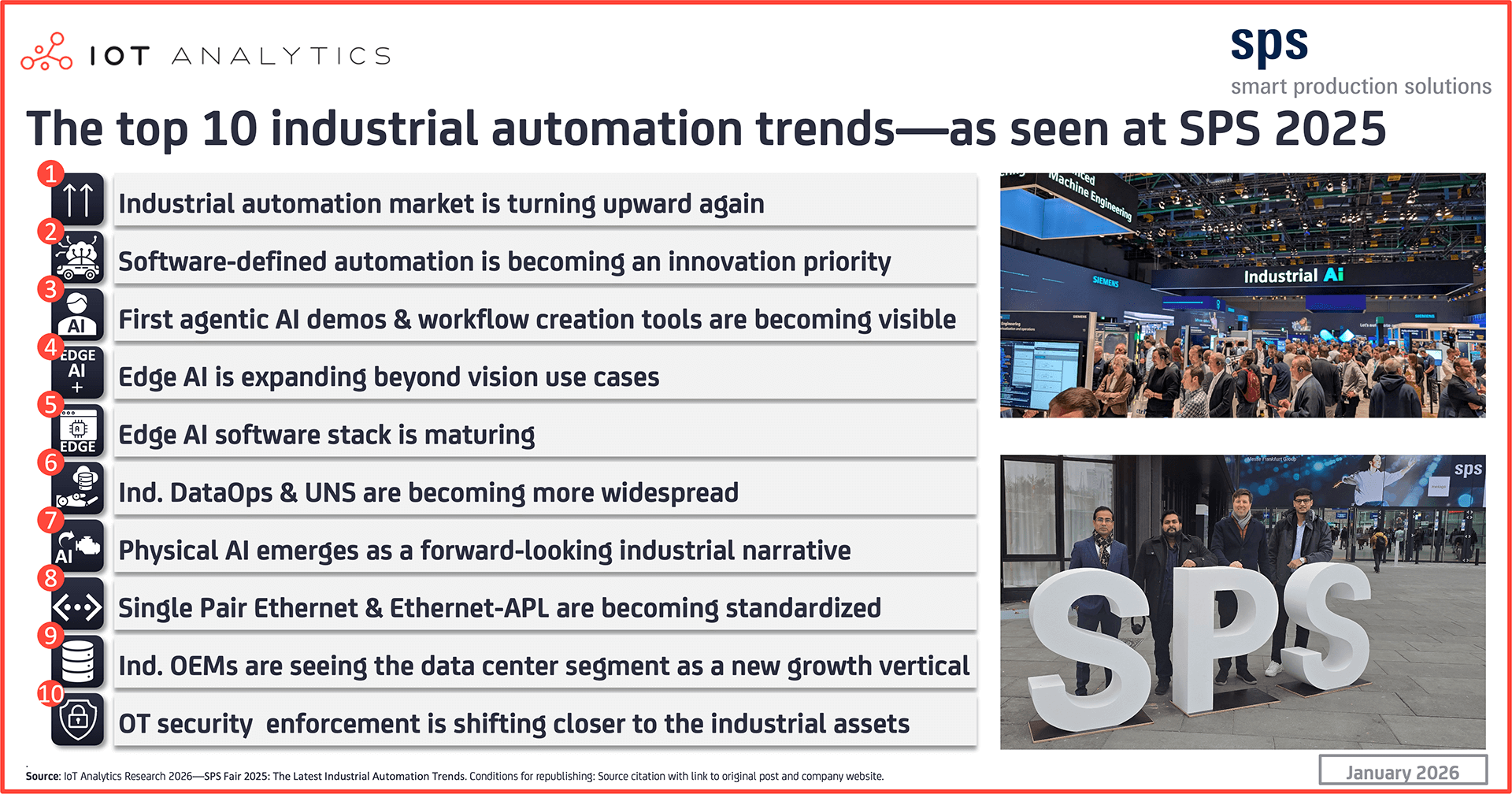

In short

- The IoT Analytics research team updated its list of top 10 industrial automation trends after attendance of SPS (the Smart Production Solutions fair) in November 2025 .

- IoT Analytics had a team of 4 analysts in attendance, together producing a 79-page event report.

- Key standout trends based on observations and extensive interviews with industry experts on-site include: Software-defined automation, Industrial AI, and edge AI.

Why it matters?

- SPS is one of the world’s most important industrial automation fairs. The showcased technologies are widely applicable to any industrial company.

In this article

- 10 industrial automation trends observed at SPS 2025

- 1. The industrial automation market is turning upward again

- 2. Software-defined automation is becoming an innovation priority

- 3. First agentic AI demos and workflow creation tools are becoming visible

- 4. Edge AI is expanding beyond vision use cases

- 5. The edge AI software stack is maturing

- 6. Industrial DataOps and unified namespace are becoming more widespread

- 7. Physical AI emerges as a forward-looking industrial narrative

- 8. Single Pair Ethernet and Ethernet-APL are becoming standardized

- 9. Industrial OEMs are seeing the data center segment as a new growth vertical

- 10. OT security enforcement is shifting closer to the industrial assets

- Comparison of edge AI showcases (Insights+ exclusive)

- Comparison of virtual PLC showcases (Insights+ exclusive)

Smart Production Solutions 2025

Software, IT, and AI took center stage at SPS 2025. Smart Production Solutions (SPS), a leading industrial automation exhibition fair encompassing a broad spectrum of digital and smart automation solutions, returned November 25–27, 2025, in Nuremberg, Germany. Attendance continued its upward trend, up 9% over 2024 at just over 55,000 people.

