In short

- IoT Analytics reflects on the last four years covering CEO priorities in earnings calls.

- Most notable developments are: 1. The impact of COVID-19 and the Ukrainian War; 2. The rising importance of inflation; 3. The lower importance of trade-related themes; and 4. The small shifts in (tech) megatrends.

This article is based on our Quarterly Trend Report: What CEOs talked about in Q1/2023.

Already a subscriber? Browse your reports here →

Click on the button to load the content from .

Changes in the CEO agenda since Q1/2019

At the end of every quarter for the last four years, we have performed an analysis of keyword mentions for more than 4,500 US-listed companies during their quarterly earnings calls. We feel it is time to reflect on the changes that are visible over time, not just on a quarter-by-quarter basis. You may be familiar with our quarterly analysis that we publish regularly as part of our “What CEOs talked about” blog series. For your reference, here are some recent examples:

- Q1/2023: “Economic uncertainty, layoffs, and the rise of ChatGPT”

- Q3/2022: “Economic slowdown, raw materials, and Industry 4.0”

- Q1/2022: “War in Ukraine, Inflation, and SaaS”

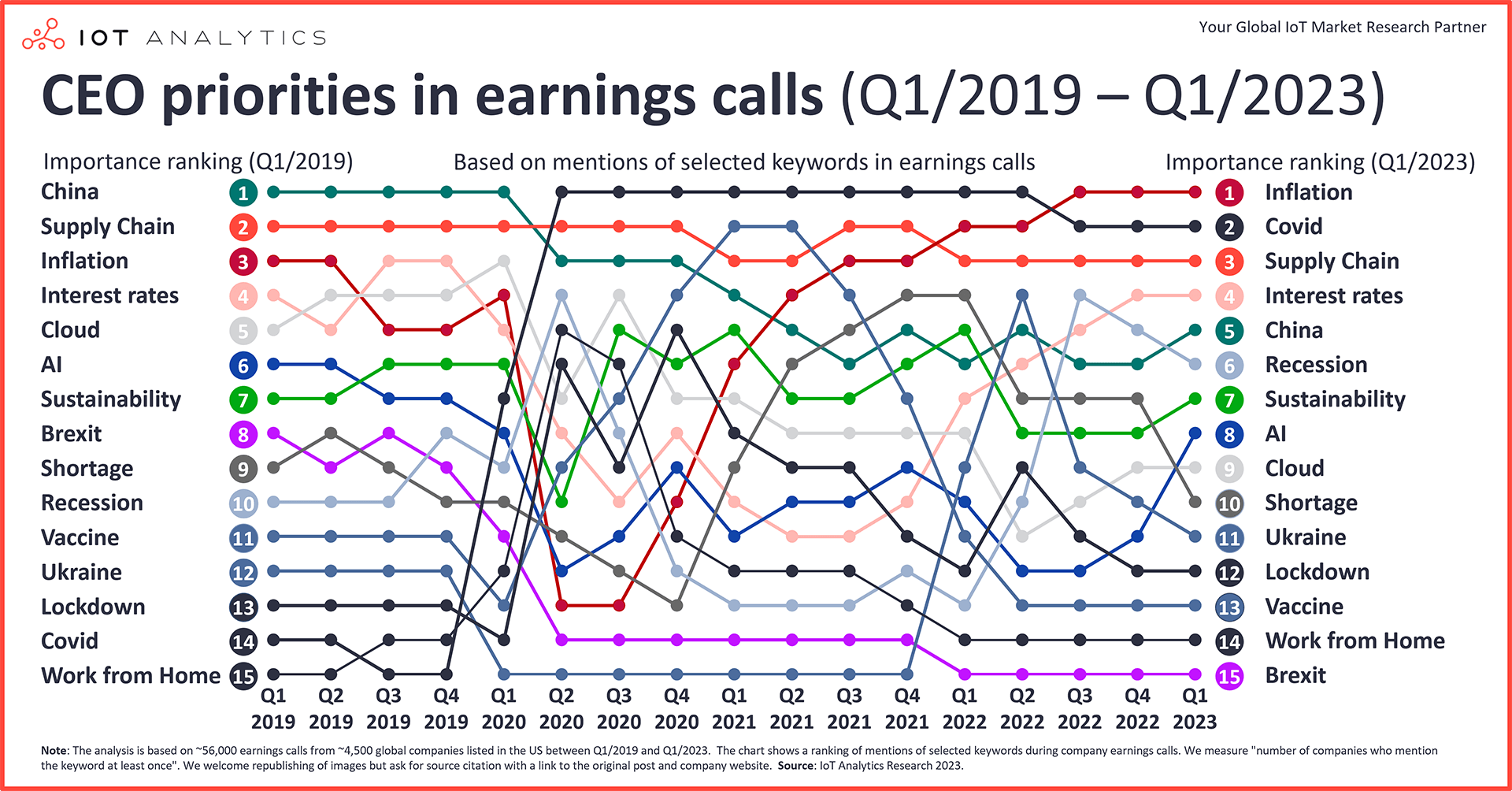

For this analysis, we took 15 of the most prominent keywords in earnings calls since Q1/2019 and looked at how they ranked quarter-by-quarter over a four-year period. Here are four takeaways:

- COVID-19 disrupted key CEO themes for more than one year.

