In short

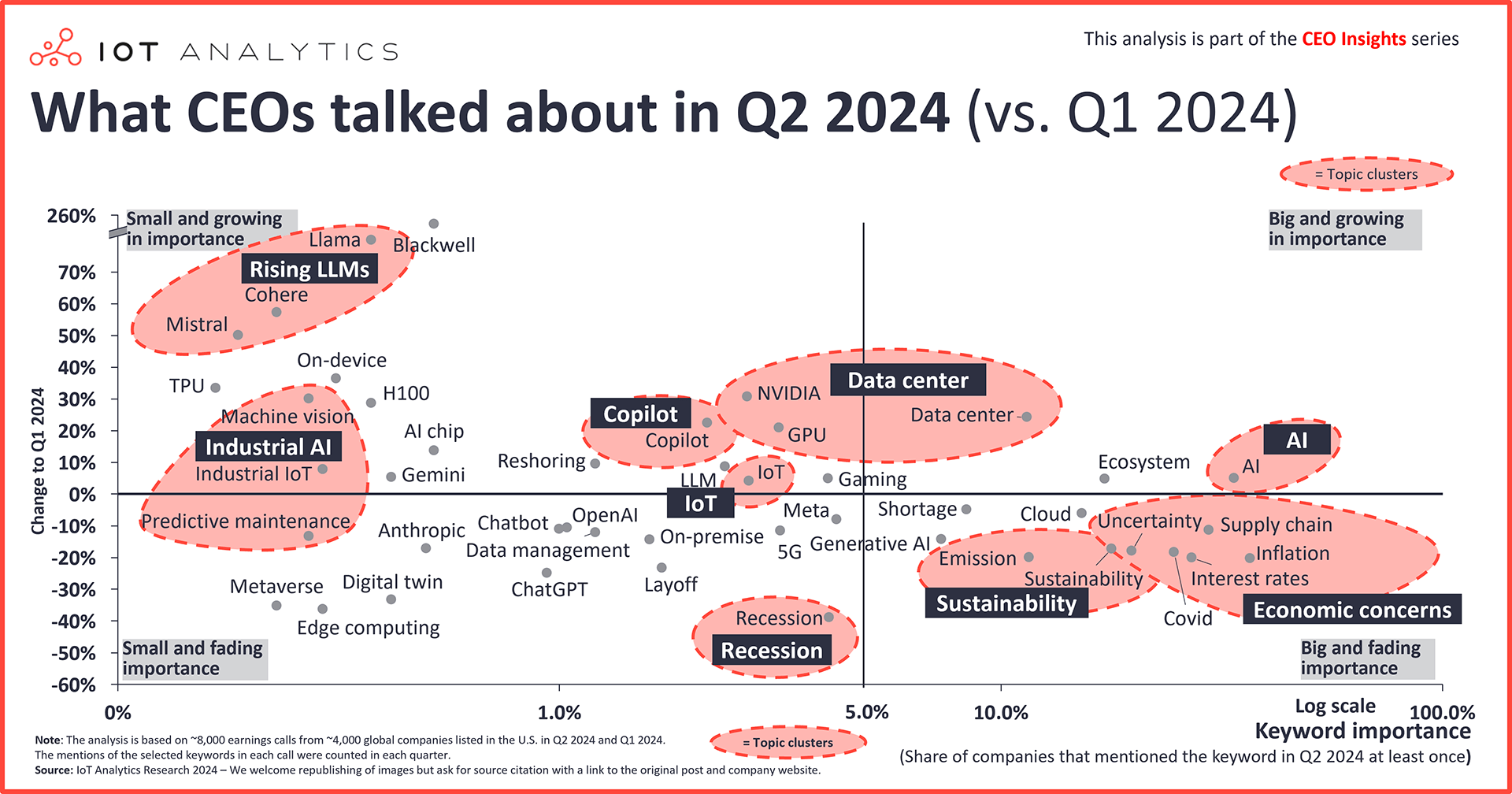

- According to the latest “What CEOs talked about” report, three themes gained noticeable traction in Q2 2024: 1) AI, 2) data center, and 3) specific up-and-coming LLMs

