IT and OT both started on individual paths in the 70s and slowly converged in the 90s and 2000s to form today’s widely accepted 5-layer architecture. Over the past few decades, hundreds of successful companies such as Wonderware (SCADA/MES), Modicon (PLC) and Keyence (I/O) began providing products and services for each of the different layers in the 5-layer stack.

As we head into 2020, the clear lines between the 5-layers are becoming more blurred than ever before. Early adopters of new industrial connectivity technologies and protocols are creating new data collection architectures that challenge the 5-layer architecture status quo and promise to usher in a new area of more scalable, cost-effective and purpose-built industrial connectivity solutions.

IoT Analytics’ latest Industrial Connectivity Market Report 2019-2024 looks at the different industrial connectivity architectures, components and protocols that are being deployed to create industrial data collection solutions. Here are 5 key industrial connectivity trends that emerged from the research:

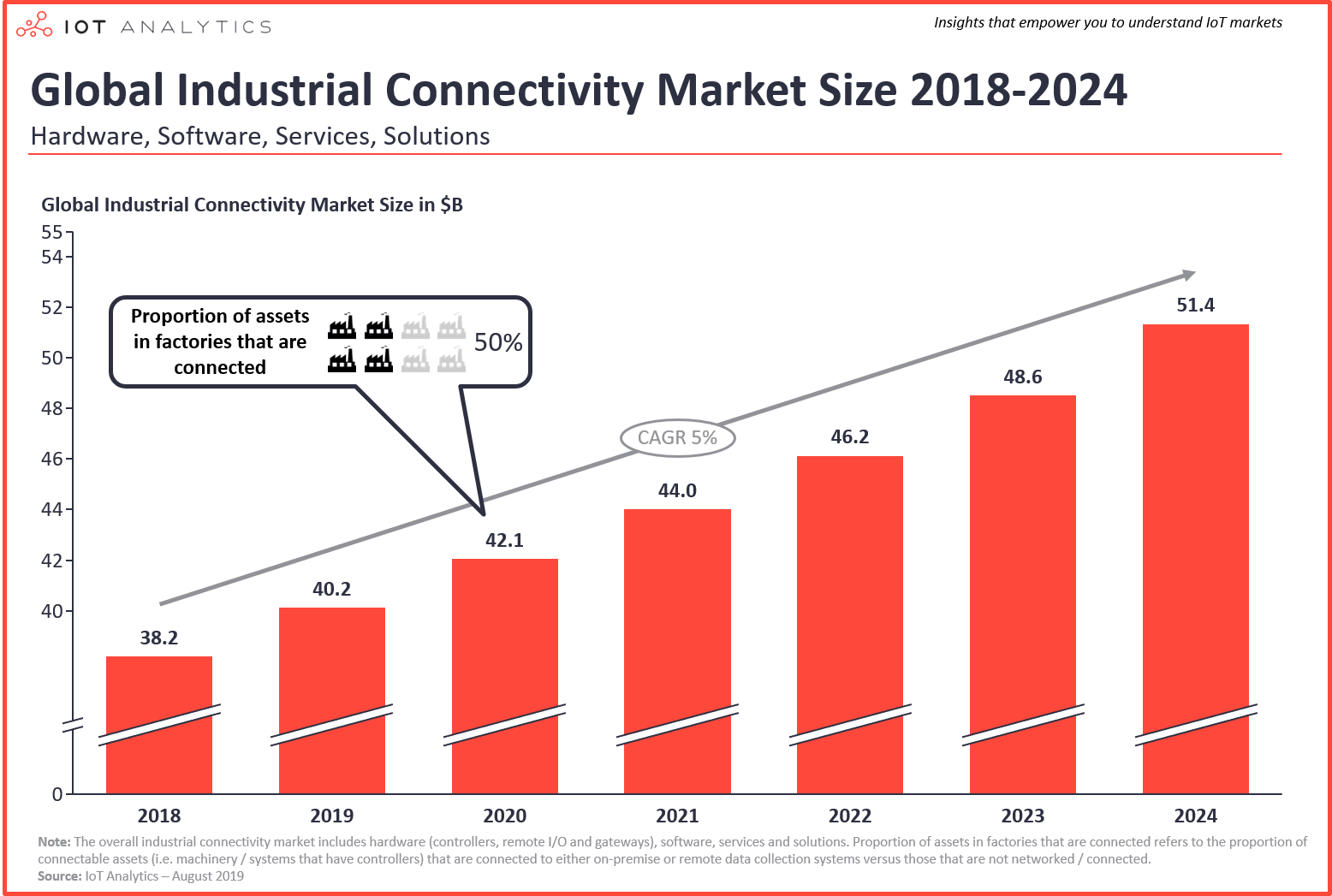

1. ~50% of industrial assets in factories will be connected by 2020

An increasing number of industrial asset operators and manufacturers are adding industrial connectivity to their assets. IoT Analytics’ latest report finds that by 2020, ~50% of industrial assets in factories will be connected to some form of on-premise or remote data collection system. The proportion of connected assets is projected to continue to rise and will be a key growth driver of the 5% CAGR that the $38.2B industrial connectivity market is projected to have between now and 2024.

