Structured nested market database

Discover in-depth data on global IoT module and chipset

- In-depth look at the quarterly market for cellular IoT modules and chipsets.

- Includes over 6.9 million data points, that allow for detailed drill-down options per region, technology, industry, and company.

- The tracker gets updated with the most recent data every quarter.

What is included

The tracker & forecast includes these global data points

- 38 cellular IoT module brands

- 13 cellular IoT chipset companies

- 10 regions

- 10 technology splits

- 16 industry verticals

- 150 unique model-level chipsets

- 737 unique model-level modules

The accompanying interactive web tool

Discover the Global Cellular Module and Chipset Dashboard

Your Title Goes Here

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

Click to show dashboard

Ready to purchase?

Not sure what fits your needs? Have unanswered questions?

The update process

How we update the data

Constant monitoring

Industry-level forecasts

based on revenue estimates of chipset vendors, module manufacturers, and network operations.

Numerous interviews

with senior IoT experts from chipset vendors, module manufacturers, and network operations.

Integrating financial and operational data modeling

from model level to brand, technology, and region.

faq

Frequently asked questions

Tracker & Forecast

Does this tracker contain the latest IoT module models launched in QX 2024?

Yes, this tracker has been updated in Q2 2024 and includes the latest IoT modules launched (if applicable).

Does this tracker cover information on the industry verticals?

Yes, it includes 16 industry verticals (Building & Infrastructure, Consumer Smartphone, Embedded Automotive, Fixed Access Points, Health Care, Home & Consumer, Industrial & Manufacturing, Laptop, Mobile Access Points, Other Energy, Retail, Smart Cities & Others, Smart Meters, Tablet, Telematics – OBD and Aftermarket, Transportation, Supply Chain & Logistics) as a nested database with modules and chipset shipments, revenue, and ASP at the company level.

Which regions are included in this tracker?

The tracker splits the global data into 10 regions: China, North America, Western Europe, Eastern Europe, the Middle East, and Africa, Latin America, Japan, India, Korea, Asia, and Others.

Is the tracker customizable?

Yes, we offer diverse customization options to give you access to the data you need. You could get the tracker in a chipset-only version, module-only version, or specify a region. Please contact our sales representatives for further information.

Does this tracker cover any information on module fallback support and its categories for each technology?

Yes, it does. The tracker covers extensive information on module fallback support along with its categorization.

Will we be able to find the shipments and revenues of the modules based on LTE-Cat 1 bis in this tracker?

Yes, this tracker also includes shipments, revenues, and ASPs of the modules based on LTE-Cat 1 bis technology. You can slice down the shipments, revenues, and ASPs by region, company, and technology.

Dashboard

What is the difference between a tracker and a dashboard?

Our trackers are EXCEL-based nested market databases that allow in-depth cross-tabulation. Our dashboards are web applications that allow users to slice and dice the market and instantly visualize the selection via a user-friendly interface. The dashboard (cellular IoT chipset and module) is included with the purchase of the Global Cellular IoT Chipset and Module Tracker & Forecast.

What is the difference between a tracker and a dashboard?

Our trackers are EXCEL-based nested market databases that allow in-depth cross-tabulation. Our dashboards are web applications that allow users to slice and dice the market and instantly visualize the selection via a user-friendly interface. The dashboard (cellular IoT chipset and module) is included with the purchase of the Global Cellular IoT Chipset and Module Tracker & Forecast.

How do I download the data from the dashboard?

You can download the current dataset by clicking on the “Download the current dataset (.CSV)” text at the bottom of the selection panel (gray area on the left side of the application).

Definitions

What is an IoT connectivity module?

An IoT connectivity module is an electronic assembly of components embedded in objects, machines, and things connected to wireless networks that sends and receives data with a connectivity chipset.

What is an IoT connectivity module?

An IoT connectivity module is an electronic assembly of components embedded in objects, machines, and things connected to wireless networks that sends and receives data with a connectivity chipset.

What are cellular IoT modules?

Cellular IoT modules are connectivity modules with an embedded cellular chipset.

What are IoT connectivity chipsets?

