As we start 2021, the IoT Analytics team has again evaluated the past year’s main IoT developments in the global “Internet of Things” arena. This article highlights some general observations and our top 10 IoT stories from 2020, a year that was largely influenced by the global Covid-19 pandemic. (For your reference, here is our 2019 IoT year in review article.)

A. The effect of Covid-19 on IoT 2020

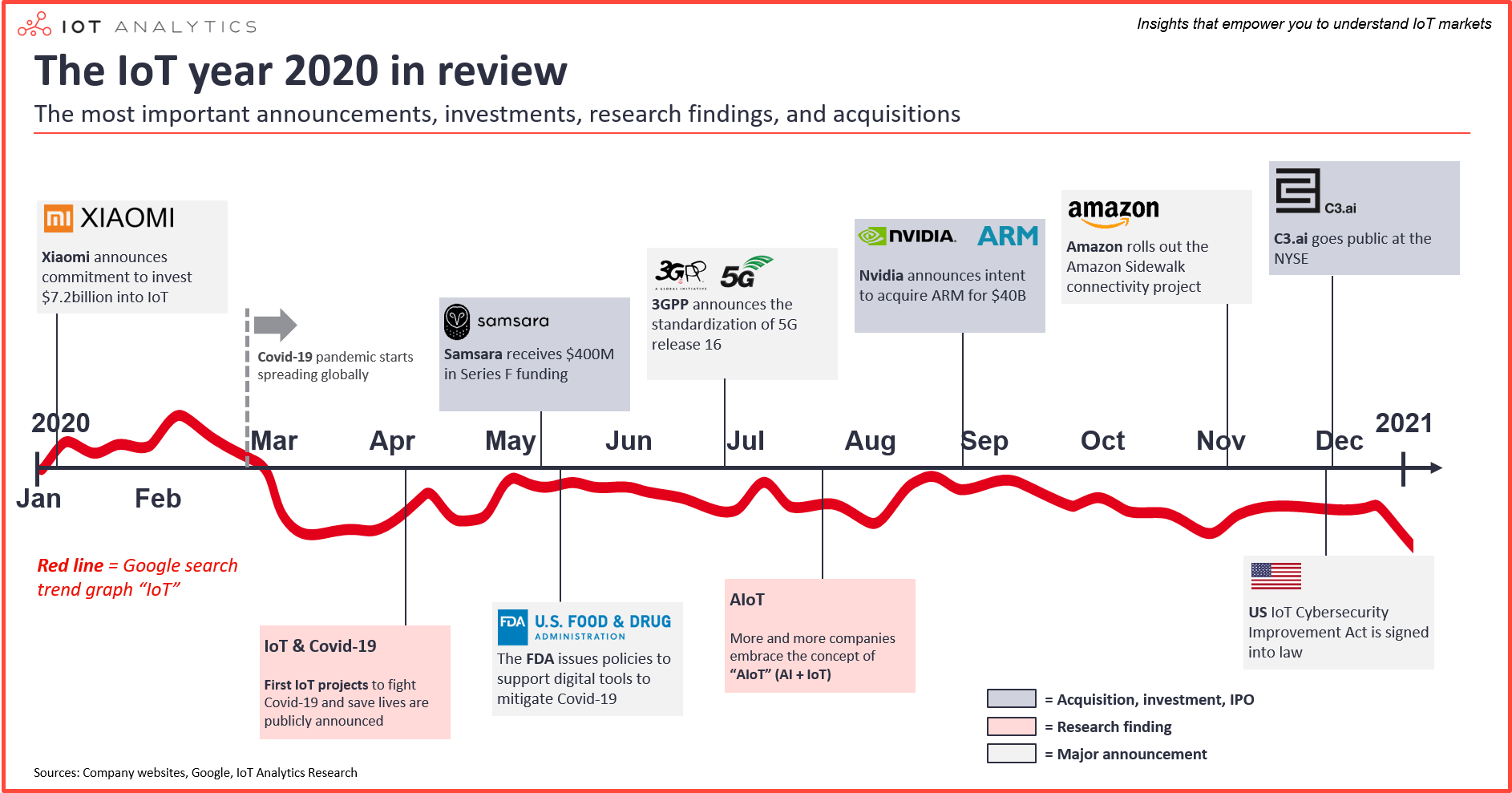

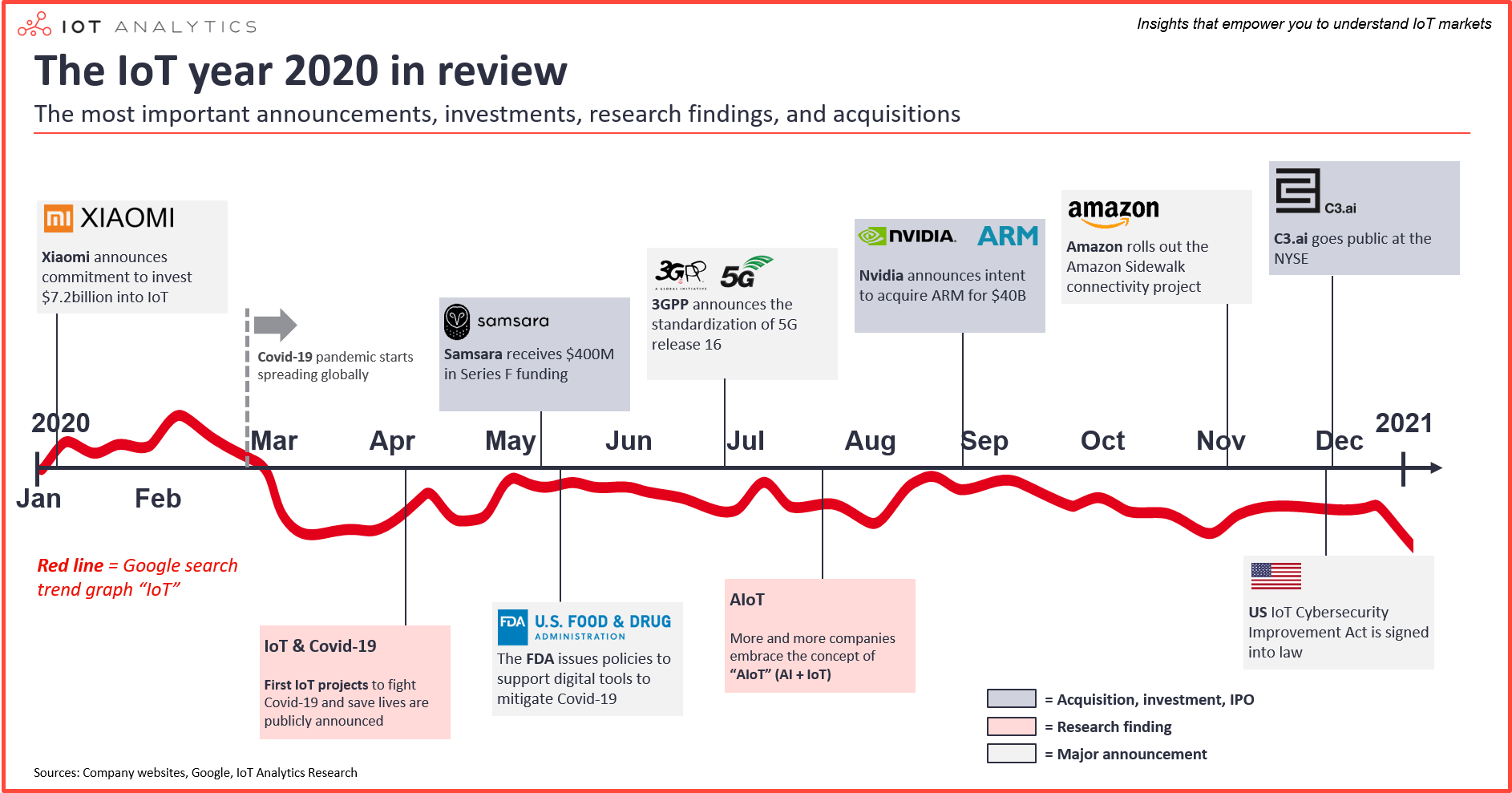

Public interest for IoT declined 15% due to Covid-19

Google searches for the topic “Internet of Things” suddenly dropped approx. 15% with the start of the pandemic in March 2020. Search volume has remained relatively stable at this lower level since, not signaling a recovery in interest. IoT apparently did not play as big of a role for the general public as other topics did. Public search interest for gaming, for example, surged approximately 65% in the same timeframe, interest for “work from home” increased 104%, and interest for “unemployment benefits” soared a staggering 250%. IoT Analytics’ analysis of 3,000+ earnings calls showed a similar decline in the use of the term “IoT” in Q2/2020 (more here); however, discussion of IoT (especially “Industrial IoT”) picked back up in Q3 (more on that analysis here).

