Industrial AI Market Report 2025-2030

(see all)

Questions answered

- What is industrial AI (i.e., an industrial AI definition)?

- Which technologies are used for implementing industrial AI projects (including hardware and software deep-dive)?

- What is the current industrial AI market size and its forecast (by sub-markets, regions, technologies, industries)?

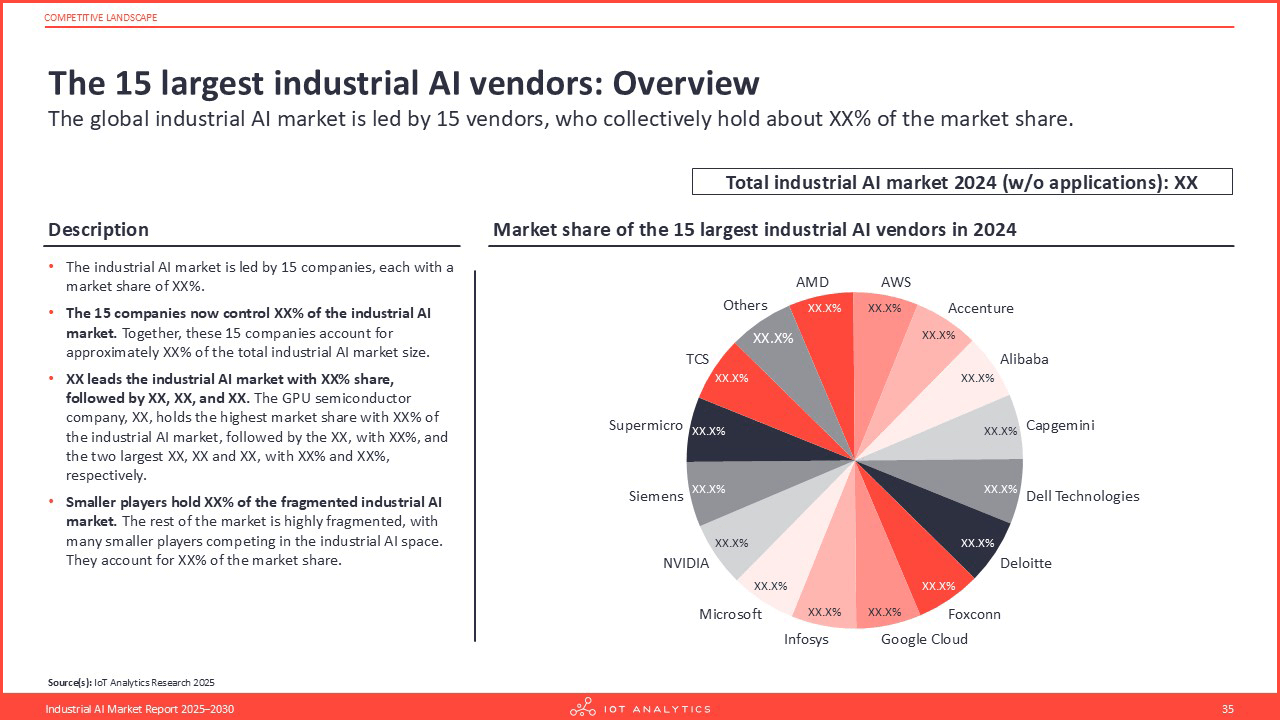

- Who are the key industrial AI vendors and what are their market shares?

