Summary

- The IoT market potential for business-facing applications is larger than for consumer-facing applications

- Manufacturing and Healthcare are the largest IoT market segments within business-facing applications

- Specifically Oil&Gas as a subsegment of manufacturing is currently leading the IoT adoption along with the energy sector as well as applications in mobility and transportation.

- Within consumer-facing applications, Home automation will dominate the market in the next years (smart thermostats, security systems, and refrigerators). The wearable hype seems to be over.

Introduction

In my last analysis, I summarized all public market forecasts around the Internet of things. The results:

- By 2020 for every person there will be at least 2 connected devices, maybe even 6.

- The revenue opportunities in the IoT field are far superior to what Apple, Facebook, and Google are selling together today

- The economic impact of IoT could surpass the size of the German economy within 10 years.

(See my analysis: IoT market – forecasts at a glance)

Building on this analysis, I have looked one level deeper. This time I interpreted forecasts and surveys regarding market size and investment activity in different segments of the IoT market.

IoT market segmentation approach

There are three general lenses to look at the market:

- From an application/industry point of view (i.e. distinguishing between applications in mining and applications in transportation)

- From a technology point of view (i.e. distinguishing sensor manufacturers from analytics solution providers)

- From a geography point of view (i.e. distinguishing between Europe and the US)

I solely focus on the first. There will soon be another article in which I will also talk about IoT technology.

