Update November 2020: IoT Analytics published a more recent blog on: What CEOs talked about in Q3 2020.

The second quarter of 2020 was like no other. A record rise in unemployment, widespread layoffs, empty offices, and entire industries like travel or sports & entertainment losing the majority of their business within weeks. At the same time governments around the world provided a record $10 trillion in economic stimulus, while the value of Gold as well as the Nasdaq climbed to new all-time highs.

Nasdaq’s record levels, which are a surprise to many, are driven by the fact that technology has taken center stage during the pandemic. -> see also the related analysis: 5 themes that dominated tech and IoT conferences in Q2 2020).

IoT Analytics’ latest publication (available to download for corporate subscription clients), titled “IT & IoT Trends – Mid 2020 update” looks one layer deeper and analyzes the importance of different digital and tech topics during and after the pandemic.

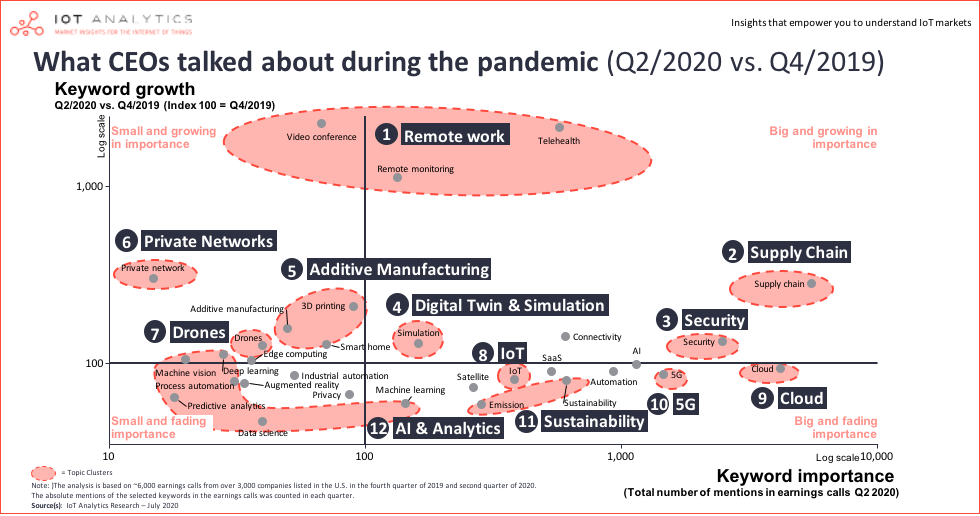

One of the analyses is a “keyword-based” visualization of the earnings transcripts of 3,000 US-listed companies (Q2 2020 vs. Q4 2019). It provides an indication of which technology topics CEOs prioritized during the pandemic.

The chart visualizes the keyword importance and growth during the pandemic:

- X-axis: Keyword importance (i.e. how often have keywords been mentioned in Q2). The further out on the x-axis, the more often the topic has been mentioned all together.

- Y-axis: Keyword growth (i.e. what is the increase or decrease Q2/2020 vs. Q4/2019, indexed to 100). A number >100 on the Y-axis indicates the topic has grown importance, a number <100 indicates the topic has lost in importance.

These were some of the hottest topics discussed by CEOs:

Priority #1: Remote work

Mention of remote work topics (e.g., videoconferencing, remote monitoring as well as remote healthcare / telehealth) jumped by more than 10x compared to pre COVID-19 levels.

Sample CEO quote from Q2:

“Remote monitoring and service delivery, including condition-based maintenance, will significantly increase. These types of solutions are being deployed in some of our marquee projects today, and the list of ideas and offerings continues to expand.”

George Oliver – CEO, Johnson Controls Inc, May 1, 2020

Priority #2: Supply Chain

Managing the supply chain to maintain customer satisfaction was key during the pandemic. This included having supply chain visibility, ensuring there were no supply disruptions, and focusing on creating overall resiliency. The topic “supply chain” was mentioned 2.8 times more than prior to the pandemic.

Sample CEO quote from Q2:

“Having agile supply chain processes is more important than ever to manage our expenses and cash investments. Therefore, we condensed our sales, inventory and operations planning process from a traditional monthly cycle to a weekly cycle.”

