Description

Industrial Connectivity Market Report 2019-2024

The Industrial Connectivity Market Report 2019-2014 is part of IoT Analytics’ ongoing coverage of IoT Connectivity.

The information presented in this report is based on extensive primary and secondary research, including 38 interviews with industrial connectivity experts and end users conducted between December 2018 and July 2019.

Find out:

- How big the overall industrial connectivity market is and how fast the market is growing

- How the industrial connectivity market is developing across 3 regions (46 countries), 2 industries (10 sub-industries) and 4 components (15 segments)

- Which industrial connectivity vendors are market leaders (30+ leaders across 15 categories)

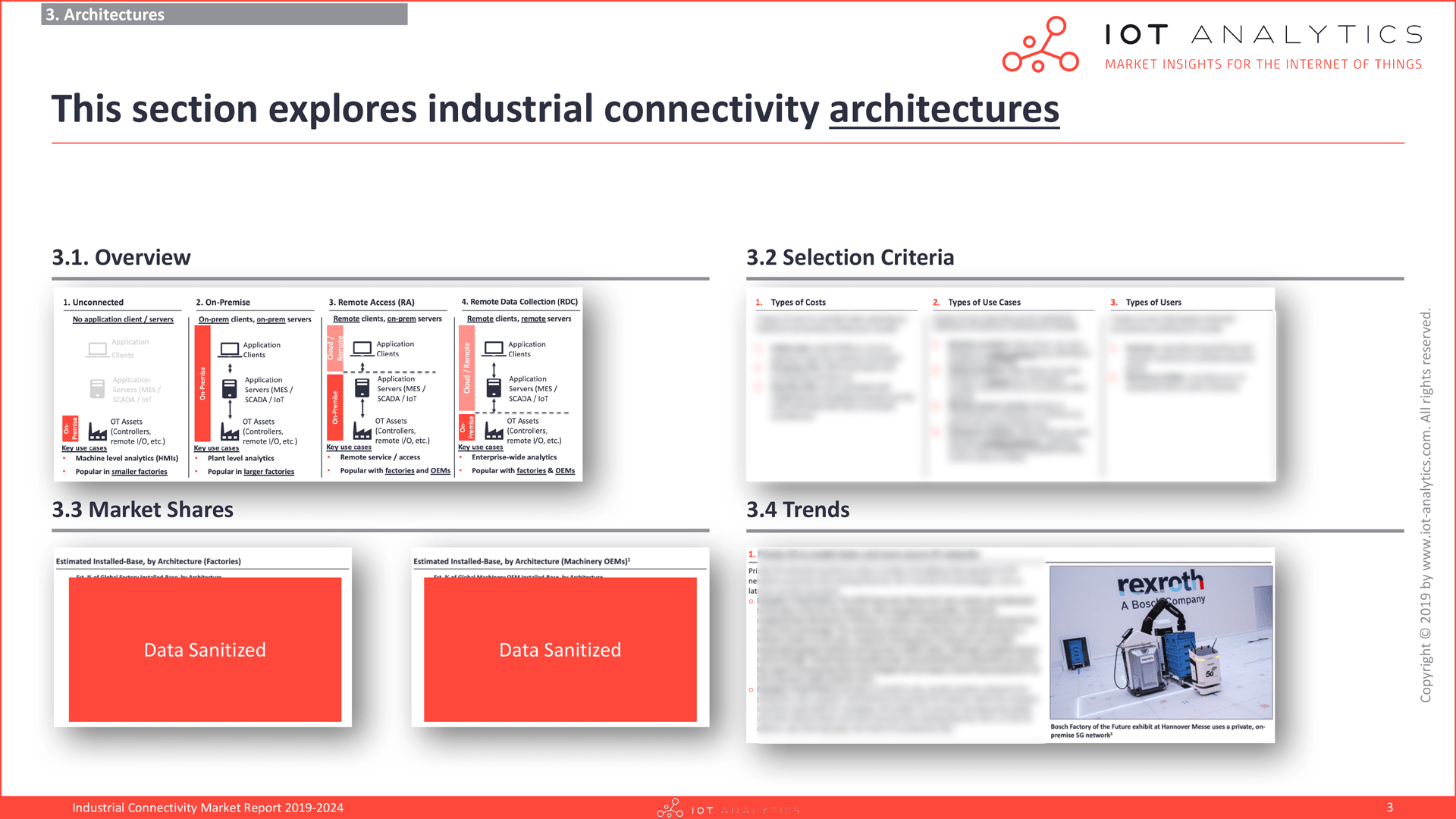

- How factories and machinery OEMs are adopting 4 different types of industrial connectivity architectures

