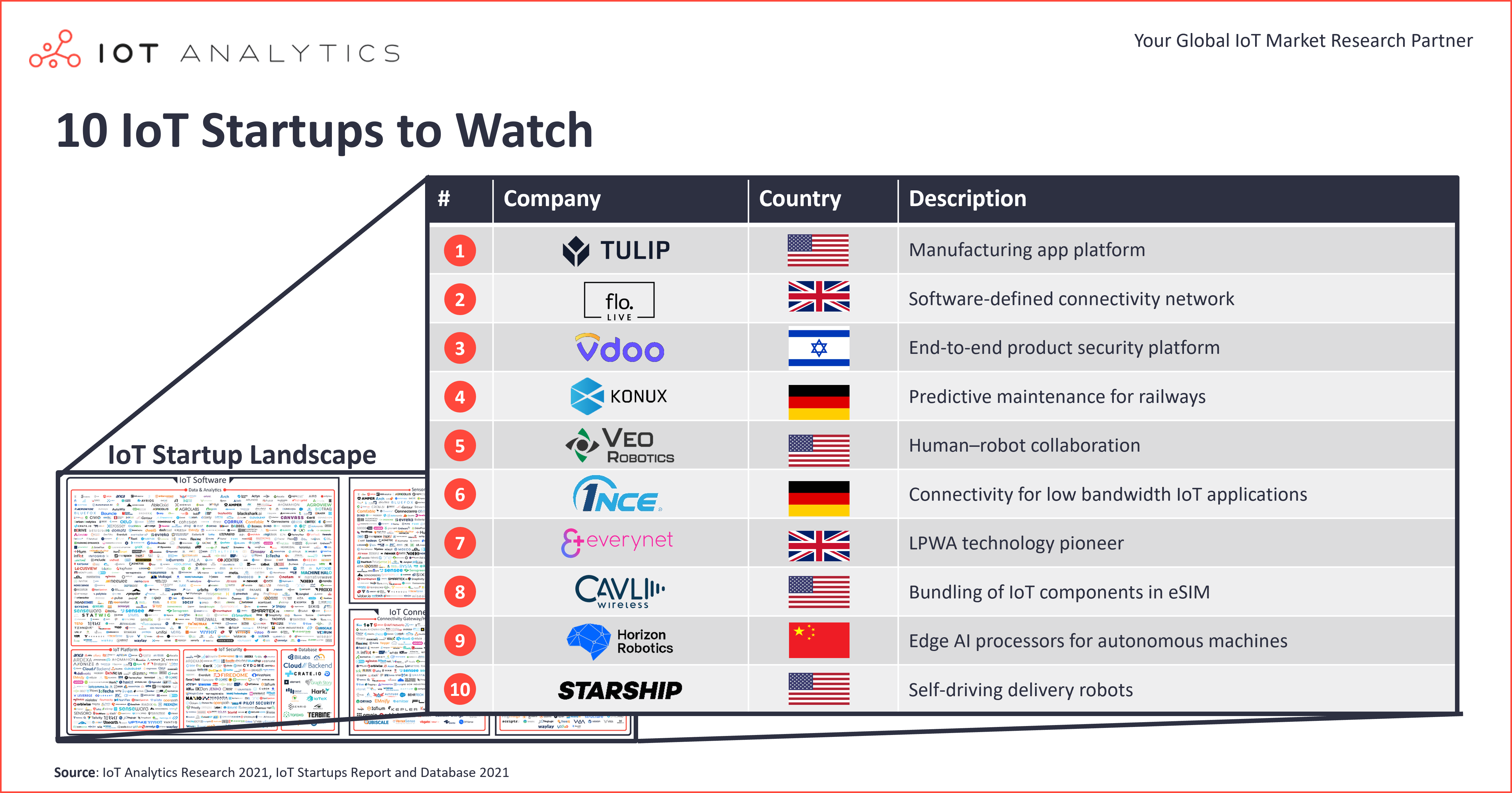

In June 2021, IoT Analytics published the IoT Startup Landscape 2021, mapping more than 1,200 companies that are creating the connected world of the future. Although it is impossible to predict which of these companies will thrive in the coming years and which ones might hit a dead end, our research team often discovers some very impressive upstarts that are developing cutting-edge technology or have impressive customer stories to share.

Our research team has shortlisted 10 IoT companies (all founded in the last seven years) that they have recently analyzed and would label as “to be watched.” These 10 companies do not all compete with each other. Quite the contrary, their offerings are as diverse as the IoT landscape, ranging from companies focused on manufacturing to those covering all verticals and companies offering software, to those covering hardware, or connectivity components. What they all have in common is that they have found strong partners and key investors who have enabled them to hone in on the next sought-after key products. One company, Vdoo, has been acquired since our team shortlisted these companies.

(Note: The inclusion of companies in this article is entirely based on our analysts’ research and opinions. IoT Analytics acts as an independent research provider and does not accept sponsored blog content.)

Here are the 10 IoT startups to watch (in alphabetical order) and our team’s opinions of each:

1. 1nce

“1NCE was the first MVNO to offer low-cost cellular connectivity services based on an IoT flat rate (10 years for 10 EUR, 500 MB*** included). Its services are now available almost worldwide, China included. That is a great position for further growth, and together with its partner Deutsche Telekom, it will play a major role in the future connectivity landscape.”