There were 1,175 exhibitors (a 5% climb over 2024), all showcasing their expertise and aiming to help companies understand and meet their challenges today and tomorrow. Traditional industrial automation themes (e.g., control, drive, and sensor technology) were largely present, but software, IT, and AI held significant focus. There was also a remarkable 41% jump in participation by Chinese vendors at the fair compared to 2024.

“SPS is a fixture on the automation industry’s calendar. If you don’t exhibit here, you don’t exist! Meanwhile, it doesn’t just offer maximum visibility; it’s an environment where key ideas are shared, which is indispensable in challenging times.”

Felix Kranert, Vice President Marketing DACH at Schneider Electric

IoT Analytics had a team of 4 analysts on the ground. The team visited over 80 booths and conducted over 60 individual interviews to get a handle on the latest industrial automation trends. This article only highlights some of the major takeaways; our research clients can refer to the 79-page SPS Fair 2025: The Latest Industrial Automation Trends report for other takeaways, further examples from those discussed below, key announcements, and insightful quotes from key industry automation players.

This article is derived from SPS 2025, a leading industrial automation exhibition

Get insights from the world’s leading industrial technology exhibitions 2026

Full SPS 2025 exhibition coverage is available to IoT Analytics corporate subscribers. Throughout 2026, subscribers will receive 10 post-conference reports from major industrial technology fairs, including Hannover Messe, SPS, and Automate.

Corporate subscription access includes:

- 10 comprehensive post-conference write-ups

- Key market numbers and market reports

- Analysis of trends, vendor strategies, and more

Already a subscriber? View your reports and trackers here →

10 industrial automation trends observed at SPS 2025

1. The industrial automation market is turning upward again

Industrial automation market upturn signals appear, but recovery remains uneven. Following a volatile 2025 notably marked by tariff uncertainties, SPS 2025 discussions and referenced indicators point to a gradual normalization in ordering and a more constructive setup for 2026, albeit with material macro risk still in view.

Siemens Digital Industries (DI), a business unit of Germany-based Siemens, positioned its year-end performance as a cyclical inflection. The business unit closed fiscal 2025 with 9% comparable growth in Q4 (to ~€5 billion), attributed to a 10% increase in automation revenue and 8% in software, despite a -4% comparable change for the full year, indicating the rebound is back-end loaded rather than broad-based. For fiscal 2026, Siemens DI expects 5–10% comparable revenue growth and a 15–19% profit margin, with management noting factory automation as a specific area for growth opportunity.

“The market is picking up, in particular in the factory automation space. Machine building still holds back a little bit. […] We see traction in the market for our new products, which we launched. We are about to launch 20 new ones, for example, IOs and they would even go global.”

Roland Busch, CEO, Siemens AG, on November 13, 2025 (source)

Germany-based Beckhoff similarly framed 2025 as volatile (strong Q2, weaker Q3), but argued that inventory-hoarding, which it claims distorted its previous revenue figures, has largely cleared. Following a 33% decline in 2024 tied to inventory correction, the company anticipated 7–10% overall growth in 2025 and a healthier trajectory into 2026.

Germany’s Association of the Electrical and Digital Industry (ZVEI)’s outlook data reinforced the “upward” narrative, citing a September order rebound that lifted year-to-date growth. However, the association cautioned that global trade barriers and geopolitical uncertainty remain persistent downside risks.

