Industrial Connectivity Market Report 2024–2028

(see all)

Questions answered

- What is industrial connectivity (i.e., an industrial connectivity definition)?

- What is the size of the overall industrial connectivity market by component, region, and industry?

- What are some key trends and challenges in the industrial connectivity space?

- What types of hardware are used for data acquisition, who are the leading suppliers, and how might the landscape change in the future?

- What types of protocol converters software are used for data acquisition, who are the leading suppliers, and how will the landscape change in the future?

- What is the role of message broker software in industrial connectivity, who are the leading vendors, and how will the market change in the future?

- What are the elements of the quickly evolving space of industrial data operations (DataOps) software, who are the leading suppliers, and what changes are anticipated in the future?

- What technologies are involved in transmitting the data from source to destination?

- What are the most common architectures for achieving industrial connectivity, and how might this change in the future?

- What are the most common protocols used between each layer of the connectivity stack, and how could this change in the future?

- What are some examples of factories and original equipment manufacturers (OEMs) using industrial connectivity to create value (i.e., industrial connectivity case studies)?

Table of Contents

Industrial Connectivity Market Report 2024–2028 (PDF)

- Introduction

- Executive Summary

- Topic at a glance

- 3.1 Chapter overview

- 3.2 How manufacturers envision the factory of the future in three to five years

- 3.3 Seven key shifts are emerging that are impacting industrial connectivity

- 3.4 Current search trends for trending industrial connectivity technologies

- 3.5 Case in point – Equinor’s connectivity-driven digital transformation

- 3.6 Industrial connectivity definition – 7 elements (4 covered in this report) and 5 dimensions

- Overarching Trends and Challenges

- 4.1 Chapter summary

- 4.2 General industrial connectivity trends

- 4.3 General industrial connectivity challenges

- Market Size & Outlook

- 5.1 Chapter overview

- 5.2 Global overall industrial connectivity market size and market drivers/inhibitors

