The Smart Meter is considered as one of the most mature and most widely adopted applications of IoT technology today.

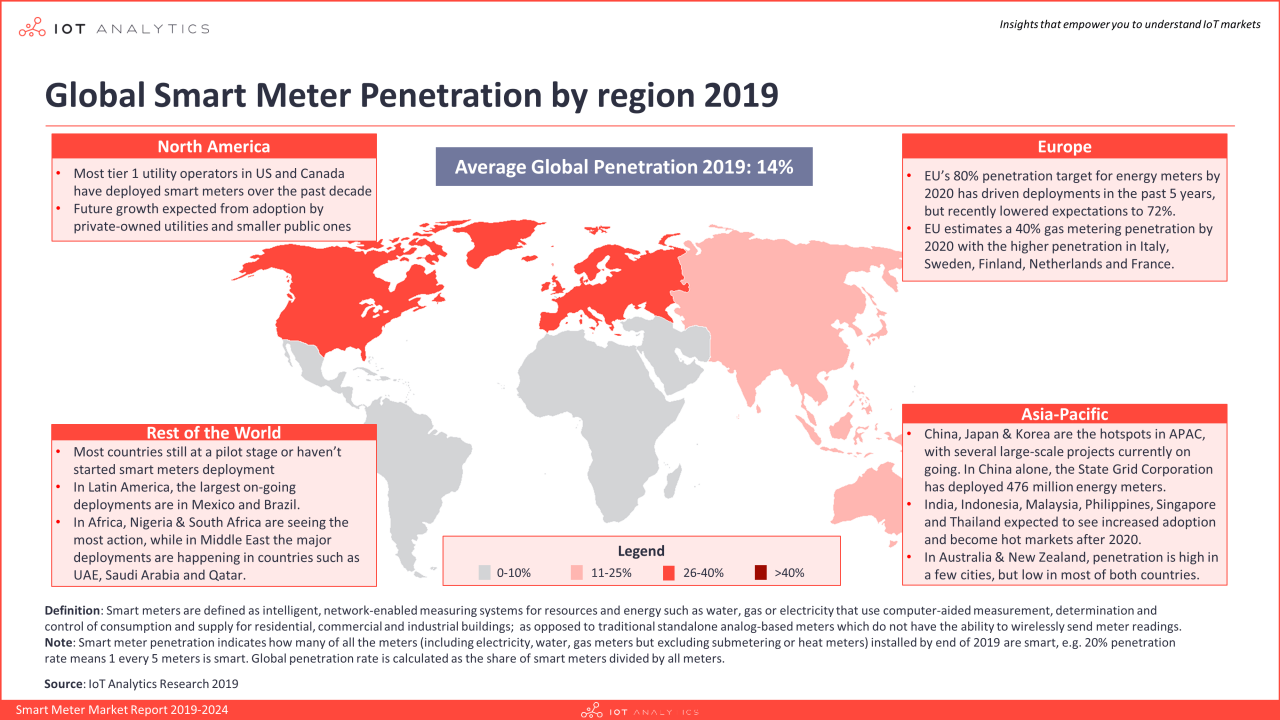

IoT Analytics’ new Smart Meter Market Report 2019-2024 estimates global smart meter penetration (electricity, water and gas) to have surpassed 14% in 2019 i.e., 14% of all meters are now smart meters. (Note: A smart meter is defined as an intelligent and network-enabled measuring system for resources and energy such as water, gas or electricity that use computer-aided measurement, determination and control of consumption and supply for residential, commercial and industrial buildings.)

