In short

- Data centers are the smartest types of commercial buildings today, according to the latest IoT Analytics research on smart building adoption.

- Incentives and regulations focused on sustainability are pushing smart building initiatives forward with investments for smart building use cases expected to increase across the board.

- Vendor transparency and availability are key pain points for adopters of smart building technology.

Why it matters

- The sustainability push of recent years is changing the equation for both vendors and end users of smart building technology.

- In this increasingly dynamic market, all market participants should know the best practices and technologies that drive adoption.

- Adopters in this market reported often feeling “lost in translation.” Vendors should provide better education for them.

Could smart buildings be the next digitization frontier?

The average American spends 87% of their time inside buildings, according to the U.S. Environmental Protection Agency. However, core building technologies have not kept pace with advancements in other technologies (e.g., smartphones, cars, or TVs). Smart buildings thus might represent the next frontier for making people’s lives more efficient, productive, joyful, and sustainable.

| Smart building definition:

“Smart buildings are those buildings that use technology to interact with the people, systems, and external elements around them. They adapt to the needs of people and businesses within them by increasing comfort, efficiency, resiliency, [and] safety.”

Disclaimer: IoT Analytics’ Smart Building Adoption Report 2022 focuses on commercial buildings and large residential buildings. Consumer IoT/smart homes are not part of the study.

Here are five things to know about the smart building market according to our latest Smart Building Adoption Report 2022:

1. The reality of smart buildings is not represented in the press.

The smartest of the smart buildings, such as The Edge in Amsterdam or cube in Berlin, make headlines. And while they are magnificent examples of the future of smart buildings, they do not represent the majority of buildings or what is feasible for the average building in the coming years. Of the commercial/large-scale residential buildings in our data set, 58% have the underlying technological infrastructure for further digitization (i.e., they have a building automation system in place). Among that 58%, almost two-thirds (or 36% of the total) are further advanced in their digitization (they have a building management system in place and have digitized several parts of the building, such as building access and security systems). In the next two years, respondents expect this number to jump from 36% to 48%.

Data centers are the smartest type of buildings today. The advanced digitization classification applies to 65% of their gross floor area. Hotels (46%) and educational facilities (41%) complete the list of top three smartest buildings. Within the next two years, however, this ranking is expected to change. According to our research, offices will be the second-smartest building type globally in two years (with an expected 52% of gross floor area classified as advanced digitization), while data centers will remain at the top (71%), and hotels (51.5%) will be third. Warehouses are expected to have the largest increase in digitization (from 27% to 49%). According to the research, the building types that are least smart today are expected to catch up the fastest (excluding historical buildings).

2. Connected HVAC has been the single most deployed smart building use case, but others are catching up.

According to IoT Analytics’ research, more than half (52%) of the total area across all smart buildings uses some form of connected heating, ventilation, and air conditioning (HVAC).

HVAC systems have been in use for more than a century following their invention by Willis Carrier in 1931. Today’s state-of-the-art HVAC systems look very different though: They enable building managers to modify settings centrally (e.g., from their smartphones) or allow to set up usage based on pre-defined rules. In some cases artificial intelligence (AI) is used to learn from past behavior. Other data points (such as room occupancy or outside temperature) are also used for optimization. The equipment itself uses algorithms to predict failures before it is too late and thereby allows for reduced maintenance costs and increased uptime (i.e no cold buildings in the winter or hot buildings in the summer).

Other use cases with high adoption rates include air quality monitoring (48%) and sensor-based intrusion and alarm systems (47%). The former is seeing one of the biggest demand influxes of all 26 analyzed use cases as a follow-up effect of the COVID-19 pandemic.

Based on our survey, the average investment in a use case is expected to increase by 13% within the next two years.

3. Regulations and government incentives are the main forces behind smart building initiatives.

Sticks and carrots seem to be equally important for smart building initiatives. Incentives (carrots) motivate building owners/managers to start the digitization process. Among our interviewees, 89% reported that incentives had at least some influence on their decision to digitize their buildings. Regulations (sticks) also have a noticeable influence on the progress of smart building initiatives. For 45% of respondents, regulations were a “significant factor that pushed their smart building implementation forward.” Decreasing costs, increasing user satisfaction, and increasing the sustainability footprint also impact adopters’ internal decision processes.

