Key Insights

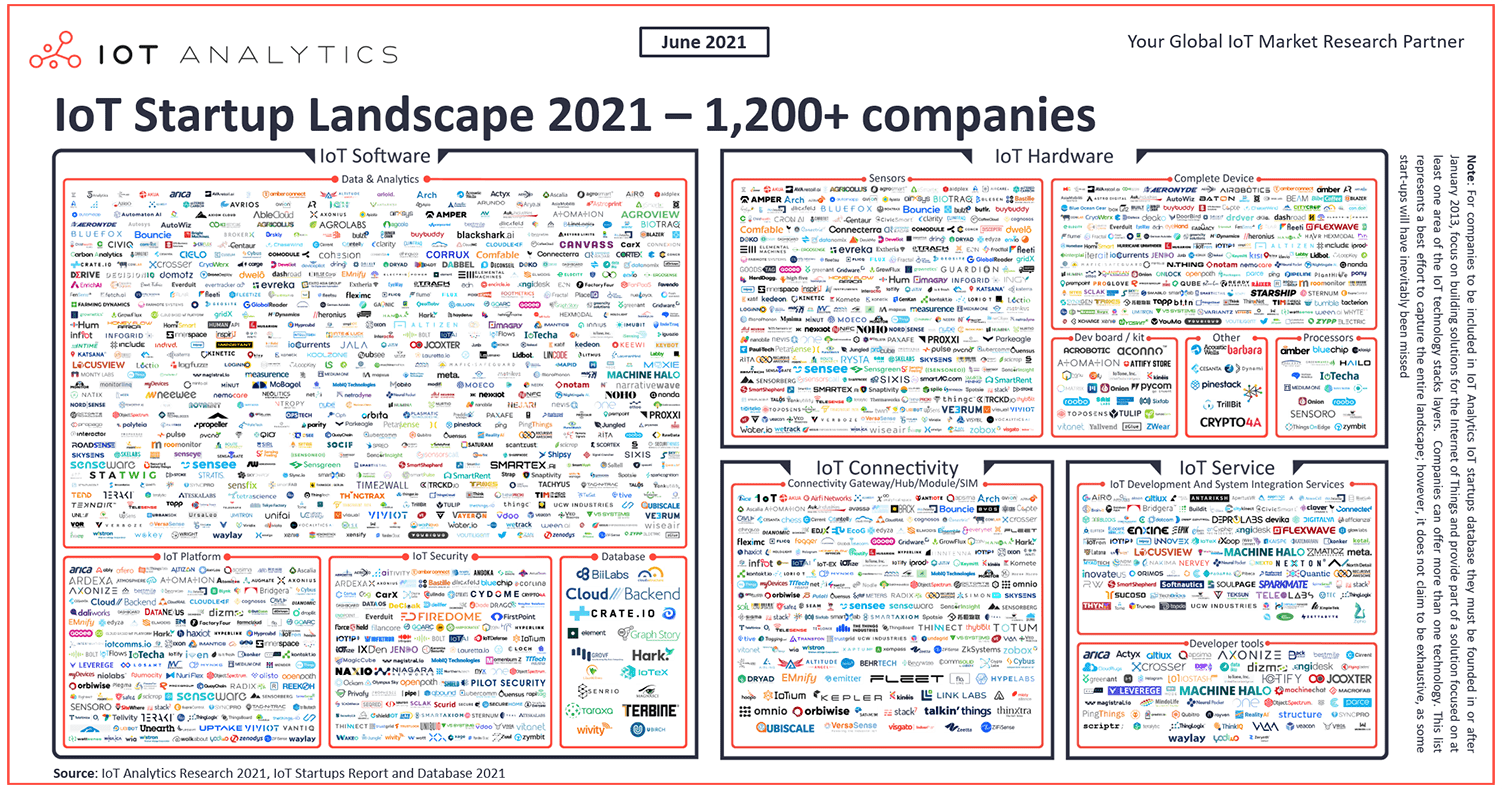

- In 2021, the number of identified active Internet of Things (IoT) startups has grown to over 1,200, according to IoT Analytics’ latest report on the topic.

