In short

- 99% of companies that build motors into their equipment believe that the digitalization of industrial drives will lead to greater operational efficiency, according to IoT Analytics’ Digitalization of Industrial Drives — Adoption Report 2025 (published September 2025).

- Energy savings through the digitalization of drives could yield 164 TWh in reduced electricity consumption worldwide, equivalent to 21 nuclear reactors (at one-gigawatt capacity).

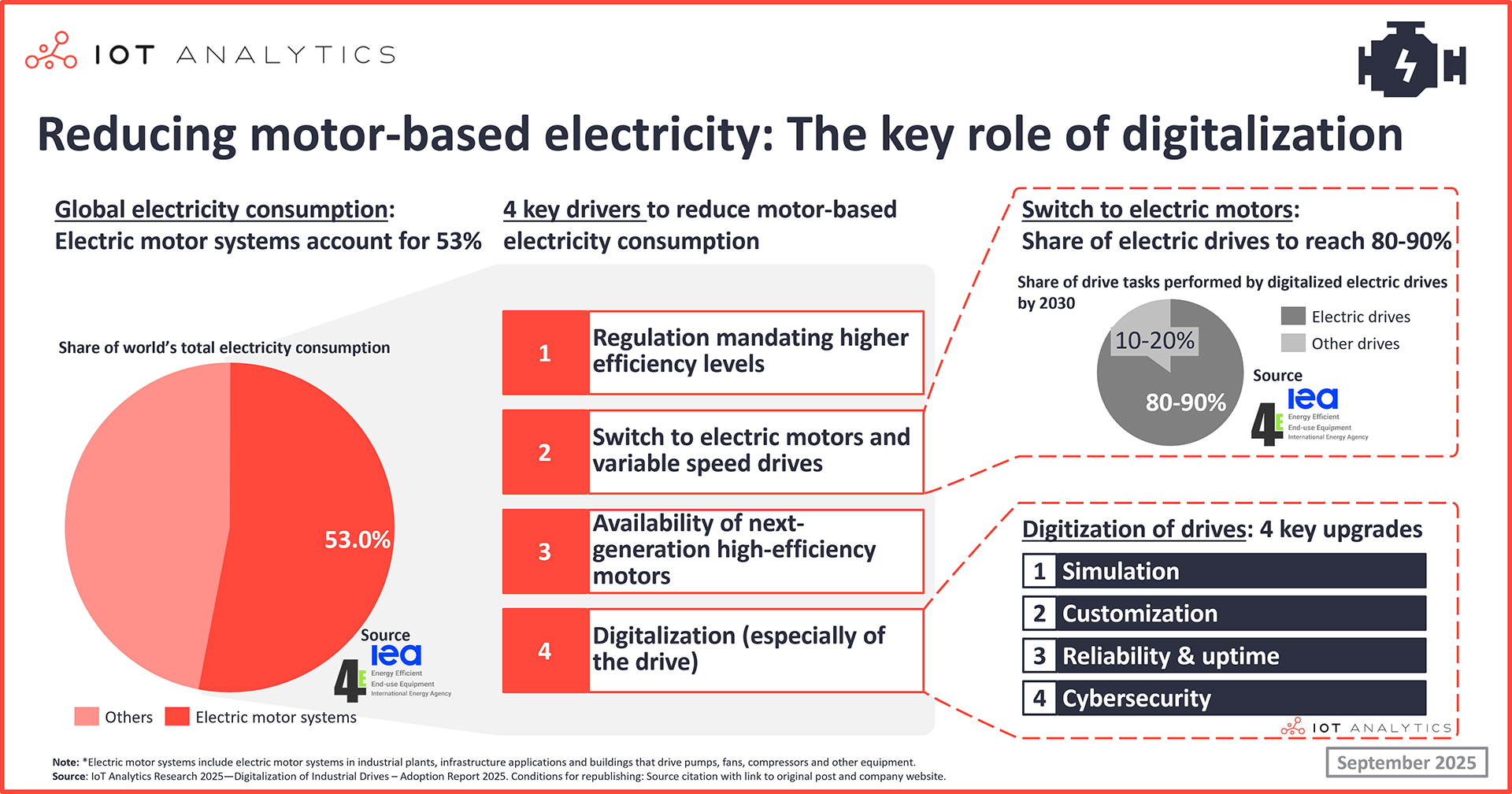

- 4 areas are key for the digitization of industrial drives: simulation, customization, reliability & uptime, and cybersecurity. However, the greatest barrier to wide-scale industrial drive digitalization is not technical but human.

Why it matters

- For digital solutions providers: Digitalization of drives is progressing rapidly, and customers are ready for adoption. Vendors must remain innovative to stay competitive.

- For OEMs/integrators/end-users of motors&drives: Digitalized industrial drives have the potential for significant increased operational efficiency and asset lifetime extension. Keeping abreast with the latest developments and offerings from vendors may prove valuable.

In this article

- Digitalized motor drives hold large energy savings potential

- Why drive digitalization is happening now

- 4 digital upgrades reshaping industrial drives

- Upgrade 1: Simulation – De-risking drive design and deployment

- Upgrade 2: Customization – Tailoring drives for specific jobs

- Upgrade 3: Reliability & uptime – Fixing problems before they happen

- Upgrade 4: Cybersecurity – Protecting the industrial brain

- The adoption paradox: Benefits vs. real-world roadblocks

- Outlook: The biggest upgrade is human

- Top industrial drive digital solutions providers (Insights+ exclusive)

- Top use cases by upgrade area (Insights+ exclusive)

Digitalized motor drives hold large energy savings potential

Industrial drive systems advancing through targeted digital upgrades. Industrial drives, the “brains” that control motors, are undergoing significant digitalization, becoming smarter, according to IoT Analytics’ 157-page Digitalization of Industrial Drives — Adoption Report 2025 (published September 2025). Specifically, digitalization is happening through 4 main digital solutions, or upgrades, each discussed in depth below: 1. simulation, 2. customization, 3. reliability & uptime, and 4. cybersecurity.

