The Industry 4.0 & Smart Manufacturing 2018-2023 report details the $310B market opportunity

PRESS RELEASE: Hamburg, Germany – 14 November 2018 //

IoT Analytics, a leading provider of market insights & competitive intelligence for the Internet of Things (IoT), M2M, and Industry 4.0, today published a comprehensive 375-page market report titled Industry 4.0 & Smart Manufacturing 2018-2023.

The report, which was compiled over the course of 18+ months, is a holistic compendium that analyzes 350+ related product offerings, details 38 case studies, and describes a total of 79 trends. It serves as a strategic guideline and strong foundation for any company aiming to make sense of what is happening at the intersection of digitalization and the manufacturing sector today and in the coming 5 years.

The term Industry 4.0 (I4.0) has become a global term to describe the 4th industrial revolution. Unlike the prior industrial revolutions, this revolution is not built around a single technology, but rather the combination of multiple technologies that forward-thinking manufacturers are implementing to realize key use cases that are improving efficiencies, creating new revenue streams, and reducing risks.

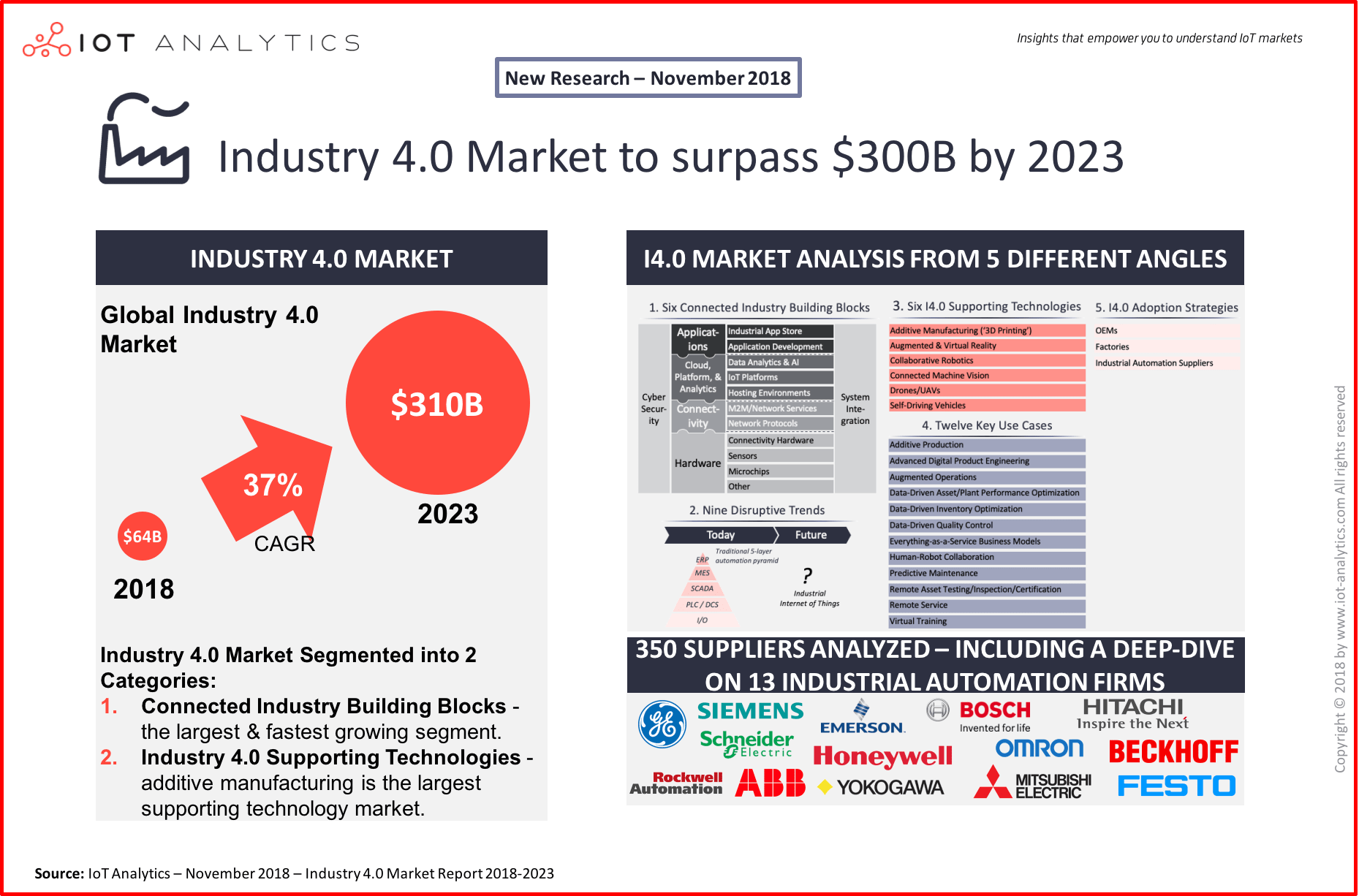

The market for Industry 4.0 products and services is expected to grow to $310B by 2023. These numbers are based on the state of I4.0 adoption across manufacturing verticals and the analysis of two distinct technological subsets of the I4.0 market: the connected industry building blocks and other I4.0 supporting technologies.