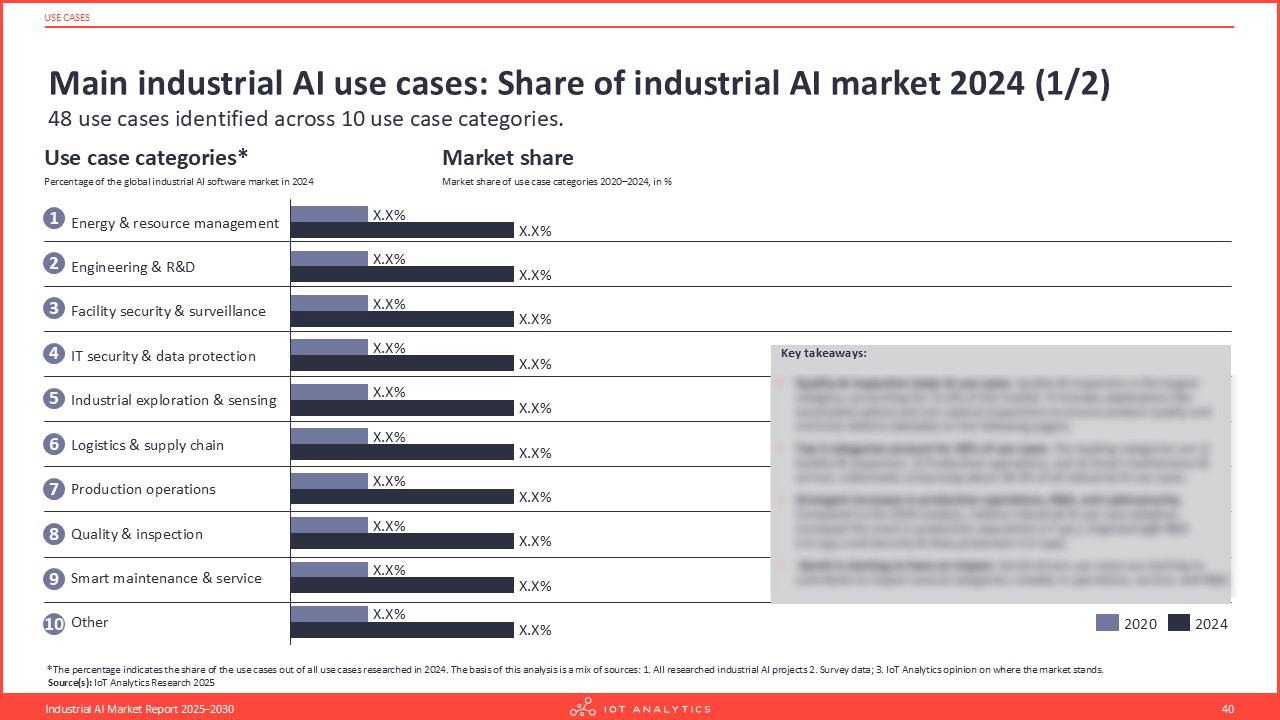

- What are the 50 most common industrial AI use cases?

