In short

- Many CEOs are making key decisions due to recent tariffs, according to IoT Analytics’ latest research note, The Evolving Tariff Landscape: Impact on the Economy and Businesses, which is based on an analysis of over 1,500 recent corporate earnings calls.

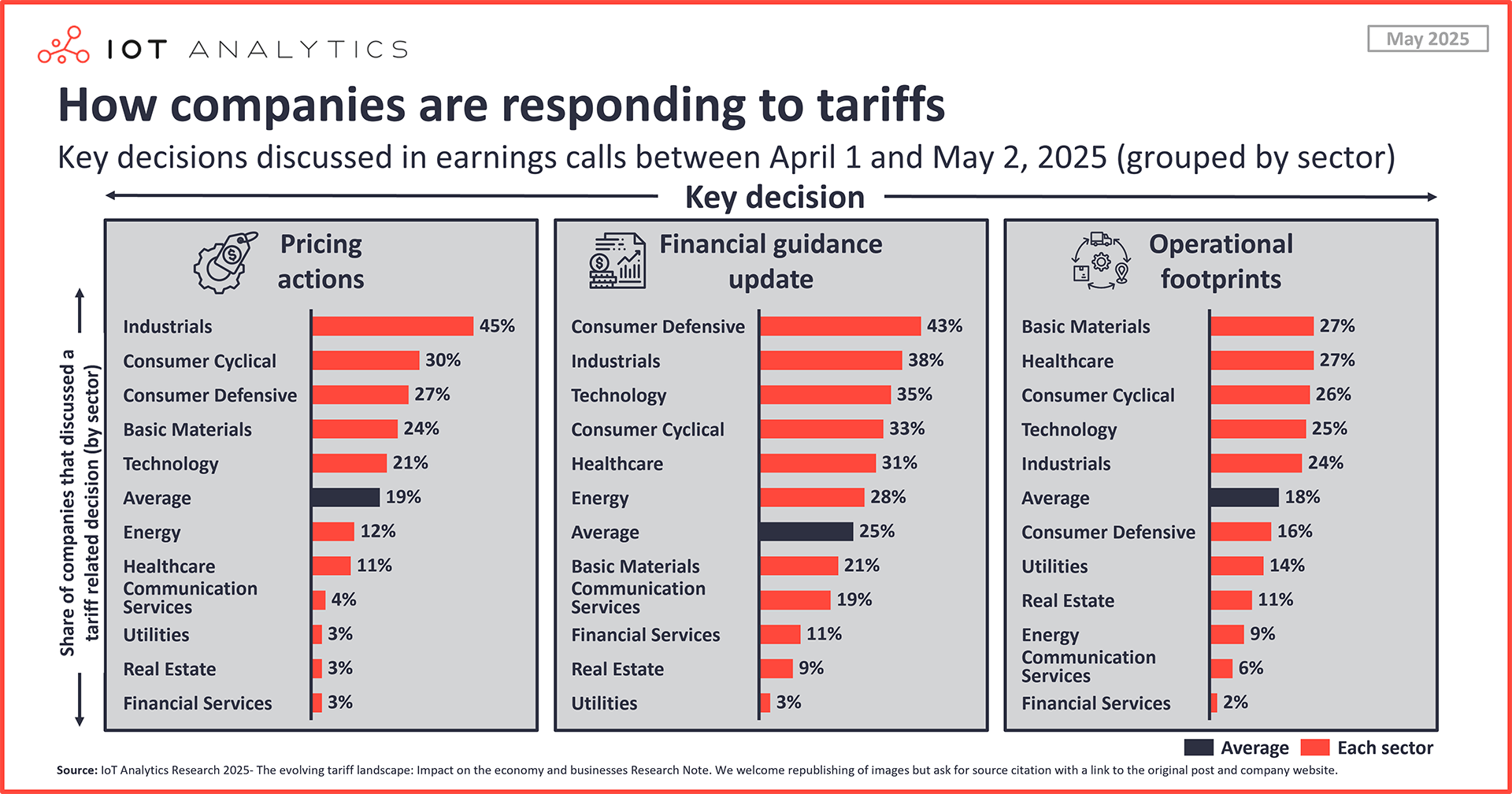

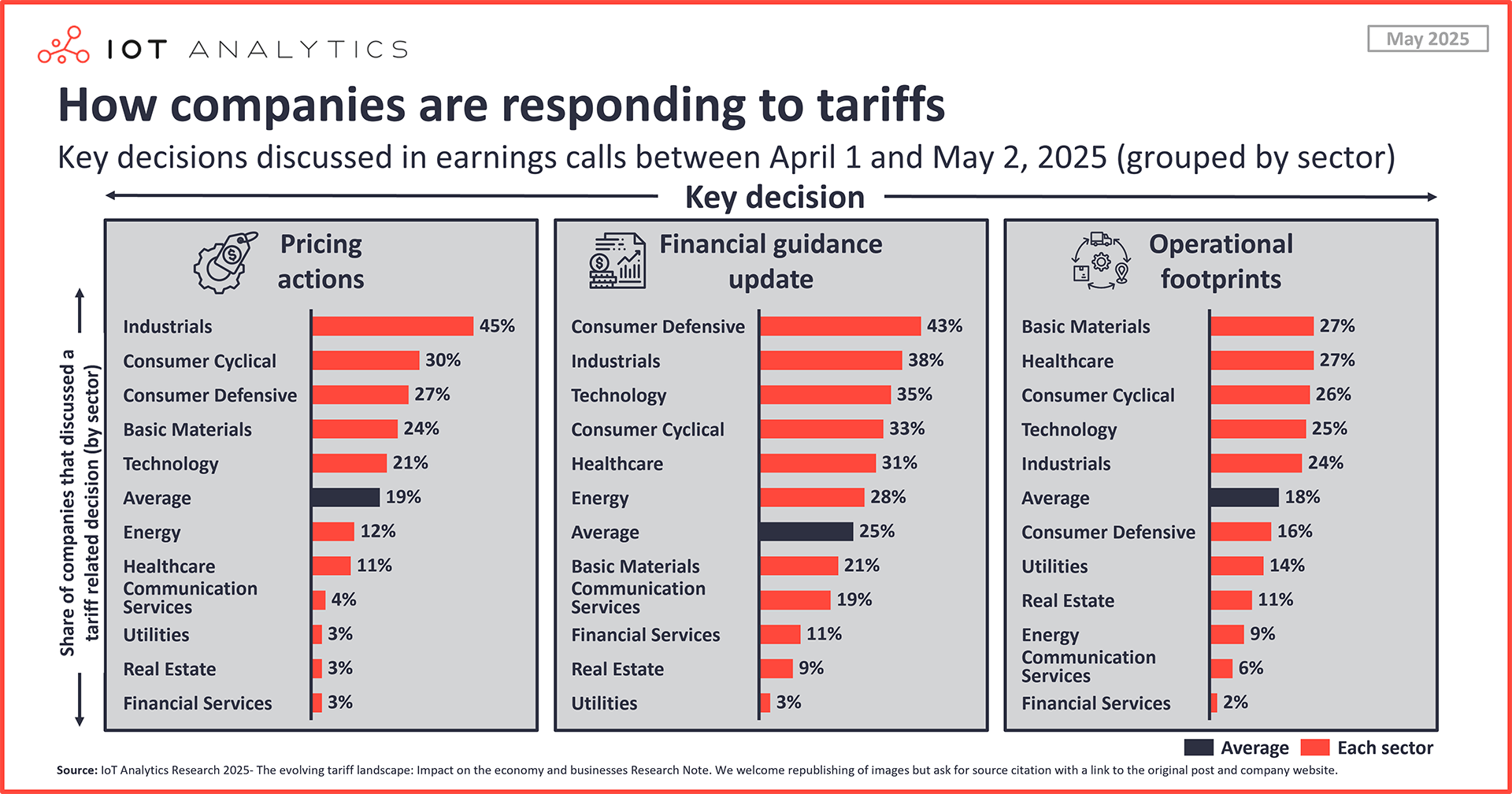

- Notably, 25% of companies updated their financial guidance due to tariffs, 19% announced price increases, and 18% are changing their operational footprint due to tariffs.

- Decisions vary greatly by sector with nearly half of industrial companies increasing prices and nearly half of consumer defensive companies updating guidance.

Why it matters

- The disruptive effect of tariffs is leading to uncertainty across companies, but understanding how peers are addressing and mitigating the impact can help guide short- and long-term strategic planning.

The insights from this article are based on

The evolving tariff landscape: Impact on the economy and businesses

A 50-page research note on the current US tariffs and their impact on the economy and companies, with a zoom-in on industrials.

Already a subscriber? View your reports here →

CEOs’ tariff sentiment is becoming more positive. In early May 2025, 32% of CEOs expressed a positive outlook for their companies despite the recent volley of tariffs initiated by the US, according to IoT Analytics’ 50-page research note, The Evolving Tariff Landscape: Impact on the Economy and Businesses (published May 2025). This marks a sharp climb of 23 percentage points since the first week of April 2025, when the corporate earnings season started and IoT Analytics began its research into the impact of the tariffs.