- Investments in IoT startups are back to pre-COVID-19 levels, after funding decreased substantially in Q2 and Q3 of 2020.

- The most common offering of IoT startups is IoT software (offered by 77% of startups), followed by IoT hardware (45%), IoT connectivity (17%), and IoT services (14%).

Why it matters?

- Some of today’s IoT startups will be dominant IoT companies in the future, shaping our connected world.

According to IoT Analytics’ latest IoT Startup Report & Database 2021, more than 1,200 companies make up the landscape of upcoming, innovative companies competing for market share in the connected IoT world of the future.

The IoT Startup Landscape in 2021

While the IoT space continues to see a constant inflow of new startups every year, the gold rush to become the next big IoT platform or connectivity service is a thing of the past. In 2014 and 2015, the “golden” years of IoT startup funding, more than 200 startups were founded annually (2014: 237; 2015: 209). Since then, the number of new firms started each year has been stabilizing below 200. Moreover, some IoT startups vanish every year. Of the 1,018 startups identified in IoT Analytics’ 2019 IoT Startups Report (IoT Startups Report & Database 2019), 237 have ceased to exist in 2021, and 46 have been acquired.

Startup investors hope to see high growth rates and an initial public offering (IPO) or exit after a few years. Of the more than 541 companies in our database that were founded between 2013 and 2015, and that have not undergone an IPO, 37% reached the status of a scale-up, laying the foundation for a potential public offering in the coming years.

COVID-19 had a devastating effect on startup funding in 2020. Funding for IoT startups decreased substantially in Q2 2020 ($127 million) and Q3 2020 ($31 million) as investments were halted globally. However, the total amount invested in IoT startups has since returned to pre-COVID-19 levels. Contributions to IoT startup funding rounds in Q4 2020 amounted to $372 million, leading to an overall funding increase in 2020 as compared to 2019.

Software is the area in which IoT startups compete the most. The majority of IoT startups (77%) have a dedicated IoT software offering, while 45% offer IoT hardware, 17% offer IoT connectivity, and 14% offer services for IoT (Note: Many startups compete in more than one category). Within IoT software, data and analytics is the largest segment (37% of all new IoT startups in 2020). New IoT security startups are also rising quickly. IoT startups with a dedicated focus on IoT security made up 10% of all IoT startups founded in 2020.

Further notes:

For companies to be included in IoT Analytics’ IoT startups database, they must have been founded on or after January 2013 and must focus on building solutions for the Internet of Things and provide part of a solution in at least one area of the IoT technology stacks layers.

Scale-ups (as defined for this report) are startups that fulfill at least two of the following three requirements: more than $1 million in annual revenue, more than 50 employees, and at least series B funding.

More information and further reading

Are you interested in learning more more about IoT startups?

The IoT Start-ups Report and Database 2021 is a comprehensive 67-page report & database assessing the current IoT startup landscape. It also includes a Global IoT startup database, with classification of 1,200+. It is part of IoT Analytics’ ongoing coverage of general IoT.

This report provides answers to the following questions (among others):

- How many IoT startups are in the global market?

- Which startups have received the highest funding in the IoT space?

- Which region and country have the highest number of IoT startups?

- Which segment do the majority of IoT startups focus on?

- What type of IoT technology do the majority of IoT startups focus on?

- Which IoT startup trends over time are becoming evident for the tech stack?

- And more…

The sample of the report gives you a holistic overview of the available analysis (outline, key slides). The sample also provides additional context on the topic and describes the methodology of the analysis.

The sample of the report also includes a high-resolution version of the IoT Startup Landscape 2021 overview image of 1,200+ companies.

Related articles

Are you interested in continued IoT coverage and updates?

Subscribe to our newsletter and follow us on LinkedIn and Twitter to stay up-to-date on the latest trends shaping the IoT markets. For complete enterprise IoT coverage with access to all of IoT Analytics’ paid content & reports including dedicated analyst time check out Enterprise subscription.