In short

- IoT sensors represented one-third of all sensors shipped in 2022, according to new research on the topic. The average IoT device now comes with four sensors.

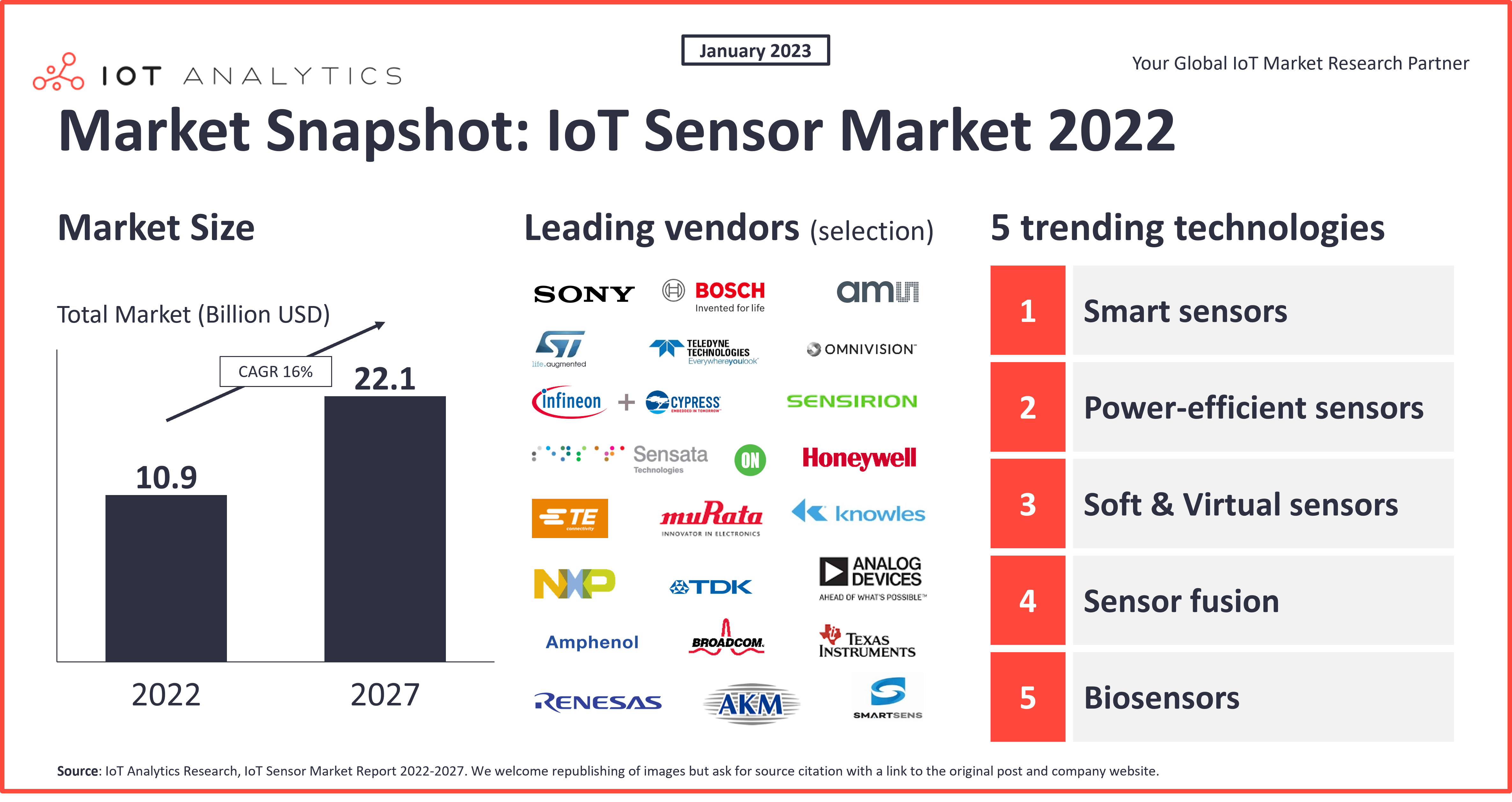

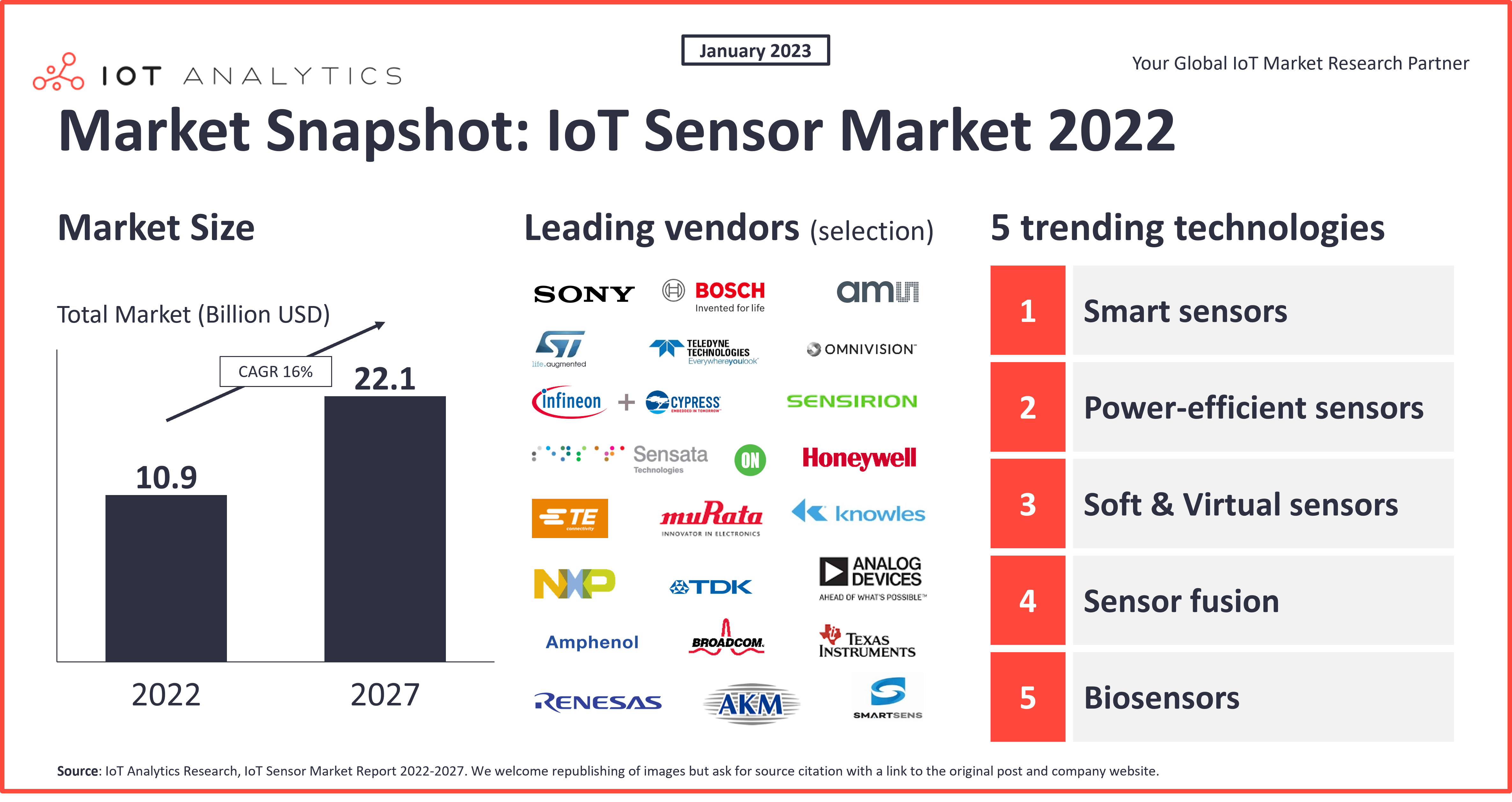

- 5 sensor technologies are set to change the IoT sensor landscape in the coming years, i.e., 1. smarter sensors; 2. more power-efficient sensors; 3. soft and virtual sensors; 4. sensor fusion; 5. biosensors.

Why it matters?

- The increasing penetration of IoT devices is leading to different technical requirements for sensor manufacturers (e.g., ultra-low power, smaller form factor, pre-processing, and connectivity).

50 billion IoT sensors and counting

The rise of the Internet of Things in recent years has gone hand-in-hand with the rise of sensors. On average, four new sensors are connected with every new IoT device that comes online. With approximately 14 billion current IoT connections, this means more than 50 billion connected sensors have been deployed. IoT sensor technology plays a crucial role in the IoT tech stack because these sensors collect data from the physical world and convert it into digital signals.

One-third of all sensors shipped in 2022 were IoT sensors, meaning they were part of an IoT-connected device. According to the 136-page IoT Sensor Market Report 2022–2027, the market for IoT sensors reached $10.9B in 2022 and is predicted to grow at a compound annual growth rate of 16% in the next five years.