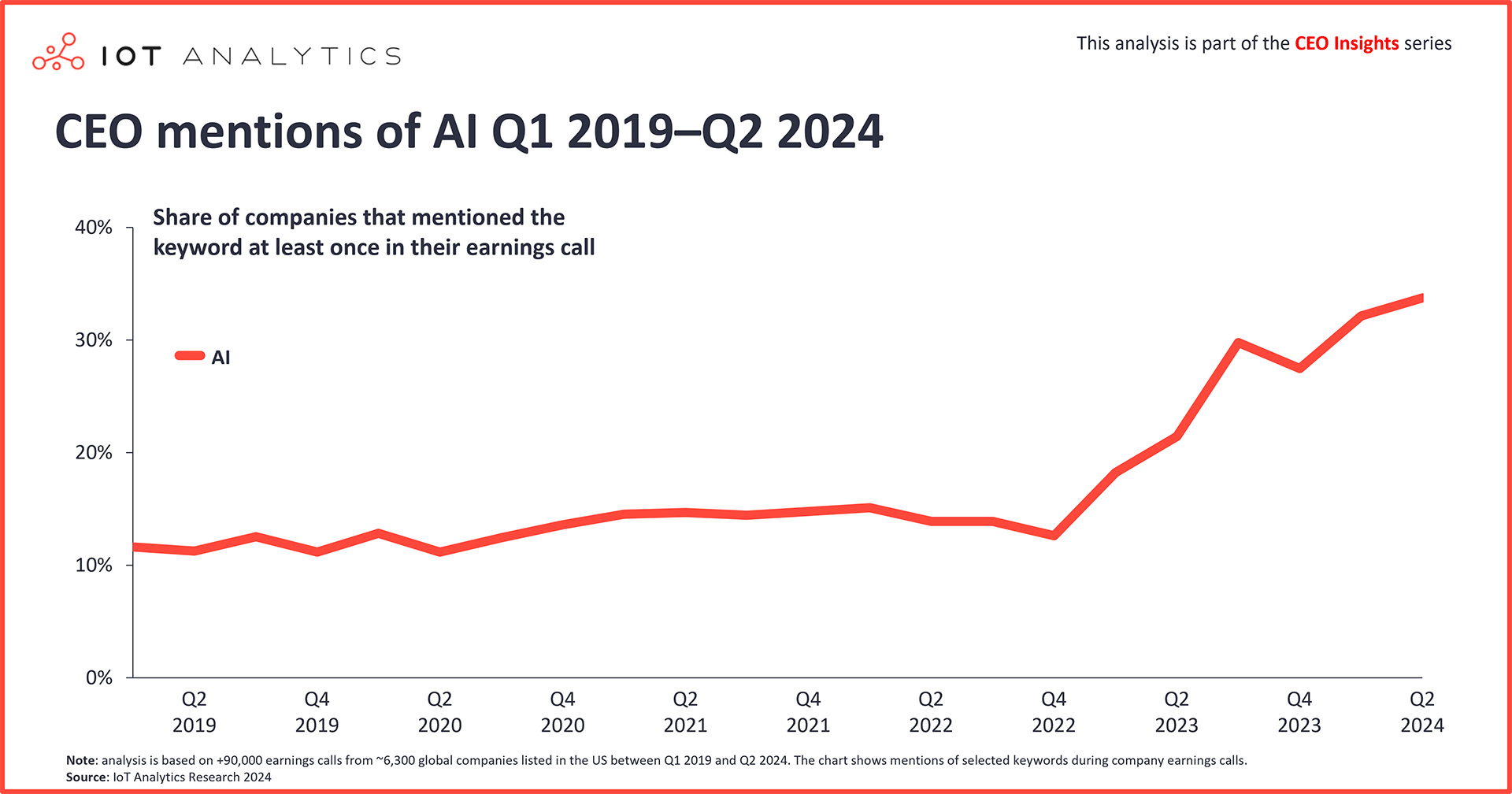

- AI is inching closer to overtaking inflation as the leading topic in boardroom discussions.

