In short

- According to IoT Analytics’ latest What CEOs Talked About report, tariffs and AI stood out as leading themes during earnings calls in Q3 2025, with discussions around data centers and agentic AI continuing to rise.

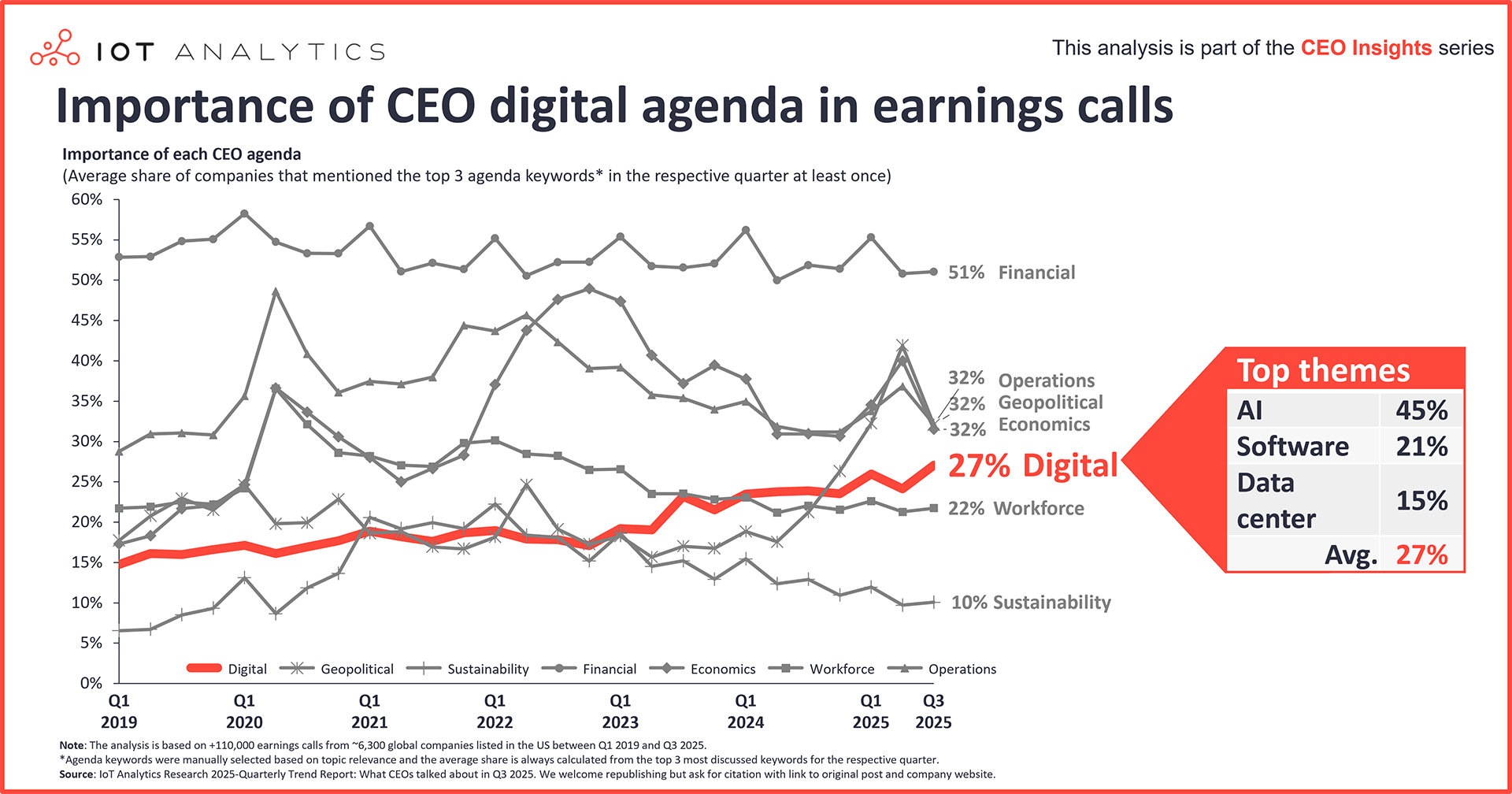

- A historical analysis shows that both geopolitical themes and digital themes have risen strongly in the last 5 years on the CEO agenda. The average mentions of leading technology themes nearly doubled over the last 5 years, with AI, software, and data centers the leading themes in Q3 2025.

