We updated this research article. Visit the link to view the latest insights.

In short

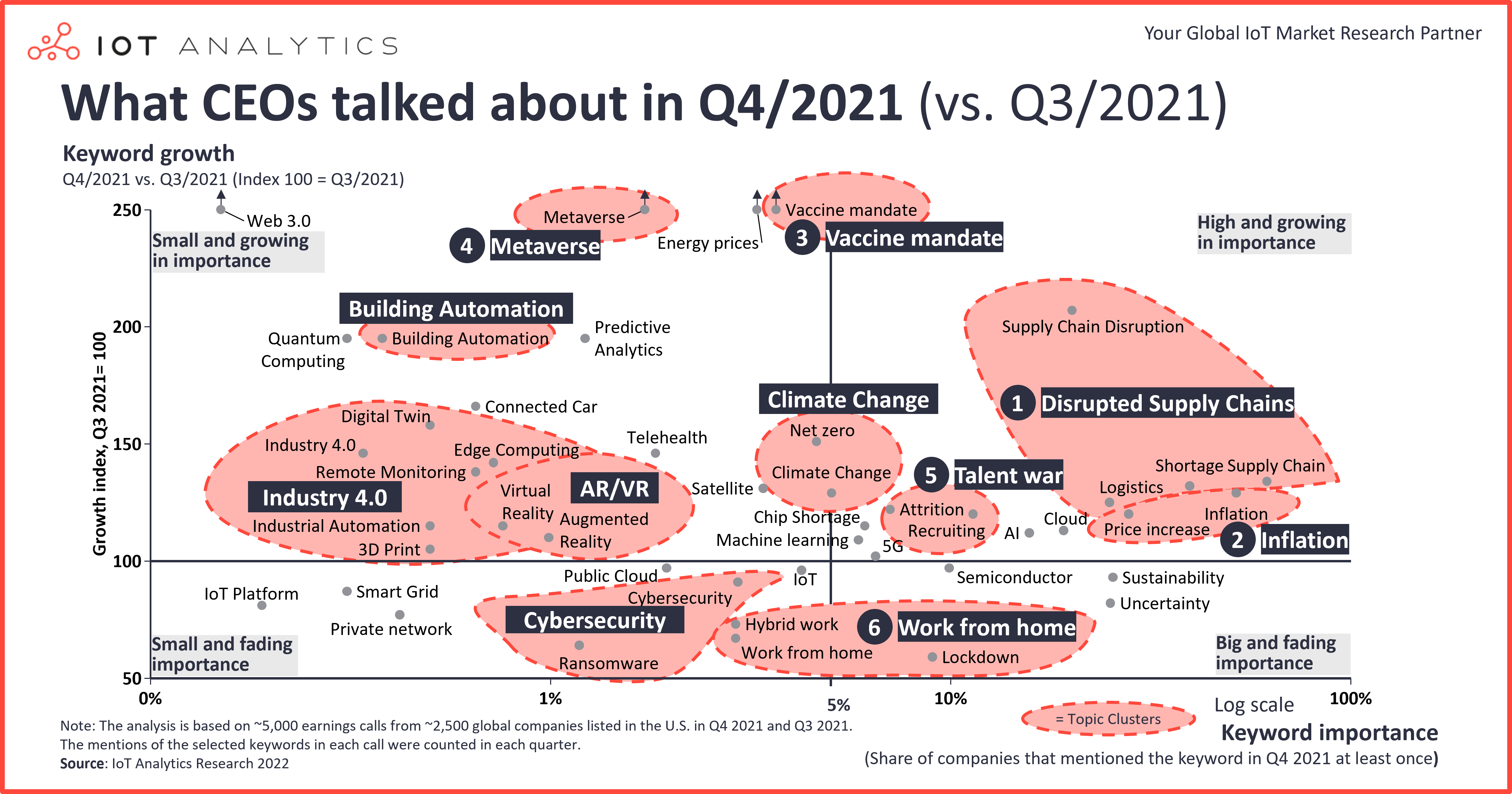

- The topic of supply chain disruptions topped Q4/2021 as the most widely discussed theme among executives. Other important and growing themes on the CEO agenda include inflation, vaccine mandates, the talent war, climate change, and the metaverse.

- Work-from-home themes declined sharply.

- In general, the prevalence of many digitalization and tech topics increased strongly after falling in Q3/2021 (e.g., AR/VR, building automation, Industry 4.0, cloud technology, AI).

Why it matters

- CEOs’ prioritization of specific topics will likely lead to further investment in these areas.

Introduction

60% of CEOs discussed pandemic-evoked supply chain disruptions in their earnings call in Q4/2021 (+30% growth compared to Q3/2021). Disrupted supply chains are a key component leading to higher input costs and therefore a factor in the rise of inflation.