Industrial connectivity hardware (such as gateways, PLCs, and remote I/O modules) is by far the largest industrial connectivity segment; however, the faster-growing software and services segments will take an increasing share of the spend by 2024 as more processing moves away from gateways and PLCs and into industrial PCs and datacenters. The solutions segment of the market will also grow faster than the overall market, as an increasing number of factories opt for end-to-end data collection solutions that bypass the traditional automation pyramid and send data directly to the cloud.

2. 340+ industrial connectivity vendors are fighting for market share

There are now more than 340 companies in the Industrial Connectivity market. The hardware and services segments contain the largest number vendors (170+ and 130+, respectively), and they are home to the two largest sub-segments: gateways (70+ vendors) and OT integration (100+ vendors). These large sub-segments are particularly fragmented despite ongoing consolidation; in 2019 at least four companies in these segments were acquired, including Comtrol Corp. (by Pepperl+Fuchs), Maestro Wireless (by Lantronix), Trimax (by Tesco Controls) and JR Automation (by Hitachi).

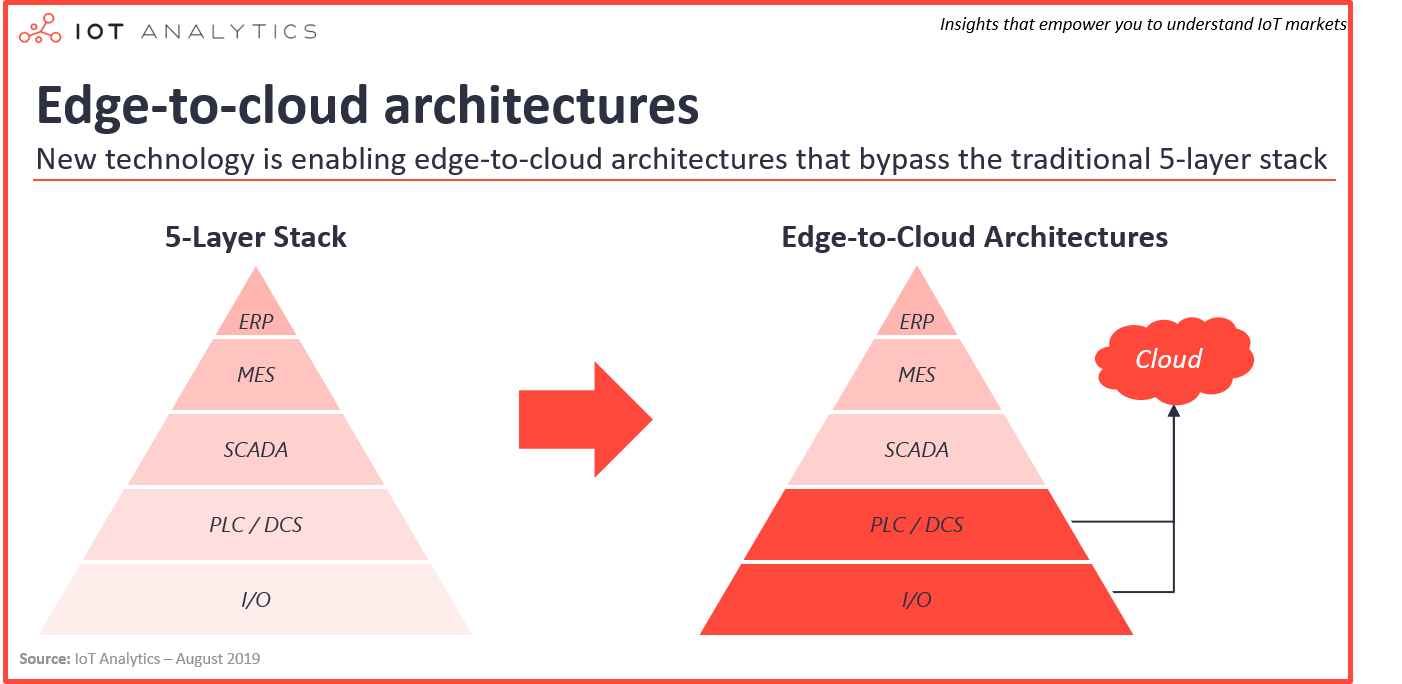

3. New edge-to-cloud architectures

As the top of the traditional 5-layer automation pyramid consolidates and moves to the cloud, new industrial connectivity architectures are being used to achieve direct edge-to-cloud connectivity.

The traditional method of communication through centralized SCADA and MES systems usually depends on OPC servers to translate Industrial Ethernet and fieldbus protocols into OPC compatible protocols. Technological advancements in A. Connectivity, B. Computing Hardware, and C. Software enable new connectivity architectures that bypass the traditional automation stack and provide direct edge-to-cloud connectivity.

- Connectivity: Companies like Oleumtech and WellAware are using novel connectivity protocols, in this case LPWAN networks (SigFox and RPMA, respectively), to connect their industrial sensors directly to the cloud.

