Industry 4.0 technology roll-out in 2020 is still low, with less than 30% of manufacturers reporting extensive adoption today -– this is a key finding of IoT Analytics’ latest 286-page Industry 4.0 & Smart Manufacturing Adoption Report, published in January 2020.

Key findings of the Industry 4.0 & Smart Manufacturing Adoption Report 2020 include:

- Overall adoption: Less than 30% of manufacturers report extensive adoption today

- Regional differences: North American manufacturers have the greatest adoption of Industry 4.0 technologies

- Industry differences: Manufacturers in the automotive industry adopt more Industry 4.0 technology than manufacturers in other industries

- Leading adopters: Siemens, GE and Boeing are considered to be the leading manufacturers in Industry 4.0 adoption

- Adoption of specific Industry 4.0 technologies and use cases varies greatly by industry

- More…

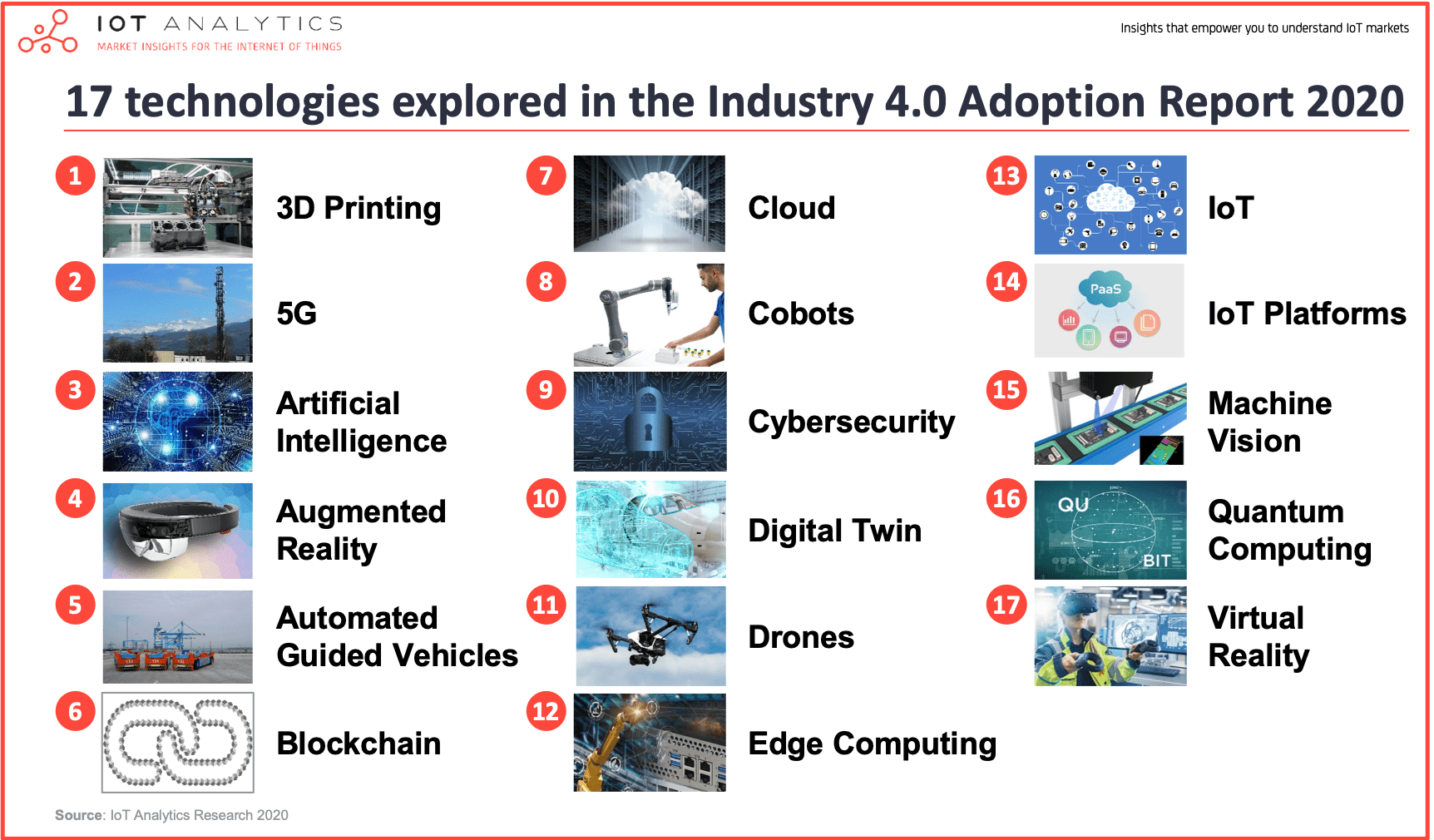

IoT Analytics performed an extensive, in-depth survey of 150 IT and OT decision makers from some of the leading manufacturers around the world in order to better understand Industry 4.0 adoption across regions, industries, use cases and technologies. Among other things, IoT Analytics asked respondents to comment on the current and future adoption of the following 17 Industry 4.0 technologies:

- 3D Printing

- 5G

- Artificial Intelligence

- Augmented Reality

- Automated Guided Vehicles (AGVs)

- Blockchain

- Cloud

- Cobots

- Cybersecurity

- Digital Twin

- Drones

- Edge Computing

- IoT

- IoT Platforms

- Machine Vision

- Quantum Computing

- Virtual Reality

In addition to Industry 4.0 adoption, respondents were asked to comment on Industry 4.0 technology ROI, spending (current and future), preferred vendors, use cases, success factors, architectures, communication protocols and various other things.

The following 4 findings highlight some of the answers pertaining to the question “Who is ahead in Industry 4.0 adoption?”

