Global IoT Enterprise Spending (Q2/2024 Update)

(see all)

Product Details

Contact us for individual pricing and bundles

- 100+ countries from seven world regions

- 10 types of technology stack elements

- 11 vertical IoT segments

- 75+ industries (based on International Standard Industrial Classification Revision 4)

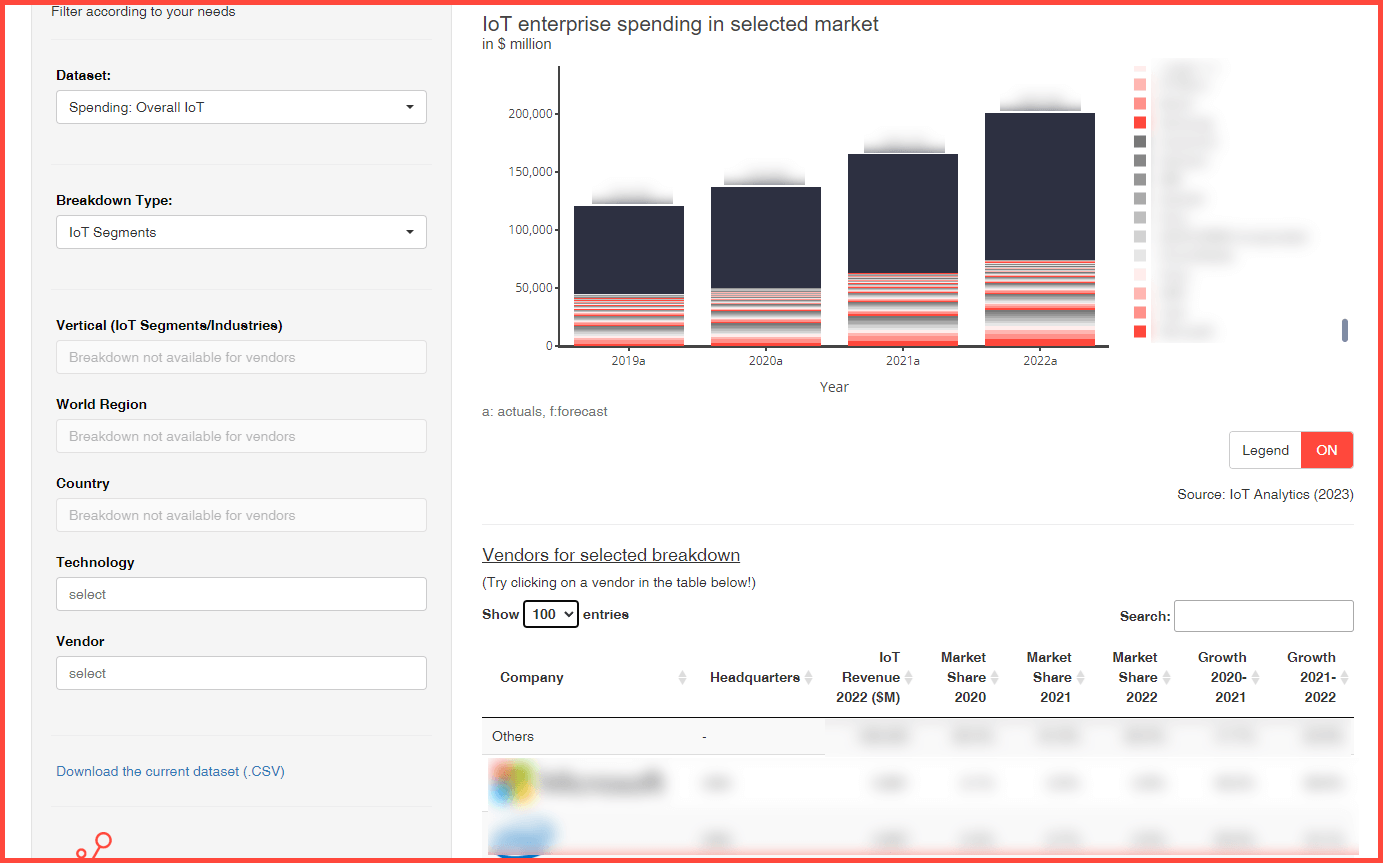

- 100+ vendors (revenue and market share)

- 40+ use cases (incl. operations use cases, connected product use cases, city & infrastructure use cases, supply chain use cases)

- Export data option

Already a subscriber?

