Structured market database and webtool

Discover in-depth data on 2G, 3G, 4G, 5G (RedCap), NB-IoT, and LTE-M

- In-depth look at the quarterly market for cellular IoT connectivity

- Includes over 4 thousand data points, that allow for detailed drill-down options per year or quarter, category, technology, and operator

- The tracker gets updated with the most recent data every 6 months

Database structure

View and analyze data points for

- 21 mobile network operators

- 9 cellular connectivity technologies

- 9 vertical IoT segments

- 11 regions

The accompanying interactive webtool

Discover the Global Cellular IoT Connectivity Dashboard

Your Title Goes Here

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

Click to show dashboard

Product specifications

All information about the tracker & forecast at a glance

General description

The Global Cellular IoT Connectivity Tracker & Forecast is a structured market size and forecast database of worldwide cellular IoT connections, comprising the following technologies: 2G, 3G, 4G, 5G (including a breakdown of private and public 5G connections), 5G RedCap, NB-IoT, and LTE-M.

The tracker includes the number of active connections for the period 2010 to Q2 2024 (quarterly for last 7 years), alongside revenue and ARPU for the period 2010 to 2023 (full years), along with forecasts for cellular IoT connections, by technology type, from Q3 2024 to 2030.

Database structure

Timeframe

- Actuals: Quarterly (Q1 2018 – Q2 2024) & annual (2010-2023)

- Forecasts: Quarterly (Q3 2024 – Q4 2024) & annual (2024-2030)

- Companies: 21 mobile network operators

- Technologies: 9 cellular connectivity technologies

- Segments: 9 vertical IoT segments

- Regions: 11 regions

Metrics

Global cellular IoT active connections:

- Breakdown by technology splits

- Breakdown by mobile network operators

- Breakdown by vertical IoT segments

- Breakdown by region

Global cellular IoT connectivity revenue:

- Breakdown by mobile network operators

- Breakdown by technology splits

- Breakdown by vertical IoT segments

Global Cellular IoT ARPU (Average Revenue Per User):

- Breakdown by mobile network operators

- Breakdown by technology splits

- Breakdown by vertical IoT segments

Global cellular 5G & 5G RedCap IoT connections:

- Breakdown by deployment type

Selected companies mentioned in the tracker & forecast

| Airtel | ATT | China Mobile | China Telecom | China Unicom |

| Deutsche Telekom | KDDI | KD Corp | LGUplus | NTTDocomo |

| Orange | SKTelecom | SoftBank | Sprint | Telefonica |

| Telenor | Telia | Telstra | Tmobile USA | Verizon |

| Vodafone |

Industry verticals covered in the tracker & forecast

| Building & infrastructure | Embedded automotive | Fixed access points | Home & consumer |

| Health care | Industrial & manufacturing | Mobile access points | Other energy |

| Retail | Smart Cities & others | Smart meters | Telematics - OBD and aftermarket |

| Transportation, supply chain & logistics |

Latest data releases

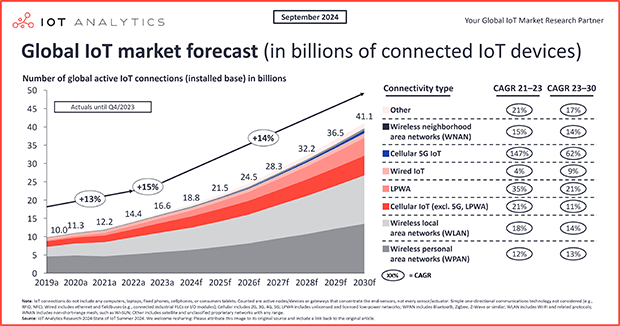

State of IoT 2024: Number of connected IoT devices growing 13% to 18.8 billion globally

Image: Global IoT market forecast (in billions of connected IoT devices) Connected IoT device market update—Summer 2024 Number of connected IoT devices to grow 13% by end of 2024. According to IoT Analytics’ 171-page State of IoT Summer 2024 report, there were 16.6 billion connected IoT devices by the end of 2023 (a growth of 15% over 2022). IoT Analytics expects this to grow 13% to 18.8 billion by the end of 2024. This forecast is lower than in 2023 due to continued cautious enterprise...

