As we start 2022, the IoT Analytics team has again evaluated the past year’s main IoT developments in the global “Internet of Things” arena. This article highlights some general observations and our top 10 IoT stories from 2021, a year that was yet again largely influenced by the global Covid-19 pandemic. (For your reference, here is our 2020 IoT year in review article.)

General IoT 2021 market

2021 was a wild year. We were supposed to witness a broad Covid recovery but things turned out to be much messier than expected. Nonetheless, companies did accelerate their digitization initiatives. The market grew to 12.3 billion connected IoT devices and roughly $160 billion in IoT enterprise spending. The outlook remains very positive. (IoT Analytics will publish the 2021 IoT spending actuals shortly).

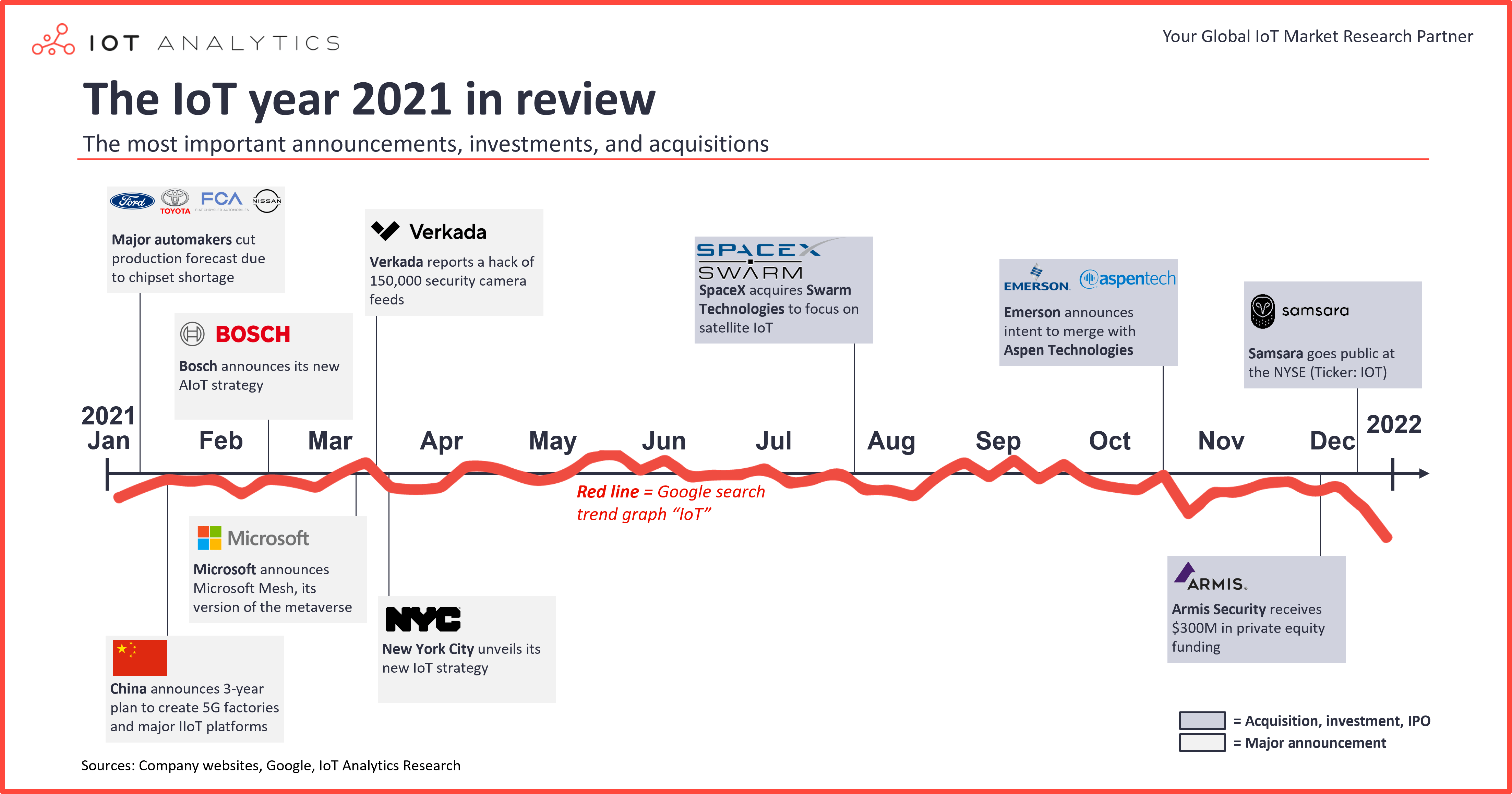

The public relevance of the term “IoT” continued to decline slightly (see Google trend graph in the lead image of this article). Nonetheless, the importance of the term “IoT” in US company earnings calls, climbed to above 5% of all calls, significantly up from a low of near 3% at the height of the pandemic and above pre-pandemic levels.