About the product

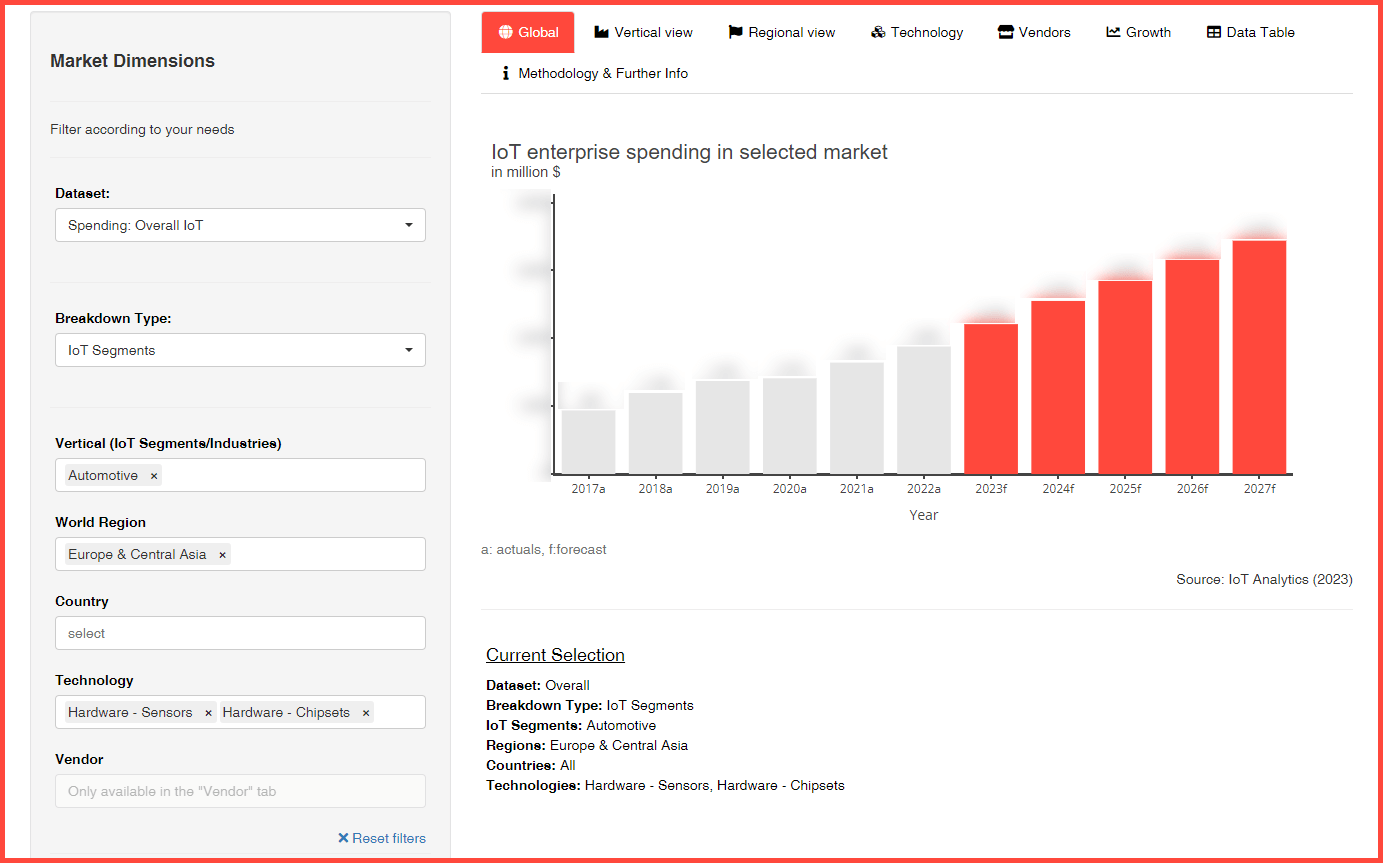

The IoT Analytics IoT Enterprise Spending Dashboard and Tracker comprises the end-user spending of IoT markets worldwide and offers a holistic view with over 800 thousand data points and detailed drill-down options per tech stack, vertical, and region/country. This product is updated every six months with the most recent data.