IoT 2020 markets remained strong, despite the pandemic

Despite the ongoing Covid-19 pandemic, and a decline in global GDP of 5% in 2020, the market for the Internet of Things grew in 2020, according to our analyses (both in terms of dollars spent as well as the total number of connected devices). While a small number of IoT projects were stopped or delayed for various reasons (e.g., due to the inability to set up the infrastructure during the lockdown), the majority of IoT 2020 projects continued.

In fact, 2020 marked an inflection point for smart devices. For the first time ever, the number of active IoT connections (e.g., connected cars, smart home devices, connected industrial equipment) surpassed the number of non-IoT connections (e.g., smartphones, laptops, and computers). IoT Analytics estimates that there are now 21.7 billion active connected devices worldwide. 54% (11.7 billion) of these are IoT device connections. By 2025, it is expected that there will be more than 30 billion IoT connections, or almost 4 IoT devices per person on the planet. (more on that analysis here)

More than a dozen IoT themes accelerated with the pandemic

IoT played (and still plays) a crucial role in navigating the pandemic. A few IoT-centric use cases played (and continue to play) essential roles in helping the world navigate through the pandemic. The most notable ones include IoT-based contact tracing in workplaces, hospitals, and elsewhere (Example: Concept Reply Tracking & Location System) as well as product tracking and verification across the vaccine supply chain (Example: Controlant – see below).

Apart from those IoT 2020 use cases that support the “new reality”, a number of additional themes emerged, many of which have longer-lasting structural implications. IoT Analytics first published these observations in April 2020 in an analysis called “The impact of Covid-19 on the Internet of Things” (Part 1 can be found here and part 2 here).

A survey of 60 senior IT decision makers in manufacturing, transportation, and industrial companies, in October 2020 confirmed that nearly all of these 25 trends were perceived as having a longer-lasting effect on their organizations (The results were published in the “Industrial IT Outlook 2021” – available for download for corporate clients).

An overwhelming 92% of respondents agreed that “company-wide digitization” will be more important in a post-Covid world (with 38% saying it will be “much more important”). The ability to perform “remote asset access” came in second (90% say it will be more important). Having more “business process automation” came third (88% say it will be more important).

Cautiously positive 2021 outlook

The overall picture for IoT technology, going into 2021, looks optimistic. There is a general consensus that any negative impact on business due to Covid-19 will fade in 2021 and that the new “digital transformation wave” will fuel IoT markets. One of the themes that companies are going to accelerate is “New tech-enabled business models” (see the analysis of top 5 IT priorities for 2021 here). Many of these new business models will be enabled by connected IoT products (see also our June 2020 analysis on how to create successful IoT business models with smart connected products here).

Another major theme that companies are focusing on is “Artificial Intelligence”; 3 of our top 10 IoT 2020 stories center around the topic of AI.

B. Top 10 IoT 2020 Stories

Throughout 2020, we monitored significant developments around IoT technology. In our opinion, these are the top 10 stories of IoT 2020 (in chronological order):

1. Biggest new IoT commitment: Xiaomi

In January 2020, Chinese electronics manufacturer Xiaomi announced that it plans to at least invest $7.2 billion into 5G and the artificial intelligence of things (AIOT) in the next 5 years. The new push includes major investments into a number of consumer and enterprise IoT devices such as smart TVs, drones, electric scooters, air purifiers, routers, security cameras, and much more.

2. Biggest IoT contribution to Covid-19 relief: Saving lives

At the beginning of 2020, nobody in the IoT industry could foresee the important role IoT technology would play to save lives throughout the year. A widely cited June 2020 study by the Imperial College London estimated that social distancing during the first wave of the Covid-19 pandemic saved 3 million lives in Europe alone. While most of these saved lives can be attributed to people simply staying at home, wearing masks, and avoiding contact, IoT technology undoubtedly prevented further spread in several instances.

Many IoT vendors raced to launch social distancing tools (including Bosch.IO’s workplace distancing and contact tracing solution, Software AG’s and Dell’s Smart Social Distancing solution, or Concept Reply’s Tracking and Location system – just to name a few).

The Goebecke bakery in the German city of Leipzig is just one of the many examples of a business using such a solution. The business owner described how both the audio alerts in the workplace and the ability to analyze the employee data led to more cautious and aware employees who subsequently changed their distancing behavior.