- 5.3 Global industrial connectivity market – overall

- by segments: Hardware, Software – protocol converter, message broker, dataops

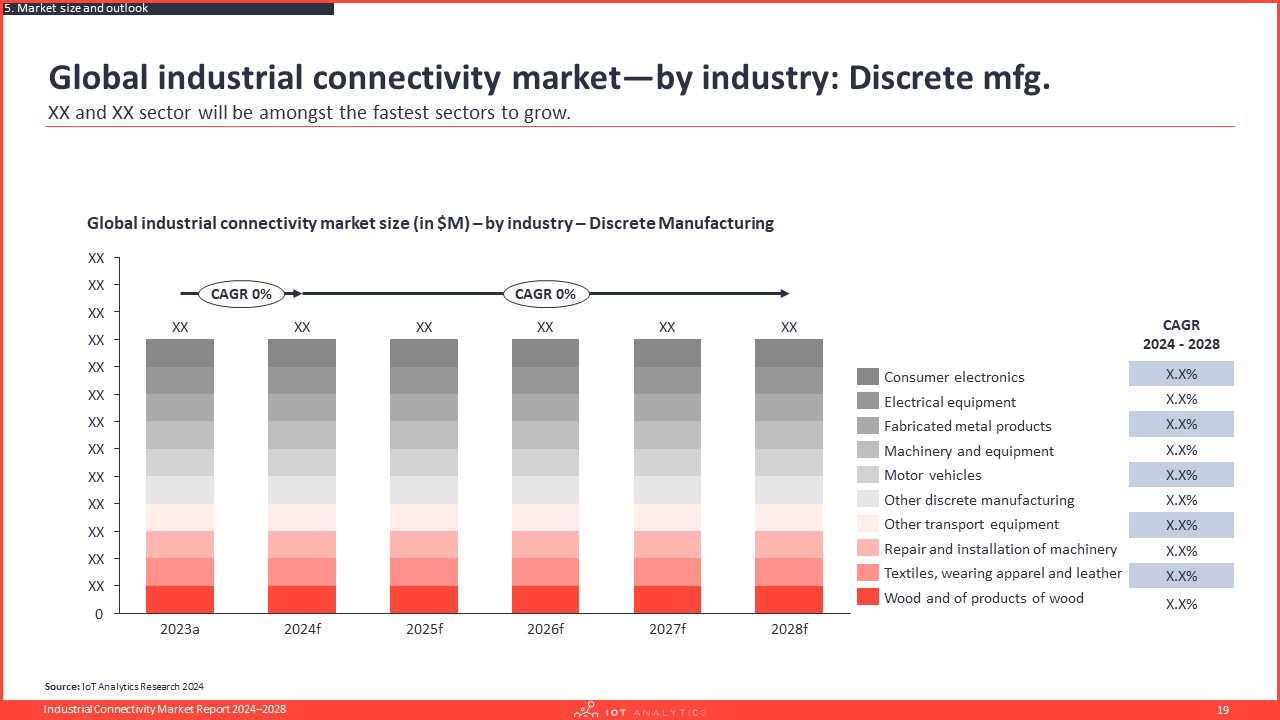

- 5.4 Global industrial connectivity market – by industry (discrete, process, hybrid)

- 5.5 Global industrial connectivity market – by region

- Industrial Connectivity Hardware

- 6.1 Chapter overview

- 6.2 Technical overview

- 6.3 Global market size and drivers

- 6.4 Technical summary – Field Instruments

- 6.5 Market summary by type (market size, leading vendors)

- – Field Instruments

- 6.6 Trends – Field Instruments

- 6.7 Technical summary – Remote I/O

- 6.8 Market summary by type (market size, leading vendors)

- – Remote I/O

- 6.9 Trends – Remote I/O

- 6.10 Technical summary – Controllers

- 6.11 Market summary by type (market size, leading vendors)

- -Controllers

- 6.12 Trends – Controllers

- 6.13 Technical summary – Gateways

- 6.14 Market summary by type (market size, leading vendors)

