In short

- 54% of small- and medium-sized plants use some combination of pen & paper or spreadsheets as their manufacturing execution system (MES), according to IoT Analytics’ 163-page MES Market Report 2025–2031.

- While the use of these methods is pervasive, they are not reliable sources of data for digital transformation and operational AI integration.

- Over 300 vendors are serving the $5.5B MES market, and they have one common goal: Help manufacturers get rid of pen, paper, and spreadsheets for managing work orders, production plans, and downtime tracking.

Why it matters

- For MES vendors: Manufacturers are undergoing digital transformation to keep up with competitive pressure and prepare for future advanced technology updates, like AI. There is an imminent opportunity.

- For manufacturers: MESs are proper systems of record for factory floor operations. Manufacturers looking to improve manufacturing metrics must consider their options within a very large software vendor landscape or an integrator-led customization.

In this article

- Pen & paper and spreadsheets reign on the factory floor

- MES adopter view: Why factories are finally ditching the sheets

- 1. Lower cost barriers to entry: Modular & OpEx-friendly

- 2. The “China factor”: Global competitive pressure

- 3. Spreadsheets are not the data sources AI models need

- MES vendor view: How vendors are evolving to win the shop floor

- 1. Modular architecture

- 2. Unified namespace integration

- 3. Spreadsheets are not the data sources AI models need

- Analyst Opinion

- MES market overview and outlook (Insights+)

- MES competitive landscape (Insights+)

Pen & paper and spreadsheets reign on the factory floor

Over 50% of factories worldwide use a mix of paper and spreadsheets. The combination of pen & paper and spreadsheets (like Microsoft Excel) serves as the unofficial, default manufacturing execution system (MES) for countless small and mid-sized businesses (SMBs) and even many large companies. IoT Analytics estimates that 54% of plants globally in 2024 used these methods to manage manufacturing operations, according to the 163-page MES Market Report 2025–2031 (published December 2025). The other 46% of production sites used one of the following: 1) a lightweight extension to an existing ERP or SCADA system, 2) a homegrown MES, or 3) a commercial MES.

