PRESS RELEASE: Hamburg, Germany – 26 June 2018 //

IoT Analytics, a leading provider of market insights & competitive intelligence for the Internet of Things (IoT), M2M, and Industry 4.0, today published two comprehensive market report updates on IoT Platforms:

- A. A 193-page report titled IoT Platforms Market Report 2018-2023

- B. A 450 page in-depth analysis of 20 leading vendors, titled IoT Platforms Vendor Comparison 2018

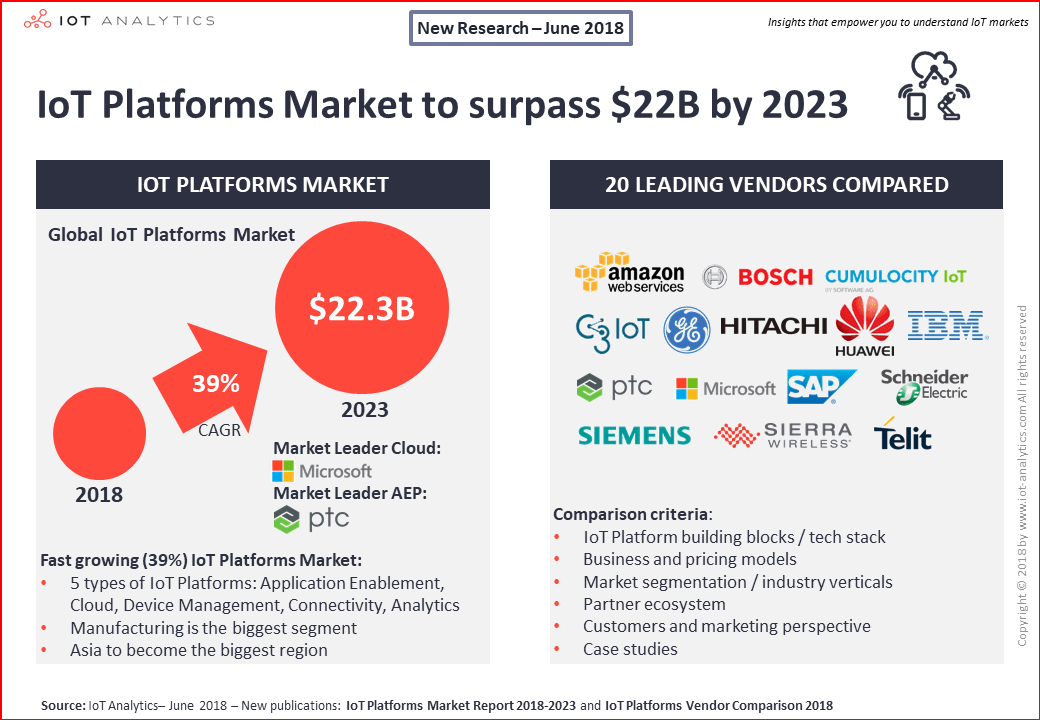

The research uncovers that the IoT Platform market is accelerating in 2018 as more and more businesses prioritize their transformation into IoT data-driven companies. Spending on IoT Platform-related software and services for connected business solutions is forecasted to grow at a rate of 39% per year until 2023. The vendor landscape remains fragmented but first winners are emerging.

Report Insight: How customers select their IoT Platforms?