For us at IoT Analytics it shows that the general public is taking IoT connectivity and IoT devices as a given at this point while companies continue to invest and increasingly use the term “IoT” in their messaging to various stakeholders.

Top 10 IoT 2021 stories

Throughout 2021, we monitored significant developments around IoT technology. In our opinion, these are the top 10 stories of IoT 2021 (in chronological order):

1. Most unexpected IoT market inhibitor: chip shortage

In January 2021, major auto makers, including Ford, Toyota, Fiat Chrysler, and Nissan Motor announced they would have to cut vehicle production due to a shortage of semiconductors. For many in the industry, the news was unexpected and seemed to come from nowhere.

In hindsight, a number of factors contributed to the shortage, including a surge in demand for computers as people worked from home, chip production facilities that were locked down due to the pandemic, the China–US trade war that imposed restrictions on Chinese chip manufacturers, and a number of individual events, such as fires at facilities and severe winter storms that caused some factories to shut.

The shortage initially impacted the automotive industry, which is known for optimized just-in-time supply chains, but soon moved to other areas, such as computers, gaming consoles, and IoT devices.

Although many auto makers have asserted that the shortage has eased for them, the supply situation remains tight. In November 2021, Nissan CEO Makoto Uchida said that it was too early to tell when normal deliveries could resume. IoT Analytics estimates that the shortage prevented deliveries of 20 million cellular IoT chips in 2021.

Many experts are predicting that the shortage will last well into 2022 and potentially into 2023, when new supply capacities will become available (e.g., from TSMC and Intel).

Satyajit Sinha, Senior Analyst Connectivity&Hardware at IoT Analytics adds: “2021 was supposed to be the recovery year from the COVID-19 impact on both the demand and supply of semiconductors. However, COVID’s new variants continued to disrupt 2021 which has resulted in severe supply chain issues, such as lack of vessels, shipping containers, and port congestion. The combination of COVID 19 and chip shortage will continue well into 2022 as chips supply chain remain disrupted.”

2. Most notable new IoT government initiative: China’s 30 fully connected 5G factories

In January 2021, the Chinese government issued a press release outlining a three-year plan to create 30 fully connected fifth generation (5G) factories. The statement did not provide any details about which factories these will be, but the Ministry of Industry and Information Technology also asserted that “three to five industrial Internet platforms with international influence will come into being…by 2023.” Sidenote: Our research on IoT platforms in 2021 did note an increased amount of Chinese IoT platforms, such as Tuya or Baidu IoT Core.

One of those 30 factories might be the Qingdao factory of China’s consumer electronics giant Haier. The company, together with Huawei and China Mobile, announced in November 2021 that it is planning to roll out 5G to 100 factories by 2025. The key 5G factory use case highlighted by the companies is quality control using high-definition cameras with AI software executed at the edge and AI model training in the cloud. The press release touts this function, claiming it enables quality control checks to be performed with 10% more accuracy.

3. Most promising IoT technology development: artificial intelligence and the IoT (AIoT)

In our 2020 year-in-review blog, we highlighted AIoT as the most prominent new buzzword, mentioning that a number of Chinese and US firms had adopted the new term.

In February 2021, German automotive supplier and early IoT pioneer Bosch unveiled its AIoT strategy. Bosch believes that the combination of artificial intelligence (AI) and the IoT will create billion-dollar growth opportunities in markets. Then-CEO Denner stated, “We want to become a leading AIoT company.” In May, the company launched its new edge AI platform, “Phantom Edge,” and in June 2021, the company opened a €1 billion semiconductor plant, known as its first AIoT factory. Bosch experts were also involved in creating the AIoT playbook, an open-access practitioners’ guide to AIoT.

Other companies that turned to AIoT in 2021 include Advantech and Qualcomm, which released a number of AI and IoT chipsets in June 2021, including Qualcomm QCS8250, an all-in one 5G, Wi-fi, and AI chipset.

An IoT Analytics market report published in November 2021 estimates that the global industrial AIoT market will reach $102 billion by 2026.

