Smart City IoT projects are becoming fundamental for city development. The EIP-SCC (European Innovation Partnership for Smart Cities and Communities), for example, is spending up to €1bn to develop 300 smart cities in Europe by the end of 2019. The opportunity is evident for IoT solution vendors – in an analysis performed by IoT Analytics in Q1/2018, Smart City was the #1 implementation area of all IoT projects globally.

IoT Analytics recently launched its Smart City Research Series in order to provide market insights and strategic recommendations on how to engage with this complex sector. The Research Series explores different smart city applications such as:

- Connected Street Lights

- Smart Parking

- Smart Metering (release date Q2 2019)

- And more…

The analysis shows that markets are growing, but at paces not necessarily comparable with other IoT sectors such as Connected Industry (CAGRs >30%). The Connected Street Lights market is expected to grow at a CAGR of 21% between 2018-2022 while the Smart Parking market is growing at a CAGR of 14% during the same period.

Considering the complex nature of Smart City IoT projects in public service areas, the growth rates are very promising. In most cases, projects are inspired by digital transformation policies of municipalities. However, as public sector organisations need to consider various city stakeholders (e.g., projects are subject to strong public accountability) the procurement process can be cumbersome and time consuming.

In this article we share 5 key insights emerging from the 350 smart city IoT projects analysed by IoT Analytics as well as subsequent discussions with city decision makers.

1. Sensor networks should be strategically designed with appropriate sensors for specific environments

Two of the most important principles when choosing sensors for smart city IoT projects are:

- a) the context in which the solution is deployed and

- b) the results that need to be achieved.

For example, in the case of smart parking, magnetometers are best suited for outdoor smart parking environments as they are resistant to weather interferences and lighting conditions. On the other hand, video camera sensors are well suited for off-street parking locations such as garages and parking lots – as they are easy to deploy and their performance is affected by lighting and weather conditions.

Magnetometers and video camera sensors are just two options for smart parking projects. IoT Analytics’ recent Smart Parking report has identified 8 types of sensors currently used in smart parking projects. The report also defined several criteria that can help smart parking designers to identify the right sensors for their projects as showed in the table below.

2. LPWAN and 4G/5G are becoming the key connectivity choices for smart city applications

As with sensor selection, choosing the right form of connectivity depends on the solution that needs to be deployed. For example, if the smart city solution requires video monitoring of parking spaces or streets through surveillance systems on lighting poles, the connectivity option should offer the necessary bandwidth. In that case, cellular technologies (4G and the coming 5G) are the most appropriate connectivity solution.