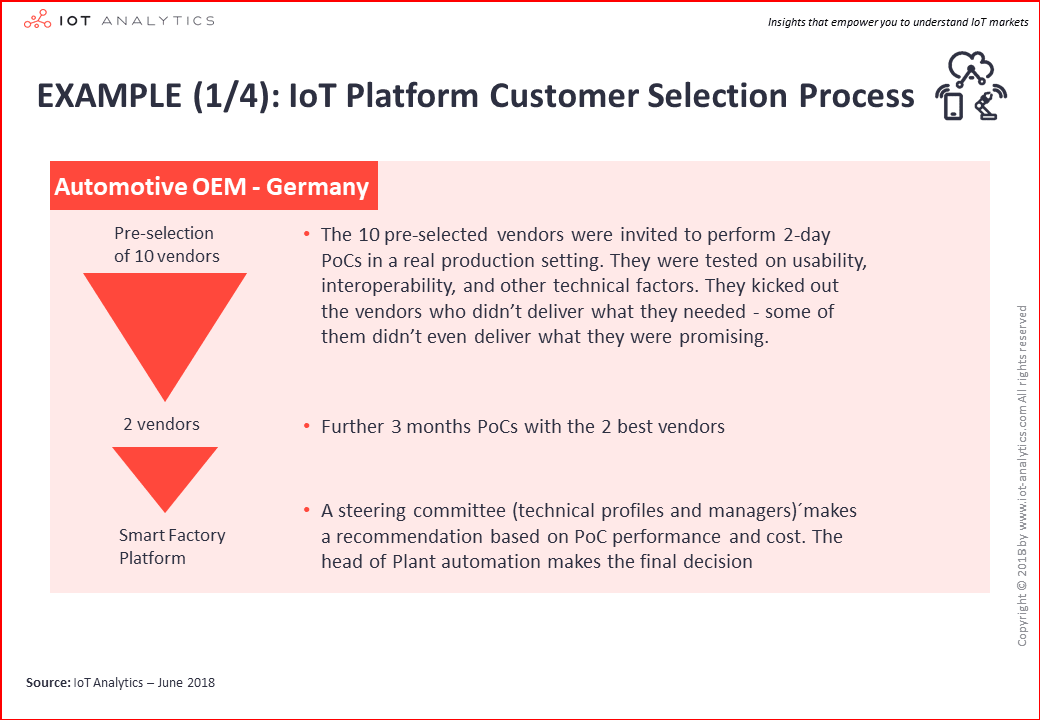

Among other things, the report highlights several examples of how customers select their IoT platforms.

One example, an automotive OEM in Germany pre-selected ten IoT platform vendors and invited them to perform 2-day Proof-of-Concepts in a real production setting. Vendors were assessed using a number of testing criteria in connecting equipment on the factory floor such as infrastructure, network, IoT, analytics, managed services, security, usability, and partner ecosystem (which each may have up to 10 weighted sub-criteria). Following this, two of the best vendors were selected for 3-month PoCs and were further ranked on their capabilities. Finally, recommendations by the IoT team involved in the PoCs were made to the steering committee and the head of plant automation made the final decision.

For more information on this case study and for other similar examples please click here.

Report Content Overview

A. IoT Platforms Market Report 2018-2023

The IoT Platforms report forecasts a compound annual growth rate (CAGR) for IoT Platforms of 39% over the time frame of 2018-2023, with annual spending surpassing US$22 Billion by 2023. These numbers are based on the IoT Platforms related revenue of the leading companies in the field, across 11 industry segments (Agriculture, Connected Buildings, Connected Car, Energy, Health, Manufacturing, Public services, Retail, Smart supply chain, Transportation, and Other). The market is broken down into 7 regions (Asia, Europe, North America, MEA, South America, Oceania, Rest of World), 5 platform types (cloud platforms, application enablement platforms, device management platforms, connectivity platforms, advanced analytics platforms), 4 deployment types (on-premise, hosted private cloud, hybrid cloud, public cloud), and 2 revenue types (platform software sales vs services sales).

In developing the 193-page report, the analyst team at IoT Analytics studied over 450 technology companies that offer IoT platform technology elements and reviewed 1,600 implemented enterprise IoT platform projects. Further input to the report included 20 completed surveys from leading IoT platform providers, 27 completed surveys from IoT platform end-users, 20+ industry interviews and numerous expert discussions at 10+ leading IoT conferences.

The report analyzes the competitive landscape of the IoT platforms market estimating the 2017 market share of leading vendors.

Microsoft and PTC are identified as the leading vendors in terms of market share in their respective platform types, cloud and AEP.

The role of certain industries (e.g., Telecommunications, Industrial Automation, System Integrators), open source vendors/communities, market funding/investment activity and M&A deals are also described.

IoT platform business models are examined in the report describing selected market strategies, the sales approach, how to bring an IoT platform to market, platform collaboration and the differences between closed and open platforms. The IoT platform report also calls out 4 major industry trends as well as various challenges, adoption barriers for technology providers, the needs and perspective of customers, and lists over 30 use cases enabled by IoT platforms.

B. IoT Platform Vendor Comparison 2018

To supplement the market report and to help end-users decide which platform to choose from, IoT Analytics is simultaneously releasing an IoT Platforms Vendor Comparison 2018. The 450-page document provides an in-depth comparison of 21 popular IoT Platforms.

The document focusses on 6 major customer decision criteria: IoT Platform Building Blocks, Business & Pricing, Market Segmentation, Partner Ecosystem, Customers & Marketing, Case Studies. These decision criteria are further broken down into 23 sub-topics.

In general, the report provides answers to the following questions:

- Which building blocks are included in the different IoT Platforms offering?

- Which pricing options do the platform vendors offer?

