Description

Industry 4.0 & Smart Manufacturing Adoption Report 2020

The Industry 4.0 & Smart Manufacturing Adoption Report 2020 is part of IoT Analytics’ ongoing coverage of Industrial IoT and Industry 4.0 (Industrial IoT Research Workstream).

The information presented in this report is based on an extensive survey with leading manufacturers conducted between July 2019 and October 2019.

The purpose is to inform other market participants about the current state of technology adoption with manufacturers across the world, their needs, challenges and many other aspects of their Industry 4.0 initiatives.

Read the corresponding blog post here.

Find out:

- What technologies are manufacturers adopting and to which degree?

- Which technologies have the highest budget allocation and yield the highest ROI?

- Which are some of the common vendors of these technologies and how well-perceived are they?

- What use cases are manufacturers trying to solve and to what degree?

- Which companies are perceived to be ahead when adopting these technologies and why?

- What are the dominant success factors when rolling out Industry 4.0 and Smart Manufacturing initiatives?

- Which architectures and protocols are in use for connected assets and how is this expected to change?

- How is Industry 4.0 different in China than elsewhere?

- How do all of the above vary by region (NA, EU, APAC), by size of company (SME, Mid-sized, MNC) and by industry (e.g., Auto, Machinery, Process)?

Available pricing plans:

See Terms & Conditions for license details.

Single User License

Market Report Single User License- 1 Named user (in your organization within the country of purchase)

- Complete market report in PDF

- Complete market report in PPT

- 1h Discussion with the analyst team

- Bonus: Database of 420+ Industrial IoT Projects (published in 2018)

- Bonus: Database of 360+ Industry 4.0 Vendors (published in 2018)

Team User License

Market Report Team User License- 1-5 Named users (in your organization within the country of purchase)

- Complete market report in PDF

- Complete market report in PPT

- 1h Discussion with the analyst team

- Bonus: Database of 420+ Industrial IoT Projects (published in 2018)

- Bonus: Database of 360+ Industry 4.0 Vendors (published in 2018)

Enterprise Premium License

Market Report Enterprise Premium User License- Unlimited users (in your organization within the country of purchase)

- Complete market report in PDF

- Complete market report in PPT

- 1h Discussion with the analyst team

- Bonus: Database of 420+ Industrial IoT Projects (published in 2018)

- Bonus: Database of 360+ Industry 4.0 Vendors (published in 2018)

At a glance:

Industry 4.0 technology adoption is not ubiquitous. Since being unveiled at Hannover Messe in 2011, Industry 4.0 has become a global term to describe the 4th industrial revolution.

This report builds on the work done in 2018 around defining and sizing the Industry 4.0 and Smart Manufacturing Market (see here), and looks at the current state of Industry 4.0 adoption from the end users’ perspectives.

IoT Analytics surveyed 150 OT and IT decision makers from manufacturing companies across the globe in order to understand Industry 4.0 adoption trends. North America emerged as leader in overall Industry 4.0 adoption (36%) and is home to some of the most popular suppliers of these technologies in Microsoft, IBM and Amazon. Europe and Asia trailed in Industry 4.0 adoption (27% and 20%, respectively) for a variety of reasons, which are explored in-depth in the report.

