Equipment as a Service Market Report 2024–2028

(see all)

About the report

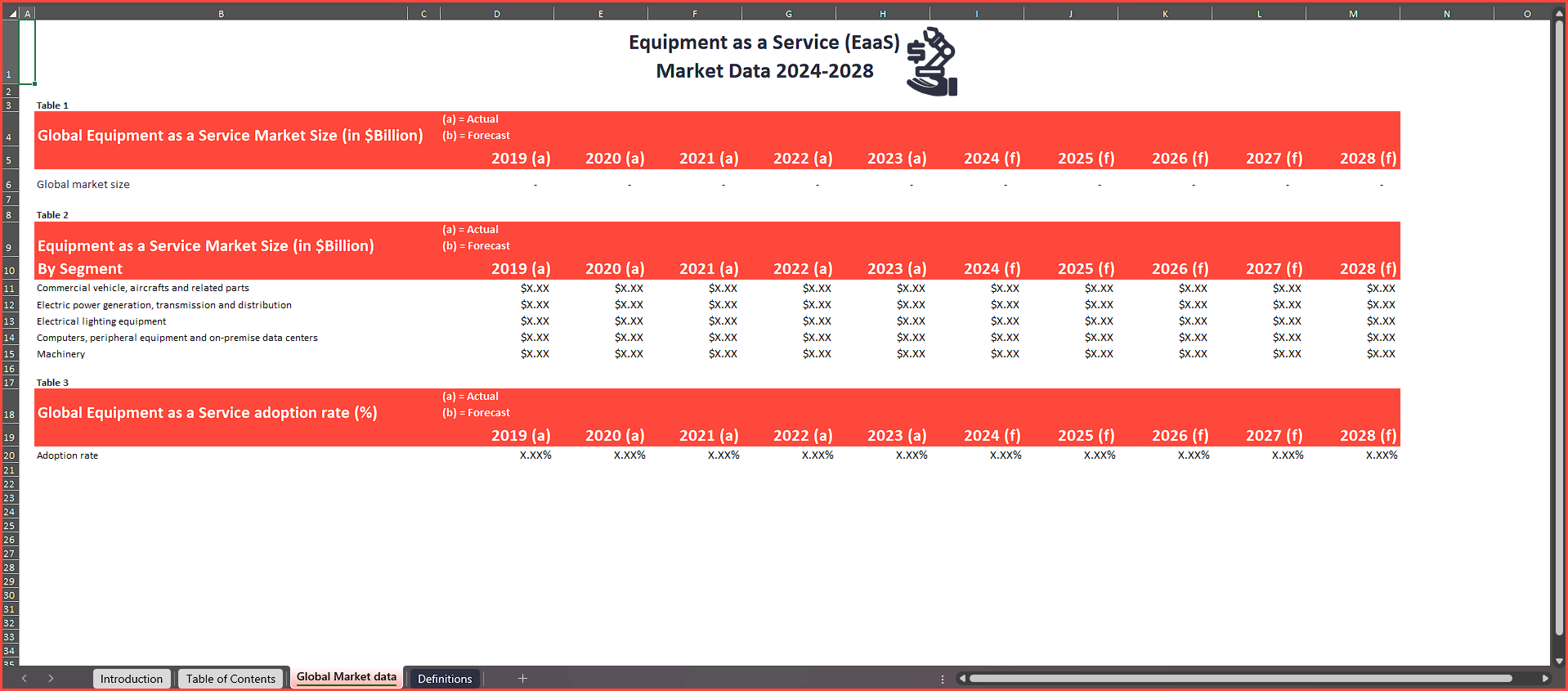

The Equipment as a Service Market Report 2024–2028 is part of IoT Analytics’ ongoing coverage of Industrial IoT. The information presented in this report is based on the results of multiple surveys, secondary research, and qualitative research, i.e., interviews with Equipment as a Service (EaaS) vendors and end users from between August 2023 and February 2024. The document includes a definition of EaaS, market projections, analysis of vendors, adoption drivers, case study analysis, key trends and challenges, and insights from relevant surveys.

The main purpose of this document is to help our readers understand the current EaaS landscape by defining, sizing, and analyzing the market.