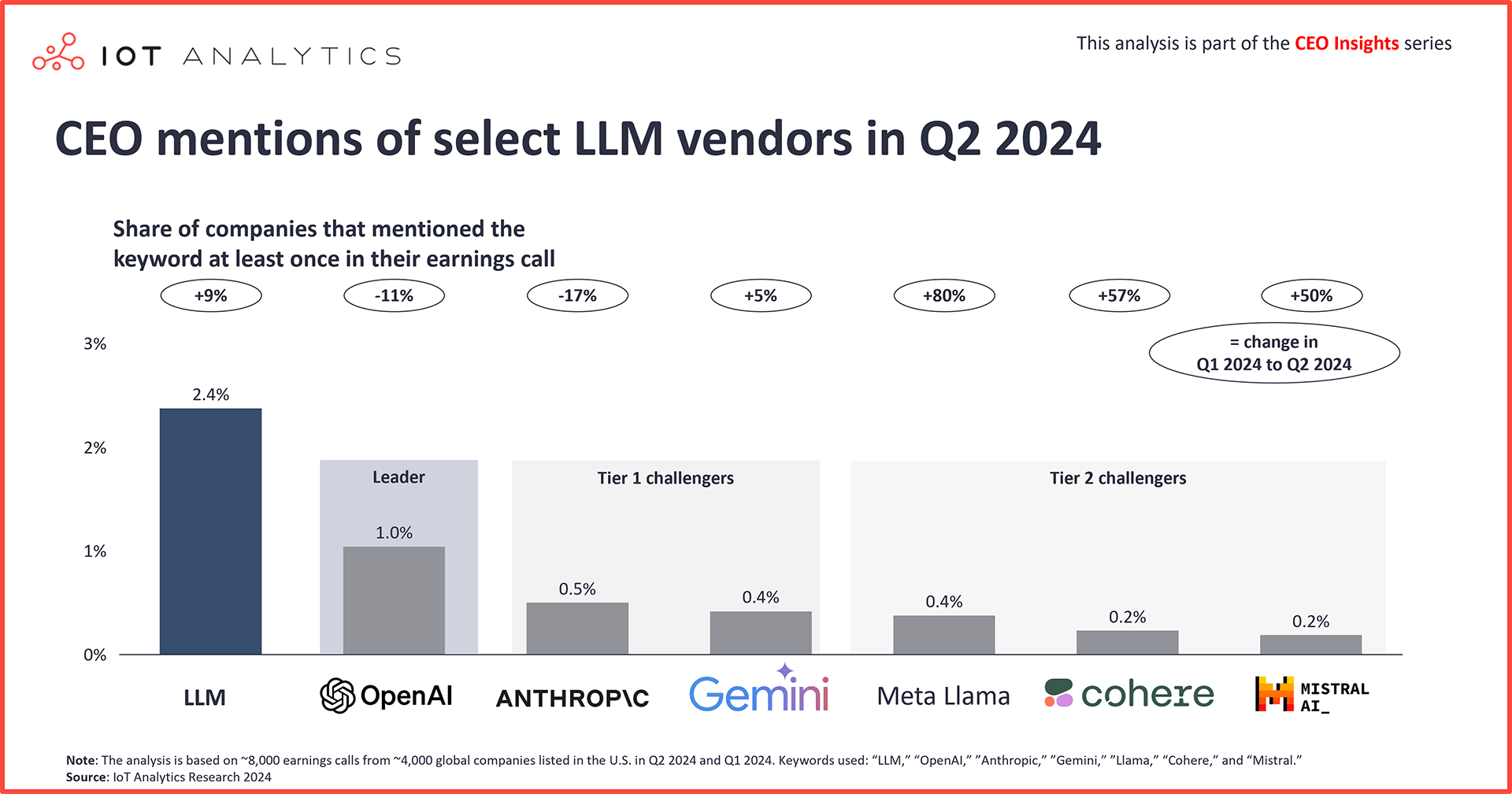

- OpenAI and other generally known LLM vendors and models decline in mentions as Llama, Cohere, and Mistral see significant climbs quarter-over-quarter.

- Economic topics and sustainability significantly declined.

Why it matters

- The prioritization of specific topics by CEOs may influence investment in these areas.

This article is based on insights from:

Quarterly Trend Report: What CEOs talked about in Q2/2024

Download a sample to learn about the in-depth data that are part of the report.