2. Software-defined automation is becoming an innovation priority

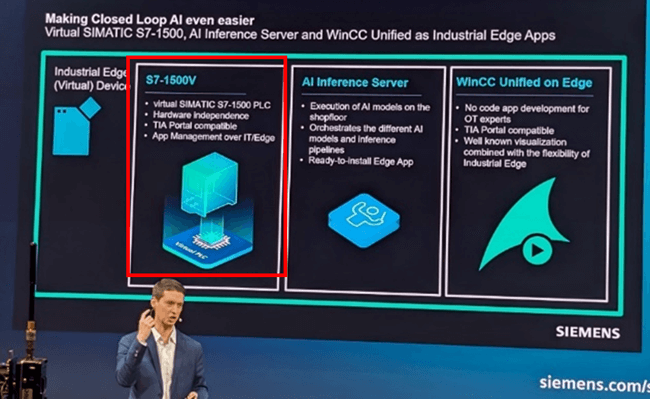

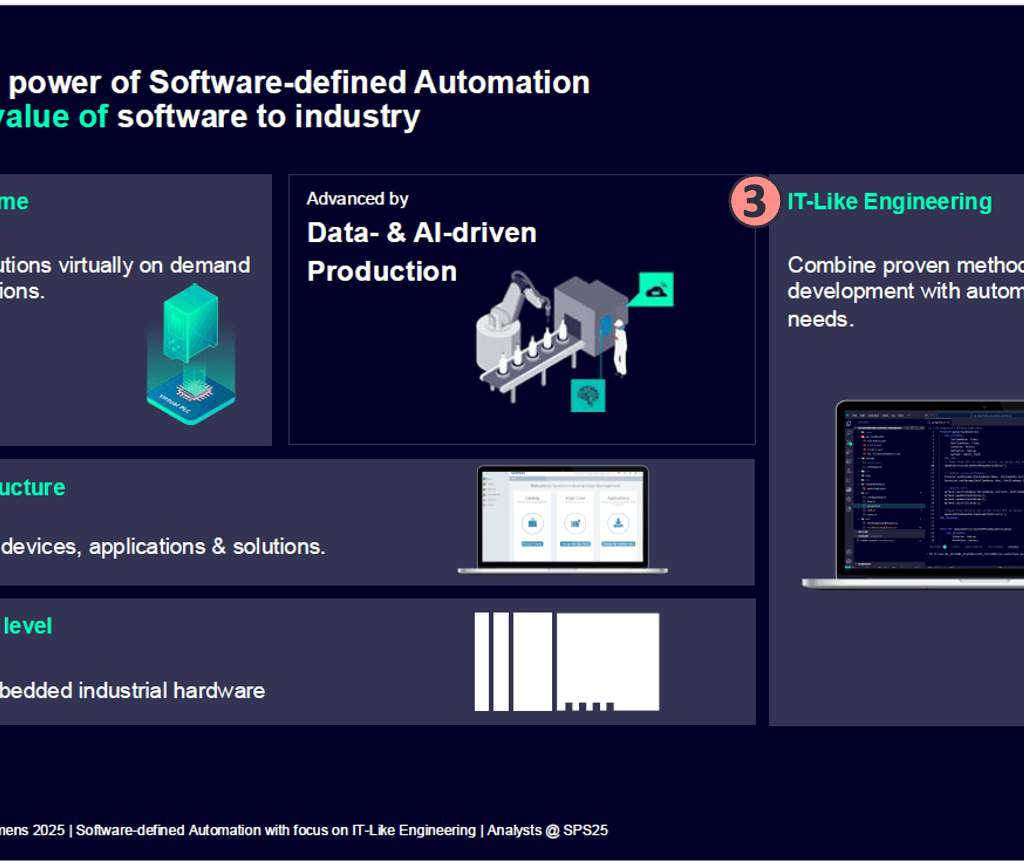

Software-defined automation (SDA) moving from “innovation topic” to platform strategy. SDA is a shift in industrial architecture by decoupling control software from proprietary hardware. At SPS 2025, it became clear to the team that the trend continues to gather steam, with several vendors (some for the first time) now actively pushing their own SDA roadmaps.

In Siemens’ framing, SDA is anchored in 3 pillars: 1) Industrial Edge as standardized software infrastructure, 2) virtualized control runtimes (vPLC), and 3) IT-like engineering via SIMATIC AX—explicitly linking the approach to both scalability and talent availability. The company highlighted that its vPLC runtime can now run on any x86 device and introduced an “entry-level” CPU 1511V to lower adoption barriers beyond high-end lighthouse deployments. Germany-based automotive company Audi, one of Siemens’ flagship customers, reported that Siemens’ vPLCs running at its Neckarsulm and Ingolstadt plants have been running for 6 months with 100% uptime.

US-based Rockwell Automation’s Logix Edge similarly signals a prioritization of software-centric control, with the Logix engine running as an isolated workload on an IPC (positioned to coexist with other edge workloads) and targeted for release in Q4 2026. Meanwhile, messaging from Germany-based Endress+Hauser indicated that the company views SDA as a shift toward treating field instruments as IT assets that are decoupled from hardware and remain update-ready in a manner similar to modern mobile devices.