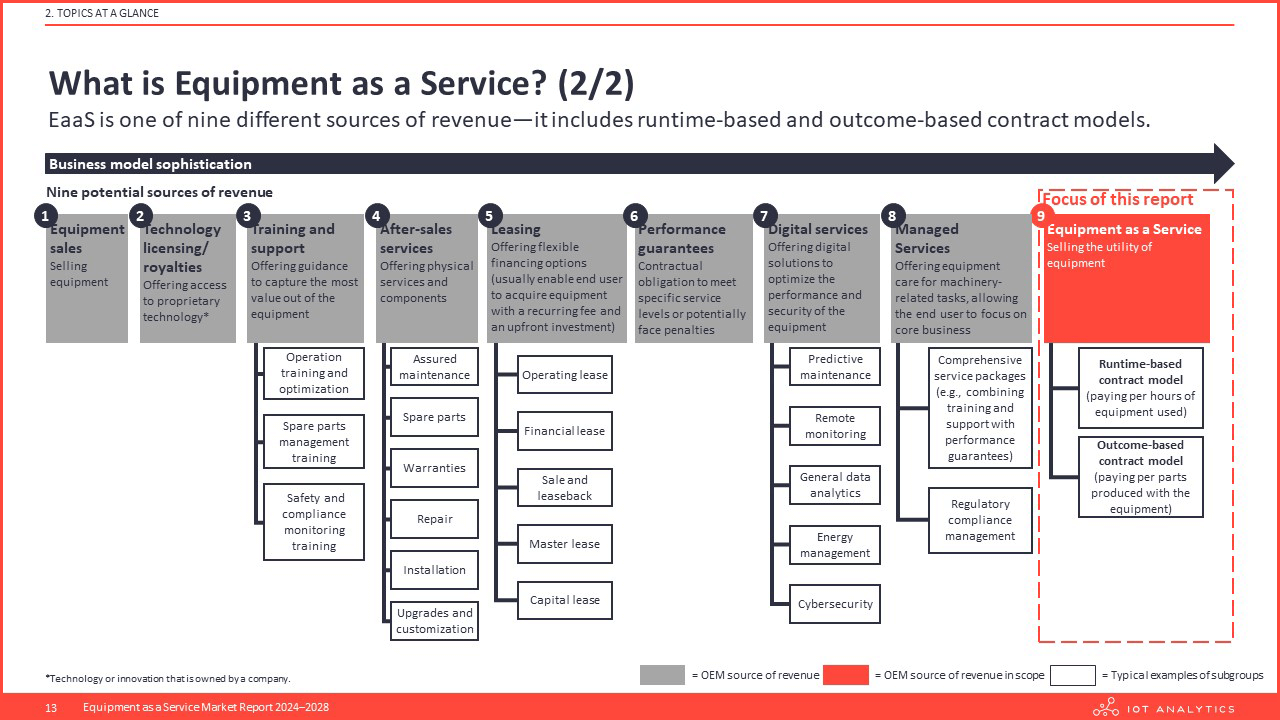

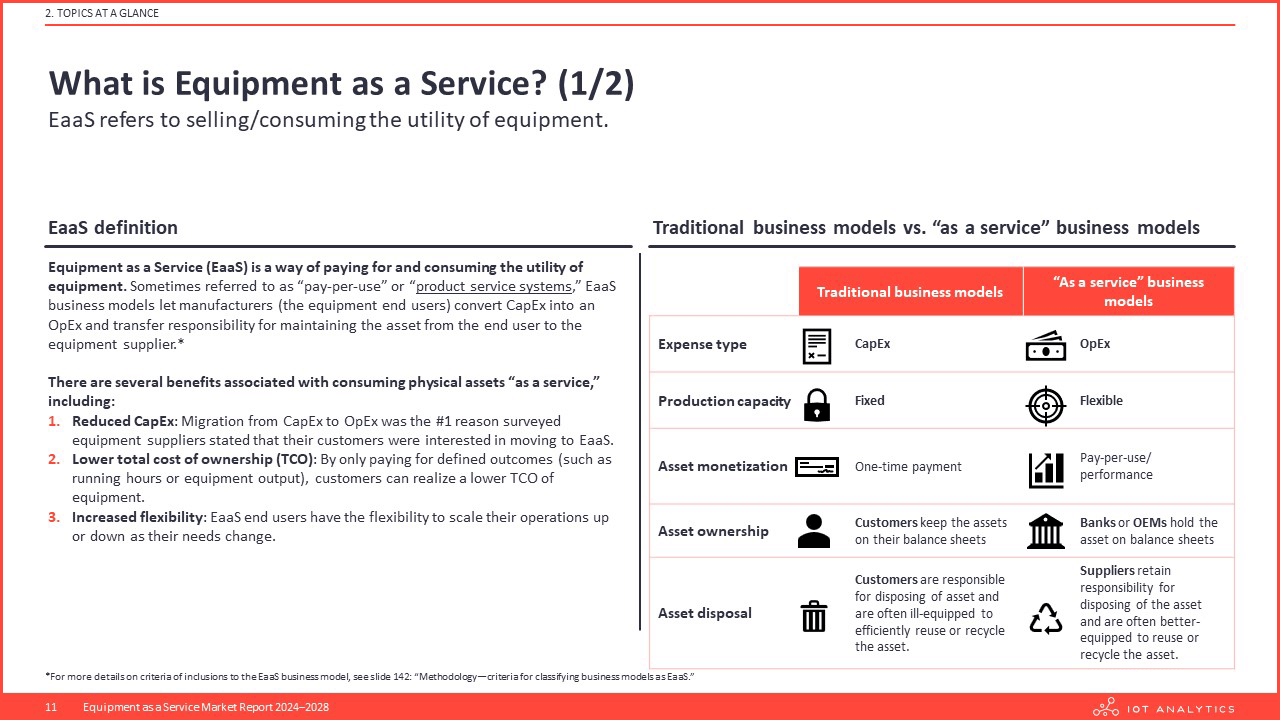

What is Equipment as a Service?

Equipment as a Service (EaaS) is a way of paying for and consuming the utility of equipment. Sometimes referred to as “pay-per-use” or “product service systems,” EaaS business models let manufacturers (the equipment end users) convert CapEx into an OpEx and transfer responsibility for maintaining the asset from the end user to the equipment supplier.*

There are several benefits associated with consuming physical assets “as a service,” including:

- Reduced CapEx: Migration from CapEx to OpEx was the #1 reason surveyed equipment suppliers stated that their customers were interested in moving to EaaS.

- Lower total cost of ownership (TCO): By only paying for defined outcomes (such as running hours or equipment output), customers can realize a lower TCO of equipment.

- Increased flexibility: EaaS end users have the flexibility to scale their operations up or down as their needs change.