Tariffs become the top topic of boardrooms. Tariff exposure is now a key consideration in procurement, operations, and customer pricing decisions. Just in Q1 2025, CEOs talked about tariffs more than any other topic, with discussions around uncertainty seeing a 49% increase quarter-over-quarter.

To assess how companies are responding, the IoT Analytics team analyzed over 1,500 corporate earnings calls held between April 1 and May 2, 2025.

The tariff timeline so far

On the back of significant trade imbalances—particularly with China, the EU, and Mexico—the Trump administration issued a series of US presidential executive orders (or EOs) and retaliatory trade measures starting in February 2025. These measures ushered in universal and reciprocal tariffs ranging from 10% to over 50% alongside product-specific duties under Section 232 of the Trade Expansion Act, which allows the US to impose restrictions on imports that are deemed national security threats.

At this point, the tariffs and duties impact $1.7 trillion worth of annual imports into the US, over half of the $3.3 trillion worth of imports in 2024.

How CEOs are reacting to tariffs

1. Pricing actions: Strategic increases and flexible surcharges

45% of industrial firms have implemented or announced price increases in response to tariffs. Pricing has become the first lever companies pull to offset costs and protect margins. Based on the earnings calls, their approaches vary, with two overarching routes:

- Direct increases: Hiking list prices and adding surcharges are being used selectively depending on the product and customer.

- Contractual flexibility: Some companies are building clauses into new deals to reprice based on tariff escalations.

These varied pricing strategies highlight the importance of flexibility and customer communication as companies seek to balance cost recovery with maintaining market competitiveness amid ongoing tariff uncertainty.

Key CEO quotes about price increases

“We plan to continue making efforts, but if we cannot fully absorb the impact, we have the escalation in almost all contracts. So, we can do pricing pass-through. That will be the next option we will consider.”

Toshiaki Tokenaga, President and CEO, Hitachi, (Source )

“In April, we successfully implemented a high single-digit average price increase across our United States retail partners. Given the magnitude of the current tariff rates, we are actively engaged with our channel partners about a second price increase, targeting implementation at the beginning of the third quarter.”

Chris Nelson, COO, Stanley Black & Decker, (Source)

“We expect to use these surcharge mechanisms to pass through the impact of any incremental tariffs on our raw materials to our customers.”

Tony R. Thene, President and CEO, Carpenter Technology, (Source)

2. Updated financial guidance: Baking tariffs into forecasts

25% of companies have revised their financial outlooks—and that number rises to 31% in industrials. In many cases, executives are revising both revenue and margin expectations to reflect cost inflation, disrupted trade flows, and uncertain demand signals. In the industrial sector, this includes:

- CapEx reassessments and delayed project timelines

- Reframing of 2025 and 2026 revenue guidance

- Reframing of 2025 and 2026 profit guidance

These shifts signal that tariff mitigation is no longer a tactical concern—it is a strategic variable in annual planning.

Key CEO quotes about financial guidance

“We are going to do pricing where we have the opportunity. At the same time, we have substantial direct material productivity options available this year. And with the combination of the two, we are going to offset the impact of this $500 million of tariff.”

Vimal Kapur, CEO, Honeywell International Inc., (Source)

“And we see that there are quite a lot of uncertainties now in the market more than before. I don’t need to repeat about tariffs and also quite a lot of hesitation in the market. If we look to the development of our industrial compressor business, our industrial vacuum business, we see quite a lot of hesitation because this level of uncertainty does not drive too many decisions.”

Vagner Rego, CEO, Atlas Copco Group, (Source)