High energy savings potential through digitalization. According to a survey conducted for the report, 99% of respondents believe that the digitalization of drives will result in better system efficiency. This is in line with previous studies about electric motors and drives in general. For example, Switzerland-based electrification and automation company ABB‘s “Achieving the COP28 UAE Consensus: The vital role of high-efficiency motors and drives in net energy addition and lower emissions globally” states that simply pairing drives with motors can yield up to 10% in energy savings. Further, the EMSA’s “Energy consumption due to the digitalization of electric motor systems” states that companies reported an average of 18% in energy savings resulting from the digitalization of electric motor systems, which includes digitalized drives.

“By optimizing the energy efficiency of industrial electric motors, we can put over 10% of energy capacity back on the grid without the trillions of dollars in new infrastructure. It allows society to do more with less—now.”

Brandon Spencer, President, Motion Business Area, ABB (source)

Insights from this article are derived from

Digitalization of Industrial Drives – Adoption Report 2025

A 157-page report on the adoption of key digital solutions across the life cycle of industrial drives, based on a survey of industrial drives OEM and system integrators as well as in-depth interviews.

Already a subscriber? View your reports and trackers here →

Digitalization of motors could reduce the need for several new nuclear reactors. Even with a very conservative assumption, such as a 1% energy savings applied only to motor-driven electricity consumption, the impact is large. In 2024, global electricity consumption was approximately 30,856 TWh/year, and industrial motors account for approximately 53% of that consumption, or 16,353 TWh/year. With 1% improvement, that would equate to 164 TWh saved per year. This is equivalent to 21 nuclear reactors (at one-gigawatt capacity), 10,700 wind turbines (at 5MW capacity), or the electricity needed to power 74 million electric cars per year (equivalent to more than the total number of cars registered in Germany). That is substantial headroom even before considering the possible, higher levels of energy savings.