- Which market segments do they cater to?

- In which regions are the vendors mainly active?

- How are the partner ecosystems structured?

- Who are the main customers of the platforms and what are some customers’ opinions on strengths and weaknesses?

On a detailed level, some of the dimensions analysed include Application Enablement and Device Management building blocks by vendor, IoT application marketplace sizes by vendor or supported communication standards by vendor. The majority of IoT Platform vendors cover 60-100% of all analysed platform building blocks.

The IoT Analytics IoT Platform Vendor Comparison also uncovers that most platforms have rather strong partner ecosystems. 16 of 21 analyzed companies have their own partner program and 20 of those are also involved in IoT consortia and standardization organizations. The highest number of those partnerships are with system integrators (30%).

The List of analysed IoT Platform Vendors includes: Accenture, ADAMOS, Amazon Web Services, Bosch, C3 IoT, Device Insight, GE, Hitachi, Huawei, IBM, Kaa IoT, Microsoft, Mnubo, PTC, SAP, Schneider Electric, Seluxit, Siemens, Sierra Wireless, Software AG, Telit.

The information put together in the IoT Platform Vendor Comparison was mainly collected through surveys that were filled out by platform vendors themselves. The information was enhanced with information from 25 interviews (45-60 mins) with: IoT Platform companies, members of IoT communities, system integrators and IoT Platform customers. Furthermore, IoT Analytics conducted extensive desktop research and screened 300+ relevant presentations and websites. IoT Analytics compiled a market model, upon which revenue estimations for all IoT Platforms included in the report are based.

Commenting on the findings of both reports, IoT Analytics Managing Director Knud Lasse Lueth said: “It has been fascinating to cover the highly-dynamic IoT Platforms market for the last 4 years. Initially the platform vendors had to educate the market and convince customers that it was more economic than do-it-yourself. Finding first reference customers was difficult but now, in 2018, customers see the benefits and are actively approaching platform vendors for their IoT projects. Over the years, about 500 platforms flooded the market – in 2018 first winners are emerging. We are currently witnessing a clear market acceleration on the back of maturing platform offerings – many of those platforms are growing >50%. At the same time the majority of IoT implementations enabled by these platforms are still in a pilot phase and there are still some inhibitors to a market explosion such as lack of confidence in cybersecurity – The potential that this market is likely to unlock in the coming years is enormous.”

The Market Report is available to download HERE and the Vendor Comparison is available to download HERE. Note: There is a significant discount if both reports are purchased together.

A sample of the market report can be downloaded HERE and the vendor comparison HERE.

About IoT Analytics

IoT Analytics is the leading provider of market insights & competitive intelligence for the Internet of Things (IoT), M2M, and Industry 4.0. The specialized data-driven research firm helps more than 40,000 Internet of Things decision-makers understand IoT markets every month. IoT Analytics tracks important data around the IoT ecosystem such as M&A activity, Startup funding, company projects, use cases and latest developments. Product offerings include in-depth market reports, technical whitepapers, sponsored research, regular newsletter, as well as Go2Market and consulting services. As a research pioneer, IoT Analytics combines traditional methods of market research such as interviews and surveys with state-of-the art web-mining tools to generate high-caliber insights. IoT Analytics is headquartered in Hamburg, Germany.