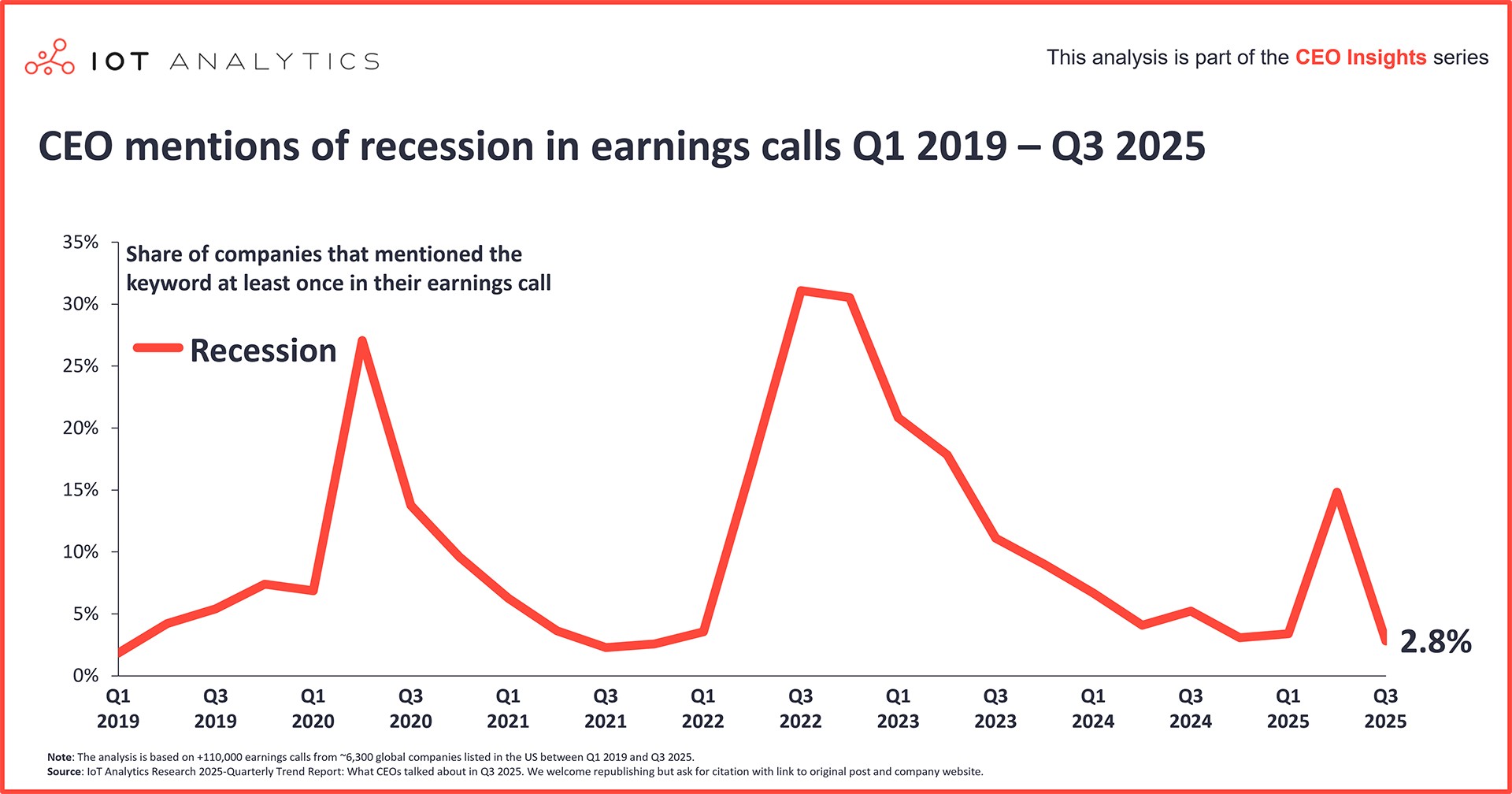

- Discussions around uncertainty and recession declined.

Why it matters

- The prioritization of specific topics by CEOs may influence investment in these areas.

