In short

- 45% of automotive OEMs and suppliers currently rank the transition to SDVs as their top strategic priority, according to IoT Analytics’ 140-page Software-defined Vehicles Adoption Report 2026.

- The research analyzes 4 key dimensions of the SDV transition: 1) centralized or fully zonal architecture, 2) vehicle-to-cloud integration, 3) software-driven engineering methodologies, and 4) vehicle software operations.

- Tech-native companies like Tesla and Rivian, together with Chinese OEMs like BYD and NIO, are among the top SDV innovators and adopters. Many legacy OEMs are still behind.

Why it matters

- For automotive OEMs: With nearly half of automotive OEMs prioritizing SDV transition, they should understand key dimensions being adopted and how peers are adopting them.

- For automotive suppliers: The move to SDVs is disrupting the supplier landscape. For traditional automotive suppliers to stay relevant, they need to closely monitor the software-centric needs of transitioning legacy OEMs and understand the new competitive landscape with tech-centric suppliers.

In this article

- The 4 dimensions of the SDV transition

- Dimension 1: Vehicle architecture

- Dimension 2: Vehicle-to-cloud integration

- Dimension 3: Software-driven engineering

- Dimension 4: Vehicle software operations

- SDV adopters: A landscape defined by speed and strategic pivots

- Tech-native and Chinese automotive OEMs

- Legacy automotive OEMs

- Automotive suppliers

- Analyst takeaway: Differing SDV strategies

- Role and adoption of AI in SDVs (Insights+ exclusive)

- AI’s value creation potential in vehicle development (Insights+ exclusive)

- Role of AI for vehicle design and vehicle applications (Insights+ exclusive)

- Role of AI in zonal architecture development (Insights+ exclusive)

- Role of AI when building specific vehicle systems (Insights+ exclusive)

Nearly half of automotive OEMs rank software-defined vehicles (SDVs) as a top priority. The SDV is no longer a forward-looking concept. Instead, it has become the automotive industry’s most important strategic objective, according to IoT Analytics’ 140-page Software-defined Vehicles Adoption Report 2026 (published December 2025). A survey of 80+ automotive OEMs and suppliers for the report found that for 45% of respondents, the transition to SDVs is now their number one strategic priority, ranking higher than the development of both advanced driver-assistance systems (25%) and electric vehicles (14%).

The report—based on the survey, over 20 interviews with industry experts, and observations made by the team at leading industry conferences (like IAA Mobility 2025)—distinguishes 4 key dimensions of SDVs being adopted by automotive OEMs (with further research insights into these and their adopters below):

- Vehicle architecture – The foundational hardware and system design that determines how computing, networking, and vehicle functions are structured

- Vehicle-to-cloud integration – The connectivity layer that links the vehicle with cloud services to enable data exchange, updates, and remote interactions

- Software-driven engineering – The approach to building vehicles where software-led development, validation, and tooling shape the product lifecycle

- Vehicle software operations & lifecycle management – The ongoing processes that manage, monitor, update, and sustain vehicle software once deployed

Insights from this article are derived from

Software-defined Vehicles Adoption Report 2026

A report detailing the adoption of software-defined vehicles, incl. deep-dive on the software stack, specific OEM and supplier adoption strategies, and key trends and challenges.

Already a subscriber? View your reports and trackers here →

SDV definition

An SDV is an automobile built with a software-first approach, both in its core functions (i.e., control, connectivity, and user experience) and in how it is engineered (through software-driven development methods).

What the definition elements mean:

- Software-first approach – A vehicle development approach wherein the core functions of the vehicle are primarily driven by software rather than hardware

- Core functions – 3 major functions of a vehicle:

- Control functions – include acceleration, braking, steering, suspension, battery management, and thermal regulation

- Connectivity functions – communication with cloud platforms, mobile apps, V2X networks, and backend services

- User experience functions – all systems that enhance in-vehicle interaction and comfort

- Engineered: Design and development of the vehicle using software-based methods (i.e., not just in how it works, but also in how it is built)