4. Most prominent new IoT-related buzzword: metaverse

In October 2021, the world was stunned when Facebook changed its name to Meta, and Mark Zuckerberg announced that the company would bet its future on the concept of the metaverse, which at that point was new to many people.

Although it seemed to many that Facebook was the first mover in this space, a number of other companies had previously invested into the same (or at least a similar) concept. Seven months prior to Facebook’s name change, in March 2021, Microsoft announced its version of the metaverse, Microsoft Mesh, a mixed reality platform that allows people in different physical locations to join collaborative and shared holographic experiences on many kinds of devices.

Nvidia presented Omniverse, a virtual environment the company describes as a metaverse for engineers in 2020.

Recently, firms such as PTC and Microsoft have coined the term “industrial metaverse” to describe mixed reality and augmented reality scenarios in enterprises and, more specifically, in product development and manufacturing.

5. IoT security breach of the year: Verkada

Major security breaches unfortunately have become common themes in our annual reviews. Widely reported hacks in 2021 include the Colonial Pipeline and the JBS meat packing plant ransomware attacks. IoT devices played less of a role in those attacks than in others. The Log4j flaw reported in December 2021 had a major impact on software all around the world, with some companies, such as Palo Alto Networks, issuing specific guidance on how to fix the flaw in IoT devices.

In June 2021, the McAfee Enterprise Advanced Threat Research team reported a major security flaw in the connected equipment of high-flying home sports equipment company Peloton.

According to Kaspersky, 1.5 billion IoT breaches occurred from January to June 2021, double the number from a year earlier. The company noted that 58% of those breaches leveraged the Telnet protocol, often with the intent of mining cryptocurrency, causing distributed denial-of-service shutdowns, or pilfering confidential data.

Some of the most vulnerable and attacked IoT devices are smart security cameras; criminal gangs are stealing and selling private videos on a massive scale.

In March 2021, hackers reportedly compromised the security feeds of some 150,000 IoT security cameras from Silicon Valley scale-up Verkada. This included access to camera feeds from enterprises (such as Tesla and Cloudflare) and public agencies (such as police stations, hospitals, schools, and prisons). According to reports, the attackers used a basic method to breach Verkada’s systems: a username and password granting access to a super admin account on the public internet. Once it was discovered, the company quickly addressed the security flaw.

6. Most notable new IoT project: New York City

With thousands of ongoing IoT projects, it is sometimes difficult to distinguish the big and serious IoT initiatives from the small and not-so-serious ones. But when the mayor’s office of the biggest city (New York) within the biggest economy in the world (U.S.) announces a holistic IoT strategy, the world takes notice.

In March 2021, John Paul Farmer, CTO of the city of New York, published a 78-page document titled “The New York City Internet of Things Strategy.”

The new IoT strategy builds on existing IoT initiatives, such as the city’s 800,000 connected water meters, 23,000 connected public transport vehicles, numerous smart connected speed cameras, air quality monitoring programs, and bike counters.

The new strategy includes training, funding, forums, and consultancy and city-wide coordination of network deployments, such as 5G, narrowband (NB)-IoT, and long-range wide-area network (LoraWAN).

In line with the new strategy, New York in March 2021 also initiated a request for proposals to expand broadband infrastructure and close the digital divide. Mayor Bill de Blasio committed $157 million in capital investment for the program and planned to make up to 100,000 city-owned assets available.

In December 2021, the city reported that it had completed the first of 22 milestones: launching a rapid IoT data insights program. As part of the program, the city installed a number of LoraWAN connected temperature/humidity sensors to analyze the effect on citizens of various city planning initiatives to address heat vulnerability. Data are publicly available.

7. Upcoming IoT connectivity technology: Satellite IoT

The race for ubiquitous satellite connectivity for IoT devices reached a new level in August 2021, when Elon Musk’s SpaceX bought IoT satellite connectivity specialist Swarm Technologies, and the world took notice. In our 2019 IoT Year in Review, we highlighted the rise of nano satellites and the related promise of ubiquitous connectivity for IoT devices in very remote places. Swarm has so far launched 120 tiny SpaceBEE satellites into orbit, with another 30 expected to follow in early 2022. The team at Swarm wrote their own 2021 year-in-review blog, which you can read here.

As exciting as the acquisition of Swarm by SpaceX sounds, many of Swarm’s competitors were facing tremendous headwinds in 2021. IoT satellite startup Hiber dropped its plans to launch its own constellation in September 2021, while Myriota partnered with Spire rather than launching its own satellites.