Inflation was mentioned in 52% of all Q4/2021 earnings calls and has risen to record levels across the world. Quotes from CEOs show that companies aim for passing costs through to their clients. Companies also generally welcomed vaccine mandates as risk mitigation for their workforce.

The fastest growing new buzzword is “metaverse” with some companies renaming existing solutions in adjacent areas, such as “the industrial metaverse.”

| About the analysis

The “What CEOs talked about” analysis highlighted in this article presents the results of IoT Analytics’ research involving the Q4 earnings calls of ~2,500 US-listed companies. The resulting visualization is an indication of the digital and related topics CEOs prioritized in Q4 2021. The chart visualizes keyword importance and keyword growth:

X-axis: Keyword importance (i.e., how many companies mentioned the keyword in earnings calls in Q4). The further out the keyword falls on the x-axis, the more often the topic has been mentioned.

Y-axis: Keyword growth (i.e., the increase or decrease in mentions from Q3/2021 to Q4/2021, indexed to 100). A number >100 on the Y-axis indicates the topic has gained importance, while a number <100 indicates the topic has decreased in importance.

Read our Q3/2021 analysis here.

These were some of the most important topics discussed by CEOs in Q4/2021:

#1 Disrupted supply chains – Still top of mind

Supply chain disruptions were still the single biggest and rising issue for most CEOs as mentioned in over 60% of all earnings calls through all sectors and verticals, which is up by ~30% compared to the previous quarter. The escalation on raw materials driven by commodities and depleted inventory levels across value chains especially concerned CEOs.

Nonetheless, it is apparent that many companies handle supply chain shortages astonishingly well underpinned by net sales increases for many of the companies effected. Depending on the sector, CEOs expect supply chain pressures to ease from 2023 onward; for example, Deloitte expects semiconductor markets to normalize in 2023.

For fiscal 2021, we estimate supply chain disruptions and the resulting loss production, operating inefficiencies, premium freight, etc, had a net impact on the top line of about $1.9 billion and adjusted EBITDA by approximately $450 million.

Doug Del Grosso – President and Chief Executive Officer, Adient plc, 11/10/2021

Net sales for the fourth quarter of fiscal 2021 were $570 million, an increase of 7%. Sales for the quarter and the full year were negatively impacted by approximately $32 million due to global supply chain disruptions, which delayed orders scheduled for shipment.

Mark D. Hartman – Chief Financial Officer, Woodward Inc., 11/18/2021

#2 Inflation – At record levels but mitigation on the horizon

Inflation was mentioned in 52% of all earnings calls (a 29% increase compared to Q3/2021.

The annual inflation rate in the US accelerated to 6.8% in November of 2021, which the US Bureau of Labor Statistics reported to be the highest inflation rate since June of 1982. However, Goldman Sachs expects the federal government to take decisive action with four rate hikes this year and a balance sheet runoff to contain further inflation.

Quotes show that, if possible, companies have tried to offset “input cost inflation” by passing it through to their customers; for instance, Berry Global Group, a Fortune 500 plastic packaging manufacturer, routed up to 95% of the cost of inflation to their customers.

As you can see, we experienced a significant increase in the level of inflation and recovered 92% of record cost inflation in the September quarter and 95% of the over $1.5 billion of cost inflation during the fiscal year. As we’ve demonstrated historically, we remain committed to passing through cost inflation.

Thomas E. Salmon – Chief Executive Officer and Director Chairman of the Board, Berry Global Group, 11/18/2021

On the cost side, we are seeing significant inflation in wages, freight, product costs, and more, and our team has worked hard to minimize the impact of these.

Erik Gershwind – Chief Executive Officer, MSC Industrial Direct, 10/20/2021

#3 Vaccine mandate – 600% increase in mentions

The keyword “vaccine mandate” appeared the first time in Q3/2021 earnings call transcripts but with negligible mentions of 0.5%. In Q4/2021, we saw a sudden popup to 3.7%, a 619% increase.

Globally, governments and politicians have discussed whether it is ethically and legally justifiable to mandate vaccination.

Most CEOs do not perceive a workforce vaccination mandate as negative, as it reduces the risk of the critical workforce being quarantined or of having an operations shut down as a result of a COVID-19 breakout. Some of the companies enforced a vaccine mandate on their own. For instance, Tyson Food Inc., the biggest US food company, required all of its 139,000 workers to be vaccinated by the 1st of November 2021 (see quote below).

And then labor, I mean, I mentioned earlier that we’re back to near complete staffing … and our team is excited in terms of just the efficiency and improvement we’ve seen since completing our vaccine mandate on November 1.