Definition of industrial drives

A drive is a hardware unit that controls and regulates the motion of an (electric) motor by managing its speed, torque, and direction of rotation.

Why drive digitalization is happening now

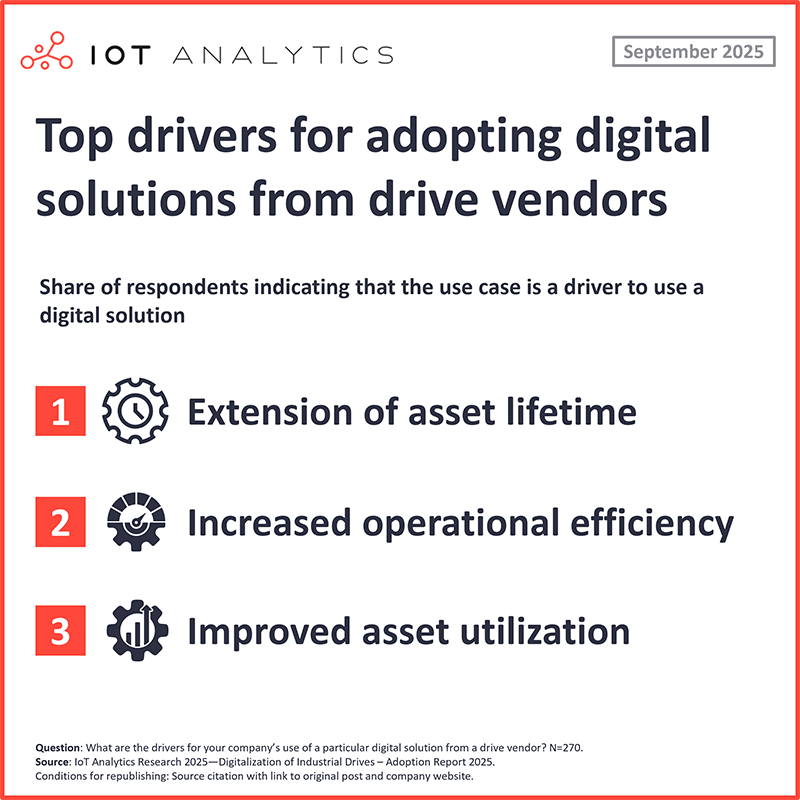

Efficiency gains drive digitalization momentum. Before diving into the 4 areas of industrial drive digitalization, it is worth looking at why the digitalization of industrial drives is happening now. The business case for digitalizing industrial drives (as well as modernizing motors) has become overwhelmingly compelling for industrial organizations worldwide, and manufacturers have largely matured to the point of adopting/using digital industrial drives. The motivations are clear, tangible, and almost universally shared across the industry: they want to increase asset lifetimes and efficiency.

But it is not only the digitalization of drives that enables lower global electricity consumption. Other drivers that enable global energy reductions include:

- Regulation on motor efficiency. New regulation has forced the global phase-out of inefficient designs.For instance, the EU’s Ecodesign rules now require motors above 0.75 kW to meet IE3 standards, pushing the market toward higher baselines.

- Adoption of variable speed drives (VSDs). VSDs enable motors in pumps, fans, and compressors to run only at the speed required, with the ability to cut energy use by 20–50% compared to throttling or bypass control.

- Next-generation high-efficiency motors. Innovations such as permanent magnet synchronous and synchronous reluctance models (often rated IE4 or IE5) further reduce losses, with case studies in manufacturing plants showing energy savings of 5–10% beyond conventional premium-efficiency motors.