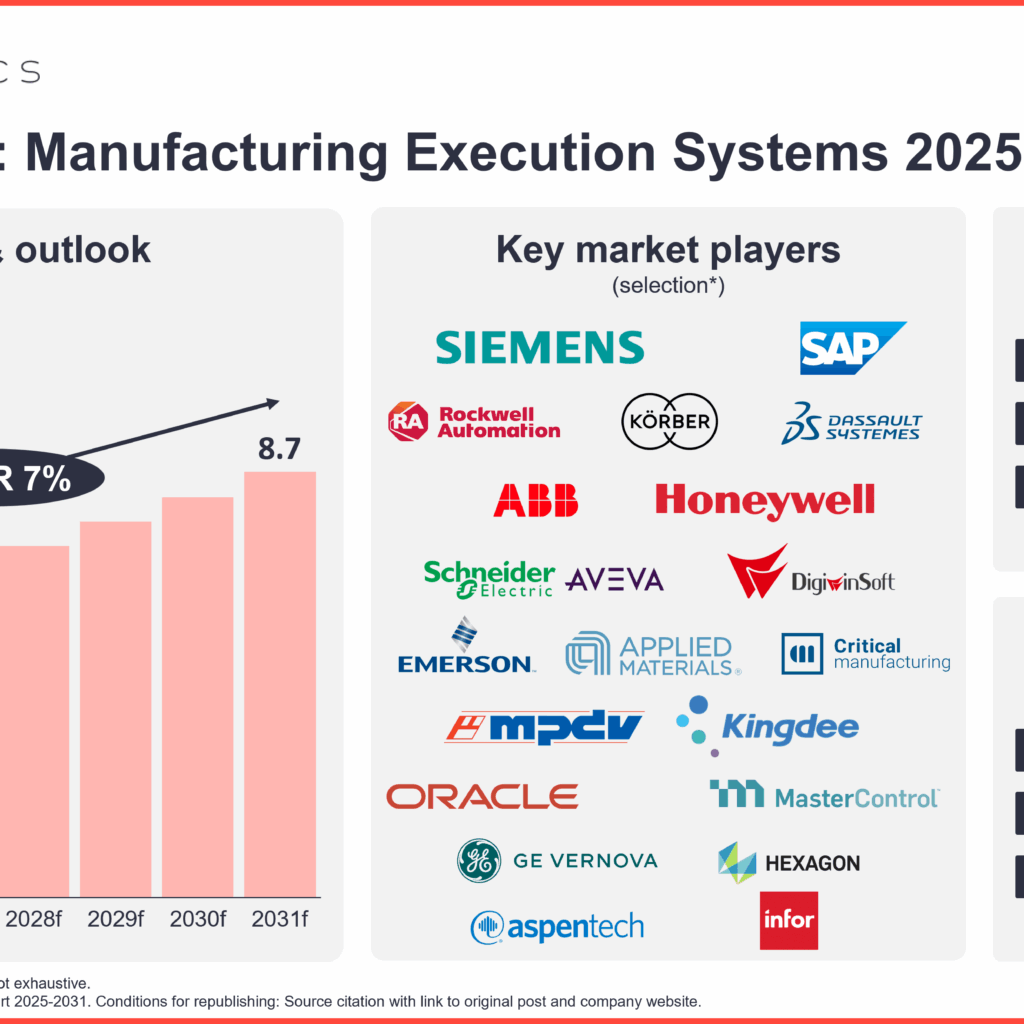

300+ vendors vying to displace clipboards and spreadsheets. The global MES market reached $5.5 billion in 2024 and now accounts for around 6.5% of the broader $85 billion industrial software market. More than 300 vendors operate in the MES space, yet competitive intensity is not as high as it may look. In many factories, the primary alternative to MES software is not a rival vendor but the continued use of pen and paper or spreadsheets, practices that manufacturers are gradually abandoning as they seek higher efficiency and stronger competitive positioning.

Insights from this article are derived from

MES Market Report 2025-2031

A 163-page report on the market for Manufacturing Execution Systems (MES) – Tech stack, evolution, market, trends, challenges and recommendations.

Already a subscriber? View your reports and trackers here →

MES adopter view: Why factories are finally ditching the sheets

While the inefficiencies of spreadsheets have been known for decades, 3 specific factors are leading manufacturers to finally adopt commercial MES solutions: costs, competitive pressure, and AI initiatives.

1. Lower cost barriers to entry: Modular & OpEx-friendly

Modular MES aiding adoption, with SaaS flexibility. The transition to modular MES offerings has fundamentally changed the economics of adoption for the user. Historically, adopting an MES required a massive upfront CapEx for a full suite. Today, manufacturers can leverage SaaS models to fund software through OpEx. This allows users to start small, purchasing just a single capability, such as production planning, for a monthly fee rather than committing to a multi-year, multi-million dollar overhaul.

Simplified view of MES Systems: The Core 4

Some practitioners simplify the MES stack by focusing on what they call the “core 4.” This shorthand groups the most commonly deployed foundational capabilities of MES:

- Work-order management

- Production scheduling

- Downtime tracking

- Overall equipment effectiveness (OEE) analysis

By concentrating on these 4 functions, consultants and vendors frame MES as an accessible entry point for manufacturers starting their digital operations journey, before expanding toward more advanced functions such as quality, traceability, and integration with ERP and PLM systems.

“MES is a list of capabilities: that basically starts with the core four… Work orders, scheduling, OEE, and downtime tracking, and then we just add a bunch of other sh*t.”

Walker Reynolds, industrial digital transformation consultant and educator (source)

2. The “China factor”: Global competitive pressure

China’s manufacturing edge necessitates factory modernization. For many Western factories, the pressure to optimize is no longer just about internal efficiency. Rather, it is about survival against intense global competition, particularly from China, the world’s manufacturing superpower.

China has evolved beyond being a source of cheap labor. Its factories are among the most advanced and automated in the world. Therefore, it is not surprising that China-based MES companies like DigiwinSoft are coming up in the list of top-20 global market MES companies, according to the competitive landscape analysis in the report.

To compete with the speed and cost-efficiency of modern Chinese production sites, factories elsewhere can no longer rely on the slow, error-prone nature of manual data entry. They need the real-time optimization that only an MES can provide.

3. Spreadsheets are not the data sources AI models need

MESs provide necessary data for advanced technology updates. IoT Analytics’ quarterly analysis of corporate earnings calls shows CEOs are demanding AI integration and results, unlocking budgets for modernization to replace non-AI-ready data sources, like spreadsheets. However, operations leaders are hitting a hard wall: spreadsheets, let alone pen & paper, are incompatible with industrial AI. While programs like Excel work for single-user data entry, they cannot serve as the structured, multi-user database required to train AI models. Manufacturers realize that if they want to leverage AI for production, yield optimization, predictive maintenance, or similar production-oriented use cases, they must first establish a proper digital foundation, driving them toward MES as the necessary system of record.