The connected industry building blocks subset of the I4.0 market is further broken down into the 6 building blocks (hardware, connectivity, cloud platform & analytics, applications, cybersecurity, system integration), and 7 regions (North America, Europe, Asia, Middle East & Africa, Oceania, South America, Other). The I4.0 supporting technologies subset of the I4.0 market is further broken down into the 6 supporting technologies (additive manufacturing [3D printing], augmented and virtual reality [AR & VR], collaborative robots, connected machine vision, drones / UAVs, self-driving vehicles [SDVs]).

Every connected industry building block and supporting technology is explored in-depth, and an Excel database of 350+ companies categorized by I4.0 offering is included with the enterprise version of the report.

Key findings from the report include 9 disruptive trends that have the potential to fundamentally change existing industrial network architectures, business models, and technology stacks. Three of the nine disruptive trends relate to the traditional 5-layer automation pyramid. One such trend is for I/O and PLC hardware to bypass the traditional automation pyramid and instead connect to the cloud either directly or via industrial gateways.

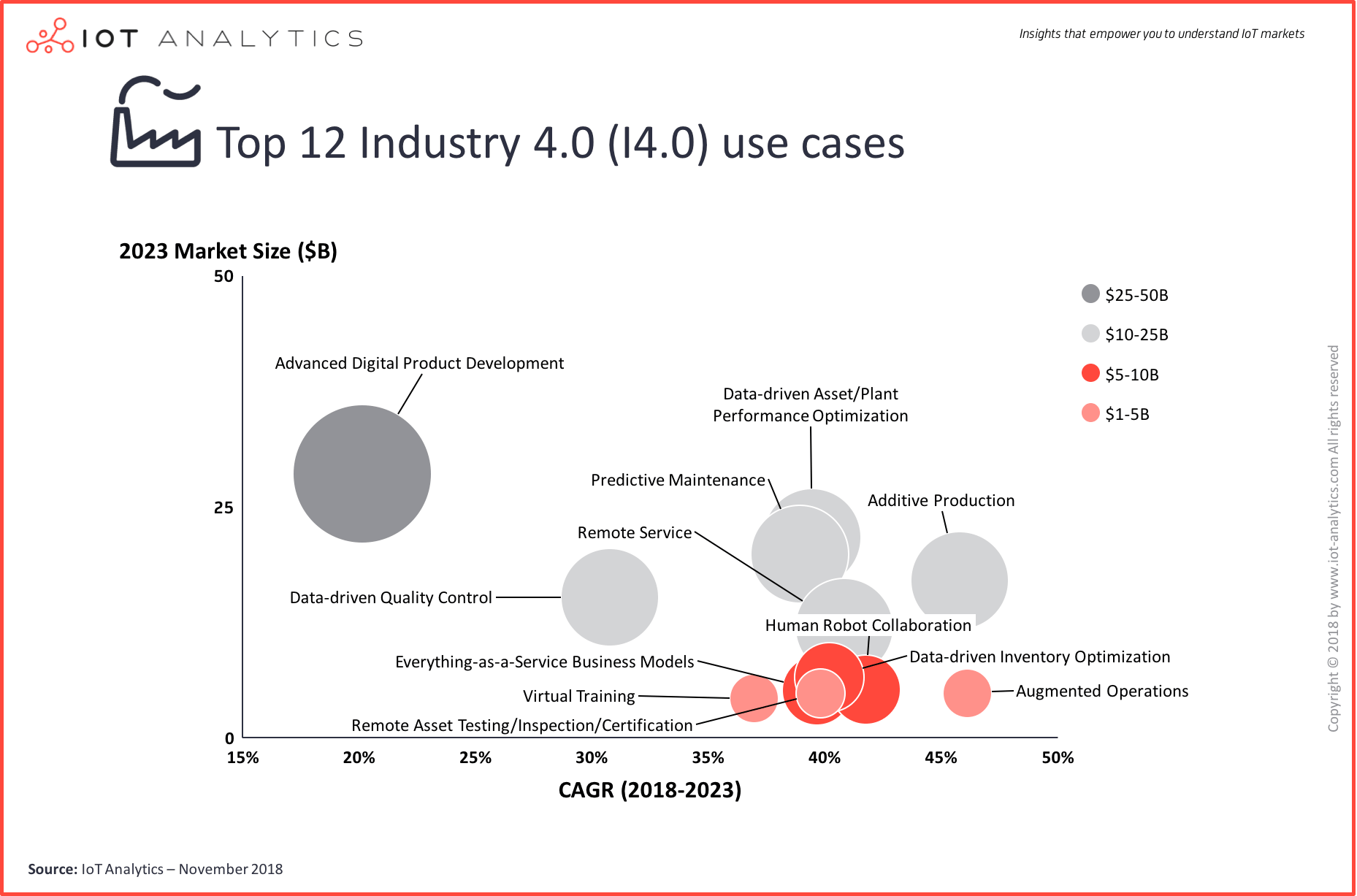

The report also ranks and analyzes the 12 most popular I4.0 use cases, the largest of which is advanced digital product development.

Each use case is accompanied by at least 2 detailed case studies, for a total of 38 detailed case studies featuring 50+ end users and I4.0 suppliers.

Matthew Wopata, main author of the report and IoT Analytics’ lead expert for Industrial IoT said:

“Advanced digital product development emerged as the largest use case for I4.0 technologies as companies are using additive manufacturing, AR/VR, and digital twin technologies to reduce product development costs and time to market. Other large use cases such as data-driven quality control, predictive maintenance, and data-driven asset/plant performance optimization will continue to grow in popularity as manufacturers use I4.0 technologies to improve their operational KPIs, such as OEE. The leading vendors of I4.0 solutions are hyper-focused on customer pain points / use cases and ensure that the data-driven insights generated from I4.0 solutions lead to measurable improvements and tangible ROIs.”