The 4 dimensions of the SDV transition

Dimension 1: Vehicle architecture

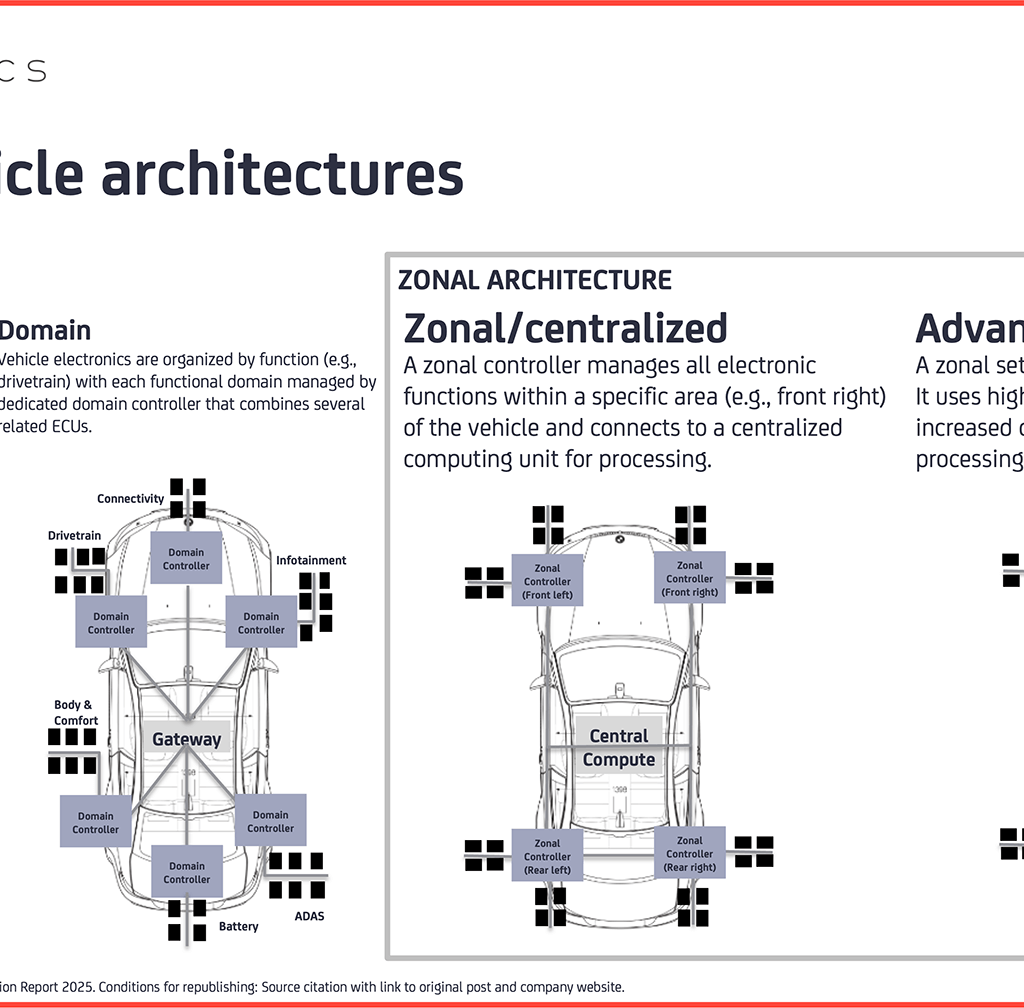

Over a supermajority of automotive OEMs adopting zonal architecture. The most significant architectural change in the automotive industry is the move away from complex distributed or domain-based electrical/electronic (E/E) systems, where electronics are either distributed across many independent electronic control units (ECUs) or are organized by function, toward 2 streamlined architectures, which the report specifically covers:

- Centralized zonal architecture – 1–4 zonal controllers manage all electronic functions within their respective areas (e.g., front right zone) and connect to a centralized computing unit for processing.

- Fully/advanced zonal architecture – High-performance zonal controllers with heightened computing power handle high-processing and software integration loads for their respective zones, without a central computing system.