It seems that there is not (yet?) enough market demand to support growth for the flurry of new IoT satellite startups. Perhaps Elon Musk’s media presence can change that in 2022.

8. Biggest IoT-related merger/acquisition: Emerson and AspenTech

On October 11, 2021, Emerson and AspenTech announced their intent to merge the Emerson industrial software business with AspenTech to create a new AspenTech, majority-owned by Emerson. The transaction equity value was valued at $11 billion. AspenTech, which since its founding in 1981 has established itself as a rare pure-play software player focused on process industries, had recently shifted toward integrating AI capabilities (e.g., by acquiring Canada-based Mnubo in 2019). As Emerson is well-positioned as a leader in process industry industrial automation (DCS systems), the deal is an opportunity to broaden its rather light software portfolio in the space (mainly consisting of previous acquisitions OSI Inc. and Geological Simulation).

Emerson in a strategy update, hinted at more acquisitions in the industrial software space. The New AspenTech will target acquisitions of companies offering adjacent software categories such as Enterprise Asset Management, Field Services Management, or Manufacturing Execution Systems.

The 55% stake by Emerson reminds us of another industrial automation player, Schneider Electric, which holds a 59% share in software provider Aveva (Note: Aveva also announced the $5bn acquisition of Osisoft in 2020 which completed in 2021).

Notable acquisition announcements of 2021 (with relevance for IoT) included:

| Acquirer | Acquired company | Deal size | Category |

|---|---|---|---|

| Emerson | Aspen Technology | $11 B | Industrial IoT |

| Panasonic | Blue Yonder | $8.5 B | IoT in supply chain |

| Renesas Electronics | Dialog Semiconductor | ~$6 B | Semiconductors |

| CDW Corporation | Sirius Computer Solutions | $2.5 B | IoT integration |

| Rockwell Automation | Plex Systems | $2.2 B | Industrial IoT |

| Marvell | Innovium | $1.1 B | Semiconductors |

| Generac Power Systems | ecobee | $700 M | Consumer IoT |

| JFrog | Vdoo | $300 M | IoT security |

| Life360 | Tile | $205 M | Consumer IoT |

| EROAD | Coretex | $158 M | IoT platform |

| Digimarc | Evrythng | n/a | IoT platform |

| Planon | Axonize | n/a | IoT platform |

| Giesecke+Devrient | Pod Group | n/a | IoT connectivity |

| Accenture | umlaut | n/a | IoT integration & consulting |

9. Biggest 2021 IoT funding round: Armis Security’s $300 million

For the first time, a company focused on cybersecurity tops the list of highest-funded IoT startups. In November 2021, Israel-based Armis Security raised $300 million from One Equity Partners with the aim of building out its visibility and security platform for all assets within an enterprise, including information technology (IT) and IoT. The funding round valued the company at $3.4 billion, a 70% increase from the investment round that closed just 10 months earlier (February 2021).

Also for the first time, no US-based startup made the list of the top five highest-funded IoT startups, showing the extent to which countries other than the US have embraced the IoT.

Notable top investment rounds of 2021 (with relevance for IoT) included:

| Company | Funding stage | Amount | Country | Category | Lead investor |

|---|---|---|---|---|---|

| Armis Security | Private equity | $300 M | Israel | IoT security | One Equity Partners |

| Infarm | Series D | $200 M | Germany | IoT-based vertical farming | Qatar Investment Authority |

| Wiliot | Series C | $200 M | Israel | IoT-based product/asset tracking | SoftBank Vision Fund |

| Aqara | Series C | ~$160 M | China | Consumer IoT/smart home | Shenzhen Capital Group |

| Hangshun Chips | Series D | ~$160 M | China | IoT semiconductors | Shenzhen Investment Holdings |

| Helium | ICO | ~$111 M | USA | IoT connectivity | Andreessen Horowitz |

10. Biggest 2021 IoT IPO: Samsara

After a strong start, the top IOT-focused IPO that we highlighted in our 2020 Year in Review, C3.ai, had a dismal 2021. Shares fell more than 80% from its all-time high in February 2021 and are currently trading at $29.54 (as of January 10, 2022), well below its IPO price of $42.

On December 15, 2021, Samsara went public, with an $11.5 billion valuation at the New York Stock Exchange (ticker symbol “IOT”). Samsara is an IoT success story that also made headlines in our previous year-in-review articles. The company topped our list of highest-funded IoT startups in both 2019 and 2020.

