Wireless IoT Connectivity Chipset Market Report 2025-2030

(see all)

Questions answered

- What are wireless IoT connectivity chipsets, and how are they classified? (i.e., definition and types of IoT connectivity chipsets)

- What does the competitive landscape for wireless IoT connectivity chipsets look like?

- What are the market shares of leading vendors across cellular IoT, Wi-Fi IoT, and Bluetooth IoT segments?

- What is the current and forecasted market size for the cellular IoT, Wi-Fi IoT, Bluetooth IoT, and unlicensed LPWA market?

- What regional dynamics shape the wireless IoT connectivity market?

- What are the emerging trends in the wireless IoT connectivity market?

Table of Contents

Wireless IoT Connectivity Chipset Market Report 2025–2030 (PDF)

- Executive summary

- Introduction

- Chapter overview: Introduction

- Starting point: The number of IoT connected devices continues to grow

- The semiconductor density within each device also continues to increase

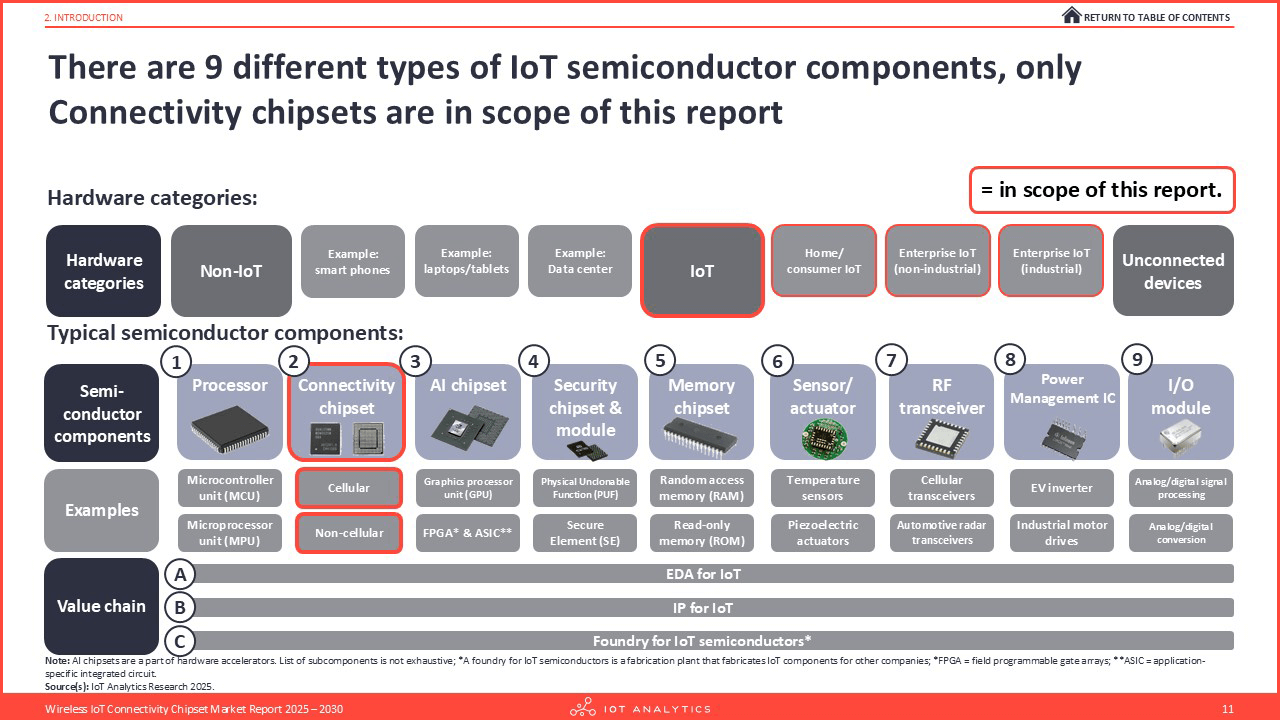

- There are 9 different types of IoT semiconductor components, only Connectivity chipsets are in scope of this report

- Definitions (1/6): Semiconductors & IoT semiconductors

- Definitions (2/6): Processors

- Definitions (3/6): Connectivity chipsets

- Definitions (4/6): Al chipsets

- Definitions (5/6): Security chipsets

- Definitions (6/6): Other key components

- Big picture: The IoT semiconductor market

- Chapter overview: Big picture – The IoT semiconductor market

- Overview: The general IoT semiconductor market is split into 2 parts

- Part 1: IoT semiconductor components – Spending by type

- Part 2: Enhanced IoT semiconductor value chain – Spending by value chain segment

