In short

- The current state of industrial technology was on full display at Hannover Messe 2024, with topics such as sustainability and industrial AI at the center of attention.

- IoT Analytics had a team of 25 on the ground to uncover the latest industrial technology trends and assess the future of industrial automation.

- The team noticed an increasing prominence of edge technologies, ecosystem collaborations, and solutions-focused demonstrations, while AI—though a growing theme—did not appear as prominent as expected.

- The IoT Analytics team published a 141-page event report with 40 in-depth insights and 5 detailed topic/vendor comparisons from the fair. A summary of the top 10 industrial technology trends as showcased at Hannover Messe are presented here.

Why it matters?

- Hannover Messe remains the world’s most important global industrial fair. Technologies showcased there are widely applicable to any industrial company.

Hannover Messe 2024

Hannover Messe (or Hannover Fair) is the top global industrial tradeshow, and it was back in action in Hannover, Germany, from 22 to 26 April 2024. It once again showcased the latest developments and industrial technology trends.

Attendance matched 2023 numbers with 130,000 visitors and 4,000 exhibitors, which is still roughly 40% below pre-COVID levels; however, the organizers noted their target attendance was reached, and that the lower number was due to the biennial rotation of several component events. Still, the fairgrounds were buzzing and filled with senior executives from many of the leading industrial hardware, software, and service providers. The conference remains one of those rare fairs where you randomly walk into senior executives, like a head of engineering for a major industrial conglomerate, and not only the pre-sales representatives giving you the usual pitch.

“Hannover Messe remains the best place for [] a true spirit of optimism, because manufacturers, customers, political decision-makers and the media come together here in greater numbers than anywhere else.”

Thilo Brodtmann, Managing Director of the German machinery manufacturers association VDMA

IoT Analytics had 25 team members on the ground to uncover the latest industrial technology trends and contribute to IoT Analytics’ Hannover Messe—The latest industrial IoT/Industry 4.0 trends report—available for IoT Analytics’ subscribers. In total, our team visited over 450 booths, conducted over 300 individual interviews, and attended a number of presentations to gauge and assess the state of industrial technology amid the rise of AI and continued corporate discussions around economic concerns.

This article is based on insights from:

Hannover Messe 2024—the latest Industrial IoT/Industry 4.0 Trends

Download a sample to learn about the in-depth analyses that are part of the report.