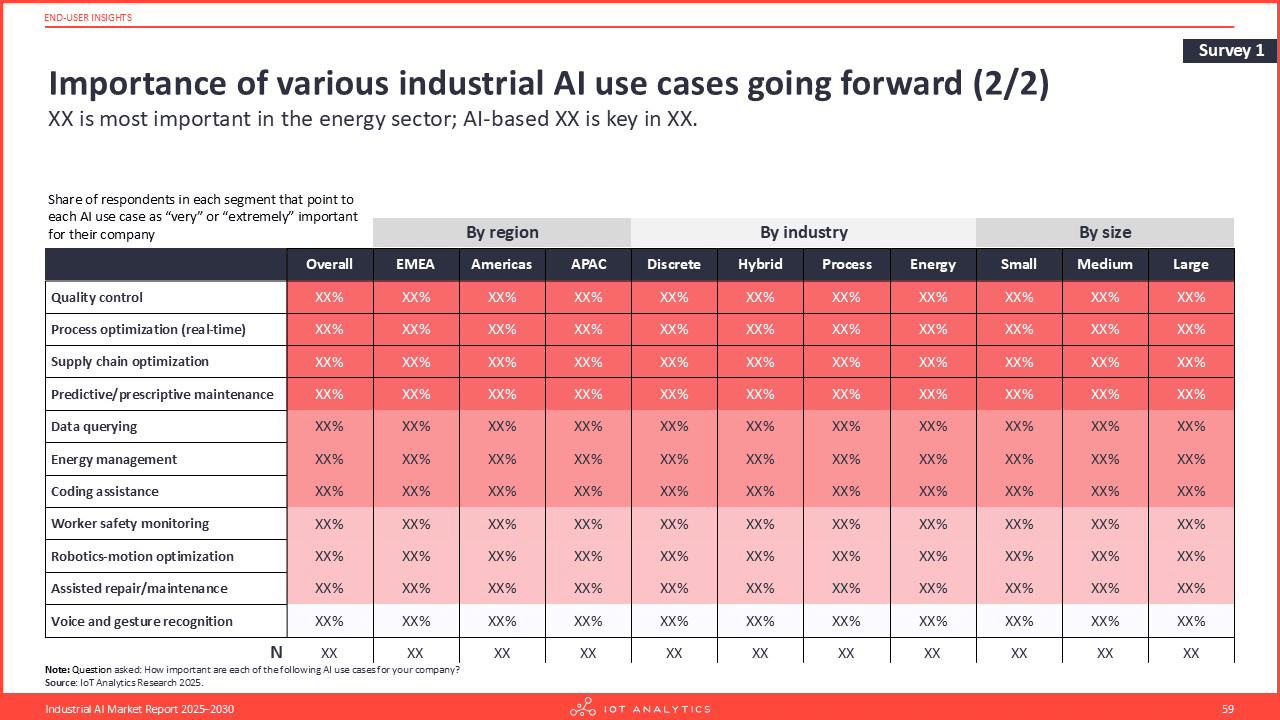

- What is the perspective of industrial AI end users? What are the factors that facilitate or limit adoption?

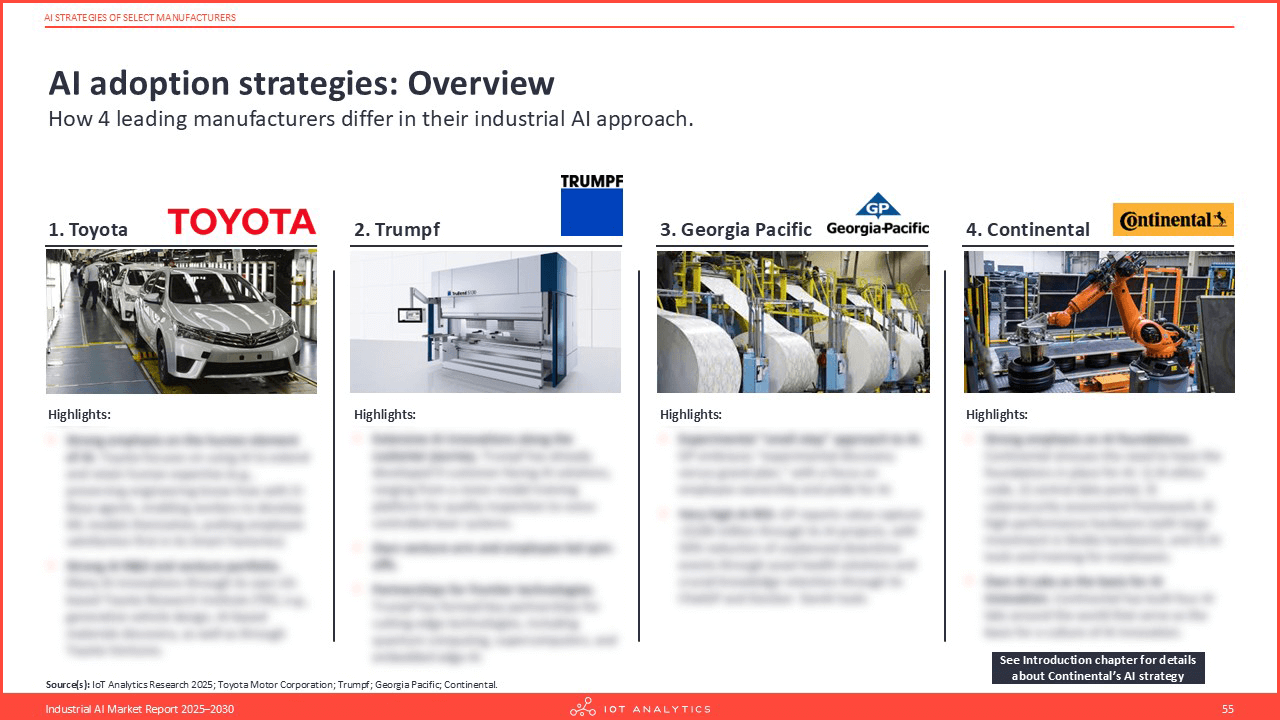

- How are selected manufacturers adopting industrial AI and what are the details of representative case studies?

- How do manufacturers adopt generative AI, edge AI and agentic AI?

- What are the key trends & challenges in industrial AI space?