- Overall IoT semiconductor competitive landscape

- Importance of IoT as a segment within several chip companies

- 5 overarching trends impacting IoT semiconductors

- Overarching trend 1 (3 parts)

- Overarching trend 2

- Overarching trend 3 (2 parts)

- Overarching trend 4 (4 parts)

- Overarching trend 5 (2 parts)

- Recent announcements for new semiconductor plants

- Methodology: Mapping IoT-related business – TSMC

- IoT connectivity chipsets: Overview

- Chapter overview: IoT connectivity: Overview

- IoT connectivity chipsets: Overview of the main standards

- IoT connectivity chipsets: Cellular (6 parts)

- IoT connectivity chipsets: Non-cellular – Wired (2 parts)

- IoT connectivity chipsets: Non-cellular – Wireless (6 parts)

- Global semiconductor component spending: IoT connectivity chipsets vs other semiconductor components (2020-2030)

- Global IoT connectivity chipset market spending

- Global IoT connectivity chipset market spending by technology

- Overall IoT semiconductor competitive landscape

- Key company profile: Qualcomm (6 parts)

- Key company profile: Broadcom (3 parts)

- IoT connectivity chipsets: Cellular IoT

- Chapter overview: IoT connectivity chipsets: Cellular IoT

- Global cellular IoT chipset spending 2020-2030-Overview

