There are now more than 1,000 startups creating Internet of Things (IoT) products or services, according to the IoT Startups Report & Database 2019 by IoT Analytics.

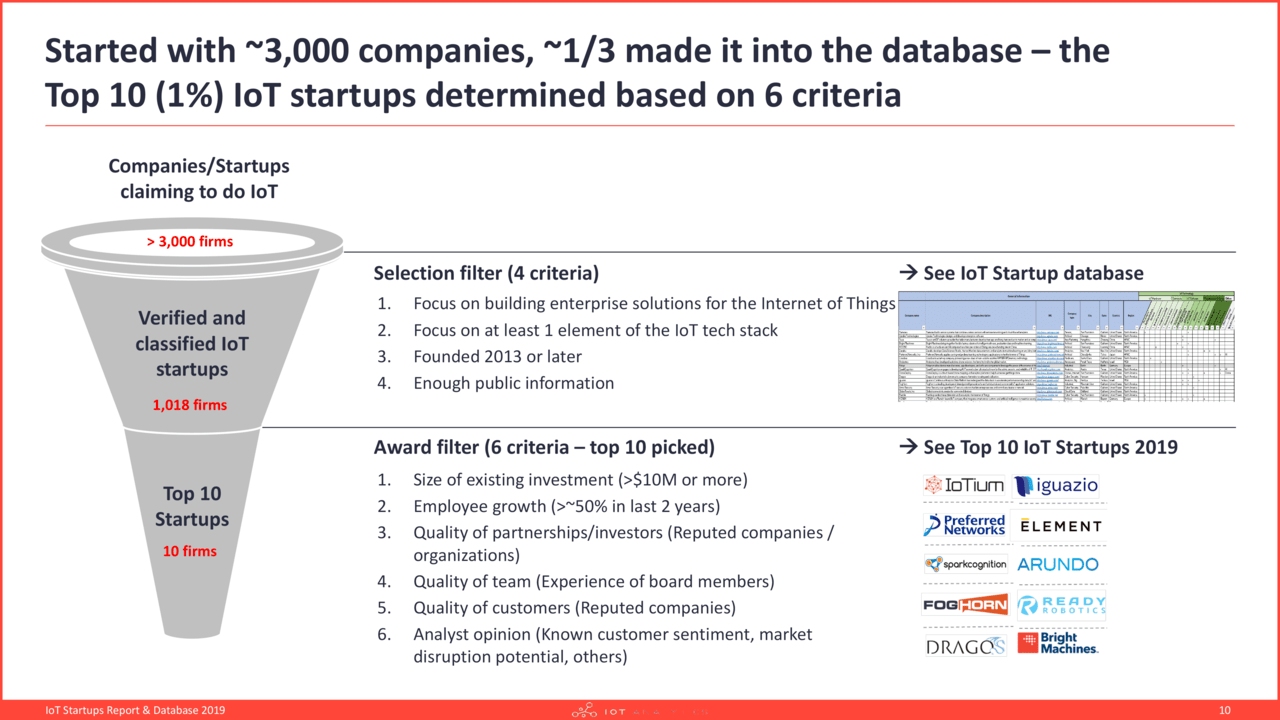

Starting with a long-list of more than 3,000 companies that claim they work on Internet of Things solutions, the analyst team at IoT Analytics verified and classified 1,018 upcoming firms around the world that are active today, no older than 6 years and fit the definition of Internet of Things (see definition below). The analyst team then picked the top 10, based on 6 criteria:

- Size of existing investment (>$10M or more)

- Employee growth (>~50% in last 2 years)

- Quality of partnerships/investors (Reputed companies / organizations)

- Quality of team (Experience of board members)

- Quality of customers (Reputed companies)

- Analyst opinion (Known customer sentiment, market disruption potential, others)

List of Top IoT startups

While many of the 1,018 IoT startups that were screened do offer promising technology there are 10 that stand out according to the above (listed in alphabetical order):

1. Arundo Analytics (IoT Middleware & Software Infrastructure)

Arundo Analytics is a hot IoT Startup that provides analytics software for industrial and energy companies. The company has formed several strategic alliances e.g., with Dell Technologies and WorleyParsons. Arundo has also formed a joint venture with DNV GL to provide stream data analytics for maritime companies. The board of directors includes Tore Myrholt, Senior Partner at McKinsey and Thomas Malone, the founding director of the MIT Center for Collective Intelligence. Recently, Arundo launched several applications incl. machine monitoring and fuel efficiency.

