Structured market database and webtool

Discover in-depth data on 2G, 3G, 4G, 5G (RedCap), NB-IoT, and LTE-M

- In-depth look at the quarterly market for cellular IoT connectivity

- Includes over 4 thousand data points, that allow for detailed drill-down options per year or quarter, category, technology, and operator

- The tracker gets updated with the most recent data every 6 months

Database structure

View and analyze data points for

- 21 mobile network operators

- 9 cellular connectivity technologies

- 9 vertical IoT segments

- 11 regions

The accompanying interactive webtool

Discover the Global Cellular IoT Connectivity Dashboard

Your Title Goes Here

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

Click to show dashboard

Product specifications

All information about the tracker & forecast at a glance

General description

The Global Cellular IoT Connectivity Tracker & Forecast is a structured market size and forecast database of worldwide cellular IoT connections, comprising the following technologies: 2G, 3G, 4G, 5G (including a breakdown of private and public 5G connections), 5G RedCap, NB-IoT, and LTE-M.

The tracker includes the number of active connections for the period 2010 to Q2 2024 (quarterly for last 7 years), alongside revenue and ARPU for the period 2010 to 2023 (full years), along with forecasts for cellular IoT connections, by technology type, from Q3 2024 to 2030.

Database structure

Timeframe

- Actuals: Quarterly (Q1 2018 – Q2 2024) & annual (2010-2023)

- Forecasts: Quarterly (Q3 2024 – Q4 2024) & annual (2024-2030)

- Companies: 21 mobile network operators

- Technologies: 9 cellular connectivity technologies

- Segments: 9 vertical IoT segments

- Regions: 11 regions

Metrics

Global cellular IoT active connections:

- Breakdown by technology splits

- Breakdown by mobile network operators

- Breakdown by vertical IoT segments

- Breakdown by region

Global cellular IoT connectivity revenue:

- Breakdown by mobile network operators

- Breakdown by technology splits

- Breakdown by vertical IoT segments

Global Cellular IoT ARPU (Average Revenue Per User):

- Breakdown by mobile network operators

- Breakdown by technology splits

- Breakdown by vertical IoT segments

Global cellular 5G & 5G RedCap IoT connections:

- Breakdown by deployment type

Selected companies mentioned in the tracker & forecast

| Airtel | ATT | China Mobile | China Telecom | China Unicom |

| Deutsche Telekom | KDDI | KD Corp | LGUplus | NTTDocomo |

| Orange | SKTelecom | SoftBank | Sprint | Telefonica |

| Telenor | Telia | Telstra | Tmobile USA | Verizon |

| Vodafone |

Industry verticals covered in the tracker & forecast

| Building & infrastructure | Embedded automotive | Fixed access points | Home & consumer |

| Health care | Industrial & manufacturing | Mobile access points | Other energy |

| Retail | Smart Cities & others | Smart meters | Telematics - OBD and aftermarket |

| Transportation, supply chain & logistics |

Latest data releases

State of IoT 2025: Number of connected IoT devices growing 14% to 21.1 billion globally

Global IoT market forecast (in billions of connected IoT devices) In this article Connected IoT device market update – Fall 2025 and 2026 – 2035 outlook Leading IoT connectivity technologies in 2025: 3 technologies make up nearly 80% of all IoT connections 1. Wi-Fi IoT 2. Bluetooth IoT 3. Cellular IoT Deep-dive: Cellular IoT connections Mobile IoT operators: Key market developments Analyst opinion on the cellular IoT market Deep-dive: Cellular IoT chipsets – Key market developments (Insights+...

State of enterprise IoT in 2025: Market recovery, AI integration, and upcoming regulations

In short IoT enterprise spending grew 10% in 2024, its lowest rate in over a decade, according to IoT Analytics’ 89-page State of IoT Spring 2025 report (published February 2025). Hardware segments struggled the most, while software and cloud-based solutions continued to expand. India experienced 14% YoY IoT spending growth, while Europe experienced slower IoT adoption rates. New IoT products in late 2024 heavily focused on AI, security, and connectivity. Why it matters Vendors and end users...

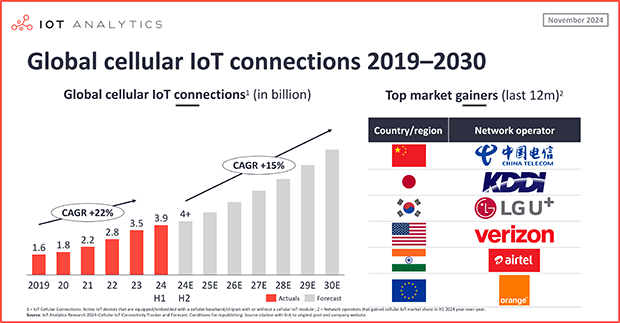

Global cellular IoT connections surpassed 4 billion in 2024, driven by 5G and LTE Cat 1 bis

In short Global cellular IoT connections reached 3.9 billion in H1 2024, according to IoT Analytics’ updated Global Cellular IoT Connectivity Tracker & Forecast. Based on ongoing tracking and analysis, cellular IoT connections have surpassed 4 billion as the end of 2024 approaches, representing approximately 22% of global overall IoT connections. Connections are expected to grow at a CAGR of 15% between 2024 and 2030, driven by LTE Cat 1 bis and 5G. Notable mobile operators that gained...

Access the full version for hands-on help on your IoT connectivity journey

Understand the global cellular IoT market: market size, market growth, players, technologies, and pricing trends, including forecasts until 2027

Receive semi-annual data updates

Slice and dice the data according to your individual needs (e.g., by region or cellular connectivity technology)

Use the data to make better decisions in your profession

Our insights are trusted by

Request a free demo

Fill out the form to get in touch with us

- Experience a walk-through of the dashboard via screen share

- Get your specific questions addressed

- Explore how our research can add value to your organization

- Receive individual pricing and bundle

Prajwal Praveen

Senior Sales Manager

Phone: + 49 (0) 408 221 1722

Email: sales@iot-analytics.com