- Analyst commentary on the cellular IoT market

- Global cellular IoT chipset spending 2020-2030-By technology

- Global cellular IoT chipset spending 2020-2030-By region

- Global cellular IoT chipset spending 2020-2030-By industry vertical

- Global cellular IoT chipset shipments 2020-2030-Overview

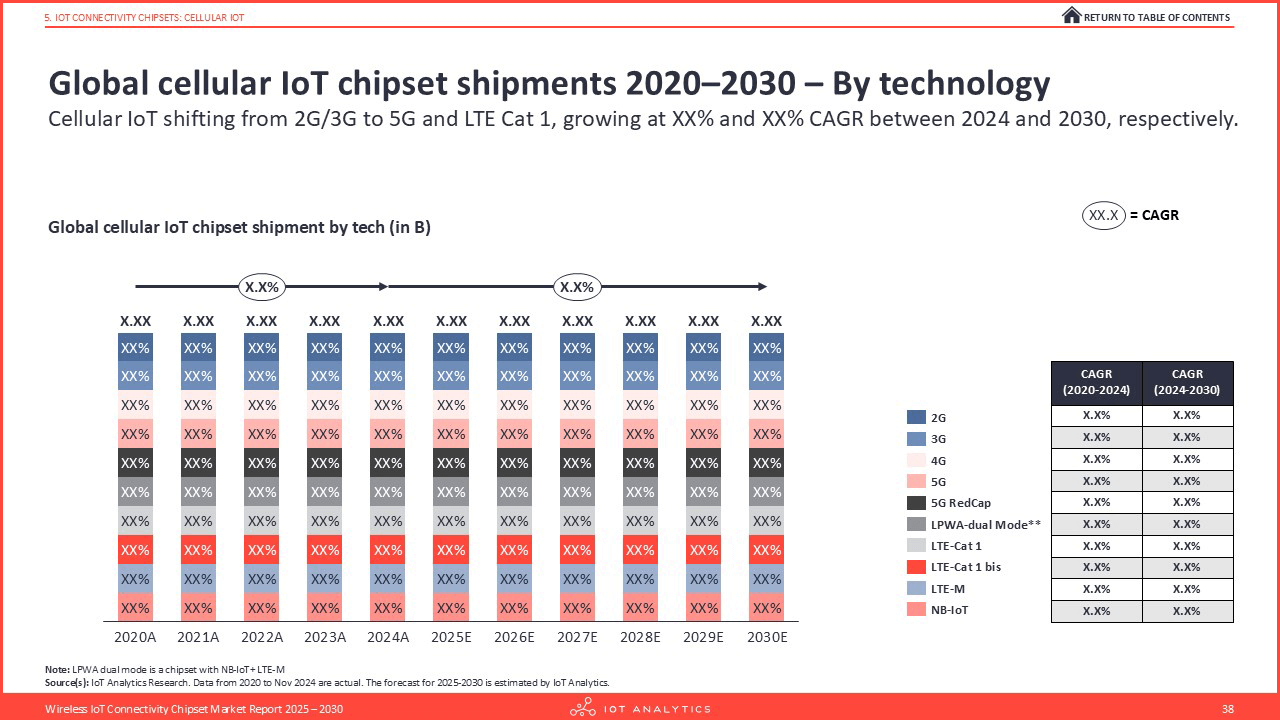

- Global cellular IoT chipset shipments 2020-2030-By technology

- Global cellular IoT chipset shipments 2020-2030-By region

- Global cellular IoT chipset shipments 2020-2030-By industry vertical

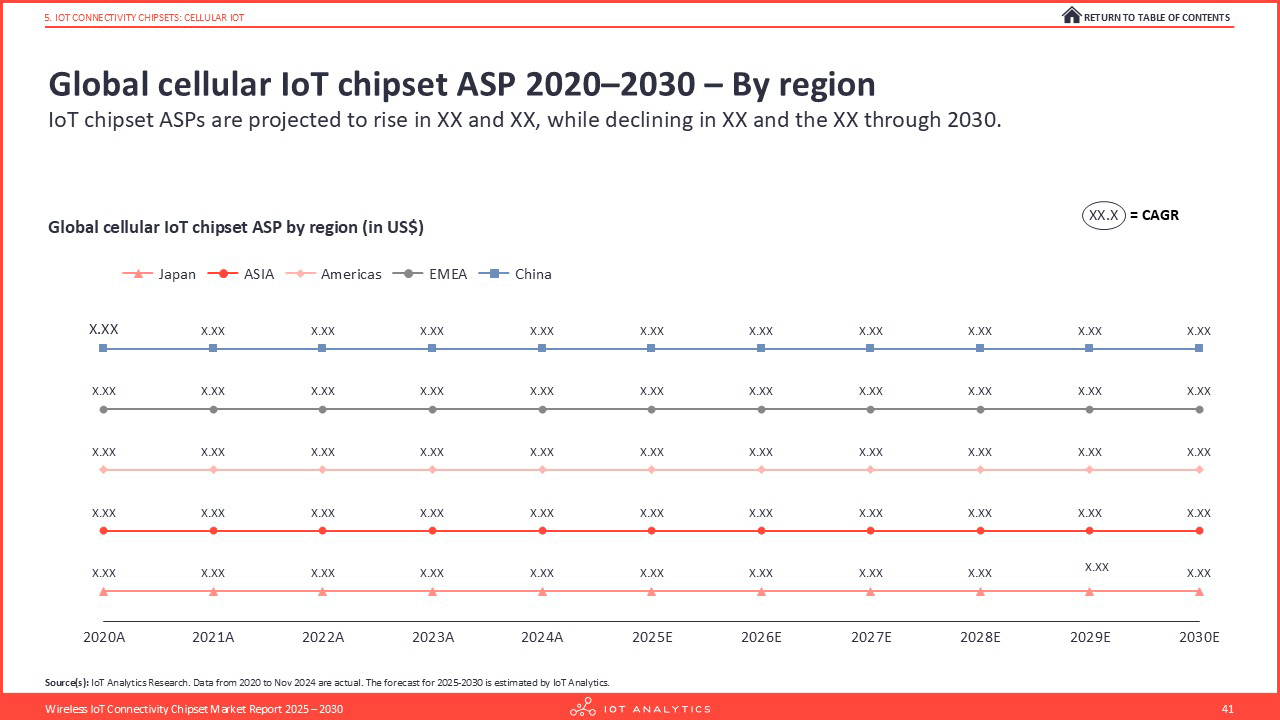

- Global cellular IoT chipset ASP 2020-2030-By region

- Cellular IoT chipsets competitive landscape (1/4): Market share of key vendors (based on revenue)

- Cellular IoT chipsets competitive landscape (2/4): Historical and expected market performance (based on revenue)

- Cellular IoT chipsets competitive landscape (3/4): Market share of key vendors (based on shipments)

- Cellular IoT chipsets competitive landscape (4/4): Historical and expected market performance (based on shipments)

- Cellular IoT chipset trend 1

- Cellular IoT chipset trend 2

- Cellular IoT chipset trend 3

- Cellular IoT chipset trend 4

- Cellular IoT chipset trend 5 (2 parts)

