Structured market database and webtool

Discover in-depth data on eSIM, iSIM, uSIM/SIM, and SoftSIM

- In-depth look at the quarterly market for IoT eSIM and iSIM

- Includes over 4 thousand data points, that allow for detailed drill-down options per year or quarter, category, technology, module & chipset model, and company

- The tracker gets regular updates

Database structure

View and analyze data points for

- 38 cellular IoT module brands, nested, with 13 cellular IoT chipset companies

- 3 UICC technologies: eSIM, iSIM, uSIM/SIM, Soft SIM

- 10 Connectivity technologies

- 10 regions

- 737 unique module models and 150 unique chipset models

The accompanying interactive webtool

Discover the Global IoT eSIM Modules & iSIM Chipsets Dashboard

Your Title Goes Here

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

Click to show dashboard

Product specifications

All information about the tracker at a glance

General description

An interactive dashboard and structured market tracker that includes quarterly data on worldwide IoT eSIM modules and iSIM chipsets from 2018 to Q1 2023.

Database structure

IoT eSIM modules & iSIM chipsets Shipments at model level (nested database)

- 38 cellular IoT module brands, nested, with 13 cellular IoT chipset companies

- Shipments 1Q 2018–1Q 2024 (actuals)

- Forecast 2Q 2024–2028

- 3 UICC technologies: eSIM, iSIM, uSIM?SIM, SoftSIM

- Connectivity technologies: 2G, 3G, LTE-Cat 1,LTE Cat 1 bis, 4G, LTE-M, NB-IoT, LPWA dual mode, and 5G.

- Ten regions: China, North America, Western Europe, Eastern Europe, the Middle East and Africa, Latin America, Japan, India, Korea, Asia, and Other

- 737 unique module models and 150 unique chipset models

Companies mentioned in the tracker

| AM Telecom | ASR | Cavli Wireless | Ccfrom | Cheerzing |

| China Mobile | Continental Automotive | Eigencomm | Fibocom | GCT |

| Gosuncn | H3C | Hisilicon | Huawei | Intel |

| Kyocera | LG Innotek | Lierda | Longsung | Marvell |

| Mediatek | Meig | MobileTek | Murata | Neoway |

| Pycom | Qualcomm | Quectel | Rinlink | Rolling Wireless |

| Ruijie | SIMCom | Sequans | Sercomm | Sierra Wireless |

| Sony Altair | Taiyo Yuden | Telit Cinterion | Titan | UNISOC |

| USR(Wenheg) | Ucloudy | Wutong | XinYi | Yuge Technology |

| u-blox | ||||

Latest data releases

State of IoT 2024: Number of connected IoT devices growing 13% to 18.8 billion globally

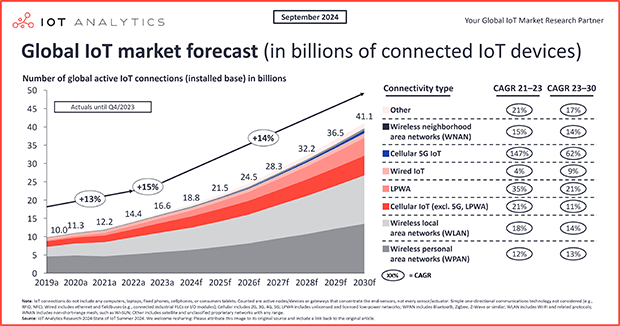

Image: Global IoT market forecast (in billions of connected IoT devices) Connected IoT device market update—Summer 2024 Number of connected IoT devices to grow 13% by end of 2024. According to IoT Analytics’ 171-page State of IoT Summer 2024 report, there were 16.6 billion connected IoT devices by the end of 2023 (a growth of 15% over 2022). IoT Analytics expects this to grow 13% to 18.8 billion by the end of 2024. This forecast is lower than in 2023 due to continued cautious enterprise...

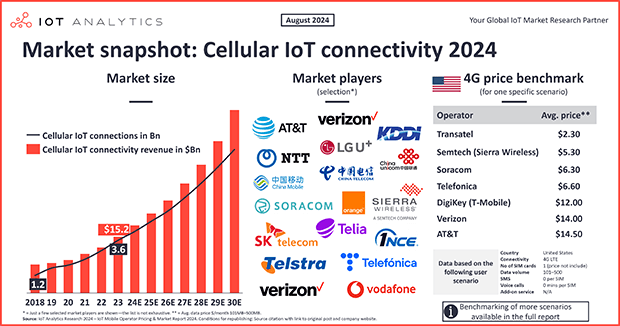

Benchmarking IoT mobile operator pricing: MNOs vs. MVNOs

In short There were 3.6 billion active cellular IoT connections in 2023, approximately 21% of global IoT connections, according to the 159-page IoT Mobile Operator Pricing and Market Report 2024–2030 and its accompanying mobile operator database. Two IoT mobile operator types provide cellular IoT connectivity: mobile network operators (MNOs) and mobile virtual network operators (MVNOs). A benchmark of the two types shows that MVNO IoT services cost substantially less than MNO IoT services due...

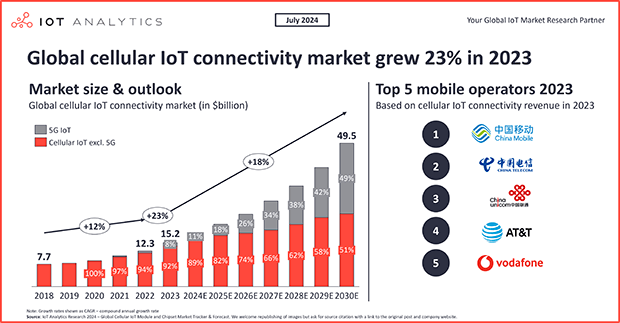

Global cellular IoT connectivity market reached $15B in 2023, 5G set to drive further growth

In short Mobile operators worldwide earned a combined $15 billion from 3.6 billion cellular IoT connections in 2023, according to IoT Analytics’ Global Cellular IoT Connectivity Tracker & Forecast (updated June 2024) and IoT Mobile Operator Pricing & Market Report 2024–2030 (released July 2024). Mobile operators’ IoT revenue growth rate of 23% YoY exceeded that of IoT software companies and hyperscalers in 2023. Cellular IoT connections grew even while the shipments and revenue for...

The update process

What we do to update the data

Constant monitoring

of investor relations documents and news releases for hundreds of IoT companies and specifically the companies that are part of this tracker.

Industry-level forecasting

based on revenue estimations of chipset vendors, module companies, and network operators.

Numerous interviewing

of senior IoT experts from connectivity chipset vendors, module companies, and network operators.

Integration of financial and operational data modeling

from model level to brand, technology, and region.

Our insights are trusted by

Request a free demo

Fill out the form to get in touch with us

- Experience a walk-through of the tracker via screen share

- Get your specific questions addressed

- Explore how our research can add value to your organization

- Receive a quote customized to your requirements

Prajwal Praveen

Senior Sales Manager

Phone: + 49 (0) 408 221 1722

Email: sales@iot-analytics.com