- Inflation and recession have moved up in the rankings.

- China and Brexit have moved down in the rankings.

- (Tech) megatrends have not moved significantly since 2019.

1. COVID-19 disrupted key CEO themes for more than one year

COVID-19 had a tremendous impact on the topics discussed in boardrooms. Changes in importance prior to Q1 2020 were gradual and the resulting quarterly comparison of “What CEOs talked about” can, in hindsight, perhaps be a bit boring. The ranking of some key themes changed dramatically quarter-by-quarter from when COVID-19 hit in early 2020 to at least Q2/Q3 2021. Lockdowns, the end of international travel, and the rapid switch to a work-from-home environment sidelined virtually all other topics. The war in Ukraine marked another disruptive event in Q1/2022, although this was less impactful to general CEO priorities. In Q1/2023, we still see meaningful quarterly changes but in less drastic ways than in some of the quarters of the preceding three years.

2. Inflation and recession have moved up in the rankings

Unsurprisingly, inflation is currently the #1 theme (up from #3 spot in 2019 and #13 during the early phases of COVID-19). Recession was the #10 theme in Q1/2019 and is currently #6 (although it is coming down). COVID-19 sidelined both topics during COVID-19.

3. China and Brexit have moved down in the rankings

Trade-related themes, such as the US-China trade war (keyword: China) and Brexit, dominated discussions in 2019 (China in #1 spot, Brexit at #8). Both topics have fallen considerably in the ranking as other themes took over (China now in #5 spot, Brexit at #15). Make no mistake: international relations are still an important discussion. Some commentators fear a worsening of relations between the two superpowers, China and the USA, could affect the world economy considerably in the coming months and years.

4. (Tech) megatrends have not moved significantly since 2019

With the world undoubtedly focusing more than ever on the themes of sustainability, cloud, and AI, it is surprising that neither topic has made any jumps in the ranking of the selected keywords (cloud started at #5 and is now #9, sustainability started at #7 and is now at #7; AI started at #6 and is now at #8). It is important to note that, on a relative basis, those three aforementioned topics increased in importance. CEOs mentioned sustainability in 9% of earnings calls in Q1/2019. That number grew to 18% in Q1/2023. AI as a keyword grew from 10% to 17% in the same period and cloud grew from 16% to 17%. AI got a recent boost from the hype surrounding ChatGPT (see below). Despite the impressive relative growth of these themes, other themes (such as inflation or supply chain) continue to have higher importance on the global CEO agenda.