Already a subscriber? Browse your reports here →

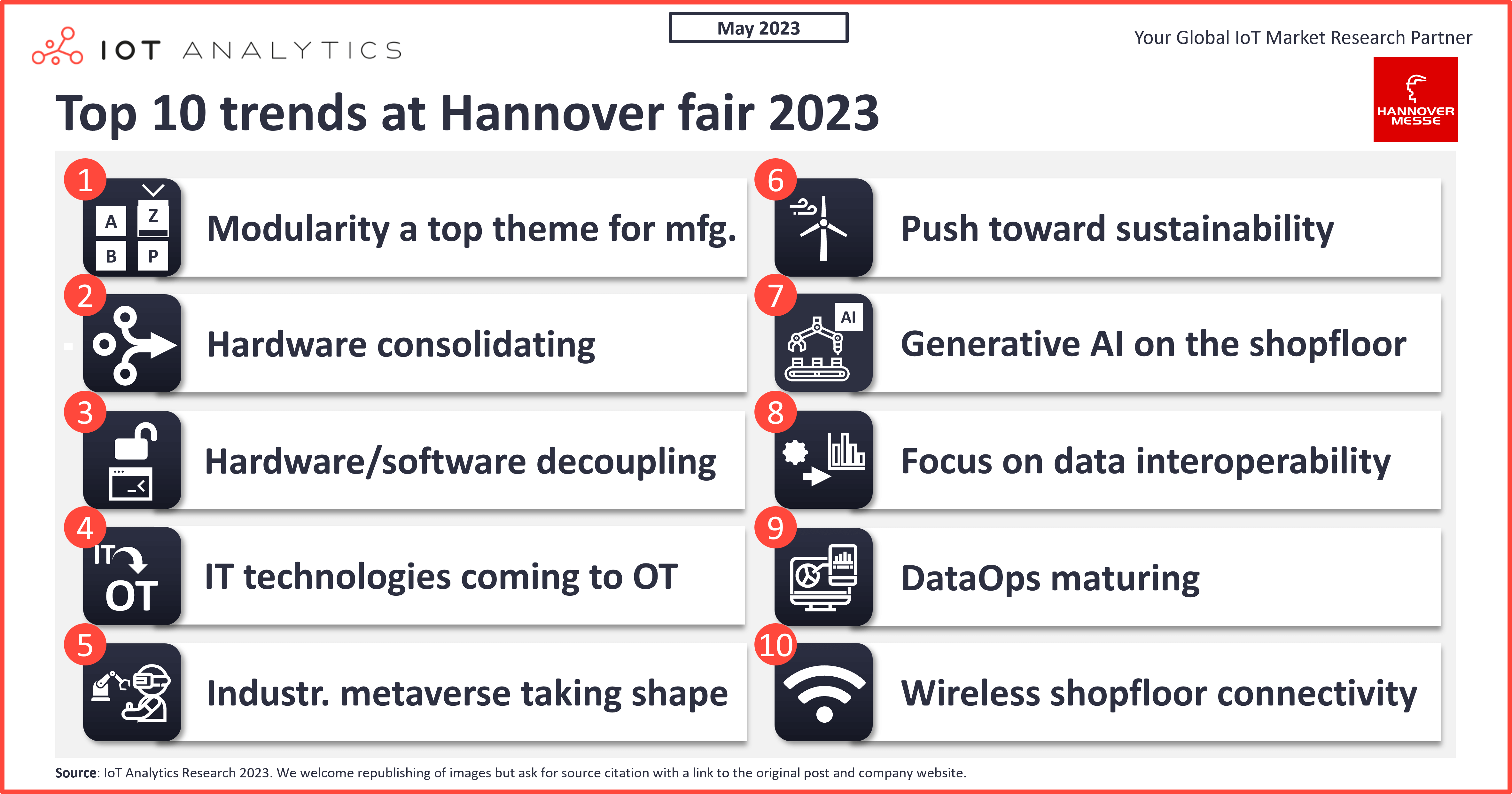

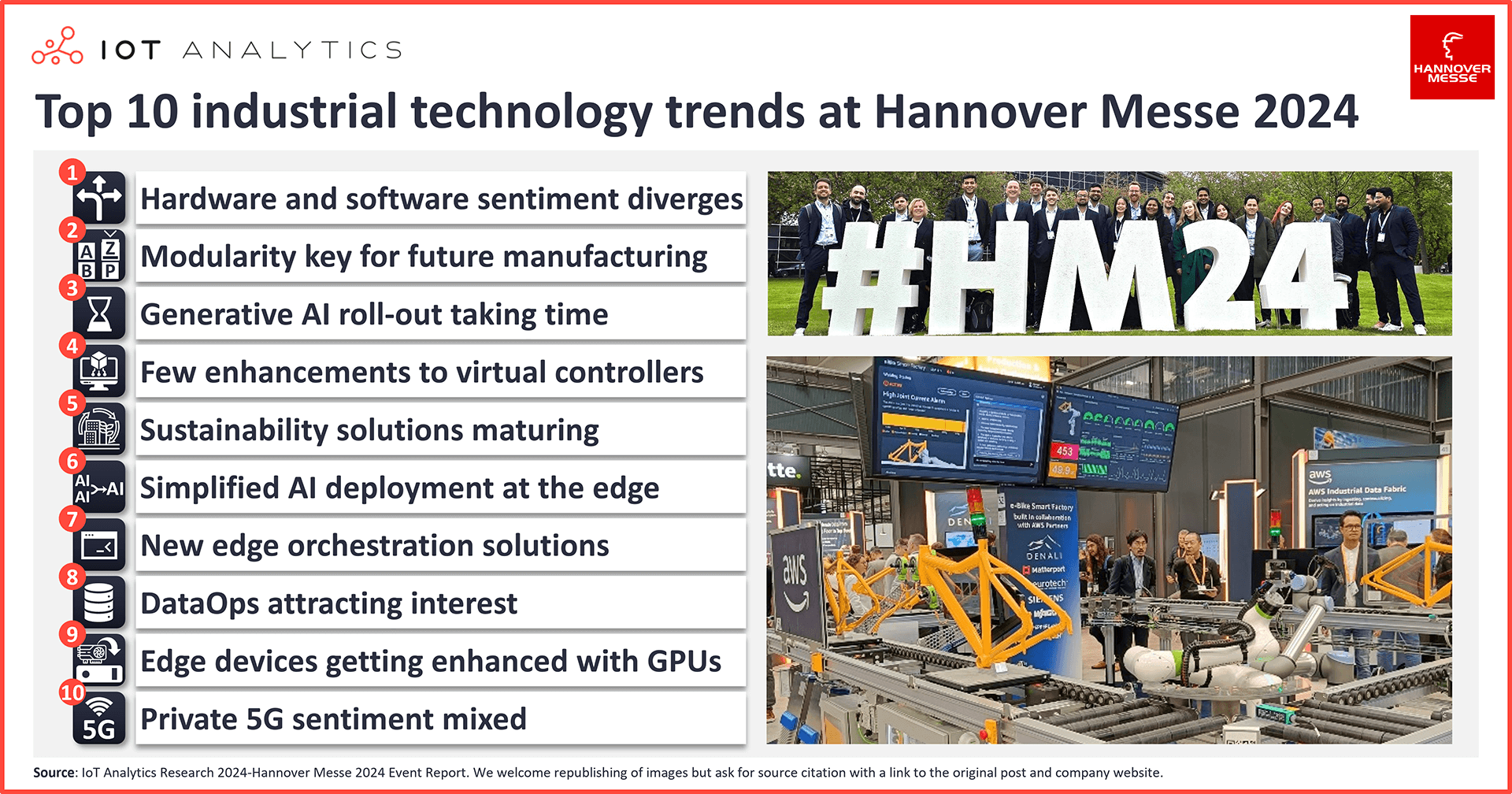

Top 10 industrial technology trends at Hannover Messe 2024

Apart from comparing key vendors and offerings in the report (e.g., hyperscaler comparisons or generative AI solution comparisons), the IoT Analytics team compiled 40 individual insights from their time on exhibit floors and presentations. Here, the team presents 10 industrial technology trends based on these insights (with select exhibitor examples where pertinent).

1. Hardware and software sentiment for 2024 diverges

Many vendors with a large hardware footprint (e.g., large industrial automation suppliers) appeared cautious in their 2024 business outlooks. Many are still grappling with customer inventory surplus and limited demand, which may lead to a dip in sales, especially for hardware like controllers. For example, a few weeks after Hannover Messe 2024, Germany-based industrial automation solutions company Siemens shared in their earnings call that orders in their industrial automation segment declined 12% year over year. Despite some optimism from several exhibitors about a potential market turnaround in the second half of 2024, no proof points were shared at the fair.

Meanwhile, large software vendors appeared extremely optimistic in their 2024 business outlooks—a stark contrast to their hardware counterparts. Driving this positive sentiment is excitement around AI products and their adoption.

This enthusiasm was almost palpable in conversations with large IT vendors like Microsoft, Amazon, and SAP. Affiliated systems integrators such as Avanade and Cognizant mirrored this sentiment, highlighting how customers are initiating new AI- and data-related projects that drive business.

This sentiment toward AI adoption parallels recent IoT Analytics surveys indicating that AI is likely to become a top-5 technology priority in 2025 (IoT Analytics plans to publish an article on notable technology priorities shifts in early June).

2. Modularity remains a top theme for future manufacturing

Manufacturers looking ahead at smart factory concepts are increasingly embracing modular, collaborative, and flexible systems to enhance adaptability and efficiency.

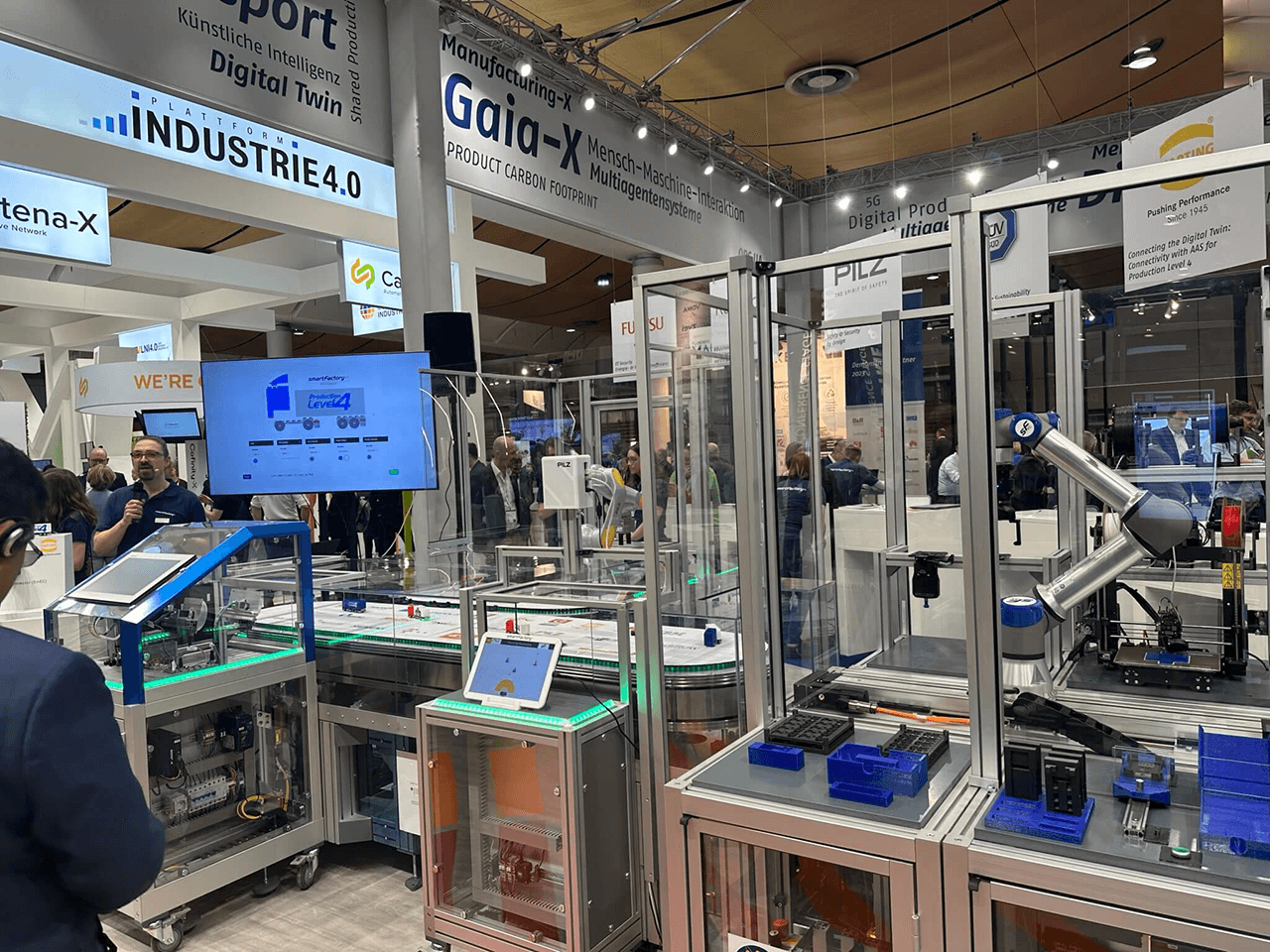

SmartFactory KL, an industry association focused on smart manufacturing, showcased this by presenting its Production Level 4 factory ecosystem for the third consecutive year at Hannover Messe 2024. This ecosystem features modular production stations that can be independently created, upgraded, or replaced to enhance flexibility and scalability.