Already a subscriber? See your reports here →

The big picture

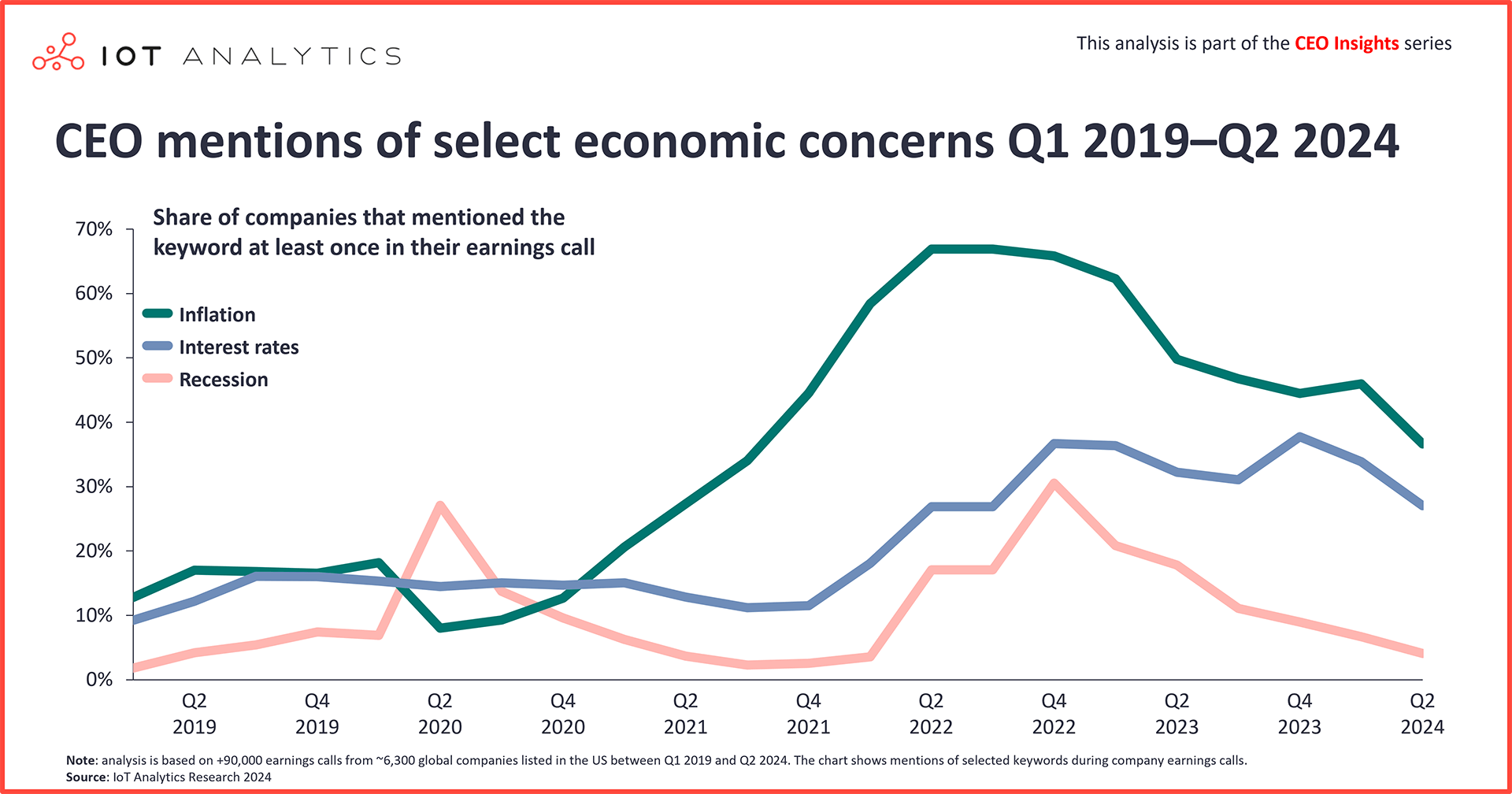

In Q2 2024, inflation remained the most discussed topic in corporate earnings calls; however, it had 20% fewer mentions quarter-over-quarter (QoQ), at 36.6% of earnings calls. This aligns with the current economic environment: globally, inflation has shown improvement, with headline inflation in advanced economies at 2.3%—approaching pre-COVID-19 levels and a significant drop from a peak of 9.5% in mid-2022. While this is in line with pre-COVID-19 pandemic levels, inflation targets have not yet been met in most economies.

Amid this decreasing trend in economic discussions, AI continues to rise (+5% QoQ) and inches close to overtaking inflation—currently 2.9 percentage points below inflation at 33.7% of earnings calls. Related to AI and also rising are mentions of data centers and LLMs.

Key rising themes in Q2

1. AI

AI moves to second-most discussed topic. In Q2 2024, discussions regarding AI rose 5% QoQ to 33.7% of earnings calls. This climb moved AI to the #2 spot of most-discussed topics, and as mentioned, it moved it closer to overtaking inflation as the leading topic. An oft-associated topic, generative AI, declined 14.3% QoQ to 7.3% of earnings calls, and ChatGPT continued to see a downward trend, appearing in only 0.9% of earnings calls (-25% QoQ). AI chips experienced a noticeable climb, rising 13.7% to 0.5% of earnings calls.