- IoT connectivity chipsets: Unlicensed LPWA

- Chapter overview: IoT connectivity chipsets: Unlicensed LPWA

- Global unlicensed LPWA chipset spending 2020-2030-Overview

- Analyst commentary on the unlicensed LPWA market

- Global unlicensed LPWA chipset spending 2020-2030-By technology

- Global unlicensed LPWA chipset shipments 2020-2030-Overview

- Global unlicensed LPWA chipset shipments 2020-2030-By technology

- Global unlicensed LPWA chipset ASP 2020-2030-By technology

- Unlicensed LPWA chipset trend 1

- Unlicensed LPWA chipset trend 2

- Unlicensed LPWA chipset trend 3

- Unlicensed LPWA chipset trend 4

- IoT connectivity chipsets: Wi-Fi IoT

- Chapter overview: IoT connectivity chipsets: Wi-Fi IoT

- Global Wi-Fi IoT chipset spending 2020-2030-Overview

- Global Wi-Fi IoT chipset shipments 2020-2030-Overview

- Global Wi-Fi IoT chipset ASP 2020-2030-Overview

- Analyst commentary on the Wi-Fi IoT market

- Global Wi-Fi IoT chipset spending 2020-2030-By region

- Wi-Fi IoT chipsets competitive landscape (1/2): Market share of key vendors (based on revenues)

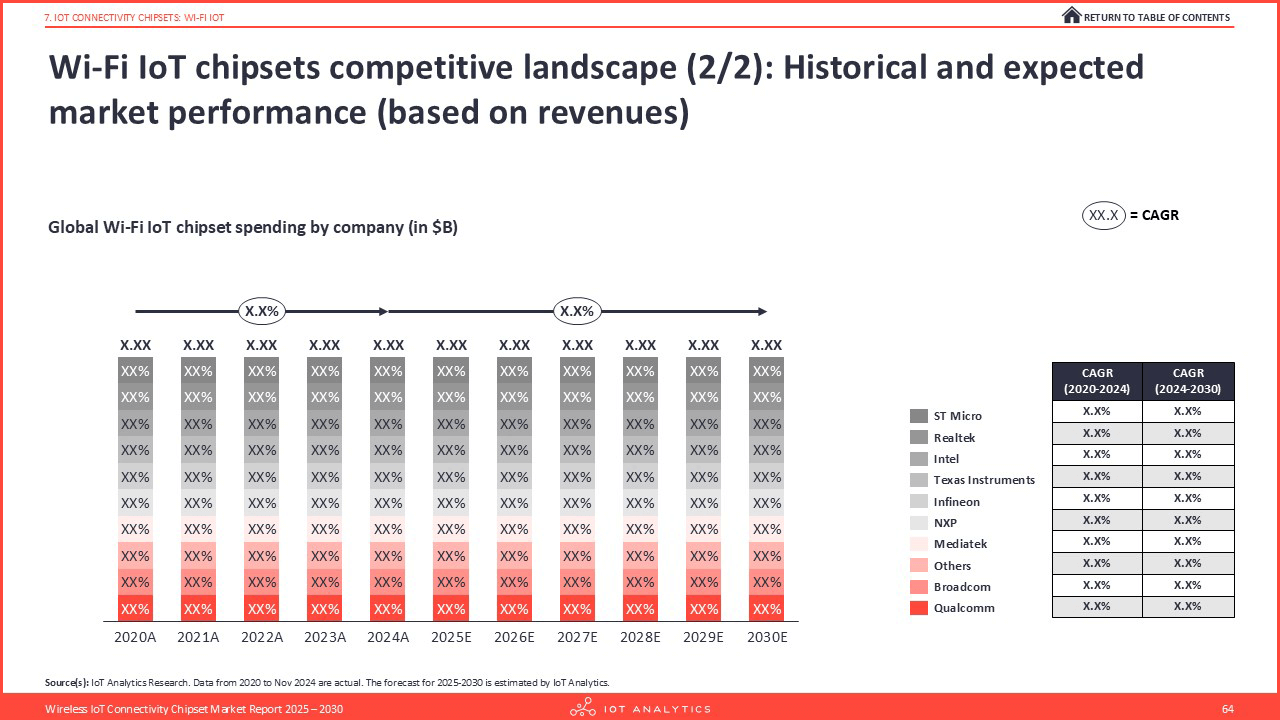

- Wi-Fi IoT chipsets competitive landscape (2/2): Historical and expected market performance (based on revenues)

