New research suggests that we may be at the beginning of a new business model paradigm for industrial equipment.

2010-2020: The decade of the consumer outcome economy

Back in 2010, few people foresaw that the 2010s would see a major shift in business models towards what is now widely known as the “subscription economy”.

Instead of purchasing things like software, music and movies, consumers started subscribing to services that provided these goods and services. Software companies that made the switch from perpetual licenses to subscriptions saw their market capitalizations skyrocket (e.g. Adobe’s market capitalization rose from $19B in January 2013 [the year in which it stopped selling perpetual licenses] to $163B in January 2020). Industries slower to adopt as a service business models (e.g. video) were disrupted by innovative start-ups (e.g. Netflix), and many of the incumbents went out of business (e.g. Blockbuster) or were forced to re-imagine their business models (e.g. Disney).

There is one underlying reason why these as a service business models thrive: consumers want outcomes, not ownership. And in the 2010s, subscriptions became the dominant model of choice to get rid of that ownership.

2020-2030: The decade of the machine outcome economy?

What will we be looking at 10 years from now, at the end of the next decade?

As the cloud computing revolution has shown towards the latter part of the 2010-decade, enterprises, just like consumers, also want outcomes and not assets. Our survey data show that manufacturers around the world also support this trend and would prefer to purchase outcomes, not assets.

We believe that we are at the cusp of a new business model innovation that would disrupt enterprise equipment ownership: equipment as a service – where companies pay for outcomes, not equipment.

Equipment as a service (EaaS) was famously pioneered in 1997 by Rolls-Royce, which lets airlines pay for their engines based on the number of flight hours. The model has yet to find widespread adoption in other industries, but our research shows that this is quickly changing.

The market for Equipment as a Service today

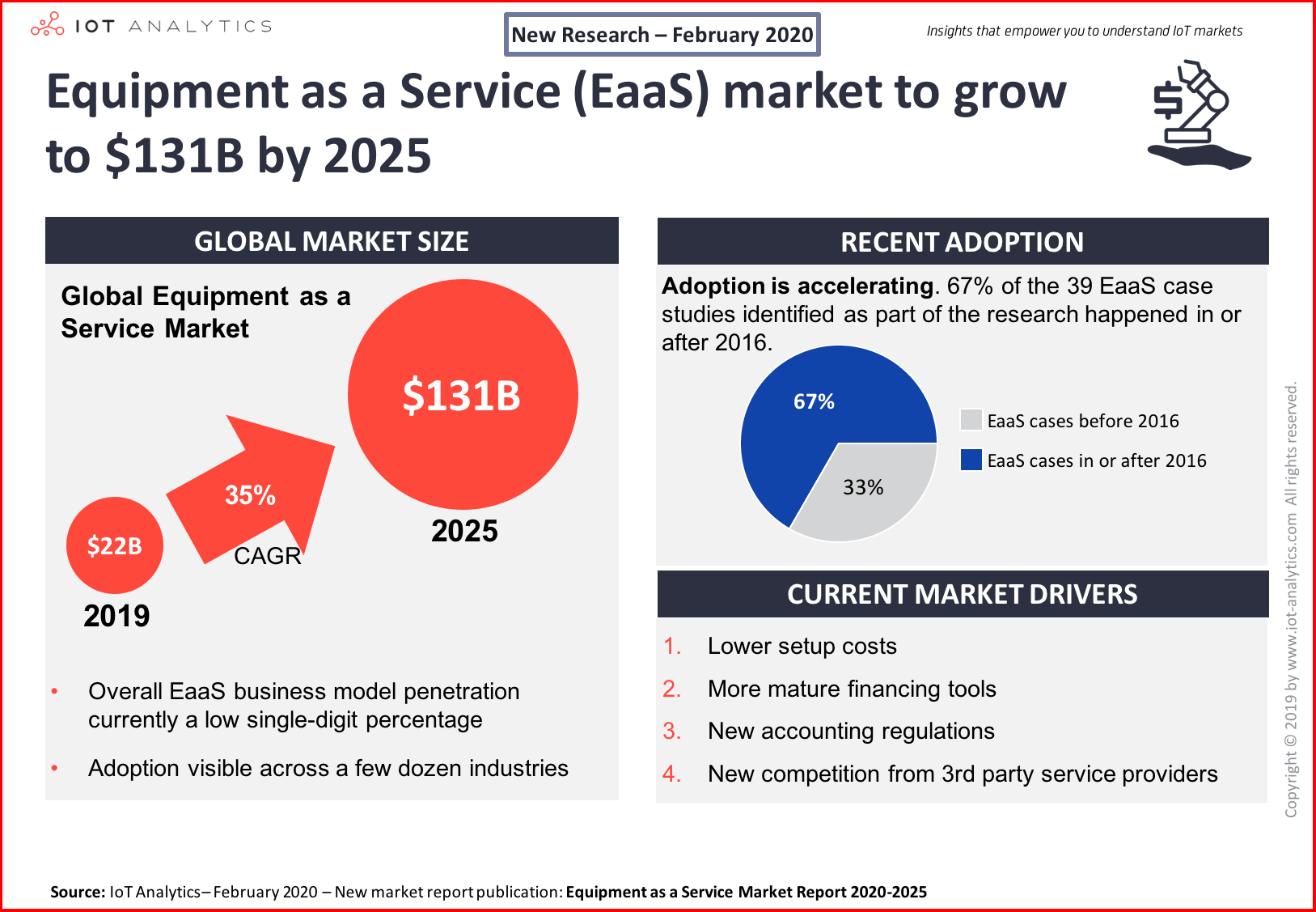

Thanks to Rolls-Royce and a few other pioneering companies, the market for equipment as a service reached $21.6B in 2019 – according to IoT Analytics’ 78-page Equipment as a Service Market Report 2020 – 2025, published in February 2020. That means that only a tiny fraction of the worldwide equipment market is sold “as-a-service” today.