Despite being an important prerequisite for many AI projects, data management has not seen the same rise as AI. In fact, in Q2 2024, declined 12% QoQ to 1.2% of earnings calls.

Key CEOs quotes on AI

“We believe that AI is a powerful secular trend that will drive growth in our industry for years to come. But it’s only the latest example in the long history of powerful secular trends in this market.”

John Lee, CEO, MKS Instruments Inc., May 9, 2024

“AI will also drive a third wave of IoT using the sensors and connected devices as a primary source of data. This will drive capacity in image sensors, analog chips, and mature logic process nodes.”

Russel Low,CEO, Axcelis Technologies Inc., May 2, 2024

Note: IoT Analytics plans to publish its Industrial AI Market Report update in Q3 2024 and its Generative AI Market Report update in Q4 2024. Those interested in accessing these reports when they are released can sign up for IoT Analytics’ IoT Research Newsletter to receive updates on the release of these and other reports.

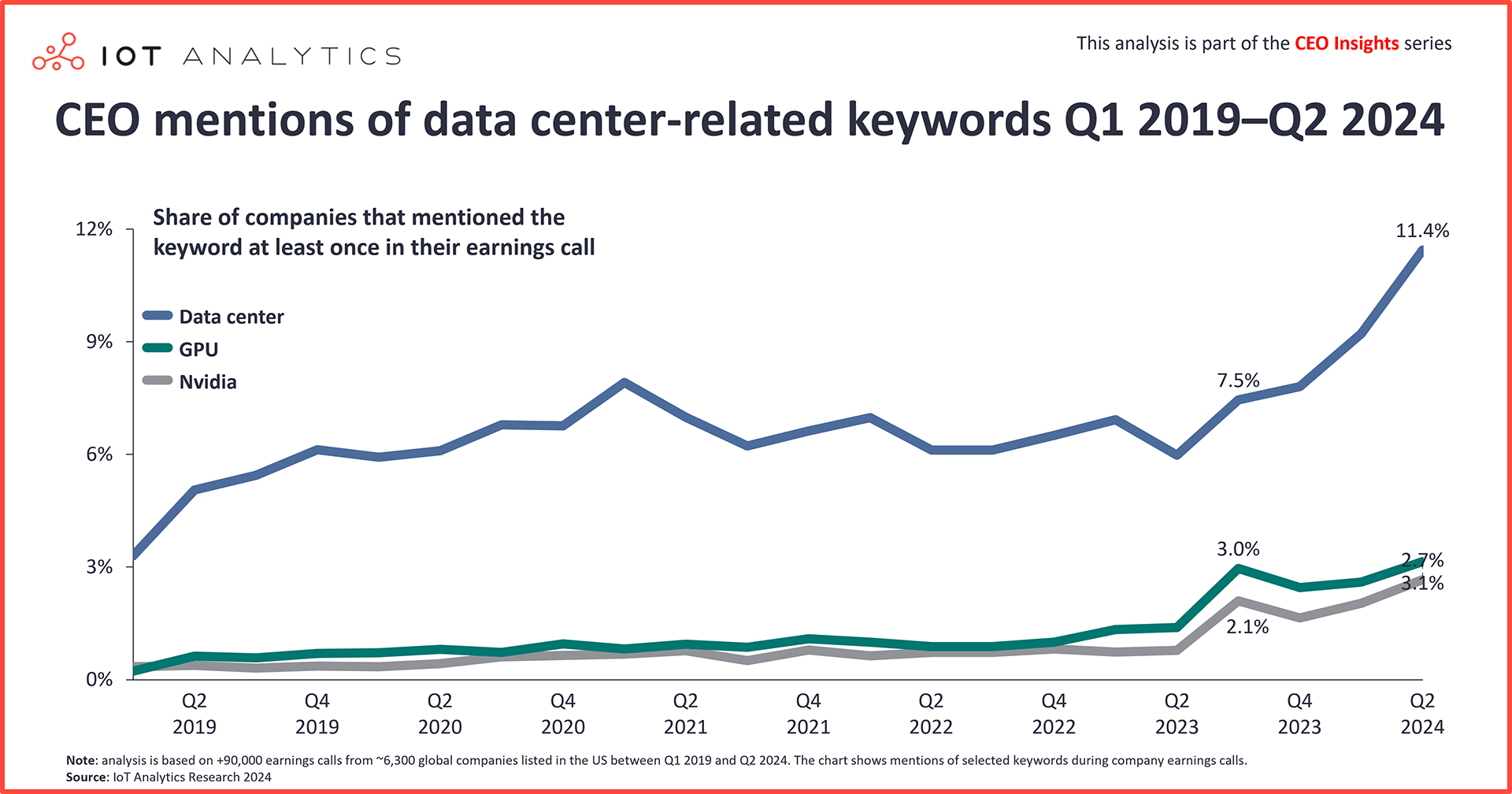

2. Data center

Data center(s) and related topics continue to rise. Riding on AI’s wave is data center, which rose 24% to 11.4% of earnings calls. Associated terms like the US-based semiconductor giant NVIDIA and its core offering, GPUs, saw significant growth in Q2 2024 as well. Discussions around NVIDIA, which was ranked as the most valuable company in the world for a few days in mid-to-late June 2024, rose 30.6% QoQ to 2.7% of calls, while its top product, GPUs, saw a 20.8% climb to 3.1% of calls.

AI driving data center power consumption growth. Many of the data center discussions revolved around AI increasing data center power consumption and capacity requirements. Currently, data centers consume around 4% of US electricity; however, this is estimated to grow to between 4.6% and 9.1% by 2030.

High-power-consuming GPUs on the horizon. As AI demand grows, so too is the demand for faster GPUs—and many of them. NVIDIA is the leading data center GPU company, and its popular H100 GPU, which saw a 28.6% climb QoQ to 0.4% of earnings calls, consumes 300W–700W depending on configuration. However, the company is expected to release its new series, the Blackwell GPUs, later in 2024. The Blackwell B200 will max around 1200W—a significant consumption jump—and CEOs are already showing interest in this series, as discussions around Blackwell climbed 257% QoQ to 0.5% of earnings calls.

Key CEOs quotes on data centers, NVIDIA, and GPUs

