In short

- New 180-page report on IoT Platforms. IoT Analytics released the 2019 IoT Platform End-User Satisfaction Report, that ranks the best IoT Platforms based on 800+ data points from actual users of various IoT Platforms.

- 4 in 5 users report positive IoT Platform ROI. An overwhelming 80% of users reported positive ROI of their IoT Platform investments, highlighting how viable IoT Platforms have become in 2019. This finding is in strong contrast to other studies that report large numbers of failed IoT projects.

- Cloud firms score best. End-users are most satisfied with the IoT Platform capabilities of big cloud companies – there are some exceptions.

- AWS IoT and Microsoft Azure IoT are top. AWS IoT is the best IoT Platform globally by end-user satisfaction. Users praise their various IoT services, particularly Analytics and Device Management and mention other stand-out aspects such as “usability”. Microsoft Azure IoT also scored “best-in-class” on several aspects, including “security features”.

- Several smaller providers stand out. Several IoT Platforms provided by startups and SMEs were rated highly. The most notable ones are MyDevices and Adamos.

- Variety of IoT Platform use cases. IoT Platforms are used for many different use cases – besides general dashboards and process improvement initiatives, using IoT Platforms for either condition monitoring or Predictive Maintenance are the most cited use cases.

- IoT Platforms are an important enabler for Artificial Intelligence. IoT Platforms play an increasingly central role for companies in their AI journey because the platforms ensure “standardized data collection and curation”.

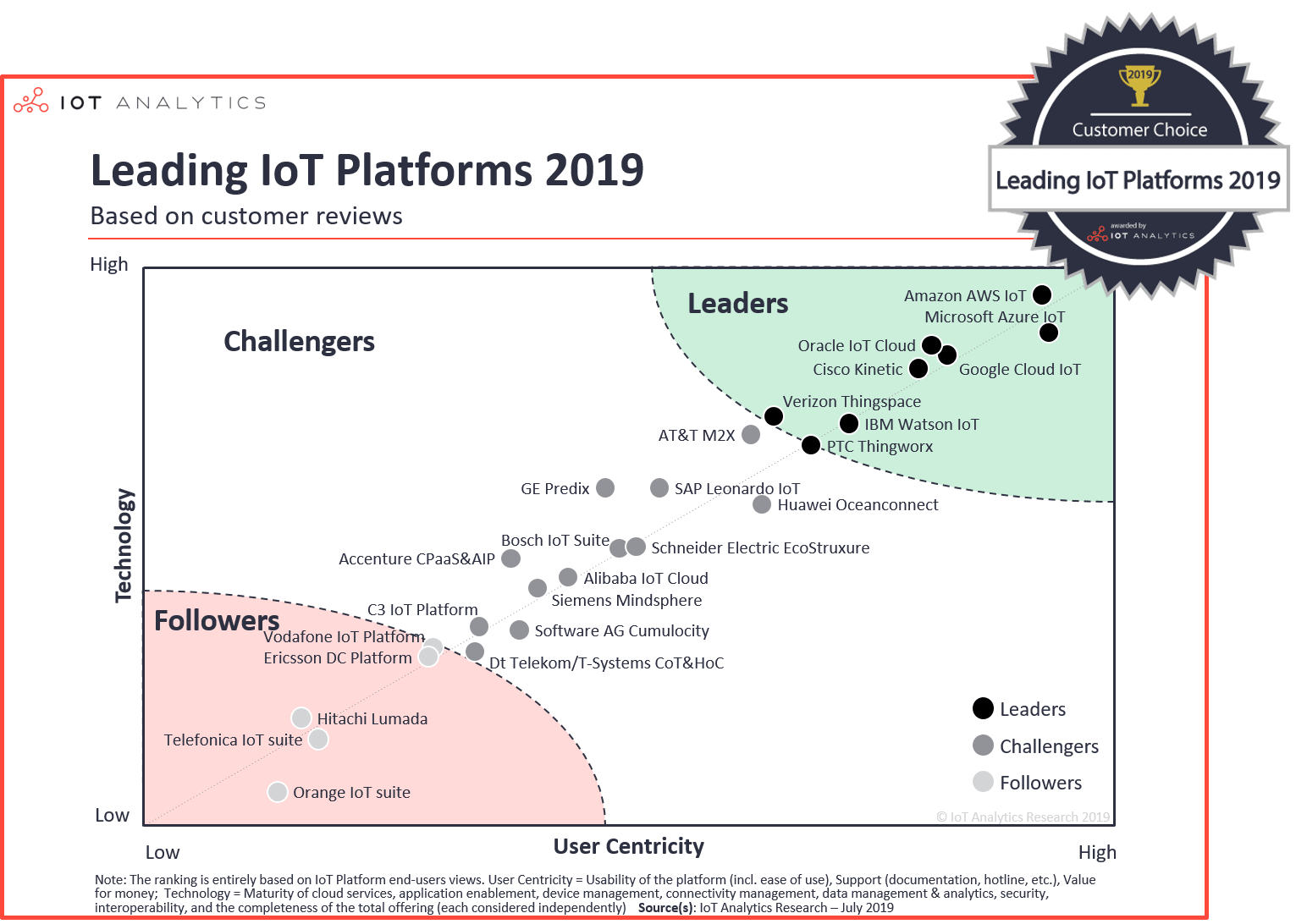

Best IoT Platforms 2019

AWS and Azure take top spots. Amazon AWS IoT and Microsoft Azure IoT top the 2019 ranking as reported by users of those platforms. Out of the hundreds of IoT Platforms on the market today, IoT Analytics shortlisted 50 and asked decision makers in organizations that have these platforms in use (or have tested them) how they made their platform selection decisions and what they did and did not like about individual vendors (on various different selection criteria). The top 25 platforms (in terms of popularity among those surveyed) made it into the final ranking.

