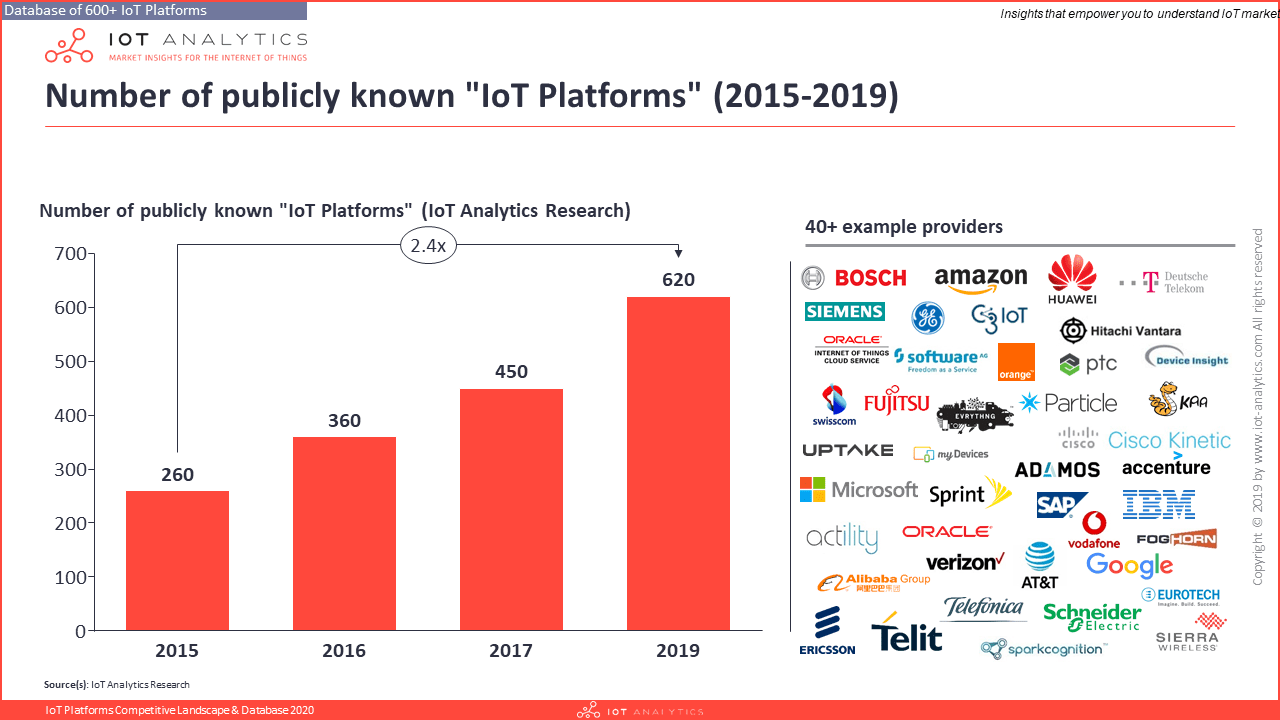

There are now officially 620 IoT Platform companies on the open market, up from 450 IoT Platforms companies in 2017 – this is according to the latest IoT Platforms competitive Landscape & database 2020.

Key findings of the IoT Platform Competitive Landscape & Database 2020 report:

- The market is NOT consolidating: There are now 620 IoT platform vendors, up from 450 in 2017

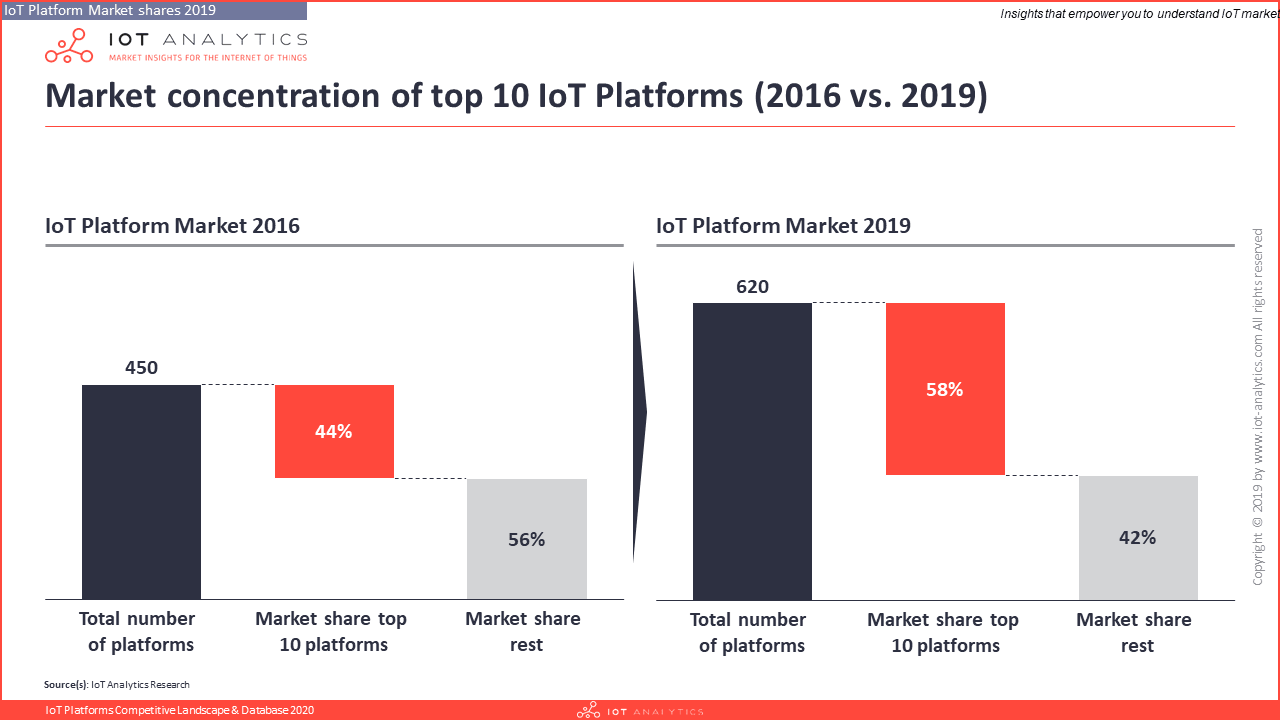

- The market is concentrating around a few providers: The top 10 providers had 58% market share in 2019, compared to 44% for the top 10 in 2016

