The rise of the IoT semiconductor

- Cellular IoT Module Market Update: Market Declined 8% in 2020 With Bright Spots in China and LTE-Cat 1

Are you interested in continued IoT coverage and updates?

Subscribe to our newsletter and follow us on LinkedIn and Twitter to stay up-to-date on the latest trends shaping the IoT markets. For complete enterprise IoT coverage with access to all of IoT Analytics’ paid content & reports including dedicated analyst time check out Enterprise subscription.