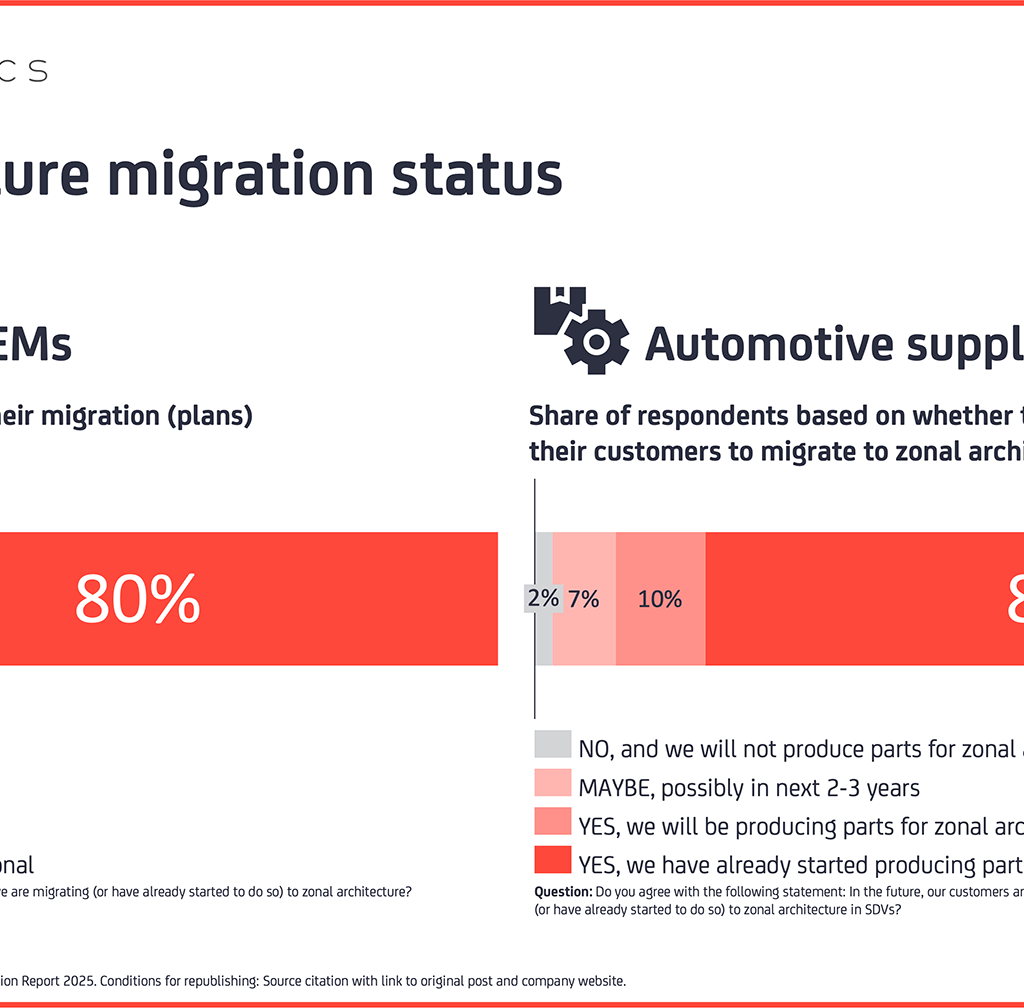

Survey data from the report shows that over 90% of automotive OEMs are committed to a zonal architecture, with 80% having already started migrating and another 11% confirming firm plans to do so. Further, the research identified 8 key benefits driving zonal architecture adoption, including reduced wiring complexity, significant weight reduction, increased manufacturing efficiency, and higher cost savings. Companies at the forefront of this architectural adoption include US-based tech-native pioneers such as Tesla and Rivian, as well as fast-moving international players like China-based NIO and BYD. This shift has had an effect across the supply chain, as tier 1 and tier 2 suppliers like Infineon (Germany), Aptiv (Ireland), and Bosch (Germany) have begun developing integrated zonal controllers that act as the backbone for these simplified architectures.

Dimension 2: Vehicle-to-cloud integration

Cloud supports SDV scale, while security shapes deployment. Cloud platforms enable scalable computing, seamless integration, and intelligent orchestration across the SDV lifecycle. The top role for cloud integration, as identified by automotive OEMs and suppliers in the research, is over-the-air updates (73% OEMs; 71% suppliers), where end-to-end platforms orchestrate the packaging, signing, distribution, and lifecycle management of software and firmware updates for vehicles. Other key roles include real-time data processing and analytics (68% OEMs; 73% suppliers) and collaborative design and development (59% OEMs; 45% suppliers).