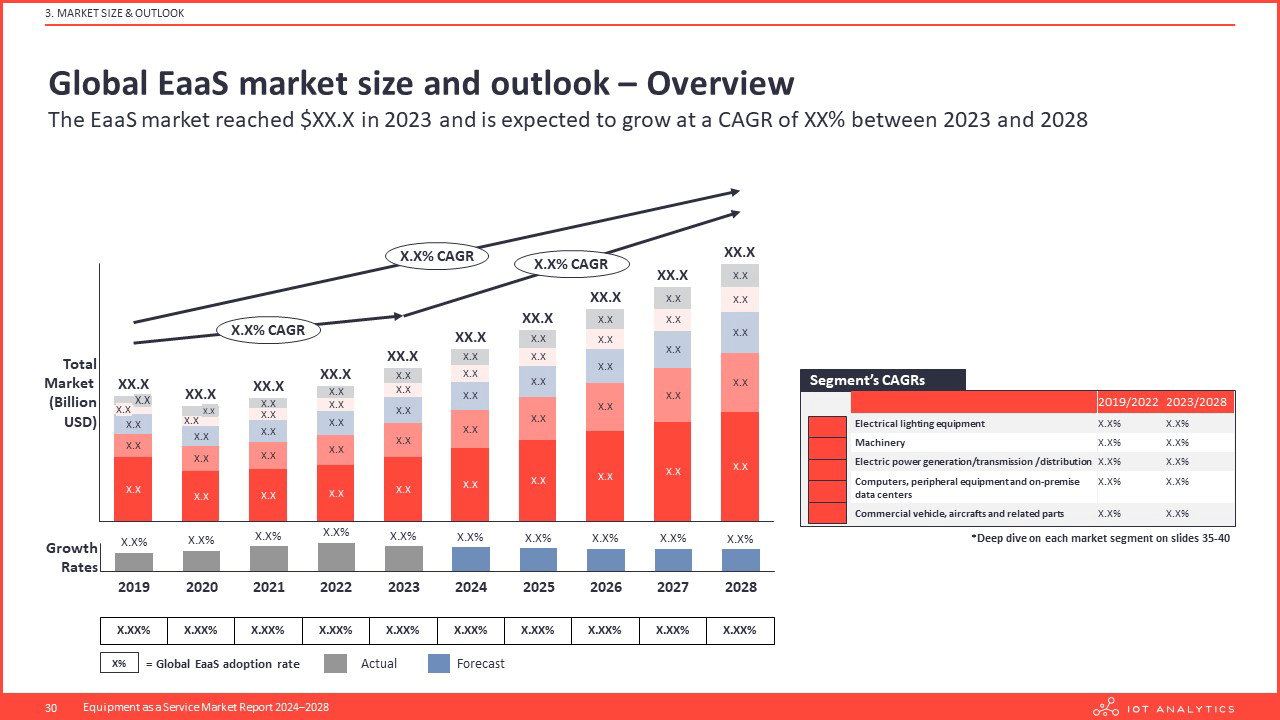

The Equipment as a Service (EaaS) market has been experiencing growth and is poised to continue growing in the coming years. This market encompasses a wide range of segments, with commercial vehicles, aircraft, and related parts leading the way. Closely followed by computers, peripheral equipment, and on-premises data centers, machinery, electric power generation, transmission, and distribution, and electrical lighting equipment.

Geographically, the Americas hold the largest share of the EaaS market, with EMEA and APAC regions also contributing substantial portions. The EaaS market’s robust growth can be attributed to the increasing adoption of this business model across various industries, offering them the flexibility to use high-quality equipment without the upfront costs of ownership.

As we move forward, the EaaS market is expected to maintain its upward trajectory, driven by technological advancements, evolving business needs, and the increasing recognition of the benefits of this service model.

Table of Contents

Equipment as a Service Market Report 2024–2028 (PDF)

- Executive summary

- Topic at a glance

- 2.1 Starting point: “Pay-per-use” and “Equipment as a Service” are important trends on the OEM digitization roadmap

- 2.2 4 prominent examples of companies that have introduced EaaS

- 2.3 What is Equipment as a Service (EaaS)?

- 2.4 Why do consumers theoretically benefit from EaaS?

- 2.5 How does Equipment as a Service work for end users?

- 2.6 OEM’s typical path towards Equipment as a Service

- 2.7 How typical EaaS solutions are created

- 2.8 Why do OEMs offer Equipment as a Service?

- Market size & outlook

- 3.1 EaaS market segments definitions

- 3.2 Definitions of OEM market, EaaS market and EaaS adoption rate

- 3.3 Global market size and outlook – Overview

- 3.4 Global EaaS market size and outlook – Analyst’s opinion on market growth

- 3.5 Global market size and outlook – by region

- 3.6 Deep-dive 1: Machinery as a Service

- 3.7 Deep-dive 2: Computers, peripheral equipment and on-premises data centers as a Service

- 3.8 Deep-dive 3: Commercial vehicle, aircrafts and related parts as a Service – Market forecast

- 3.9 Deep-dive 4: Electrical lighting equipment as a Service

- 3.10 Deep-dive 5: Electric power generation, transmission and distribution as a Service

- 3.11 Overview of headwinds and tailwinds impacting the global EaaS market growth

- 3.12 1. Rising inflation/interest rates driving the asset-light subscription economy