Table of Contents

Industrial AI Market Report 2025-2030 (PDF)

- Executive Summary

- Introduction

- Technology overview

- Market size & outlook

- Market size and outlook: Chapter overview and key takeaways

- General drivers and inhibitors for the industrial AI market 2025

- Industrial AI market: What is included and what is not

- Global industrial AI market: Overall

- Data in perspective: What the average U.S. manufacturer spends on AI

- Global industrial AI market: By tech stack

- Global industrial AI market: By AI type

- Global industrial AI market: Training by hosting type

- Global industrial AI market: Inference by hosting type

- Global industrial AI market: By use case

- Global industrial AI market: By industry

- Discrete manufacturing industrial AI market: By ISIC code

- Hybrid manufacturing industrial AI market: By ISIC code

- Process manufacturing industrial AI market: By ISIC code

- Global industrial AI market: By region

- East Asia & Pacific industrial AI market: By country

- Europe & Central Asia industrial AI market: By country

- North America industrial AI market: By country

- Middle East & North Africa industrial AI market: By country

- Latin America & Caribbean industrial AI market: By country

- South Asia industrial AI market: By country

- Global industrial AI market: By top 10 countries and industry (2024)

- China industrial AI market: Overall

- China industrial AI market: By tech stack

- China industrial AI market: By industry

- China industrial AI market: By use case

- USA industrial AI market: Overall

- USA industrial AI market: By tech stack

- USA industrial AI market: By industry

- USA industrial AI market: By use case

- Germany industrial AI market: Overall

- Germany industrial AI market: By tech stack

- Germany industrial AI market: By industry

- Germany industrial AI market: By use case

- Japan industrial AI market: Overall

- Japan industrial AI market: By tech stack

- Japan industrial AI market: By industry

- Japan industrial AI market: By use case

- South Korea industrial AI market: Overall

- South Korea industrial AI market: By tech stack

- South Korea industrial AI market: By industry

- South Korea industrial AI market: By use case

- Competitive landscape

- Competitive landscape: Chapter overview and key takeaways

- Company landscape: Vendor classifications

- Methodology: How individual companies were analyzed

- Company landscape: Company database

- The 15 largest industrial AI vendors: Overview

- Competitive landscape 2024: Market share overview by tech stack

- Industrial AI hardware: Processors – Market share

- Industrial AI hardware: Computing systems – Market share

- Industrial AI software: How to think about the comp. landscape

- Industrial AI software: Platforms – Market share

- Industrial AI software: Platforms – Upcoming companies

- Industrial AI software: AI-native Applications

- Industrial AI services: Market share

- AI Libraries

- Use Cases

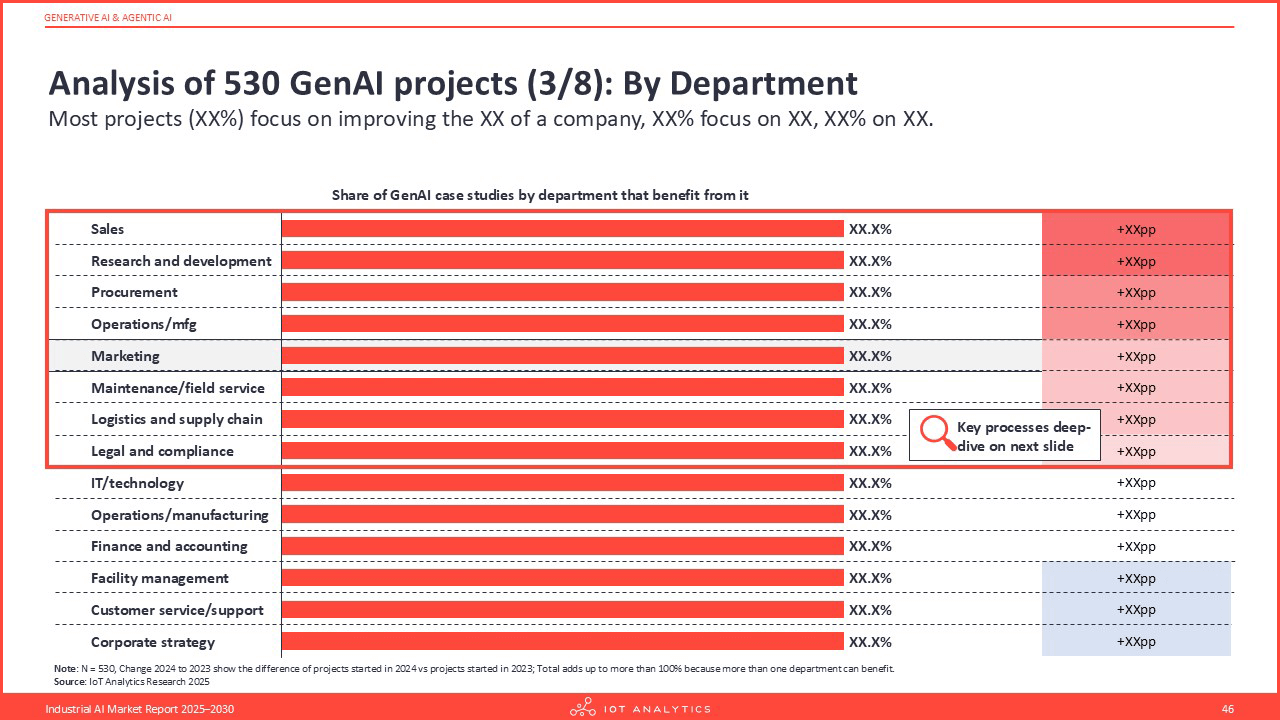

- Deep dive: Generative AI & agentic AI

- Deep dive: Edge AI

- Deep dive: AI in robotics

- Deep dive: AI strategies of select manufacturers

- Deep dive: End user insights

- Drivers, trends & challenges

- Methodology & market definitions

- About IoT Analytics

Companies mentioned

A selection from 670 companies mentioned.