2. Bright Machines (IoT Middleware & Software Infrastructure)

Bright Machines is currently the fastest growing IoT Startup, having grown from virtually zero at the beginning of 2018 to more than 400 employees a year later (April 2019). The firm focuses on “micro-factories” made up of its software and robot cells as well as new software tools that make manufacturing more efficient. The leadership team is filled with former executives from Autodesk, Flextronics, and Amazon including Amar Hanspal (CEO), Brian Mathews (CTO), Tzahi Rodrig (COO) and Nick Ciubotariu (SVP, Software Engineering). The company recently entered into a strategic partnership with BMW i Ventures.

3. Dragos (IoT Middleware & Software Infrastructure)

Dragos is a cybersecurity startup that offers a software-defined security platform for manufacturers. The company has seen a 300%+ growth in headcount the last 2 years, and collaborates with GE, Deloitte, OSIsoft, ThreatConnect, Crowdstrike, and several other companies. The company recently acquired Atlanta-based NexDefense and collaborates with Waterfall Solution for a joint solution.

4. Element (IoT Middleware & Software Infrastructure)

Element (also known as Element Analytics) is a fascinating IoT Startup that focuses on industrial analytics software such as Digital Twins, particularly in heavy industries. The company counts an impressive list of investors, including Kleiner Perkins, GE, Honeywell, and ABB. Element partners with Microsoft, Uptake, OSIsoft, and Radix (consulting).

5. FogHorn (IoT Middleware & Software Infrastructure)

In recent years, US-based startup FogHorn has gained an excellent reputation with leading manufacturers and oil and gas organizations around the world for its real-time edge computing and analytics software. The company has seen an 89% employee growth in the past 2 years and has secured partnerships with 50+ industrial solution providers, OEMs, gateway providers, and consultants/SIs, including AWS, Google Cloud, Microsoft, Cisco, HP, NTT Data, and more. FogHorn is also a member of LF Edge, an umbrella organization to drive an open, interoperable framework for edge computing to accelerate deployment among the growing number of edge devices. Investors in FogHorn include The Hive, Bosch, Dell, GE, Honeywell, Intel, Saudi Aramco, and Yokogawa.

6. Iguazio (IoT Middleware & Software Infrastructure)

Iguazio is a hot startup that provides a state-of-the-art data science platform for various verticals, including Industrial IoT, Smart Mobility, and Telecommunications. The company recently entered into collaborations with NVIDIA, Microsoft and Google. Iguazio markets its Nuclio platform product as a “serverless” framework for multi-cloud environments and is thus well-positioned for the next wave of cloud computing.

7. IoTium (IoT Connectivity)

IoTium is a quickly upcoming IoT startup from the Silicon Valley area that focuses on software-defined network infrastructure in manufacturing and related verticals. The company has seen a 100%+ growth in headcount over the last 2 years and now counts John Chambers, former Cisco CEO, as an investor along with other well-known corporate investors incl. Juniper, Qualcomm, SafeNet and Wind River. The company is also very active in the EdgeX Foundry and recently joined the Siemens’ MindSphere partner program as a gold member.

8. Preferred Networks (IoT Middleware & Software Infrastructure)

Preferred Networks is one of Japan’s IoT hot shots, focused on applying real time machine-learning technologies to new Internet of Things applications. The company has seen a 100%+ employee growth in the last 2 years and now collaborates with world leading organizations incl. Toyota Motor Corporation, Fanuc, and the National Cancer Center. The company is also very active in developing the deep-learning framework Chainer™ together with IBM, Intel, Microsoft, Nvidia.

9. READY Robotics (IoT Hardware)

READY Robotics is a rare robotics startup that is looking to benefit from the increasing automation and flexibilization of manufacturing processes around the world. The company emerged from the cutting-edge robotics research at Johns Hopkins University to develop their industrial robotic software called Forge. The company has seen a 150%+ growth in headcount in the last 2 years and is now producing roughly 15 robot systems per month.