The market for MEMS-based IoT sensors is particularly strong and accounted for 50% of global sensor revenue in 2022. The leading companies in this market segment are Bosch Sensortec and ST Microelectronics.

The market for image sensors is also particularly important for the IoT because three of the most important IoT use cases drive its adoption, i.e., machine vision, connected surveillance cameras, and advanced driver-assistance systems for cars. Leading sensor vendors in this segment include Sony and AMS AG.

5 trending sensor technologies

There are several exciting technological innovations in the IoT sensor market. In this article, we highlight five IoT sensor technology trends that are set to change the IoT sensor landscape in the coming years.

1. Sensors are becoming smarter and can act as edge devices

Sensors are becoming increasingly advanced. Key IoT sensor technology innovations include a much higher computing capacity and the ability to detect signals from multiple discrete sensing elements. The industry refers to these more advanced devices as “smart sensors.” Instead of simply passing on the sensor signals to the next level in the value chain, smart sensors can process signals directly (e.g., validating and interpreting the data, displaying the results, or running specific analytics applications); in this way, sensors become edge devices.

The most advanced smart sensors are now also incorporating AI into their design. These sensors are designed for AI inference, which has numerous advantages, e.g., decisions can be made immediately, and sensitive data can be processed without sending it elsewhere and creating the risk of data theft.

Example: In January 2022, Amazon unveiled its Ring home security glass-break sensors, which utilizes AI technology and a Syntiant NDR101BQQF neural processor for detecting glass breaking directly on the sensor. The sensor accurately detects glass-break events, such as windows being smashed or cracked, up to 25 feet away and sounds an alarm on the spot.

2. Sensors become more power-efficient (e.g., for energy harvesting)

Ever more sensors use renewable energy sources to power themselves, such as solar or kinetic energy, thereby eliminating the need for battery replacement or another power source. This innovation improves the reliability and longevity of IoT devices, particularly those deployed in remote or inaccessible locations. These devices are self-sustainable and contribute to a reduction in the environmental impact of the entire system setup.

The use of energy harvesting is leading to changes in sensor design, making the sensors more power-efficient via the following changes:

- Reducing the form factor. Using small ultra-low-powered microcontrollers (such as the STMico STM8L) sensors do not consume too much energy.

- Improving the signal-to-noise ratio. To save energy, sensors can include a signal processing component that filters out noise or interferences so that they use their power in a targeted way that detects and measures the actual signal.

Example: Eco is a temperature and humidity sensor designed for use in indoor environments. It is powered by an indoor solar cell, which allows it to operate inside buildings without batteries or external power sources. The device can last up to 30 days in the dark due to its energy-efficient design and the use of a solar cell. The device is connected via LoRaWAN technology, which allows it to transmit data wirelessly over long distances using minimal power. This makes it ideal for use in various indoor environments, such as offices, warehouses, or factories.

3. Soft & virtual sensors increasingly complement physical sensors

In some cases, it is impractical or costly to install a physical sensor (e.g., in complex or hazardous environments). Upcoming alternative solutions include soft and virtual sensors.

A soft sensor is a computational algorithm that estimates the value of a difficult-to-measure quantity, based on other existing physical sensors and algorithms/computational models that infer the value of the measured quantity.

A virtual sensor is similar to a soft sensor, the difference being that its values are not based on existing physical sensors but purely on algorithms/computational models.

Example of a soft sensor: Rockwell Automation’s Predictive Quality software application creates predictive models that use real-time data from instruments and laboratory analyses to estimate process and product conditions. These models are based on historical plant data and act as inferential sensors to predict quality parameters (as an alternative to additional physical sensors) (Link).

Example of a virtual sensor: In 2021, Siemens developed a pocket-sized edge computer that can be attached to an asset (e.g., a motor) and help to calculate virtual sensor values. For example, the temperature can be calculated in real-time by feeding the latest operational motor data into the digital model. This operation needs neither an on-site thermometer nor any other actual sensor reading, as it relies on machine status parameters and a virtual model of the motor (Link).

4. Innovations around sensor fusion (particularly for autonomous driving)

Sensors are an essential component of autonomous vehicles, as they provide it with information about its surroundings. The vehicle’s onboard computer uses this information to navigate and make decisions. Three key sensors for autonomous driving include LiDAR, radar, and 3D cameras (image sensors). Major car OEMs, such as Mercedes, BMW, Volvo, and General Motors, have opted for LiDAR as a sensor for autonomous driving. Previously (prior to 2021), Tesla mostly relied on radar technology. Recently, however, the company began the transition to Tesla Vision (a camera-based system) by removing radar from the Model 3 and Model Y in 2021, followed by Model S and Model X in 2022.