- 3.13 2. Labor shortages pushing the need for hourly equipment usage

- 3.14 3. Governments subsidizing CAPEX-type investments

- 3.15 4. Rising demand for increased flexibility

- 3.16 5. IIoT technology improvements

- 3.17 Analysis of the market growth

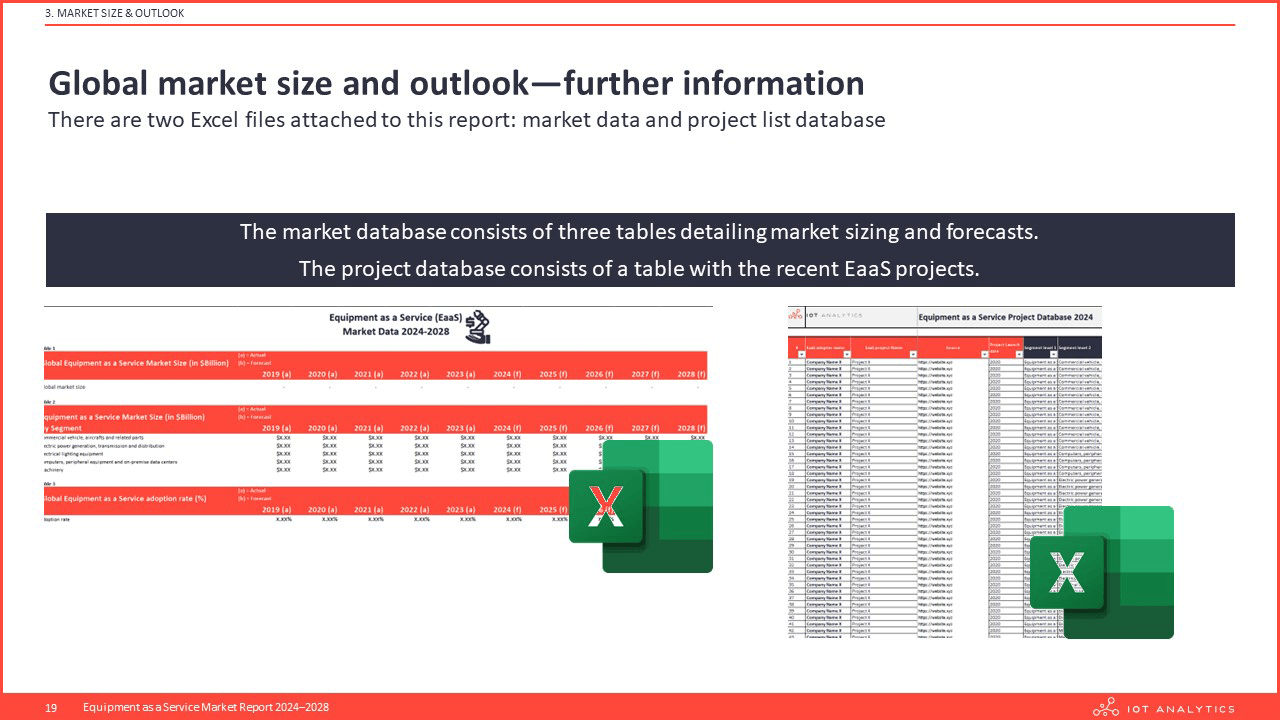

- 3.18 Global market size and outlook – Further information

- EaaS adoption

- 4.1 EaaS adoption drivers

- 4.2 EaaS adoption rate split by sub-segments

- 4.3 Overview of the EaaS opportunity (1/2): Current adoption vs future adoption

- 4.4 Overview of the EaaS opportunity (2/2): Current adoption vs future adoption – Deep dive on machinery