The report also analyzes the I4.0 adoption strategies of 3 types of companies that are affected by I4.0: OEMs, factories, and industrial automation suppliers. The OEM adoption strategy analysis explores the relative maturity of IoT projects in 29 different industries. The factory adoption strategy analysis, among other things, highlights the “smart factory” strategies of 5 different companies/institutions. Another part of the I4.0 adoption strategies section includes an analysis of 13 leading industrial automation suppliers, of which 5 of the largest suppliers are ranked based on their overall I4.0 readiness, which considers investments and product offerings in I4.0 technologies.

In developing the 375-page report, the analyst team studied over 350 companies that offer I4.0 products and services and attended 25+ leading IoT and I4.0 conferences (e.g., Hannover Messe, SPS IPC Drives, IoT Solutions World Congress, IOTHINGS, Bosch ConnectedWorld, Industry of Things World, Internet of Manufacturing, IoT Tech Expo, IoT World, Hitachi NEXT, PTC Liveworx, Siemens Analyst Day, etc.). Further insights for the report were gleaned from interviews of 100+ experts covering a variety of I4.0 technologies and industries.

Commenting on the findings, IoT Analytics Managing Director Knud Lasse Lueth said:

“It is exciting to see that the 4th industrial revolution is well underway. Nevertheless, there is still a lot of confusion in the market regarding use cases, technologies and strategic priorities going forward. We have taken quite some time to provide a holistic view and identify the leading use cases, technologies, and trends. Whether it is the virtualization of PLCs, the evolving components of the smart factory of the future, or the developing IoT software landscape – it is fascinating to just see the sheer number of different developments that are happening right now.”

The Market Report is available to download HERE, and a sample of the market report can be downloaded HERE.

About IoT Analytics

IoT Analytics is the leading provider of market insights & competitive intelligence for the Internet of Things (IoT), M2M, and Industry 4.0. The specialized data-driven research firm helps more than 40,000 Internet of Things decision-makers understand IoT markets every month. IoT Analytics tracks important data around the IoT ecosystem such as M&A activity, Startup funding, company projects, use cases and latest developments. Product offerings include in-depth market reports, technical whitepapers, sponsored research, regular newsletter, as well as Go2Market and consulting services. As a research pioneer, IoT Analytics combines traditional methods of market research such as interviews and surveys with state-of-the art web-mining tools to generate high-caliber insights. IoT Analytics is headquartered in Hamburg, Germany.