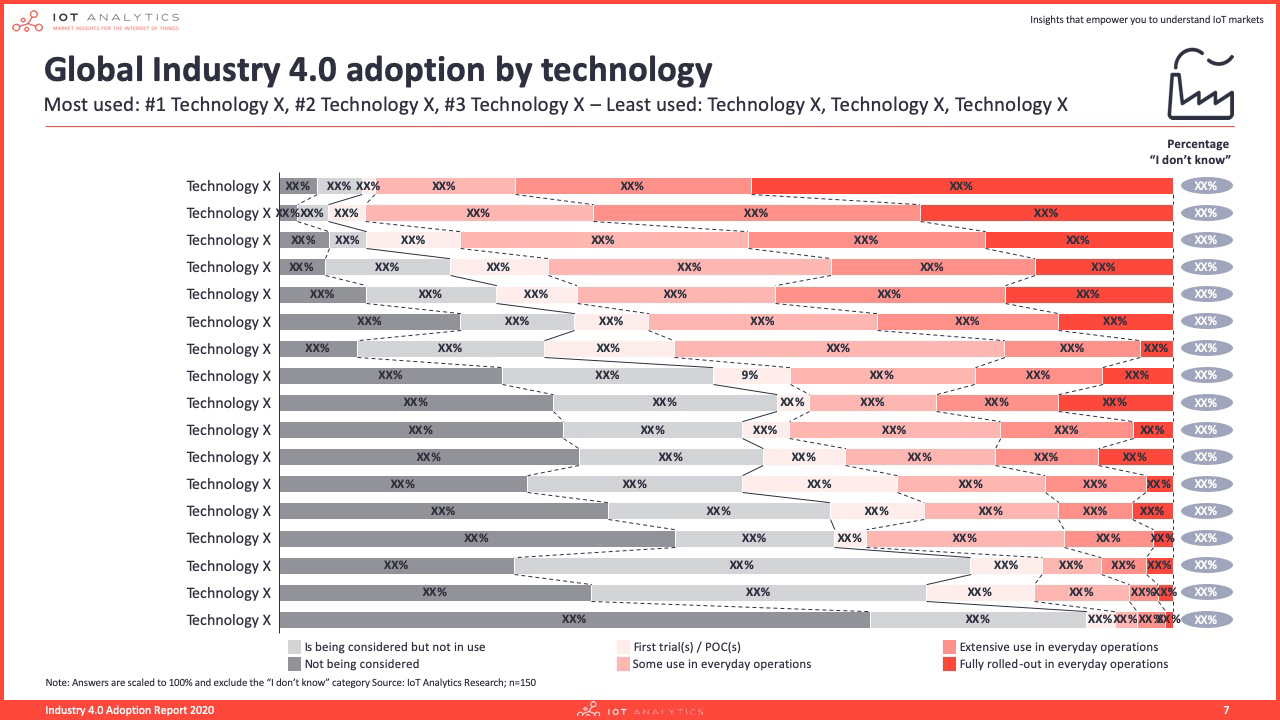

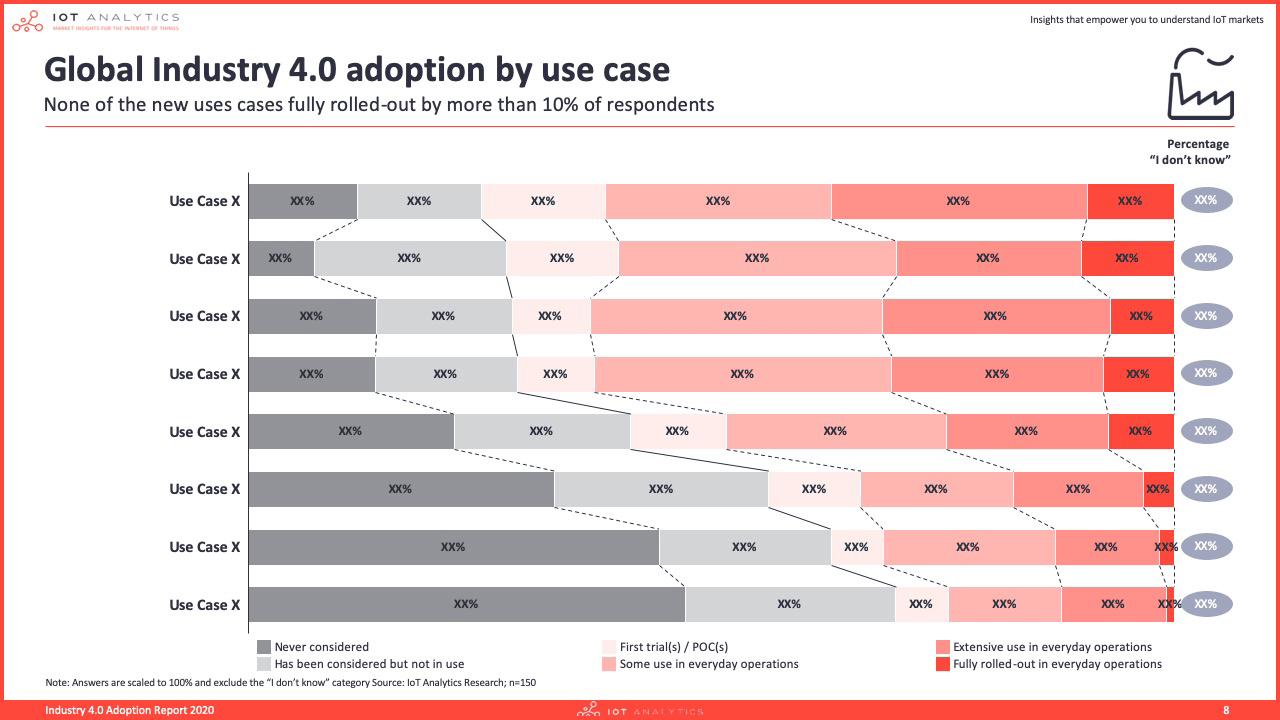

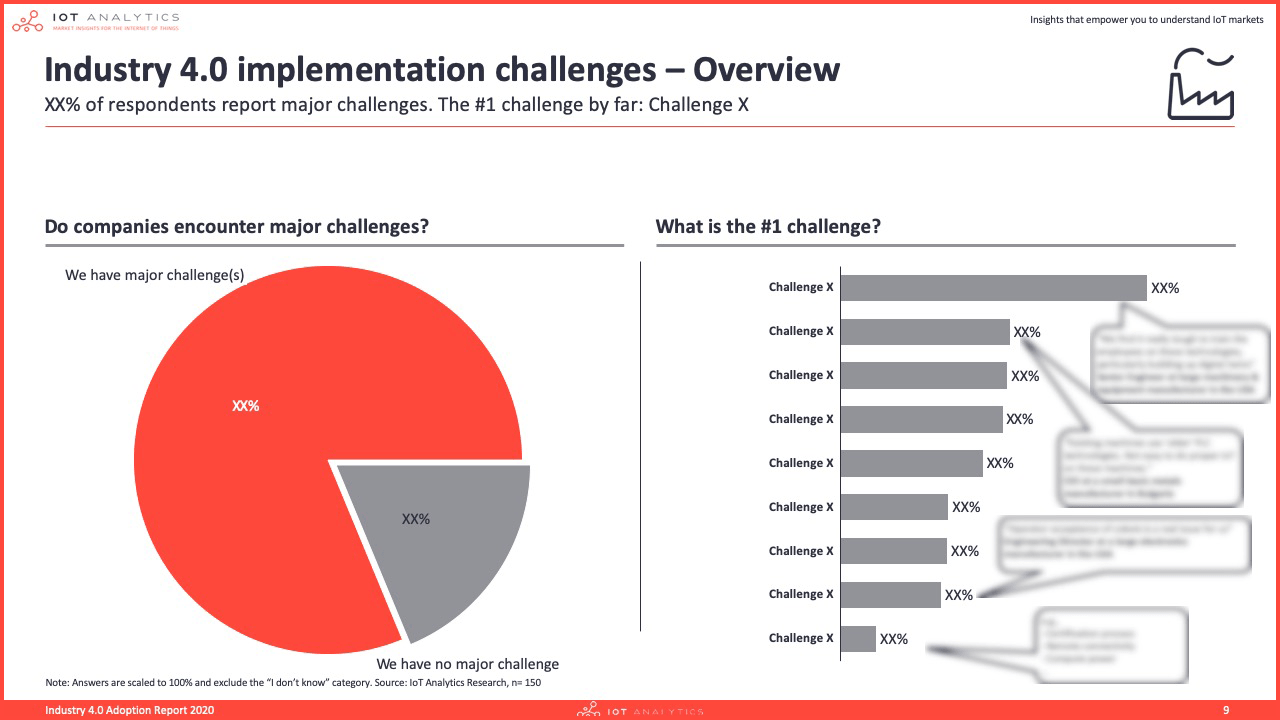

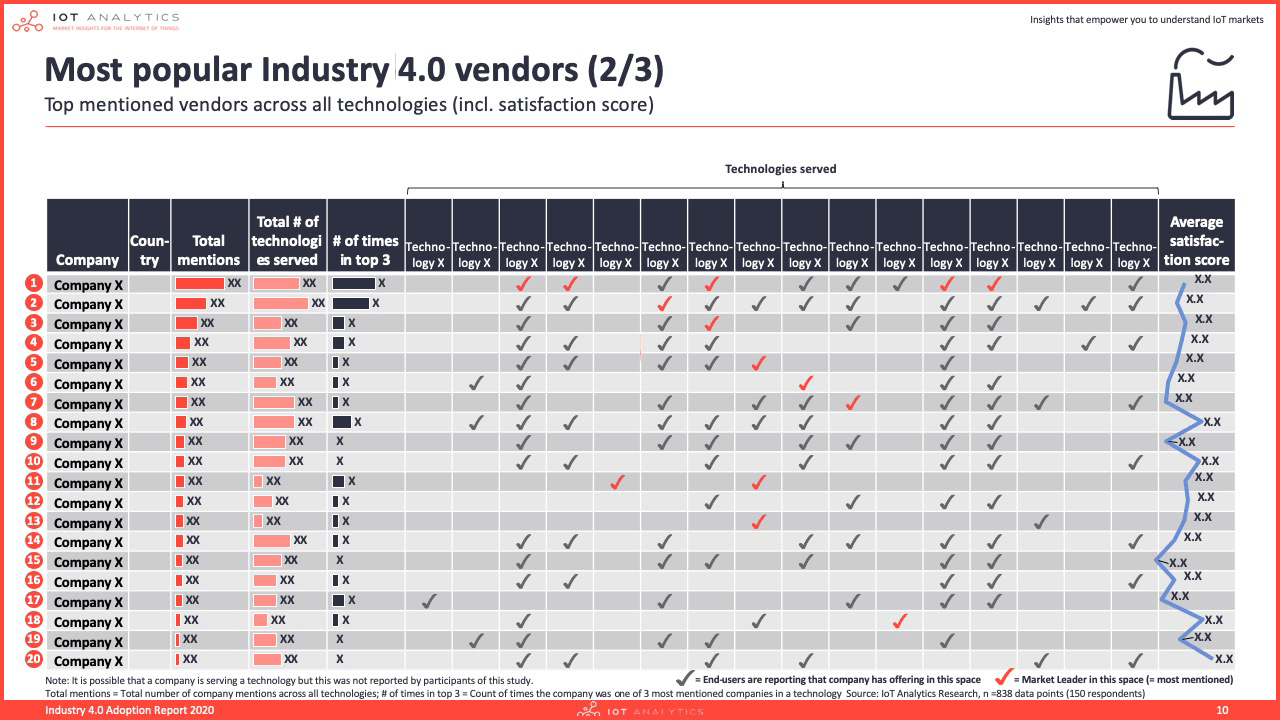

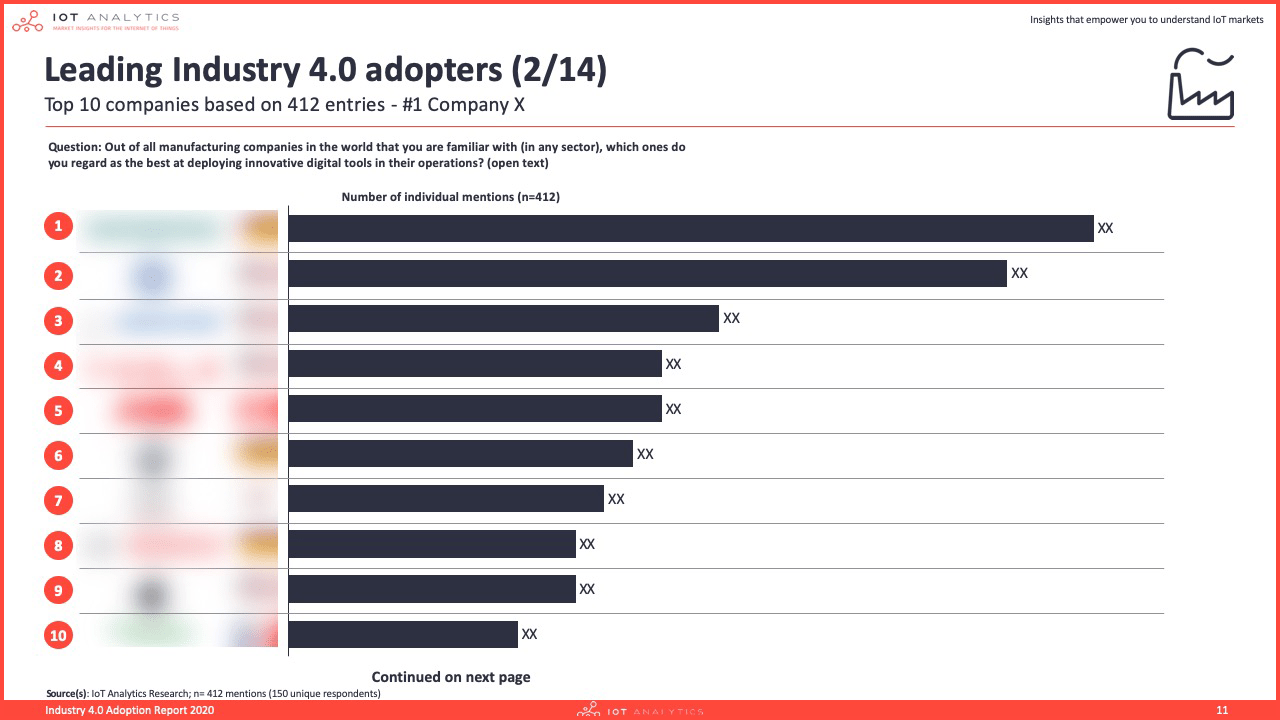

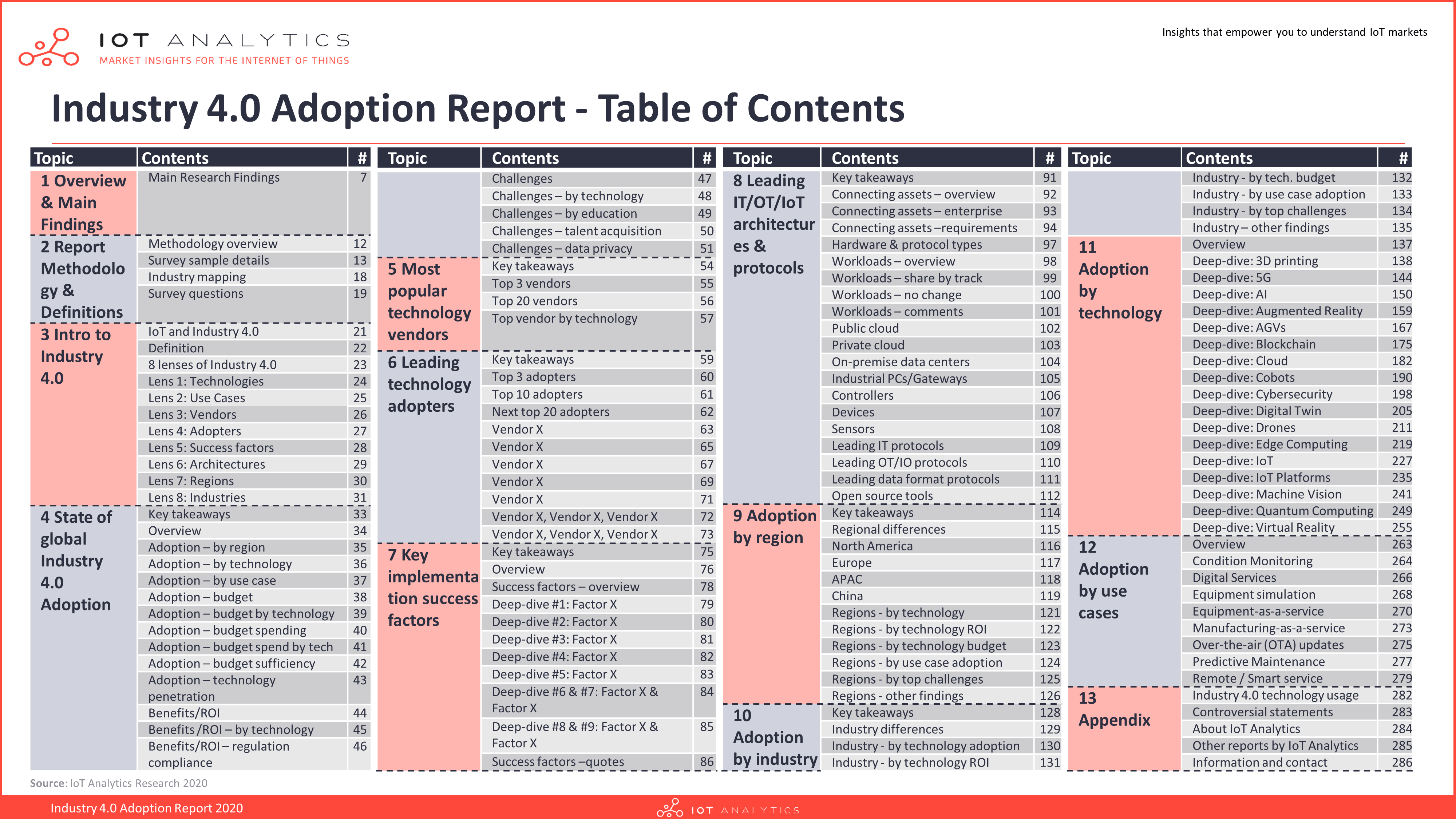

The report takes a deep dive into the technologies (17 in total), use cases (8 in total), challenges (8 in total), most popular vendors (top 20) and leading adopters (top 30) related to Industry 4.0 adoption.

Adoption rates for each of the 17 Industry 4.0 technologies are provided, including breakdowns by region, industry and company size (breakdowns not pictured below).

Each of the 17 Industry 4.0 technologies is explored in-depth, including analysis of ROI, budget, challenges, key vendors and focus areas by industry (challenges, vendors and focus areas by industry not pictured in adjacent slide)

Adoption rates for each of the 8 Industry 4.0 use cases are provided, including breakdowns by region, industry and company size (breakdowns not pictured below).

The top challenges associated with deploying Industry 4.0 technologies are explored in-depth, including breakdowns by region, industry and specific technology (breakdowns not pictured below).

The most popular vendors are ranked by number of mentions and organized by the types of technologies they offer.

30 leading adopters of Industry 4.0 technologies are identified, and profiles of the top 12 are provided.