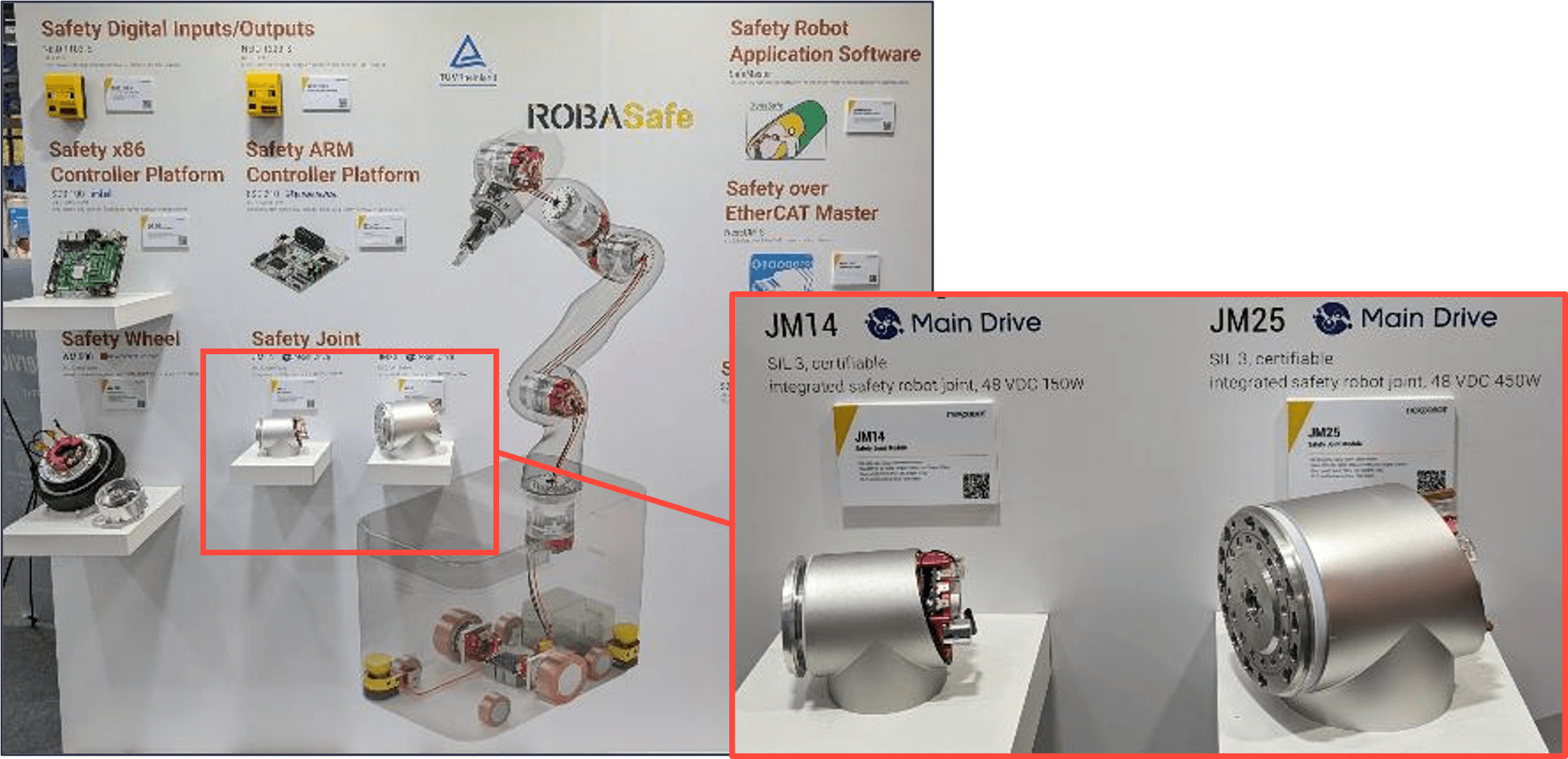

Modularity is also emerging as a key focus in robotics, enhancing customization and scalability. Taiwan-based robotics and machine automation provider NexCOBOT showcased modular robots with functional safety standards, offering customizable designs and simplified maintenance. Meanwhile, Germany-based automation technology provider Beckhoff Automation‘s ATRO modular robotic system includes modular drives and components that connect via Hirth couplings and EtherCAT drives, allowing for flexible and scalable adjustments to robot configurations.

3. Many Generative AI showcases, but roll-out is taking time

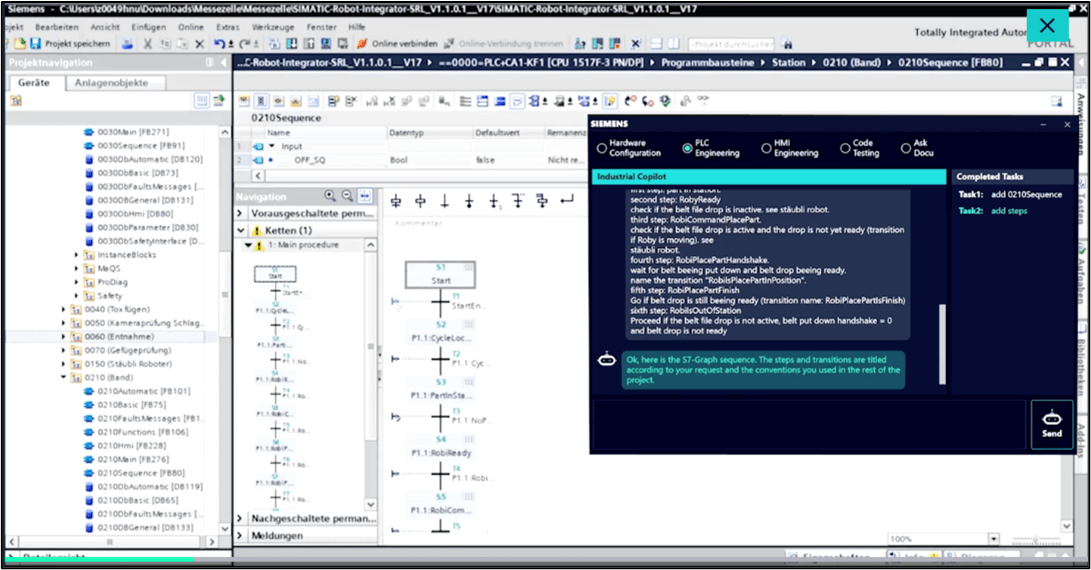

30% of the generative AI showcases that the IoT Analytics team examined were for coding, with PLC programming being the top use case. Examples included:

- Siemens showcased its Industrial Copilot offering, which helps to automatically write/generate PLC programming code through natural language input.

- Schneider Electric, a France-based digital automation and energy management company, demonstrated its solution that helps to iteratively generate PLC programming code through natural language input, available context, and Schneider Electric’s own automation libraries.