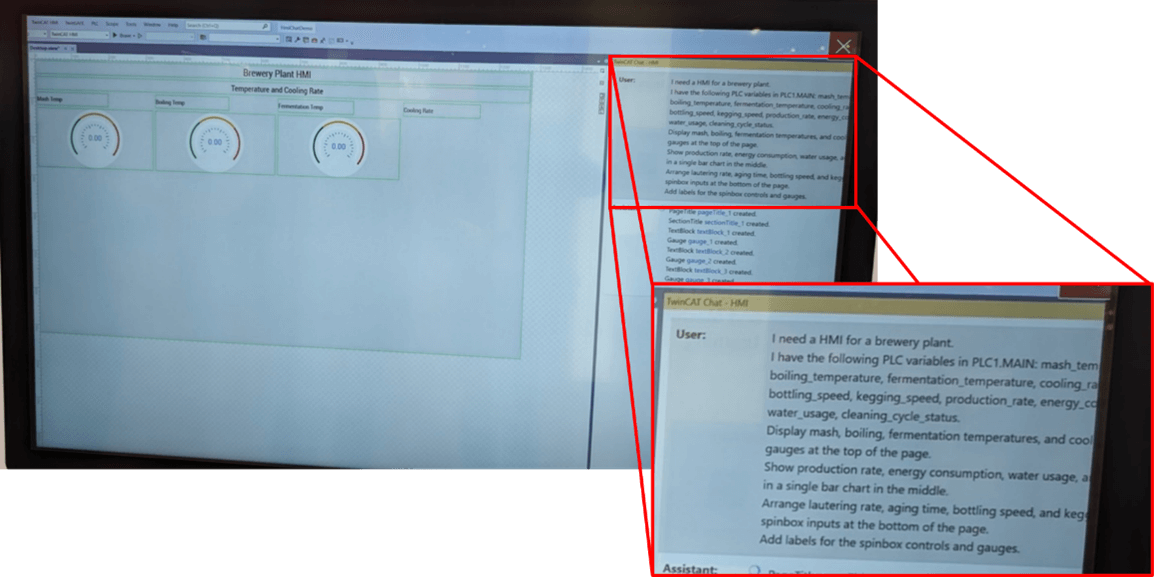

3. First agentic AI demos and workflow creation tools are becoming visible

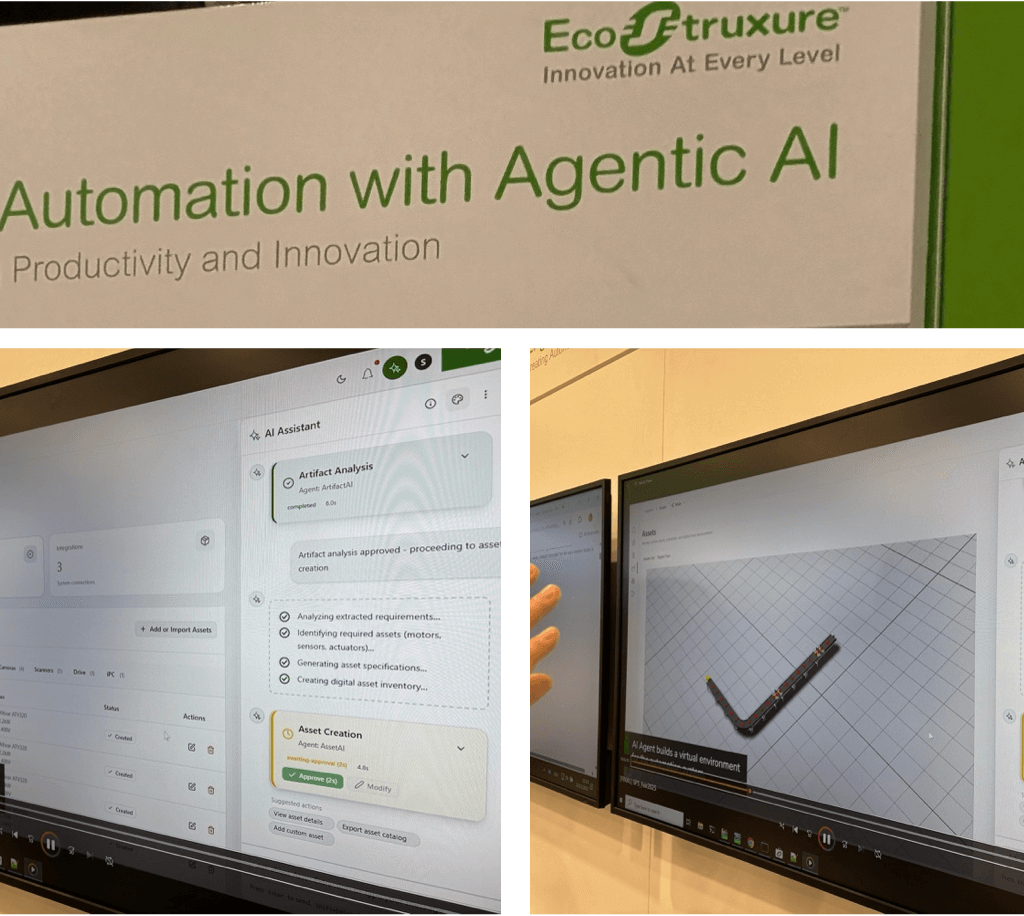

Vendors advancing generative AI (GenAI) toward autonomous agents. While vendors in general showcased multiple industrial GenAI copilots, the team noted that some vendors were moving beyond basic querying toward software that can plan, execute, and verify tasks across engineering and operations, with humans remaining in the loop for safety and approval.

France-based Schneider Electric positioned agentic AI as an autonomous engineering agent inside its EcoStruxure Automation Platform: agents convert user specifications/technical specs into control applications for EcoStruxure Automation Expert, supported by digital twin creation plus testing/simulation, and (in the more detailed demo description) tool-calling via an MCP framework for deployment, simulation, and unit testing—while keeping a human in the loop for final approval.

Meanwhile, Siemens demonstrated how its low-code Insights Hub Copilot Studio (introduced in March 2025) enables end-users to build and manage AI agents. Agents are created by defining system instructions (behavioral guardrails) within the workbench and then attaching modular “Skills” (modular, reusable task-capabilities, e.g., “analyze OEE”).