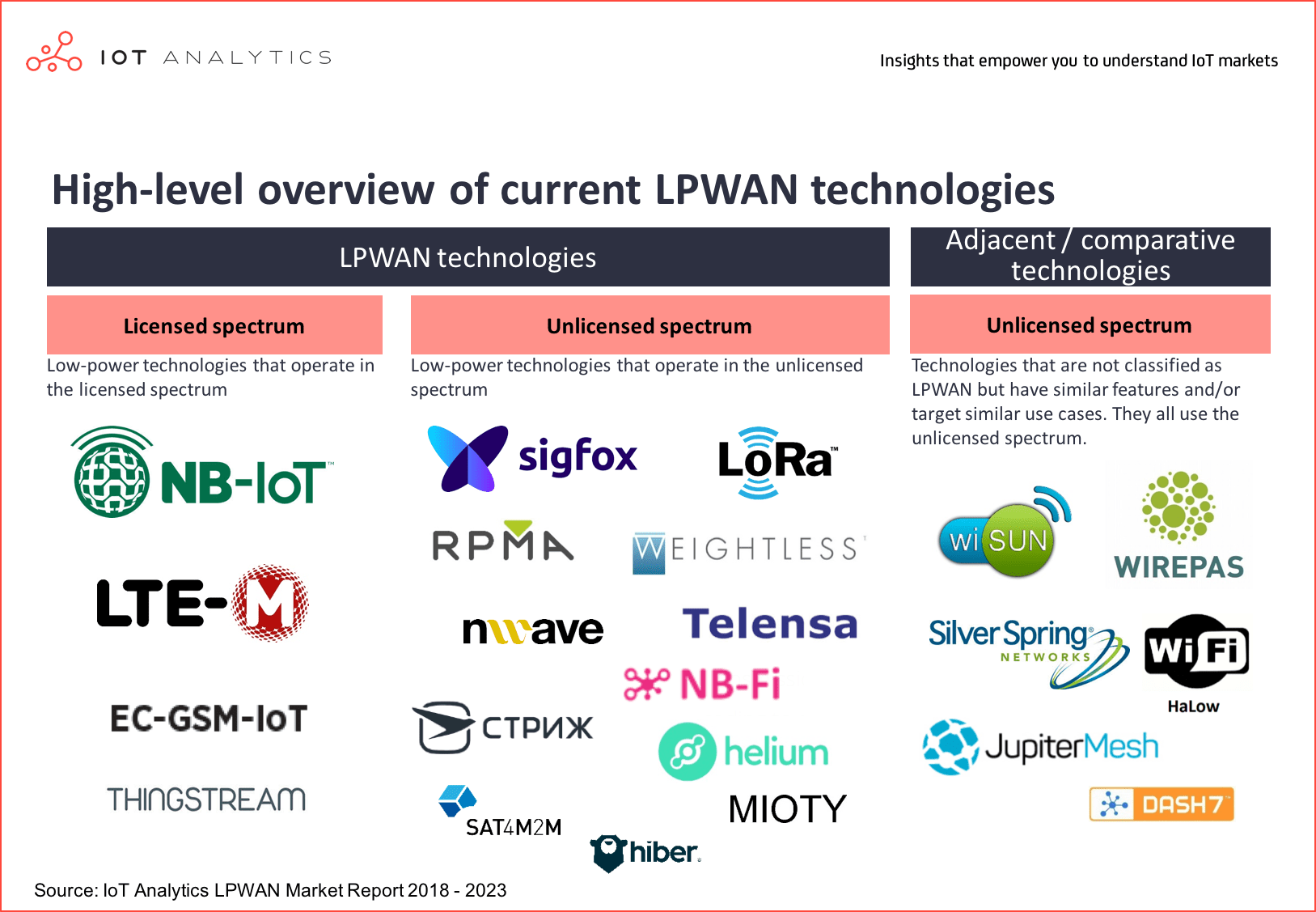

In cases of low data traffic (e.g., presence sensors, lighting intensity sensors), LPWANs, in their various forms – as shown in the picture below, are the most suitable connectivity solution for smart city IoT projects. IoT-Analytics’ recent research on LPWANs reveals that smart parking and connected street lighting are the most adopted smart city applications using LPWAN – while smart metering is the largest adopter of LPWAN in all sectors.