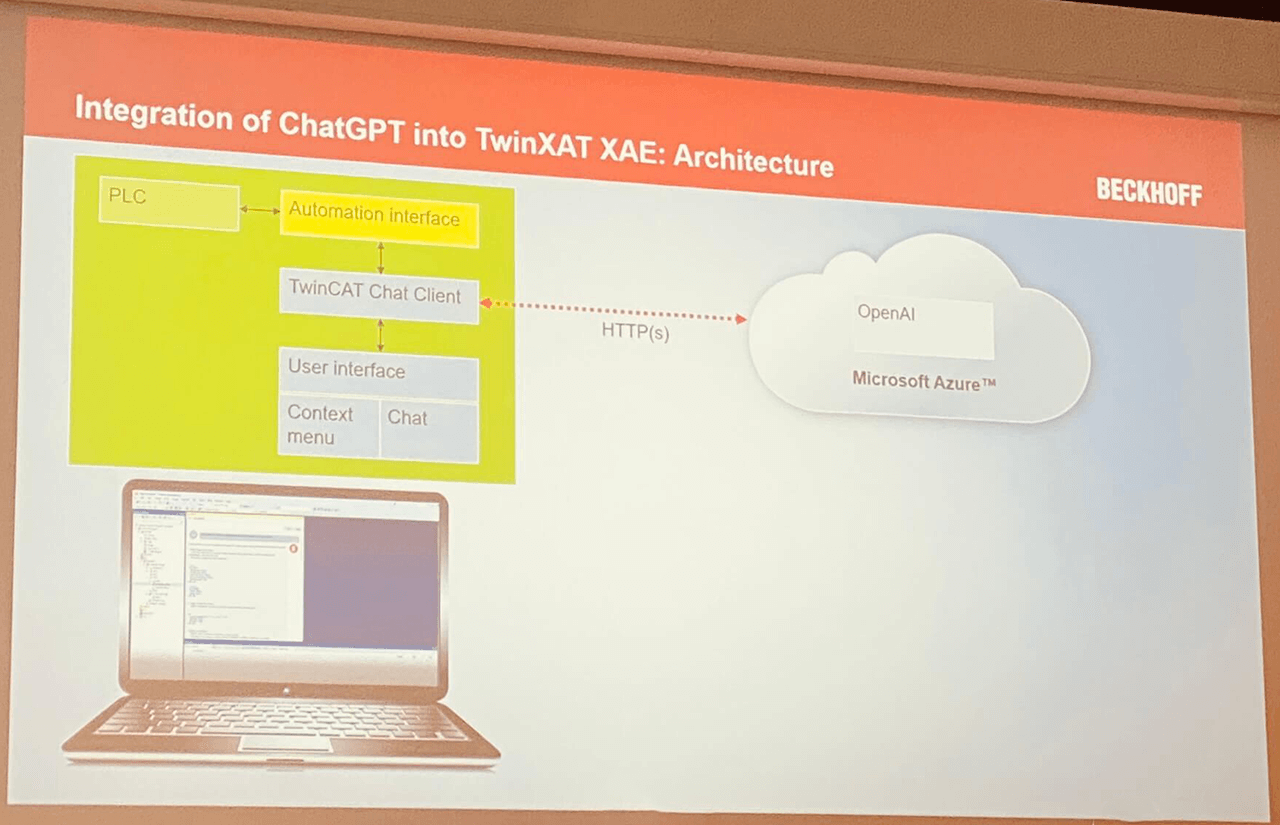

- Beckhoff Automation, a Germany-based automation control technology provider, showcased its TwinCat Chat, which integrates with Visual Studio and TwinCat XAE to offer a chatbot interface for PLC programming.

A few of these showcases were also seen at SPS 2023 in Nuremberg, Germany.

Other use cases on display include the following:

- 3D model design: Siemens’s copilot uses Siemens NX, RuleStream, and Teamcenter, along with simulation software from Germany-based industrial connectivity solutions provider HARTING, to generate a 3D model design from a simple prompt.

- Machine troubleshooting: Softserve, a Ukraine- and US-based software development and consultancy company, showcased its Industrial Copilot, which helps shop floor workers resolve machine issues. It uses documentation, guidelines, and manuals for step-by-step solutions and troubleshooting and offers a digital visualization of the recommended steps.

- Document analysis: Tulip, a US-based software company, showcased its Frontline Copilot, which provides frontline workers quick access to important information and can answer questions while simultaneously providing source PDF documentation.

During IoT Analytics’ interviews with vendors showcasing their generative AI solutions, many indicated that (public) rollouts are taking time. Vendors are primarily delaying release to ensure thorough testing of industrial-grade AI to address legal questions and meet performance and safety standards.

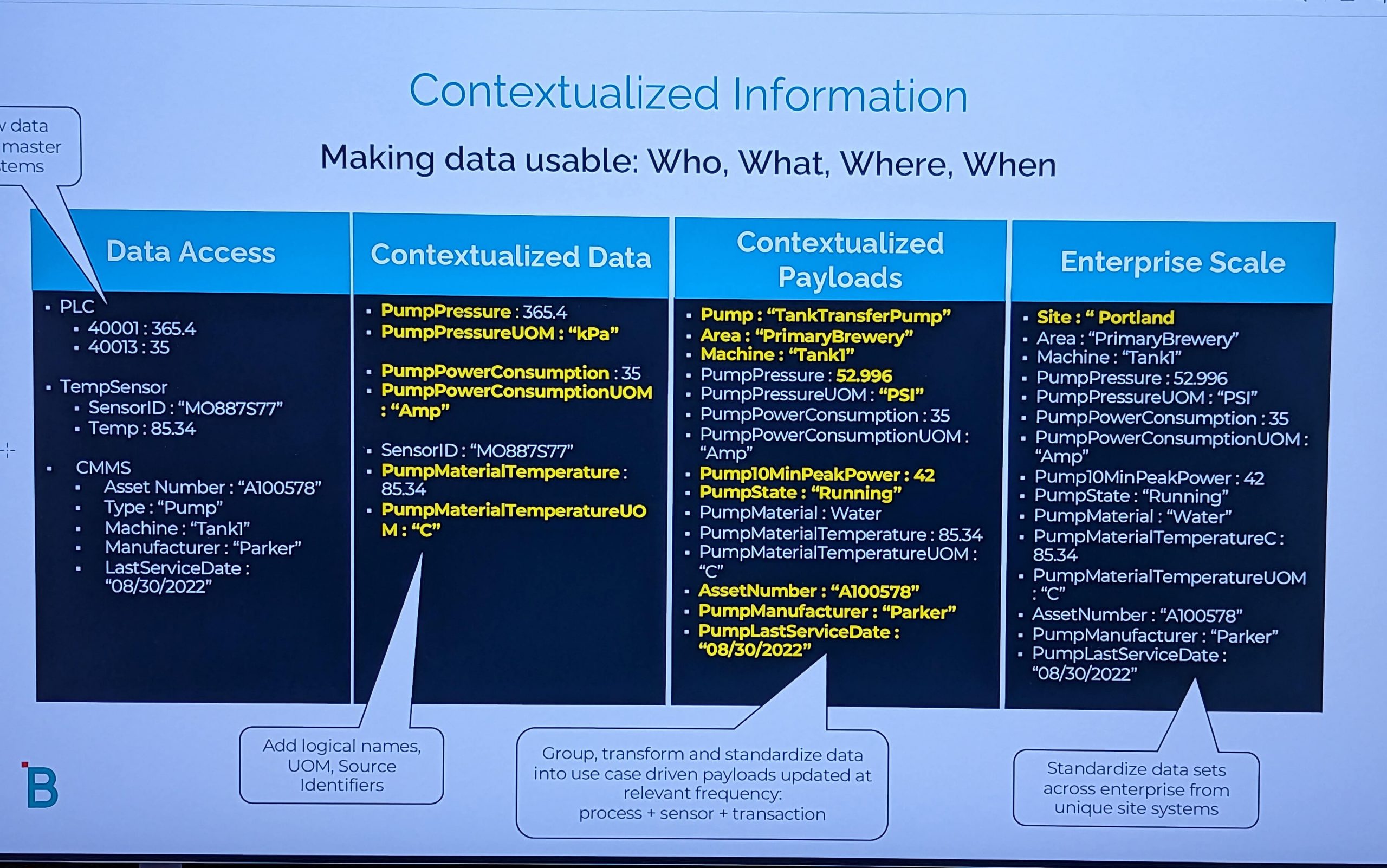

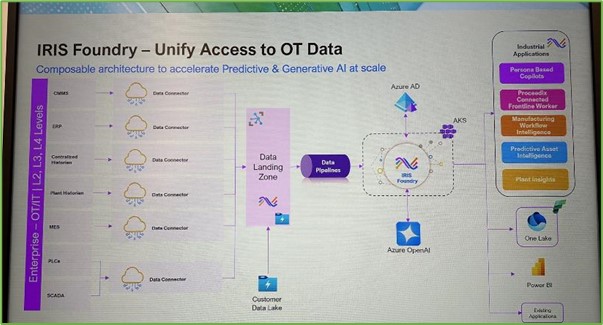

Meanwhile, end-users struggle with data quality and accessibility issues, which is leading to slow adoption. These struggles have prompted vendors to focus more on data management solutions in the near term. For example, US-based AI-based predictive and generative solutions company SymphonyAI showcased its Industrial Reasoning and Insights Service (or IRIS) Foundry, which the company designed to aggregate, query, and manage industrial data for scalable AI solutions.