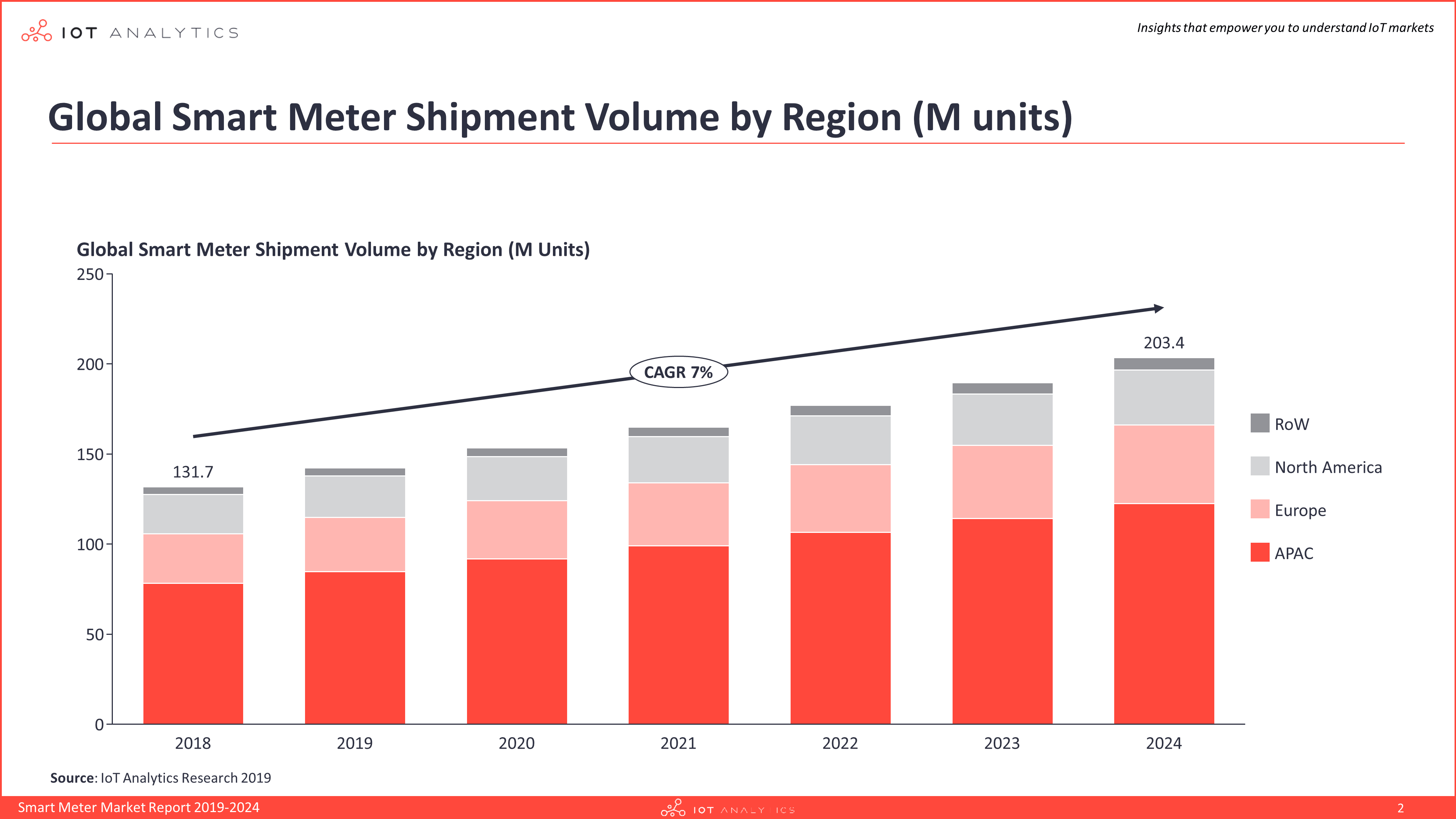

The estimated installed base of smart meters (electricity, gas and water) is expected to surpass the 1 billion mark within the next 2 years. Just under 132 million smart meters (electricity, gas and water) were shipped worldwide in 2018. This number is expected to grow 7% per year to exceed 200 million by 2024.

The analysis also shows a high level of fragmentation in the smart meter market, due to a combination of different regional or country-level institutional support and regulatory frameworks and the varying needs of utilities in different areas of the world.

The three main regions (North America, Europe, APAC) have vastly different characteristics and market dynamics – here is a high level overview including insights from the Rest of World region:

1. North America: Fairly mature market with a stable growth

The smart meter market in North America is fairly mature, with a penetration rate estimated at about 30-40% of total utility consumers of electricity, gas and water. Both USA and Canada were early adopters of smart meters. Today many of the tier 1 utility operators in the region have deployed a large-scale smart meter solution or are currently in the process of doing so.

- In the USA, smart meter deployments took off during the Obama presidency, when the government financed projects with public money, making the region the early leader in the market. At that time, many utilities opted for turn-key solutions based on proprietary RF Mesh Network technologies from large meter vendors such as Itron or Sensus.