While vehicle-to-cloud integration adoption is a significant trend in the report, security and regulatory compliance concerns are prompting OEMs to take a cautious approach. 91% of OEMs expect critical software workloads to run on on-premises servers or in a private cloud. This hybrid model allows automakers to leverage the scalability of the cloud for development and non-critical functions while keeping sensitive data and core operational workloads in a more controlled environment.

“I prefer on-premises or private cloud environments due to high concerns about data security, especially for sensitive information that must comply with regulations.”

Technology director for the IT division of an Italian sports car manufacturer

Dimension 3: Software-driven engineering

Automotive engineering adopting software-first mindset, though with skill challenges. The research found that companies that prioritize SDVs also prioritize a software-first engineering approach due to the SDV’s software-centric nature. With SDVs, the vehicle development lifecycle is becoming increasingly software-centric, with ECUs, middleware, and operating system layers designed, tested, and updated using Agile methodologies and DevOps practices. This enables faster iteration, continuous integration, and decoupling software updates from hardware production timelines.

“Traditional OEMs generated margins by optimizing hardware for different market segments, resulting in a wide hardware diversity. This is very counterproductive for software development.”

Senior engineering executive at General Motors

This shift from a hardware-centric to a software-centric mindset, however, comes with challenges for traditional OEMs. In the survey, 18% of automotive OEMs cited insufficient internal skills and expertise as a key challenge.

AI and templates adopted to help with software design and validation. SDVs also come with a high level of software complexity as well. To manage this, OEMs and suppliers are increasingly adopting tools like AI and template libraries. AI technologies, especially generative AI, are most impactful in the later stages of the V-model development process, with 89% of automotive OEMs and 79% of automotive suppliers identifying software development and validation as top areas of value. E/E system design and testing also rank highly (77% OEMs, 76% suppliers), followed by architecture and system design.

“GenAI can be very useful in optimizing the design and testing phases of SDVs, particularly by addressing conflicting requirements and improving the functional sequencing of tests. By identifying conflicts in requirements early, GenAI helps prevent issues that could arise during system integration. Additionally, GenAI assists in the functional sequencing of testing, such as in ECU software testing, ensuring that the design and testing processes are aligned with technical requirements.”

Senior program manager for connected vehicle services at a leading European car OEM

Meanwhile, template libraries provide reusable, pre-verified code components. This helps development teams manage the hundreds of millions of lines of code in modern vehicles, thereby reducing development time and cost.

Dimension 4: Vehicle software operations

Software operations unlock recurring revenue models. Vehicle software operations represent a completely new operational capability for automakers. These operations are the ability to perform runtime software updates and dynamic feature deployments, all enabled by a flexible service-oriented architecture (SOA), which allows different software components to communicate and be updated independently. Though not a hard requirement, the transition to one of the zonal architectures mentioned earlier helps enable vehicle software operations and SOA.

Vehicle software operations also serve as the foundation for new recurring revenue streams. These operations allow for software-enabled product offerings and subscriptions, a business model that can contribute to the future financial health of the industry. Automakers like US-based Stellantis, for example, have high expectations for this model, projecting it to generate €20 billion in annual revenue by 2030.

SDV adopters: A landscape defined by speed and strategic pivots

The adoption of SDV technologies is not uniform nor simply hierarchical. Instead, the market is characterized by a split between companies at the forefront (moving at “China-speed”) and established players executing complex strategic pivots to catch up.

Tech-native and Chinese automotive OEMs

Predominantly tech-first U.S. and Chinese OEMs lead SDV adoption. Tech-native automotive OEMs worldwide are currently at the forefront of SDV adoption and innovation. US-based pioneers Tesla and Rivian continue to leverage their first-mover advantage, having built vehicles with zonal architectures and vertical integration from the ground up. Chinese car OEMs, both traditional and tech-native OEMs, are also at the frontier of the SDV development cycle:

- BYD launched its Xuanji architecture, a domain-centric system that integrates cloud AI with vehicle-edge AI, in January 2024. Xuanji represents a significant step in BYD’s transition from a distributed ECU architecture toward a zonal architecture. The company has successfully scaled Xuanji across its portfolio using its tiered DiPilot computing platform, which standardizes smart driving features from mass-market to premium models. Of note, in 2025, BYD surpassed Tesla as the world’s largest seller of electric vehicles.