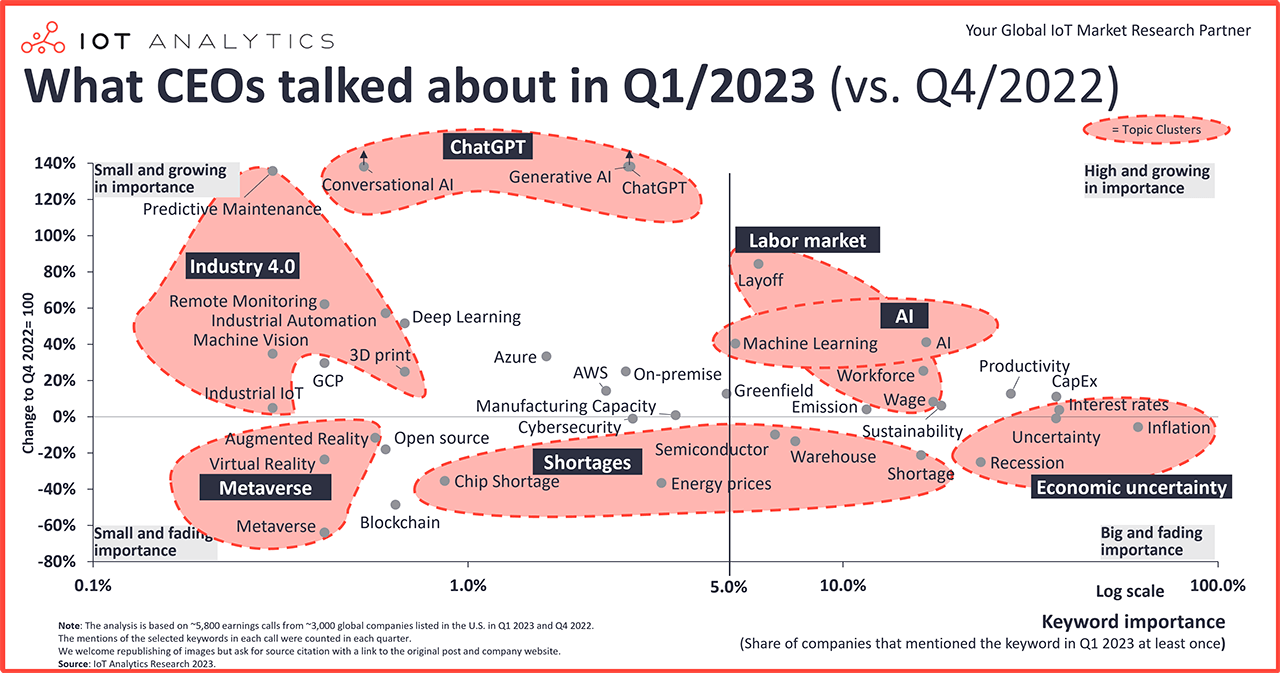

The state of the CEO agenda right now: What CEOs talked about in Q1/2023

If you want to learn more about what CEOs prioritized in Q1/2023, take a look at our most recent blog post on what CEOs discussed in Q1/2023:

In Q1 2023, economic uncertainty was at the forefront of CEOs’ minds globally and across the board. In 2023, 61% of all earnings calls discussed inflation, 23% talked about recession, and 38% mentioned interest rates. Even though inflation (a 6% decline in mentions compared to Q4/2022) and recession (25%) were less prevalent than in the last quarter of 2022, economic uncertainty was still the elephant in the room.

The three key upcoming themes in Q1/2023 were AI, the labor market, and Industry 4.0. Our analysis found that 17% of CEOs discussed AI (41%). The release of ChatGPT and the discussions around potential use cases sparked this interest in AI and machine learning. In their Q1/2023 earnings calls, 2.7% of companies mentioned ChatGPT (compared to no mentions in the previous quarter). Additionally, the labor market continues to rise in importance on CEOs’ list of topics, with 6% of all earnings calls discussing layoffs (84% compared to Q4/2022) and 18% discussing wages (

8% from Q4/2022).

| About the “What CEOs talked about” analysis

The analysis highlighted in this article presents the results of IoT Analytics’ research involving more than 56,000 earnings calls of approximately 4,500 US-listed companies between Q1/2019 and Q1/2023. The resulting visualization is an indication of the topics that CEOs prioritized between Q1/2019 and Q1/2023. The chart visualizes the ranking in the importance of 15 different keywords.

More information and further reading

Are you interested in learning more about the latest technology market developments?

IoT Analytics is a leading global provider of market insights and strategic business intelligence for the Internet of Things (IoT), AI, Cloud, Edge, and Industry 4.0.

Quarterly Trend Report: What CEOs talked about in Q1/2023

A 47-page report on the trends that emerged in Q1/2023 earnings calls. The report is based on data from ~56,000 corporate earnings calls of US-listed companies.

Click on the button to load the content from .

Already a corporate research subscriber?

Related publications

You may be interested in the following publications:

- MWC Barcelona 2023 Event Report

- Embedded World 2023—the Latest IoT Chipset and Edge Trends

- IoT Software Adoption Report 2023

- Digital Twin Market Report 2023-2027

- Enterprise Augmented/Mixed Reality Market Report 2022–2027

Related articles

You may also be interested in the following recent articles:

- 10 notable telco IoT trends—based on insights gathered in Q1 2023

- The leading IoT software companies 2023

- The top 10 IoT chipset and edge trends—as showcased at Embedded World 2023

- Decoding Digital Twins: Exploring the 6 main applications and their benefits

- Global IoT market size to grow 19% in 2023—IoT shows resilience despite economic downturn

Related market data

You may be interested in the following IoT market data products:

- Global Cellular IoT Module and Chipset Tracker and Forecast

- Global Cellular IoT Connectivity Tracker and Forecast

- Global IoT Enterprise Spending Dashboard

Are you interested in continued IoT coverage and updates?

Subscribe to our newsletter and follow us on LinkedIn and Twitter to stay up-to-date on the latest trends shaping the IoT markets. For complete enterprise IoT coverage with access to all of IoT Analytics’ paid content & reports including dedicated analyst time check out Enterprise subscription.