- – Gateways

- 6.15 Trends – Gateways

- Industrial Connectivity Software – Protocol Converters

- 7.1 Chapter overview

- 7.2 Technical overview of OT-OT and OT-IT protocol converters

- 7.3 Global market size and drivers

- 7.4 Technical summary OT-OT protocol converter

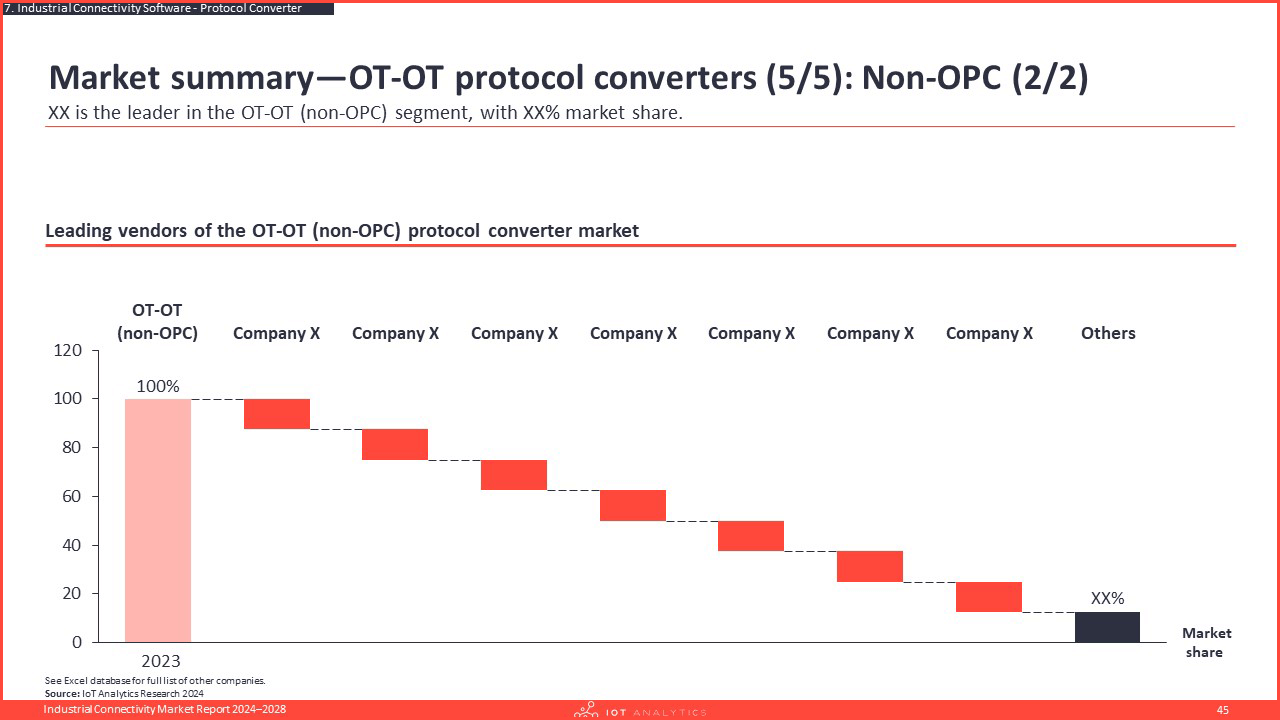

- 7.5 Market summary by type OPC/Non-OPC (market size, leading vendors)

- 7.6 Technical summary OT-IT protocol converter

- 7.7 Market summary by segment (cloud/app specific, cloud/app agnostic) and by type OPC/Non-OPC for each segment (market size, leading vendors)

- 7.8 Trends in protocol converter market

- Industrial Connectivity Software – Message Brokers

- 8.1 Chapter overview

- 8.2 Technical overview MQTT brokers

- 8.3 Market summary MQTT brokers

- 8.4 Trends in message broker market

- Industrial Connectivity Software – DataOps

- 9.1 Chapter overview

- 9.2 Definition and elements (industrial data quality management and data modeling)

- 9.3 Global market size and drivers (overall, by industry, by region)

- 9.4 Industrial data quality management: definition, data quality management steps, market summary, vendor profiles

- 9.5 Data modeling: definition, market summary, modeling steps

- 9.6 Data modeling overview

- 9.7 Data model types: asset model, use-case model

- 9.8 Standard data models (ISA-95 equipment model, CESMII SM profile, PackML, PA-DIM)

- 9.9 Data modeling standards (OPC-UA, Sparkplug B, AAS, DTDL, WoT)

- 9.10 Operationalizing data models

- 9.11 Data modeling governance

- 9.12 Data modeling vendor profiles

- 9.13 Trends in the DataOps market

- Data Transmission

- 10.1 Chapter overview

- 10.2 Definition and elements (Communication Pattern and Data Interchange Format)

- 10.3 Communication pattern description and types of communication patterns

- 10.4 Data interchange format description and types of data interchange formats

- 10.5 Data/Event streaming deep-dive

- Architectures

- 11.1 Chapter overview

- 11.2 Architectures overview

- 11.3 Asset architectures overview, selection criteria

- 11.4 Asset hierarchies overview, advantages/disadvantages

- 11.5 Network topologies overview

- 11.6 Unified Namespace – overview, key components, implementation examples

- 11.7 Trends in architectures

- Protocols

- 12.1 Chapter overview

- 12.2 3 main types of industrial connectivity protocols

- 12.3 Protocols – OSI model

- 12.4 Technical summary – L1-focused OT protocols

- 12.5 Market summary – L1-focused OT protocols

- 12.6 Deep dive of selected protocols – L1-focused OT protocols

- 12.7 Trends – L1-focused OT protocols

- 12.8 Technical summary – General OT protocols

- 12.9 Market summary – General OT protocols

- 12.10 Deep dive of selected protocols – General OT protocols

- 12.11 Trends – General OT protocols

- 12.12 Technical summary – IT protocols

- 12.13 Market summary – IT protocols

- 12.14 Deep dive of two selected protocols – IT protocols

- 12.15 Trends – IT protocols

- 12.16 Protocol survey results

- Case Studies

- 13.1 Case studies summary

- 13.2 Seven key takeaways

- 13.3 18 individual industrial connectivity case studies

- Definitions & Methodology

- About IoT Analytics

Companies mentioned

A selection of companies mentioned in the report.