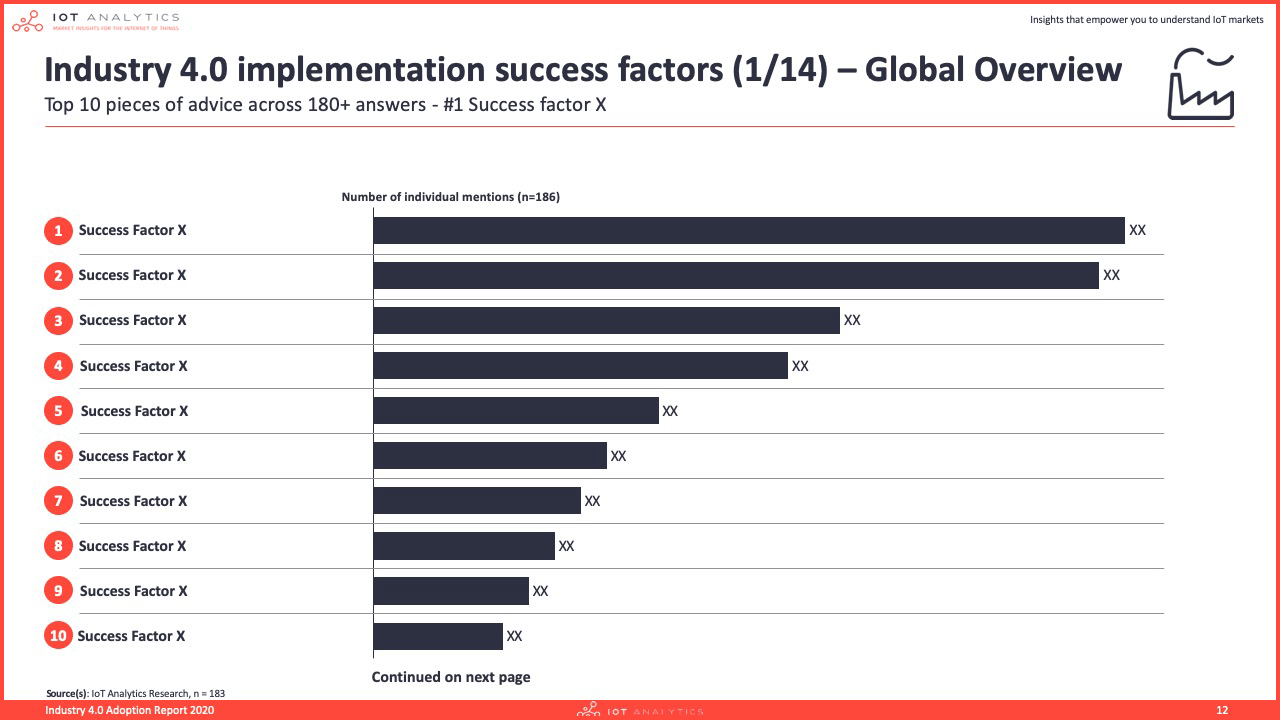

39 success factors are identified, and deep-dives are provided on the top 9 (deep-dives not pictured in adjacent slide)

Definition of Industry 4.0:

“The use of contemporary IoT building blocks and/or specific supporting technologies that enable manufacturers to integrate various data sources, achieve higher OEE, reduce costs, or improve other KPIs relevant to the production setup; mostly in conjunction with rolling out new or improved use cases”

Selected companies from the report:

3D Systems, ABB , Accenture, Alibaba, AT&T, Autodesk, AWS, Baidu, Boeing, Bosch, BMW, Cisco, Cognex, COMAU, Daifuku, Dassault Systèms, DJI, Droneup, Ericsson, FANUC, Foxconn, General Electric, Google, HP, HTC, Huawei, IBM, Intel, KUKA, Microsoft, Nokia, Oculus, Oracle, Palo Alto Networks, PTC, Rockwell Automation, SAP, Schneider Electric, Siemens, Stratasys, Swisslog, Symantec, TCS, Tesla, Toyota, Universal Robotics, Verizon, VMware and 300+ more.

Request sample:

Request a sample of the report: