Description

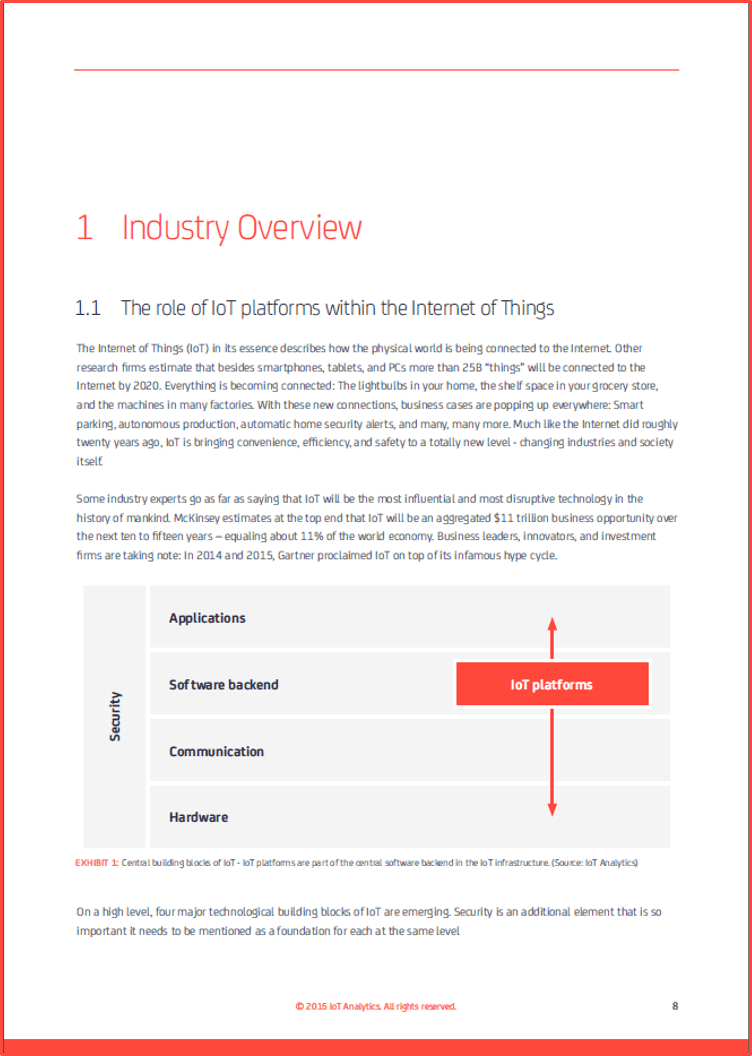

IoT Platforms are emerging as the central backbone in the overall IoT infrastructure.

Find out:

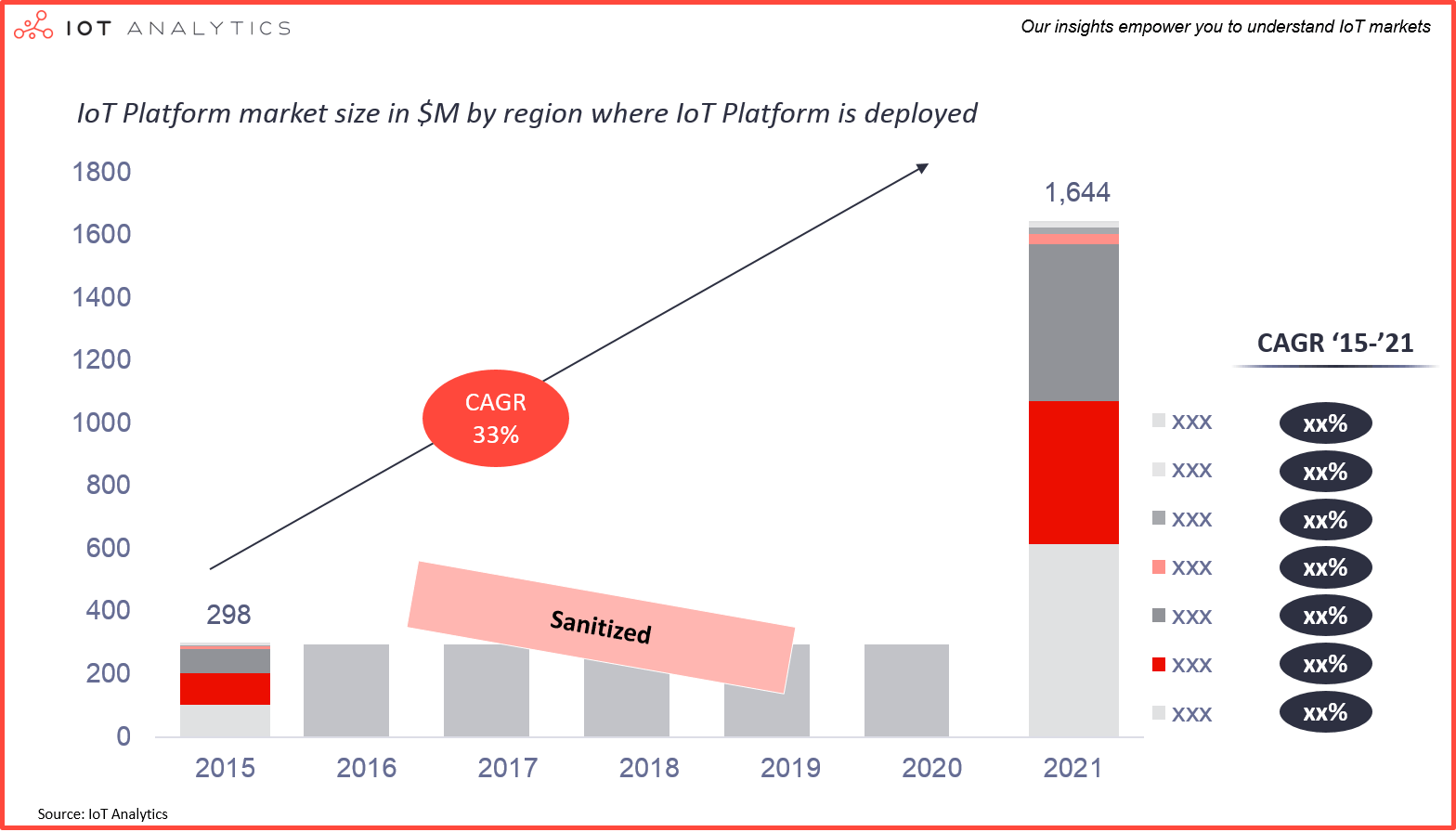

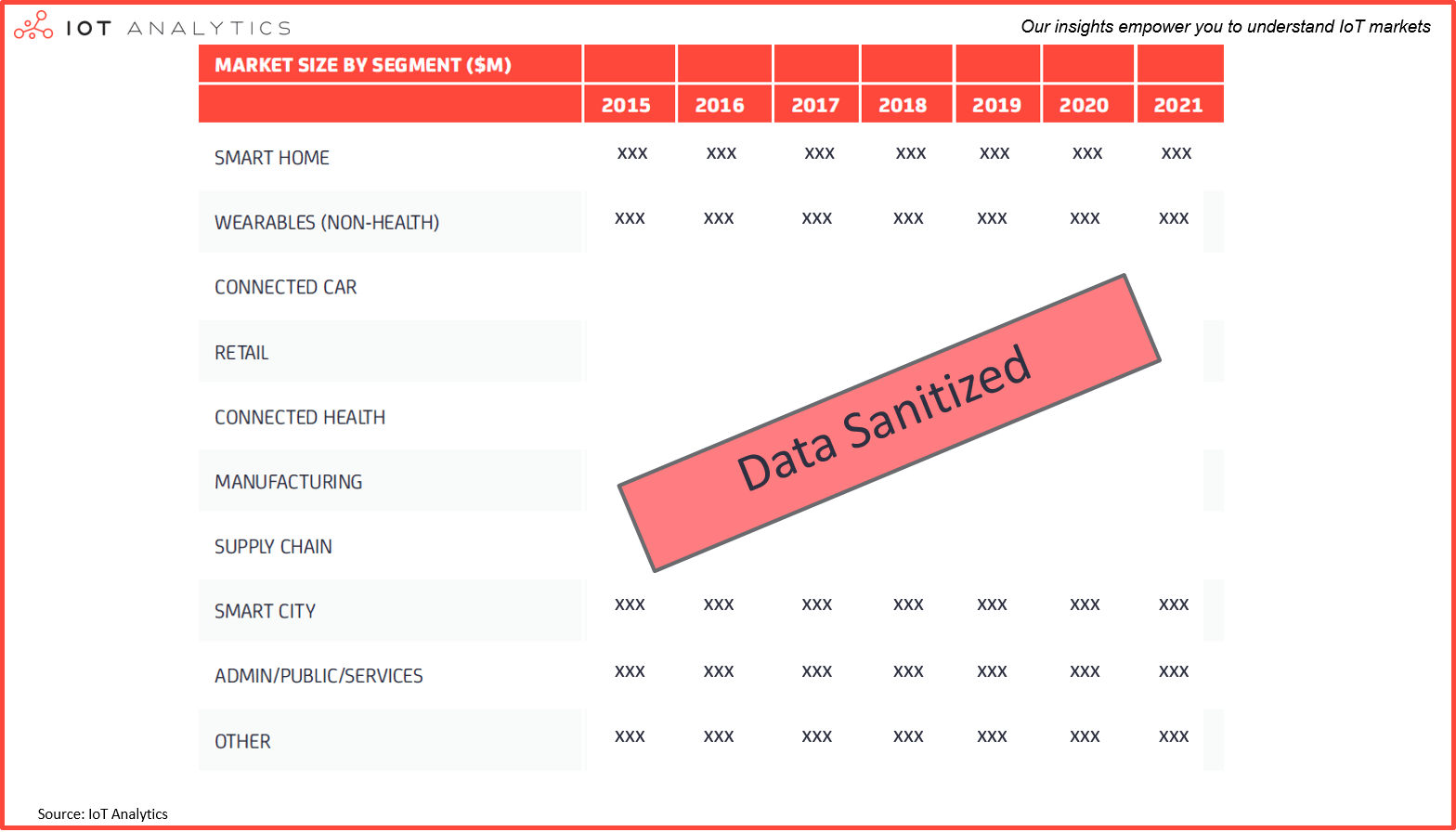

- How the market (revenue) is developing in 