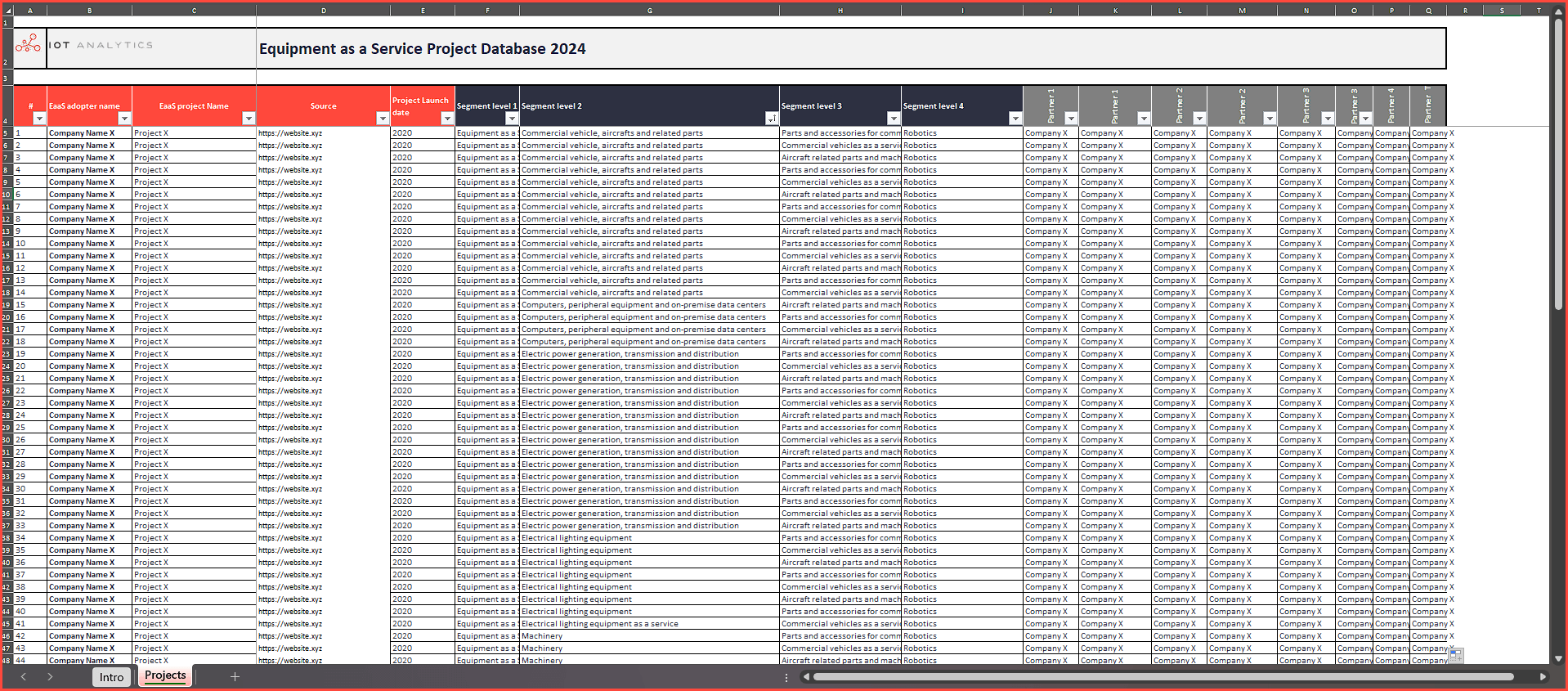

- Known adopters & vendors

- 5.1 Landscape of the EaaS enabling infrastructure

- 5.2 Landscape of known adopters

- 5.3 Deep-dive 1: Robotics as a Service

- 5.4 Deep dive 2: Compressor as a Service

- 5.5 Deep dive 3: EaaS pioneer

- 5.6 Deep dive 4: Success story – Heidelberger Druckmaschinen

- 5.7 Deep dive 5: Setback story – Festo

- Financing EaaS

- 6.1 Financial institutions are introducing pay-per-use financial products to cater to EaaS specifics

- 6.2 Background: Pay-per-use financing is a form of off-balance sheet financing

- 6.3 How OEMs generally think about equipment financing

- 6.4 3 theoretical options to finance equipment as a service from the user’s point of view

- 6.5 Landscape of financial institutions with dedicated EaaS offerings

- 6.6 Example of an OEM self-financing EaaS (1/2): Kaeser

- 6.7 Example of an OEM self-financing EaaS (2/2): Caterpillar

- 6.8 Example of an OEM financing EaaS with a 3rd party : Trumpf

- 6.9 Example of an OEM financing EaaS with an SPV Symbotic

- Case studies

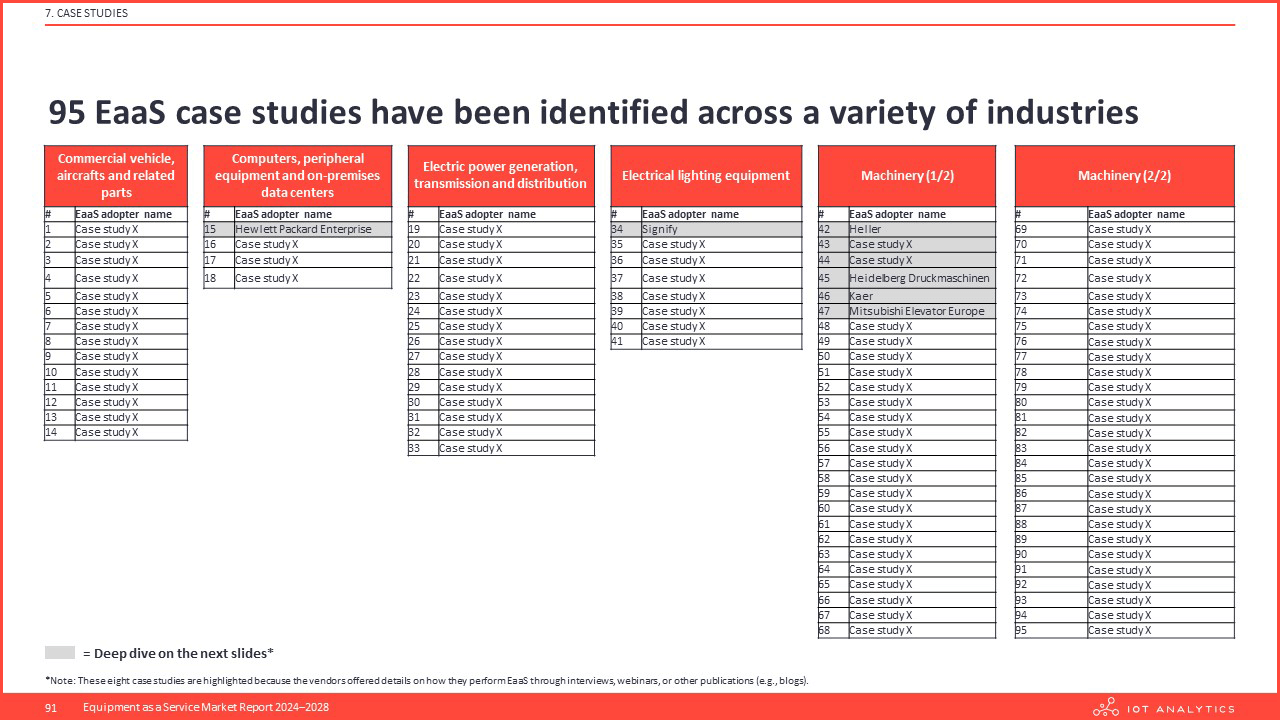

- 7.1 95 EaaS case studies have been identified across variety of industries

- 7.2 Case study 1: Heller

- Successful OEMs focus on software add-ons with a freemium model

- 7.3 Case study 2: Carrier Commercial Refrigeration

- 7.4 Case study 3: Kaeser Compressors

- 7.5 Case study 4: Heidelberg Druckmaschinen

- 7.6 Case study 5: Kaer

- 7.7 Case study 6: Hewlett Packard Enterprise

- 7.8 Case study 7: Signify

- 7.9 Case study 8: Mitsubishi Elevator Europe

- Trends & Challenges

- 8.1 Trend 1: OEMs are using EaaS to capture revenue lost to 3rd parties

- 8.2 Trend 2: Guaranteed performance contracts offer alternative to EaaS

- 8.3 Trend 3: OEMS are using EaaS to push their sustainability agenda

- 8.4 Trend 4: EaaS has become the prominent business model for commercial electric/hydrogen vehicles

- 8.5 Trend 5: EaaS adoption happens in industry cluster

- 8.6 Trend 6: Re-using spare parts as part of the EaaS setup

- 8.7 Trend 7: EaaS becoming the prominent business model for commercial electric/hydrogen vehicles

- 8.8 Challenge 1: Establishing EaaS pricing / contracts

- 8.9 Challenge 2: Transitioning from existing business models

- 8.10 Challenge 3: Procuring flexible financing sources

- 8.11 Challenge 4: Managing larger balance sheets

- 8.12 Challenge 5: End-users don’t treat EaaS equipment well

- 8.13 Challenge 6: There are no financing best-practices

- Survey insights

- 9.1 EaaS OEM adoption status—by segment

- 9.2 Customer adoption of EaaS

- 9.3 Reasons why customers adopt EaaS

- 9.4 Necessary actions to guarantee a successful pivot to EaaS

- 9.5 Common mistakes when transitioning to EaaS

- 9.6 Respondents’ profile and survey overview

- Methodology

- About IoT Analytics

Questions answered

- What is EaaS? (Definition, how it works for consumers and original equipment makers (OEMs), why and how consumers benefit from EaaS; and why OEMs offer EaaS)

- Where does EaaS fit compared to other services provided by OEMs?

- How big is the EaaS market, and how is it expected to evolve?

- Who are the OEMs leading EaaS adoption, and what is their market share?

- What macro trends impact the market growth, and what are the headwinds/tailwinds?

- What are the drivers for EaaS adoption?

- How are EaaS solutions created?

- How are OEMs financing EaaS? How are they making EaaS successful?

- What are some best-in-class case studies of EaaS?

Related reading

The OEM servitization strategies: Why Equipment as a Service hasn’t taken off yet article was recently published based on insights from this report.

→Sign up for the newsletter to be notified of future articles

Companies mentioned

A selection of companies mentioned in the report.

AIRPlan

Aggreko

Allumia

Alphastruxure

Aluvation

Ambi Robotics

Ameresco

Anybotics

Atlas copco

Balyo

Berkshiregrey

Bernhard

Boge

Budderfly

Calibrant Energy (Siemens)

Carrier

Caterpilar

Cobalt Robotics

Coborn

Coboworx

Dell

Deutsche Lichtmiete

EMAG

ETAP Lighting

Engel

Engie

Epiroc

Farmwise

Feslighting

Geek+

General Electric

Heidelberg Druckmaschinen

Heller

Hewlett Packard Enterprise

Hommel

Hylane

Hyundai

IBM

Invia Robotics

Iveco Gate

JUNA Technologies

Kaer

Kaeser

Kelvion

Konicaminolta

Koolmills

Lenovo

McKinstry

Metrus Energy

Michelin

Mitsubishi Elevator Europe

PIO

Path Robotics

Pearson

Pearsonpkg

PowerSecure

Proven Robotics

RCG LightHouse

Rapidrobotics

Redaptive

Renault Trucks

Ricerobotics

Riedel-kooling

Roboshare

Robotire

Rolls Royce

Sandvik

Schneider Electric

Seegrid

Signify

Small Robot Company

TRAKRAP

Takeoff

Tamturbo

Trilux

Trumpf

United Robotics Group

Urbanvolt

Vecnarobotics

Volta Trucks

Wasterobotic

WattEv

Willis Lease Finance

Zk-system

Our insights are trusted by global industry leaders

Single User License

- 1 named user within a particular department and country

- Complete market report in PDF

- Market data in PDF (graphs within the report)

- Market model data in EXCEL

- List of 90+ Equipment as a Service Projects in EXCEL

- Complete market report in PPTX

- 1 hour discussion with the analyst team

Team User License

- 1–5 named users within a particular department and country

- Complete market report in PDF

- Market data in PDF (graphs within the report)

- Market model data in EXCEL

- List of 90+ Equipment as a Service Projects in EXCEL

- Complete market report in PPTX

- 1 hour discussion with the analyst team

Enterprise Premium License

- Report may be distributed to all employees of the enterprise

- Complete market report in PDF

- Market data in PDF (graphs within the report)

- Market model data in EXCEL

- List of 90+ Equipment as a Service Projects in EXCEL

- Complete market report in PPTX

- 1 hour discussion with the analyst team

Get your free sample

Download the sample to learn more about:

- Report structure

- Select definitions

- Scope of research

- Market data

- Companies included

- Additional data points

Any questions?

Get in touch with us easily. We are happy to help!

Prajwal Praveen

Sales Manager

Phone: +49 (0) 408 221 1722

Email: sales@iot-analytics.com