More recently, the focus of IoT for Covid-19 has shifted to vaccine supply chain monitoring to ensure vaccines are delivered safely without product loss, tampering, or spoilage. Pfizer/Biontech, for example, selected the Iceland-based startup Controlant to monitor its Covid-19 vaccine distribution.

3. Most accelerated IoT vertical: Healthcare

For years, implementing IoT projects in healthcare settings had proven to be cumbersome due to the highly regulated nature of the industry, and a lack of sponsorship and urgency to digitize portions of the sector.

Now, there is growing evidence that Covid-19 has led to a digital explosion in healthcare, particularly in hospitals. The US Food and Drug Administration (FDA), in May 2020, issued multiple temporary policies to support digital tools during 2020. For the first time, Germany in October 2020 allowed doctors to prescribe access to digital health apps for specific diseases (e.g., an app that helps in curing anxiety disorder).

One of the applications that surged during the pandemic is “telehealth”, where a doctor treats a patient via video conference. Doctors report that telehealth is often seen as just a first step towards digital diagnostics that leans on IoT devices to diagnose patients from afar. Several hospitals started experimenting with it in 2020. In December 2020, a video of a London surgeon went viral who performed remote surgery on a banana in California using 5G.

4. Biggest IoT 2020 funding round: Samsara

Samsara has done it again. Samsara already topped our 2019 list of biggest IoT funding rounds ($300M, Series F). In May 2020, in the middle of the first Covid-19 lockdown, the company raised another $400 million with the aim to further build out its Industrial IoT presence. The funding round valued the company at $5.4B, a 14% valuation decrease from the 2019 investment. While announcing the funding round, CEO Sanjit Biswas, also announced the layoff of 300 jobs (18% of the workforce) due to Covid-19 impact on their key vertical of transportation.

Notable top investment rounds of 2020 (with relevance for IoT) included:

| Company | Funding stage | Amount | Country | Category |

|---|---|---|---|---|

| Samsara | Series F | $400M | USA | Industrial IoT |

| Infarm | Series C | $170M | Germany | IoT-based vertical farming |

| COSMOplat | Series A | $150M | China | Industrial Iot Platform |

| Skylo | Series B | $103M | USA/India | IoT Connectivity (Satellite) |

| ForgeRock | Series D | $93.5M | USA | IoT Security |

| Verkada | Series C | $80M | USA | Smart Buildings |

5. Most important technology standardization: 5G Release 16

In July 2020, the 3GPP standards body reached an important milestone: It released version 16, its second set of specifications for 5G technology, and a crucial step for 5G IoT. The new set of specifications that make up Release 16 include major improvements for “ultra-reliable, low-latency communication” (eURLLC), positioning capabilities, as well as support for TSN (Time-Sensitive Networking) – all aspects which are very important for IoT connectivity for various IoT use cases, particularly for higher-end applications such as those often found in the Industrial IoT space. Besides, Release 16 enables the deployment and management of NB-IoT and LTE-M technologies over the new 5G Core networks, allowing 5G networks to manage massive and low complexity IoT through these technologies. Currently, there are globally about ~200 million IoT connections that use NB-IoT/LTE-M. IoT Analytics expects 5G IoT for higher-end applications to take off in 2022 and beyond.

6. Most prominent new buzzword: AIoT

For years, people have argued that IoT’s real value gets unlocked with AI/ML algorithms that are applied to the IoT data streams. Therefore, in hindsight, it is not surprising that 2020 produced a new buzzword that became mainstream: AI + IoT= AIoT. In December 2020, there were roughly 70% more Google searches for the topic than 12 months prior. Interestingly, the term seems to have originated in China (and not in the US, like the term “IoT”). Huawei and Xiaomi but also Taiwanese semiconductor giant TSMC have been pushing the idea of the Artificial Intelligence of Things, the convergence of AI and IoT for a couple of years now.

In 2020, a number of “non-Chinese” firms took up the term in their branding efforts. US-based industrial software provider, Aspen Technology in August 2020, announced its new AIoT hub for Industry 4.0, Swiss cybersecurity company Wisekey in September 2020 launched a new digital strategy centered around AIoT. Other examples of firms pushing the term in 2020 include Singapore-based ASM Pacific Technology and US-based analytics software provider SAS.