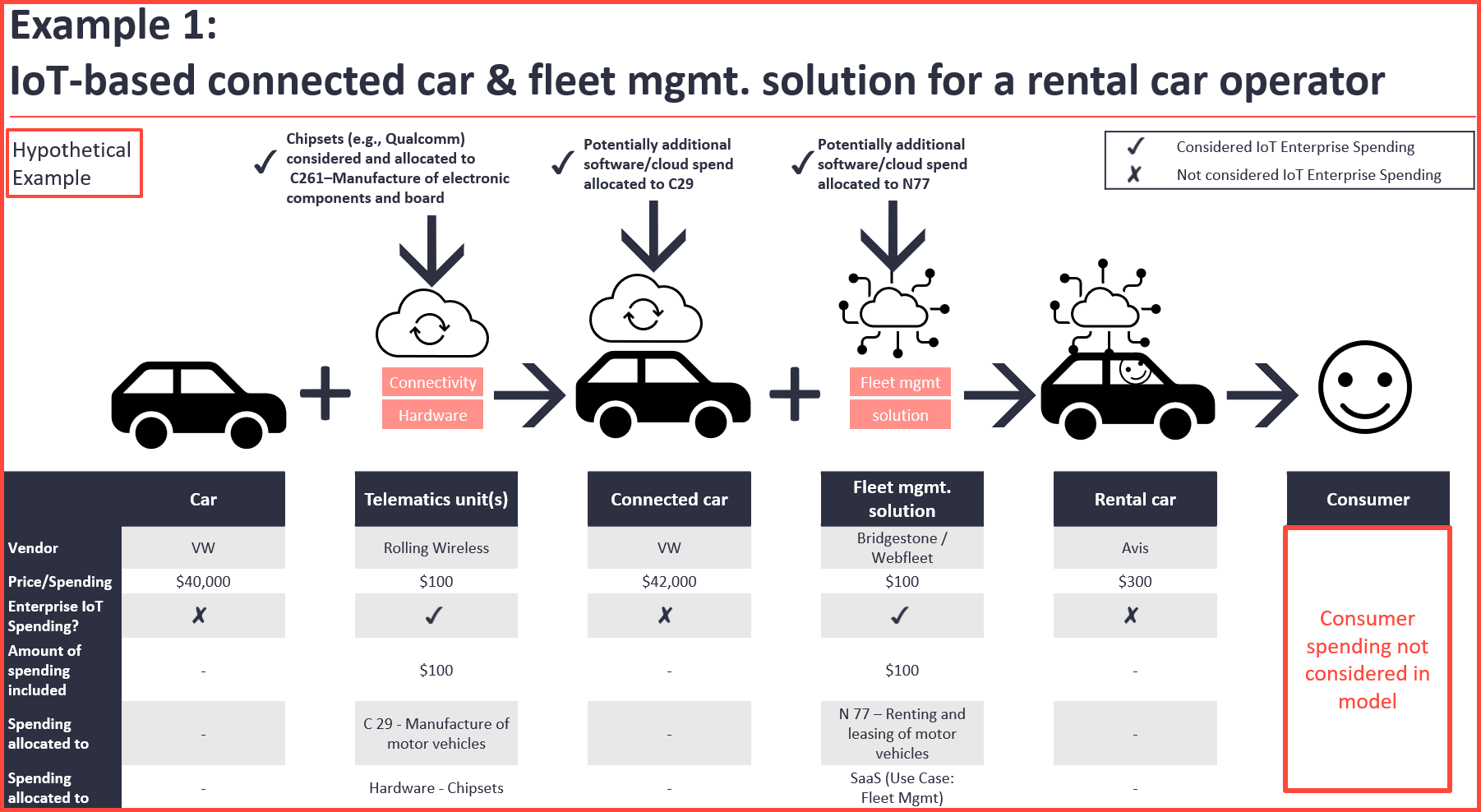

Methodology

Enterprise IoT spending refers to spending of enterprises (not consumers) on external solutions that are classified as IoT or portions thereof. Internal spending (e.g., personnel) is not included. The following is a hypothetical example highlight of what is included in the data and what is not included.