“AI data center racks consume significantly more power than traditional data centers, with a search on ChatGPT consuming 6 to 10 times the power of a traditional search on Google.”

Lal Karsanbhai, CEO, Emerson Electric Co., May 08, 2024

“I think it’s important to understand that we wouldn’t have a massive AI networking opportunity if NVIDIA didn’t build some fantastic GPUs.”

Jayshree Ullal, CEO, Arista Networks, June 04, 2024

“The bulk of the growth across all three hyperscalers was really spent on reselling GPU capacity because there’s a lot of demand for training models. We don’t see a lot of, at least today, a lot of AI apps in production. We see a lot of experimentation, but we’re not seeing AI apps in production at scale.”

Dev Ittycheria, CEO, MongoDB Inc., May 30, 2024

3. LLMs

Three LLMs on the rise. In Q2 2024, CEOs appeared to turn their attention to three LLM providers or their products:

- Meta, a US-based technology firm, offering its Llama series of LLMs

- Cohere, a Canada-based AI company offering 3 flagship models: Command, Embed, and Rerank

- Mistral AI, a France-based AI company offering 3 models: Mistal 7B, Mixtral 8x7B, and Mixtral 8x22B.

Seeing the largest jump in mentions was Llama, rising 80% QoQ to 0.4% of earnings calls. Meanwhile, Cohere and Mistral rose 57% and 50% QoQ, respectively, and each sat around 0.2% of calls. The rise of these three LLMs is juxtaposed with OpenAI (-11% QoQ), Anthropic (-17% QoQ), and Gemini (+5%).

Key CEO quote on LLMs

“[Clients] appreciate having the ability to leverage a combination of AI models, whether they are IBM‘s, their own models, open-source models such as Llama from Meta and Mixtral from Mistral, and they can deploy these AI models across multiple environments.”

Arvind Krishna, CEO, IBM, April 24, 2024

Declining themes in Q2

1. Economic concerns

Across the board, discussions related to economic concerns declined in Q2 2024:

- Inflation: Down 20.3% QoQ to 36.6% of earnings calls

- Supply Chain: Down 11.4% QoQ to 29.6% of earnings calls

- Interest Rates: Down 20% QoQ to 27% of earnings calls

- Uncertainty: Down 18% QoQ to 19.8% of earnings calls

In mid-June 2024, the US Federal Reserve board met to decide on an anticipated interest rate drop; however, it chose to keep the interest rate at 5.25%–5.5%—the same level since July 2023. In a post-meeting conference, Jerome Powell, Chair of the US Federal Reserve, shared his views that the economy was strong, and thus, the Fed could approach the question of decreasing interest rates conservatively to help mitigate economic risks with a rate cut.