1. Which region is ahead with Industry 4.0 adoption?

North America is clearly leading Europe and Asia when it comes to overall Industry 4.0 adoption, with 36% of respondents indicating the Industry 4.0 technology was either “extensively” or “fully” rolled out in operations. This finding is somewhat surprising given the fact that many European and Asian countries seem to have more governmental initiatives which aim to drive Industry 4.0 adoption (e.g. Germany’s Industrie 4.0, China’s Made in China 2025, etc.).

- North America: North American manufacturers were far more likely to have rolled out cloud, IoT and IoT platform technologies, which should not come as a surprise given that the three most popular North American vendors (Microsoft, Amazon and IBM) all provide cloud and IoT offerings. In addition, two out of the top 3 manufacturers that were considered to be “leading adopters” (General Electric and Boeing) are based in the United States.

- Europe: European manufacturers also showed higher than average adoption of cloud, but they trailed in Industry 4.0 adoption of other technologies such as collaborative robots (cobots) and edge computing. Respondents from Europe also had the most cautious budget outlook for 2020.

- Asia: Asian manufacturers showed a higher adoption of collaborative robots but a much lower than average adoption of cloud and IoT technologies. While Asian companies had the lowest overall adoption of Industry 4.0 technologies, they had the most optimistic budget outlook for 2020.

Another factor affecting regional adoption is the mix of companies that were surveyed from each region. European respondents represented a higher proportion of machinery & equipment and energy industries, Asian respondents represented the computer, electronic & electrical industries at a higher proportion, and North American respondents represented more metals & mining and other discrete industries.