ABB

Advantech

Amazon-AWS

Belden

Cognite

Cybus

dDriven

Emerson

Endress+Hauser

Eurotech

HMS Industrial Networks

HighByte

HiveMQ

Honeywell

IFM Electronic

Kepware/PTC

Litmus

Matrikon/Honeywell

Microsoft

Omron

Phoenix Contact

Rockwell

SICK

Schneider Electric

Siemens

Softing

TimeSeer

Yokogawa

About the report

The Industrial Connectivity Market Report 2024–2028 is part of IoT Analytics’ comprehensive coverage of industrial and connectivity topics. The content presented in this report is based on a combination of primary and secondary research, including 35+ interviews with industrial connectivity vendors and system integrators conducted between June 2023 and June 2024.

The primary objective of this document is to provide our readers with a comprehensive understanding of the current industrial connectivity market landscape. It offers in-depth analysis of industrial connectivity hardware, software, architectures, protocols, technologies, market projections, factors driving adoption, notable trends, and insightful case studies to facilitate informed decision-making and strategic planning.

Industrial connectivity definition

Industrial connectivity is the process of data exchange between industrial nodes, with seven key elements. These are data acquisition, DataOps, data storage, data transmission, data governance, architecture, and security.

Overview of the industrial connectivity market

According to the Industrial Connectivity Market Report 2024–2028 by IoT Analytics, the global industrial connectivity market is projected to grow from $89 billion in 2023 to $104 billion by 2028 at a CAGR of 5% over the next 4 years.

As manufacturers get ready for the factory of the future, industrial connectivity is changing. Emerging shifts include widespread data availability enabled by smart nodes, streamlined data management through DataOps, and flexible architectures facilitated by edge and cloud advancements.

Industrial connectivity hardware will continue to have the dominant share of the overall industrial connectivity market but is expected to grow the slowest, with the software segments growing the fastest. Within the software segments. the industrial connectivity protocol converter software market is projected to grow at above 10% CAGR, while the smaller segment of message brokers (MQTT brokers) software is expected to grow at much faster pace. The industrial DataOps market is emerging rapidly. The DataOps software market, which consists of data quality management and data modeling, is expected to grow at the fastest pace in the next four years.

Seven key shifts are emerging with an impact on industrial connectivity

| In the past | In the future |

|---|---|

| Limited data availability | Widespread data availability-enabled by smart nodes, protocols, converters |

| Rigid, siloed architectures | Flexible, scalable architectures—enabled by edge and cloud advancements |

| Poor data management | Streamlined data management—enabled by industrial DataOps practices |

| Slow and fragmented connectivity | Fast connectivity—enabled by interoperable Ethernet-based networks |

| Restrictive wired connections | Flexible wireless networks—enabled by wireless mediums and protocols |

| Basic hardware capabilities | Advanced hardware—enabled by integration of powerful CPUs/GPUs |

| Hardware dependent computing | Distributed computing—enabled by edge and software-defined hardware |

Related reading

A research article based on insights from this report:

- Avoiding digital transformation icebergs: Can industrial DataOps steer projects away from disaster?

- 8 notable developments in software-defined manufacturing

→Sign up for the newsletter to be notified of future updates

Our insights are trusted by global industry leaders

Single User License

- 1 named user within a particular department and country

- Complete market report in PDF

- Market data in PDF (graphs within the report)

- Market model data in EXCEL

- Complete market report in PPTX

- 1 hour discussion with the analyst team

Team User License

- 1–5 named users within a particular department and country

- Complete market report in PDF

- Market data in PDF (graphs within the report)

- Market model data in EXCEL

- Complete market report in PPTX

- 1 hour discussion with the analyst team

Enterprise Premium License

- Report may be distributed to all employees of the enterprise

- Complete market report in PDF

- Market data in PDF (graphs within the report)

- Market model data in EXCEL

- Complete market report in PPTX

- 1 hour discussion with the analyst team

Get your free sample

Download the sample to learn more about:

- Report structure

- Select definitions

- Scope of research

- Market data

- Companies included

- Additional data points

Any questions?

Get in touch with us easily. We are happy to help!

Prajwal Praveen

Senior Sales Manager

Phone: +49 (0) 408 221 1722

Email: sales@iot-analytics.com