IoT Commercialization & Business Model Adoption Report 2024

(see all)

About the report

The IoT Commercialization & Business Model Adoption Report 2024 is part of IoT Analytics’ ongoing coverage of Industrial IoT and Industry 4.0. The information presented in this report is based on an extensive survey, conducted in Q3 2023, of 100 OEMs of smart, connected products. The purpose of the report is to inform other market participants, most notably other OEMs that start developing their own connected IoT product and their vendors, of the process for creating such products, as well as the benefits they provide. Survey participants were selected randomly, and their knowledge was verified independently. To ensure complete objectivity, IoT Analytics did not alter or supplement any survey results and did not accept participants that were suggested by third parties. The IoT Analytics team added a number of examples to make some of the survey results more “real” for the reader (e.g., pricing examples and examples of specific connected product features introduced by some OEMs).

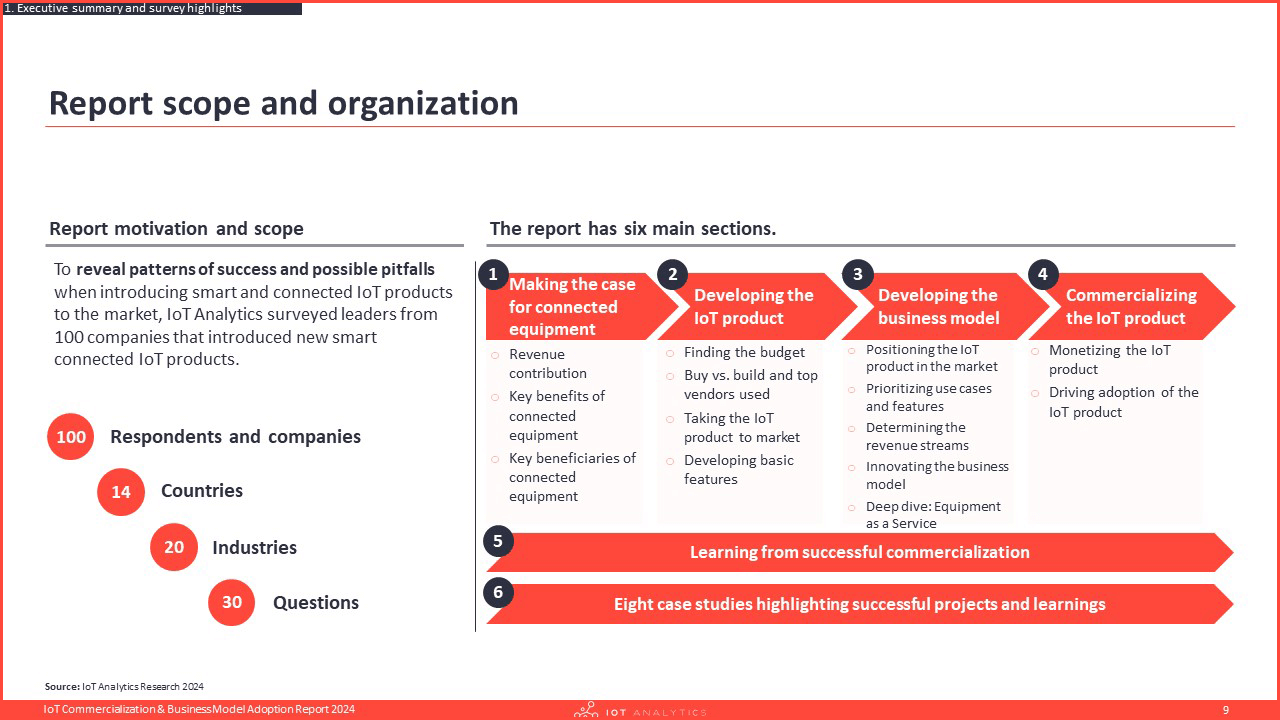

This publication analyses the process of commercializing smart connected IoT products along 6 main sections:

- Making the case for connected equipment

- Revenue contribution

- Key benefits of connected equipment

- Key beneficiaries of connected equipment

- Developing the IoT product

- Finding the budget

- Buy vs. build and top vendors used

- Taking the IoT product to market

- Developing basic features

- Developing the business model

- Positioning the IoT product in the market

- Prioritizing the use cases and features

- Determining the revenue streams

- Innovating the business model

- Deep dive: Equipment as a Service

- Commercializing the IoT product

- Monetizing the IoT product

- Driving adoption of the IoT product

- Learning from successful commercialization

- Case studies highlighting successful projects and learnings

Table of Contents

IoT Commercialization & Business Model Adoption Report 2024 (PDF)

- Executive summary and survey highlights

- Report scope and organization

- Who participated in this research (selection)?

- Survey audience overview

- This report is an update of the “IoT Commercialization & Business Model Adoption Report 2020″

- Executive Summary

- Highlight: 6 key insights from the analysis performed in the report

- Highlight: 5 characteristics of successful OEMs

- Introduction

- Starting point: OEMs can tap into nine potential sources of revenue

- Search terms related to new OEM business models are slowly but steadily trending upwards

- Conceptual approach—the more connected, the higher the value potential

- IoT enables OEMs to develop new competitive advantages

- Universal Robots—an OEM journey in six years

- Connected products drive an OEM’s services business

- This report takes the reader through the journey of an OEM

- Making the case for connected equipment

- Contribution of connected products to OEM revenue (1/3)—overall/regions)

- Contribution of connected products to OEM revenue (2/3)—industry

- Contribution of connected products to OEM revenue (3/3)—size/customer type

- Value of IoT products (1/5)—overall

- Value of IoT products (2/5)—example: getting insights from customers

- Value of IoT products (3/5)—by industry

- Value of IoT products (4/5)—by region, company size, and customer type

- Value of IoT products (5/5)—by department and seniority

- How IoT products enhance a company’s operations (1/7)—overview

- How IoT products enhance a company’s operations (2/7)—by segment

- How IoT products enhance a company’s operations (3/7): product design/engineering of the physical product

- How IoT products enhance a company’s operations (4/7): product design/engineering of software

- How IoT products enhance a company’s operations (5/7): field service operations and mfg. processes

- How IoT products enhance a company’s operations (6/7): after-sales services and customer support

- How IoT products enhance a company’s operations (7/7): sales/marketing processes to sell SW/services