- Leading providers continue to grow at 40%+

- Industrial/Manufacturing is the #1 vertical – 50% of platforms focus on it

- More…

Disclaimer: This article does not provide guidance or intend to compare technical features of different IoT platforms. It looks at the market and compares platforms purely on a market meta level.

Some of the key findings from the competitive landscape report include:

1. The market for IoT Platform companies is NOT consolidating

Despite numerous articles circulating the internet claiming that the IoT Platform market is showing signs of consolidation, our research shows that the exact opposite is happening: The market is becoming even more fragmented.

Of the 450 IoT Platform companies that made the IoT Analytics list in 2017, 47 ceased operations and 70 were acquired. Of the 70 acquired, 22 continue to operate standalone. One may think that this reduces the total number of IoT Platforms to 355. However, through our research of hundreds of websites, presentations, and other materials, IoT Analytics identified an additional 265 IoT platforms which satisfy the IoT Analytics definition of IoT Platform, thereby bringing the total number up to 620.

These additional companies include new IoT Platform startups like IOTech (founded in 2017) as well as IoT platforms provided by larger companies or joint ventures (e.g., Adamos – founded 2017, Open Manufacturing Platform by BMW and Microsoft – launched 2019).

There are several reasons why many of the small players continue to survive in a market with hundreds of competitors.

- There are many niches in IoT. By focusing on specific use cases or industries, some firms bring a value proposition to customers that the larger more horizontal players cannot.

- It is easy to become an IoT platform company on paper. Several companies seem to have gone the route of doing a customized IoT software project with a customer and afterwards standardizing the elements of that solution to market them as a platform.

- Many smaller providers are profitable. Our team has talked to several providers who sometimes just cater to 5-10 customers with a team of 20 people and are profitable. Their customers seem to enjoy the service they are getting so one can imagine these players to continue to exist for a while.

2. The market is concentrating around a few providers

While the IoT Platform market is not consolidating, it is certainly concentrating around a few key providers. The top 10 of the 450 providers in 2017 held about 44% of the market share according to IoT Analytics estimates. In 2019, the top 10 of the 620 providers are estimated to hold 58% market share.

Cloud companies AWS and Microsoft stand out particularly. Both firms have added tremendous capabilities to their IoT platform offerings since 2017. At that time, their IoT Platform offerings were extremely limited. In April 2018, Microsoft committed an investment of $5B to their IoT offering. The investments seem to have started to pay off already. Both companies rank very well in the list of top 10 IoT Platforms by revenue and they also dominate end-user satisfaction of IoT platforms.

One should note that there are some large well-known multi-national companies that do not manage to keep up with the pace of the market and therefore seem to be falling behind. Instead of pulling out of the market, some of these firms are quietly retracting their IoT Platform marketing and using the existing platform technology to build their own IoT software applications (SaaS) instead e.g., focusing on specific end-user applications such as machine health monitoring or factory OEE analysis.

3. Many providers still growing ~40%+

The article that described the research findings of the 2017 IoT Platform companies landscape highlighted the fact that leading platforms were growing 50%+ at that time. While the growth rates are slowly coming down, most providers are sustaining very high growth rates (e.g., Software AG ~50% Q3 2019 vs Q3 2018). On average, the market as a whole is still growing at around 40% and has become a single-digit billion dollar market that is expected to grow into double digit $B territory within the next 2 years.

4. Manufacturing is the #1 focus area of IoT Platforms

50% of all profiled IoT Platform companies now have a dedicated focus on manufacturing/industrial use. Many of those companies highlight numerous case studies on their own website that showcase how their technology has helped manufacturers save costs or capture new revenue streams. Typical use cases of IoT Platforms in the manufacturing space include condition monitoring and predictive maintenance, general dashboards and visualizations, energy monitoring, and quality control.

SAP stands out as the company with most public case studies in the manufacturing domain (Please note: This number does not mean that SAP is the market leader for IoT Platforms in the manufacturing domain).

The other two large target areas for IoT Platforms are Energy (34%) and Mobility (32%).

More information and further reading

Interested in learning more about the IoT Platforms market?

The 4 IoT Platform findings discussed in this article are explored in much further depth in the 70-page “IoT Platform Competitive Landscape & Database 2020 report”.

The report also provides a detailed excel database with 40+ columns of information for 620 IoT Platform companies currently on the market today. A meta-analysis of the database provides market breakdowns by region, country, city, tech stack, industry and by number of case studies. Furthermore, recent news and current market trends are outlined in the report.

A sample of the report and the database can be downloaded here:

Other IoT Platform related content includes:

- IIoT Platforms for Manufacturing 2019-2024

- IoT Platforms Market Report 2018-2023

- IoT Platforms End-user Satisfaction survey 2019

Are you interested in continued IoT coverage and updates?

Subscribe to our newsletter and follow us on LinkedIn and Twitter to stay up-to-date on the latest trends shaping the IoT markets. For complete enterprise IoT coverage with access to all of IoT Analytics’ paid content & reports including dedicated analyst time check out Enterprise subscription.