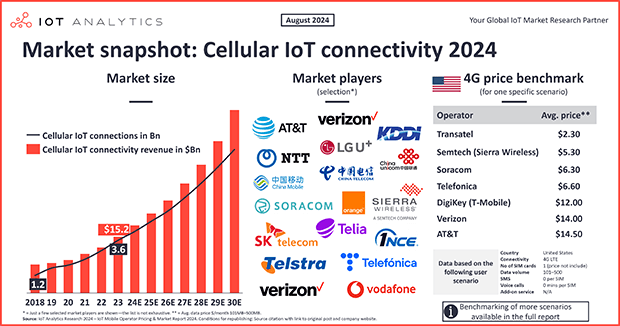

Benchmarking IoT mobile operator pricing: MNOs vs. MVNOs

In short There were 3.6 billion active cellular IoT connections in 2023, approximately 21% of global IoT connections, according to the 159-page IoT Mobile Operator Pricing and Market Report 2024–2030 and its accompanying mobile operator database. Two IoT mobile operator types provide cellular IoT connectivity: mobile network operators (MNOs) and mobile virtual network operators (MVNOs). A benchmark of the two types shows that MVNO IoT services cost substantially less than MNO IoT services due...

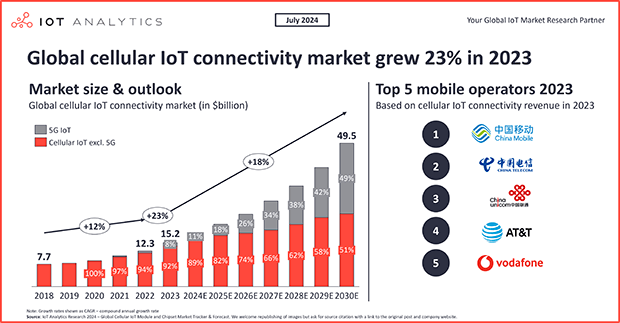

Global cellular IoT connectivity market reached $15B in 2023, 5G set to drive further growth

In short Mobile operators worldwide earned a combined $15 billion from 3.6 billion cellular IoT connections in 2023, according to IoT Analytics’ Global Cellular IoT Connectivity Tracker & Forecast (updated June 2024) and IoT Mobile Operator Pricing & Market Report 2024–2030 (released July 2024). Mobile operators’ IoT revenue growth rate of 23% YoY exceeded that of IoT software companies and hyperscalers in 2023. Cellular IoT connections grew even while the shipments and revenue for...

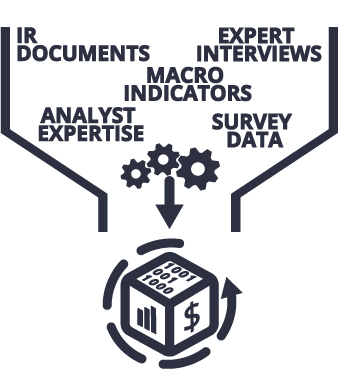

What we do to update the data every 6 months

- Constant monitoring of investor relations documents and news releases for hundreds of IoT companies and specifically the 33 companies that are part of this tracker.

- Industry-level forecasting based on revenue estimations of chipset vendors, module companies, and network operators.

- Interviewing of numerous senior IoT experts from connectivity chipset vendors, module companies and network operators.

- Approximating missing data using several indicators such as general country KPIs (e.g., GDP, population), number of companies supporting or adopting the technology, in a specific region or announcements of network roll-outs and deployments, etc.

Access the full version for hands-on help on your IoT connectivity journey

Understand the global cellular IoT market: market size, market growth, players, technologies, and pricing trends, including forecasts until 2027

Receive semi-annual data updates

Slice and dice the data according to your individual needs (e.g., by region or cellular connectivity technology)

Use the data to make better decisions in your profession

Our insights are trusted by

Request a free demo

Fill out the form to get in touch with us

- Experience a walk-through of the dashboard via screen share

- Get your specific questions addressed

- Explore how our research can add value to your organization

- Receive individual pricing and bundle

Prajwal Praveen

Senior Sales Manager

Phone: + 49 (0) 408 221 1722

Email: sales@iot-analytics.com