The report includes a detailed definition of EaaS, market projections, key trends & challenges, insights from relevant surveys and more.

One of the findings of the report: adoption of EaaS business models is accelerating. 26 of the 39 (67%) of the EaaS case studies we identified occurred in the last 3 years.

This recent acceleration of new equipment as a service offerings may beget future growth as companies that have yet to adopt EaaS do so to remain competitive.

Rolls-Royce is a great example of what can happen to market share if OEMs are not first-movers; since introducing its jet engine equipment as a service offering “TotalCare” in 1997, Rolls-Royce has seen its large engine market share increase from ~14% to ~35%, with >90% of its new engines signed-up for the TotalCare program.

Why the market is poised for growth

Conversations we have had with end users, OEMs, and IoT technology vendors lead us to believe that the Equipment as a Service Market is set to accelerate in various industries in the coming years. Here are 4 reasons that are covered in the market report:

1. Lower setup costs

EaaS business models depend on accurate measurements of equipment usage or performance because EaaS vendors are compensated based on these metrics (e.g. a user of compressed air pays the compressor OEM per m3 of air produced).

The emergence of IoT-enabled solutions for measuring and collecting equipment usage has dramatically reduced the costs associated with measuring performance / usage and thus has made it economically viable to “connect the unconnected” and offer equipment as a service. Leveraging the right IoT technology and finance partners, new EaaS business models can be created in deployed in less than 2 years, where previously it took much longer.

2. More mature financing tools

Managing cash flow during the transition to EaaS can be a major challenge for companies, as traditional banks are often ill-equipped to provide the products and services OEMs and their customers require to move to EaaS. Over the past few years, a number of financiers specializing in EaaS business models have emerged, and in some situations governments have even started assisting with financing for EaaS projects that reduce energy consumption (e.g. ESCOs). Siemens Financial Services, for example, supports Siemens’ customers with financing equipment as a service projects, including energy performance contracts.

3. New accounting regulations

IFRS 16 and ASC 842 accounting regulations have changed the way leases are treated on balance sheets. End users that have traditionally used leases to minimize the assets on their balance sheets may look to switch to EaaS business models that comply with the new regulations while minimizing the assets on their balance sheets. One of the machinery OEMs analyzed in the report (HELLER) now offers 5 different methods for purchasing its equipment:

- Traditional leasing

- Loan financing

- Hire purchase

- Hire

- HELLER4Use

Each method offers slightly different financing arrangements to address the diverse needs of its customers. The HELLER4Use plan lets customers pay on a usage basis and includes insurance for lost machine hours.

4. New competition from 3rd party service providers

When 3rd party service providers / tech companies find success in reselling existing products as a service, it has historically been a sign that disruption (and subsequent as-a-service growth) is imminent. In fact, a clear pattern has emerged in several as-a-service business models over the years:

- A 3rd party service company (usually a tech start-up) begins reselling a product that has traditionally been sold on a one-time basis as a service (e.g. Netflix with video, AWS / Azure with IT infrastructure)

- The 3rd party service company develops an intimate relationship with its customers and creates its own products (e.g. Netflix creating original content, AWS and Azure creating their own server hardware)

- Incumbent suppliers start offering their own products as a service in response to competition from the 3rd parties (e.g. Disney offering Disney+; Dell, HPE and Lenovo offering IT equipment as a service)

The pattern is repeating itself in the machinery industry: 3rd party service / tech companies have started offering equipment as a service. A couple of examples include:

- EquipmentShare (construction equipment)

- Xometry and Hubs (3D printers, CNC, injection molding machines, etc.)

While these new software companies have not started manufacturing their own equipment (#2 mentioned in the pattern above), equipment OEMs like Caterpillar, HELLER, 3D Systems and others have started offering their equipment as a service (#3 above), which may be a sign that the rapid adoption of equipment as a service is just around the corner.

More information and further reading

Interested in learning more about equipment as a service?

The Equipment as a Service Market Report 2020-2025 is part of IoT Analytics’ ongoing coverage of Industrial IoT and Industry 4.0 (Industrial IoT Research Workstream). The main purpose of the report document is to help our readers understand the current EaaS landscape by defining, sizing and analysing the market.

This report provides answers to the following questions (among others):

- What is Equipment as a Service (EaaS)?

- How big is the equipment as a service market and how fast is it growing (by region and industry)?

- What percentage of equipment is currently sold as a service and how will this change over the next 5 years?

- What are the benefits of EaaS business models for both OEMs and end users?

- What are the key EaaS adoption drivers?

- What types of OEMs are currently adopting EaaS and why?

- What IoT technology and finance companies are OEMs partnering with to build EaaS businesses?

- Which customers (by region, industry, size, etc.) prefer to purchase EaaS and why?

- What are the key challenges associated with building EaaS business models?

- What are examples of successful EaaS business models?

A sample of the report can be downloaded here:

Are you interested in continued IoT coverage and updates?

Subscribe to our newsletter and follow us on LinkedIn and Twitter to stay up-to-date on the latest trends shaping the IoT markets. For complete enterprise IoT coverage with access to all of IoT Analytics’ paid content & reports including dedicated analyst time check out Enterprise subscription.