Industry 4.0 & Smart Manufacturing 2018-2023 Market Report Structure

1 Executive Summary

1.1 Overall Highlights

1.2 Market Analysis

1.3 Key Use Case Analysis

1.4 Nine Disruptive Trends

1.5 I4.0 Adoption Strategies

2 Introduction

2.1 History of Industry 4.0

2.2 Elements of Industry 4.0

3 Industry 4.0 Market Analysis 2018-2023

3.1 Overall I4.0 Market

3.2 Connected Industry Building Blocks Market

3.2.1 By Connected Industry Building Block

3.2.2 By Region

3.2.3 Regional deep-dive: North America

3.2.4 Regional deep-dive: Europe

3.2.5 Regional deep-dive: Asia

3.2.6 Regional deep-dive: Other

3.3 Supporting Technologies Market

4 Connected Industry Building Blocks

4.1 Hardware

4.1.1 Microchips

4.1.2 Sensors

4.1.3 Connectivity Hardware

4.2 Connectivity

4.2.1 Network Protocols

4.2.2 M2M/Network Services

4.3 Cloud, Platform, & Analytics

4.3.1 Hosting Environment

4.3.2 IoT Platforms

4.3.3 Data Analytics & AI

4.4 Applications

4.4.1 Application Development and AEPs

4.4.2 Industrial App Store & Distribution Methods

4.5 System Integration

4.6 Cyber Security

4.6.1 IT vs. OT Security

4.6.2 Overview of IoT Attack Surfaces

4.6.3 Common IoT Threats

4.6.4 Recent I4.0 Related Attacks

4.6.5 Industry 4.0 Trends

4.6.6 Leading Suppliers

5 Disruptive Trends

5.1 Trends Disrupting the 5-Layer Automation Pyramid

5.1.1 Trend 1: xx

5.1.2 Trend 2: xx

5.1.3 Trend 3: xx

5.2 Other Disruptive Trends

5.2.1 Trend 4: xx

5.2.2 Trend 5: xx

5.2.3 Trend 6: xx

5.2.4 Trend 7: xx

5.2.5 Trend 8: xx

5.2.6 Trend 9: xx

6 Supporting Technologies

6.1 Additive Manufacturing (AM)

6.1.1 Overview

6.1.2 I4.0 Applications

6.1.3 Market Size and Growth

6.1.4 Disrupted Industries

6.1.5 Trends

6.1.6 Leading Suppliers

6.2 Augmented and Virtual Reality

6.2.1 Overview

6.2.2 I4.0 Applications

6.2.3 Market Size and Growth

6.2.4 Disrupted Industries

6.2.5 Trends

6.2.6 Leading Suppliers

6.3 Collaborative Robotics

6.3.1 Overview

6.3.2 I4.0 Applications

6.3.3 Market Size and Growth

6.3.4 Disrupted Industries

6.3.5 Trends

6.3.6 Leading Suppliers

6.4 Connected Machine Vision

6.4.1 Overview

6.4.2 I4.0 Applications

6.4.3 Market Size and Growth

6.4.4 Disrupted Industries

6.4.5 Trends

6.4.6 Leading Suppliers

6.5 Drones/UAVs

6.5.1 Overview

6.5.2 I4.0 Applications

6.5.3 Market Size and Growth

6.5.4 Disrupted Industries

6.5.5 Trends

6.5.6 Leading Suppliers

6.6 Self-Driving Vehicles (SDVs)

6.6.1 Overview

6.6.2 I4.0 Applications

6.6.3 Market Size and Growth

6.6.4 Disrupted Industries

6.6.5 Trends

6.6.6 Leading Suppliers

7 Key Use Cases

7.1 Additive Production

7.1.1 Case Study: xx

7.1.2 Case Study: xx

7.1.3 Case Study: xx

7.2 Advanced Digital Product Engineering

7.2.1 Case Study: xx

7.2.2 Case Study: xx

7.2.3 Case Study: xx

7.2.4 Case Study: xx

7.3.1 Case Study: xx

7.3.2 Case Study: xx

7.4 Data-Driven Asset/Plant Performance Optimization

7.4.1 Case Study: xx

7.4.2 Case Study: xx

7.4.3 Case Study: xx

7.4.5 Case Study: xx

7.5 Data-Driven Inventory Optimization

7.5.1 Case Study: xx

7.5.2 Case Study: xx

7.6.1 Case Study: xx

7.6.2 Case Study: xx

7.6.3 Case Study: xx

7.6.4 Case Study: xx

7.7 Everything-as-a-Service Business Models

7.7.1 Case Study: xx

7.7.2 Case Study: xx

7.7.3 Case Study: xx

7.8 Human-Robot Collaboration

7.8.1 Case Study: xx

7.8.3 Case Study: xx

7.8.4 Case Study: xx

7.9 Predictive Maintenance

7.9.1 Case Study: xx

7.9.2 Case Study: xx

7.9.3 Case Study: xx

7.10 Remote Asset Testing/Inspection/Certification 280

7.10.1 Case Study: xx

7.10.2 Case Study: xx