- Which industrial connectivity protocols are experiencing the greatest growth in adoption rates

- How factories and OEMs are deploying industrial connectivity to reduce costs, increase revenues, reduce risks and comply with regulations (13 detailed case studies)

Questions answered in this report:

- What is industrial connectivity (i.e., an industrial connectivity definition)?

- What is the size of the overall industrial connectivity market, by component, region, and industry?

- What are the most common architectures for achieving industrial connectivity, and how will this change in the future?

- What the most common protocols used between each layer of the connectivity stack, and how will this change in the future?

- What types of hardware are used to achieve industrial connectivity, who are the leading suppliers, and how will the landscape change in the future?

- What types of software are used to achieve industrial connectivity, who are the leading suppliers, and how will the landscape change in the future?

- What types of services are used to achieve industrial connectivity, who are the leading suppliers, and how will the landscape change in the future?

- What types of solutions are used to achieve industrial connectivity, who are the leading suppliers, and how will the landscape change in the future?

- What are some examples of factories and OEMs using industrial connectivity to create value (i.e., industrial connectivity case study analysis)?

- What are some key trends in the industrial connectivity space?

Read the corresponding blog post here.

Available pricing plans:

See Terms & Conditions for license details.

Single User License

Market Report Single User License- 1 Named user (in your organization within the country of purchase)

- Complete market report in PDF

- Market Model Data

- List of of 350+ Ind. Connectivity Companies

- List of 60 Ind. Connectivity Projects

- Complete market report in PPT

- 1 hr discussion with the analyst

Team User License

Market Report Team User License- 1-5 Named users (in your organization within the country of purchase)

- Complete market report in PDF

- Market Model Data

- List of of 350+ Ind. Connectivity Companies

- List of 60 Ind. Connectivity Projects

- Complete market report in PPT

- 1 hr discussion with the analyst

Enterprise Premium License

Market Report Enterprise Premium User License- Unlimited users (in your organization within the country of purchase)

- Complete market report in PDF

- Market Model Data

- List of of 350+ Ind. Connectivity Companies

- List of 60 Ind. Connectivity Projects

- Complete market report in PPT

- 1 hr discussion with the analyst

At a glance:

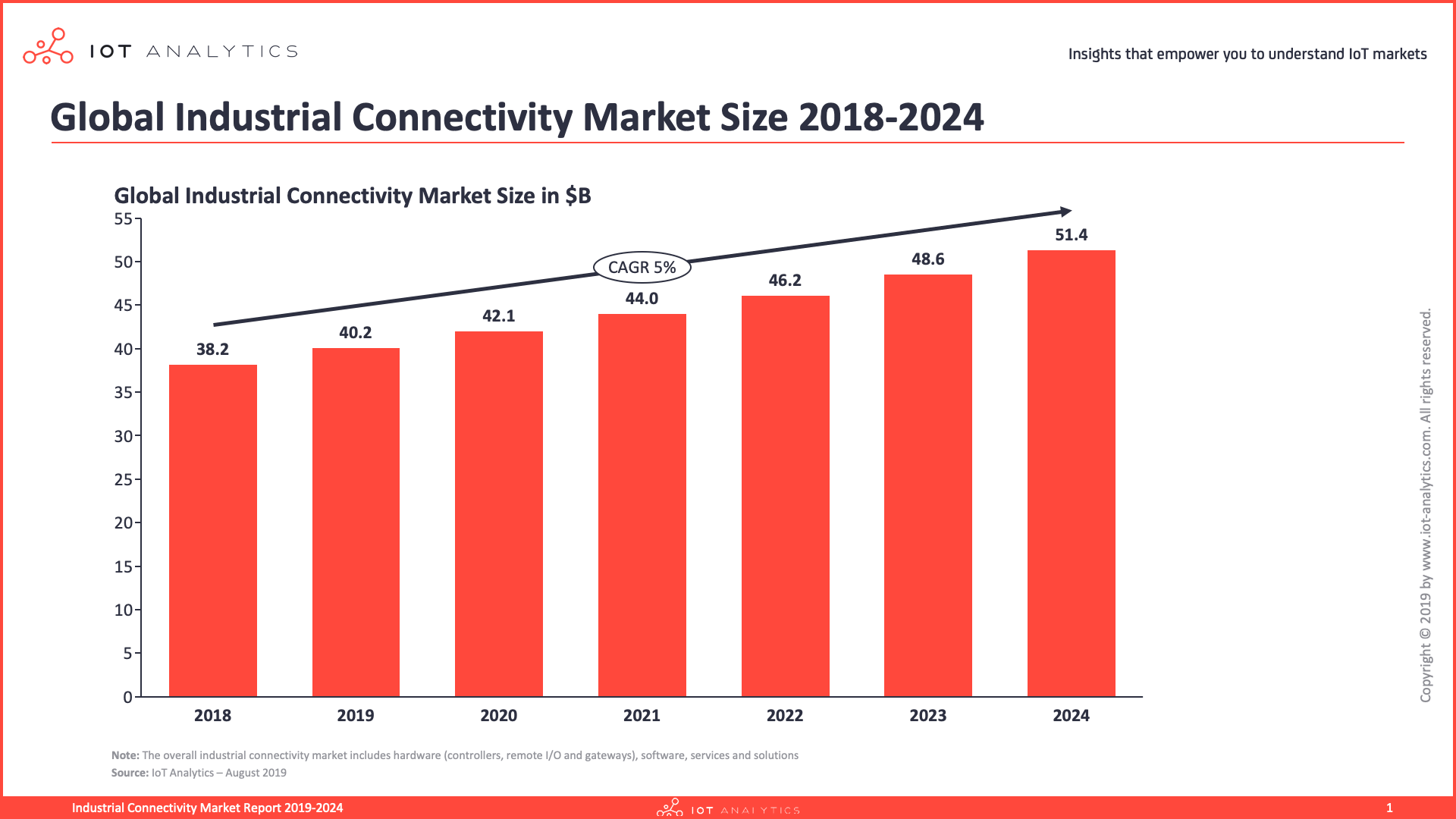

The market for industrial connectivity hardware, software, services and solutions is projected to grow at a CAGR of 5% to $51.4B by 2024.

Industrial connectivity hardware will attract the majority of the spending throughout forecast period, but the faster-growing software and services segments will take an increasing share of the spend by 2024 as technology continues to disrupt the traditional automation stack and reduce the costs associated with collecting data from industrial assets.