3. Operational footprints: From global to local

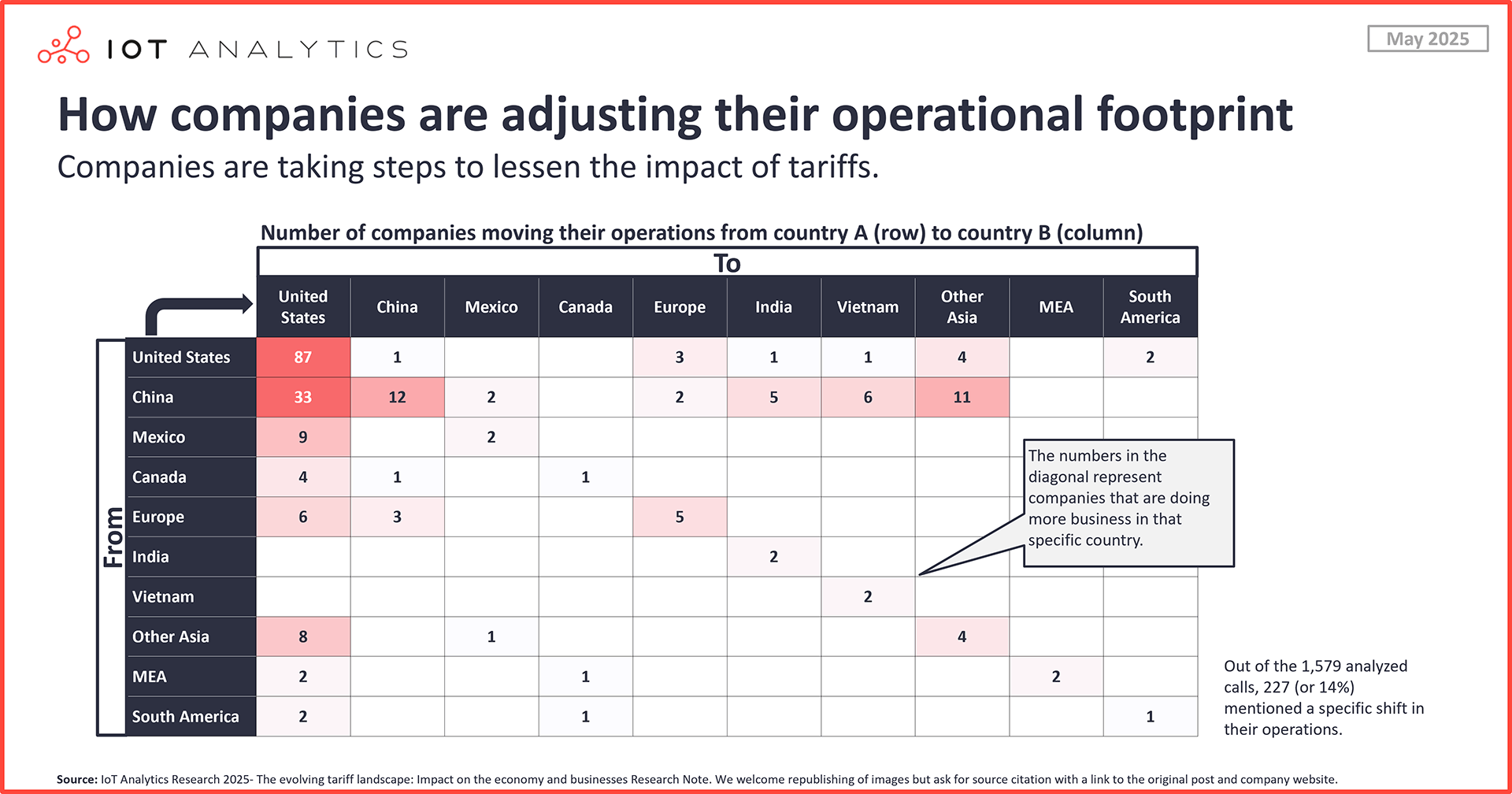

24% of industrial companies have changed their operational footprint due to tariffs. A clear trend has emerged: reshoring and nearshoring to the United States. Among the 227 companies that mentioned specific shifts in their operations:

- 87 companies operating in the US announced expanding their US operations.

- 33 companies operating in China announced moving production to the US, while 22 are moving to other Asian countries.

- 13 companies operating in either Mexico or Canada announced moving their operations to the US.

US–Mexico–Canada Agreement (USMCA) compliance, sourcing diversification, and risk mitigation are driving these decisions. Importantly, this is not just about cost—it is about resilience and control.

Key CEO quotes about their operational footprints

“I recently met with a large customer, an industrial company that produces products in the US, Mexico, and Canada, and now they are moving more of the manufacturing here to Texas in the US.”

Mario Harik, CEO, XPO, (Source)

“We are actively pursuing longer-term tariff mitigation strategies, including production shifts to better serve our US and Canadian customers. We are also working closely with our supply partners on tariff-sharing models and leveraging more US-based components to enhance flexibility within our North America network.”

Alok Maskara, CEO, Lennox, (Source)

“In services, we will be closing our Toronto manufacturing site and aligning resources to support growth in the US. In metals, we will continue to optimize our footprint and make organizational changes to gain more efficiency.”

Ty Silberhorn, Apogee, (Source)

Key takeaways for executives

The 2025 tariff wave is redefining what strategic agility looks like for industrial CEOs. While the evolving tariff landscape presents challenges for industrial leaders, some appear to be seeing opportunities as well, as indicated by the sharp rise in positive outlooks in just one month. As shown above, many companies are taking action to navigate and mitigate the impact of tariffs, and these paths forward likely help ease the uncertainty and offer a brighter position.