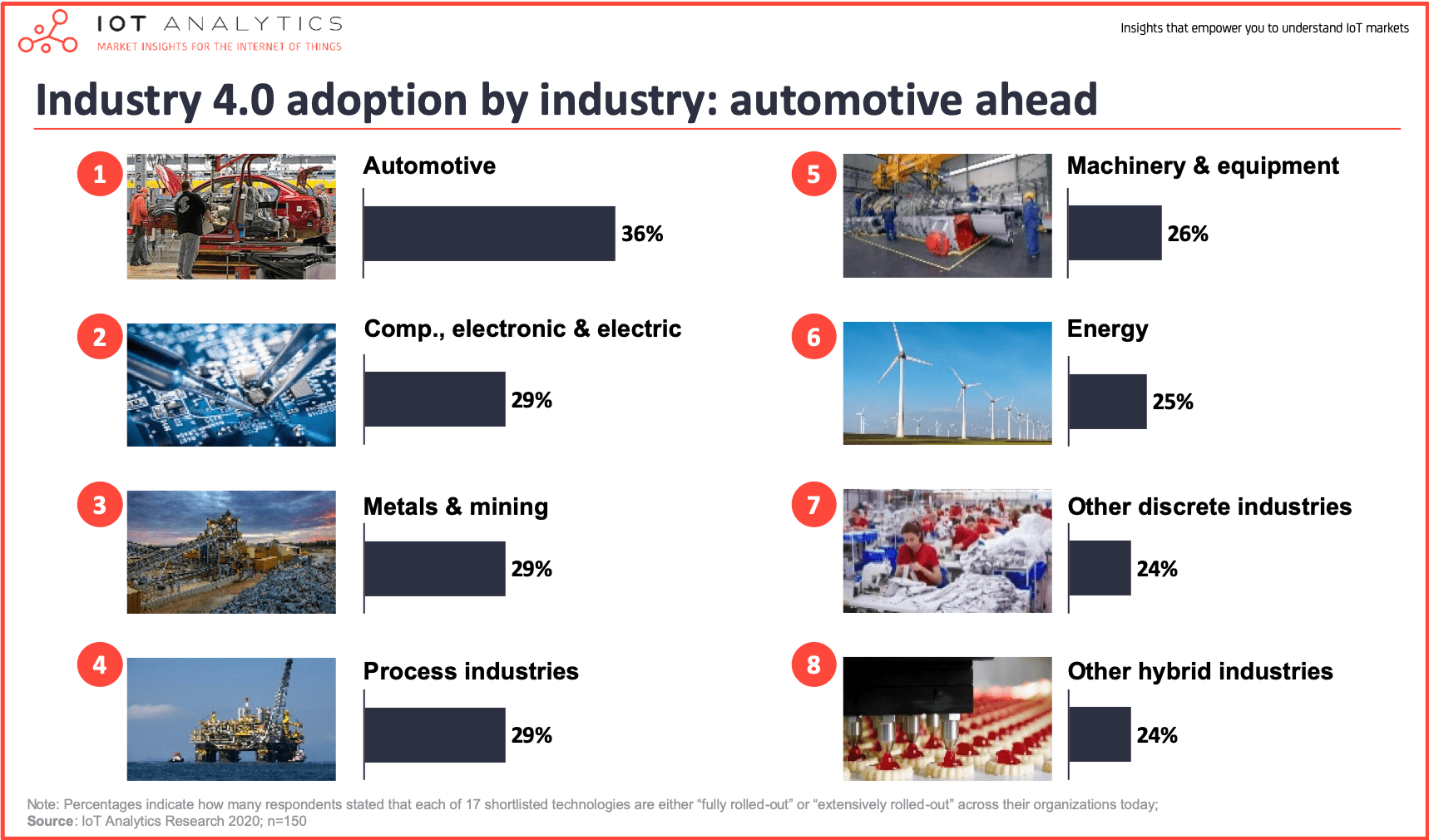

2. Which industry is ahead with Industry 4.0 adoption?

Competition has been driving innovation in the automotive industry for decades. As a result, automotive OEMs have been big adopters of both innovative technologies (such as robotics) and management practices (such as TPS) which yield more efficient operations and thus a competitive edge. Today, evolving customer preferences (such as the demand for customization and quick delivery), the upcoming migration away from combustion engines and regulations require automotive OEMs and their suppliers to be more adaptable and flexible. This demand for adaptability helps to explain why survey respondents from the automotive industry were much more likely to adopt Industry 4.0 technologies such as collaborative robots and automated guided vehicles (AGVs) than respondents from other industries.