- In the next 5 years, the region is expected to experience a stable growth driven by the large-scale rollouts planned by the remaining tier 1 utilities (particularly private-owned ones), and by smaller deployments from many small cooperative and municipal utilities. In addition to new deployments, a large share of shipped smart meters will be destined to the replacement of old devices, as the first-generation deployments approach the end of their lifecycle.

2. Europe: Highly fragmented market approaching maturity

In Europe, the smart meter market has a similar rate of adoption as North America, estimated at about 30-40% of all utility customers. The adoption is comparable to North America however it is much more heterogeneous, with large variations between countries in terms of regulations, the disparity of the local utility markets, and also the willingness to adopt smart meter solutions. Over the past decade the adoption of smart meters in the region has been driven by the roll-out target of 80% market penetration for electricity by 2020, established by the EU with the 2009 Third Energy Package plan. However the roll-out progress is not proceeding as fast as planned, and in a recent progress review the EU said that almost 72% of European households and commercial buildings will have smart electricity meters by 2020, which means the 80% market penetration target will not be reached in time.

- Leading countries: Italy, Sweden, Finland and the Netherlands have already hit the 80% target and expect 95%+ penetration by 2020.

- On-schedule: France, Spain, Greece and Denmark rollouts are proceeding at a steady pace and they are expected to reach the 80% target by 2020

- Behind schedule: Progress in other countries has been slower, and the 80% target will not be reached by 2020. UK is the most noticeable example, where various technical and consumer-related challenges have delayed the roll-out and recently convinced the government to extend the deadline by 2024.

- Not following the EU plan: A few countries, including Germany, Belgium and Portugal have opted not to follow EU’s smart meter plan due to a negative cost-benefits analysis and are planning or implementing selective rollouts instead.

In terms of gas and water meter, the level of adoption remains lower than electricity, but growing faster. Only a few countries in the EU have started or are planning large scale rollouts (e.g. Italy, France, UK, Netherlands). According to estimates, 40% of households and commercial buildings in the EU will have a smart gas meter by 2020.

3. Asia Pacific: Leading region by overall volume of shipments

Asia Pacific today represents the largest region in the global smart meter market, with an estimated 78.1 million smart meters shipped in the region in 2018. That number corresponds to almost 60% of the global shipments volume. The overall penetration of smart meters in the region remains lower than North America and Europe however, with less than 20% of utility customers equipped with smart meters. As in Europe, there are large differences among countries. In general, electricity meters have been the primary focus in most leading countries, while gas and water meters have only recently witnessed increasing traction, although the rate of adoption grows slowly due to the general lack of capital for these projects in many countries.

- China: The leading country in the APAC Smart Meter market. Back in 2011, The State Grid Corporation of China began the deployment of smart electricity meters in various areas of the country, installing a total of 476 million meters that represent more than half the worldwide installed base today.

- Japan and South Korea: Two other hotspots in the region, with large scale deployments of smart energy meters currently ongoing.

- India: Expected to play an increasingly important role in the smart meter market, following the recent introduction of a centralized AMI procurement and financing process that will drive adoption of smart meters in the country over the next 5 years.

- Indonesia, Malaysia, Philippines, Singapore and Thailand: Expected to become key markets after 2020.

- Australia: The state of Victoria was the first to complete a large-scale rollout in 2013, installing 2.8 million meters to cover 93% of households and small businesses. Various other states (e.g. Western Australia) are currently either planning or launching large-scale smart meter deployments in the country.

4. Rest of the World: Early stage market with low institutional support

In the rest of the world, the smart meter market is largely still at an early stage. Most countries in Africa, Latin America or the Middle East that are either still in a pilot stage or haven’t started yet introducing smart meters. To date, market penetration rates in these regions are below 5% of total utility customers, with electricity meters being the most adopted, followed by water and then gas.

In general, the main barrier to the adoption of smart meters in these regions is the lack of funding and government initiatives that have played a major role in the development of smart metering in other regions with larger penetration. In addition, in many cases there is also the problem of an inadequate infrastructure, based on obsolete technologies and often covering only urban areas, which makes the deployment of smart meters still prohibitive for many utilities.

- Africa: Most of the projects are still in a pilot phase, with the major implementation occurring in Nigeria and South Africa, while Egypt recently announced its plan to deploy 30 million smart meters in the next 10 years.