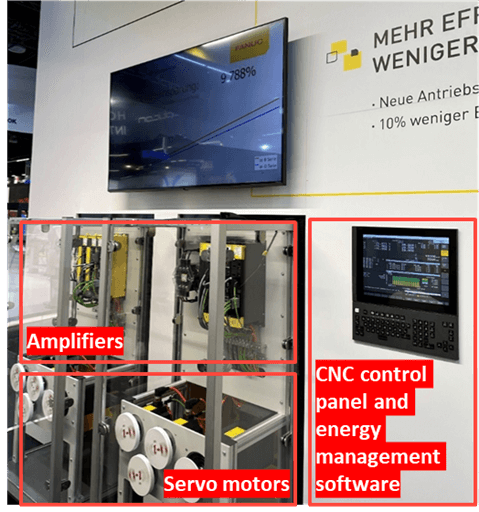

4. Edge AI is expanding beyond vision use cases

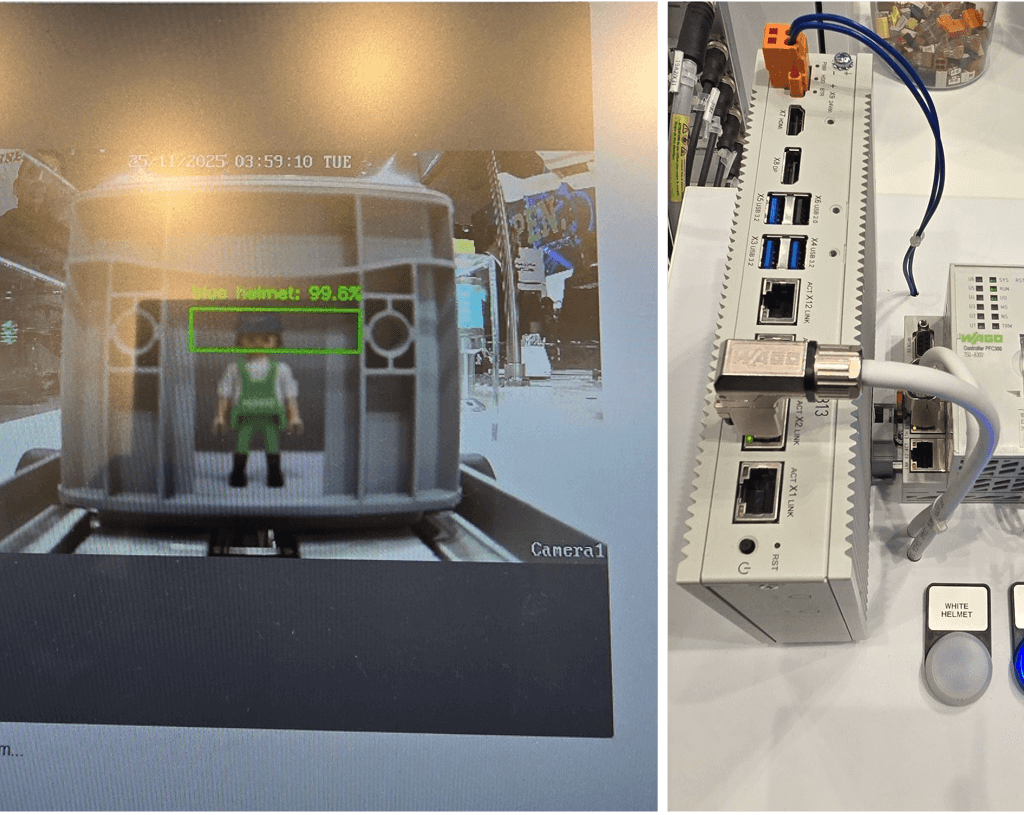

Integrated NPUs now enable edge analytics. Edge AI exhibits atSPS 2025 showed a clear shift toward embedding NPUs directly into IPCs and controllers, enabling real-time inference locally without cloud latency or bandwidth costs. This fills the performance and cost gap between CPU-only analytics at the low end and GPU-based workloads at the high end. Additionally, the report’s analysis of the various edge AI stacks observed at the fair found that use cases are moving beyond traditional vision applications, including safety-critical vision, diagnostics, and troubleshooting/support use cases.

Germany-based Bosch Rexroth extended its ctrlX CORE with a Hailo-8 M.2 module (and highlighted optional NVIDIA GPU extensions on ctrlX IPCs) to run AI workloads directly alongside real-time control tasks, including safety-/compliance-adjacent vision use cases like near-miss and PPE monitoring without cloud streaming. WAGO, also based in Germany, similarly demonstrated an IPC-based vision workflow accelerated by a Hailo-8 M.2 NPU; notably, the same IPC can host a virtual PLC runtime, implying a converged edge platform where AI monitoring and control logic coexist locally.

Regarding use cases, Beckhoff expanded its TwinCAT Machine Learning Creator from vision toward time-series automation signals, enabling engineers to label cyclic data and trigger training with minimal effort (e.g., classifying tool–workpiece engagement using internal signals). Likewise, Taiwan-based Advantech showcased edge IPC platforms positioned not only for vision but also for on-device LLM/VLM-style workloads to support troubleshooting and technician workflows.

5. The edge AI software stack is maturing

Edge AI: From AI hardware to full AI pipeline ownership. Industrial automation vendors are building end-to-end edge AI software stacks that cover data ingestion, application packaging, deployment, and operations, typically using containerized delivery to keep the AI application layer portable across IPC/edge-server hardware options. In that context, differentiation is increasingly becoming “who owns the AI deployment pipeline” (distribution, versioning, and lifecycle controls) rather than who sells the compute box.

Advantech highlighted packaged stacks plus on-device continuous learning. The company framed its WISE-Edge as a containerized software layer (with SDKs/APIs) for deploying and managing industrial AI workloads as pre-integrated, application-ready platforms, reportedly reducing custom integration effort and enabling repeatable scaling. It also demonstrated local annotation and retraining on the device (including federated learning approaches) and highlighted its partnership with eNeural’s eSL Craft for “self-learning” edge workflows where models can be updated without pushing raw data to the cloud.

Meanwhile, Beckhoff promoted engineer-driven training into standard PLC workflows. The aforementioned expansion of TwinCAT Machine Learning Creator from vision into time-series signals helps engineers label cyclic automation data and trigger training “with a single click,” generating a deployable model artifact alongside corresponding PLC code.

6. Industrial DataOps and unified namespace are becoming more widespread

Vendors continue to sharpen their UNS offerings. The exhibition highlighted a shift in technical maturity as the UNS is now maturing beyond just MQTT connectivity. As the industrial DataOps space matures, vendors are leveraging high-throughput backends (such as Kafka and NATS), integrating historical data with real-time streams, and introducing architectural modularity (independent, decoupled data nodes that scale hierarchically).

Germany-based United Manufacturing Hub (UMH) demonstrated “stream + history” convergence, enabling UNS to be usable at scale. It mirrored an entire namespace into a SQL database with identical naming conventions, so historical queries (e.g., prior shifts/weeks) became as accessible as real-time streams, which can enable downstream business intelligence usage via familiar SQL tools rather than bespoke stream processing.

i-flow, a Germany-based industrial DataOps company, presented a modular, multi-tier UNS design bridging edge-level factory nodes to enterprise brokers. By leveraging the NATS protocol as a high-performance messaging backbone, the architecture enables horizontal scaling across distributed sites. This setup supports data contextualization either on a per-use-case basis or by mapping data to standardized ISA-95/ISA-88 payload structures per asset type.