IoT Platforms Market Report Structure

Executive summary

2016-2018 IoT developments

1. Introduction to IoT platforms

1.1 Role of IoT platforms in the IoT

1.2 Definition of IoT platforms

2. Technical overview

2.1 Technology segmentation

2.2 Hosting environment

2.3 Application deployment architecture

2.4 Security elements of the platform

2.5 Role of edge computing

2.6 Role of digital twins

2.7 Role of interoperability and standardization

3. Market analysis

3.1 Market characteristics overview

3.2 Overall market

3.3 Market by segment

3.4 Market by technology

3.5 Market by region

3.6 Market share by solution provider

4. Competitive landscape

4.1 Overview

4.2 General vendor landscape

4.3 Role of open source vendors/communities

4.4 Role of open certain industries

4.5 Funding/investment activity

4.6 M&A activity

5. IoT platform business models

5.1 Overview

5.2 Selected market strategies

5.3 Bringing an IoT platform to market

5.4 Closed vs. open platforms

5.5 Platform collaboration

5.6 Sales approach

5.7 IoT implementation and consulting services

6. Market trends

6.1 Trends for IoT platforms

6.2 Customer perspective and needs

6.3 Challenges / adoption barriers

7 Appendix

About IoT Analytics

IoT Platforms Vendor Comparison 2018 Report Structure

1. Introduction

1.1 Report Overview

1.2 The 6 major Dimensions of the Analysis

1.3 Definition: IoT Platform Building Blocks

1.4 IoT Analytics IoT Platform Publications

1.5 Methodology

2. Overview of platforms and dimensions

2.1 Overview of analyzed platforms

2.2. Not included: Further notable IoT Platforms

2.3 Not included: Notable IoT Platform StartUps

2.4 Dimensions used for vendor analysis

3. Comparison of Vendors

3.1 Executive Summary of Vendor Comparison

3.2 Coverage of Building Blocks by Vendor

3.2.1 Device Management Capabilities by vendor

3.2.2 Cloud backend / IaaS Capabilities by Vendor

3.2.3 Application Enablement Capabilities by Vendor

3.2.4 Advanced Analytics Capabilities by Vendor

3.2.5 General & Selected Security Capabilities by Vendor

3.2.6 IoT Application Marketplace Comparison

3.3. IoT Platforms Revenue by Vendor

3.3.1 Percentage of Revenue by Hosting Type

3.4 Business KPIs by Vendor

3.4.1 Publicly available Case Studies by Vendor and Industry

3.5 Pricing Model by Vendor

3.6 Market Channels by Vendor

3.7 Served Segments by Vendor

3.8 Membership Programs and Consortia by Vendor

3.9 Supported Standards by Vendor

3.10 Partner Ecosystem Size by Vendor

3.11 Partner Ecosystem Split by Vendor

3.12 Top Partners by Category

3.13 Connectivity Partnerships by Vendor

3.14 Hardware Partnerships by Vendor

3.15 System Integration Partnerships by Vendor

3.16 Cloud & Data Analytics Partnerships by Vendor

3.17 Security Partners by Vendor

3.18 Key Customers by Vendor

3.19 Marketing Message by Vendor

3.20 Vendor Opinion – Strengths & Weaknesses/Challenges

3.21 Customer Opinion – Strengths & Weaknesses/Challenges

3.22 Positioning on Security – by Vendor

3.23 Positioning on Scalability – by Vendor

3.24 Positioning on Usability – by Vendor

3.25 Positioning on Interoperability – by Vendor

3.26 Positioning on Modularity – by Vendor

3.27 Positioning on Open Source – by Vendor

3.28 Positioning on Edge Capabilities – by Vendor

3.29 Positioning on Multi-Cloud by Vendor

3.29.1 Positioning on Data Migration to other Platforms – by Vendor

3.30 Positioning on Preconfigured Solutions by Vendor

4. Vendor Profiles

4.1 Accenture

4.2 ADAMOS

4.3 Amazon Web Services

4.4 Bosch

4.5 C3 IoT

4.6 Device Insight

4.7 General Electric

4.8 Hitachi

4.9 Huawei

4.10 IBM

4.11 Kaa IoT

4.12 Microsoft

4.13 Mnubo

4.14 PTC

4.15 SAP

4.16 Schneider Electric

4.17 Seluxit

4.18 Siemens

4.19 Sierra Wireless

4.20 Software AG

4.21 Telit

5. Appendix

Companies Mentioned (selection from the IoT Platforms report)

Accenture, Actility, Aeris, Alibaba, Amazon, AT&T, Ayla Networks, Bosch, C3 IoT, Carriots, Cisco Jasper, Davra, Ericsson, Evrythng, Fujitsu, GE, Gemalto, Google, Huawei, IBM, Kore Wireless, Microsoft, Mnubo, myDevices, Nokia, Oracle, PTC, Relayr, Salesforce, Schneider Electric, SAP, Siemens, Sierra Wireless, Software AG, TCS, Telit, Tencent, Uptake, Verizon.

Next Actions

Direct Purchase/Request a Sample

- The Market Report is available to download HERE and the Vendor Comparison is available to download HERE. Note: There is a significant discount if both reports are purchased together.

- A sample of the market report can be downloaded HERE and the vendor comparison HERE.

Bespoke Research on the topic

- If you are considering a project of a similar nature or require related research services, get in contact with our bespoke research team to see how we could assist you. Contact Abhay Rastogi: research@iot-analytics.com

- If you are already in the process of implementing a project of this nature, check out our supporting documents website: iot-analytics.com

Sales & Marketing

- For all other sales, marketing or partnership related inquiries please contact: sales@iot-analytics.com

Public Relations

- For further comments or more information on this press release, please contact: press@iot-analytics.com