India-based IT services and consulting company Tata Consultancy Services (TCS) also acknowledged that data quality and accessibility are major hurdles for scaling industrial AI. Instead of a specific technical fix, the company addresses data challenges through a broad network of partners and its own cross-industry expertise. Additionally, cloud computing services platform Google Cloud introduced its Cortex Framework, aimed at managing and transforming data for AI applications, acknowledging the challenges of unstructured and inaccessible data.

4. Few noticeable enhancements to virtual controllers

Continuing from Hannover Messe 2023, vendors highlighted the decoupling of hardware and software for control by showcasing their soft/virtual PLCs products:

- Siemens highlighted ongoing deployments of its SIMATIC S7-1500V (together with their customer Audi as an example).

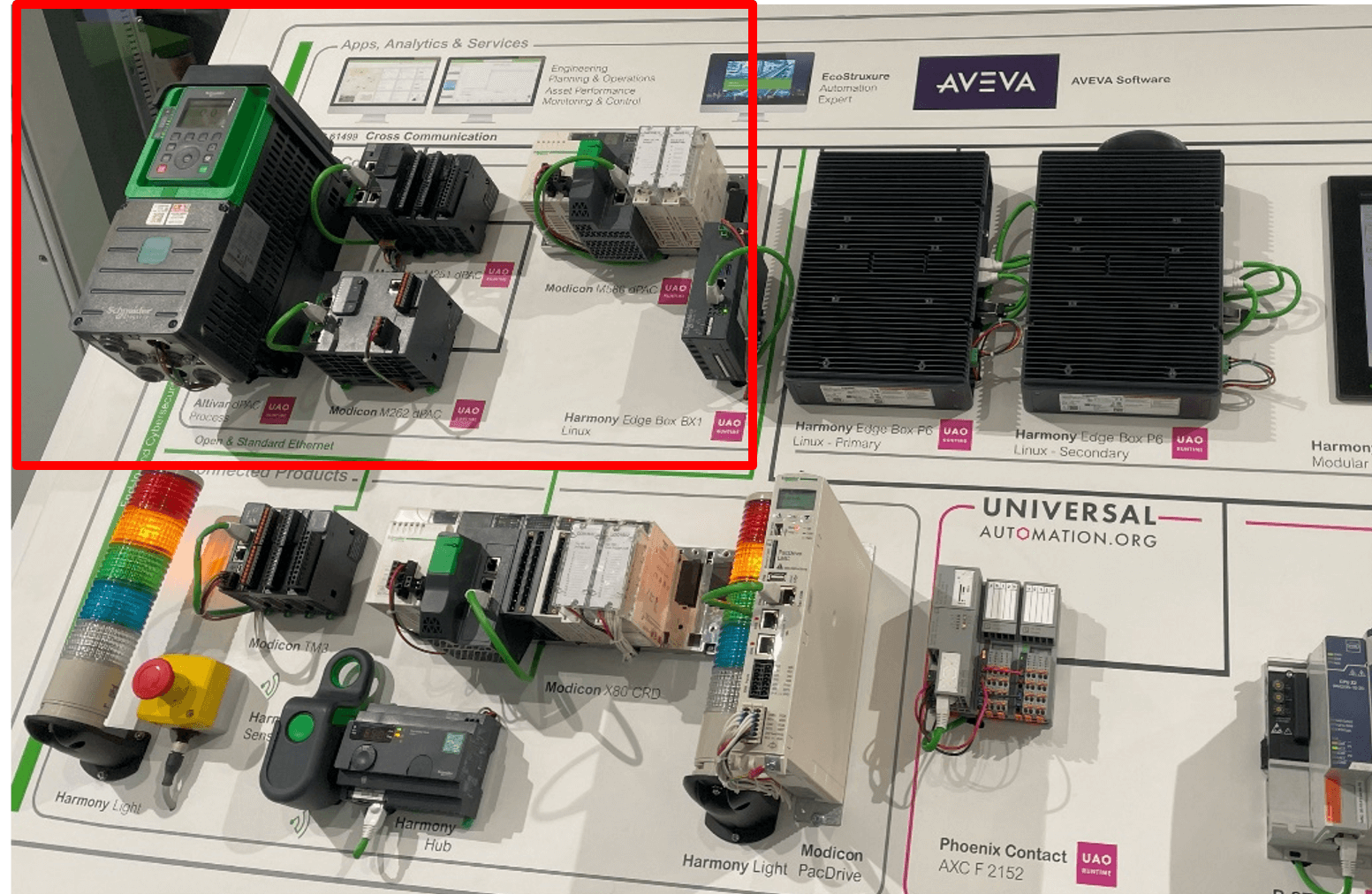

- Schneider Electric demonstrated its EcoStruxure Automation Expert, which integrates the IEC-61499 standard for software-based controllers as part of its software-defined automation vision.

- Bosch Rexroth, a Germany-based industrial automation engineering firm, showcased its ctrlX PLC solution, a virtual PLC running on VMware’s hypervisor.

- Beckhoff Automation showcased its TwinCAT-based soft PLC and introduced TwinCAT Runtime for Linux.

Despite these demonstrations, the absence of substantial advancements, new features, or new powerful customer stories was notable. This may be due to the nascent nature of these technologies and markets as vendors assess adoption, pricing, and go-to-market strategies.

5. Sustainability data management solutions maturing to enable streamlined ESG reporting

Sustainability remained a central theme at this year’s Hannover Messe, driven by upcoming ESG reporting regulations that impact IoT product launches. Vendors are focusing on enhancing data management solutions and adopting sustainability data standards.

- Microsoft demonstrated its Cloud for Sustainability, leveraging AI to build ESG data lakes for clients like Kuka Robotics,a Germany-based industrial robots and factory automation systems manufacturer.