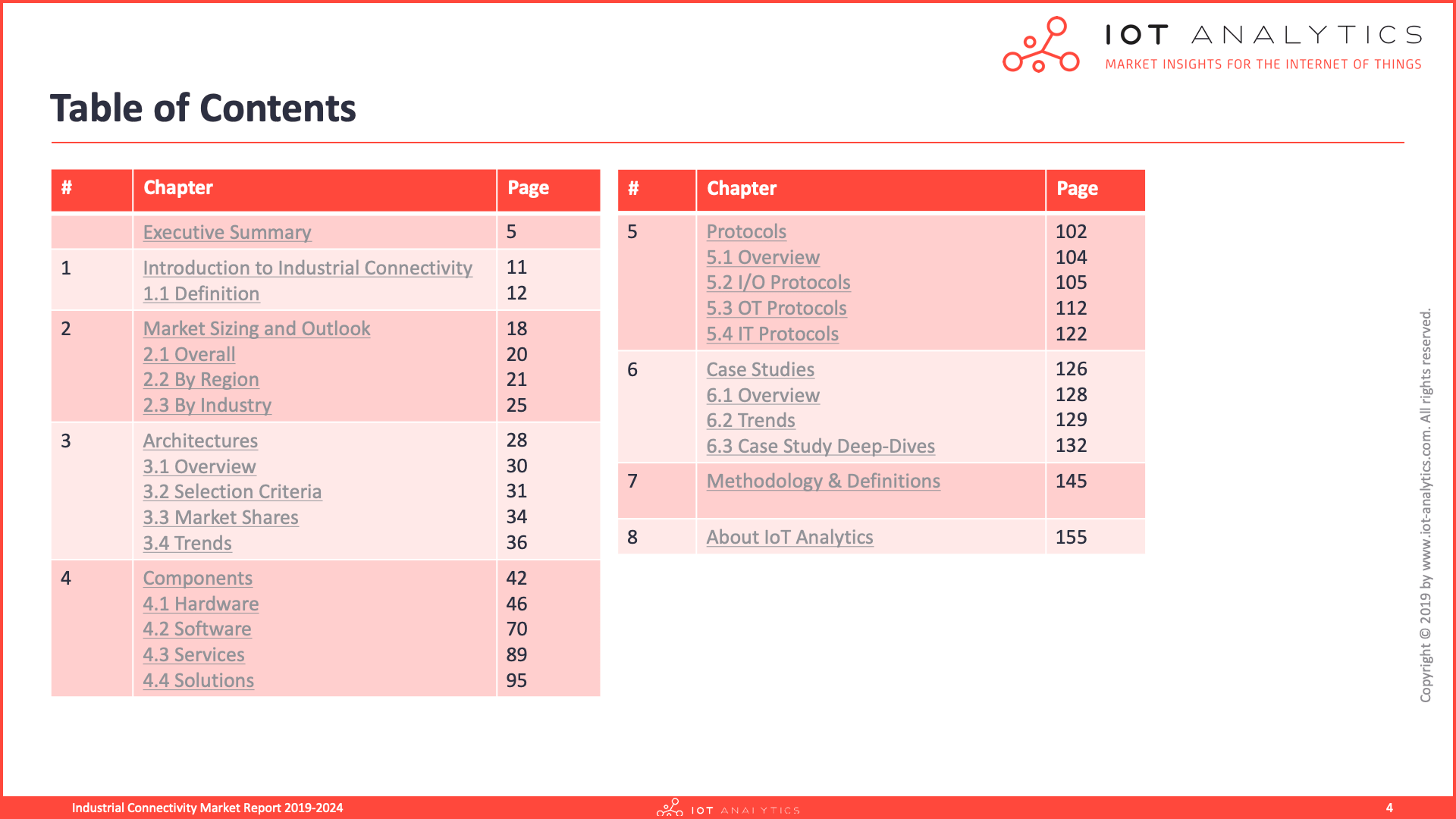

This report explores 3 different dimensions of industrial connectivity: architectures, components and protocols.

Each dimension is comprised of multiple segments which are analyzed from both a qualitative and quantitative perspective based on primary and secondary research.

The first chapter of the report analyzes the market for industrial connectivity hardware, software, services and solutions by component, region and industry.

The second chapter takes a deep-dive into the 4 types different industrial connectivity architectures, including selection criteria, projected adoption rates and trends.

The Industrial Connectivity Market Report looks at the market for each of the different industrial connectivity components (hardware, software, services and solutions) as well as their sub-elements (gateways, remote I/O, controllers, etc.).

Subsequent chapters break down the 3 types of industrial connectivity protocols and provides an in-depth analysis of the protocols that are gaining traction in the market.

The report includes a deep-dive into 13 industrial connectivity case studies and highlights 3 key trends that emerged from the case study analysis.

Selected companies from the industrial connectivity market report:

ABB, ADLink, Advantech, Amazon, Atos, Bosch, Belden, Cisco, Dell, Emerson, FogHorn, Hitachi, Honeywell (Matrikon), Huawei, Litmus Automation, Microsoft, Multitech, PTC (Kepware), Relayr, Rockwell Automation, Schneider Electric, Secomea, Siemens, Sierra Wireless, Telit, Yokogawa, and more…

Request a sample:

Request a sample of the report: