Update October 2021: IoT Analytics published a more recent blog on: Soft PLCs: Revisiting the industrial innovator’s dilemma.

In short

- Software is increasingly replacing hardware in industrial environments

- Software-based controllers (Soft PLCs) today are reliable, powerful and flexible.

- Soft PLC adoption is expected to double between 2019 and 2025, posing an “innovator’s dilemma” for incumbent industrial automation vendors.

- Actions taken by incumbents will prevent significant disruption in the near-term, but the long-term threat of soft PLCs will remain.

Why it matters?

- Widespread adoption of soft PLCs would completely change the way industrial automation works and how factories operate.

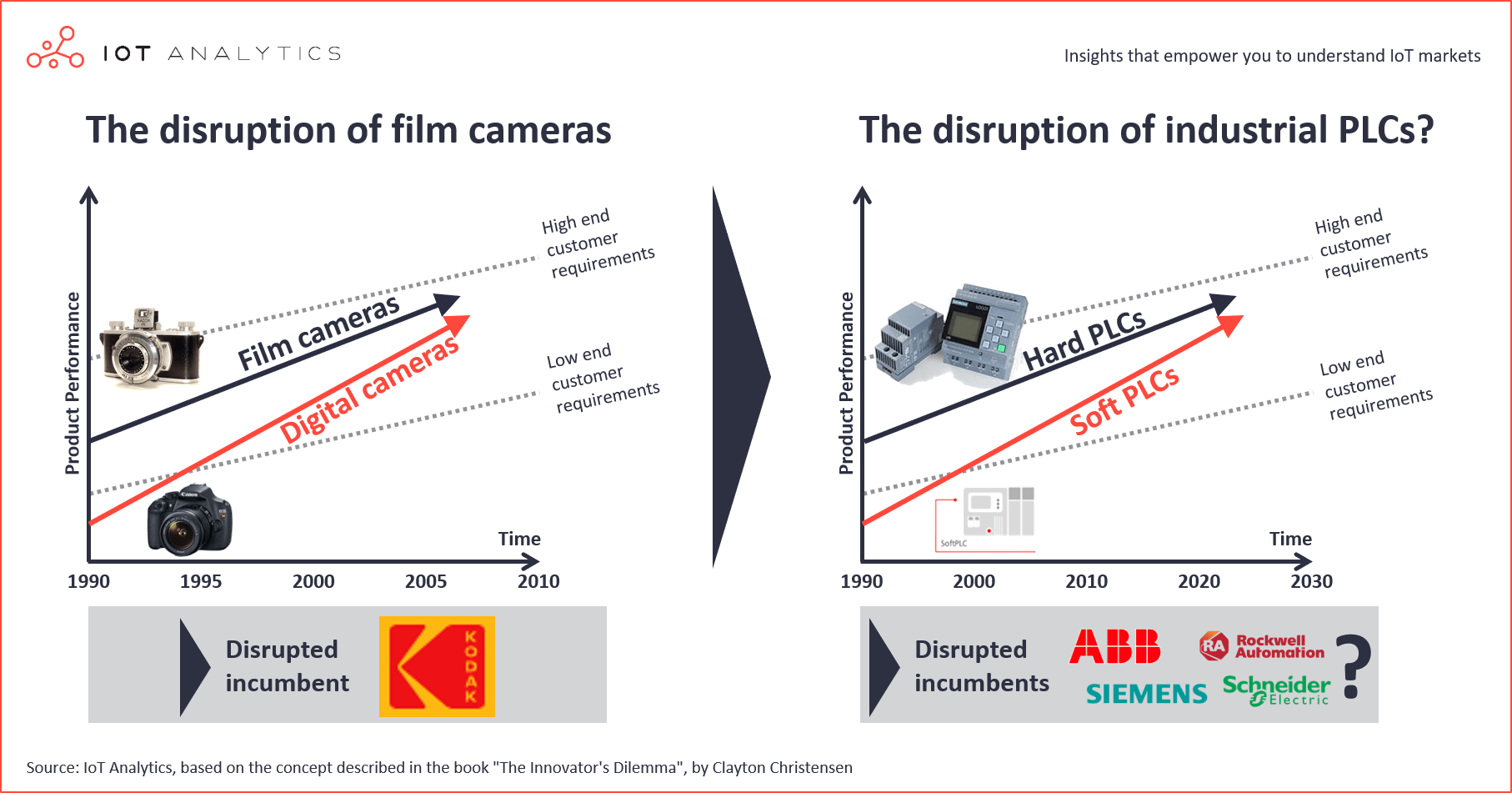

Kodak is an infamous example of a successful company which went from totally dominating its space to going bankrupt due to digital disruption. The company held 90% market share of the global photographic film sales in 1976 and was also the first to develop and patent the world’s first digital handheld camera in 1975. But fear of cannibalizing its existing, highly profitable film business caused Kodak to delay development and commercialization of the digital handheld camera. This delay left the door open for lower cost Asian competitors and ultimately resulted in Kodak filing for bankruptcy in 2012.

This lesson from history is as relevant as ever today. The battle between protecting existing business by addressing the customer’s current needs vs. embracing new technologies to cater to future needs is referred to as the “innovator’s dilemma” (made popular by Clayton Christensen). It has plagued corporations for decades and has led to the total collapse of several market leaders, such as Kodak.

The industrial world too, is not immune to digital disruption and is now on the brink of a technological revolution. Today, industrial control is largely managed by PLCs (programmable logic controllers), fondly called the industrial black box. It is hardwired to steer time critical processes such as motor control and valve control and operates based on a program written and fed by the user. Almost every manufacturing process today makes use of this technology which is supplied by industrial automation companies such as Siemens, Rockwell Automation, ABB, Schneider Electric and others.

Advances in virtualization technologies, real-time Linux operating systems and cheap but powerful edge computers are allowing companies to replace these “industrial black boxes” with software-based PLCs (soft PLCs) running on standardized hardware such as industrial PCs. Adoption of these soft PLCs represents a dramatic shift in automation deployments

A brief history of industrial controllers and soft PLCs

Industrial control has come a long way from being bulky, maintenance heavy relay-based systems in the 1960s to today’s high-speed processor-based programmable logic controllers (PLCs). What began as a basic attempt to replace relay control quickly transformed as the foundation of modern industrial control and automation.

The introduction of Windows in 1985 spawned the first wave of soft PLCs which manifested themselves in PC-based control systems. The engineering community quickly saw the benefits of combining PLC control and HMI in one box – the PC. Several Windows-based control systems emerged in the 1990’s (e.g. ASAP, Think and Do, Steeplechase Software and Wonderware), but none managed to gain sustained traction in the marketplace. “Blue screens of death” raised questions about the reliability of these systems, and the lack of virtualization / containerization technologies made it difficult to efficiently run multiple workloads (e.g. HMI and control) on a single box. Fast forward to 2020, and the value proposition of PC-based control is much stronger than it was in the 90’s as the maturation of Linux operating systems, virtualization technologies and low-cost edge computing hardware have addressed many of the early issues that plagued the first wave of PC-based control systems. Today’s soft PLCs are dramatically more reliable, powerful and flexible than the PC-based systems of the past, and pose a real threat to beloved “black boxes”.

The “Innovator’s Dilemma” posed by soft PLCs

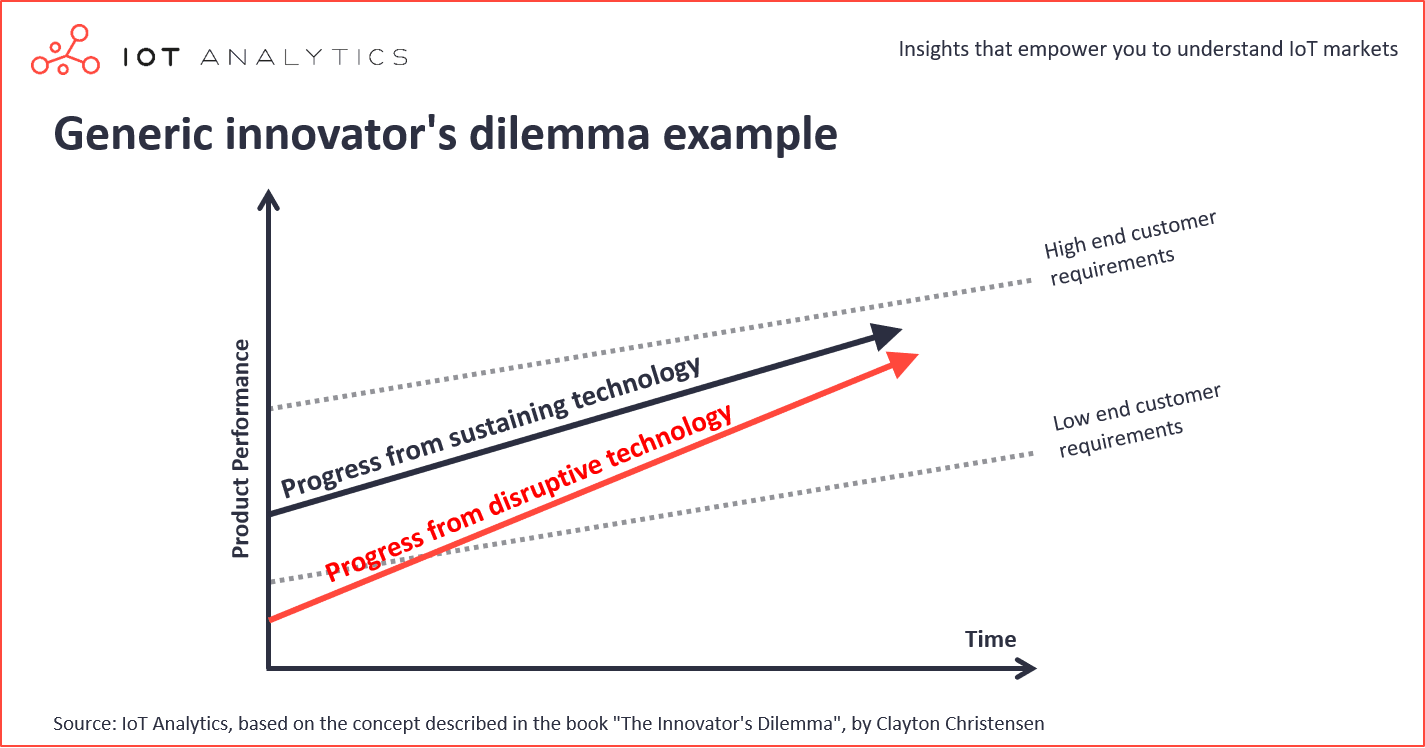

Soft PLCs represent a disruptive technology that is creating a classic “innovator’s dilemma” for incumbent “hard PLC” vendors. An innovator’s dilemma occurs when an incumbent business is disrupted by new technology. When the disruptive technology emerges, incumbent companies are faced with the “innovator’s dilemma” which is to either serve existing / high end customers by making sustaining improvements to existing products or to serve new / lower end customers by developing offerings built leveraging the disruptive technologies. A generic depiction of this scenario is shown below:

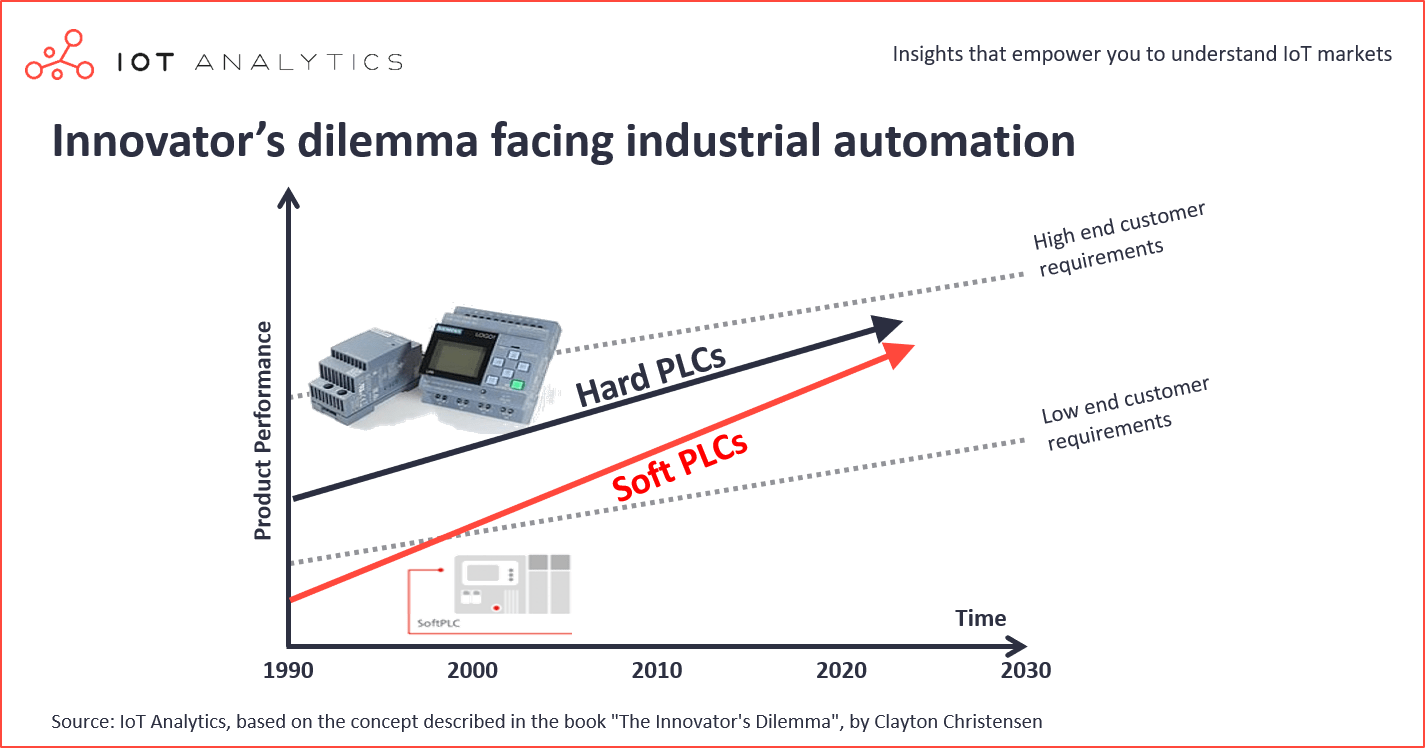

If we apply the generic innovator’s dilemma picture above to the PLC market, we get the following picture:

The picture is overly simplistic (e.g. different types of hard PLCs address high and low ends of the market, there are at least 2 types of soft PLCs, etc.), but it captures the essence of the market dynamics, which are analogous to a classic “innovator’s dilemma”. Hard PLCs (a market in which incumbent vendors dominate) have historically addressed most of the needs of the existing / high end market, such as high reliability, fast cycle times and, perhaps most importantly, the ability of existing workforce to support and maintain the systems. Soft PLCs, on the other hand, initially addressed the needs of new / lower end customers by providing more flexible, non-deterministic control solutions often at a fraction of the cost of similar hard PLCs. Since entering the market in the 90’s, soft PLCs have rapidly become more performant thanks to advances in virtualization technologies, real-time Linux operating systems and more powerful edge computing hardware, thus moving up the y-axis (product performance) in the chart above.

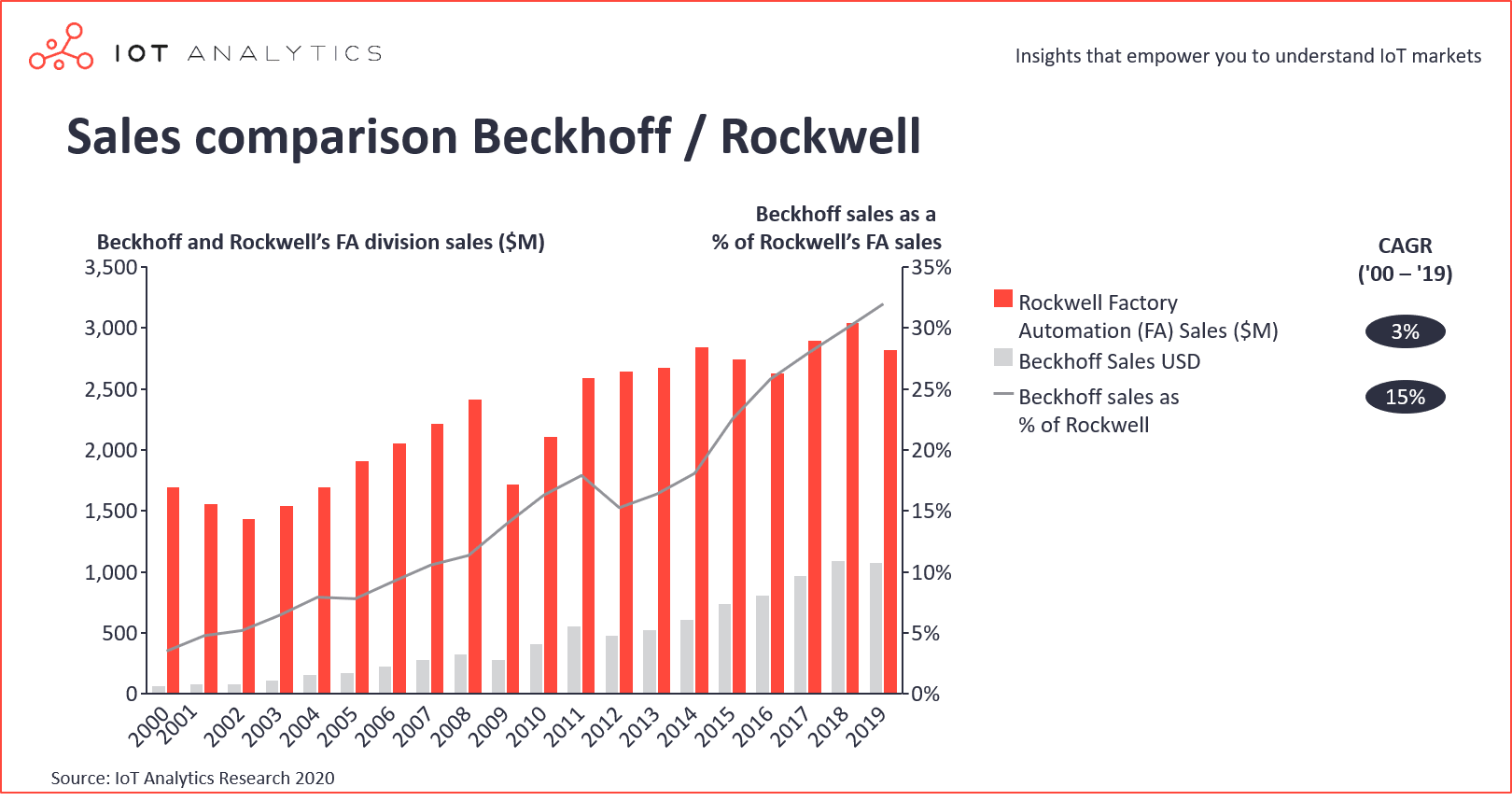

To further support the argument that soft PLCs are indeed a disruptive force in the market, we can look at the success Beckhoff (a vendor that leverages soft PLC technology) has had relative to a leading “hard PLC” vendor, Rockwell Automation.

The chart below illustrates how Beckhoff sales have increased at a CAGR of ~15% since 2000 vs. Rockwell Automation’s Factory Automation business unit’s 3% CAGR over the same time period. This growth differential has resulted in Beckhoff accounting for >30% Rockwell’s Factory Automation division sales in 2019, up from <5% in 2000.

How incumbent vendors are avoiding being disrupted

According to Christensen, incumbent vendors are often disrupted when they focus on improving their existing products instead of jumping the train and adopting new disruptive technologies. Competitors that develop products based on the new technology eventually disrupt the incumbents because the new products eventually improve enough to serve the higher end customers – so the story goes.

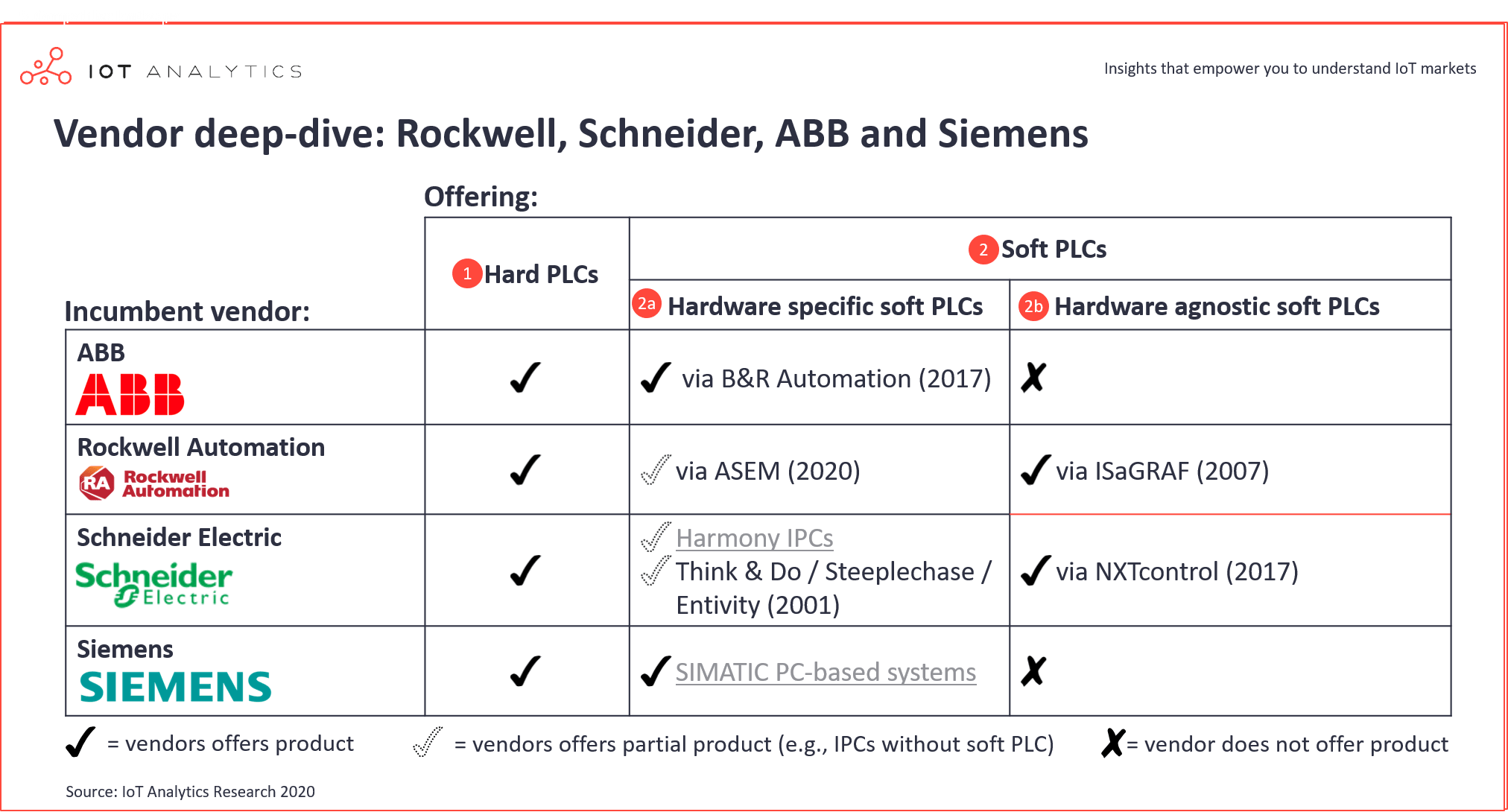

Our market analysis shows that incumbent vendors are not blind to the disruptive threat that soft PLCs pose to their hard PLC businesses. As the table below shows, major incumbent automation vendors have soft PLC offerings, many of which are from acquisitions that have occurred within the past 5 years:

Future outlook

IoT Analytics’ opinion

Due to the slow pace of adoption and risk adverse nature of industrial end users, it is not likely that incumbent vendors face an imminent threat of being majorly disrupted by soft PLCs. Even though soft PLCs will likely meet or exceed certain hard PLC performance characteristics within the next 5 years, they will still have an enormous obstacle to overcome in the form of decision makers who are comfortable with the existing hard PLCs and are resistant to change. At the end of the day, it doesn’t matter how performant a particular technology is if employees do not know how to use it. As an employee from a major German industrial components manufacturer stated during an interview featured in our latest report:

“We have standardized on Siemens [hard] PLCs because it’s what our employees know – they are educated on Siemens in school and so in the end we have to go with what we know, even if it is more expensive.”

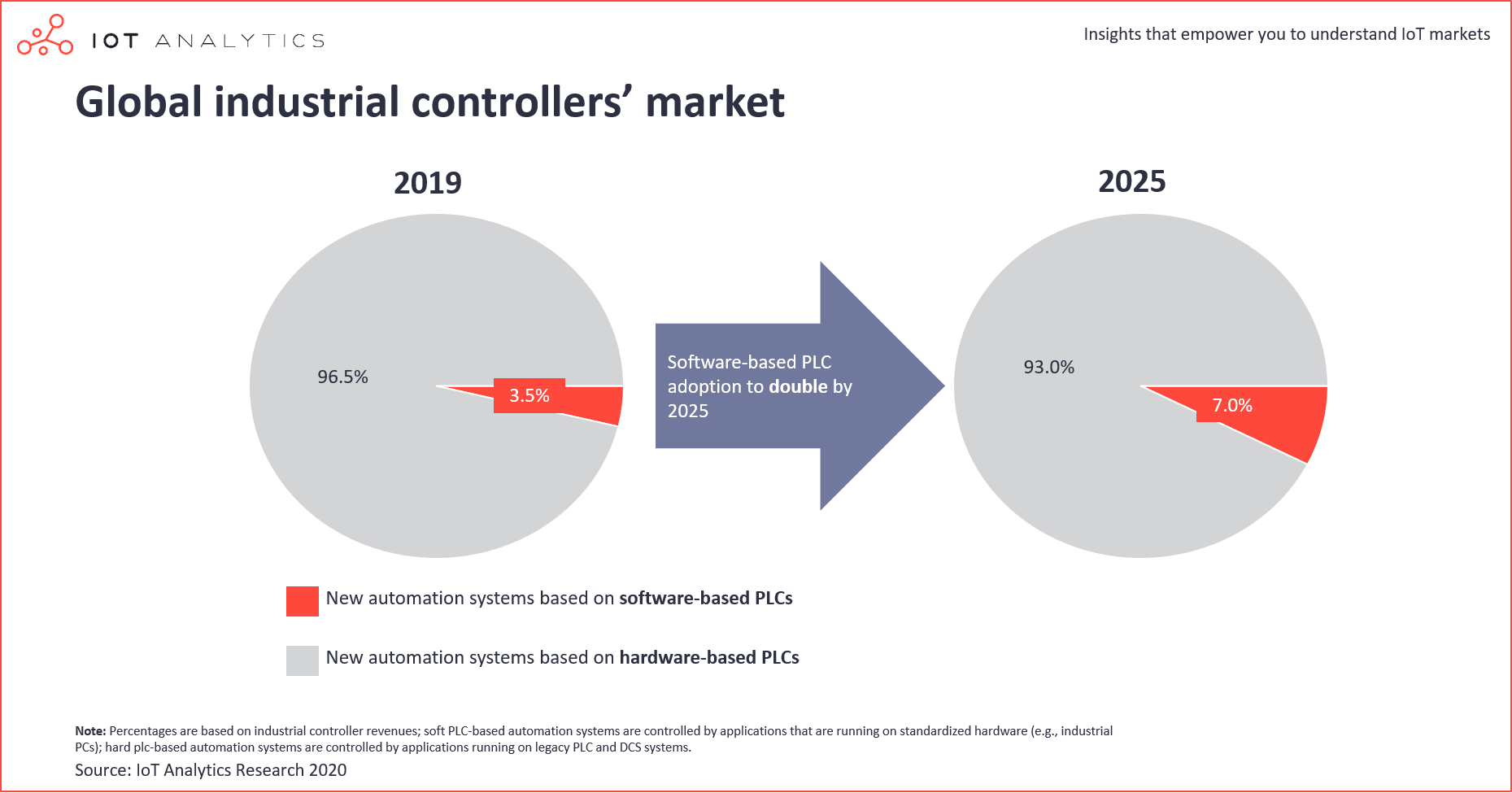

That being said, the threat of soft PLCs is not benign. Despite the workforce inertia that hard PLCs (and therefore incumbents) have, soft PLCs are expected to continue to take share from hard PLCs in the future. According to our latest research, the proportion of automation systems that are based on soft PLCs is expected to double from 2019 to 2025, growing from 3.5% of the overall industrial controllers market to 7%.

If incumbents continue to make incremental improvements to their existing products (at the expense of new innovations) to appease their existing customer base, they may find themselves becoming, to coin a phrase, “Kodaked”. One could even argue that this “mild” disruption is already underway – the inertia that CODESYS and its army of SME vendors possesses is definitely a threat to exiting vendors’ businesses, as evidenced by Rockwell’s lawsuits against CODESYS (3S) / Advantech and Wago over the last decade.

Advisor opinions

We asked a team of advisors to offer their opinions on what might accelerate the pace of adoption of soft PLCs; here is what they said:

“Widespread adoption of Ethernet-based I/O is lowering the switching and integration costs associated with migrating from legacy control systems which often deploy proprietary I/O networks.” – Gary Mintchell, Founder of The Manufacturing Connection

“Changing workforce demographics are making it more difficult to find traditional (hard) PLC programmers and easier to find programmers familiar with object-oriented languages. The next generation workforce will be familiar with docker containers, virtual machines, Git repositories and object-oriented programming. This will shift the workforce “familiarity” advantage that hard PLCs currently have to soft PLCs.” – Chris Hoemke, Industry 4.0 Manager @Infosys

” The integration of modern IT tools and practices in OT environments will pave the way for the adoption of soft and virtual PLCs. Modern asset management, software lifecycle management, workload consolidation, containerization and highly distributed / available architectures are just some of the IT tools and practices that OT organizations are adopting which will both enable and be driven by soft and virtual PLC adoption.” – Flavio Bonomi, Former CEO at Nebbiolo Technologies, Inc.

More information and further reading

Are you interested in learning more about virtual PLCs and soft PLCs?

The Virtual PLC & Soft PLC Market Report 2020-2025 is part of IoT Analytics’ ongoing coverage of Industrial IoT and Industry 4.0 topics (Industrial IoT Research Workstream). The information presented in the report is based on extensive primary and secondary research, including 15 interviews with virtual PLC and soft PLC experts and end users conducted between April 2020 and October 2020. The document includes a definition of virtual PLCs and soft PLCs, market projections, adoption drivers, interesting case studies, key trends & challenges, and insights.

This report provides answers to the following questions (among others):

- What is soft PLC?

- What is the difference/similarity between virtual PLC and soft PLC?

- What are the different types of soft PLCs?

- What are the technologies that are accelerating adoption of soft PLCs?

- What is the biggest threat/restraint to the soft PLC market?

- How big is the soft PLC market? Market segments include:

- Product type (hardware agnostic, hardware specific)

- Control level type (machine level control, supervisory control)

- End hardware type (IPC, HMI, datacenter and others)

- Region

- End user industry

- Distribution channel type

- Who are the leading soft PLC vendors and how competitive is the landscape?

- What are the key trends and developments associated with virtual and soft PLC market?

And more…

Sample:

The sample of the report gives you a holistic overview of the available analysis (outline, key slides). The sample also provides additional context on the topic and describes the methodology of the analysis. You can download the sample here:

Related articles:

You may also be interested in the following recent article:

- Soft PLCs: Revisiting the industrial innovator’s dilemma

- IoT edge computing – what it is and how it is becoming more intelligent

Are you interested in continued IoT coverage and updates?

Subscribe to our newsletter and follow us on LinkedIn and Twitter to stay up-to-date on the latest trends shaping the IoT markets. For complete enterprise IoT coverage with access to all of IoT Analytics’ paid content & reports including dedicated analyst time check out Enterprise subscription.