7. Biggest IoT-related acquisition: ARM-Nvidia

On September 13, 2020, Nvidia announced its intent to acquire ARM in the largest semiconductor deal to date, valued at $40 billion. Apart from being the largest semiconductor deal, the acquisition is expected to result in new technology innovation for AI & edge IoT. NVIDIA purchased the major segment of the business, ARM’s Processor IP, which also has a significant IoT component, especially for edge computing. However, ARM’s IoT product & service group (ARM’s Pelion IoT Platform, MbedOS, SoC Solution/Security, and KigenSIM solution) will not be a part of this transaction. If the deal receives regulatory approval, it could lead to a scenario in which Chinese companies are permanently withheld from ARM’s technology. This may further create imbalances in the US-China trade relation, creating a US dominance in the semiconductor IP market.

Notable acquisitions of 2020 (with relevance for IoT) included:

| Acquirer | Acquired company | Deal size | Category |

|---|---|---|---|

| Nvidia | ARM | $40B | Semiconductor |

| Infineon Technologies | Cypress | $9.4B | Semiconductor |

| Nvidia | Mellanox | $7B | Semiconductor |

| Aveva | OSIsoft | $5B | Industrial IoT |

| BMC | Compuware | $2B | Smart Enterprise |

| HPW | SilverPeak | $925M | Edge Computing |

| Netapp | Spot.io | $450M | Edge Computing |

| Silicon Labs | RedpineLink | $308M | Semiconductor |

| Synaptic | DisplayLink | $305M | Semiconductor |

| Amdocs | Openet | $180M | Smart Enterprise |

| Microsoft | CyberX | $165M | IoT Security |

8. Most ambitious new IoT connectivity technology: Amazon Sidewalk

In November 2020, Amazon informed customers of Amazon Echo devices and Ring security cameras that Amazon Sidewalk will soon be rolled out to their devices. Sidewalk is an ambitious project aiming to create a neighborhood-shared network to allow IoT devices such as pet or asset trackers to connect to the internet even when someone’s home wi-fi network is down or out of range. This is done by linking different wi-fi networks into a single low-bandwidth network that can be used by IoT devices from different users.

In September 2020, Semtech, the chip company behind the Lora low-power standard, announced that it had entered into a partnership with Amazon to collaborate on building out the network. A few months later, in December, it was reported that the Lora Alliance was in talks to also come on board and support Sidewalk by using the open LoRaWAN standard, which the alliance and its 500+ member companies support.

9. Most important government initiative: US IoT Cybersecurity Improvement Act

In December 2020, the “IoT Cybersecurity Improvement Act” was finally signed into law in the US. We had already discussed the importance of the law in our 2017 IoT year in review article (here). Among other things, the law requires the National Institute of Standards and Technology (NIST) to update IoT security standards and guidelines regularly (at least every 5 years). Experts hope that the law will lead manufacturers to design IoT devices with a number of cybersecurity features in mind (e.g., using secure coding practices, providing adequate authentication, patch devices on a regular basis).

10. Biggest IoT 2020 IPO: C3.ai

On December 9, 2020, C3.ai went public (Traded with the ticker “AI” at the New York Stock Exchange). C3 is a true IoT success story. The company was founded in 2009 by American billionaire Tom Siebel who is well-known for founding Siebel Systems, which he sold in January 2006 to Oracle. C3.ai was initially called C3 Energy and had a heavy focus on digitizing grids, meters, and utilities. The company later (in 2016) branded into C3IoT and broadened its focus beyond energy and as a horizontal IoT platform. In recent years, the company has emphasized horizontal analytics and AI capabilities, which is why the company rebranded yet again into C3.ai. C3.ai, today, claims that it reads data from 57 million sensors, but Siebel makes it clear that the focus is AI (including non-IoT applications ). The December 2020 IPO has been a success so far, with shares having soared >40% from its opening price, valuing the company at almost $14B (as of January 8).

C. Further information:

IoT Analytics constantly monitors current trends in IoT markets and makes them available to enterprise subscription clients.

Our IoT coverage in 2020:

If you would like to take a deeper look at current IoT markets, you may be interested to know that IoT Analytics publishes a semi-annual “State of the IoT” market update (Enterprise subscription-only content).

Our IoT coverage in 2021:

For continued coverage and updates (such as this one), you may subscribe to our newsletter. In 2021, we will keep our focus on important IoT topics such as IoT Connectivity, Industry 4.0, and various other IoT applications such as Smart Buildings. Plenty of new reports will be published in the first half of the year.

For a complete enterprise IoT coverage (Enterprise subscription) with access to all of IoT Analytics paid content & reports as well as dedicated analyst time, your company may subscribe to the Corporate Research Subscription.

Much success for 2021 from our IoT Analytics team to yours!