In this article

- The big picture

- Key rising themes in Q3 2025

- 1. Data centers

- 2. Agentic AI and AI agents

- 3. Robotics

- Declining themes in Q3 2025

- 1. Tariffs

- 2. Uncertainty

- 3. Recession

- What it means for CEOs

- CEO digital agenda (Insights+ Exclusive)

- Key digital themes and trends (Insights+ Exclusive)

- Forward-looking implications of the digital agenda (Insights+ Exclusive)

- Manufacturing challenges (Insights+ Exclusive)

- Most discussed common challenges (Insights+ Exclusive)

- Sector-specific highlights (Insights+ Exclusive)

The big picture

Global growth around 3%. According to the OECD’s Economic Outlook Interim Report September 2025, the global economy is forecast to slow from 3.3 percent in 2024 to 3.2 percent in 2025, with a 2.9 percent global GDP growth expected in 2026. Much of the resilience in early 2025 stemmed from firms and households pulling forward purchases ahead of anticipated tariff increases. Still, as those buffers unwind and higher trade barriers take hold, growth is expected to soften. The OECD report highlights a series of downside risks that resonate with corporate leadership, including the further escalation of trade barriers, inflation surprises, tighter fiscal constraints, and financial market repricing that could test credit and liquidity conditions.

Sticky core inflation limits policy easing. On inflation and policy, the OECD’s picture is more nuanced than a simple easing story. Disinflation has stalled: headline inflation in G20 economies is projected to fall from approximately 3.4 percent in 2025 to 2.9 percent in 2026, but core inflation in advanced economies is expected to remain sticky around 2.6 percent in 2025 (moving only marginally to 2.5 percent in 2026). With this, central banks are finding room for maneuvering to be narrow.

Macro concerns declined overall. According to IoT Analytics’ 62-page What CEOs Talked About Q3 2025 report (published September 2025), while geopolitical trade issues and uncertainty remain dominant concerns, these topics were generally discussed less compared to Q2 2025 earnings calls. The specific topic of tariffs remained the #1 topic at 53% of calls, down 28% quarter-over-quarter (QoQ); however, discussions around the impact of tariffs dropped even further, indicating that CEOs are settling into the reality of tariffs. Meanwhile, mentions of uncertainty dropped 32% QoQ to 42% of calls. Likewise, discussions about economic concerns, such as inflation and recession, decreased. On the heels of these macro topic declines, the 3 major US stock indices (the NASDAQ, Dow Jones, and S&P 500) have reached record highs following a pandemic-recovery slump and a major drop in Q2 2025 as tariffs were announced and levied.

The only tracked economic topic that saw an increase in mentions was interest rates, rising 5% QoQ to18% of calls. On September 17, 2025, after many of the 5,000+ tracked Q3 earnings calls were held, the US Federal Reserve cut the benchmark interest rate by 0.25 percentage points to a target range of 4.00%–4.25%.