MES vendor view: How vendors are evolving to win the shop floor

To finally displace the prominence and flexibility of pen & paper and spreadsheets, MES vendors are overhauling their technology stacks. It is no longer enough to offer a rigid record-keeping system; vendors are now building open and intelligent platforms. Below are just 3 of several notable technological trends for MES vendors (The market report highlights 8 other key technology trends):

1. Modular architecture

Vendors embraced microservices to meet user flexibility. To support the flexible consumption models that users demand, vendors are re-engineering their backends. Some in the industry are moving toward composable, microservices-based architectures. Unlike the rigid codebases of the past, these modern architectures allow vendors to deploy updates faster and enable manufacturers to “compose” their own solution by mixing and matching specific micro-apps (sometimes even from different providers) without being locked into a single vendor’s ecosystem for every function.

Examples

- Critical Manufacturing: Portugal-based MES and Industry 4.0 solutions company Critical Manufacturing’s MES for Industry 4.0 is a modular system that offers 36 individual capabilities grouped into 8 categories that the company says are fully interoperable and aim to provide users with real-time visibility and control across global manufacturing operations.

- Tulip: US-based frontline operations platform provider Tulip offers the Composable MES App Suite, consisting of configurable, ready-built apps (e.g., Performance Visibility Terminal and Order Management) across production management, quality, and inventory built on a flexible common data model. Tulip claims the modular approach enables manufacturers to pick and configure exactly the apps they need, enhancing adaptability, extensibility, and rapid deployment without reliance on rigid, monolithic systems.

2. Unified namespace integration

UNS architecture cuts MES integration complexity. One of the biggest historical hurdles for MES adoption has been the cost and complexity of integrations required to connect the numerous shop‑floor assets. While asset and protocol diversity remains, vendors are embracing the UNS architecture, which changes where that complexity is managed. Instead of each MES instance having to build custom connections, data diversity is consolidated at the UNS layer, typically implemented via MQTT brokers and contextual data models. MES solutions then subscribe to standardized data/topics and publish insights back into the same namespace, reducing integration effort while relying on well‑designed data governance and semantic consistency within the UNS.

Examples:

- FlowFuse: US-based software company FlowFuse offers an eponymous platform based on Node-RED that allows manufacturers to build modular MES functionalities that natively integrate into a UNS, making data instantly accessible across the enterprise without complex proprietary interfaces.

- Sepasoft: US-based industrial software company Sepasoft offers an MES built natively on Inductive Automation’s Ignition platform. The system leverages Cirrus Link MQTT Engine/Transmission modules to integrate in brokered, Sparkplug-compliant UNS architectures. The system is targeted toward event-driven, UNS-enabled projects, making contextualized data available across multi-vendor manufacturing ecosystems without custom point integrations.

3. GenAI integration and beyond

GenAI improves the MES user experience. Vendors are using generative AI (GenAI) to address the “usability” advantage of spreadsheets. While users favor Excel for its flexibility and familiar interface, its usefulness also depends on knowing the right formulas and performing complex cross‑referencing. GenAI‑enabled MES platforms reduce this barrier by allowing users to interact with MES data using natural language, enabling the same sense of control and accessibility.

Examples

- iTAC Software: Germany-based MES vendor iTAC’s MES supports GenAI through its iTAC.Ask.Our.Doc (or iTAC.AOD) tool, which uses LLMs. Users can ask queries about production performance, critical issues, etc., and receive answers based on SOPs and other documents.

- AVEVA: UK-based industrial software company AVEVA, a subsidiary of France-based energy management and digital automation company Schneider Electric, offers an MES that integrates with LLMs through its Industrial AI Assistant, delivered via the AVEVA CONNECT platform. This enables users to interact with MES data using natural language, investigate asset events, find root causes, and ask objective-driven questions.

MES vendors looking ahead at agentic AI. For some vendors, GenAI is just a start. MES vendors are now looking toward agentic AI in MES. In June 2025 at the MES & Industry 4.0 Summit 2025, Francisco Almada Lobo, CEO of Critical Manufacturing, laid out his company’s vision for how AI agents will transform the MES landscape. Rather than relying on rigid, rule-based systems, he believes future MES systems will be augmented with AI agents that not only execute tasks but also learn from outcomes, propose improvements, and optimize production in real time.

“AI is turning MES from a rule follower into a real-time thinker.”