The adoption of Industry 4.0 technologies is not exclusive to automotive OEMs like Tesla or BMW; it also includes tier 1 suppliers like Bosch, which ranked #8 for adopters in this report. Unsurprisingly, respondents in the automotive industry also indicated a faster than average ROI on Industry 4.0 adoption, as well as a higher likelihood to increase budget allocation across most of the Industry 4.0 technologies.

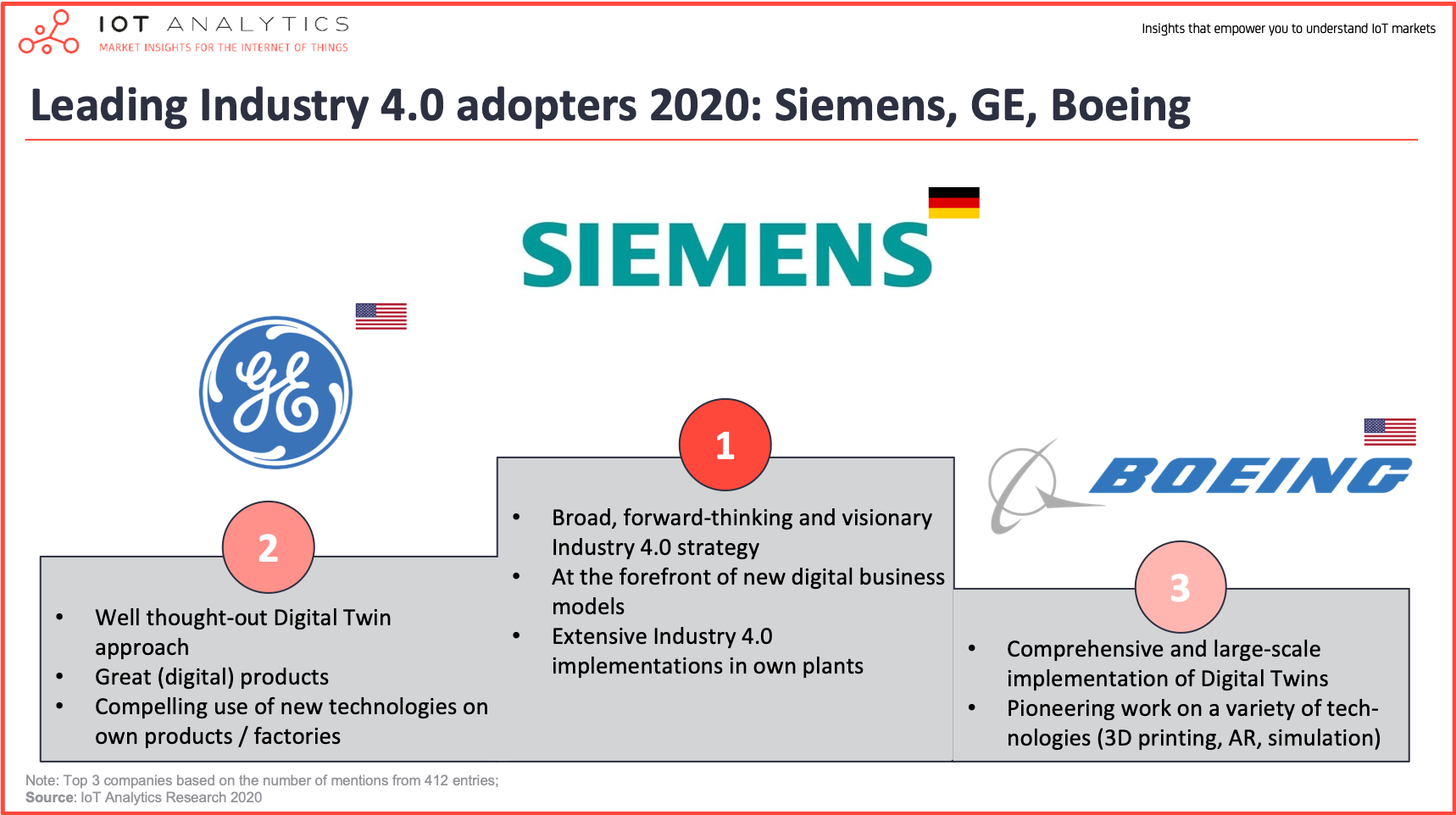

3. Which manufacturers are ahead with adoption?

Siemens, GE and Boeing are considered to be the leading companies in Industry 4.0 adoption based on responses to the survey question: “Which manufacturers do you regard as the best at deploying innovative digital tools in their operations?”.