- Example: Three main benefits when OEMs connect their equipment

- Integrating IoT product usage data into business systems (1/2)—overview

- Integrating IoT product usage data into business systems (2/2)—example

- Developing the IoT product

- Budgeting for smart, connected products (1/3)—overall cost

- Budgeting for smart, connected products (2/3)—by component

- Budgeting for smart, connected products (3/3)—by component/segment

- Budget distribution for the components of smart, connected products

- Procurement sources for each technology stack layer

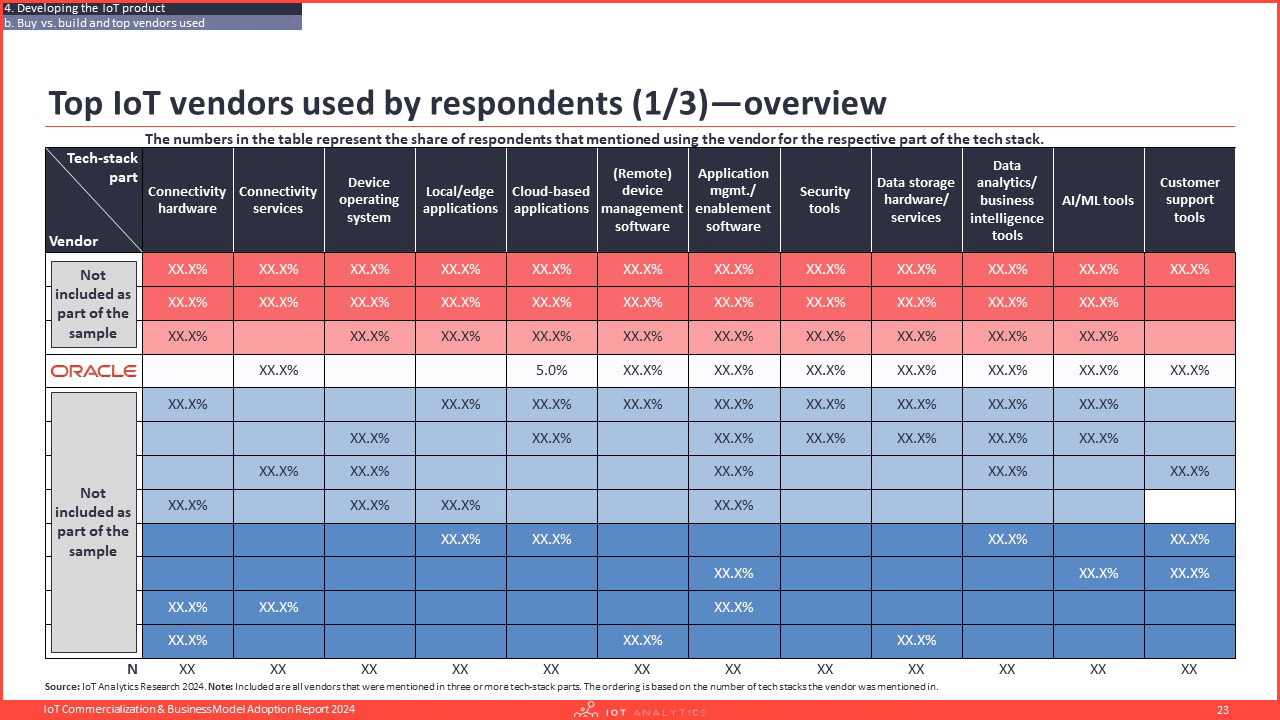

- Top IoT vendors used by respondents (1/3)—overview

- Top IoT vendors used by respondents (2/3)—by tech stack (1/2)

- Top IoT vendors used by respondents (3/3)—by tech stack (2/2)

- Open-source tools/vendors mentioned

- Time to market (1/5)—overview

- Time to market (2/5)—by industry and region

- Time to market (3/5)—by launch year, business model, and company size

- Time to market (4/5)—three-year comparison

- Time to market (5/5)—our interpretation of the results

- Developing basic features—overview

- Providing self-service options

- Offering a usage dashboard (1/2)

- Over-the-air (OTA) updates (1/2)