IoT connectivity chipsets are baseband processors embedded in an intelligent device (either directly or via a module) that enables and manages the device’s connectivity. Cellular chipsets are based on the 3GPP architecture and include technologies such as 4G, 5G, LTE-M, and NB-IoT.

Product specifications

All information about the tracker & forecast at a glance

General description

The forecast is based on the information and data available until June 3, 2024. This analysis considers significant macro and micro-events, such as the global economic situation, the recovery scenarios for general chip shortages, and the rise of AI chip shortage. Additionally, we have considered technological advancements, such as LTE-Cat 1, Cat 1 bis, 5G, and 5G RedCap. We have included 5G RedCap as a distinct technology in this projection. This research focuses only on cellular IoT chipsets embedded within IoT modules. It does not include cellular IoT chipsets embedded standalone in a device.

Find out

- What is the global cellular IoT module and chipset market size in terms of shipment, revenue, and ASP (wholesale average selling price)?

- Who are the leading players globally?

- What are the ASP trends by cellular connectivity technology and region?

- Which cellular IoT player is strong across 4G?

- Which cellular connectivity technology is leading globally?

- How is LTE-Cat 1 performing in China and the rest of the world?

- Which regions are leading the market in terms of growth and in terms of market share?

- Which companies are leading the market, and what are their market shares?

- Which industry vertical has the highest demand for cellular IoT connectivity chipsets and modules, and which is growing the fastest?

Database structure

Module & Chipset Model level: Modules & Chipset Shipments, Revenue and ASP at Model level (nested database)

- 38 cellular IoT module brands, nested, with 13 cellular IoT chipset companies

- 1Q 2018–1Q 2024 (actuals)

- Connectivity technologies: 2G, 3G, LTE-Cat 1, LTE Cat 1 bis, 4G, LTE-M, NB-IoT, LPWA dual mode, 5G RedCap, and 5G. Including fallback and categories for each technology

- Ten regions: China, North America, Western Europe, Eastern Europe, the Middle East and Africa, Latin America, Japan, India, Korea, Asia, and Other

- 737 unique module models and 150 unique chipset models

Industry Vertical & Forecast: Modules & Chipset Shipments, Revenue and ASP at Company level (nested database)

- 38 cellular IoT module brands, nested, with 13 cellular IoT chipset companies

- 1Q 2018–1Q 2024 (actuals)

- Quarterly forecast 2Q 2024-4Q 2025

- Annual forecast 2026-2028

- Connectivity technologies: 2G, 3G, LTE-Cat 1, LTE Cat 1 bis, 4G, LTE-M, NB-IoT, LPWA dual mode, 5G RedCap, and 5G

- 10 regions: China, North America, Western Europe, Eastern Europe, the Middle East and Africa, Latin America, Japan, India, Korea, Asia, and Other

- 16 industry verticals

Companies mentioned in the tracker & forecast

| AM Telecom | ASR | Cavli Wireless | Ccfrom | Cheerzing | China Mobile |

| Continental Automotive | Eigencomm | Fibocom | GCT | Gosuncn | H3C |

| Hisilicon | Huawei | Intel | Kyocera | LG Innotek | Lierda |

| Longsung | Marvell | Mediatek | Meig | MobileTek | Murata |

| Neoway | Pycom | Qualcomm | Quectel | RENESAS | Rinlink |

| Rolling Wireless | Ruijie | SIMCom | Sequans | Sercomm | Sierra Wireless |

| Sony Altair | STMicroelectronics | Taiyo Yuden | Telit | Titan | UNISOC |

| USR(Wenheg) | Ucloudy | Wistron Neweb | Wutong | XinYi | Yuge Technology |

| u-blox | Others |

Industry verticals covered in the tracker & forecast

| Building & infrastructure | Consumer smartphone | Embedded automotive | Fixed access points |

| Health care | Home & consumer | Industrial & manufacturing | Laptop |

| Mobile access points | Other energy | Retail | Smart Cities & others |

| Smart meters | Tablet | Telematics - OBD and aftermarket | Transportation, supply chain & logistics |