AMD

AWS

Accenture

Alibaba

Capgemini

Dell Technologies

Deloitte

Foxconn

Google Cloud

Infosys

Microsoft

NVIDIA

Siemens

Supermicro

TCS

About the report

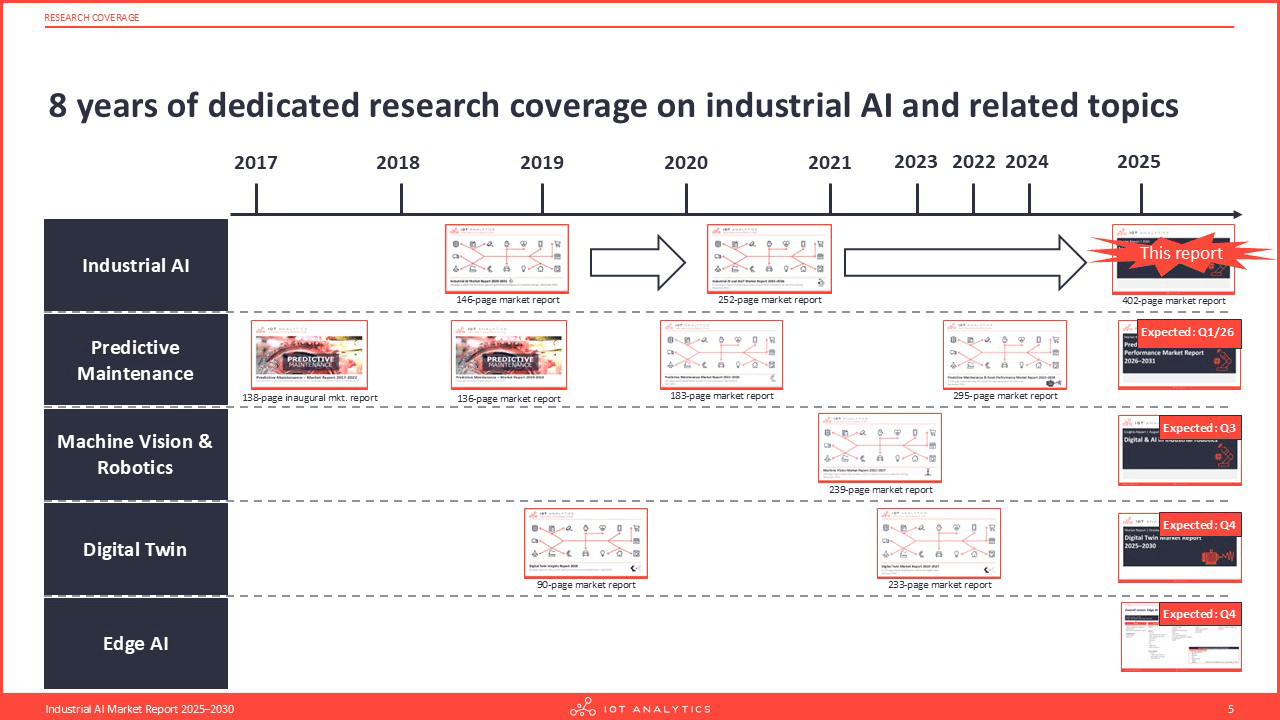

The Industrial AI Market Report 2025-2030 is part of IoT Analytics’ ongoing coverage of smart manufacturing and AI topics. The information presented in this report is based on the results of multiple surveys, secondary research as well as qualitative research i.e., interviews with experts and end users in the field. The document includes definitions for industrial AI and related topics (Edge AI, AI in robotics, Generative AI), market projections, adoption drivers, competitive landscapes, key trends and developments, and case studies.

This report is the third installment of our dedicated research coverage on industrial AI and related topics, including predictive maintenance, machine vision & robotics, digital twin, and edge AI.

The main purpose of this document is to help our readers understand the current industrial AI landscape by defining, sizing and analyzing the market.

The Industrial AI Market Report 2025-2030

The global industrial AI market, a multi-billion dollar market in 2024, is forecast to experience significant double-digit growth through 2030. This report delivers market data and insights helping decisions makers navigate through the market landscape.

Report highlights:

- Market sizing & forecasts: A detailed market model and forecast to 2030, segmented by tech stack (hardware, software, services), AI type, industry, region, and by top five countries.

- Competitive landscape: In-depth analysis of the 15 largest vendors with market shares and 30+ upcoming companies.

- Use case & adoption analysis: Deep dive into 48 key use cases across 10 categories, enriched with end-user perspectives on adoption drivers and barriers.

- Strategic insights: A review of 21 key market trends and 6 challenges shaping the industrial AI space.

- Technology deep dives: Dedicated chapters providing in-depth analyses of Generative AI & Agentic AI, Edge AI, and AI in Robotics.

- In-depth studies: Features 6 detailed use case studies and 4 deep dives into the AI strategies of leading manufacturers.