Eugenio Pasqua, principal analyst, Connectivity at IoT Analytics

2. Cavli Wireless

“Cavli’s Hubble99 is gaining a lot of traction within the IoT connectivity module industry. As Cavli understood from the beginning, subscription-based IoT offerings with ZERO hardware cost, bundled with connectivity, device management, and cloud platform would give them the upper hand in high-volume manufacturing [in the] module industry. I like the idea of bundling every component of IoT with eSIM at the cost of $0.99/month/device.”

Satyajit Sinha, senior analyst, Connectivity at IoT Analytics

3. Everynet

“Everynet seems to be growing fast thanks to its unique business model, and it now claims to be the most utilized LoRaWAN network in the world. Everynet counts carrier-grade networks in Asia, EMEA, and the Americas, and since summer 2020, it has announced the roll-out of new national networks in Indonesia, Italy, UK, Ireland, Iceland, and Puerto Rico. All in all, an ambitious and fast-growing company.”

Eugenio Pasqua, principal analyst, Connectivity at IoT Analytics

4. floLIVE

“floLIVE’s software-defined connectivity network was designed from the ground to solve the pain points associated with connecting and managing IoT devices on a cellular network. With strong strategic investors like Dell and Qualcomm and a comprehensive platform built for IoT and designed on a modern, scalable technology stack, floLIVE appears to be well-positioned to provide a valuable service for companies looking to connect and manage IoT devices.”

Matthew Wopata, principal analyst, Industrial IoT at IoT Analytics

5. Horizon Robotics

“In the age of self-dependence, especially by China’s semiconductor industries, Horizon Robotics emerged as a critical replacement for Nvidia and Intel’s Mobileye. Further, the most exciting aspect of Horizon Robotics is that it brings large-scale cloud-based deep neural network algorithms into high-performance and low-power brain processing units (BPUs).”

Satyajit Sinha, senior analyst, Connectivity at IoT Analytics

6. Konux

“Between 6% and 8% of all delays of German trains are due to failures of switches. Konux’s home market is therefore the perfect test bed and incubator for its predictive maintenance system for rail switches. In December 2020, Konux signed a long-term framework agreement with Deutsche Bahn (the de facto train monopolist in Germany). The strong partners and the expected global investment into (greener) train services in the coming years put the company in a great position.”

Philipp Wegner, senior analyst, Data Analysis at IoT Analytics

7. Starship Technologies

“With more than one million deliveries completed by January this year, hundreds of trials completed in more than 20 countries, along with a total raised of $99.2 million, Starship has the potential to become not only a well-stablished player within the self-driving robot delivery market but also a serious competitor in the self-driving car market, if one also takes into consideration the miles traveled so far.”

Fernando Brügge, analyst, Industrial IoT at IoT Analytics

8. Tulip Interfaces

“Tulip’s low-code manufacturing platform addresses many of the pain points associated with traditional MES systems, such as lack of flexibility and high initial deployment costs. The strategic investment by DMG MORI (part of a $39.5 million round in Sept. 2019) provides a strong distribution channel for medium-sized manufacturers looking to improve their operations with apps built on Tulip’s flexible digital platform.”

Matthew Wopata, principal analyst, Industrial IoT at IoT Analytics

9. Vdoo

“The experienced founders (who founded Cyvera, acquired by Palo Alto Networks) were able to get additional funding of $25 million in January 2021. Vdoo’s security platform enables distributors and resellers of hardware (like investors Verizon and Dell) to add a holistic security layer to their product. In the current cybersecurity-focused environment, the company seems to be in a great position for further scaling with their experienced leadership team and great product.”

Philipp Wegner, senior analyst, Data Analysis at IoT Analytics

10. Veo Robotics

“Veo Robotics’ flagship product, FreeMove, enables human–robot collaboration in heavy-duty articulated robots without compromising on worker safety. Industrial workcells are monitored by sensors to generate a 3D field, based on which the algorithm operates. The speed and positioning of the robot is dynamically altered to provide the maximum level of safety and collaboration to the user.”

Sharmila Annaswamy, analyst, Industrial IoT at IoT Analytics

More information and further reading

Are you interested in learning more about the latest IoT developments?

The IoT Start-ups Report and Database 2021 is a comprehensive 67-page report & database assessing the current IoT startup landscape. It also includes a Global IoT startup database, with classification of 1,200+ companies. It is part of IoT Analytics’ ongoing coverage of general IoT.

This report provides answers to the following questions (among others):

- How many IoT startups are in the global market?

- Which startups have received the highest funding in the IoT space?

- Which region and country have the highest number of IoT startups?

- Which segment do the majority of IoT startups focus on?

- What type of IoT technology do the majority of IoT startups focus on?

- Which IoT startup trends over time are becoming evident for the tech stack?

- And more…

The sample of the report gives you a holistic overview of the available analysis (outline, key slides). The sample also provides additional context on the topic and describes the methodology of the analysis.

The sample of the report also includes a high-resolution version of the IoT Startup Landscape 2021 overview image of 1,200+ companies.

Related articles

You may be interested in the following recent articles:

- 5 Things to Know About the IoT Platforms Market

- The 7 Most Demanded IoT System Integration Services

- The 1,200 IoT companies that are creating the connected world of the future – IoT Startup Landscape 2021

Are you interested in continued IoT coverage and updates?

Subscribe to our newsletter and follow us on LinkedIn and Twitter to stay up-to-date on the latest trends shaping the IoT markets. For complete enterprise IoT coverage with access to all of IoT Analytics’ paid content & reports including dedicated analyst time check out Enterprise subscription.