In short

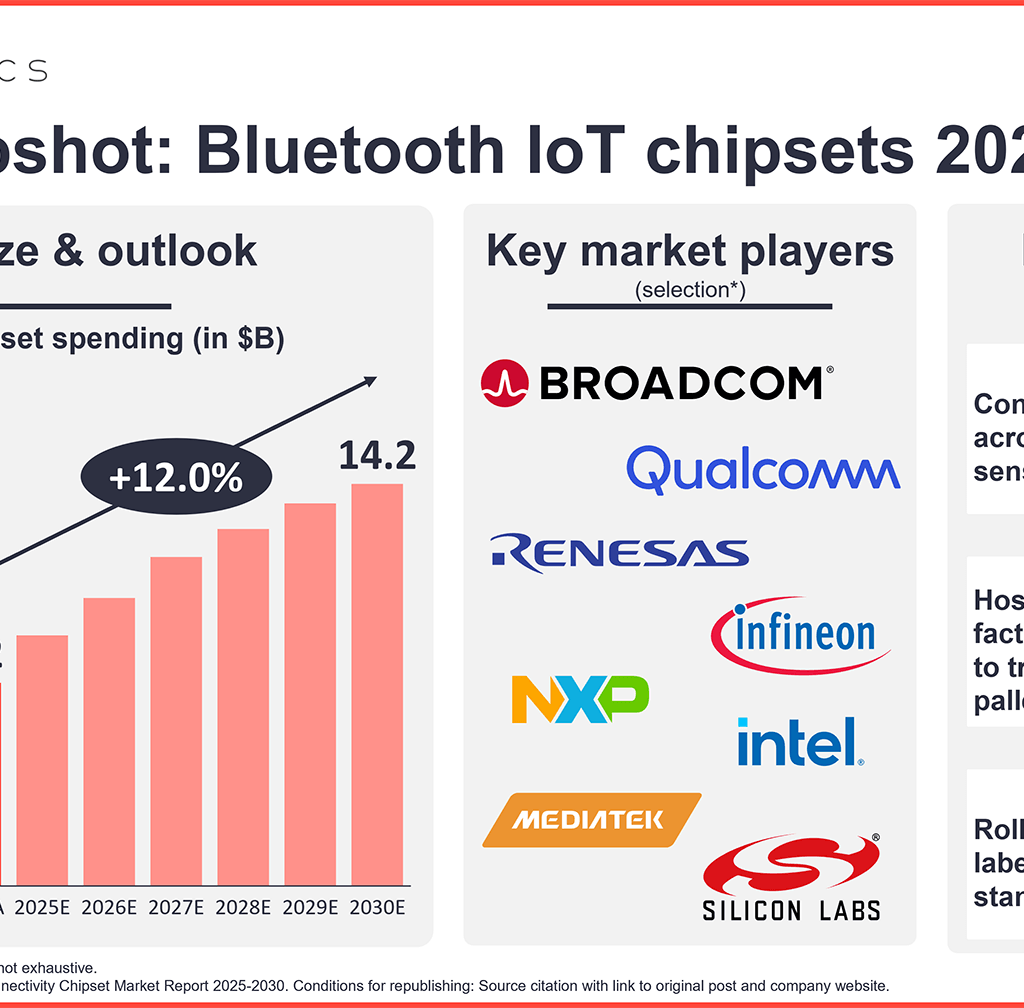

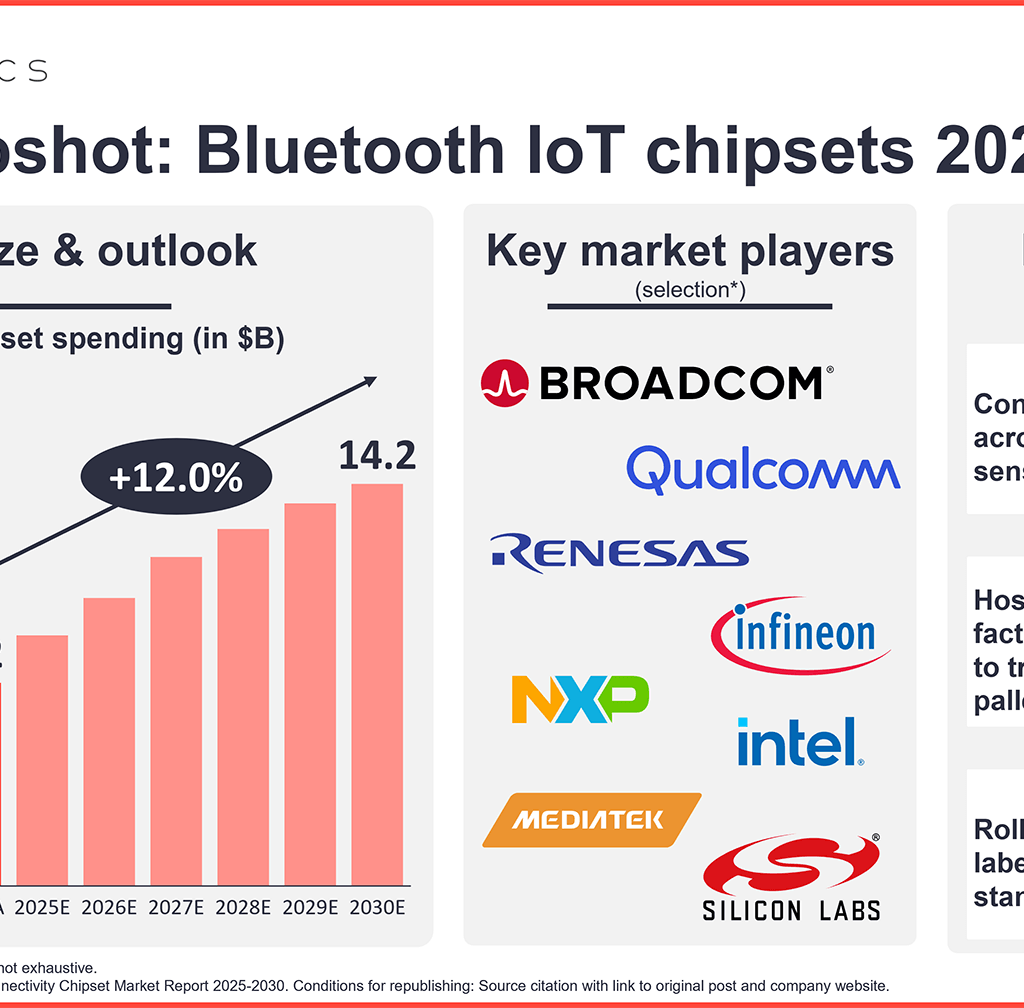

- The Bluetooth IoT chipset market reached $7.2 billion in 2024 and is expected to reach $14.2 billion by 2030, according to IoT Analytics’ 156-page Wireless IoT Connectivity Chipset Market Report 2025–2030.

- The top 3 drivers of this growth are 1) continued BLE integration across cost- and power-sensitive IoT devices, 2) hospitals, warehouses, and factories adopting BLE RTLS to track patients, equipment, pallets, and tools, and 3) large-scale Bluetooth IoT projects rolling out in retail.

In this article

- Bluetooth IoT chipset market snapshot and outlook

- Bluetooth IoT chipset market drivers

- 1. Continued BLE integration across cost- and power-sensitive IoT devices

- 2. Hospitals, warehouses, and factories adopting BLE RTLS to track patients, equipment, pallets, and tools

- 3. Roll-out of electronic shelf labels using the Bluetooth 5.4 standard

- Bluetooth IoT chipset spending by region (Insights+ exclusive)

- Bluetooth IoT chipset competitive landscape (Insights+)

Bluetooth IoT chipset market snapshot and outlook

Bluetooth IoT chipset market growth to slow but still surpass $14 billion in 2030. Market spending on Bluetooth IoT chipsets reached $7.2 billion in 2024 and is forecast to reach $8.88 billion in 2025, according to IoT Analytics’ 156-page Wireless IoT Connectivity Chipset Market Report 2025–2030 (published October 2025). According to the report, the market is projected to grow at 9.9% CAGR until 2030, reaching $14.24 billion. While this growth rate is significantly lower than the 26% CAGR between 2020 and 2024, it reflects maturity in core IoT markets such as wearables, audio, and smart homes.