Cloud firms dominate the ranking. Other providers of cloud technology also scored rather well, particularly Google, Oracle, and IBM. The common recurring themes for these vendors revolve around “ease of use”, “integration with other systems”, “scalability”, and great “support”. As a CTO of a municipality in Asia commented:

“The cloud platforms enable quick learning and setup along with practically immediate scalability. This ease of entry, usability, and integration with related platform services has led to a comprehensive offering particularly for collection, store and analysis of IoT data.”

8 platforms classified as “Leaders”. Besides the already mentioned firms, Cisco Kinetic, Verizon Thingspace and PTC Thingworx complete the picture. Both Cisco and PTC scored particularly well with industrial/manufacturing users. Cisco Kinetic particularly excels with their “connectivity management features”. Out of all telecommunications IoT platforms, Verizon Thingspace scored best.

Upcoming IoT Platforms. In order to understand how some of the smaller startups and SMEs are stacking up, the report has a dedicated section on “Upcoming Platforms”. Those providers are scoring particularly well with customers but are too small to be considered in the main ranking. The two providers that stand out are MyDevices Cayenne and Adamos. MyDevices scored particularly well for its user centricity, Adamos stands out for its platform technology targeted at machine builders.

Co-opetition among providers. It is important to note that not all IoT Platforms are completely comparable because features, capabilities, and sector strengths vary. In fact, some vendors may claim that another vendor is rather a “partner” than a competitor. This statement is particularly often made for cloud providers. The customer-view shows why: Many customers choose more than one IoT platform provider, often with a set of unique and a set of overlapping features. The recent announcement of Volkswagen to connect their factories (Industrial Cloud) through a combination of AWS/AWS IoT features and Siemens Mindsphere features is a good example of that.

Other report highlights

IoT Platform investments pay off. An overwhelming 80% of users reported positive ROI of their IoT Platform investments. This shows how viable and important IoT Platforms have become in 2019. The best are often amortizing themselves in less than a year. This finding from the study is in strong contrast to other studies that have reported large numbers of failed IoT projects.

Variety of IoT Platform use cases. Dashboards and general process improvement initiatives are the top cited use cases for IoT Platforms. Condition Monitoring and Predictive Maintenance type of use cases represent the other top family of use cases cited.

IoT Platforms are an important enabler for Artificial Intelligence. As companies ramp up their AI initiatives, they often discover just how important IoT Platforms are as a necessary complement/building block. The study shows that companies pursuing AI initiatives, view IoT platforms as a crucial prerequisite for “standardized data collection and curation”.

Commenting on the findings of the study, IoT Analytics Managing Director Knud Lasse Lueth said:

“This study was purposely designed to take a very broad perspective of IoT Platforms. We looked at a wide variety of providers and surveyed a rather senior audience. I am particularly stunned by the positive ROI that people are reporting. A couple of years ago, many people were claiming that the IoT is failing. The data coming from this study shows quite the opposite and indicates that the millions of dollars spent in recent years by IoT platform providers to build out the technology is finally starting to pay off.”

More information and further reading

The full 180-page “IoT Platforms End User Satisfaction Report” is available for purchase HERE.

This report provides answers to the following questions:

- What are the needs of IoT Platform end-users (e.g., dominant platform selection criteria)?

- Which IoT Platforms are ranked best-in-class (by technology and main selection criteria)?

- What are the profiles of leading IoT platform vendors (incl. individual strengths and weaknesses of all 50 vendors)?

- What does the platform selection process look like (e.g., timeframe, methods to select the platform)?

- What are the dominant use cases that get implemented with the IoT Platforms?

- Which benefits and what kind of ROI are companies seeing from their IoT Platform investments?

- How are end-users thinking about the interplay of IoT Platform, edge, digital twin, and AI?

- Which smaller IoT Platforms (startups and SMEs) are scoring well with end-users?

A sample of the report can be downloaded HERE.

Are you interested in continued IoT coverage and updates? Subscribe to our newsletter and follow us on LinkedIn and Twitter to stay up-to-date on the latest trends shaping the IoT markets. For complete enterprise IoT coverage with access to all of IoT Analytics’ paid content & reports including dedicated analyst time check out Enterprise subscription.

Report Methodology

- Type of research. Primary research via prequalified online survey

- Audience type. C-level / Senior predominantly in IT / Engineering domains with either technology end-users or system integrators

- Study timeframe. January – March 2019

- Region mix. 40% North America, ~25% Europe, ~25% APAC, ~10% MEA

- This survey has been designed to be as objective as possible. All respondents were randomly chosen from locations across the world and no responses were routed through any particular IoT Platform Vendors. All results are solely based on the survey findings and not the opinion of IoT Analytics analysts.