Digital maturity levels

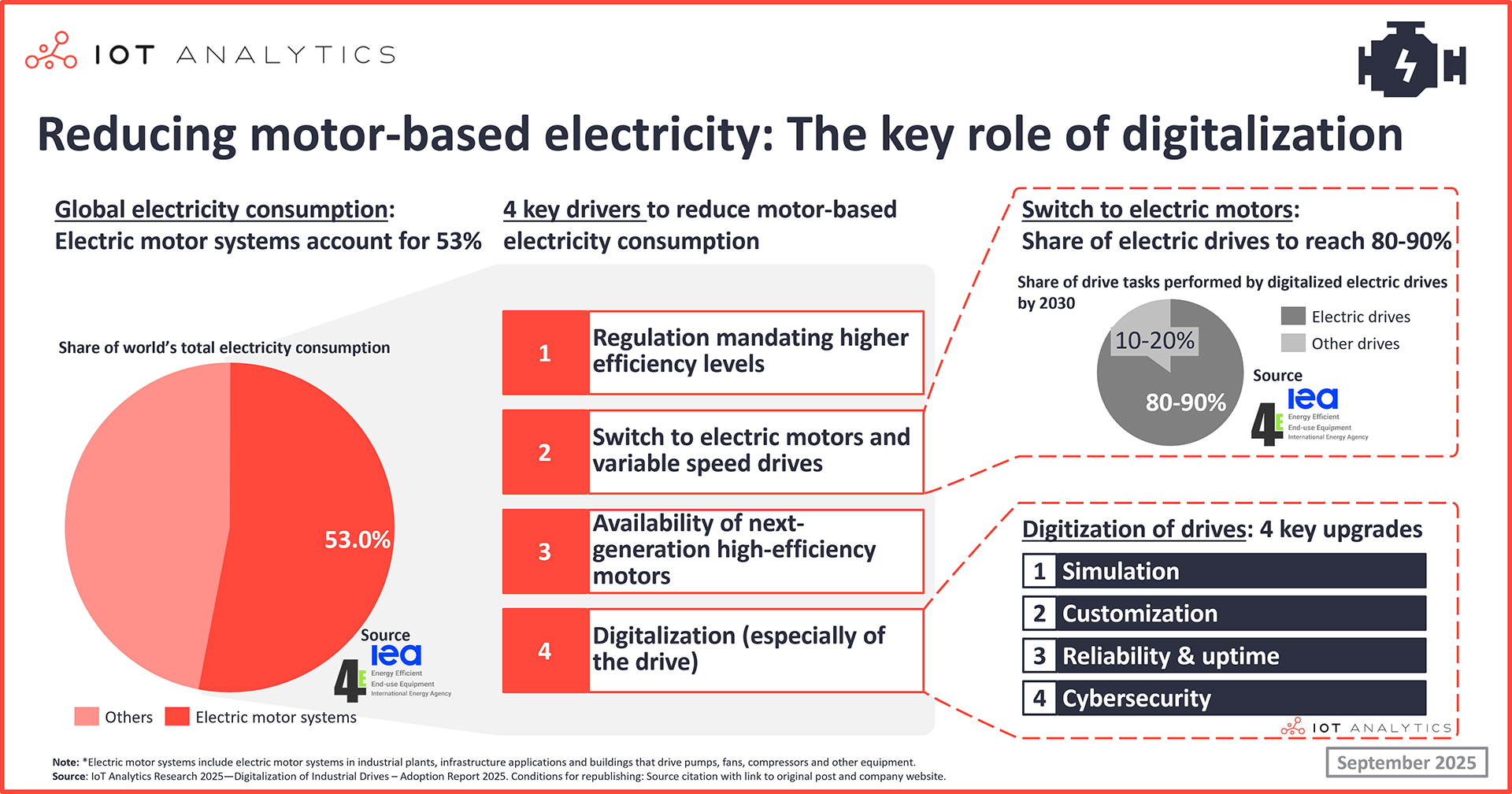

Manufacturers have reached a moderate or above level of digital maturity. According to a survey of 270 OEMs and system integrators for the research in the report, 73% of end customers have achieved a moderate or higher level of digital maturity. This includes 38% at the “Moderate Implementation” stage and 24% at “Advanced Implementation.” Crucially, another 11% have reached the “Optimization and innovation” stage, leveraging technologies like digital twins and AI.