The company was founded in 2015 by Sanjit Biswas and John Bicket, two former MIT PhDs who successfully sold a cloud networking device business to Cisco in 2012 for $1.2 billion. An IoT pure-play, Samsara initially focused on vehicle telematics and fleet management solutions. The company has been expanding its product portfolio in recent years, offering a holistic connected operations cloud and targeting other industries, such as utilities, manufacturing, and retail.

Samsara reported a net loss of $102 million on revenue of $303 million for the nine months ending on October 30 (+74% year on year).

The December 2021 IPO has been a success, with shares appreciating ~30% from the IPO price of $23 in just 2 weeks. Shares have come back down to $23 since (as of January 10, 2022).

Notable 2021 IPOs with an IoT component:

| Name | IoT product | IPO date | Ticker |

|---|---|---|---|

| View Inc. | Smart windows | Mar 9, 2021 | VIEW |

| Tuya | Consumer IoT, IoT Platform | Mar 18, 2021 | TUYA |

| Kore Wireless | IoT Connectivity | October 1, 2021 | KORE |

| Samsara | Fleet Management, IoT operations | December 15, 2021 | IOT |

Further information

IoT Analytics constantly monitors current trends in IoT markets and makes them available to enterprise subscription clients.

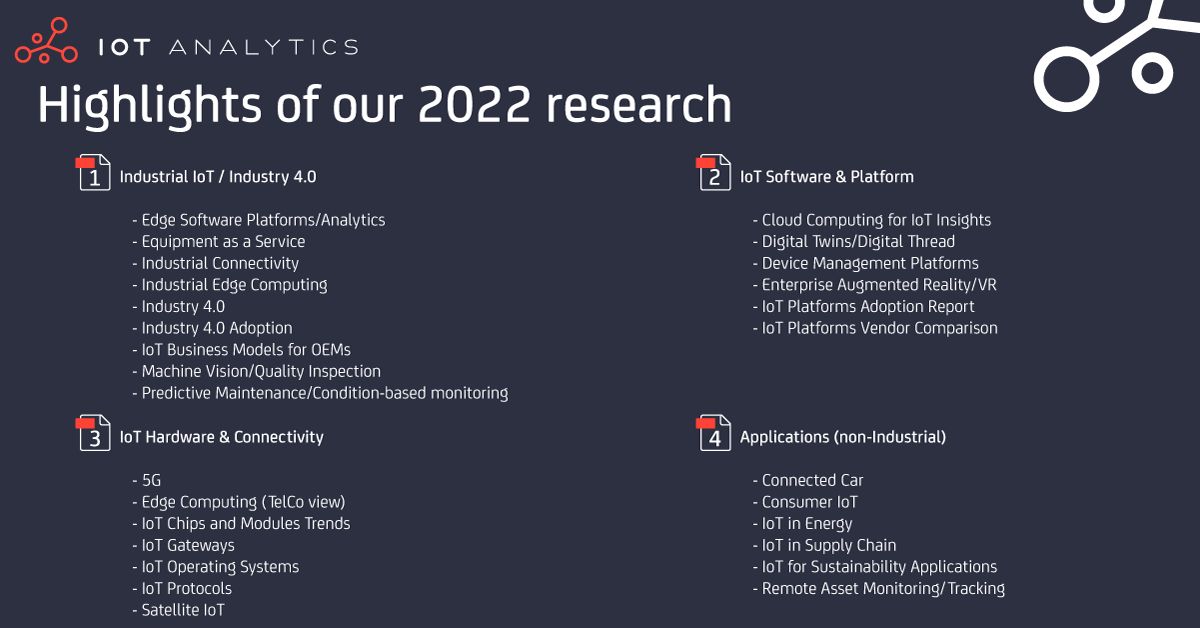

Our IoT coverage in 2021

If you would like to take a deeper look at current IoT markets, you may be interested in one or several of the 24 market reports we published in 2021. You can find the complete overview here.

Our IoT coverage in 2022

For continued coverage and updates (such as this one), you may subscribe to our newsletter. In 2022, we will keep our focus on important IoT topics such as Industrial IoT, Cloud, Sensors, IoT connectivity, and more. Plenty of new reports will be published in the coming months.

For a complete enterprise IoT coverage (Enterprise subscription) with access to all of IoT Analytics paid content & reports as well as dedicated analyst time, your company may subscribe to the Corporate Research Subscription.

Much success for 2022 from our IoT Analytics team to yours!