Donnie King – President and Chief Executive Officer, Tyson Food Inc., 11/15/2021

We have not factored in that the vaccine mandate will further crimp the labor market. I think the impact that it could have is some incremental cost … it would probably be an incremental cost of a handful of millions of dollars to us to monitor and test.

Robert V. Vitale – President and Chief Executive Officer, Post Holdings Inc., 11/19/2021

#4 Metaverse – The new buzzword (also in industrial IoT)

The term “metaverse” was coined in the science fiction novel “Snow Crash” (1992) and describes an iteration of the internet as a single, universal 3D-world facilitated using virtual and augmented reality headsets, allowing remote, immersive cooperation that feels like “being almost physically together”.

The keyword “metaverse” was mentioned in only 1.7% of all Q4/2021 earnings calls, but that percentage is up 338% compared to Q3/2021. Not everyone is convinced that the metaverse is the next big thing. For example, Elon Musk highlighted in an interview that “motion sickness” and “bulky headsets” are the biggest potential inhibitors to mass metaverse adoption.

In industrial IoT, we observe many companies jumping on this potential “next big thing” bandwagon. Instead of referring to some of their technology as AR/VR or digital twin technology, companies like PTC now reference the “industrial metaverse” in some of their marketing materials and keynotes (see quote below).

Also, with all the buzz you hear about Metaverse these days, you might enjoy watching the amazing live industrial metaverse demonstration delivered as part of our manufacturing live keynote using our Vuforia Spatial Toolbox technology. Steve and I standing in front of our anonymized digital representations whose movement in activity is being measured and analyzed in real-time.

Jim Heppelmann – President and Chief Executive Officer, PTC Inc, 11/4/2021

With that, Creative Cloud crossed $10 billion in ARR and we saw continued strength in our Creative Cloud offers, while seeing outsized growth for Substance, which grew 100% year-over-year, thanks to increasing demand for 3D and the emerging Metaverse platforms.

David Wadhwani – President of Digital Media Business, Adobe Inc, 12/16/2021

#5 The talent war – Continuing to gain importance

“Attrition” was mentioned in 7.7% of all Q4 earnings calls, which is up 22% compared to the previous quarter.

With many people leaving their jobs, the global talent shortage is further amplified and creating more headaches for companies. This shortage is especially visible in areas pushed by technology, most notably e-commerce and cloud computing. According to the Wallstreet Journal, there were more than one million open (unfilled) job postings for “the cloud” going into Q4 2021, thereby keeping some firms out of the cloud.

Companies try to address the shortage with special recruiting initiatives, upskilling programs, and better employee attrition forecasting. For instance, ABM Industries, a facility management company with 48,000 employees, has implemented predictive data models to calculate where attrition may occur so that the company can react preemptively (see quote below).

Demand for talent is highly competitive. Our implementation of these requirements may result in some workforce attrition and difficulty meeting our existing or future hiring needs.

Bruce Caswell – President and Chief Executive Officer, Maximus Inc., 11/18/2021

We developed a predictive retention model to identify areas of the business that may experience higher levels of team member attrition. This data coupled with strong HR and operational partnership has led to site-specific action plans.

Raul Valentin – Executive Vice President and Chief Human Resources Officer, ABM Industries Inc., 12/15/2021

#6 Work from home – Not at the top of the agenda anymore

The term lockdown was still present in 9% of all Q4/2021 earnings calls but was down substantially at 41% compared to the previous quarter. One can infer that the fear of partial or total lockdowns affecting private life and businesses might be decreasing.

This aligns well with the fact that Q4/2021 earning call mentions of “hybrid work” and “work from home” were down 27% and 33%, respectively, compared to the previous quarter in which they already held low keyword importance levels.

As this three-keyword cluster starts to shrink, there is an indication that more and more employees will return to the office, see their colleagues in person, or begin business travel. Credit card giant Visa’s analysis of billions of credit card transactions underpinned this thesis, as the company expects cross-border travel to continue to recover through 2022 (see quote below).

For domestic volumes and transactions, we are assuming no disruptions from COVID-related lockdowns. For cross-border travel, we assume the recovery underway continues steadily through fiscal year ’22 to reach 2019 levels in the summer of 2023.