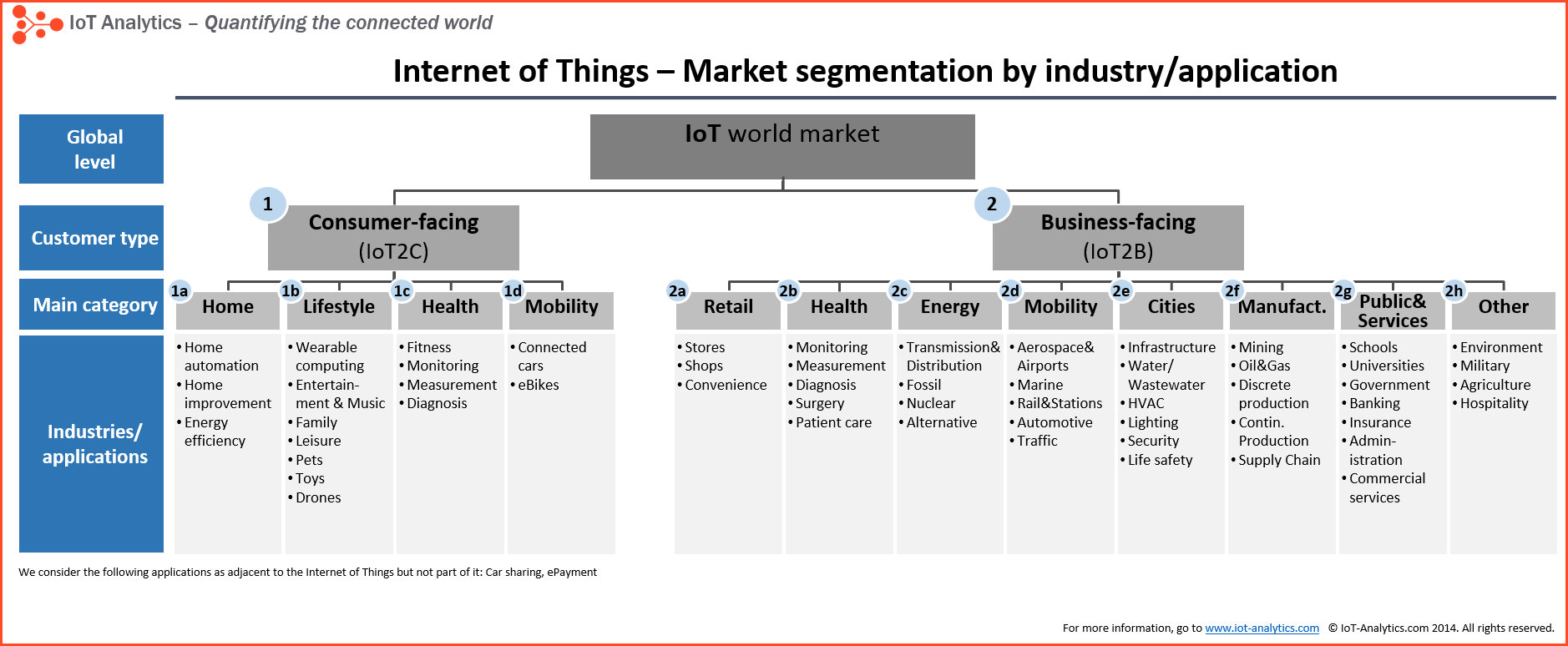

Together with other IoT experts, we have developed a market segmentation that is suitable for understanding the IoT ecosystem. See below.

We find this IoT market segmentation the most compelling for two reasons:

- It distinguishes consumer-facing IoT and business-facing IoT. Companies active in the IoT Consumer segment like the wearables manufacturers have very little overlap with industrial IoT companies like Cisco because their customers are different.

- It depicts main categories that play a major role in terms of importance and which are clearly different from each other.

I will use this segmentation to compare all existing reports and data points: Comparing segment forecasts, then surveys, and finally giving application examples for the most important applications.