46 countries in the world

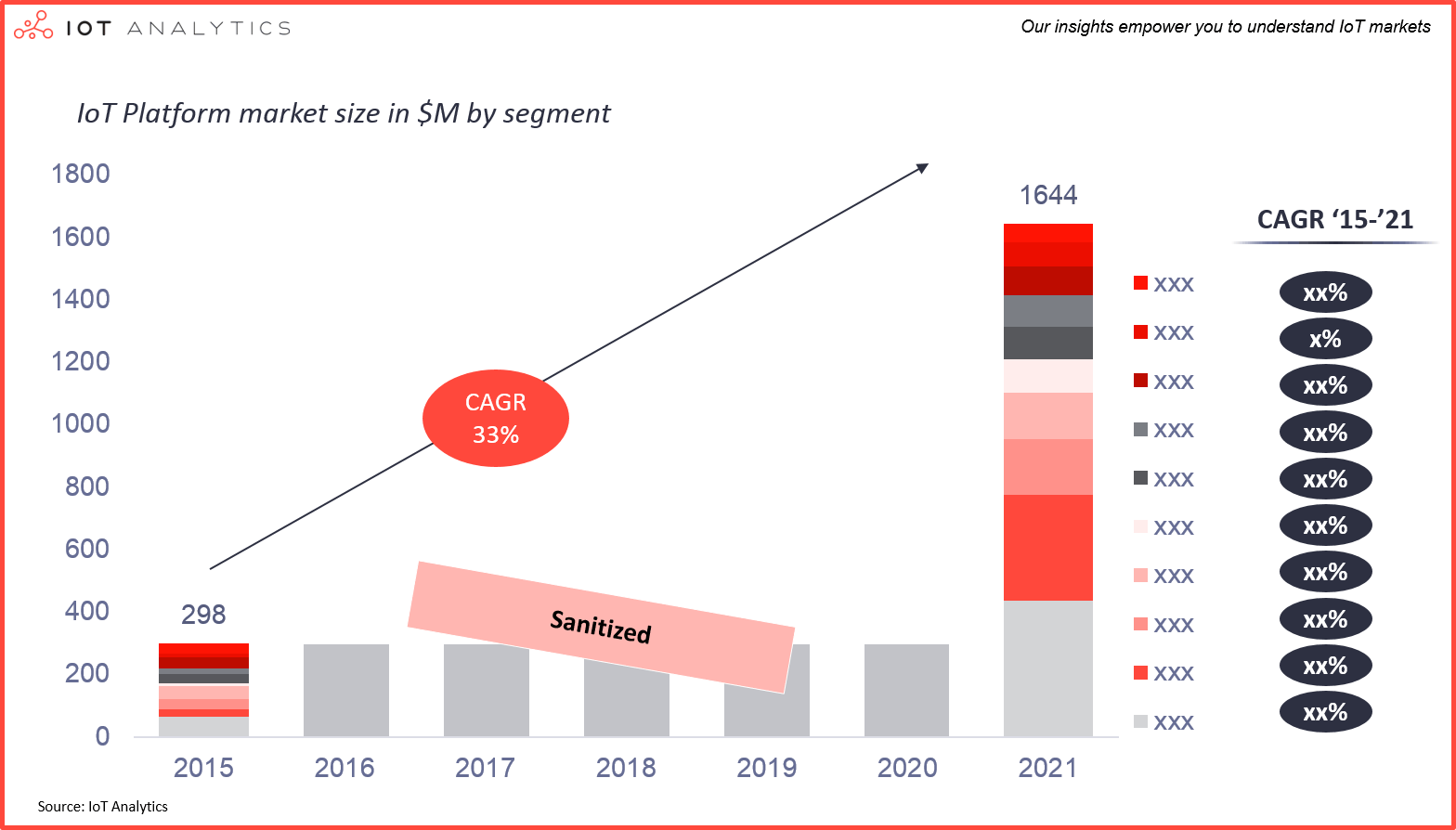

- How the market (revenue) is developing in 10 key segments (Connected Car, Connected Health, Home, Manufacturing, Other, Public Services, Retail, Smart City, Supply Chain, Wearables)