Vasant Prabhu – Vice Chairman and Chief Financial Officer, Visa, 10/27/2021

More information and further reading

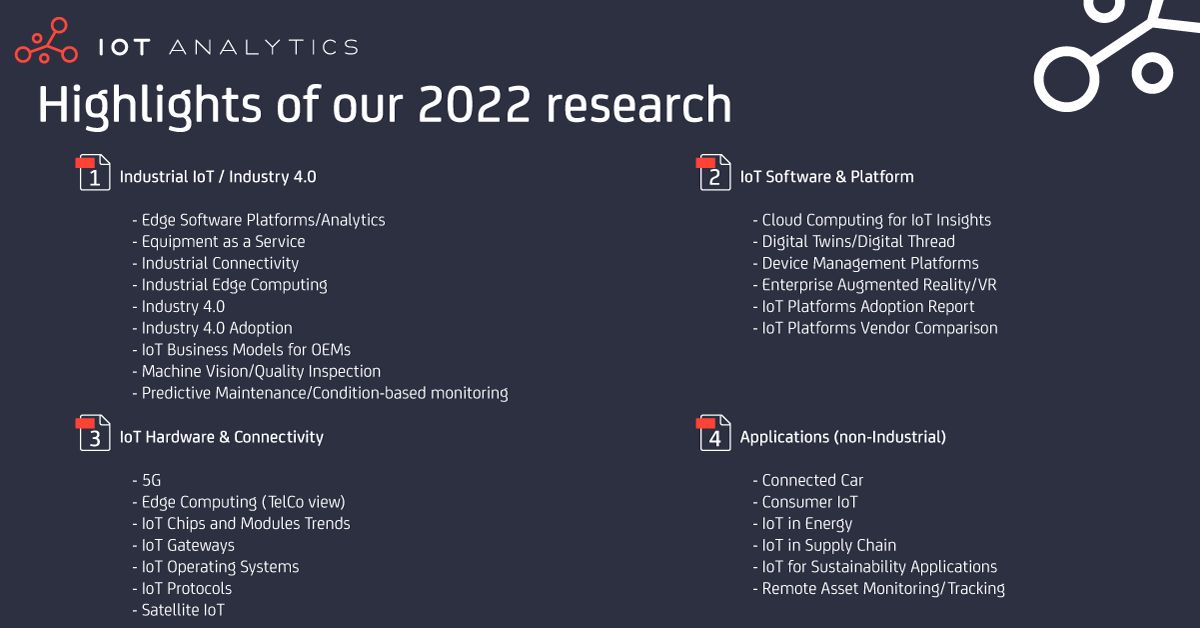

Are you interested in learning more about the latest technology market developments?

IoT Analytics is a leading global provider of market insights and strategic business intelligence for the Internet of Things (IoT), AI, Cloud, Edge and Industry 4.0.

Overview of our 2021 publications

In 2021, we have released the following publications (Q1 – Q4):

1. Industrial IoT

- Industrial IoT Software Companies Acquisition Target List 2022

- Industrial AI and AIoT Market Report 2021–2026

- Virtualization in Industrial Automation | Adoption Report 2021

- Smart Factories Insights Report 2021

- Predictive Maintenance Market Report 2021-2026

- Cloud MES Market Report 2021-2026

2. Non-industrial IoT

3. IoT Platforms and Software

- Cloud Computing Market Report 2021-2026

- Industrial AI Software Platform Vendor Landscape Report 2021

- IoT Platforms Competitive Landscape 2021

- IoT Platforms Market Report 2021-2026

- 2021 List of IoT Platforms Companies

- List of 700+ IoT system integration & services companies 2021

- IoT System Integration & Services Report 2021-26

4. IoT Connectivity & Hardware

- LPWAN Market Report 2021-2026

- Cellular IoT & LPWA Market Tracker (Q3 2021)

- Global Cellular IoT Chipset Tracker 2021

- Global Cellular IoT Module Tracker 2021

- IoT Semiconductor Market Report 2020-2025

5. General IoT

- IoT Use Case Adoption Report 2021

- State of IoT – Summer 2021

- IoT Startups Report and Database 2021

- IoT Enterprise Spending (June 2021 update)

- IT & IoT Trends – Q1 / 2021

Overview of our upcoming publications

Stay tuned for the following upcoming reports:

Related articles

You may also be interested in the following recent articles:

- IoT 2021 in review: The 10 Most Relevant IoT Developments of the Year

- What CEOs talked about in Q3/2021: Inflation, supply chain disruptions, and new ways of work

- Global IoT spending to grow 24% in 2021, led by investments in IoT software and IoT security

- The 15 key challenges with IoT Project Development in 2021

- 6 IoT adoption trends for 2022

- The top 10 IoT Use Cases

Are you interested in continued IoT coverage and updates?

Subscribe to our newsletter and follow us on LinkedIn and Twitter to stay up-to-date on the latest trends shaping the IoT markets. For complete enterprise IoT coverage with access to all of IoT Analytics’ paid content & reports including dedicated analyst time check out Enterprise subscription.

The article was jointly developed by the IoT Analytics data team and Jan Kotzorek.