Jeff Winter, VP Strategy at Critical Manufacturing

Analyst opinion

IoT Analytics Principal Analyst Anand Taparia and CEO Knud Lasse Lueth performed the majority of the analyses in this report and spoke to dozens of MES practitioners during the research. Here are 5 things that stood out to them:

- MES penetration remains low across global manufacturing. Commercial MES systems are present in only a small share of the world’s roughly 5 million factories. Our research shows that just 8% of plants use a commercial MES today. Many more rely on homegrown tools, ERP add-ons, or a mix of spreadsheets and paper-based processes to run core production activities. This limited penetration highlights a sizable, potentially >$50 billion addressable market, as a large portion of manufacturers have yet to implement standardized, vendor-supported execution systems.

- The MES market is highly fragmented. MES remains one of the most fragmented software categories in industrial technology. The global leader holds less than 10% market share. Fragmentation is even more pronounced at the vertical level: across the 13 industries analyzed, 9 different vendors lead their respective segments. The team identified nearly 300 MES suppliers, including many small firms offering comprehensive, vertically focused solutions. One should also note that many MES implementations include a large share of integrator-led customization, which in some cases leads to a fully home-grown system.

- Deep industry expertise is critical for MES vendor success. Deep domain and process knowledge are vital for delivering impactful MES solutions. A technology-driven approach will not suffice. Only MES offerings developed for specific industries can truly meet manufacturers’ complex, evolving needs. “One size fits all” is unrealistic—vendors should strategically focus on specific verticals.

- MES systems are becoming adaptable and modular. The rigid “all-in-one” product mindset is giving way to a composable modular approach. Manufacturers will benefit from platforms composed of interoperable, best-of-breed modules that get “combined” into a precise solution. Typical strategies (build-your-own, off-the-shelf, configuration/low-code, customization) each face challenges such as scalability, fit-to-needs, compliance, and reliability. As such, modular/composable architectures that permit the assembly and scaling of specialized modules emerge as the optimal path. However, interoperability, maintenance, and security across diverse modules/vendors will be hurdles to manage.

- AI is accelerating MES market growth. AI has the potential to shift MES from a workflow and record-keeping system to an adaptive operational platform. High-quality, plant-level execution data makes MES a natural foundation for emerging industrial AI use cases such as predictive maintenance, intelligent quality assurance, and autonomous process optimization. We estimate that AI will contribute roughly 2 percentage points of additional annual growth to the MES market over the coming years, on top of baseline expansion. Vendors are already experimenting with AI agents for focused MES tasks, such as resource allocation and maintenance scheduling. Over time, these agents could evolve into the system’s decision engine, delivering recommendations and, in some cases, autonomous actions. This upside is not included in current forecasts and may provide further uplift.

MES market overview and outlook (Insights+)

Access key market data for $99/month per user

The Insights+ Subscription unlocks exclusive facts & figures. You will gain access to:

- Additional analyses derived directly from our reports, databases, and trackers

- An extended version of each research article not available to the public

Full report access not included. For enterprise offerings, please contact sales: sales@iot-analytics.com

Disclosure

Companies mentioned in this article—along with their products—are used as examples to showcase market developments. No company paid or received preferential treatment in this article, and it is at the discretion of the analyst to select which examples are used. IoT Analytics makes efforts to vary the companies and products mentioned to help shine attention on the numerous IoT and related technology market players.

It is worth noting that IoT Analytics may have commercial relationships with some companies mentioned in its articles, as some companies license IoT Analytics market research. However, for confidentiality, IoT Analytics cannot disclose individual relationships. Please contact compliance@iot-analytics.com for any questions or concerns on this front.

More information and further reading

Related publications

You may also be interested in the following reports:

- MES Market Report 2025-2031

- Data Center Equipment & Infrastructure Market Report 2025-2030

- Digitalization of Industrial Drives – Adoption Report 2025

- Digital & AI in Industrial Robotics Insights Report 2025

- Industrial AI Market Report 2025-2030

Related articles

- Data center infrastructure market: AI-driven CapEx pushing IT and facility equipment spending toward $1 trillion by 2030

- Digitalizing industrial motors & drives: 4 upgrades enabling the next era of efficiency

- Industrial AI market: 10 insights on how AI is transforming manufacturing

- Smart manufacturing check-in: 6 learnings from ongoing digital transformation initiatives

Sign up for our research newsletter and follow us on LinkedIn to stay up-to-date on the latest trends shaping the IoT markets. For complete enterprise IoT coverage with access to all of IoT Analytics’ paid content & reports, including dedicated analyst time, check out the Enterprise subscription.