- Computing Hardware: Industrial PC manufacturers like HPE or PLC/RTU manufacturers like Advantech are taking advantage of low-cost edge computing by developing products that can run software applications which enable edge-to-cloud industrial connectivity.

- HPE’s Edgeline industrial PC has been optimized to run a variety of industrial connectivity software applications, including HPE’s Edgeline OT Link, Kepware’s industrial connectivity software, and Softing’s dataFEED OPC Suite

- Advantech’s ADAM-3600 RTU natively supports connectivity to the Azure cloud

- Software: Industrial connectivity software vendors are now offering software specifically designed to run on edge devices as small as a Raspberry Pi. To streamline the connectivity process and reduce integration costs, edge connectivity software vendors have created partner programs that pre-certify industrial connectivity hardware from 3rd party vendors. Examples of hardware pre-certification programs include:

- Inductive Automation’s Ignition Edge Onboard program

- Microsoft’s Azure Certified for IoT program

- Telit’s deviceWISE Ready Partner program

4. Software enables small firms to challenge incumbents

More powerful edge processing, the increasing popularity of Linux, and new virtualization technologies are helping drive two key trends that are enabling smaller and medium-sized industrial automation vendors (SMEs) to better compete with the larger incumbents:

- De-coupling of hardware and software.

Traditional industrial connectivity included embedded software that was written specifically for that hardware. Moving forward, industrial connectivity hardware will be Linux-based and able to run variety of 3rd party industrial connectivity software applications. Factories and machine builders alike are adopting these de-coupled, Linux-based solutions in part because they help avoid hardware vendor lock-in and enable more scalable and future-proof architectures. - Consolidation of the hardware stack.

Industrial connectivity functions such as protocol conversion, cloud connectivity, and even process control can now be performed on a single piece of Linux-based hardware using software from 3rd parties. Combining all of this functionality within a single device (such as an industrial PC or data center) can dramatically reduce hardware costs for end users who have traditionally purchased separate pieces of equipment to perform each function.

Small and medium-sized industrial automation hardware vendors (such as those in the picture above) have been leading the way in offering Linux-based industrial connectivity hardware that takes advantage of the above-mentioned trends. Many of the large incumbents are faced with an innovator’s dilemma and are dis-incentivized to take advantage of these trends because doing so could lower their existing customers’ switching costs and potentially cannibalize highly profitable existing businesses.

Two hardware-agnostic software applications that are enabling these trends are CODESYS and Node-RED.

- CODESYS is an IEC 61131-3 compliant software-based PLC that runs on Linux and is embedded in a wide range of Linux-based industrial connectivity hardware offerings, including remote I/O (such as the Beijer Electronics BREN577), PLCs / RTUs (such as the KEB C6 Smart), HMIs (such as the Turck TX500) and gateways (such as the TTTech Nerve). By writing PLC programs in a hardware-agnostic software platform like CODESYS, factories and machine builders are able to more seamlessly execute control logic on different types of industrial hardware. This flexibility has a number of advantages, including better negotiating power with hardware vendors, avoidance of expensive PLC conversion projects (e.g. PLC-5 migrations) and the ability to more seamlessly scale up computing power as requirements evolve.

- Another Linux-based software offering is Node-RED, which is the most popular open-source software tool for enabling (among other things) protocol conversion and edge-to-cloud connectivity. Industrial connectivity hardware vendors that support Node-RED in their offerings include Advantech and at least 12 others.

5. New industrial connectivity protocols

IO-Link, OPC UA and MQTT are emerging as the fastest growing I/O, OT and IT protocols, respectively, as vendors and end users alike look to capture richer industrial datasets more efficiently. A key barrier preventing more widespread adoption of the OPC UA and MQTT protocols is the lack of widely adopted data structure standards. Efforts are being made to establish standard data structures (such as OPC UA companion specifications), but in practice most installations resolve to using custom data structures corresponding to custom PLC tag structures. Despite these remaining challenges, many industrial connectivity vendors have introduced products that natively support these protocols, such as:

- IO-Link remote I/O modules (10+ vendors, including ifm’s IO-Link masters)

- PLCs with native OPC UA servers (5+ vendors, including Schneider Electric’s M262)

- IoT and SCADA platforms with native support for MQTT (10+ vendors, including Microsoft’s Azure IoT)

- Gateway vendors with native support for MQTT (10+ vendors, including Hilscher’s netIOT gateways)

Further reading

Interested in learning more about the industrial connectivity market?

The 5 trends discussed in this article are explored in much further depth, including numerous additional examples, in the 159-page Industrial Connectivity Market Report 2019-2024. The report takes a deeper look at the industrial connectivity market, including architectures, protocols, hardware, software, services, solutions, key players, case studies and trends. The study, published in August 2019, also includes an industrial connectivity case studies database (60+ case studies), vendor list (340+ vendors) and market model data (21 tables) in Excel format.

A sample of the report and the database can be downloaded here.

Interested in continued IoT coverage and updates?

Subscribe to our newsletter and follow us on LinkedIn and Twitter to stay up-to-date on the latest trends shaping the IoT markets. For complete enterprise IoT coverage with access to all of IoT Analytics’ paid content & reports including dedicated analyst time check out our Enterprise subscription.