Included data

- 100+ countries from seven world regions

- 10 types of technology stack elements

- 11 vertical IoT segments

- 75+ industries (based on International Standard Industrial Classification Revision 4)

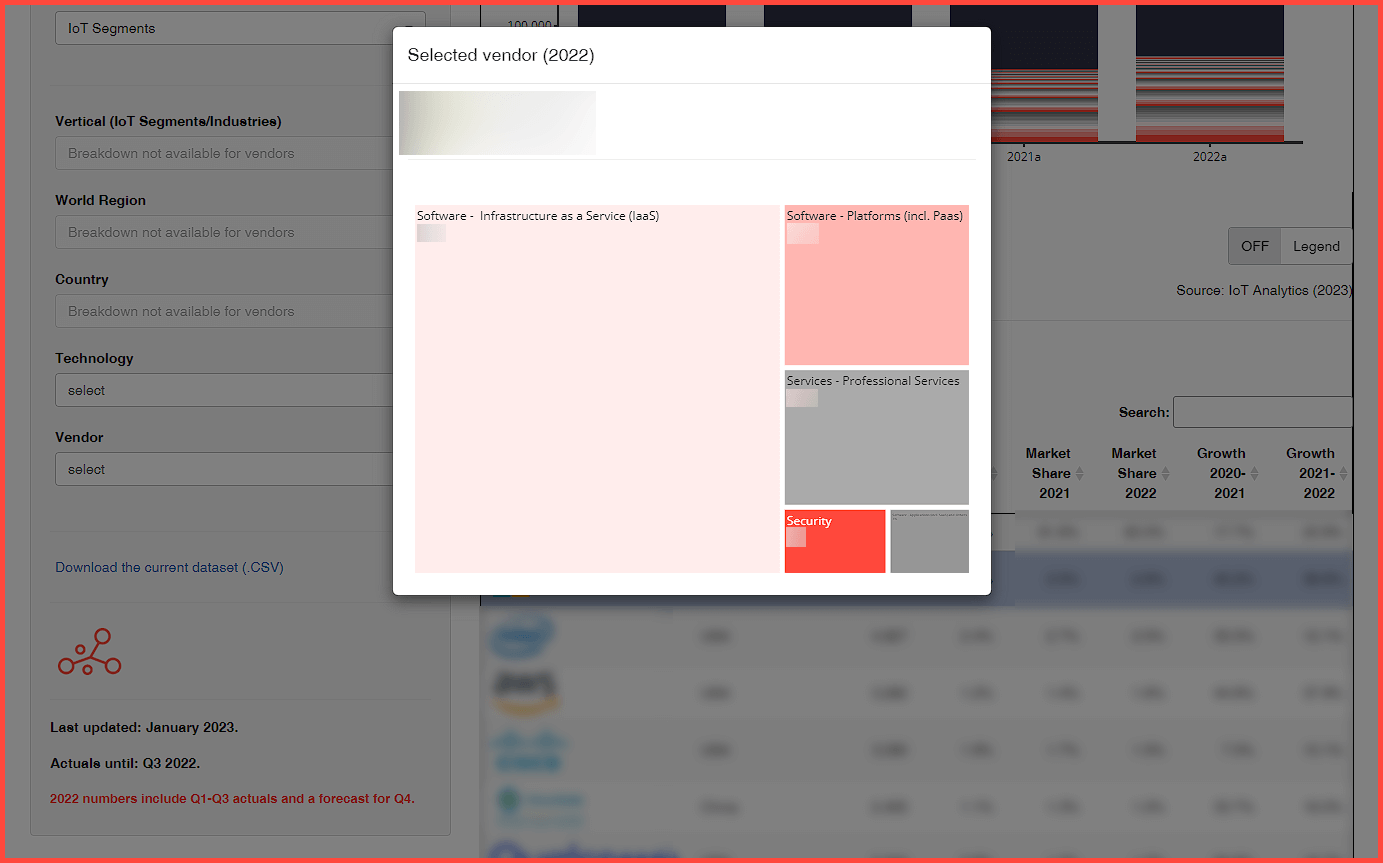

- 100+ vendors (revenue and market share)

- 40+ use cases (incl. operations use cases, connected product use cases, city & infrastructure use cases, supply chain use cases)

- Export data option

Related reading

A research article based on insights from this tracker: IoT market update: Enterprise IoT market size reached $269 billion in 2023, with growth deceleration in 2024

→Sign up for the newsletter to be notified of future updates

Our insights are trusted by global industry leaders

Request your free demo

- Experience a walk-through of the dashboard via screen share

- Get your specific questions addressed

- Explore how our research can add value to your organization

Any questions?

Get in touch with us easily. We are happy to help!

Prajwal Praveen

Sales Manager

Phone: +49 (0) 408 221 1722

Email: sales@iot-analytics.com