7. Physical AI emerges as a forward-looking industrial narrative

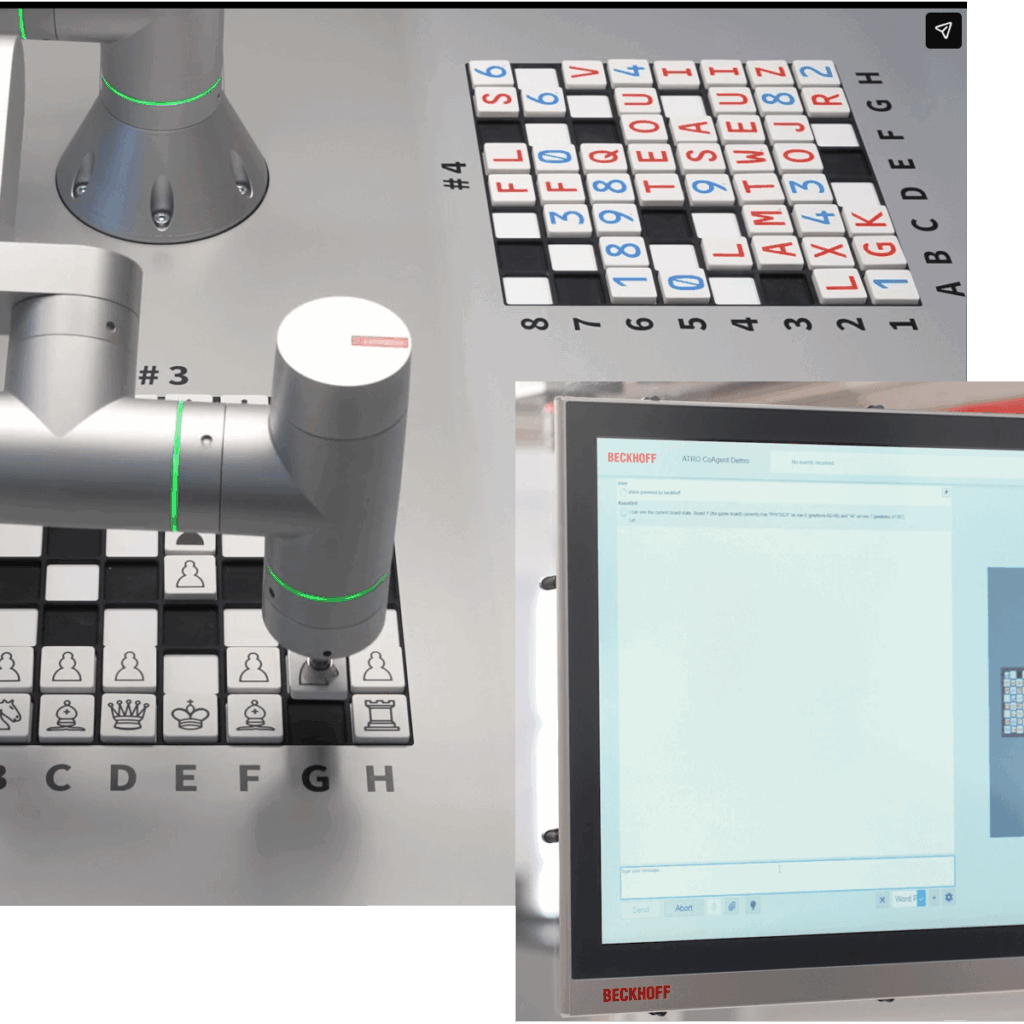

Physical AI being framed as the next step after agentic workflows. At SPS 2025, so-called physical AI surfaced as a forward-looking narrative for applying AI models (including LLM-driven reasoning) to perception and higher-level decision-making in systems that act in the physical world, while conventional automation layers continue to execute deterministic control and safety functions.

Beckhoff demonstrated a physical AI setup in which an LLM guided a Beckhoff ATRO robot playing board games. The ATRO modular robot arm was used to play Scrabble and Chess against a human opponent, with a camera capturing the game board and sending the video stream to a large language model that interpreted the board position and suggested the next move in text form. TwinCAT CoAgent wrapped this LLM interaction and passed the move to the automation system via MCP, while the existing PLC and motion control on a C6043 IPC with an NVIDIA GPU executed the robot motion. The control code remained unchanged when switching between games, illustrating that AI-based perception and reasoning can be adapted without re-engineering vision algorithms or motion programs.