Still, analysis of the earnings calls shows that 3/5 of CEOs maintained a neutral outlook in early May 2025, with many seemingly in wait-and-see mode as negotiations and agreements are still to take place. While the immediate focus for many may be on mitigating cost pressures, a takeaway from the research note, The Evolving Tariff Landscape: Impact on the Economy and Businesses, is that long-term success lies in strategic adaptation and resilience.

There are several actions CEOs should consider as the final tariff levels remain in limbo:

- Understand what peers are doing: While every company is unique in how they do business, CEOs should study their peers, identify lessons learned, and assess their corporate outlooks. IoT Analytics’ long-running What CEOs Talked About series offers quarterly analysis on the leading topics for boardrooms, along with economic and business sentiments.

- Remain flexible and transparent with pricing. Price agility is a must, but open customer communication and contract design are equally critical.

- Continue to cut costs. Though tariffs greatly impact supply chains, this is also an area for cost savings—by ensuring items are transported in the most timely, efficient, and effective way. Helping this are asset-tracking solutions, and while paying for new solutions seems counter to cost savings at the moment, research for the IoT Asset Tracking and Visibility Adoption Report 2025 found that the average amortization time for these solutions is 22.5 months, with ROI meeting or exceeding expectations in 74% of cases.

- Look into manufacturing enhancements. Factories are becoming smarter, enabling greater efficiency, modularity,

- Consider adjusting operational footprint. Reshoring and supplier diversification are more than buzzwords—they can become competitive necessities in a volatile trade environment. However, moving operations to a place with lower tariffs can come with similarly costly policies, such as cyber and data regulations, which can increase the cost of producing and testing digital products. Companies should consult regulatory compliance experts—the 2nd most in-demand professional service, according to the IoT System Integration and Professional Services Market Report 2024–2030—to learn how such regulations may impact their bottom lines.*

- Look into manufacturing enhancements. Many companies are making their factories smarter, enabling greater efficiency and flexibility and further aiding cost-competitiveness. The Smart Factory Adoption Report 2024 dives into the adoption, paradigms, technologies, and use cases in smart factories based on an extensive survey of manufacturers worldwide. Further, the IT/OT Convergence Insights Report 2024 offers over 70 real-world implementation examples of integrating IT and OT to enhance industrial operations.

- Above all, be realistic. Financial guidance must reflect tariff realities and include contingencies, not just assumptions of future rollback.

*Note: IoT Analytics plans to publish a report on the impact of regulations in Summer 2025. Those interested in accessing this and other insights reports when they are released can sign up for IoT Analytics’ IoT Research Newsletter by clicking below.

Disclosure

Companies mentioned in this article—along with their products—are used as examples to showcase market developments. No company paid or received preferential treatment in this article, and it is at the discretion of the analyst to select which examples are used. IoT Analytics makes efforts to vary the companies and products mentioned to help shine attention to the numerous IoT and related technology market players.

It is worth noting that IoT Analytics may have commercial relationships with some companies mentioned in its articles, as some companies license IoT Analytics market research. However, for confidentiality, IoT Analytics cannot disclose individual relationships. Please contact compliance@iot-analytics.com for any questions or concerns on this front.

More information and further reading

Are you interested in learning more about the tariff landscape?

The evolving tariff landscape: Impact on the economy and businesses

A 50-page research note on the current US tariffs and their impact on the economy and companies, with a zoom-in on industrials.

Already a subscriber? View your reports here →

Related articles

You may also be interested in the following articles:

- What CEOs talked about in Q1 2025: Tariffs, rising uncertainty, and agentic AI

- The 9 most demanded IoT system integration services

- The evolution of enterprise IoT asset tracking: From locating assets to optimizing operations.

- IT/OT convergence: The 27 themes that define the future of industrial integration

- 8 notable developments in software-defined manufacturing

Related publications

You may also be interested in the following reports:

- Quarterly trend report: What CEOs talked about in Q1 2025

- Hannover Messe 2025—the latest Industrial IoT/Industry 4.0 Trends

- IoT Asset Tracking & Visibility Adoption Report 2025

- IoT System Integration and Professional Services Market Report 2024–2030

- Smart Factory Adoption Report 2024

- IT OT Convergence Insights Report 2024

Subscribe to our research newsletter and follow us on LinkedIn to stay up-to-date on the latest trends shaping the IoT markets. For complete enterprise IoT coverage with access to all of IoT Analytics’ paid content & reports, including dedicated analyst time, check out the Enterprise subscription.