key features

Discover in-depth data on IoT module shipments, revenue, and wholesale ASPs

Understand past, present, and future IoT market data, with all relevant data points at your fingertips.

The IoT Analytics Global Cellular IoT Module Dashboard provides an in-depth look at the quarterly market for cellular IoT modules. With over 86 thousand data points, the dashboard allows for detailed drill-down options per region, technology, and company. The tool gets updated with the most recent data every six months.

It contains global data points for:

- 33 companies

- 10 regions

- 8 technology splits

Discover the tool

Global Cellular IoT Module Dashboard

Latest data releases

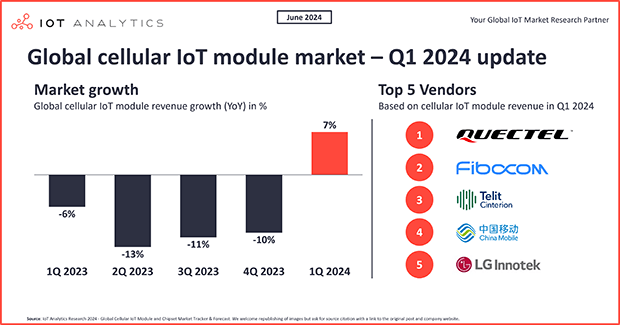

Cellular IoT module market Q1 2024 update: Demand recovery, market trends, and competitive landscape

Key insights In Q1 2024, the cellular IoT module market grew 7% year-over-year, according to IoT Analytics’ latest Global Cellular IoT Module and Chipset Tracker & Forecast update. Driving this growth was an upswing in module demand in China, which counterbalanced the remaining inventory and demand issues in much of the world. Connectivity technologies like 5G and LTE Cat-1 bis experienced a combined 67% market growth year-over-year, contributing to the overall cellular IoT module market...

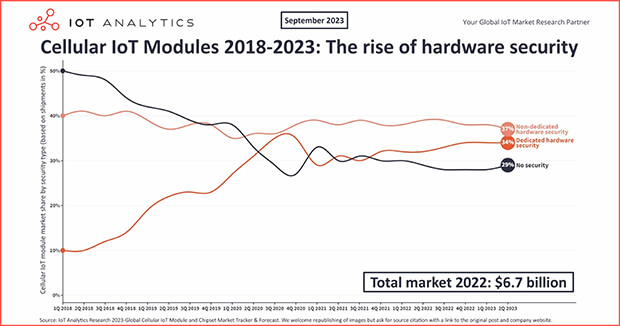

Cellular IoT module market Q2 2023: 66% of IoT modules shipped without dedicated hardware security

In short The cellular IoT module market was stagnant in Q2’23 according to IoT Analytics latest data. Although IoT modules with dedicated security features are increasingly adopted, 66% of IoT modules shipped in Q2’23 had no dedicated hardware security and 29% had no security features at all. Recent demonstrations of vulnerabilities in non-dedicated hardware security features should drive the market further towards hardware-based security. Post-quantum cryptography is also an important...

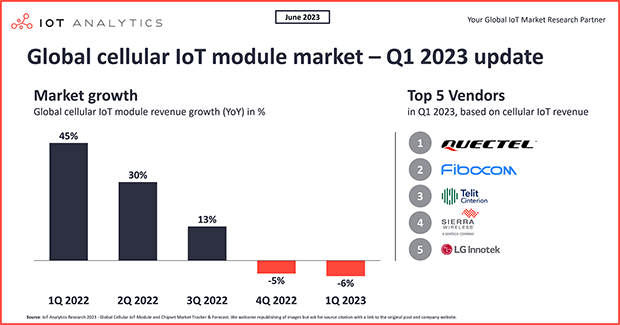

Global cellular IoT module market declined 6% in Q1 2023 in a weakening demand environment

Key insights In Q1 2023, global cellular IoT module revenue declined 6% YoY; shipments declined 16%. The key reasons for the decline are: 1. Cautious end-user spending; 2. Inventory reductions; and 3. Chip supply issues. The top five cellular IoT module companies—Quectel, Fibocom, Telit Cinterion, Sierra Wireless, and LG Innotek—currently account for 66% of the global market. The Q1 market weakness is seen as a bump in the road, with six billion cellular IoT connections expected by 2027,...

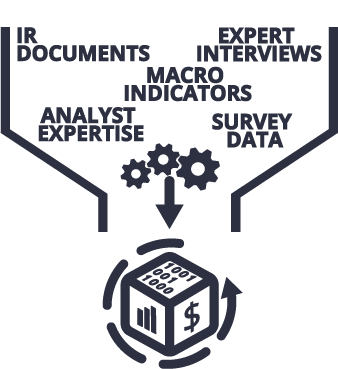

What we do to update the data every 6 months

- Constant monitoring of investor relations documents and news releases for hundreds of IoT companies and specifically the 33 companies that are part of this tracker.

- Industry-level forecasting based on revenue estimations of chipset vendors, module companies, and network operators.

- Interviewing of numerous senior IoT experts from connectivity chipset vendors, module companies and network operators.

- Approximating missing data using several indicators such as general country KPIs (e.g., GDP, population), number of companies supporting or adopting the technology, in a specific region or announcements of network roll-outs and deployments, etc.

Access the full version for hands-on help on your IoT cellular journey

Understand the global cellular IoT market: market size, market growth, players, technologies, and pricing trends, including forecasts until 2026

Receive semi-annual data updates

Slice and dice the data according to your individual needs (e.g., by region or cellular connectivity technology)

Use the data to make better decisions in your profession

Our insights are trusted by

Individual Pricing and Bundles

Gain access to the Global Cellular IoT Module dashboard for as little as $1,000 per month

For unrestricted access to the data, you need the Corporate Research Subscription 2021—Global Cellular IoT Module package:

- Slice and dice the data per metric, region, technology, and company

- Download as a CSV file

Get in touch with us

Pratik Akhairamka

Phone: + 49 (0) 408 221 1721

Email: sales@iot-analytics.com

Please fill out all details, and we will get back to you shortly.