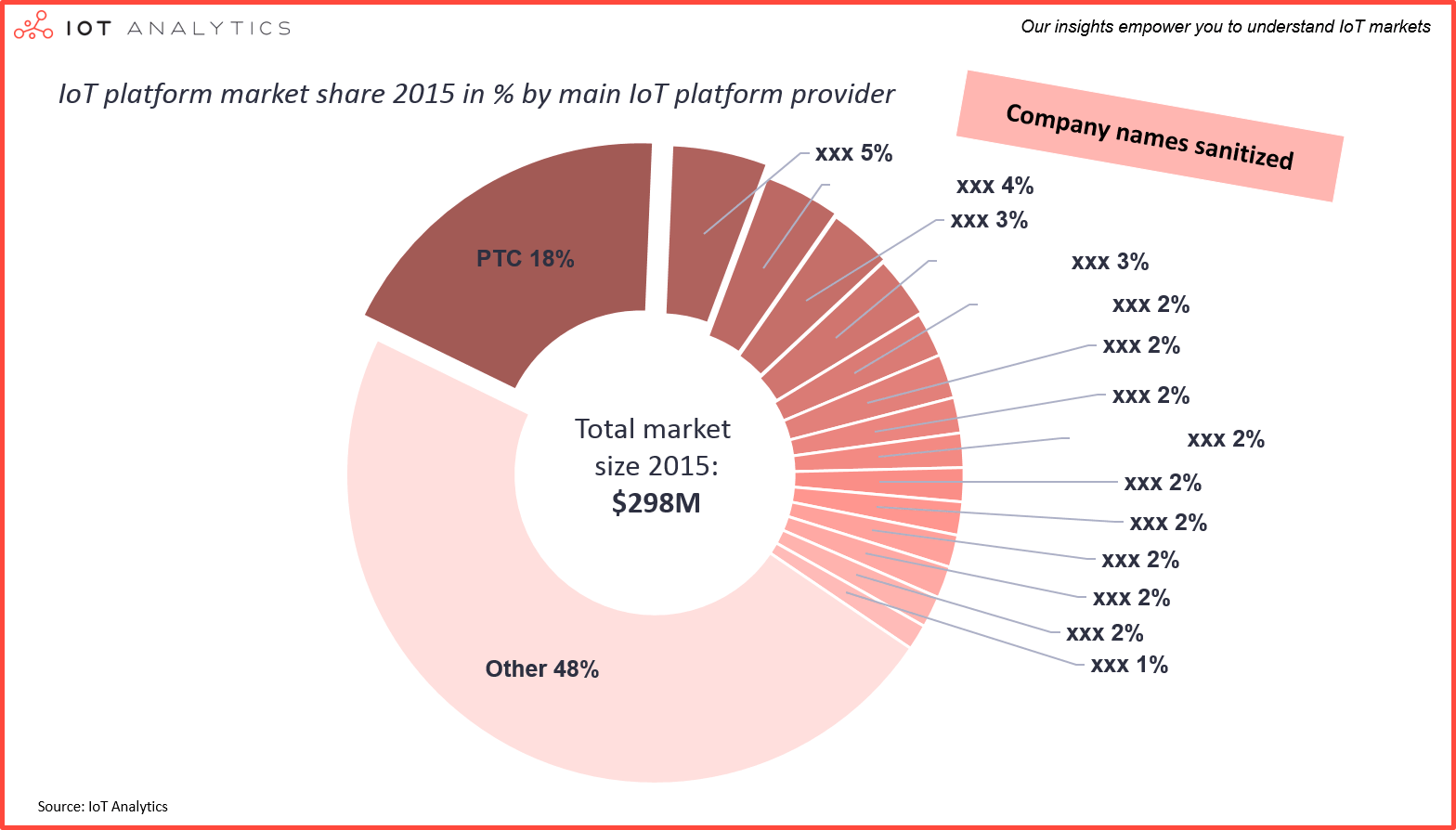

- Who the emerging 15 market leaders are (market share)

- How IoT platforms are being implemented today (7 use cases)

- What the 5 current main trends are

- How the 12 leading IoT Platforms compare (not included in Standard License)

- Rationales of the latest M&A transactions

- Relevant Startup funding rounds

Available pricing plans:

See Terms & Conditions for license details.

Standard License

- 1 Named user

- No detailed company profiles

- No data tables for the market model

- No IoT platform company list

- No discount on future purchases

Extended License

- 1-5 Named users

- 12 detailed company profiles

- 3 data tables for the market model

- 2016 List of 360+ IoT Platform companies

- No discount on future purchases

Enterprise Premium License

- Unlimited users in your organization within the country of purchase

- 12 detailed company profiles

- 3 data tables for the market model

- 2016 List of 360+ IoT Platform companies

- 20% discount on a future purchase

At a glance:

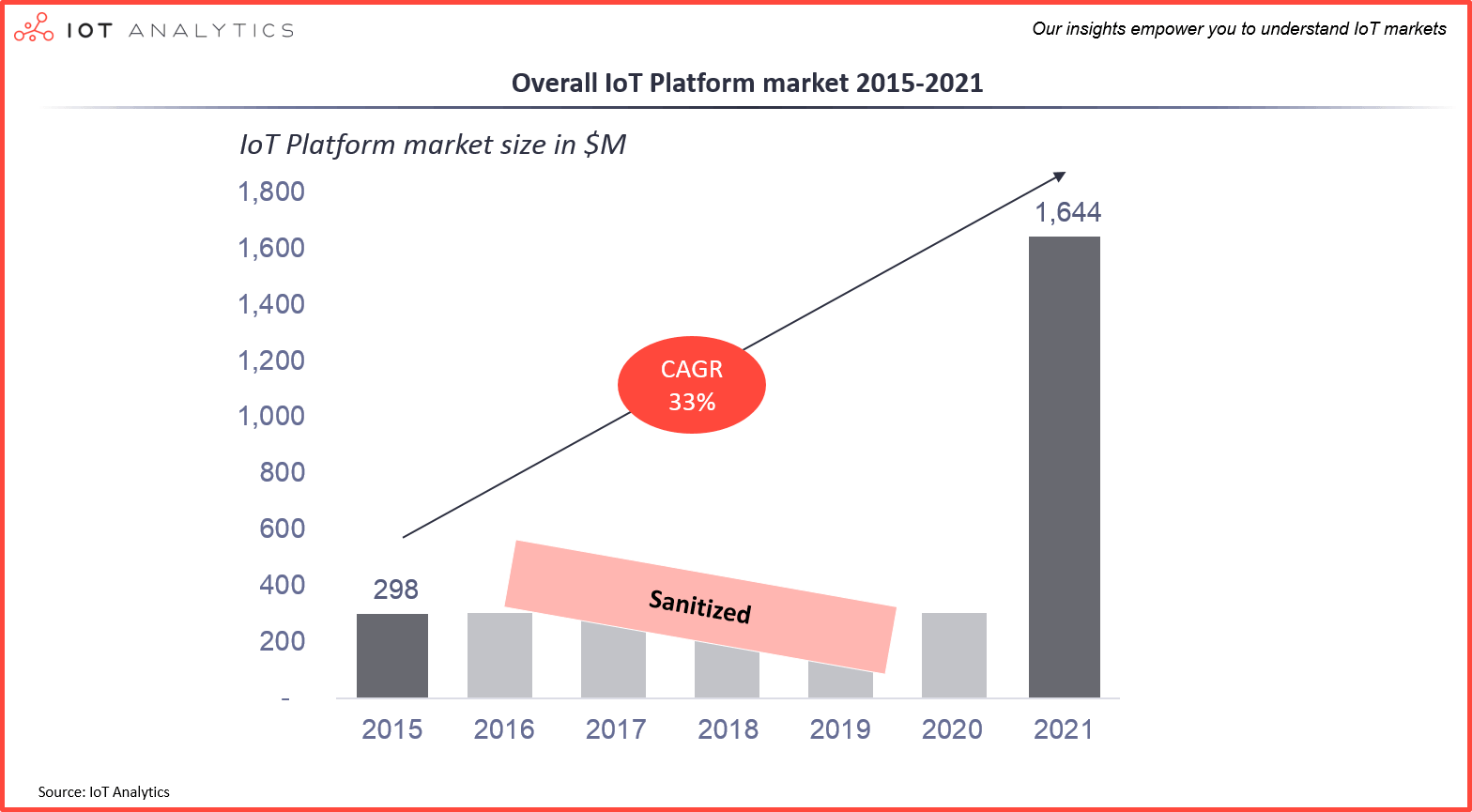

The emerging IoT Platform market continues to exhibit strong momentum as businesses accelerate their transformation into IoT data-driven companies. This momentum is driving strong growth in IoT Platform-related hardware, software and integration services for connected business solutions.

This study outlines the $1.6B IoT Platform market by region, segment, and platform provider. It examines (expected) revenue of the leading IoT Platform providers in greater detail across 10 vertical-industry segments and 7 regions with deep dives into North America, Europe and Asia.

To better understand the market players 12 of the top IoT platform providers are profiled, corresponding market share is estimated and 90 other notable contenders are outlined. The study also describes the top 5 trends affecting IoT platforms as the fast growing market is being transformed by increasing M&A and funding activity (see Report Structure below).

IoT Platform Disambiguation

The term “IoT Platform” is often used ambiguously.

This report focuses on IoT application enablement platforms. IoT application enablement platforms are used to build IoT solutions and typically consist of elements such as Device connectivity & normalization, device management, database, processing & action management, analytics, visualization, additional tools, and external interfaces.

The following types of platforms are NOT CONSIDERED an IoT platform (and are not part of this report):

- Connectivity / M2M platforms. Platforms that enable the management of SIM-cards or similar connectivity solutions without focusing on the application enablement for the actual IoT data.

IaaS backends. Infrastructure-as-a-service backends that solely focus on the hosting and processing of applications and services. - Hardware-specific software backends. Platforms that support just one proprietary type of IoT device that are not targeting external customers.

- Consumer/Enterprise software extensions. Existing enterprise software packages and operating systems such as Microsoft Windows 10 are currently not classified as full-scale IoT platforms even though these systems are increasingly allowing the integration of IoT devices.

Selected Companies Mentioned

2lemetry, Accenture, Amazon, Analog Devices, Alcatel-Lucent, Apple, Arrayent, Artik, AT&T, Ayla Networks, Autodesk, Axeda, BlackBerry, Blacksumac, Bosch, Carriots, Cisco, CloudPlugs, Davra Networks, Ericsson, Evrythng, GE, Good Technologies, Google, Greenwave Systems, Huawei, IBM, iControl Networks, Jasper, LogMeIn, Microsoft, Mnubo, Motorola, Murata, myDevices, Nokia, Oracle, Qualcomm, Predix, ProSyst, PTC, PubNub, Relayr, Salesforce.com, Samsung, SAP, SeeControl, Siemens, SmartThings, ThingWorx, Verizon, Vuforia, Wipro, wot.io, Xively, Zebra Technologies