This foundational maturity indicates that a majority of the market is now equipped to adopt and benefit from more sophisticated digital solutions.

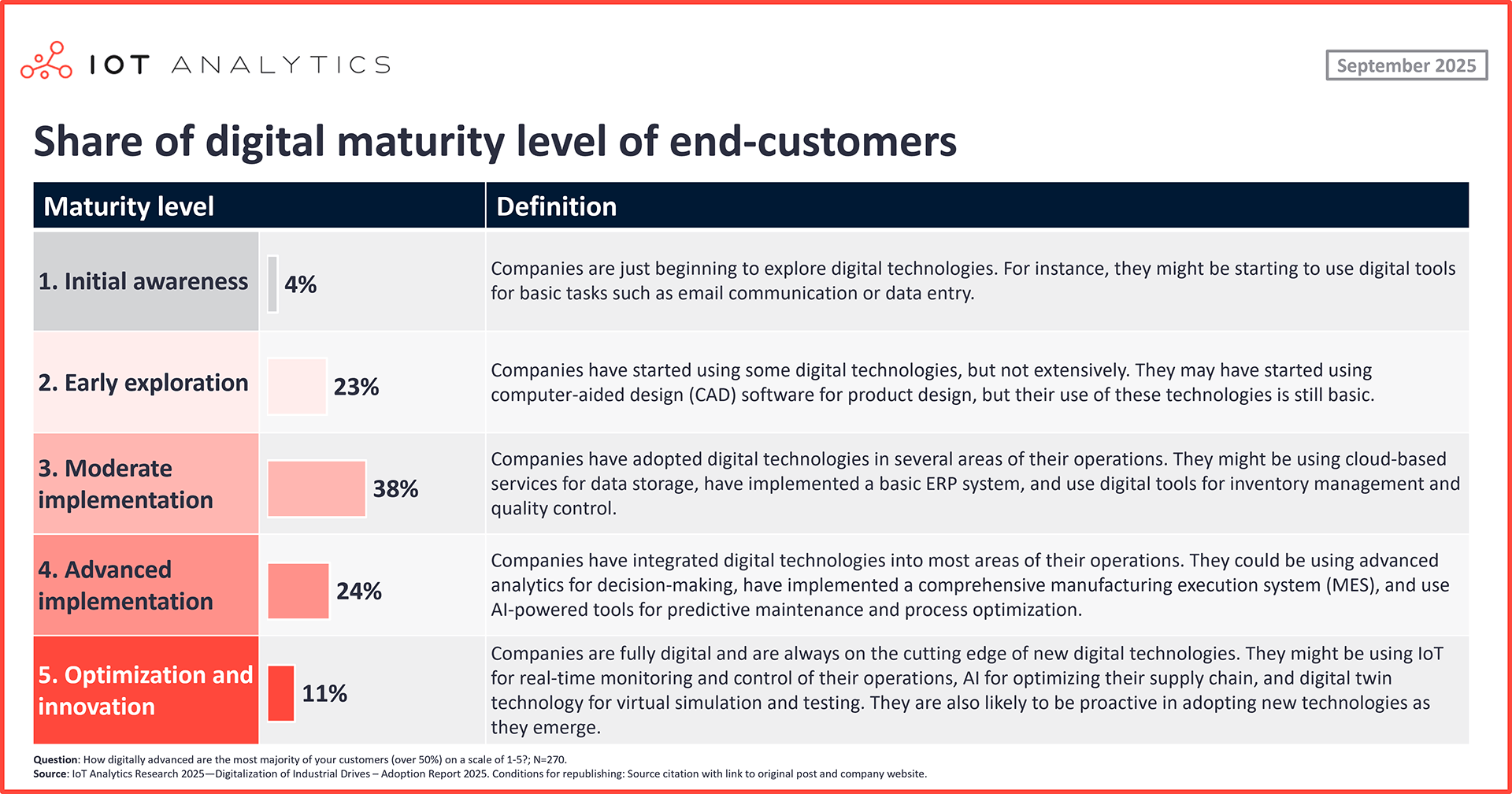

Extended asset lifetime

Extending asset lifetime and improving efficiency are overwhelming drivers. Based on the same survey, a full 100% of survey respondents identified extending asset lifetime as a key motivator for using digital solutions from their drive vendors. The next most frequently cited motivators are the desire for improved operational efficiency (99%) and better asset utilization (99%), painting a clear picture of an industry focused on maximizing the value and performance of its existing capital-intensive equipment.

4 digital upgrades reshaping industrial drives

The Digitalization of Industrial Drives — Adoption Report 2025 organizes the ongoing upgrades of industrial drives into 4 key digital pillars: simulation, customization, reliability & uptime, and cybersecurity. These upgrades represent the core toolset that companies are using to build the next generation of industrial motors.

Upgrade 1: Simulation – De-risking drive design and deployment

Simulation enables faster, safer system deployment. Simulation is applied across the entire drive lifecycle, from feasibility and pre-studies to lifetime extension. Of the 11 use cases discussed in the report (and shared below in the Insights+ section), the top 2 drive simulation use cases are

- optimizing drive performance during operations and testing and

- validating drive performance during commissioning

both with 45% of respondents.

Virtual simulation and digital twins have become the primary method for de-risking drive deployment and optimizing performance before installation. With this method, engineers can now create a virtual model of a drive system to test, validate, and fine-tune its behavior under a full range of operating conditions. This practice helps identify and mitigate risks early in the design phase, accelerating deployment and avoiding costly real-world errors.

Data limitations hinder wider simulation adoption. Despite its benefits, adoption is not without hurdles. The top challenges identified by survey respondents are ensuring sufficient data quality and quantity (41%) and scaling the solution (41%), highlighting the critical need for robust data infrastructure.