IoT Market segments forecasts: Manufacturing the biggest

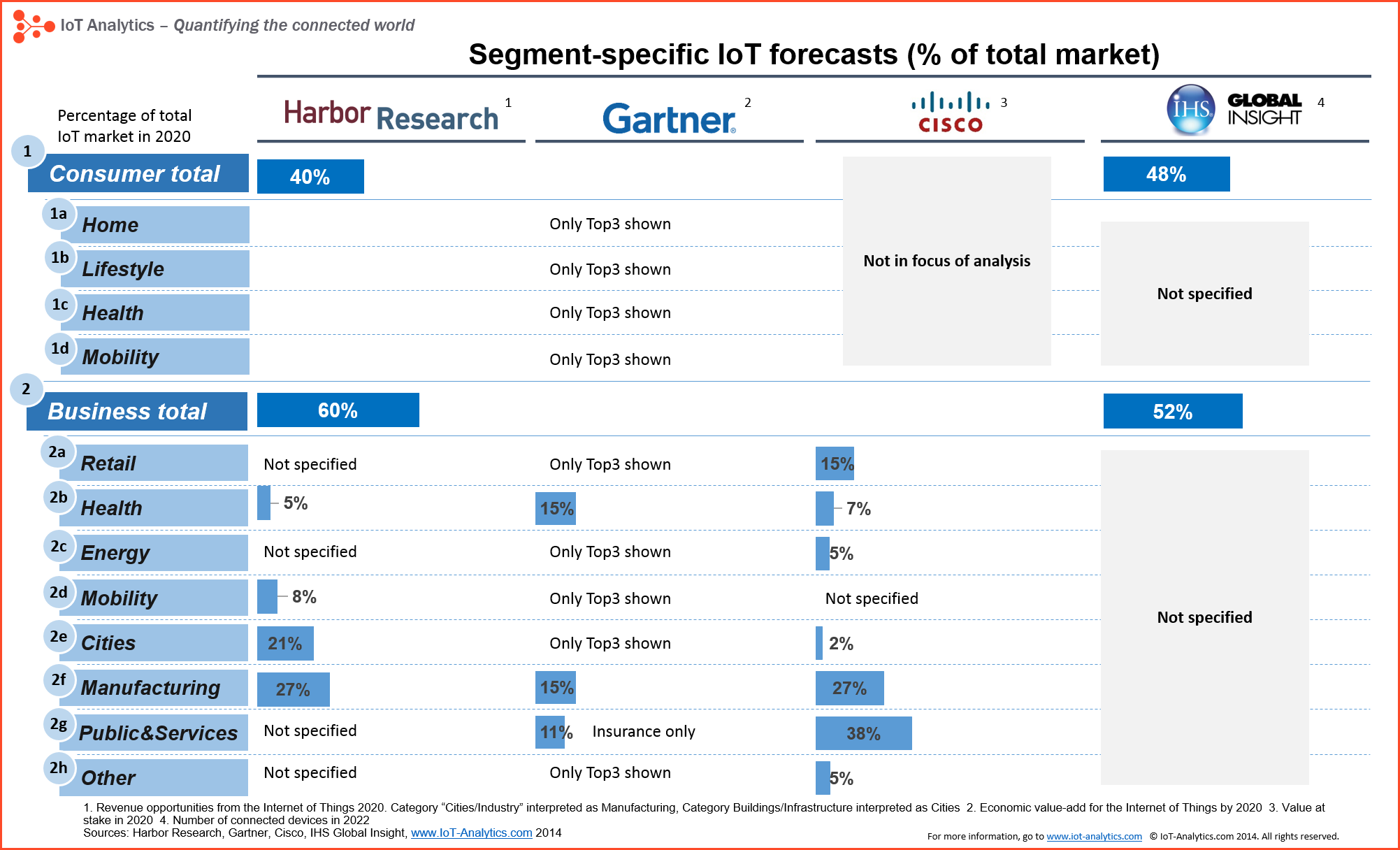

I have come across 4 publicly available reports that try to forecast revenue or device specific development per segment.

The picture is by no means complete. It seems that Cisco and Harbor have missed important segments in their analysis or at least not labeled these. Gartner has not missed them. They are only publicly disclosing the top 3 segments.

Interpretation of the numbers:

- The IoT potential in business applications is larger than in consumer applications (~55% vs. 45%)

- Manufacturing will supposedly be the largest segment of IoT (potentially more than ¼ of the total IoT market).

- Healthcare will be another important area (potentially between 5% and 15% of the total IoT market)

- There are vastly different opinions about the potential of public and commercial services

IoT Market segments surveys

In addition to the forward-looking segment-specific market forecasts, there are a number of surveys that are examining where money is being invested and what the industry/application adoption rate is.

Consumer IoT: “Automated home” applications with highest projected adoption

Consumer IoT: “Automated home” applications with highest projected adoption

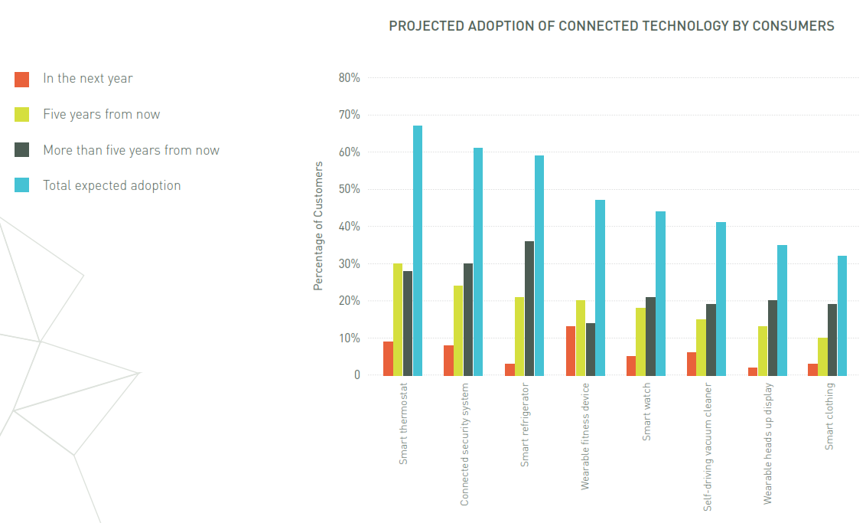

The only notable survey on the consumer side was recently performed by the Acquity group, a subsidiary of Accenture. Acquity polled more than 2000 US consumers to estimate the likely adoption of different technologies over the next 5+ years.

Interpretation of the numbers:

- Wearable fitness devices that are currently dominating the Consumer lifestyle category are currently getting the most attention but the hype seems to be over now

- Home applications will dominate the consumer IoT market in the next years (smart thermostats, security systems, and refrigerators)

Unfortunately the survey did not poll about any consumer health applications such as remote health monitoring.

More detailed analyses:

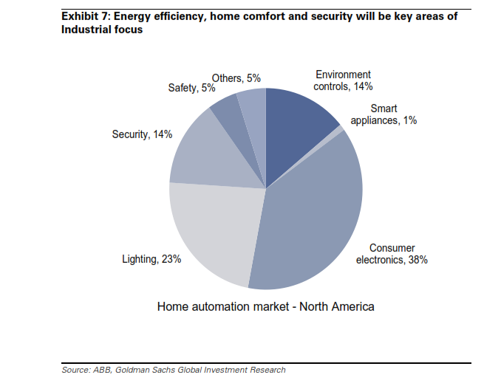

Home automation: Since the acquisition of Nest by Google earlier in 2014, the broad public has become aware about home automation. Goldman Sachs predicts that it will be mainly consumer electronics as well as lighting that will emerge as the “key areas”.

The Dutch company Philipps was one of the first to introduce internet-connected light bulbs. While their light bulb starter pack called Philipps HUE which includes 3 bulbs still costs around $200 today, these prices are expected to drop sharply in the future. OnWorld is predicting that by 2020 there will be 100 million internet connected LED lights, up from only 2 million today. (http://onworld.com/news/100-Million-Internet-Connected-LED-Lights-by-2020.html)

Lifestyle: On the topic of wearables, Juniper predicts that the number of wearable devices shipped will explode from 14 million in 2014 to ten times that (140 million) in 2018. This study stems from 2013 however. The predicted wearables growth explosion needs to be revisited – not only because the Acquity survey is more recent. Recent reports are highlighting that wearable companies like Jawbone and Fitbit are sitting on large amounts of stock. Nike even laid off some people in their Fuelband division. (http://www.cnet.com/news/wearable-tech-revenue-to-hit-19b-by-2018/)

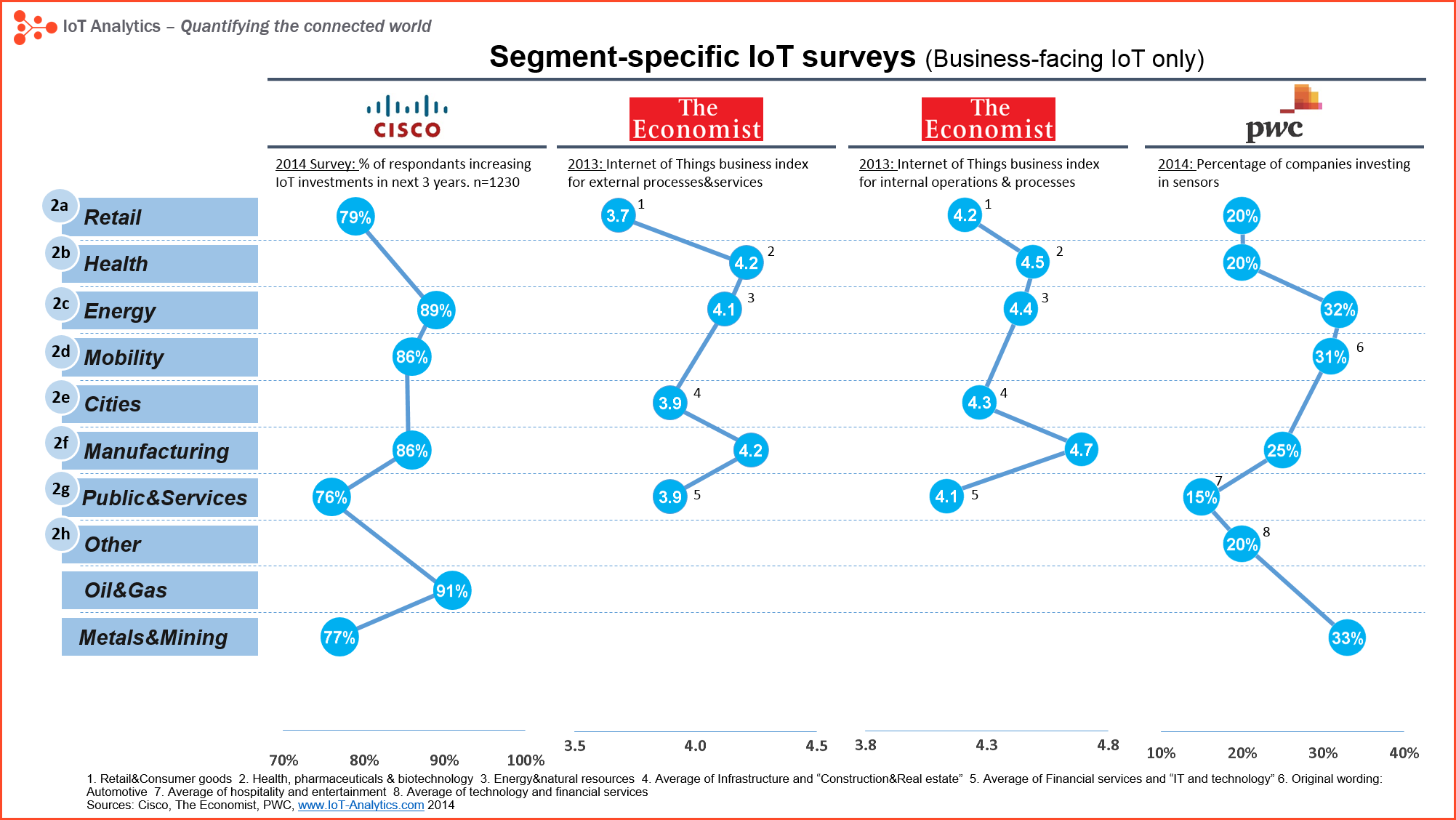

Business IoT: Energy, mobility, and manufacturing are leading the way

There are a number of business-facing Internet of Things surveys. In contrast to the market forecasts, these surveys don’t rank the different market segments in terms of size but in terms of business activity. In order to facilitate their interpretation, the surveys are plotted into one graph below.

Interpretation of the numbers:

- Consistently, energy, mobility, and manufacturing are leading the way in IoT adoption/investments

- The latest Cisco survey highlights Oil&Gas as a key industry within “Manufacturing” that is currently strongly increasing IoT investments

- Retail as well as cities, the public sector and commercial services such as “financial services” are lagging behind in IoT investments and adoption.

- The view on healthcare as well as metals&mining IoT market segments is very divergent: While the Economist rates the business index in healthcare as rather advanced, PWC sees little sensor investment in this area. And while PWC is measuring the highest sensor investment rate in metals&mining, Cisco is measuring the second lowest investment activity, compared to other industries.

More detailed analyses:

Energy: One of the large topics within energy are smart grids and smart meters. Navigant research predicts that worldwide smart meter shipments will reach their peak in 2018. The revenue from smart meters is expected to reach $7.4bn, up from $4.4bn in 2013 and will decline slowly after 2018 again. (http://www.navigantresearch.com/research/smart-meters)

Mobility: Connected cars are a large application within the mobility sector. IHS Automotive predicts that by 2020, 152 million cars will be connected to the internet (http://press.ihs.com/press-release/country-industry-forecasting/big-data-drivers-seat-connected-car-technological-advance)

Manufacturing: It is no surprise that two of the keynote speakers at the recent IoT World Forum in Chicago came from Oil&Gas as well as mining companies. Both John McGagh, Head of Innovation at Rio Tinto, as well as Arjen Dorland, VP of technical and competitive IT at Shell, highlighted the enormous potential of IoT in their industries. It is the ability to perform remote operations on extremely high-value assets that makes the IoT business case so compelling for these industries. On his desktop in Chicago, John McGagh showed how he could visualize operations data in one of Rio Tinto’s mine in Utah in real-time. He showcased remote monitoring of tire pressure, fuel level, and vehicle load for all the vehicles in the mine in real-time. According to him it allows Rio Tinto to make smarter dispatching and maintenance decisions.

Conclusion

These numbers are very high-level. As an example, just because cities score relatively low, it doesn’t mean that a subsegment like “Building security” isn’t very hot right now. What can be seen, however, the level of activity in different IoT market segments varies significantly. Here are the other important takeaways:

What are your thoughts? Are the numbers mirroring your sentiment? Let me know.