Structured market database and webtool

Discover in-depth data on eSIM, iSIM, uSIM/SIM, and SoftSIM

- In-depth look at the quarterly market for IoT eSIM and iSIM

- Includes over 4 thousand data points, that allow for detailed drill-down options per year or quarter, category, technology, module & chipset model, and company

- The tracker gets regular updates

Database structure

View and analyze data points for

- 38 cellular IoT module brands, nested, with 13 cellular IoT chipset companies

- 3 UICC technologies: eSIM, iSIM, uSIM/SIM, Soft SIM

- 10 Connectivity technologies

- 10 regions

- 737 unique module models and 150 unique chipset models

The accompanying interactive webtool

Discover the Global IoT eSIM Modules & iSIM Chipsets Dashboard

Your Title Goes Here

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

Click to show dashboard

Product specifications

All information about the tracker at a glance

General description

An interactive dashboard and structured market tracker that includes quarterly data on worldwide IoT eSIM modules and iSIM chipsets from 2018 to Q1 2023.

Database structure

IoT eSIM modules & iSIM chipsets Shipments at model level (nested database)

- 38 cellular IoT module brands, nested, with 13 cellular IoT chipset companies

- Shipments 1Q 2018–1Q 2024 (actuals)

- Forecast 2Q 2024–2028

- 3 UICC technologies: eSIM, iSIM, uSIM?SIM, SoftSIM

- Connectivity technologies: 2G, 3G, LTE-Cat 1,LTE Cat 1 bis, 4G, LTE-M, NB-IoT, LPWA dual mode, and 5G.

- Ten regions: China, North America, Western Europe, Eastern Europe, the Middle East and Africa, Latin America, Japan, India, Korea, Asia, and Other

- 737 unique module models and 150 unique chipset models

Companies mentioned in the tracker

| AM Telecom | ASR | Cavli Wireless | Ccfrom | Cheerzing |

| China Mobile | Continental Automotive | Eigencomm | Fibocom | GCT |

| Gosuncn | H3C | Hisilicon | Huawei | Intel |

| Kyocera | LG Innotek | Lierda | Longsung | Marvell |

| Mediatek | Meig | MobileTek | Murata | Neoway |

| Pycom | Qualcomm | Quectel | Rinlink | Rolling Wireless |

| Ruijie | SIMCom | Sequans | Sercomm | Sierra Wireless |

| Sony Altair | Taiyo Yuden | Telit Cinterion | Titan | UNISOC |

| USR(Wenheg) | Ucloudy | Wutong | XinYi | Yuge Technology |

| u-blox | ||||

Latest data releases

Cellular IoT module market Q2 2023: 66% of IoT modules shipped without dedicated hardware security

In short The cellular IoT module market was stagnant in Q2’23 according to IoT Analytics latest data. Although IoT modules with dedicated security features are increasingly adopted, 66% of IoT modules shipped in Q2’23 had no dedicated hardware security and 29% had no security features at all. Recent demonstrations of vulnerabilities in non-dedicated hardware security features should drive the market further towards hardware-based security. Post-quantum cryptography is also an important...

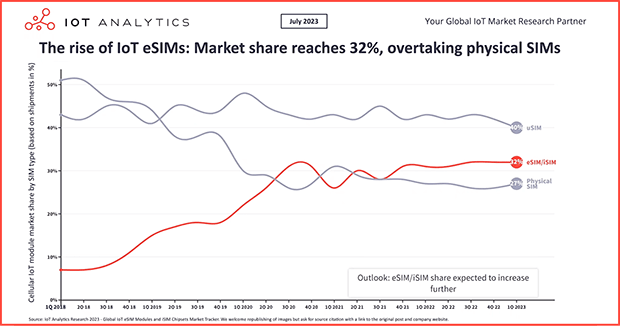

Entering the new age of cellular IoT: eSIM/iSIM market to surpass 500 million units in 2023

In short: eSIM/iSIM is transforming the dynamics of the cellular IoT market, offering increased flexibility, reduced provisioning time, smaller form factor, enhanced security, and sustainability. The eSIM/iSIM IoT market is poised to surpass the 500-million-units mark in 2023. Two factors will likely drive the growth of eSIM and iSIM in the cellular industry: cybersecurity regulations and GSMA specifications. Why it matters For IoT device makers: With eSIM and iSIM, IoT device makers have a...

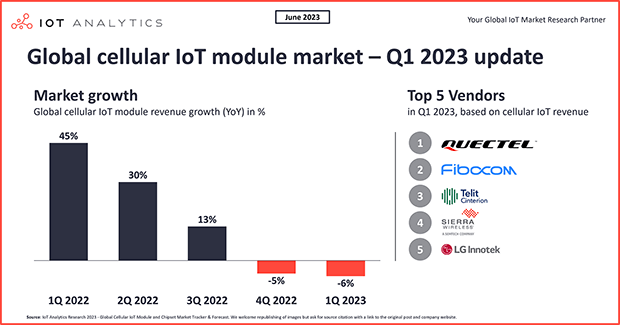

Global cellular IoT module market declined 6% in Q1 2023 in a weakening demand environment

Key insights In Q1 2023, global cellular IoT module revenue declined 6% YoY; shipments declined 16%. The key reasons for the decline are: 1. Cautious end-user spending; 2. Inventory reductions; and 3. Chip supply issues. The top five cellular IoT module companies—Quectel, Fibocom, Telit Cinterion, Sierra Wireless, and LG Innotek—currently account for 66% of the global market. The Q1 market weakness is seen as a bump in the road, with six billion cellular IoT connections expected by 2027,...

The update process

What we do to update the data

Constant monitoring

of investor relations documents and news releases for hundreds of IoT companies and specifically the companies that are part of this tracker.

Industry-level forecasting

based on revenue estimations of chipset vendors, module companies, and network operators.

Numerous interviewing

of senior IoT experts from connectivity chipset vendors, module companies, and network operators.

Integration of financial and operational data modeling

from model level to brand, technology, and region.

Our insights are trusted by

Request a free demo

Fill out the form to get in touch with us

- Experience a walk-through of the tracker via screen share

- Get your specific questions addressed

- Explore how our research can add value to your organization

- Receive a quote customized to your requirements

Prajwal Praveen

Senior Sales Manager

Phone: + 49 (0) 408 221 1722

Email: sales@iot-analytics.com