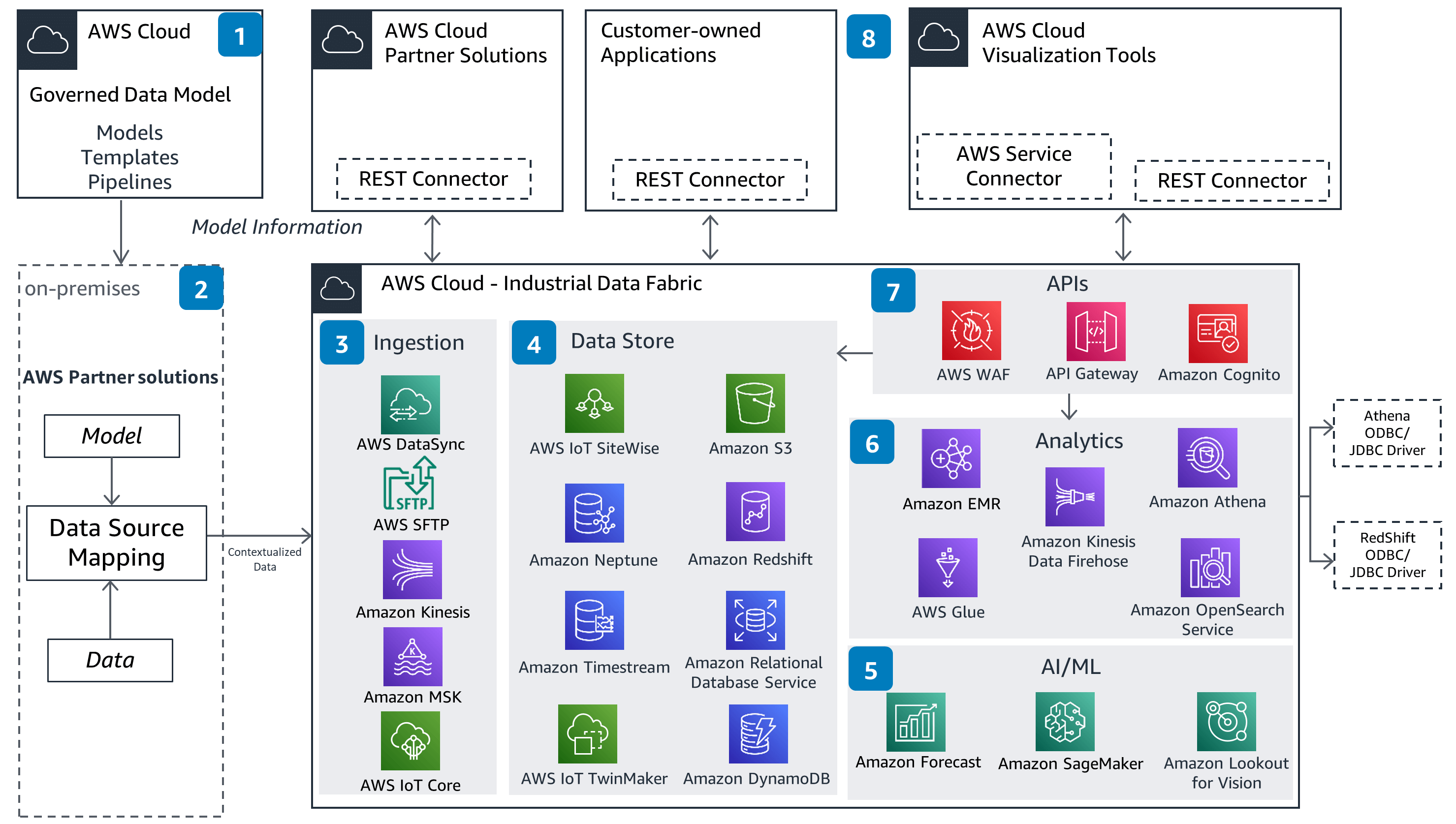

- AWS introduced its Sustainability Intelligence Portal for customizable carbon footprint tracking.

- SAP, a Germany-based enterprise software company,highlighted its Sustainability Control Tower for integrated ESG data management across business functions.

- Fujitsu, a Japan-based IT and communications technology provider,showcased its approach to ESG management for the manufacturing industry, which consists of two parts: an energy consumption and optimization platform and ESG optimization.

Meanwhile, initiatives like the Partnership for Carbon Transparency (PACT) framework and the Digital Product Passport (DPP) are also making significant progress in standardizing data exchange and promoting circular economies.

6. Vendors are taking steps to simplify AI deployment at the edge

Several vendors highlighted solutions that facilitate the deployment of AI on edge devices. US-based technology and communications services company Hewlett Packard Enterprise (HPE), for example, showcased its new machine learning platform, which enables model training and inferencing on various GPU-accelerated infrastructures. It integrates with frameworks like TensorFlow and PyTorch and supports both cloud and on-premises deployments.

Meanwhile, US-based intelligent device platform provider Edge Impulse’s Edge AI Platform allows users to collect data from multiple sources, build and train models, and evaluate performance using the ONNX file format. These platforms aim to streamline the deployment process by providing pre-trained models and optimizing AI performance on specific hardware, ensuring scalable AI integration at the edge.

Vendors are also focusing on making AI functionalities and solutions available on various edge devices.

- Siemens, for example, has integrated Inspekto’s machine vision solution with their Industrial Edge platform (Siemens AG acquired Inspekto in February 2024).

- Sony Semiconductor Solutions, a Japan-based semiconductor designer and producer, highlighted its edge AI sensing platform, AITRIOS, which includes a marketplace of pre-trained AI models for machine vision applications.

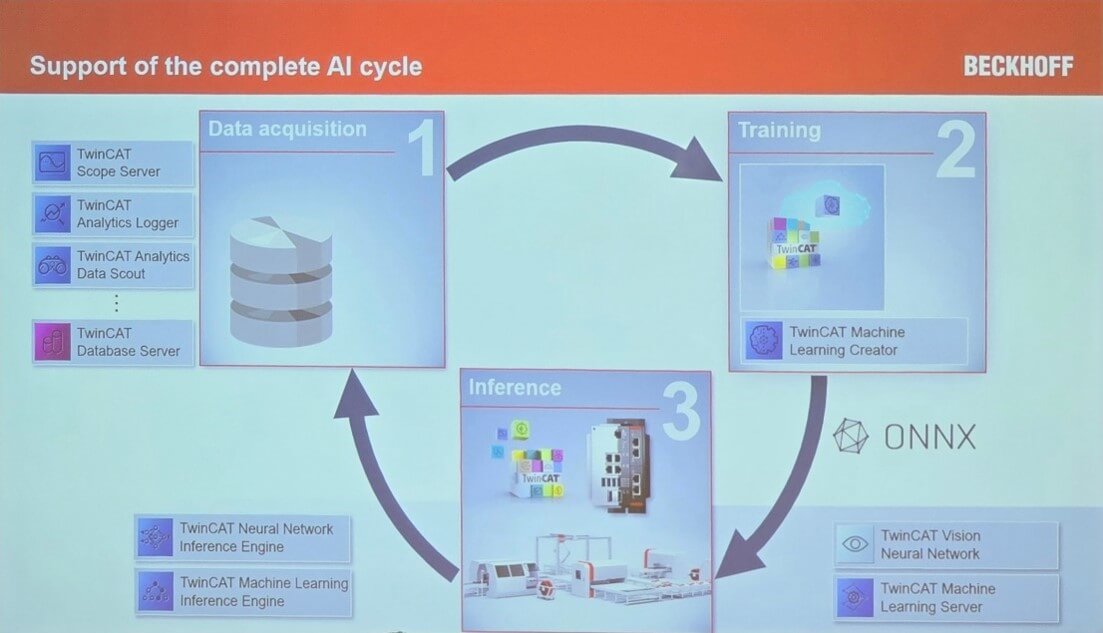

- Beckhoff Automation introduced the TwinCAT Machine Learning Creator platform, aiming to help non-expert customers simplify AI development for real-time control and address the shortage of AI expertise.

7. New edge node and application orchestration solutions

Edge orchestration as a topic garnered significant attention at the fair. Driven by the anticipated explosion of edge nodes and the need to update/maintain them, IT and traditional OT vendors alike showcased their latest products in this space.

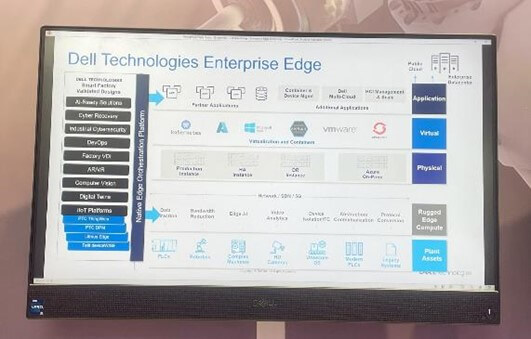

- Dell, a US-based computer and IT equipment manufacturer, showcased NativeEdge, a platform for centralized deployment and management of edge infrastructure and applications. It features zero-touch orchestration, pre-validated blueprints, and secure voucher-based authentication.