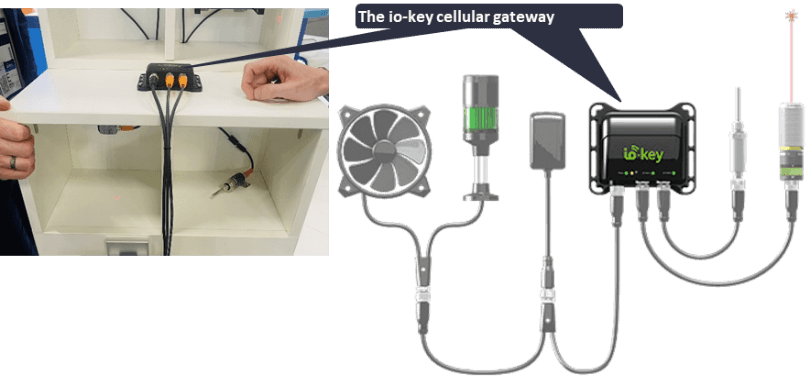

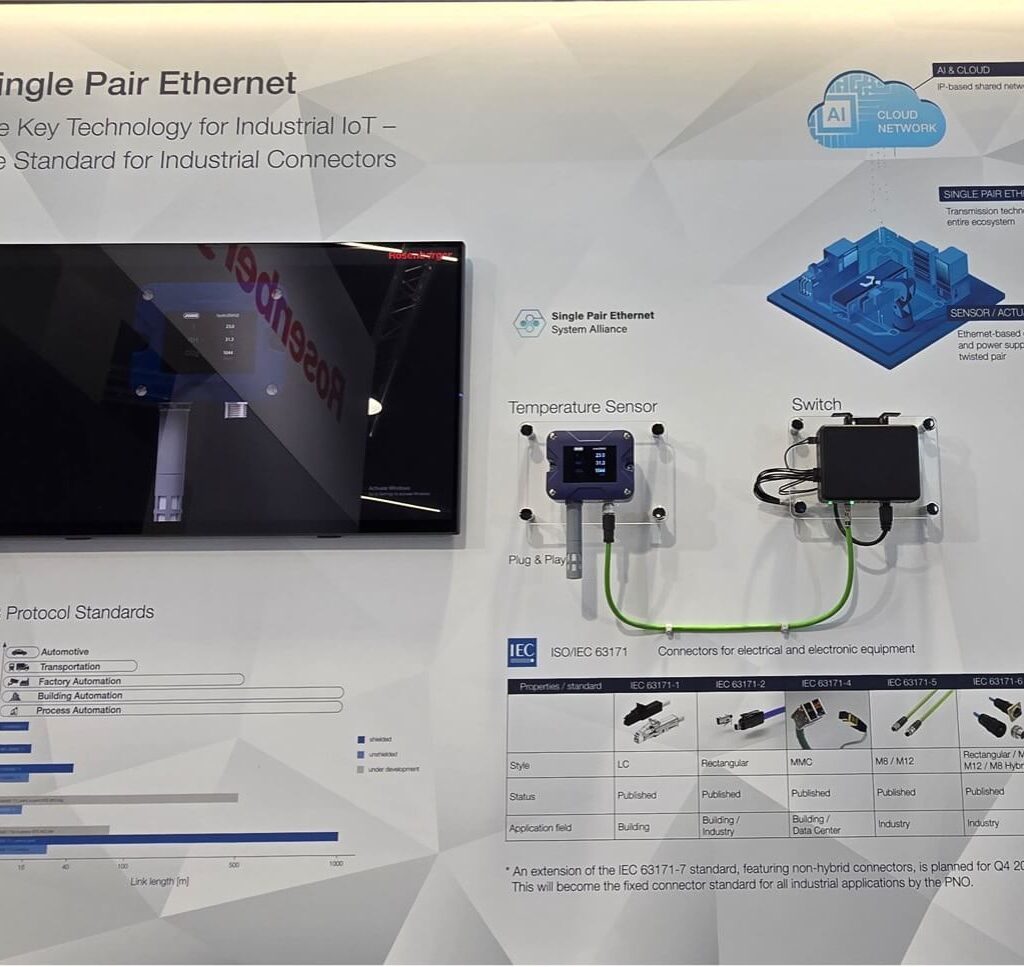

8. Single Pair Ethernet and Ethernet-APL are becoming standardized

Single Pair Ethernet (SPE) and Ethernet-APL standardization signal major connectivity advances. SPE is being repositioned from a technically promising but commercially slow technology into a scalable industrial connectivity option, driven by connector standard consolidation. Industry bodies and ecosystem players, including the SPE Industrial Partner Network and the Single Pair Ethernet System Alliance, have aligned on IEC 63171-7 as the common industrial SPE connector standard, resolving the compatibility deadlock that previously slowed product roadmaps and enabling vendors to design SPE interfaces with confidence that they will be interoperable across suppliers and applications.

Germany-based Rosenberger’s booth presentation positioned SPE as “the key technology for Industrial IoT,” showcasing complete SPE link implementations from sensors through switches to higher-level networks. Its volume-ready IEC 63171-7 portfolio marks a move away from SPE’s pilot phase, offering OEMs the industrial-scale supply needed for mass-market adoption.

Meanwhile, Ethernet-APL switch vendor messaging appears to be shifting from architecture diagrams to deployable field-switch products and the commissioning and operations workflows needed for plant rollout. Vendors are positioning the APL field switch as the anchor that connects 10BASE-T1L field devices into the Ethernet control network.

At the fair, Taiwan-based Moxa demonstrated its TWS-3010-APL-8PS-2GC-T (TWS meaning two-wire switch). The company emphasized the process-grade performance of its switch, offering 10 Mbps data and power over 1,000 meters. The technology is purpose-built for hazardous zones, utilizing intrinsically safe design to provide high-speed connectivity in potentially explosive environments.

9. Industrial OEMs are seeing the data center segment as a new growth vertical

Automation vendors target data center infrastructure. Driven by the explosive growth of AI compute, leading automation vendors are extending their industrial portfolios into the data center segment. These vendors see significant automation value in data center support systems, such as cooling loops, pumps, power auxiliaries, and redundancy layers, where uptime requirements and operational complexity more closely resemble those of high-availability industrial environments than those of traditional building automation.

Schneider’s approach centers on scaling thermal management and integrating it with high-availability control, with the company’s executives describing the segment as strategically critical. The portfolio focus is specialized cooling infrastructure, explicitly leveraging acquisitions such as MotiveAir (liquid cooling) and Uniflair for cooling distribution units (CDUs), combined with redundant control and building automation to target near-zero downtime. Partnerships (including NVIDIA and APC) and a cited order backlog were used to substantiate near-term demand, with the U.S. identified as the largest growth region.

Siemens is positioning data centers as “AI factories,” emphasizing redundancy plus IT/OT scale. The company highlighted redundant control (e.g., S7-1500H) for high-availability power/cooling and positioned WinCC OA as an IT/OT layer suited to hyperscale data-point volumes. Switzerland-based ABB also reinforced its data center presence, spanning electrical distribution, liquid-cooling components, and automation services, along with a shift toward DC grids. This signals that this vertical is becoming a multi-vendor battleground across the power-to-cooling stack.