Several drivers are set to propel enterprise Bluetooth IoT chipset spending, as discussed below.

Insights from this article are derived from

Wireless IoT Connectivity Chipset Market Report 2025-2030

A 156-page report on the wireless IoT chipset market with forecast. Details market sizing (spending, shipments, ASP), vendor shares, and technology trends across cellular, Wi-Fi, Bluetooth, and unlicensed LPWA segments.

Already a subscriber? View your reports and trackers here →

Bluetooth IoT chipset market drivers

1. Continued BLE integration across cost- and power-sensitive IoT devices

BLE SoCs and MCUs drive device efficiency. New Bluetooth Low Energy (BLE)-integrated systems-on-chips (SoCs) and microcontroller units (MCUs) reduce costs and power consumption in sensors, locks, meters, remotes, toys, and medical patches. BLE remains the local interface for provisioning and diagnostics on devices that backhaul via LoRaWAN or cellular. Examples of SoCs and MCUs with BLE integration include Norway-based Nordic’s nRF54-class SoCs, US-based Silicon Labs’ EFR32BG27-class SoCs, and US-based Texas Instruments’ CC23xx-class MCUs.

2. Hospitals, warehouses, and factories adopting BLE RTLS to track patients, equipment, pallets, and tools

Bluetooth enables precise indoor tracking demand. Channel Sounding, a Bluetooth feature that enables secure, fine-level distance measurement between devices, delivers 1–2 m distance awareness for access control and indoor location tracking. This is particularly useful in hospitals, warehouses, and factories to track patients, equipment, pallets, and tools. Automotive digital keys also use BLE with secure ranging, in addition to ultra-wideband (or UWB) technology. Further, gateways, anchors, scanners, and handheld devices drive demand for Bluetooth chipsets beyond just tags.

3. Large-scale Bluetooth IoT projects rolling out in retail

Bluetooth 5.4 expected to become the standard for electronic shelf labels (ESLs). BLE Periodic Advertising with Responses (PAwR), introduced with Bluetooth 5.4 in early 2023, enables large star networks and reliable two-way updates during brief scheduled wake windows, extending sleep time between updates. This application is ideal for electronic shelf labels, with national programs in North America and Europe being rolled out across the entire chain. Examples include Walmart (US), Carrefour (EU), and Sobeys (Canada), which have multi-year, multi-store deployments. IoT Analytics estimates peak annual additions of tens of millions of labels during 2026–2028, which lifts units while lowering the blended average selling price.

Large-scale, energy-efficient pallet-tracking is rolling out in retail. In 2025, Walmart and Israel-based supply chain IoT startup Wiliot began deploying battery-free ambient IoT sensors across Walmart’s large US supply chain to track pallets nationwide. When the sensors are fully deployed (estimated by the end of 2026), an estimated 90 million pallets of inventory will have real-time insights, including location and conditions.

Bluetooth IoT chipset spending by region (Insights+)

Access key market data for $99/month per user

The Insights+ Subscription unlocks exclusive facts & figures. You will gain access to:

- Additional analyses derived directly from our reports, databases, and trackers

- An extended version of each research article not available to the public

Full report access not included. For enterprise offerings, please contact sales: sales@iot-analytics.com

Disclosure

Companies mentioned in this article—along with their products—are used as examples to showcase market developments. No company paid or received preferential treatment in this article, and it is at the discretion of the analyst to select which examples are used. IoT Analytics makes efforts to vary the companies and products mentioned to help shine attention on the numerous IoT and related technology market players.

It is worth noting that IoT Analytics may have commercial relationships with some companies mentioned in its articles, as some companies license IoT Analytics market research. However, for confidentiality, IoT Analytics cannot disclose individual relationships. Please contact compliance@iot-analytics.com for any questions or concerns on this front.

More information and further reading

Related publications

You may also be interested in the following reports:

- Global Cellular IoT Connectivity Tracker and Forecast

- Cellular IoT Module and Chipset Market Tracker & Forecast

Sign up for our research newsletter and follow us on LinkedIn to stay up-to-date on the latest trends shaping the IoT markets. For complete enterprise IoT coverage with access to all of IoT Analytics’ paid content & reports, including dedicated analyst time, check out the Enterprise subscription.