- The Linux Foundation, a 501(c)(6) non-profit that provides a neutral hub for developers, introduced Margo, an open standard for edge orchestration to simplify the deployment and management of edge applications across multi-vendor environments.

- Advantech Co., a Taiwan-based industrial automation solutions company, and Namla, a France-based tech startup specializing in cloud and edge computing, demonstrated a cloud-edge orchestration solution for managing devices and orchestrating applications.

- Siemens also presented its SIMATIC IPC ORCLA framework for setting up, updating, and maintaining Siemens industrial PCs for driver and firmware updates.

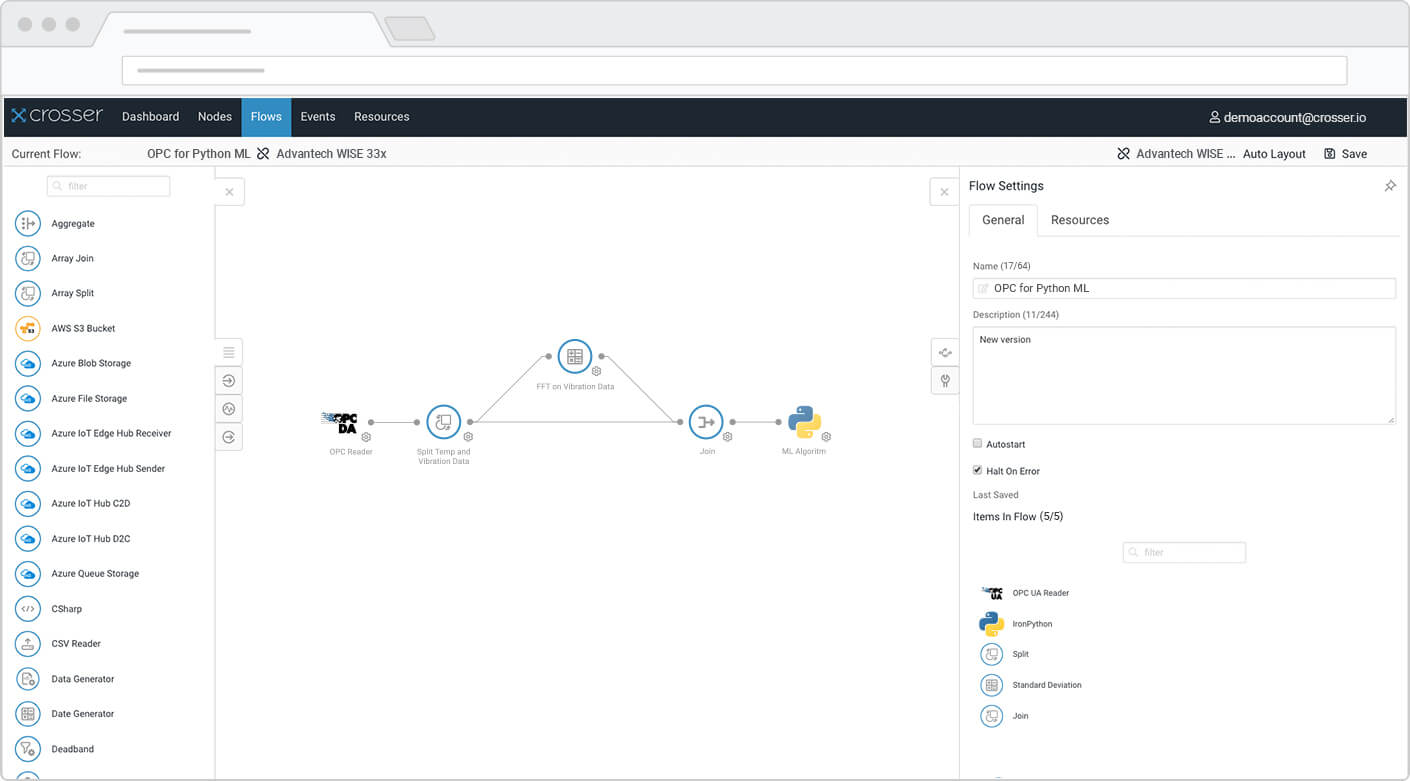

8. DataOps continues to attract interest to improve data usability

Building on last year’s interest, DataOps remained a key topic of interest. US-based industrial software company HighByte, present at the AWS booth, showcased its Intelligence Hub with features like a connector for Snowflake and AWS IoT SiteWise integration, emphasizing its Series A funding success.

Meanwhile, US-based industrial software company Litmus Automation introduced its MQTT broker-based Unified Namespace (or UNS), which is compatible with major cloud platforms and supports ISA-95. Several companies (e.g., Google and Dell) highlighted Litmus as a key strategic partner for OT data ingestion and orchestration, underscoring the importance of DataOps for established vendors. Litmus is also pairing with Microsoft’s new manufacturing data solutions (MDS) in Microsoft Fabric, acting as a DataOps platform at the edge to extract, normalize, and model data.

Germany-based DataOps startups Cybus and United Manufacturing Hub were two other promising companies in this space that our team interacted with.

“Information models are important for interoperability. We see a significant interest from the customers to standardize how their data [are] transmitted and saved. It’s a slow process but gives huge benefits in the long term.”

CXO at a major DataOps vendor

9. Edge devices are getting enhanced with GPUs for AI capabilities

Several industrial automation and edge device vendors highlighted the integration of GPUs to enhance edge AI capabilities and decision-making speeds by boosting parallel computation and on-device model training.

- Beckhoff Automation introduced new C6043 IPC variants with NVIDIA GPUs, enhancing computing performance for AI applications.

- Zotac, a China-based computer hardware manufacturer, presented its mini-IPCs, leveraging AMD and NVIDIA GPUs to provide high-performance AI inference.

- APQ, a China-based industrial AI edge computing manufacturer, showcased its TAC-3000 robotic controller, designed for autonomous mobile robots and featuring NVIDIA GPUs for powerful on-edge processing.