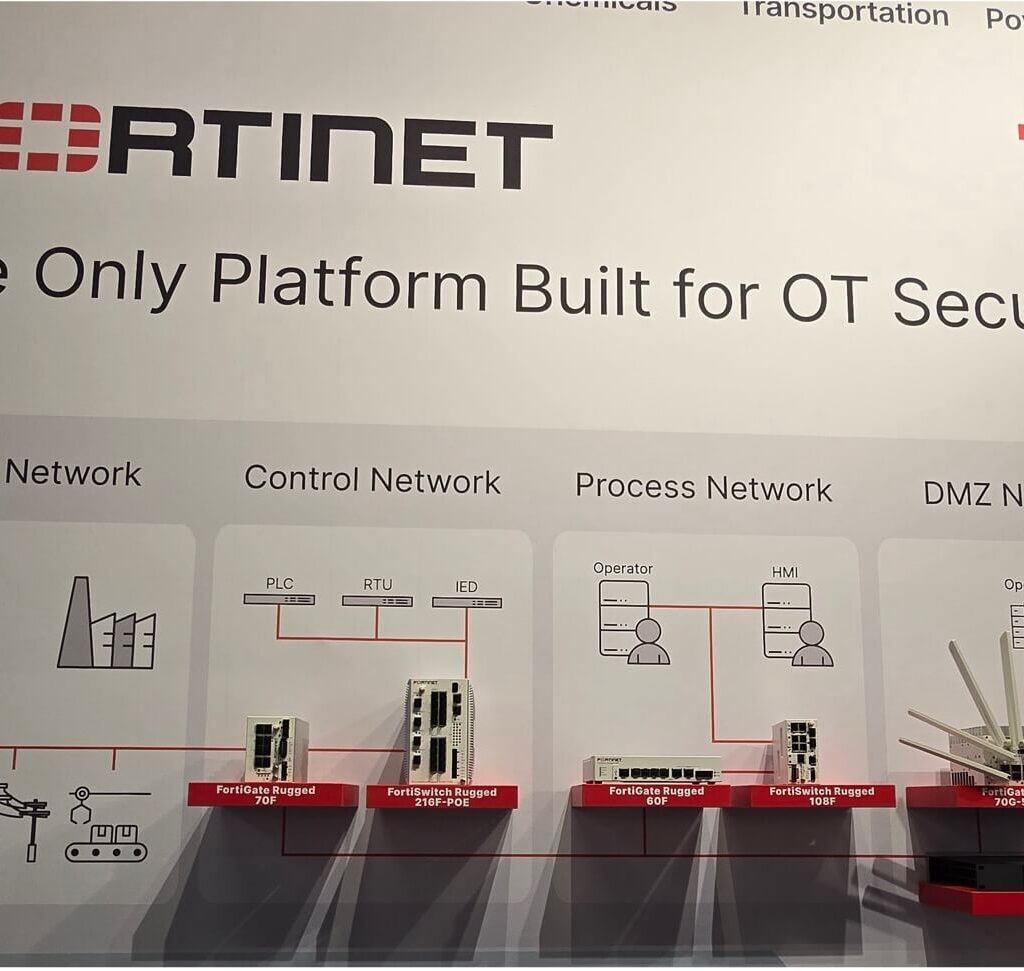

10. OT security enforcement is shifting closer to the industrial assets

OT cybersecurity vendors are moving security architecture from perimeter-centric monitoring to “in-network” enforcement, closer to critical controllers. This reflects the reality that many OT incidents spread laterally inside plant networks, where segmentation gaps and legacy constraints are hardest to manage through security operations center (SOC)-only visibility. This move is also being reinforced by regulatory pressure (explicitly referenced via NIS2 and the Cyber Resilience Act) and by emerging zero-trust design principles that prioritize enforceable policy controls near the assets.

Note: IoT Analytics’ recently published 5 AI and IT/OT convergence trends affecting OT cybersecurity, based on the 49-page OT Cybersecurity Insights Report 2026 (published December 2025).

Taiwan-based TxOne emphasized OT-native intrusion prevention at lower Purdue layers, placing EdgeOne and EdgeIPS products inline in a network defense layer adjacent to PLCs to separate PLC-side traffic from SCADA-side systems and other subsystems. This enforces segmentation and blocks threats close to the process rather than only detecting them upstream. Meanwhile, US-based Fortinet reinforced a zone-based approach across field/control/process/DMZ layers, positioning ruggedized firewalls and switches as the backbone for consistent segmentation and policy enforcement. The implied operational takeaway is that scalable OT security programs increasingly standardize on repeatable “infrastructure patterns” (security + switching) across sites instead of bespoke point solutions per asset class.

Comparison of edge AI showcases (Insights+)

Comparing the various edge AI solutions at SPS 2025, the team noted 2 general trends in the report:

Access key market data for $99/month per user

The Insights+ Subscription unlocks exclusive facts & figures. You will gain access to:

- Additional analyses derived directly from our reports, databases, and trackers

- An extended version of each research article not available to the public

Full report access not included. For enterprise offerings, please contact sales: sales@iot-analytics.com

Note: This article was updated in January 2026 to include the latest market data and insights from IoT Analytics.

Disclosure

Companies mentioned in this article—along with their products—are used as examples to showcase market developments. No company paid or received preferential treatment in this article, and it is at the discretion of the analyst to select which examples are used. IoT Analytics makes efforts to vary the companies and products mentioned to help shine attention on the numerous IoT and related technology market players.

It is worth noting that IoT Analytics may have commercial relationships with some companies mentioned in its articles, as some companies license IoT Analytics market research. However, for confidentiality, IoT Analytics cannot disclose individual relationships. Please contact compliance@iot-analytics.com for any questions or concerns on this front.

More information and further reading

Sign up for our research newsletter and follow us on LinkedIn to stay up-to-date on the latest trends shaping the IoT markets. For complete enterprise IoT coverage with access to all of IoT Analytics’ paid content & reports, including dedicated analyst time, check out the Enterprise subscription.

Already a customer?

Read the full SPS Fair 2025: The Latest Industrial Automation Trends

A 79-page PDF presenting a comprehensive summary of the key highlights and in-depth insights assembled by the IoT Analytics analyst team at SPS fair 2025.