Key CEO quotes on the economy

“We expect the global economy to behave similarly to last year, albeit with some uncertainty due to persistently high interest rates.”

Arvind Krishna, CEO, IBM, April 24, 2024

“Once inflation data came in higher than expected and the hope for several interest rate cuts later this year diminished, real estate capital markets became much quieter again.”

Christian Ulbrich, CEO, Jones Lang LaSalle Inc., May 30, 2024

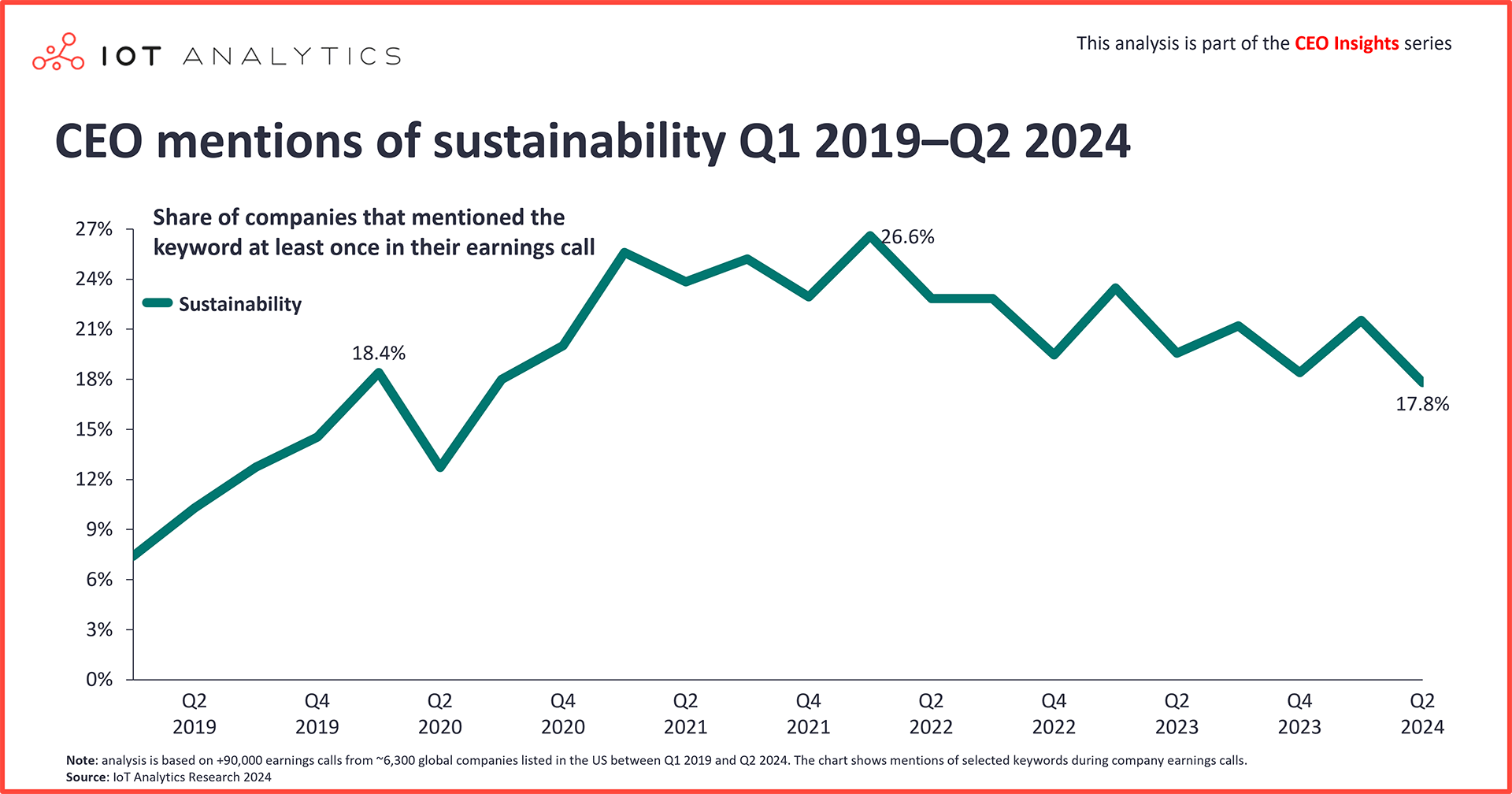

2. Sustainability

In Q2, it slid 17.3% QoQ to 17.8% of earnings calls, as did a related term, emissions, which decreased 20% QoQ to 11.6%. Overall, sustainability-related topics are not growing in importance and appear to be trending downward. Since Q2 2023, mentions of sustainability have generally bounced between increasing and decreasing, but none of the increases have matched the Q1 2022 peek of 26.6% of earnings calls.

That said, results from a recent IoT Analytics survey of senior IT decision-makers found that sustainability is expected to rise in technology prioritization in 2025.

“As for our sustainability solutions, we won another 100 customers in Q1 on top of more than 1,000 we had before.”

Christian Klein, CEO, SAP, April 22 2024

3. Recession

In Q2 2024, of the tracked keywords, recession had the biggest decline in mentions, dropping 39% QoQ to 4% of earnings calls. Since Q2 2023, recession has been a declining topic, eventually separating from its related economic concerns by a wide margin. This is perhaps a sign that in light of continued concern regarding inflation and high interest rates, the fear of a recession is easing in the minds of CEOs.

Key CEO quote on recession

“A bit like the U.S., we both see improved macros, actually, I think today a number of the markets came out and said they’d come out of recession from the previous quarters.”

James Quincey, CEO, The Coca-Cola Company, April 30, 2024

Analyst takeaway

“The discussions around AI have become even more prevalent with data centers and emerging LLMs becoming key focus areas. This shift indicates a growing recognition of the infrastructure and advanced models needed to support AI advancements.”

Philipp Wegner, Principal Analyst at IoT Analytics

What it means for CEOs

6 key questions that CEOs should ask themselves based on the insights in this article:

- AI integration: How can we leverage AI to enhance our existing products and services, and what new opportunities can we explore to stay competitive?