- Middle East: The major deployments are happening in countries like UAE, Saudi Arabia and Qatar, but the majority are pilot projects and to our knowledge only one utility in Abu Dhabi has completed the roll-out of smart electricity and water meters for its customers.

- Latin America: The market is led by Mexico and Brazil where various smart meter projects were launched in the past decade, from pilot-phase to large-scale deployments. For example, in Mexico the state-owned utility CFE is currently installing smart meters with the objective of 30 million installations by 2025. Contribution from other countries is currently small, but future growth is expected in countries like Colombia, Peru, Chile, Uruguay and Costa Rica where major utilities have announced plans for large-scale rollouts in the next decade.

More information and further reading

Interested in learning more about the Smart Meter market?

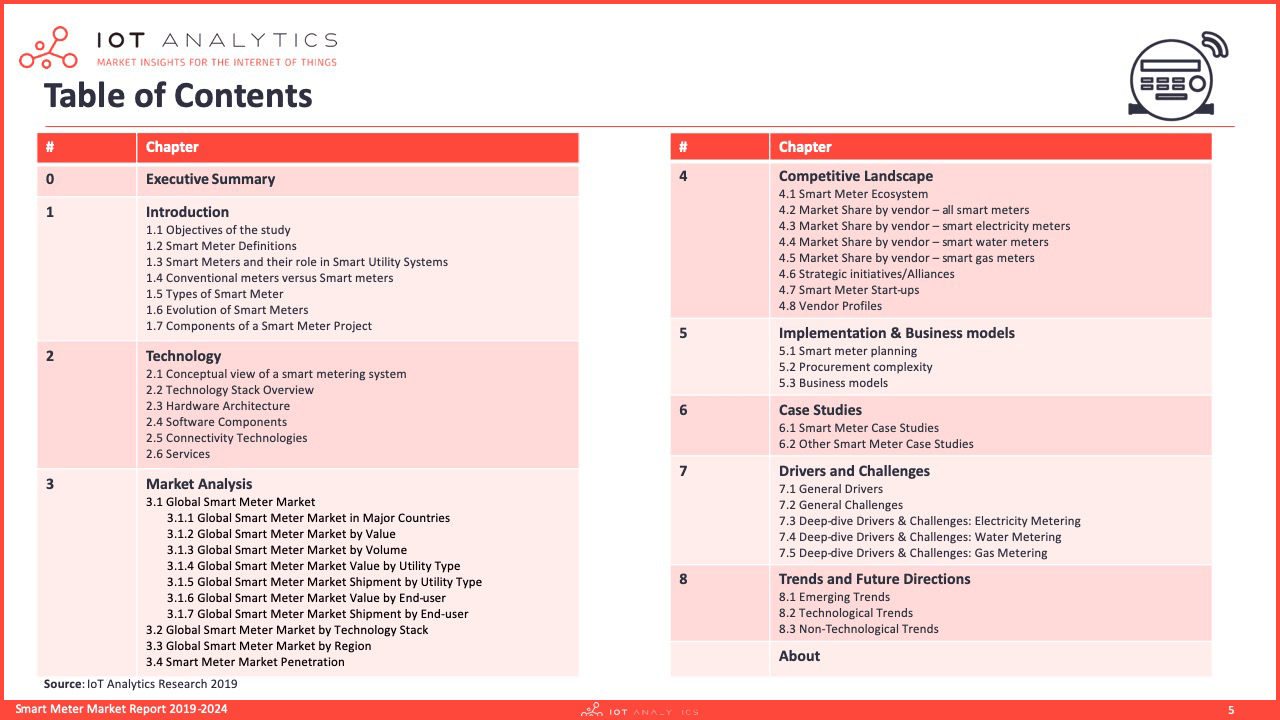

The details discussed in this article are explored in much further depth in the 134-page Smart Meter Market Report 2019-2024.

The report takes a deeper look at the Smart Meter market, including technology stack, market sizing and outlook, business models and case studies, vendor landscape, drivers, challenges and trends. A sample of the report and databases (including a list of 100+ smart meter companies) can be downloaded here:

Are you interested in continued IoT coverage and updates?

Subscribe to our newsletter and follow us on LinkedIn and Twitter to stay up-to-date on the latest trends shaping the IoT markets. For complete enterprise IoT coverage with access to all of IoT Analytics’ paid content & reports including dedicated analyst time check out Enterprise subscription.