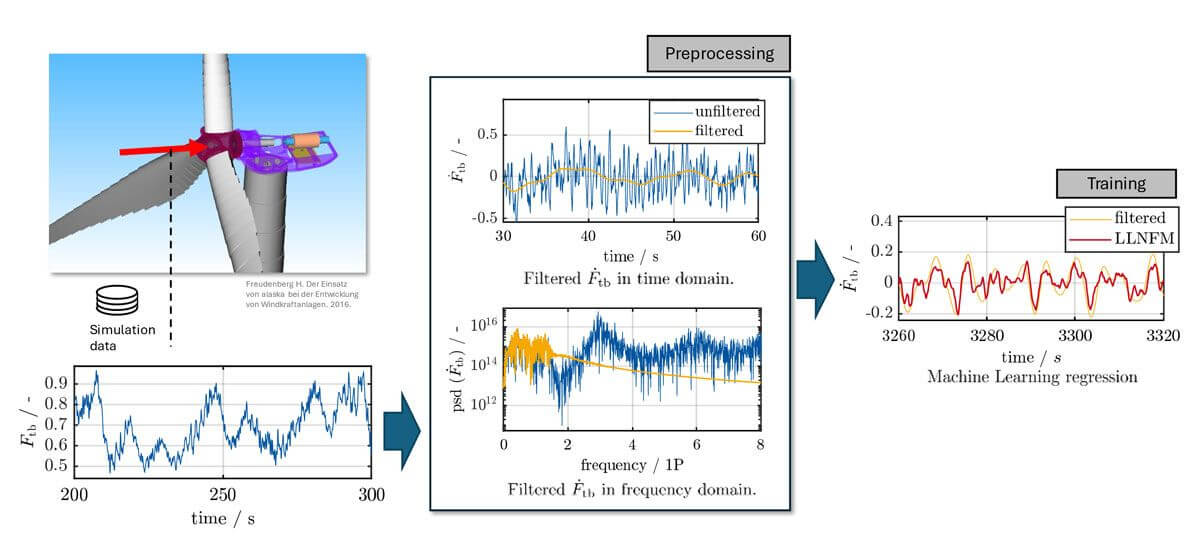

Example: W2E GmbH optimizes wind turbine control with MATLAB and Simulink

Germany-based wind turbine developer W2E GmbH used US-based mathematical computing software company MathWorks’ MATLAB and Simulink-based tools to develop and validate a model predictive control algorithm for a wind turbine drivetrain. Once virtual tests validated the design, the control logic was automatically converted into deployable code and loaded onto the turbine’s controller. This approach reportedly reduced development risk, accelerated time-to-market, and lowered overall testing costs.

Upgrade 2: Customization – Tailoring drives for specific jobs

Customized monitoring and efficiency lead. Tailoring drive software for specific applications has become a standard practice for optimizing operational performance. This moves beyond factory presets to fine-tune performance, monitoring, and control logic for specific tasks, ensuring that the drive operates at peak efficiency for its given environment.

The most common application for this capability is operational monitoring, with 51% of respondents stating they frequently customize drives for this purpose. The data also shows a clear preference for proven, accessible tools, as the majority of users (42%) leverage customization solutions provided directly by the drive vendor rather than developing their own from scratch.

Example: Rivoira Group customizes drive vibration thresholds to improve predictive maintenance accuracy

Rivoira Group, an Italy-based fruit storage and distribution company, customizes vibration thresholds in DrivePro Remote Monitoring, an application from Denmark-based drives supplier Danfoss, for its cooling systems. By setting precise operational baselines that reflect their specific equipment and conditions, they can receive meaningful alerts for potential malfunctions, enabling proactive maintenance and preventing costly downtime that could jeopardize their inventory.

Upgrade 3: Reliability & uptime – Fixing problems before they happen

Predictive maintenance gained ground with IoT adoption. To combat downtime, companies are shifting from reactive repairs to predictive maintenance powered by real-time data. Instead of fixing equipment after it fails, companies are using continuous data streams to anticipate and address issues before they can halt production.

The industry’s top reliability strategies are a near-even split among preventive maintenance (55%), proactive maintenance (55%), and predictive maintenance (54%). To power these, half of all companies now maintain a permanent IoT connection to their drive systems, enabling a continuous stream of health and performance data for analysis.

Resistance and cost slow digital adoption. Despite these clear benefits, adoption challenges persist. The leading barriers are once again human and financial, with organizational resistance to change (46%) and the cost of the solution (40%) cited as the primary obstacles.

Example: Century Aluminum uses Siemens drives to reduce downtime

Century Aluminum, a US-based metals and mining company,reportedly reduced its cooling-tunnel downtime by over 50% after upgrading to Germany-based industrial automation company Siemens’ SINAMICS G120 drives, which provided continuous data reporting and automated alerts. This improvement translated to a productivity gain of approximately 300,000 pounds in daily throughput, providing a clear example of how digital upgrades deliver on the primary business driver of extending asset lifetime.

Upgrade 4: Cybersecurity – Protecting the industrial brain

Cybersecurity upgrades are a must-have. Protecting drive systems has become essential for industrial players. A compromised drive can lead to operational disruption, equipment damage, or even safety incidents, making cybersecurity non-negotiable.

However, the report reveals a significant, uneven gap in cybersecurity readiness. While 47% of OEMs and system integrators advise their customers on cybersecurity during the design phase, only 35% of end customers have a formal cybersecurity strategy in place. This maturity varies starkly by region: North America leads with 47% of customers having a formal strategy, while MEA lags at just 24%.