4. Smart buildings are crucial to achieving global sustainability goals.

More than one-fourth (28%) of global energy-related CO2 emissions are attributed to the operation of buildings, according to a 2021 UN-led report. It is therefore crucial that buildings become more energy efficient to reach climate-related sustainability goals, and digitization is a key enabler. Fraunhofer, a Germany-based research institute, claims that connected HVAC combined with connected blinds/windows can save up to 10% of the total energy used to heat and cool a building. For this reason, many regulations and incentives focus on sustainability in place and aim to motivate non-adopters to transform their current buildings into more energy-efficient ones. Examples of such incentives include Germany’s Federal Funding for Efficient Buildings scheme or San Francisco’s Green Building Program.

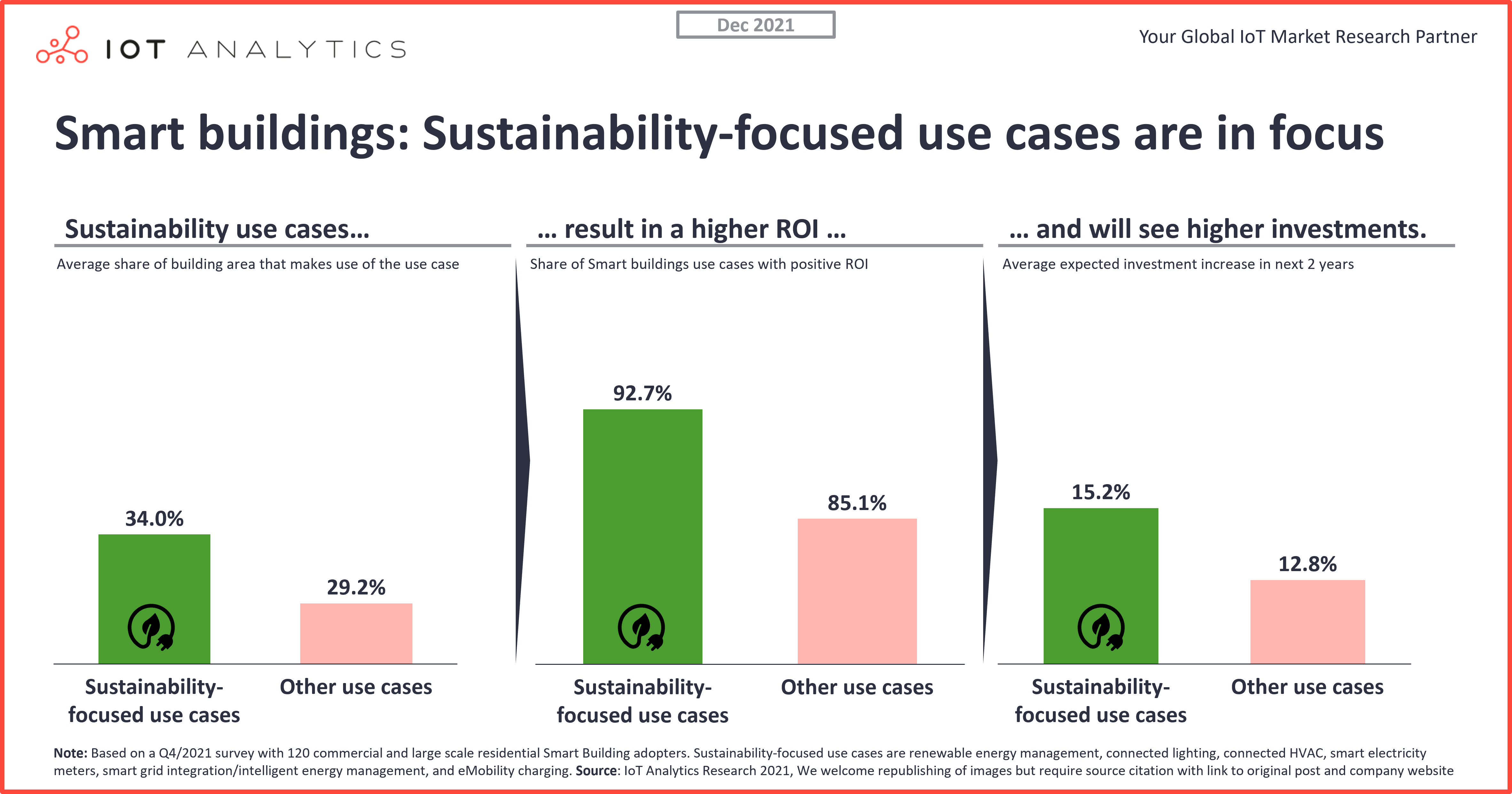

Our interview data show that smart building use cases that have a direct effect on sustainability result in higher ROI than other use cases (93% of them show a positive ROI). These use cases are also expected to be adopted more quickly in the coming years (Investments into sustainability-focused use cases are expected to increase 15% in the next two years vs. an average increase of 13%).

5. Many building owners and operators are unsure how start a smart building initiative.

When shopping for a smartphone, hundreds of reviews and opinions are available. When shopping for a smart building solution, however, it is often unclear where to begin. In our research, 52% of respondents claimed it was difficult to find the right vendor, and only 10% believed it was easy to find one. Respondents mentioned that a lack of knowledge about potential vendors was a key challenge during their smart building initiatives. At the same time, “finding an appropriate vendor” was the second most mentioned success factor, with the first being “proper planning” before the project commences.

Conclusion and Outlook

Smart building adoption is increasing, with sustainability moving into the center of digitization efforts.

Based on the research the following could be action items considered by stakeholders in the ecosystems (analyst opinion):

- Smart building vendors clearly need to do a better job at educating the market as finding the right vendors is a huge problem for many building managers today. Even finding relevant Smart Building project references on the internet is not easy. Don’t scare adopters off by showcasing new, flashy high-value buildings only. Present real-world average building examples that have the possibility to offer surprisingly positive results (i.e., older buildings with retrofitted solutions). Keep in mind that the average U.S. commercial building is 53 years old).

- Smart building vendors should also consider to “combine use cases” into one solution. Take the example of air quality monitoring. Vendors of connected HVAC system, connected lights, or connected security systems could easily integrate air quality monitoring into their hardware, thereby addressing more than one use case with their solution.