Out of the 412 responses, thirty companies were mentioned more than once, and each entry was accompanied with a brief description as to why they were considered the best. The three most mentioned manufacturers were Siemens, General Electric and Boeing. Leadership on digital twins emerged as a common theme across all manufacturers, and respondents noted that both Siemens and GE “eat their own dog food” and implement their new technologies in their own factories. Main comments included:

- Siemens:

- Broad, forward-thinking and visionary Industry 4.0 strategy

- At the forefront of new digital business models

- Extensive Industry 4.0 implementations in own plants

- GE

- Well thought-out Digital Twin approach

- Great (digital) products

- Compelling use of new technologies on own products / factories

- Boeing

- Comprehensive and large-scale implementation of Digital Twins

- Pioneering work on a variety of technologies (3D printing, AR, simulation)

4. Adoption of specific Industry 4.0 technologies varies greatly by industry

The adoption of Industry 4.0 technologies varied greatly across industries. Drones, for instance, were much more likely to be adopted in the metals & mining or energy industries than in automotive, while 3D printing was much more likely to be adopted in automotive than in metals & mining or energy. This variance in adoption for particular technologies shows that while some industries may have a low overall industry adoption score, it does not necessarily imply that the industry is lagging in innovation.

A more likely explanation is that there are simply fewer Industry 4.0 technologies that are appropriate for solving the needs of that industry (i.e. energy companies do not derive as much value from technologies like machine vision, AGVs and 3D printing).

Report Methodology

The Industry 4.0 & Smart Manufacturing Adoption Report 2020 is part of IoT Analytics’ ongoing coverage of Industrial IoT and Industry 4.0 (Industrial IoT Research Workstream). The information presented in the report is based on an extensive survey with leading manufacturers conducted between July 2019 and October 2019. The purpose is to inform other market participants about the current state of technology adoption by manufacturers across the world, including their needs, challenges and many other aspects of their Industry 4.0 initiatives. Survey participants were randomly selected, and their knowledge independently verified. In order to ensure complete objectivity, IoT Analytics did not alter or supplement any survey results and also did NOT accept any participation from participants that were suggested from third parties (e.g. customers from specific vendors).

- Type of research. Primary research via prequalified online survey

- Audience type. Predominantly C-level / Senior employees in both OT and IT roles who currently work for manufacturers

- Study timeframe. July – October 2019

- Region mix. 34% North America, ~27% Europe, ~34% APAC, ~5% MEA and South America

Please note: In this report, overall Industry 4.0 adoption is measured by adding up all responses that indicated any of the 17 technologies above are “fully” or “extensively” rolled-out in the manufacturers operations today. That sum of responses was divided by all responses in regards to each technology with the exception of responses that indicated “I don’t know”. (Example: If a respondent indicated Cloud, IoT Platforms, and Cybersecurity are fully or extensively rolled-out in their operations but none of the other 14 technologies are rolled out to the same degree (e.g., some technologies just in pilot phase), that organization is considered as having an Industry 4.0 adoption rate of 3/17 = 18%).

More information and further reading

Interested in learning more?