- Wi-Fi IoT chipset trend 1

- Wi-Fi IoT chipset trend 2

- IoT connectivity chipsets: Bluetooth IoT

- Chapter overview: IoT connectivity chipsets: Bluetooth IoT

- Global Bluetooth IoT chipset spending 2020-2030-Overview

- Global Bluetooth IoT chipset shipments 2020-2030-Overview

- Global Bluetooth IoT chipset ASP 2020-2030-Overview

- Analyst commentary on the Bluetooth IoT market

- Global Bluetooth IoT chipset spending 2020-2030-By region

- Bluetooth IoT chipsets competitive landscape (1/2): Market share of key vendors (based on revenues)

- Bluetooth IoT chipsets competitive landscape (2/2): Historical and expected market performance (based on revenues)

- Bluetooth IoT chipset trend 1

- Methodology & market definitions

- Market category definitions (2 parts)

- Other definitions (2 parts)

- Country mappings to regions (3 parts)

- Research Methodology

- Methodology: How individual companies were analyzed

- About IoT Analytics

- About IoT Analytics

- Other publications by IoT Analytics

- Information and contact

Companies mentioned

A selection of companies mentioned in the report.

ASR

Broadcom

Hisilicon

Infineon

Intel

Mediatek

NXP

Qualcomm

Realtek

Renesas

ST Micro

Sequans

Sony Altair

Texas Instruments

UNISOC

XINYI

About the report

The number of connected IoT devices continues to grow, with rising semiconductor value per device. Each IoT device typically contains up to nine semiconductor components. This report focuses on connectivity chipsets, which enable wireless communication across cellular and non-cellular networks.

This report provides an in-depth analysis of the wireless IoT connectivity chipset market, focusing on four core technology segments: Cellular IoT, Unlicensed LPWA, Wi-Fi IoT, and Bluetooth IoT. It offers a structured view of market size and forecast, competitive dynamics, and the key technology developments shaping each segment.

The analysis is grounded in primary research, including interviews with experts from chipset vendors and end-user organizations. These insights are supported by extensive secondary research and observations from major industry trade events.

Report at a glance

- 156-page report: Detailing the wireless IoT connectivity chipset market with a 5-year forecast.

- 4 technology deep dives: A structured analysis of Cellular IoT, Wi-Fi IoT, Bluetooth IoT, and Unlicensed LPWA.

- 12+ technology trends analyzed: Examination of key developments, including 5G RedCap, LTE Cat-1 bis, energy harvesting, and Wi-Fi 7 adoption.

- Vendor market share analysis: A breakdown of the competitive landscape for cellular, Wi-Fi, and Bluetooth IoT chipset markets.

Key areas of analysis

- IoT semiconductor market overview: Defines nine types of IoT semiconductor components and sizes the general IoT semiconductor market and its enhanced value chain (foundries, EDA, IP). It also outlines five overarching trends impacting the industry: AI integration, hardware security, geopolitical dynamics, strategic national investments, and supply chain diversification.

- IoT connectivity technology overview: Details 24 main standards across cellular and non-cellular technologies, including legacy, broadband, and licensed LPWA for cellular, and wired, WPAN, unlicensed LPWA, WLAN, and satellite for non-cellular.

- Cellular IoT deep dive: Analyzes the market for cellular IoT chipsets, including spending, shipments, and average selling price (ASP), with forecasts to 2030. It provides breakdowns by technology, region, and industry vertical and details five key trends, such as the introduction of 5G RedCap and the growth of LTE Cat-1 bis

- Unlicensed LPWA deep dive: Examines the market for unlicensed LPWA chipsets, covering market spending, shipments, and ASP by technology. It discusses four key trends, including energy harvesting for battery-free devices and the convergence of LPWAN and satellite connectivity.

- Wi-Fi IoT deep dive: Details the market for Wi-Fi IoT chipsets, with analysis of spending, shipments, and ASP, alongside a regional breakdown. The competitive landscape is outlined, as are key trends such as low-power Wi-Fi modules and the expansion of Wi-Fi 7.

- Bluetooth IoT deep dive: Presents an analysis of the Bluetooth IoT chipset market, including spending, shipments, and ASP, with a regional breakdown. It covers the competitive landscape and the trend toward dual-mode Wi-Fi & Bluetooth modules for optimized connectivity.