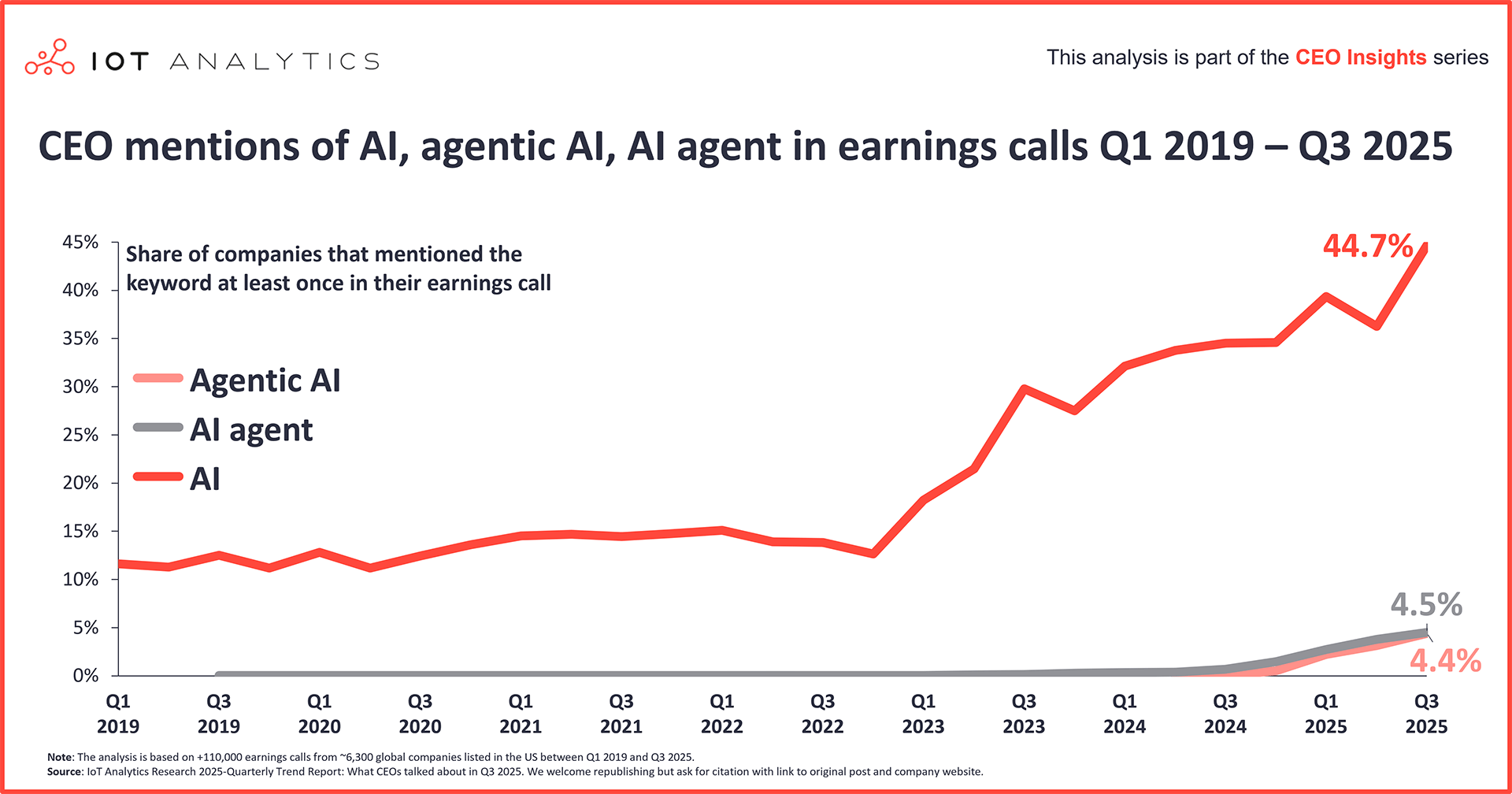

CEO digital agenda continues to gain momentum in earnings calls. Earnings calls are traditionally dominated by the CEO financial agenda, with discussions around debt, Capex, and key acquisitions taking center stage in earnings calls. Over the last 6 years, the geopolitical and digital agendas have increased strongly. While the top 3 digital themes of Q1 2019 were only discussed in 15% of all earnings calls, the top 3 digital themes of Q3 2025 were discussed by 27% of all earnings calls, with AI taking center stage. AI experienced a 23% rise in mentions QoQ, reaching 45% of calls, its highest level of mentions after a small drop in Q2 2025 (more on the CEO digital agenda in Insights+ below).

Key rising themes in Q3 2025

1. Data centers

Data center mentions on the rise. Discussions about data centers appeared in 15% of all earnings calls, rebounding 15% QoQ. These conversations were especially concentrated in 2 sectors vital to the vast expansion of these large, resource-intensive buildings: utilities (59% of its sector’s calls) and construction (58%).

Many executives report that the demand for data centers remains strong; however, the demand exceeds the supply that companies can provide, resulting in capacity constraints. Still, executives appear to see data centers as fundamental to digital revolution, and some reported higher sales to data centers than initially expected.

Key executive quotes about data center demand

“Data center demand is so strong that [it] is overshadowing the [softening] in the rest of the nonresidential business.”

Massimo Battaini, CFO, Prysmian S.p.A, August 2, 2025

“And while we brought additional data center capacity online this quarter, demand remains higher than supply. […] Even as we continue bringing more data center capacity online, we currently expect to remain capacity-constrained through the first half of our fiscal year.”

Amy E. Hood, CFO, Microsoft, July 30, 2025

Energy a key concern regarding data centers. Another constraint was also in the minds of executives: energy. The high demand and rapid expansion of data centers put intense pressure on local power utilities, focusing not only on energy management but also on investments in energy efficiency.

Key CEO quotes about the energy demand of data centers

“Really, the large hyperscale data center providers right now are facing major challenges on the energy management side.”