- Over-the-air (OTA) updates (2/2)—example

- Developing the business model

- New vs. existing product (1/2)—overview

- New vs. existing product (2/2)—by industry and region

- Value of connected product features (1/3)—overview

- Value of connected product features (2/3)—detailed view

- Value of connected product features (3/3)—by segment

- Connected products in metalworking machines

- Remote service / Remote control: Grupo Cimbali

- Condition monitoring: Trumpf

- Operational dashboard: König & Bauer

- Operational dashboard: Liebherr (1/3): Overview

- Operational dashboard: Liebherr (2/3): Machine info

- Operational dashboard: Liebherr (3/3): Report info

- Energy monitoring: Liebherr

- Monitoring customer usage (1/2): overview

- Monitoring customer usage (2/2): case in point

- Revenue contribution of each product part (1/2)—through the years

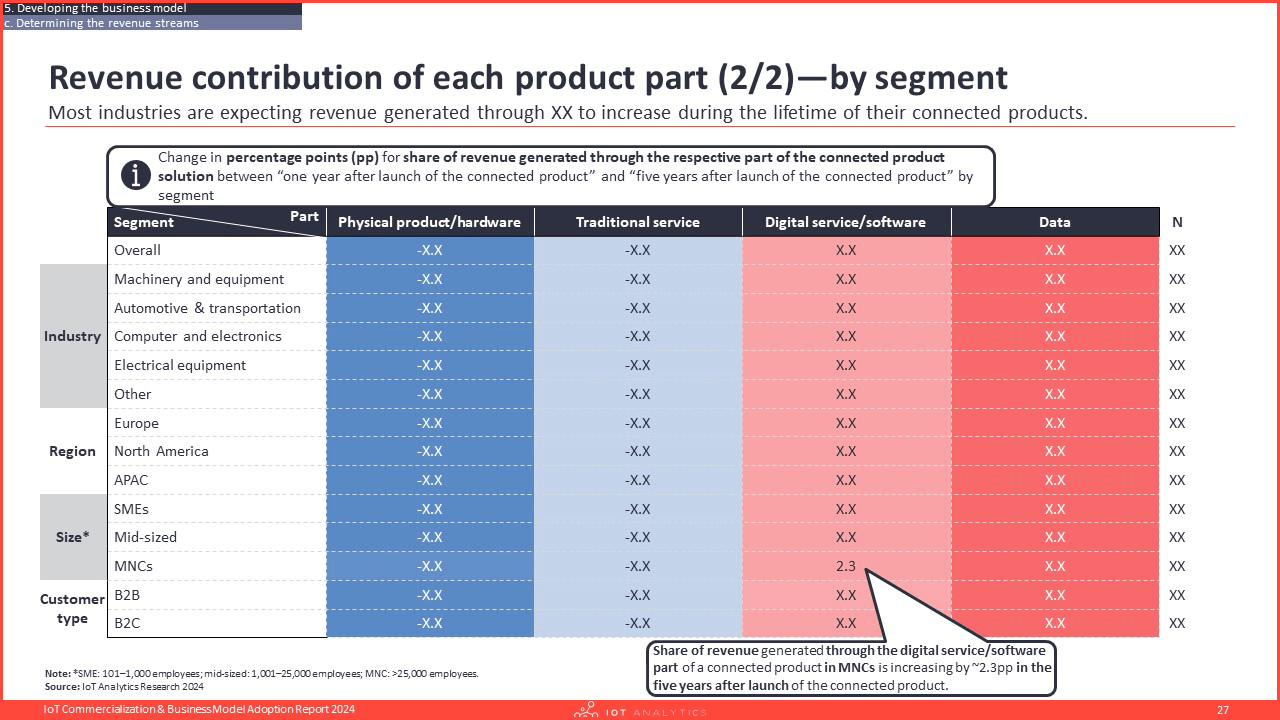

- Revenue contribution of each product part (2/2)—by segment

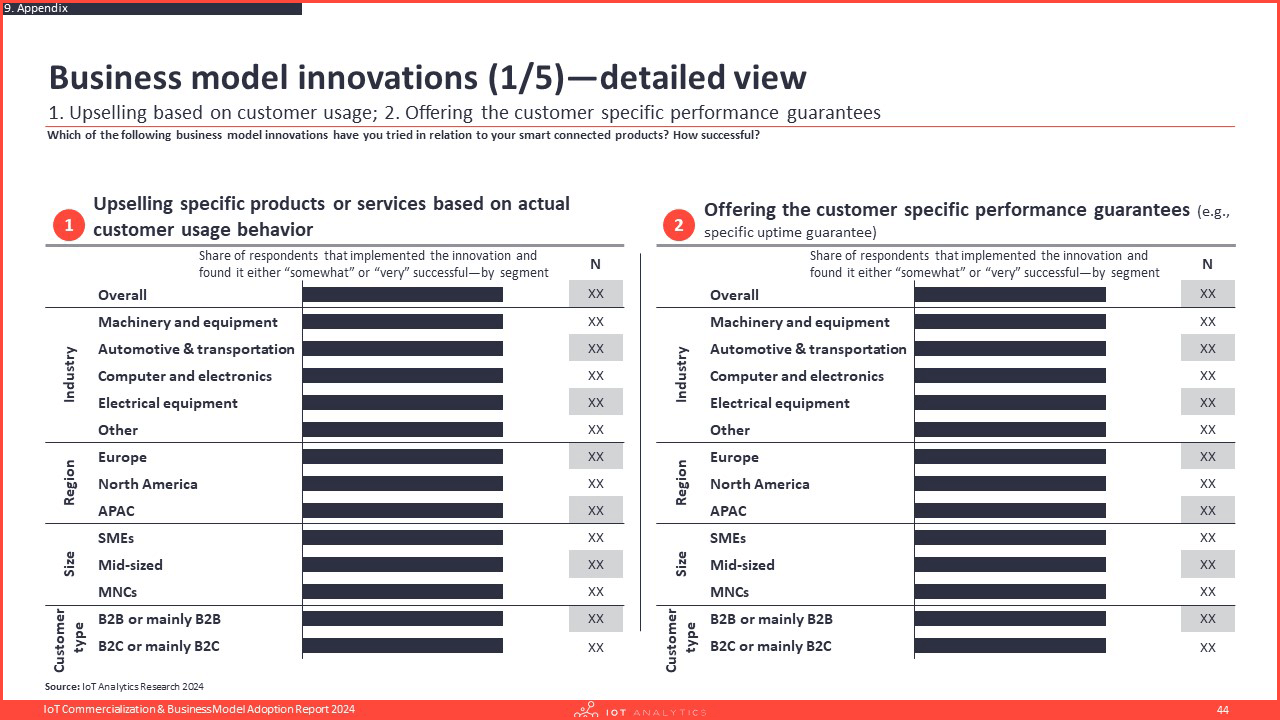

- Business model innovations (1/3)—overview

- Business model innovations (2/3)—detailed overview

- Business model innovations (3/3)—industry view

- Additional business model insights—overview

- Offering and monetizing software add-ons—example: UNOX

- Letting the customer lease the equipment—example: Tetra Pak

- Offering specific performance guarantees—example: Johnson Controls

- EaaS OEM adoption status (1/2)—overview

- EaaS OEM adoption status (2/2)—by segment

- Four prominent examples of companies that have introduced EaaS

- Customer adoption of EaaS

- Reasons why customers adopt EaaS

- Reasons why customers are reluctant to adopt EaaS

- Necessary actions to guarantee a successful pivot to EaaS

- Additional respondent insights for a successful pivot to EaaS

- Example: Having a clear value proposition

- Common mistakes when transitioning to EaaS

- Common mistakes when transitioning to EaaS—respondent insights

- Commercializing the IoT product

- Monetization and additional guarantees (1/2)—overview

- Monetization and additional guarantees (2/2)—by segment

- Monetization of different solution elements (1/3)—today

- Monetization of different solution elements (2/3)—in two years

- Monetization of different solution elements (3/3)—expected change

- Overview—data ownership and privacy

- Example—privacy and security laws affecting connected products

- Factors that drive customer adoption (1/2)

- Factors that drive customer adoption (2/2)