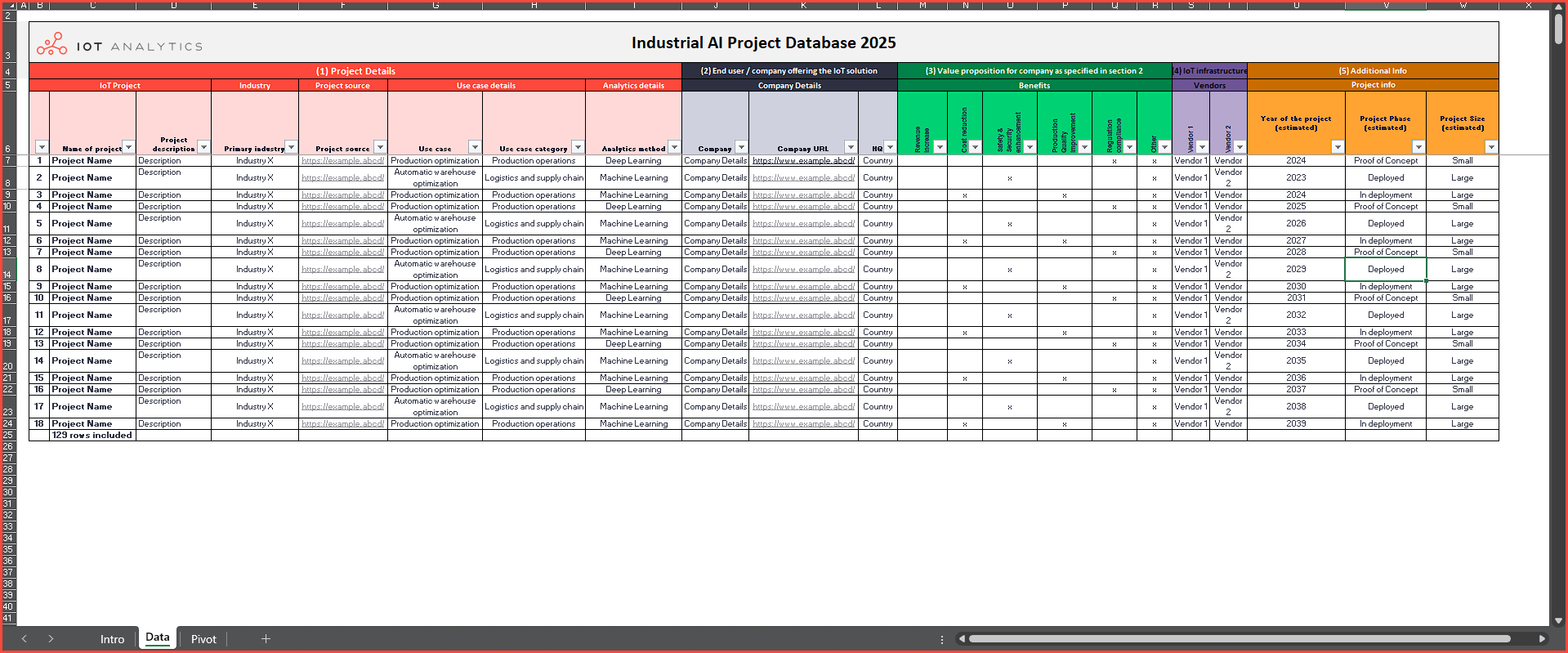

The market report comes with the full market model data in EXCEL, a list of 670 industrial AI vendor in EXCEL, and a list of industrial AI projects (only team user and enterprise premium license).

What is industrial AI?

Definition of AI

AI (Artificial Intelligence) is defined as machine driven intelligent behavior that involves the ability to acquire and apply knowledge.

AI consists of an analytics (learning) and an outcome (action/decision/prediction) component:

- Analytics corresponds to the data management processes and data science algorithms through which the device learns.

- Outcome corresponds to the intelligent behavior, e.g., generating a decision, a prediction, or triggering an action.

Definition of industrial AI

Industrial AI is defined as the application of AI techniques to data generated by operational technology and engineering systems in asset-heavy sectors, optimizing industrial processes at any stage of the product and asset lifecycle.

- Operational technology and engineering systems: Control, monitoring, and design platforms that generate real-time and engineering data about physical assets (e.g., PLC, SCADA networks, sensors, CAD/CAE suites, and PLM tools)

- Asset-heavy sectors: Industries whose business relies on extensive physical infrastructure and equipment (e.g., discrete and process manufacturing, energy, chemicals, mining, and transportation)

- Industrial processes: Technical workflows that create, move, or sustain physical goods and assets (e.g., product design, manufacturing, maintenance, logistics, field service)

Related reading

A research blog derived from the insights of this report: Industrial AI market: 10 insights on how AI is transforming manufacturing

.

Our insights are trusted by global industry leaders

Single User License

- 1 named user within a particular department and country

- Complete market report in PDF

- Market data in PDF (graphs within the report)

- Market model data in EXCEL

- List of 670 Industrial AI vendors EXCEL

- List of 125+ Industrial AI projects EXCEL

- Complete market report in PPTX

- 1 hour discussion with the analyst team

Team User License

- 1–5 named users within a particular department and country

- Complete market report in PDF

- Market data in PDF (graphs within the report)

- Market model data in EXCEL

- List of 670 Industrial AI vendors EXCEL

- List of 125+ Industrial AI projects EXCEL

- Complete market report in PPTX

- 1 hour discussion with the analyst team

Enterprise Premium License

- Report may be distributed to all employees of the enterprise

- Complete market report in PDF

- Market data in PDF (graphs within the report)

- Market model data in EXCEL

- List of 670 Industrial AI vendors EXCEL

- List of 125+ Industrial AI projects EXCEL

- Complete market report in PPTX

- 1 hour discussion with the analyst team

Get your free sample

Download the sample to learn more about:

- Report structure

- Select definitions

- Scope of research

- Market data

- Companies included

- Additional data points

Any questions?

Get in touch with us easily. We are happy to help!

Prajwal Praveen

Senior Sales Manager

Phone: +49 (0) 408 221 1722

Email: sales@iot-analytics.com