- Building owners and facility managers need to keep an eye out on the current local and national incentives and regulations. These are key to making Smart Building projects financially successful. According to our research and feedback from research participants, financial incentives are available in many regions in the world.

- Governments, on the other hand, need to embrace the power of these incentives, because they work. If governments want to be serious about reaching climate goals, smart building incentives and related regulations should be top of their agenda.

More information and further reading

Are you interested in learning more about Smart Buildings?

The Smart Building Adoption Report 2022 is a comprehensive 298-page report assessing the current state of Smart Buildings initiatives. It includes key smart building vendors and vendor satisfaction, deep-dives for 26 smart building use cases, digitization state and trends for 12 different building types, an in-depth look at 35 supporting building technologies, best practices and lessons learned, detailed smart building case studies, and more.

It is part of IoT Analytics’ ongoing coverage of non-industrial IoT applications and IoT in general.

This report provides answers to the following questions (among others):

- What are the most adopted smart building use cases (out of a list of 26 use cases)?

- Which smart building use cases have the highest return on investment (ROI)?

- Which smart building use cases do companies plan to invest in during the next two years?

- Who are the leading vendors for smart building technology, what do they offer, and how satisfied are end users?

- What supporting technologies do smart building end users implement as part of their smart building projects?

- What are the best practices of and lessons learned of companies that have adopted smart building use cases?

- What are the key drivers to smart building adoption?

- What role does sustainability play in smart building initiatives?

And more…

Sample:

The sample of the report gives you a holistic overview of the available analysis (outline, key slides). The sample also provides additional context on the topic and describes the methodology of the analysis. You can download the sample here:

Related articles

You may also be interested in the following recent articles:

- The 15 key challenges with IoT Project Development in 2021

- 6 IoT adoption trends for 2022

- Smart Cities of the future: 7 things that successful cities do

Are you interested in continued IoT coverage and updates?

Subscribe to our newsletter and follow us on LinkedIn and Twitter to stay up-to-date on the latest trends shaping the IoT markets. For complete enterprise IoT coverage with access to all of IoT Analytics’ paid content & reports including dedicated analyst time check out Enterprise subscription.