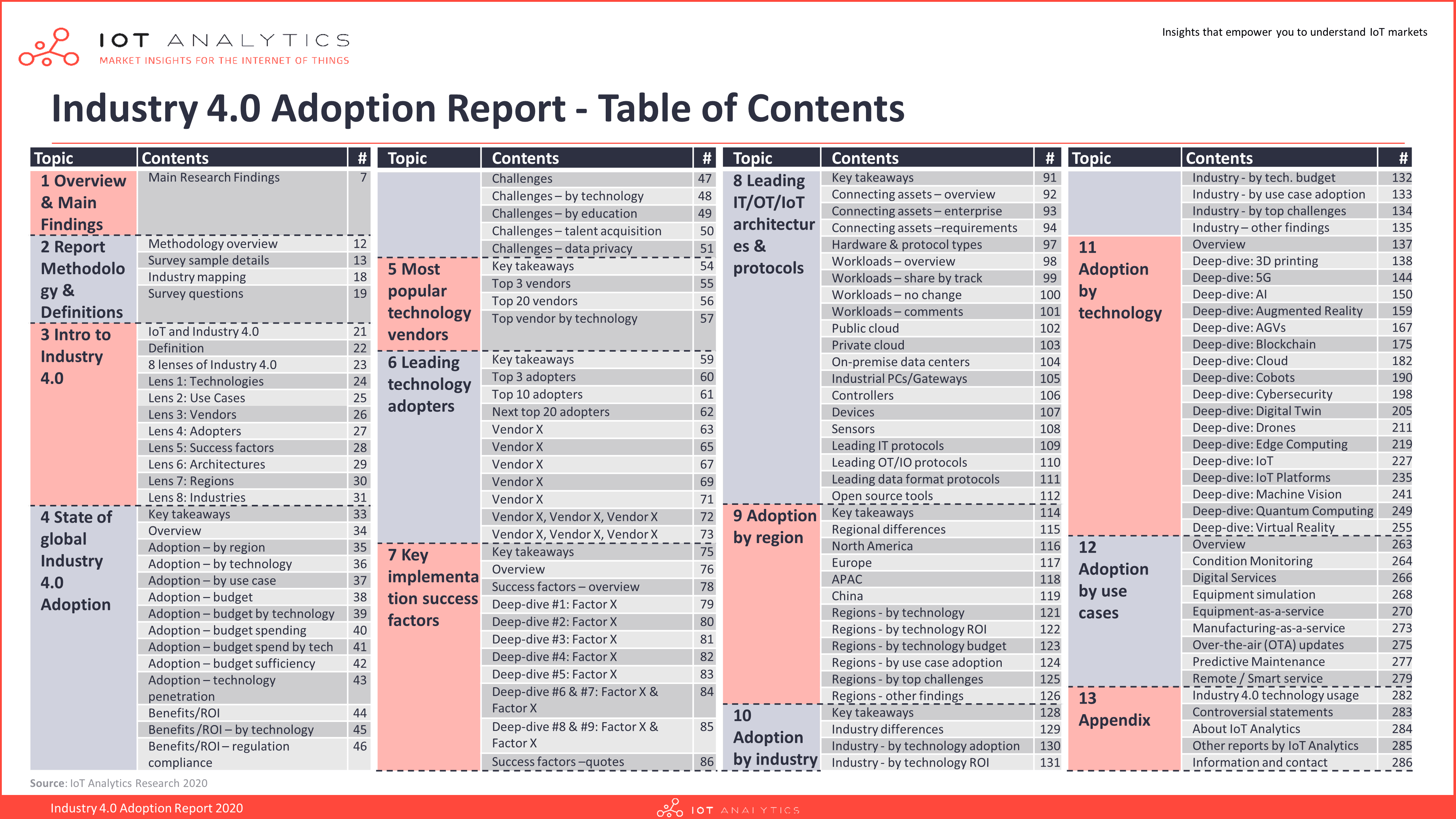

The results from the survey discussed in this article are explored in much further depth in the 286-page report.

A sample of the report can be downloaded here:

Are you interested in continued IoT coverage and updates?

Subscribe to our newsletter and follow us on LinkedIn and Twitter to stay up-to-date on the latest trends shaping the IoT markets. For complete enterprise IoT coverage with access to all of IoT Analytics’ paid content & reports including dedicated analyst time check out Enterprise subscription.