10. SparkCognition (IoT Middleware & Software Infrastructure)

SparkCognition excels in AI-powered analytics, particularly in manufacturing and related verticals. SparkCognition has seen a 100%+ growth in headcount over the last 2 years. The company has launched Skygrid, a joint venture with Boeing and it has partnered with Siemens as part of its Mindsphere program. The company is also a Google Cloud Technology Partner and works with IBM as a trusted partner.

Other report findings

In addition to highlighting the top 10 IoT startups, the 62-page report presents the main findings from the analysis of the current IoT Startup landscape, based on the database of 1,000+ IoT Startups.

Selected findings:

- IoT startups continue to attract millions of dollars. The total funding of all verified IoT startups to date stands at $3.6billion (see methodology for the definition of IoT startup). It shows that IoT continues to be a significant area of innovation, with some startups having raised $100M+ in less than 6 years.

- 7 of the top 10 IoT startups focus on Analytics/AI/Data Science. Analytics, AI, and Data Science are extremely hot topics right now from an IoT point of view. Startups that are focusing on the intersection of these 3 topics and IoT are seeing beyond-average funding amounts. Many of those have developed state-of-the-art software that is optimized for harnessing real time sensor data and learning from it continuously, catering to use cases such as increased automation and predictive maintenance for downtime prevention.

- Most IoT Startups focus on the manufacturing vertical. 30% of identified startups focus on Industrial/manufacturing clients. Industrial/manufacturing environments offer great potential for IoT disruption and in recent years the vertical has experienced high growth in the number of IoT deployments. Most of these startups are developing software to enhance operational efficiencies and create new factory and field applications e.g., interactive robots.

- North America is the #1 region of identified IoT Startups. 43% of the startups are founded in North America. USA and in particular the San Francisco Bay area is a traditional hotbed for tech startups with many reputed investors and a strong talent pool. The region has a relatively high share of Analytics, IoT Platform, and IoT Security focused startups while having a rather low share of hardware focused startups (e.g., complete IoT device solutions and other hardware).

Commenting on the findings, Knud Lasse Lueth, Managing Director of IoT Analytics said:

“8 years ago IoT hardware device startups like Nest (acquired by Google) were hot, 4 years ago IoT software platform startups like Relayr (acquired by MunichRe) were hot. The topic landscape continues to shift. The hot IoT startups today have a strong focus on data analytics and AI and are increasingly targeting industrial and manufacturing clients. It remains to be seen how much of the analytics technology that today’s startups are building will really be scalable across IoT use cases and across industries. For now, most of the IoT startups are adding value in specific industries or for specific use cases.”

Methodology

The methodology for this research involved analyzing ~3,000 companies, and selecting those offering products or services for IoT. This resulted in over 1,000 companies making it into the database. From this database, the Top 10 (1%) of IoT startups were determined based on 6 criteria (see chart).

Definition of the Internet of Things: IoT Analytics defines the Internet of Things as a network of internet-enabled physical objects. Objects that become internet-enabled (IoT devices) typically interact via embedded systems, some form of network communications, as well as a combination of edge and cloud computing. The data from IoT-connected devices is often (but not exclusively) used to create novel end-user applications. Connected personal computers, tablets, and smartphones are not considered IoT, although these may be part of the solution setup. Devices connected via extremely simple connectivity methods such as RFID or QR-codes are not considered IoT devices.

More information and further reading

The full 62-page report (+ 1,018 line item database) titled “IoT Startups Report & Database 2019” is available for purchase HERE.

This report provides the following analysis:

- Global IoT Startup analysis, by founded year

- Average funding per startup by Technology layer focus

- Global IoT Startup analysis, by Technology focus type

- Total & average IoT Startup funding by Technology focus type

- Breakdown of IoT Startups by industry

- Funding of IoT Startups by industry

- Global distribution of IoT Startups by region, country, and city analysis

- Regional deep-dive IoT Startup analysis

- IoT Startup employee analysis, by department and region

- Average funding per employee by region, segment, and technology

- And More

A sample of the report and the database can be downloaded here.

Continued IoT coverage and updates

Subscribe to our newsletter and follow us on LinkedIn and Twitter to stay up-to-date on the latest trends shaping the IoT markets. For complete enterprise IoT coverage with access to all of IoT Analytics’ paid content & reports including dedicated analyst time check out Enterprise subscription.