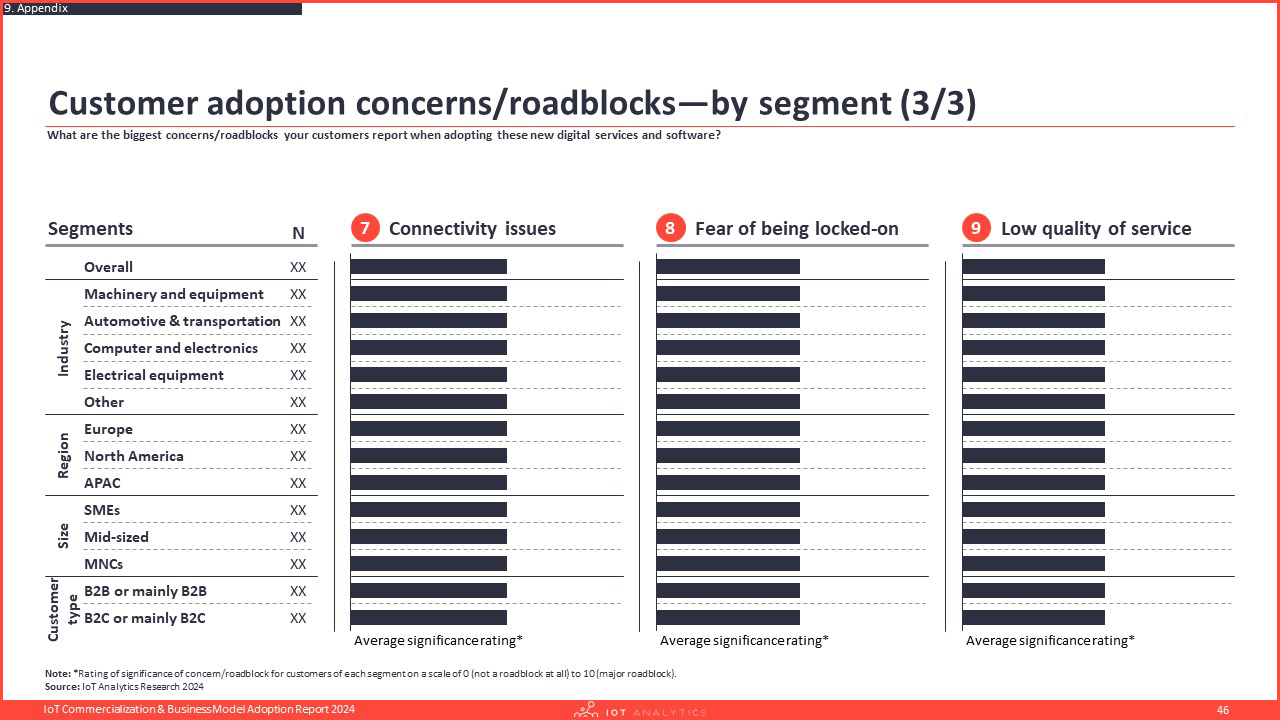

- Customer adoption concerns/roadblocks (1/2)—overview

- Customer adoption concerns/roadblocks (2/2)—changes since 2020

- Learning from successful commercialization

- Five characteristics of successful OEMs

- Identifying a successful IoT commercialization

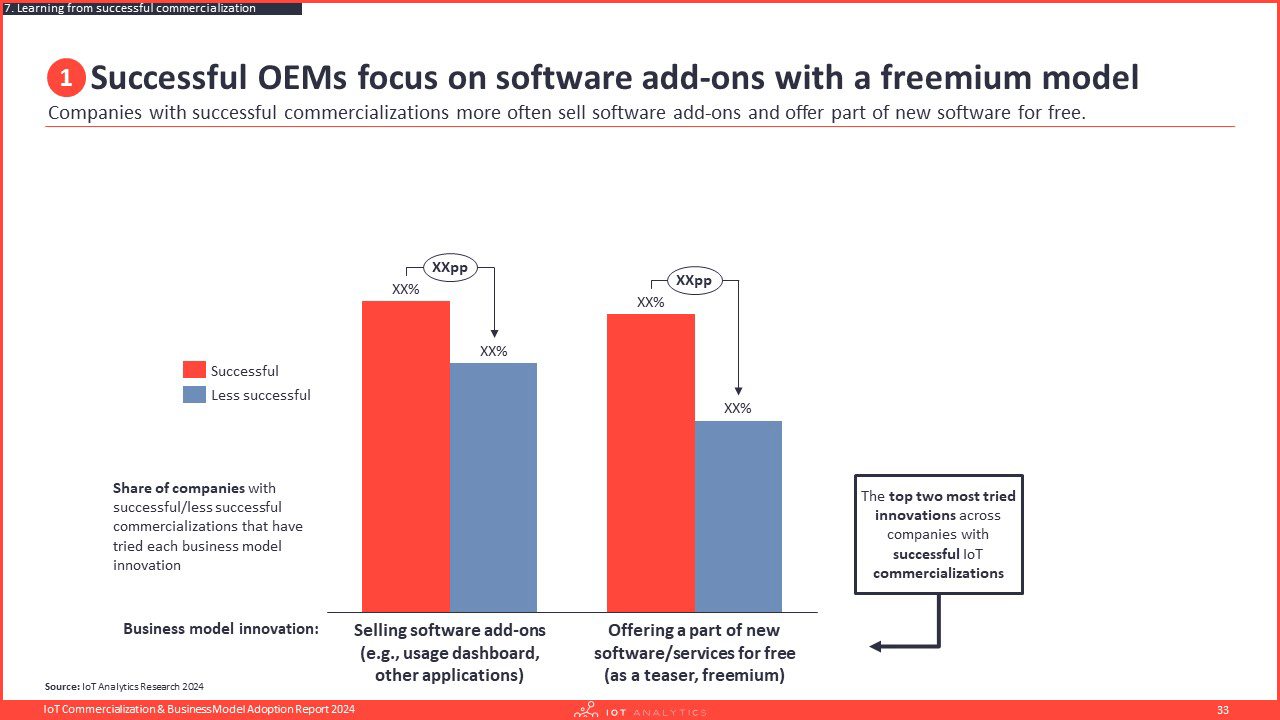

- Successful OEMs focus on software add-ons with a freemium model

- Successful OEMs help their customers optimize the workflow

- Example: Trumpf workflow optimization

- Successful OEMs prioritize understanding customer hurdles in service adoption

- Successful OEMs integrate IoT data with CRM and ERP systems

- Successful OEMs effectively utilize IoT data to boost sales and marketing

- Case studies

- Connected products case study 1: Hilti power tools

- Connected products case study 2: John Deere

- Connected products case study 3: Schindler elevators

- Connected products case study 4: BMW cars

- Connected products case study 5: UNOX ovens

- Equipment-as-a-Service case study 1: Heller

- Equipment-as-a-Service case study 2: Carrier

- Equipment-as-a-Service case study 3: Mitsubishi

- Appendix

- Methodology

- About IoT Analytics

Questions answered

- How much are connected products contributing to OEM revenue, and how is this expected to change in the future?

- How are OEMs sourcing their tech stack?

- Which vendors are being used most often for each part of the tech stack?

- How valuable have the connected products been for the organization, and which company activities are they improving upon?

- What is the necessary budget for a company to create smart, connected products from scratch?

- How are OEMs innovating their business model?

- What are the biggest factors for driving customer adoption of connected products, and what are the most important concerns/roadblocks?

- How are OEMs monetizing their solutions?