Ashish Chand, CEO, Belden Inc., July 31, 2025

“We estimate that more than half of our sales in data centers are made with products that help [reduce] the energy bill.”

Benoît Coquart, CEO, Legrand SA, August 1, 2025

2. Agentic AI and AI agents

Agentic AI remains the leading AI topic. While AI reached its highest level of boardroom discussions in Q3 2025 at 45% of calls, the sharpest growth continued to be in practical applications, namely agentic AI and related topics. Mentions of agentic AI rose 40% QoQ to 4% of calls, while mentions of AI agents rose 20% QoQ to 5% of calls. These discussions were highly skewed toward companies in the information and communication sector, which discussed agentic AI and AI agents in 21.8% and 20.9% of the sector’s earnings calls, respectively.

Key CEO quote about the adoption of agentic AI

“We recently began collaborating with Cognition Labs and are piloting the usage of Devin, an autonomous generative AI agent designed to transform the way we build, maintain and develop software with risk oversight and supervision of our engineers. We will be deploying these agentic AI developers for prioritized use cases, which we believe will significantly enhance velocity, transform our capabilities and drive efficiency.”

David M. Solomon, CEO, Goldman Sachs, July 17, 2025

More companies discussing agentic AI standards. The Model Context Protocol (MCP) appears to be gaining the attention of more CEOs. This universal, open standard that enables AI agents to access and share data, tools, and resources climbed a sharp 69% QoQ to 1% of calls. Even Anthropic, the US-based AI company that created MCP, experienced a 27% QoQ climb to 1% of earnings calls.

“Through MCP, Claude users can access our proprietary data sets in real time during conversations, but only for S&P Global subscribers.”

Martina L. Cheung, CEO, S&P Global, July 31, 2025

ChatGPT sees renewed attention. Related to agentic AI is generative AI, and following the August 2025 release of the GPT-5 generative AI model by US-based AI company OpenAI, references to ChatGPT rose 81% QoQ to 3% of calls.

3. Robotics

Robotics experienced increased interest in Q3 2025, particularly around humanoids and AI-driven robotics applications. The share of companies mentioning robotics in earnings calls grew by 28% QoQ to nearly 2% of calls. Humanoids are specifically moving into focus, rising 38% QoQ to almost 1% of calls.

There is a strong belief that AI-driven robotics will present many opportunities and potential for growth in the coming years. The manufacturing sector shows the highest engagement, with 11% of manufacturing companies mentioning robotics, a 37% increase from the prior quarter. CEOs appear excited about a wide range of applications for robotics, including electronics and EV production, logistics, agriculture, and aerospace, with humanoids being highlighted as the most exciting category.

Key CEO quote on robotics and humanoids

“[…] just in robotics, we’re very excited about all the applications that were being designed in, a range of new application in robotics, for example, all the way from electronics, EV production, logistics, warehouse automation, agriculture, industrial automation, aerospace, grocery logistics, smart city, oil and gas, and last but not least, the category we’re most excited about humanoids.”

Fouad G. Tamer, CEO, Lattice Semiconductor Corporation, August 4, 2025

Insights from this article are derived from

Quarterly trend report: What CEOs talked about in Q3 2025

A 60-page report on the trends that emerged in Q3 2025 earnings calls. The report is based on data of 110,000+ earnings calls of US-listed companies from Q1 2019 through Q3 2025.

Already a subscriber? View your reports and trackers here →

Declining themes in Q3 2025

1. Tariffs

Companies turn to tariff management. While tariffs remained the most frequently cited topic in Q3, the narrative has shifted from mitigation to structured management to some degree. Mentions fell to 53% of calls from their Q2 peak, and this drop happened in every tracked sector. This suggests that, despite the issue persisting, companies are adapting to the realities of tariffs.

Tariff effects drop across the board. While uncertainty remains, many companies reported normalization of business, citing either less-than-expected fallout or even positive returns following the implementation of mitigation strategies. These generally positive discussions are in line with significant drops in discussions around tariff effects:

- Trade war: Down 82% QoQ to 1% of calls

- Supply chain: Down 59% QoQ to 1% of calls

- Trade policy: Down 41% QoQ to 4% of calls

- Reshoring: Down 22% QoQ to 2% of calls

- Local-for-local: Down 52% to 0.4% of calls

Key executive quotes on tariff effects

“We’re at a point in time where the tariff narrative seems to be settling down.”