3. Software middleware tools are the central backbone to successful smart city IoT projects

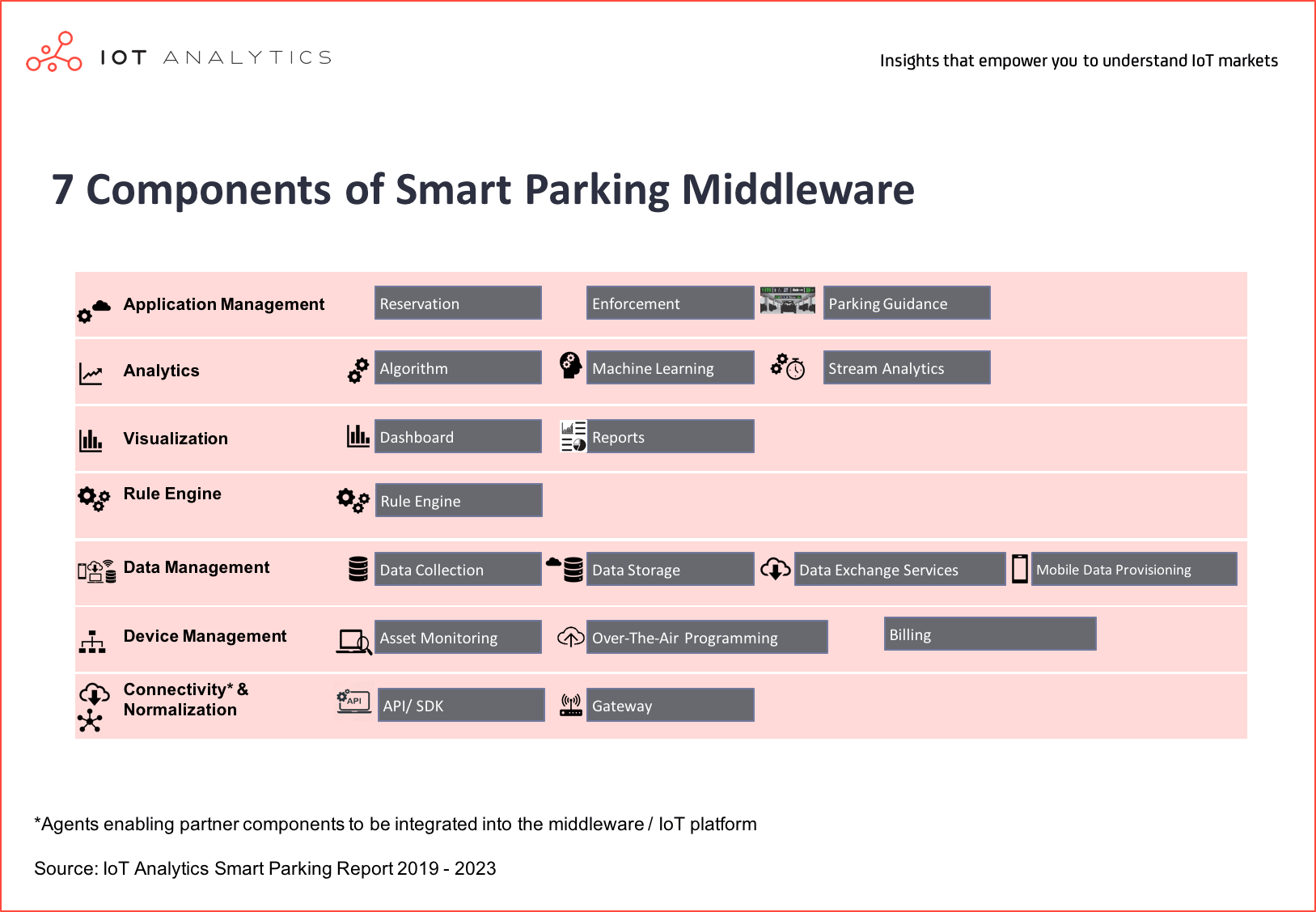

Smart city IoT projects provide a new view of the city via sensors and the data they gather. The landscape of sensors must be managed remotely. The data gathered must be used for analysing the behaviour of the solutions, for predicting malfunctions, and, most importantly, for taking decisions that can positively impact the life of city inhabitants. All that requires a set of software middleware tools as the central backbone of the smart city solution. For example, the architecture of a smart parking software middleware tool is shown in the picture below.

This architecture can be provided by a number of players such as , smart city software solution specialists or even traditional vertical solution specialists (e.g., parking companies, lighting companies, etc). For example, there are several IoT platform providers with strong experience in smart cities and communities such as theThings.io, Verizon ThingSpace, and well-known players such as Microsoft Azure and AWS. Others offer software solutions for specific applications or in some cases more holistic smart city IoT projects such as Living Plan IT, UrbanOS, Chordant by , and Interact by Signify (formerly Philips Lighting).

Choosing the right vendor is not easy, but it is a necessary step . There are several examples of cities using software middleware solutions such as Silverstone (Chordant), Montevideo (FIWARE), Toronto (Microsoft Azure), Manchester (consortium including CISCO), and Almere Smart City (Plan IT Urban OS). More insights on IoT platforms can be found in the extensive IoT-Analytics market report on the topic.

4. Public-Private Partnerships (PPP) are the most dominant financial and operational modus operandi for smart city IoT projects

Smart city IoT projects clearly have a strong public sector nature. However, municipalities cannot deliver smart city applications on their own as, often, they cannot afford the financial investment and/or they lack the necessary technical and managerial resources for running the project. Public-private partnerships are becoming an important way of overcoming that situation. In a typical PPP set-up, a private entity will finance the design, deployment and management of the smart city project. At the end of the collaboration, the private entity will transfer the smart parking facilities to the public local authority at zero cost.

For example, the Chicago Parking Meter project is a PPP. A concession was granted the project against an upfront payment of US$1.2bn. The concession is involved in running, maintaining, and improving over 36,000 on-street parking meters and retains the generated revenues. The local authority in Chicago is only in charge of parking law enforcement.