- What is the state of Equipment as a Service (EaaS), including adoption, necessary actions to be successful when pivoting to the model, and common pitfalls to avoid?

- Which business systems are integrated with the IoT product usage data?

- What extra features are OEMs offering to their customers on top of their connected products?

- What are the six main factors that differentiate companies with more successful IoT commercializations?

- What are some connected product and EaaS case studies?

Related reading

How to create a successful IoT business model—Insights from successful OEMs article was recently published based on insights from this report.

→Sign up for the newsletter to be notified of future articles

Companies mentioned

A selection of companies mentioned in the report.

AWS

BMW Group

Cisco

DMG Mori

Hilti

IBM

John Deere

Liebherr

Microsoft

Oracle

Schindler

Trumpf

UNOX

Our insights are trusted by global industry leaders

Single User License

- 1 named user within a particular department and country

- Complete adoption report in PDF

- Complete adoption report in PPTX

- 1 hour discussion with the analyst team

Team User License

- 1–5 named users within a particular department and country

- Complete adoption report in PDF

- Complete adoption report in PPTX

- 1 hour discussion with the analyst team

Enterprise Premium License

- Report may be distributed to all employees of the enterprise

- Complete adoption report in PDF

- Complete adoption report in PPTX

- 1 hour discussion with the analyst team

Get your free sample

Download the sample to learn more about:

- Report structure

- Companies included

- Methodology

- Additional data points

Any questions?

Get in touch with us easily. We are happy to help!

Prajwal Praveen

Sales Manager

Phone: +49 (0) 408 221 1722

Email: sales@iot-analytics.com