Darius Adamczyk – CEO, Honeywell International Inc May 1, 2020

Priority #3: Security

As the pandemic forced organizations to quickly change IT setups, hackers tried to benefit. Q2 saw a spike in phishing attacks, malspams and ransomware attacks as attackers were using COVID-19 as bait to impersonate brands thereby misleading employees and customers. Security topics were mentioned 30% more in Q2 than prior to the pandemic.

Sample CEO quote from Q2:

“Data breaches in cloud-delivered services will accelerate as many info sec and dev ops organizations, in their rush to the cloud, have not yet brought their cloud security posture to the level of their traditional data centers.”

Nikesh Arora – CEO, Palo Alto Networks Inc , May 21, 2020

Priority #4 Digital Twin & Simulation

In a world where nothing seems certain and a wide range of future scenarios are possible, simulation becomes more important. The inability for people to travel was another driver for digital twin and simulation technologies. One such use case is “Virtual commissioning”, i.e. setting up equipment remotely without being physically present. Relying on a digital replica of the asset and simulating the asset’s behavior proved to be very valuable for those companies that could not allow its employees to travel during the lockdown.

Sample CEO quote from Q2:

“In these tough economic times, people are looking to reduce costs. And that again is a good guide to tailwind for simulation.”

Ajei Gopal CEO, ANSYS, May 7, 2020

Priority #5: Additive Manufacturing

Additive manufacturing moved into the spotlight during the pandemic. The benefits of being able to produce with maximum flexibility proved valuable in a number of cases and was partially driven by a shortage in critical equipment to treat COVID-19 patients (e.g., companies used 3D printers to quickly produce ventilators).

Sample CEO quote from Q2:

“This pandemic has shown the benefits of 3D printing specifically speed, agility, and localized production. This has led to deeper, more strategic engagement with customers as they evaluate the supply chain and consider more distributed manufacturing models.”

Enrique Lores – CEO, HP Inc, May 27, 2020

Other notable observations (and opinions)

- Cloud not (yet) top of mind. There is a widespread belief that COVID-19 is accelerating legacy software applications and other enterprise workloads moving to the cloud. Our keyword analysis, however, does not show a meaningful increase in CEOs that discussed the topic throughout Q2. Nonetheless, our team believes that cloud adoption will accelerate in the coming quarters and that we will see a trend reversal in future such keyword analyses.

- Limited focus on IoT, 5G, and AI during the pandemic. Digital acceleration did not include IoT, 5G and AI during Q2 (at least not on a broad scale so it would have a measurable affect in CEO discussions). In fact, some longer-lasting AI initiatives and IoT projects which require an on-site setup were postponed during the crisis and thus less in focus. Based on recent discussions with various experts in the field, IoT Analytics expects all 3 topics to bounce back.

- Private networks on the rise. While discussions about public wireless networks (such as public 5G), did not accelerate during Q2, private telecommunications networks (i.e. wireless networks owned by organizations) did. The topic of private networks is on the rise (although the topic is small compared to other topics analyzed). Of particular importance are private LTE, private 5G, and private LPWAN (e.g., Lora) that allow companies to perform wireless tracking of goods and assets on a company’s site without relying on a third-party network.

- Sustainability deprioritized. While tech vendors at their own conferences during Q2 emphasized sustainability as a theme they are prioritizing going forward (see theme #5 here), there was little mention throughout Q2 as CEOs had more immediate needs to discuss with the analyst community.

More information and further reading

The findings discussed in this article are part of a wider analysis which is derived from the 29-page IT & IoT Trends – Mid 2020 update report. The report includes a number of further insights related to the effect of COVID-19 on different IT as well as Internet of Things topics and includes many recent quotes and data points.

A sample of the report can be downloaded here:

Are you interested in continued IoT coverage and updates?

Subscribe to our newsletter and follow us on LinkedIn and Twitter to stay up-to-date on the latest trends shaping the IoT markets. For complete enterprise IoT coverage with access to all of IoT Analytics’ paid content & reports including dedicated analyst time check out Enterprise subscription.