7.10.3 Case Study: xx

7.11 Remote Service

7.11.1 Case Study: xx

7.11.2 Case Study: xx

7.11.3 Case Study: xx

7.12 Virtual Training

7.12.1 Case Study: xx

7.12.2 Case Study: xx

7.13 Other use cases

7.14 Use Case Appendix

7.14.1 Advanced Digital Product Engineering: Definition of Digital Twins

7.14.2 Data-Driven Inventory Optimization:

Definition of Multi-Echelon Inventory Optimization

8 I4.0 Adoption Strategies

8.1 OEMs

8.1.1 Overview

8.1.2 Case Study: xx

8.1.3 Case Study: xx

8.1.4 Case Study: xx

8.1.5 Case Study: xx

8.1.6 Adoption Strategy Comparison: OEMs from Different Industries

8.1.7 Adoption Strategy Deep-Dive: Elevator OEMs

8.2 Smart Factories

8.2.1 Overview

8.2.2 TRUMPF Smart Factory

8.2.3 GE Brilliant Factory

8.2.4 Audi Smart Factory

8.2.5 SmartFactoryKL

8.2.6 SmartFactory OWL

8.2.7 Other Smart Factories

8.2.8 Deep-dive: Lean Manufacturing and Industry 4.0

8.3 Industrial Automation Suppliers

8.3.1 Overview

8.3.2 I4.0 Readiness Assessments of Top 5 Industrial Automation Vendors

8.3.3 Others Large Vendors ($3B+ I4.0 Related Revenue)

8.3.4 Smaller Vendors (<$3B I4.0 Related Revenue)

9 Associations, Foundations, Committees to watch

9.1 Labs Network Industrie 4.0

9.2 Industrial Internet Consortium (IIC)

9.3 OPC Foundation

9.4 Industrial Data Space Association

9.5 CyberValley of Baden Württemberg

9.6 Center for the Development and Application of Internet of Things Technologies

9.7 Manufacturing USA

10 Appendix

10.1 Market definition, sizing, and methodology

10.1.1 Industry 4.0 definition:

10.1.2 IoT definition:

10.1.3 IIoT and Connected Industry definition:

10.1.4 Connected Industry building blocks definition:

10.1.5 Market Sizing:

10.1.6 Methodology:

10.2 List of Acronyms

10.3 List of Exhibits

10.4 List of Tables

About

Selected recent publications

Upcoming publications

Subscription

Newsletter

Author

Contact Us

Copyright

Companies Mentioned (selection from report)

ABB, Accenture, ADLink, Alluvium, Amazon, Atos, Audi, Baylo, Bechtle AG, Bosch, Bühler, C3, Cisco, CODESYS, Cognex, Cyberhawk, Daimler, DMG-Mori, Emerson, EOS, Ericsson, ESI Group, Fanuc, Fero Labs, Festo, Ford, General Electric, GOM GMBH, Heidelberg, Heller, Hilscher, Hitachi, Honeywell, IBM, Inductive Automation, Itizzimo, Kaeser Compressors, Kemppi, KPMG, Kuka, Mercedes-Benz (Daimler), Mevea, Microsoft, Mitsubishi Electric, Oculus, Omron, Opel AG, Pepperl+Fuchs, Protolabs, PTC, Rockwell Automation, SAP, Schneider Electric, Seat, Seeq, Sepasoft, Siemens, Sky Futures, SparkCognition, Standard Motor Products, Stanley Black & Decker, Stratasys, TE Connectivity, Teledyne Dalsa, Thyssenkrupp, TRUMPF, Universal Robotics, Volvo, WiPro, Xometry, Yaskawa, Yokogawa

Next Actions

Direct Purchase/Request a Sample

- The Market Report is available to download HERE A sample of the market report can be downloaded HERE

Bespoke Research on the topic

- If you are considering a project of a similar nature or require related research services, get in contact with our bespoke research team to see how we could assist you. Contact IoT Analytics: research@iot-analytics.com

- If you are already in the process of implementing a project of this nature, check out our supporting documents website: iot-analytics.com

Sales & Marketing

- For all other sales, marketing or partnership related inquiries please contact our Head of Sales, Leon Whyte: sales@iot-analytics.com

Public Relations

- For further comments or more information on this press release, please contact: Stephanie Baumann press@iot-analytics.com