- NIO is a digital-native company that has used software-driven engineering and software-defined architecture from its start. The company is executing an AI-first strategy anchored by SkyOS, a proprietary operating system launched in July 2024 and designed to manage heterogeneous compute resources. NIO utilizes generative AI through its WorldModel (launched in May 2025) to simulate complex driving scenarios, further accelerating its software iteration cycles.

Legacy automotive OEMs

BMW and Volvo at the forefront of SDV adoption. While many traditional automakers face challenges with legacy infrastructure, specific players are successfully pivoting toward software-centric capabilities.

- BMW, headquartered in Germany, is executing a comprehensive transition with its upcoming “Neue Klasse” models, set to launch in 2026. This strategy moves away from distributed architectures to a zonal approach featuring a “SuperBrain” ECU hierarchy. On the software side, BMW is introducing Operating System X (OS X), a cloud-native platform developed in-house to enable rapid feature updates and seamless integration.

- Volvo, headquartered in Sweden, has moved toward full-stack control, with former CEO Jim Rowan noting that Volvo is one of the few companies, alongside Tesla and Rivian, to have managed to write software from “layer one of the silicon all the way up to the application layer.”

Automotive suppliers

Traditional suppliers under pressure to change their business model. As automakers like Tesla, Rivian, and Volvo pursue full-stack control over vehicle software and architecture, they are increasingly taking over integration tasks traditionally managed by tier-1 automotive suppliers. This has forced these suppliers to move from providing proprietary “black-box” hardware to sharing transparent “white-box” code, fundamentally altering their long-standing business models.

- Bosch,a Germany-based engineering and technology company, has shifted its automotive focus to providing deterministic middleware and testing frameworks that bridge legacy ECU environments with next-generation high-performance computing platforms through its subsidiary ETAS.

- Nexteer, a US-based steering systems supplier, noted that it now shares source code openly with OEMs to facilitate tighter integration into centralized architectures, a distinct move away from the isolated subsystem model of the past.

Automotive technology suppliers eyeing the potential to increase presence. Long-standing software vendors are expanding their scope from specific tools to comprehensive SDV operating platforms. Elektrobit (a software-focused subsidiary of Germany-based automotive parts company Continental) has evolved into a critical enabler for centralized architectures. Its software platform, EB Corbos, unifies Classic and Adaptive Automotive Open System Architecture (AUTOSAR) to serve as the so-called digital chassis for modern fleets. Elektrobit’s new Software Platform ECU underlies Germany-based automotive manufacturer Volkswagen’s transition to centralized, service-oriented SDV architecture. This ECU runs Linux and adaptive AUTOSAR to consolidate functions and enable OTA/service features in Volkswagen’s ID. family of electric vehicles.

New, traditionally non-automotive suppliers entering the scene. Existing semiconductor and computing leaders that traditionally lacked an automotive focus have been deepening their automotive footprints to support automotive OEMs. NXP (The Netherlands) and STMicroelectronics (Switzerland) are developing the microcontrollers necessary for zonal gateways, while NVIDIA (US)and Qualcomm (US) provide the high-performance centralized compute platforms that serve as the brains for advanced SDV functions.

IAA 2025 spotlighted virtualization and edge AI. The IoT Analytics team observed that the shift toward advanced computing was a central theme at IAA Mobility 2025 in Munich. The team noted 2 critical pillars of the SDV transition at the exhibition: hardware virtualization and edge AI. On the virtualization front, suppliers like Valeo (France) and AUMOVIO (Germany) demonstrated technologies designed to decouple software from underlying hardware, a necessary step for enabling the flexible, zonal architectures. Beyond infrastructure, the event showcased the move toward sophisticated edge AI. BMW used the venue to pilot its SDV strategy via its “Neue Klasse” models, while Qualcomm demonstrated Snapdragon Cockpit platforms that integrate vision language models (or VLMs), enabling vehicles to process human-like AI interactions directly at the edge rather than relying solely on the cloud.