Christina L. Zamarro, CFO, The Goodyear Tire & Rubber Company, August 18, 2025

“We believe we have executed a swift response to the current tariffs that are in effect and being able to offset them in the quarter fully.”

Stefan Widing, CFO, Sandvik AB, July 16, 2025

2. Uncertainty

Uncertainty remains high but eases. Corresponding with these discussions of tariffs were a high, though declining, level of mentions about uncertainty. CEOs discussed uncertainty in 42% of calls, the 3rd highest of the tracked topics, and most of the discussions related to tariffs. This volatility continues to shape corporate outlooks, and the persistent unpredictability is forcing companies to continue contingency planning into the core of their supply chain and financial forecasting.

Key CEO quote on trade-related uncertainty

“Our second quarter was characterized by a high degree of economic uncertainty in light of ongoing geopolitical tensions and unresolved global tariff discussions.”

Christian Kohlpaintner, CEO, Brenntag SE, August 13, 2025

3. Recession

Recession discussions sharply receded. Mentions of recession dropped 81% QoQ to 3% of calls in Q3. This is the topic’s lowest level in 2025 after a 343% QoQ surge in Q2 2025 and suggests a shift in the macroeconomic outlook among top executives.

Key CEO quote on recession

“I think, you know, you actually are seeing a little bit of strength in the economy that we haven’t had. We’ve talked about kind of an industrial recession over the last probably five or six quarters, and I think that’s largely kind of dissipated […].”

Jim Fish, CEO, Waste Management, Inc., August 7, 2025

What it means for CEOs

- Are our tariff responses still fit for Q3 conditions? Tariffs remain the most cited topic. Recheck pricing, supplier mix, and mitigation strategies (e.g., dual sourcing, nearshore options).

- Are we set to win the AI talent race? Demand is rising fast. Check on the plan to hire, upskill, and retain AI engineers, data scientists, and product owners. Identify which roles need to be filled immediately. Do we have partnerships that can fill a potential gap at this time?

- Do we have measurable ROI from AI and agents today? AI mentions hit a new high, with agentic AI rising fast. Prioritize use cases with tracked outcomes, tighten governance, and plan skills and hiring where needed.

- What is our automation and robotics roadmap for 12 months? Interest in robotics (including humanoids) is growing. Identify pilot lines, define safety and change management steps, and establish simple ROI gates for scale-up.

- Should we stress-test demand planning and capacity to handle sudden demand fluctuations now? Add weekly leading indicators (orders, cancellations, and channel inventory). Pre-approve flex capacity and overtime rules. Trim long-tail SKUs. Tighten pricing guardrails for rapid moves up or down.

CEO digital agenda (Insights+)

Access key market data for $99/month per user

The Insights+ Subscription unlocks exclusive facts & figures. You will gain access to:

- Additional analyses derived directly from our reports, databases, and trackers

- An extended version of each research article not available to the public

Full report access not included. For enterprise offerings, please contact sales: sales@iot-analytics.com

Disclosure

Companies mentioned in this article—along with their products—are used as examples to showcase market developments. No company paid or received preferential treatment in this article, and it is at the discretion of the analyst to select which examples are used. IoT Analytics makes efforts to vary the companies and products mentioned to help shine attention to the numerous IoT and related technology market players.

It is worth noting that IoT Analytics may have commercial relationships with some companies mentioned in its articles, as some companies license IoT Analytics market research. However, for confidentiality, IoT Analytics cannot disclose individual relationships. Please contact compliance@iot-analytics.com for any questions or concerns on this front.

More information and further reading

Related publications

You may also be interested in the following reports:

- Digital and ESG Regulations Outlook 2025-2030

- Industrial AI Market Report 2025-2030

- Digital & AI in Industrial Robotics Insights Report 2025

Related articles

You may also be interested in the following articles:

- 2025 regulatory landscape: 40+ digital & ESG laws to have on the radar

- Industrial AI market: 10 insights on how AI is transforming manufacturing

Sign up for our research newsletter and follow us on LinkedIn to stay up-to-date on the latest trends shaping the IoT markets. For complete enterprise IoT coverage with access to all of IoT Analytics’ paid content & reports, including dedicated analyst time, check out the Enterprise subscription.