- Data center strategy: With the growing demand for AI and data-intensive applications, how can we optimize our data center operations to meet future needs while managing costs? How do we manage the impact of new and upgraded data centers on our CO2 footprint?

- Copilot vs. Chatbot: Are we utilizing the full potential of generative AI and LLMs by integrating copilots for our customers and employees, or are we stuck with non-connected chatbots?

- Regulatory compliance: What proactive measures can we take to stay ahead of regulatory changes in critical areas such as AI, data privacy, and environmental standards?

- Digital transformation: How can we accelerate our digital transformation efforts to enhance operational efficiency and drive innovation across our business units?

- Economic resilience: What strategies should we implement to build resilience against potential economic downturns and ensure sustainable growth in a volatile economic environment?

More information and further reading

Are you interested in learning more about latest CEO insights?

Quarterly Trend Report: What CEOs talked about in Q2/2024

A 61-page report on the trends that emerged in Q2/2024 earnings calls. The report is based on data from 90,000+ corporate earnings calls of US-listed companies from Q1/2019 through Q2/2024.

Related articles

You may also be interested in the following articles:

- Top 5 enterprise technology priorities: AI on the rise, but cybersecurity remains on top

- State of IoT Spring 2024: 10 emerging IoT trends driving market growth

- How global AI interest is boosting the data management market

- The leading generative AI companies

Related publications

You may also be interested in the following reports:

- 5G IoT & Private 5G Market Report 2024–2030

- Global IoT Enterprise Spending (Q2/2024 Update)

- Data Management and Analytics Market Report 2024–2030

- State of IoT Spring 2024

- Generative AI Market Report 2023–2030

Related dashboard and trackers

You may also be interested in the following dashboards and trackers:

- Global Cellular IoT Connectivity Tracker & Forecast

- Global Smart Meter Market Tracker

- Global Cellular IoT Module and Chipset Market Tracker & Forecast

- Global Cellular IoT eSIM Module & iSIM Chipset Tracker

- Global IoT Enterprise Spending Dashboard

Subscribe to our newsletter and follow us on LinkedIn and Twitter to stay up-to-date on the latest trends shaping the IoT markets. For complete enterprise IoT coverage with access to all of IoT Analytics’ paid content & reports including dedicated analyst time check out Enterprise subscription.