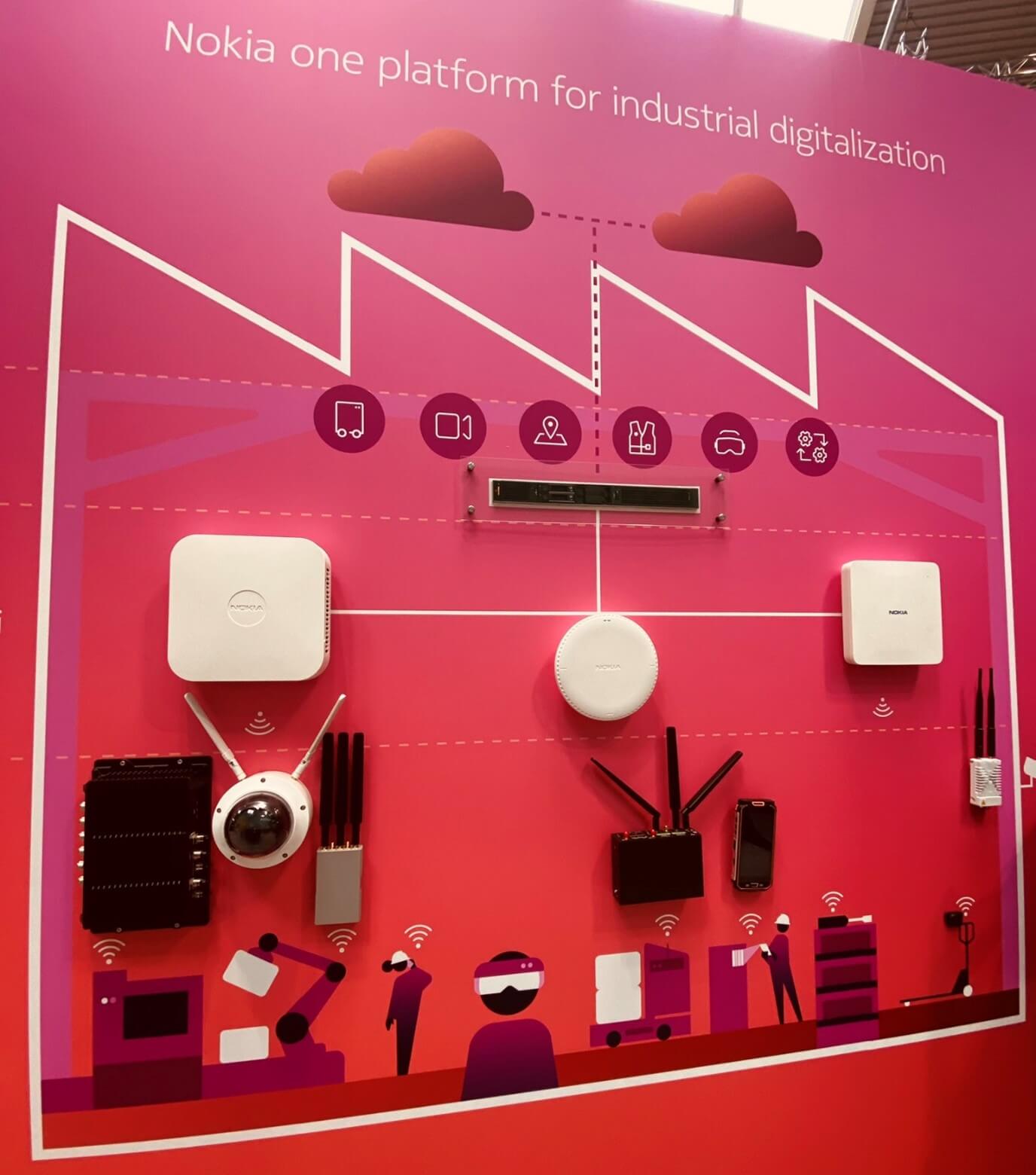

10. Private 5G sentiment mixed with managed 5G services in the spotlight

Interest in private 5G solutions (Hall 14) appeared muted this year, and some vendors seemed to mirror this sentiment, highlighting significant adoption obstacles for private 5G, such as high deployment costs, network maintenance complexity, and an immature ecosystem lacking necessary devices. Telecom vendors like Japan-based NTT and Sweden-based Ericsson remain optimistic, though. They emphasized their flexible pricing models (e.g., NTT’s OpEx-based solutions) and the launch of new industrial devices to overcome these barriers (e.g., Wireless Bolt 5G and MultiTech 5G Redcap modems).

Managed private 5G services and device-as-a-service models were also presented as cost-effective solutions to encourage uptake and address key pain points. Managed services simplify the deployment and management of private 5G networks by reducing complexity, providing expert management, and offering scalability. These cost-effective services address the existing skills gap, allowing adopters to focus on their core operations without needing in-house expertise. Ericsson highlighted its private 5G solution that includes a network management portal and integration with several operator services, while NTT showed custom-built 5G services for sectors like healthcare, automotive, and manufacturing.

Putting the observations into perspective

Hannover Fair 2024 did not present any new, radical technology breakthroughs. However, a closer examination reveals important developments beneath the surface, with several trends becoming more prominent and new nuances emerging.

Beyond the top 10 trends highlighted in this article, here are 5 other characterizations of Hannover Messe 2024:

- Exhibitors showcased solutions, not technology. Exhibitors continued to put a heavier focus on showcasing their technology as part of solutions rather than standalone technology showcases. For example, this year, Siemens had several end-to-end manufacturing demonstrations (e.g., for automotive and chemical manufacturing) that characterized their booth, showcasing their various solutions in context.

- Exhibitors focused on ecosystem collaboration. IoT Analytics observed that industrial software vendors continue to emphasize integrating and showcasing solutions within ecosystems, actively working with other vendors (e.g., Rockwell Automation showcased its human-machine interface software embedded with Tulip’s MES).

- Exhibitors addressed workforce challenges. Many exhibitors focused on addressing the urgent need for skilled labor and innovative training solutions (e.g., Hexagon announced that Safran Aircraft Engine is now using its machine trainer software for faster workforce onboarding).

- Most innovation was related to edge technologies. The team witnessed a growing number of edge orchestration solutions to make the growing number of edge nodes easier to manage, and vendors are preparing to find a place in the edge AI market by enhancing edge solutions with AI capabilities, both in hardware and in AI software simplification.

- AI was not as prominent as expected. There was a striking difference between the world’s biggest telecommunication fair, Mobile World Congress 2024 (February 2024), and the world’s biggest industrial fair, Hannover Messe 2024 (April 2024), when it comes to AI showcases. AI absolutely dominated MWC showcases and discussions, according to our perception, while AI was just one of several key themes at the Hannover fair. Though AI is clearly becoming a bigger theme among industrial companies, it felt clear that it is just one of many developments and not necessarily the leading one (yet?).

Did we miss anything?

We strive to provide comprehensive coverage of the latest trends and developments. However, it is important to acknowledge that our ability to cover all 4,000+ exhibitors within the span of just five days at Hannover Messe is limited.

We value the insights of our readers who have attended or exhibited at the event, and we warmly welcome and encourage your input.

If you attended Hannover Messe and would like to share your thoughts, we invite you to reach out to us through the contact form below. We appreciate the opportunity to engage in a knowledge-sharing session with our analysts, where we can further explore and discuss your perspectives and how we can include them in our research and publications.

Disclosures

Companies mentioned in this article—along with their products—are used as examples to showcase market developments. No company paid or received preferential treatment in this article, and it is at the discretion of the analyst to select which examples are used. IoT Analytics makes efforts to vary the companies and products mentioned to help shine attention to the numerous IoT and related technology market players.

It is worth noting that IoT Analytics may have commercial relationships with some companies mentioned in its articles, as some companies license IoT Analytics market research. However, for confidentiality, IoT Analytics cannot disclose individual relationships. Please contact compliance@iot-analytics.com for any questions or concerns on this front.

Note: This article was updated in June 2024 to include the latest market data and insights from IoT Analytics.

Click to read previous analysesMore information and further reading

Are you interested in learning more about the latest industrial technology developments?

Our 141-page Hannover Messe event report goes much deeper into each of the 10 main trends highlighted in this article, with various pictures, examples, proof-points, and quotes. We also highlight 30 other insights we uncovered at the event and illustrate the differences.

Hannover Messe 2024—the latest Industrial IoT/Industry 4.0 Trends

A 141-page comprehensive summary of the key highlights and 40 in-depth insights based on >450 booth visits, >300 individual interviews by the IoT Analytics analyst team at Hannover Fair 2024.

Already a corporate research subscriber?

Related publications

You may be interested in the following publications:

- Data Management and Analytics Market Report 2024–2030

- IoT Enterprise Projects Adoption Report 2024

- State of IoT Spring 2024

- Equipment as a Service Market Report 2024–2028

- IoT Commercialization & Business Model Adoption Report 2024

- B2B Technology Marketplaces Market Report 2024–2030

- Generative AI Market Report 2023–2030

Related articles

You may also be interested in the following recent articles:

- How global AI interest is boosting the data management market

- The top 6 edge AI trends—as showcased at Embedded World 2024

- Challenges with IoT product launches: Why time-to-market has increased 80% in 4 years

- State of IoT Spring 2024: 10 emerging IoT trends driving market growth

- How to create a successful IoT business model—Insights from successful OEMs

Related market data

You may be interested in the following IoT market data products:

- Global Cellular IoT Connectivity Tracker and Forecast

- Global IoT Enterprise Spending Dashboard

- Global Cellular IoT Module and Chipset Tracker and Forecast

Are you interested in continued IoT coverage and updates?

Subscribe to our newsletter and follow us on LinkedIn and Twitter to stay up-to-date on the latest trends shaping the IoT markets. For complete enterprise IoT coverage with access to all of IoT Analytics’ paid content & reports including dedicated analyst time check out Enterprise subscription.