A data-driven foundation for key business functions

- Strategy & corporate development: Inform long-term strategy with market forecasts, regional growth analysis, and insights into the five overarching trends shaping the semiconductor industry, from geopolitics to supply chain diversification.

- Product management & marketing: Shape product roadmaps with detailed analysis of technology adoption (e.g., 5G RedCap vs. LTE Cat-1 bis), competitive landscapes for each connectivity segment, and emerging use cases driven by new standards.

- R&D & engineering leadership: Direct technical priorities with insights into key trends like low-power chipset design, multi-protocol integration.

- Market intelligence & competitive analysis: Benchmark company performance with granular market share data for cellular IoT, Wi-Fi IoT, and Bluetooth IoT chipsets, alongside profiles of key vendors’ product portfolios and R&D focus areas.

Key concepts defined

- IoT semiconductor: Specialized semiconductor-based components that provide the core functionality and connectivity of IoT devices, including processing, communication, sensing/actuating, power management, and security. The report categorizes these components based on their intended use at the “design stage” of a product’s life cycle.

- IoT connectivity chipset: An IoT connectivity chipset is a radio SoC or baseband transceiver embedded in an IoT device, either directly or via a communication module, that enables and manages wired or wireless connectivity. It supports communication over technologies such as cellular (2G–5G, NB-IoT, LTE-M), Wi-Fi, Bluetooth, Zigbee, Thread, LoRa, or Ethernet, allowing the device to connect and exchange data within the IoT ecosystem.

- Cellular IoT chipset: A cellular IoT chipset is a radio SoC or a baseband/transceiver solution embedded in an IoT device, either directly or via a communication module, that enables and manages connectivity over licensed cellular networks. It supports technologies such as 2G, 3G, 4G (LTE, LTE-M, NB-IoT, Cat-1 bis) and 5G (RedCap, eRedCap) to facilitate wide-area IoT communication.

- Wi-Fi IoT chipset: A Wi-Fi IoT chipset is a radio SoC or a transceiver embedded in an IoT device, either directly or via a module, that enables wireless local-area connectivity using Wi-Fi standards such as Wi-Fi 4, 5, 6, 6E, 7, or 802.11ah (HaLow).

- Bluetooth IoT chipset: A Bluetooth IoT chipset is a radio SoC or a transceiver solution embedded in an IoT device, either directly or through a module, that provides short-range wireless communication based on Bluetooth Classic, Bluetooth Low Energy (BLE), or Bluetooth Mesh standards for applications such as lighting and building controls. It excludes chipsets primarily used for consumer audio applications.

- Unlicensed LPWA chipset: An unlicensed LPWA (Low-Power Wide-Area) chipset is a radio SoC or a transceiver solution embedded in an IoT device, either directly or via a module, that enables long-range, low-power connectivity over unlicensed spectrum technologies such as LoRa, LoRaWAN, or mioty. It supports both public and private network deployments and is designed for IoT applications requiring low data throughput, extended battery life, and wide coverage.

Related reading

A research article based on this report:

- State of IoT 2025: Number of connected IoT devices growing 14% to 21.1 billion globally

- Wi-Fi IoT chipset market: Spending expected to grow to $4.8 billion by 2030 as new standards improve efficiency, reliability, and range

- Bluetooth IoT chipset market: $14.2 billion by 2030 as BLE adoption and RTLS drive growth

- 6 IoT semiconductor predictions for 2026

→Sign up for the newsletter to be notified of future releases

Our insights are trusted by global industry leaders

Single User License

- 1 named user within a particular department and country

- Complete market report in PDF

- Market data in PDF (graphs within the report)

- Market model data in EXCEL

- Complete market report in PPTX

- 1 hour discussion with the analyst team

Team User License

- 1–5 named users within a particular department and country

- Complete market report in PDF

- Market data in PDF (graphs within the report)

- Market model data in EXCEL

- Complete market report in PPTX

- 1 hour discussion with the analyst team

Enterprise Premium License

- Report may be distributed to all employees of the enterprise

- Complete market report in PDF

- Market data in PDF (graphs within the report)

- Market model data in EXCEL

- Complete market report in PPTX

- 1 hour discussion with the analyst team

Get your free sample

Download the sample to learn more about:

- Report structure

- Select definitions

- Scope of research

- Market data

- Companies included

- Additional data points

Any questions?

Get in touch with us easily. We are happy to help!

Prajwal Praveen

Senior Sales Manager

Phone: +49 (0) 408 221 1722

Email: sales@iot-analytics.com