Latest data releases

Cellular IoT module market Q1 2024 update: Demand recovery, market trends, and competitive landscape

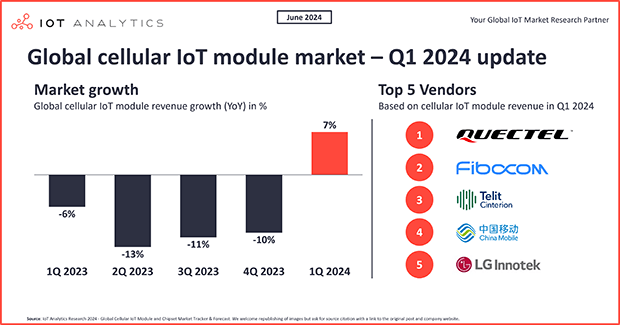

Key insights In Q1 2024, the cellular IoT module market grew 7% year-over-year, according to IoT Analytics’ latest Global Cellular IoT Module and Chipset Tracker & Forecast update. Driving this growth was an upswing in module demand in China, which counterbalanced the remaining inventory and demand issues in much of the world. Connectivity technologies like 5G and LTE Cat-1 bis experienced a combined 67% market growth year-over-year, contributing to the overall cellular IoT module market...

Cellular IoT module market Q2 2023: 66% of IoT modules shipped without dedicated hardware security

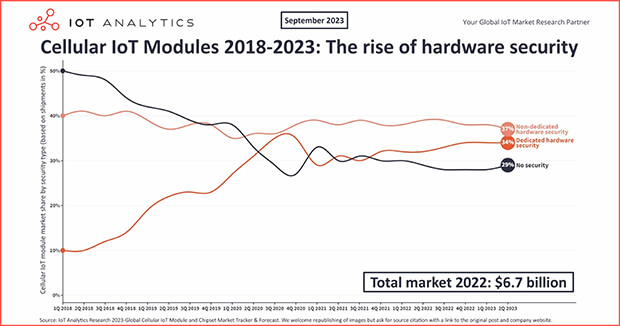

In short The cellular IoT module market was stagnant in Q2’23 according to IoT Analytics latest data. Although IoT modules with dedicated security features are increasingly adopted, 66% of IoT modules shipped in Q2’23 had no dedicated hardware security and 29% had no security features at all. Recent demonstrations of vulnerabilities in non-dedicated hardware security features should drive the market further towards hardware-based security. Post-quantum cryptography is also an important...

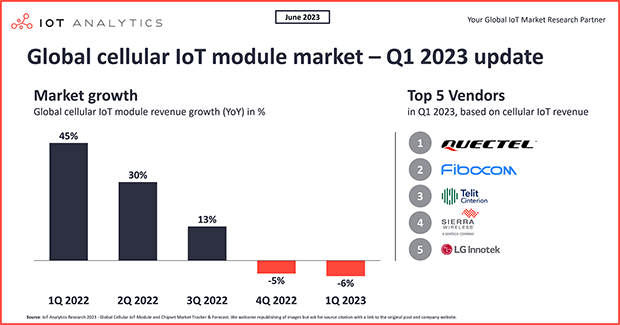

Global cellular IoT module market declined 6% in Q1 2023 in a weakening demand environment

Key insights In Q1 2023, global cellular IoT module revenue declined 6% YoY; shipments declined 16%. The key reasons for the decline are: 1. Cautious end-user spending; 2. Inventory reductions; and 3. Chip supply issues. The top five cellular IoT module companies—Quectel, Fibocom, Telit Cinterion, Sierra Wireless, and LG Innotek—currently account for 66% of the global market. The Q1 market weakness is seen as a bump in the road, with six billion cellular IoT connections expected by 2027,...

Our insights are trusted by

Request a free demo

Fill out the form and get in touch with us

- Experience a walk-through of the tracker via screen share

- Get your specific questions addressed

- Explore how our research can add value to your organization

- Obtain detailed license and pricing information

- Receive a sample file in EXCEL

Get in touch with us

Prajwal Praveen

Sales Manager

Phone: + 49 (0) 408 221 1722

Email: sales@iot-analytics.com