Companies, including Sony, Mobileye, and Waymo, are currently focusing on IoT sensor technology innovation by combining cameras with other sensing technologies like LiDAR and radar to improve the image analysis of their autonomous driving solutions. As cameras, radars, and LiDARs sense different features of the environment, the idea behind this combination (also referred to as “sensor fusion” or “redundancy”) is to provide systems with a richer single-world model to decide a course of action or calculate an output. Overall, the sensors in an autonomous vehicle work together to provide a complete picture of the vehicle’s surroundings, enabling it to make safe and efficient driving decisions.

Example: Sony is relying on the benefits of using cameras with either LiDAR or radar for object recognition tasks in autonomous driving applications. For example, the company is currently working on a solution that combines camera and radar. This combination may be beneficial for recognizing people and vehicles at night. The camera and LiDAR combination is beneficial for parking assistance functions, which require highly accurate distance measurements (Link).

“Autonomous vehicles will only succeed when all of the technological pieces are built as a single integrated system, enabling synergies among all of its parts. It is a formidable task to build the full stack from silicon up to the full self-driving system–this is what Mobileye has set out to do.”

Prof. Amnon Shashua, CEO and Founder of Mobileye

5. Biosensors are becoming more mature (mostly for healthcare applications)

Biosensor and disposable sensor technology have matured in recent years and have been adopted in the healthcare industry. Recent breakthroughs in biosensor research suggest that this technology is also nearly market-ready in other sectors. The term “biosensor” is short for “biological sensor.” The bio element interacts with the tested analyte, and the transducer converts the biological response into an electrical signal. Depending on their application, biosensors are also known as immunosensors, optrodes, resonant mirrors, chemical canaries, biochips, glucometers, or biocomputers.

Example of a biosensor: Abbott FreeSTyle Libre is one of the most commercialized biosensor solutions for glucose monitoring. The FreeStyle Libre system currently has more than 3 million users globally. In Q2 of 2022, Abbot reported more than 25% organic growth in sales of FreeStyle Libre systems.

More detailed IoT sensors insights

IoT Sensors Market Report 2022–2027

A 136-page report detailing the market for sensors, with a specific focus on IoT sensors, incl. Sensor vs. IoT sensor definitions and market shares, industry deep dives, competitive landscape, and company profiles.

Download the sample to learn more about: the report structure, select definitions, frameworks, companies included, and additional data points.

Click on the button to load the content from .

The report answers questions such as:

- What is the difference between a sensor and an IoT sensor?

- What are the various ways to deploy an IoT sensor?

- Who are the leaders in the sensor market and the IoT sensor market?

- What is the size of the IoT sensor market compared to the sensor market?

- What type of sensor has the highest market share and the highest growth rate?

- Which regions have the highest market share for sensors and IoT sensors respectively?

- Which industries are leading in terms of IoT sensor deployment?

- What is the market size and growth trajectory of smart sensors?

Definition: IoT Sensor

IoT sensors are sensors that sit within connected devices which are classified as IoT devices (excluding smartphones, tablets, and computers). IoT sensors are designed to collect and transmit data directly/indirectly to the cloud or at the edge. These sensors can be integrated with equipment/devices, embedded with processing and communication capabilities, or implemented as standalone devices, where processing and key communication capabilities are pushed to the gateway. Many IoT applications require sensors with adapted specifications, such as low or high power, wireless connectivity, and smart sensing capabilities. This allows sensors to be used in various scenarios, from those requiring only a few data points per day to high-volume data streaming.

Related publications

You may be interested in the following publications:

- Machine Vision Market Report 2022-2027

- Industry 4.0 Adoption Report 2022

- Industrial AI and AIoT Market Report 2021-2026

Related articles

You may also be interested in the following recent articles:

- 8 key technologies transforming the future of global supply chains

- The top 10 IT/OT convergence trends—as showcased at SPS fair 2022

- Evolution of cellular IoT modules since 2010: Eight new technologies and a 15x bigger market

Related market data

You may be interested in the following IoT market data products:

- Global IoT Enterprise Spending Dashboard

- Global Cellular IoT Module and Chipset Market Tracker & Forecast

Are you interested in continued IoT coverage and updates?

Subscribe to our newsletter and follow us on LinkedIn and Twitter to stay up-to-date on the latest trends shaping the IoT markets. For complete enterprise IoT coverage with access to all of IoT Analytics’ paid content & reports including dedicated analyst time check out the Enterprise subscription.