Analyst takeaway: Differing SDV strategies

IoT Analytics Senior Analyst Harsha Anand, Principal Analyst Satyajit Sinha, and CEO Knud Lasse Lueth performed the majority of the analyses in the Software-Defined Vehicles Adoption Report 2026 and spoke to dozens of automotive OEMs and experts during the research. Below are 4 key observations:

1. Differing SDV strategies

SDV strategies diverge despite shared architecture vision. While the industry aligns on zonal architectures as the future, execution varies widely: BYD deploys its hybrid domain-centralized Xuanji architecture, whereas NXP observes other OEMs adopting distributed zonal or even fully consolidated compute models. Technology sourcing strategies are equally distinct: While Volvo and Tesla pursue a “full-stack” in-house ethos, Stellantis, for example, relies heavily on supplier partnerships to accelerate development. Platform philosophies also differ: BMW and NIO architect proprietary multi-OS environments (OS X and SkyOS), while others leverage standardized Android Automotive solutions. Other considerations include different approaches to in-car security, the level of cloud computing for development and simulation, and the integration of AI.

2. SDV transition leaders

Tech-native and Chinese OEMs currently lead the transition to SDVs. Players such as Tesla, Rivian, NIO, and BYD leverage software-first architectures without legacy constraints, allowing them to develop new models more than 1 year faster compared to some traditional OEMs. Among traditional incumbents, Volvo and BMW are viewed as the most advanced in bridging this capability gap. Volvo is recognized for mastering full-stack software control. BMW has also fundamentally restructured its tech stack around the software-centric “Neue Klasse” platform.

3. Industry friction

The SDV transition is creating friction between OEMs and suppliers. As automakers like Tesla, Rivian, and Volvo pursue full-stack control over vehicle software and architecture, they are increasingly taking over integration tasks traditionally managed by Tier-1 suppliers. This strategic pivot forces suppliers to move from providing proprietary “black-box” hardware to sharing transparent “white-box” code, fundamentally altering their long-standing business models.

4. Organizational struggles

The steepest hurdles for SDV adoption are organizational and cultural, not technical. The challenge of insufficient internal skills and expertise is well summarized by Sangeeta Theru, the director of virtual validation platforms at Stellantis, who notes that because automakers “are always hardware first,” the switch to software requires massive effort in “upskilling and training internal people.” Volkswagen is a prime example of this challenge. After its in-house software unit, Cariad, faced persistent delays and organizational hurdles that pushed back key model launches (e.g., Audi Q6 e-tron), Volkswagen shifted strategy in 2024 by investing up to $5.8 billion in a joint venture with tech-native OEM Rivian.

Role and adoption of AI in SDVs (Insights+)

Below is an analysis of the role of AI in vehicle design and development.

Access key market data for $99/month per user

The Insights+ Subscription unlocks exclusive facts & figures. You will gain access to:

- Additional analyses derived directly from our reports, databases, and trackers

- An extended version of each research article not available to the public

Full report access not included. For enterprise offerings, please contact sales: sales@iot-analytics.com

Disclosure

Companies mentioned in this article—along with their products—are used as examples to showcase market developments. No company paid or received preferential treatment in this article, and it is at the discretion of the analyst to select which examples are used. IoT Analytics makes efforts to vary the companies and products mentioned to help shine attention on the numerous IoT and related technology market players.

It is worth noting that IoT Analytics may have commercial relationships with some companies mentioned in its articles, as some companies license IoT Analytics market research. However, for confidentiality, IoT Analytics cannot disclose individual relationships. Please contact compliance@iot-analytics.com for any questions or concerns on this front.

More information and further reading

Sign up for our research newsletter and follow us on LinkedIn to stay up-to-date on the latest trends shaping the IoT markets. For complete enterprise IoT coverage with access to all of IoT Analytics’ paid content & reports, including dedicated analyst time, check out the Enterprise subscription.

Already a customer?

Register for our monthly research readout. This edition features the Software-defined Vehicles Adoption Report 2026. Join Knud Lasse Lueth (CEO), Satyajit Sinha (Principal Analyst), and Harsha Anand (Senior Analyst) as they provide expert commentary.