Example: Arkansas City water treatment plant enhances cybersecurity to prevent future attacks

On September 22, 2024, a cyber intrusion targeted the control systems of Arkansas City’s water treatment plant, attempting to compromise its pump-drive controllers via the corporate IT network. To prevent future attacks, the utility brought in an OT security integrator to implement strict network segmentation:

- Network isolation with VPN – VLANs and firewalls are now used to isolate all drive controllers and SCADA systems from the business network, and only authenticated VPN access is granted to remote engineers.

- Drives housed in protected zone – In the new arrangement, each electric-drive cabinet, which powers the pumps, motors, and valves, is housed in its own protected zone.

- Restricted zone communication – Communication between zones is limited to essential control commands, and every remote session goes through a hardened VPN gateway.

- Automatic breach alerts – Any unauthorized attempt to connect triggers automatic alerts that are sent to both the internal IT team and the integrator’s security operations center.

The adoption paradox: Benefits vs. real-world roadblocks

The greatest barrier to drive digitalization is not technical but human. Despite the clear technological advantages and compelling business case for digitalized drives, the path to adoption is rarely straightforward. The process is frequently complicated by challenges that have more to do with people and processes than with technology.

The report data is unambiguous: 96% of companies identify “resistance to change and unrealistic expectations” as a top challenge. This is followed by concerns over the cost of the solution (94%) and difficulties integrating new technology into existing systems (93%). This human factor is a pervasive thread, appearing as the top challenge for customization (52%) and a top-2 challenge for reliability & uptime (46%).

This creates the central tension in the market today: the conflict between incredible business goals, like extending the lifetime of multi-million dollar assets, and the messy reality of implementing that vision. On one side is the immense potential of digital technology; on the other are legacy systems, tight budgets, and teams resistant to new ways of working.

This adoption paradox raises a critical question: What are customers demanding from vendors to help them bridge this gap between potential and practice?

Outlook: The biggest upgrade is human

The findings from the Digitalization of Industrial Drives — Adoption Report 2025 show that the technology needed to create highly efficient, intelligent, and self-monitoring industrial systems is not a future promise. It is available and being deployed today, highlighting that vendors are on a good path to putting the right tools in place. However, adoption does not occur naturally or overnight. To achieve global energy savings in the 100TWh+ range through motor and drive digitalization, vendors and adopters must emphasize change management, training, and evolving the industry’s mindset. As with so many other technologies, the biggest barrier is not the technology itself, but us.

Top industrial drive digital solutions providers (Insights+)

Access key market data for $99/month per user

The Insights+ Subscription unlocks exclusive facts & figures. You will gain access to:

- Additional analyses derived directly from our reports, databases, and trackers

- An extended version of each research article not available to the public

Full report access not included. For enterprise offerings, please contact sales: sales@iot-analytics.com

Disclosure

Companies mentioned in this article—along with their products—are used as examples to showcase market developments. No company paid or received preferential treatment in this article, and it is at the discretion of the analyst to select which examples are used. IoT Analytics makes efforts to vary the companies and products mentioned to help shine attention to the numerous IoT and related technology market players.

It is worth noting that IoT Analytics may have commercial relationships with some companies mentioned in its articles, as some companies license IoT Analytics market research. However, for confidentiality, IoT Analytics cannot disclose individual relationships. Please contact compliance@iot-analytics.com for any questions or concerns on this front.

More information and further reading

Related publications

You may also be interested in the following reports:

- Digital & AI in Industrial Robotics Insights Report 2025

- Industrial AI Market Report 2025-2030

- Industry 4.0 Case Studies from Leading Manufacturers 2025

Related articles

You may also be interested in the following articles:

- Industrial AI market: 10 insights on how AI is transforming manufacturing

- Smart manufacturing check-in: 6 learnings from ongoing digital transformation initiatives

- 2025 regulatory landscape: 40+ digital & ESG laws to have on the radar

Sign up for our research newsletter and follow us on LinkedIn to stay up-to-date on the latest trends shaping the IoT markets. For complete enterprise IoT coverage with access to all of IoT Analytics’ paid content & reports, including dedicated analyst time, check out the Enterprise subscription.