5. Main barriers to adoption of smart city IoT projects are not technology related

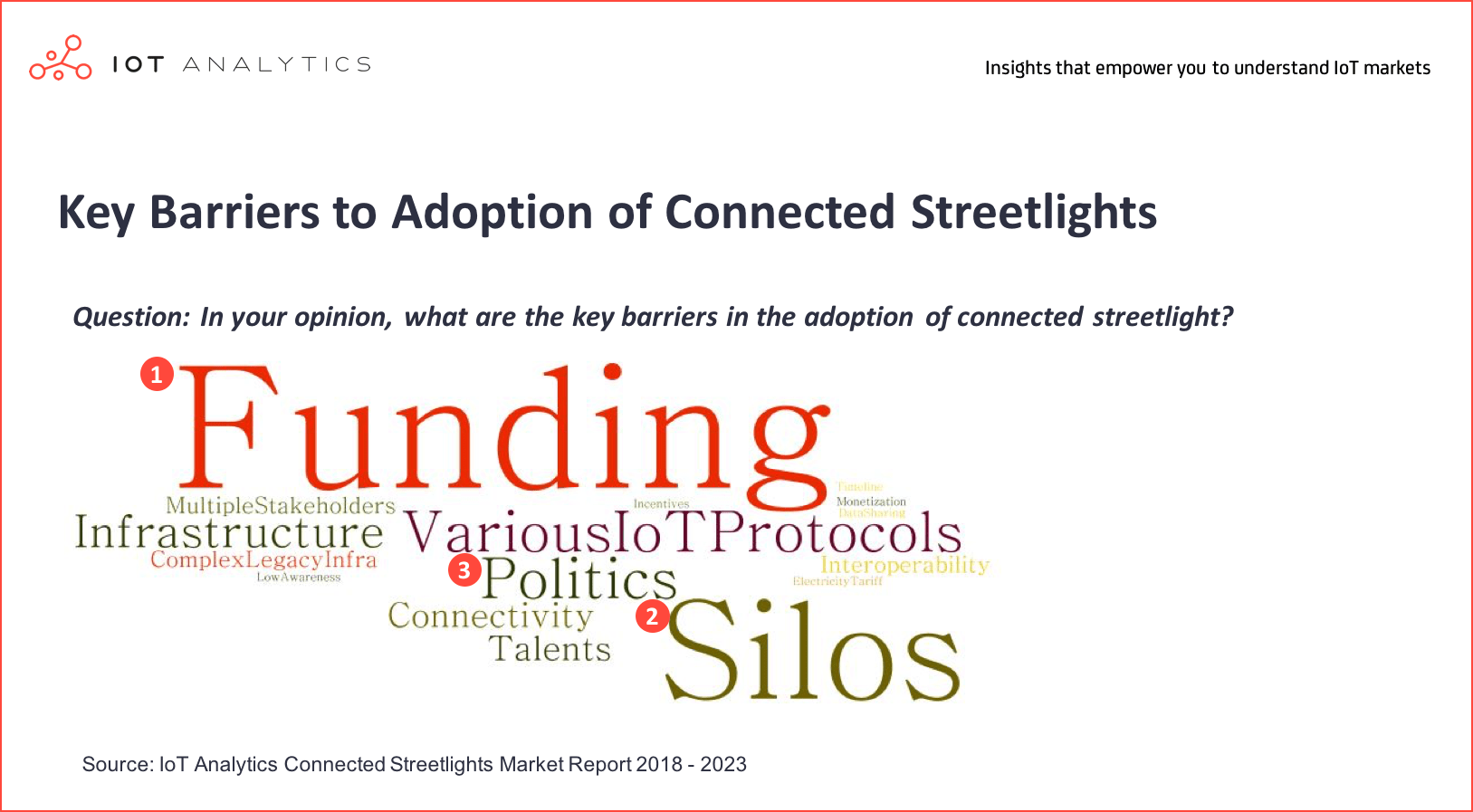

Almost everywhere in the world, cities have embarked on smart city IoT projects. IoT Analytics has identified and assessed 350+ projects to find some common challenges cities are currently facing. Surprisingly technology related aspects were not highlighted as the main barriers to adoption. For example, recent IoT Analytics’ research shows the key challenges observed in smart lighting projects.

Funding was the #1 barrier due to budget constraints and various non-IoT priorities of governing bodies of cities. Silos were the #2 barrier as most smart city IoT projects are vertically driven rather than a holistic smart city approach. Politics was the #3 barrier identified as the complexity of smart city IoT projects touches multiple stakeholders including the general public which can be cumbersome and time consuming.

However, governing bodies can learn how to solve these challenges by looking at other successful project approaches. For example, projects such as Paris’ City of Light and Madrid’s Connected Lighting Project show how public-private partnerships are good models to overcome cost issues. Furthermore, the move from a vertical project-based view of smart cities to a more holistic view has been successfully addressed by cities such as Barcelona, Amsterdam and Bristol. Finally involving all stakeholders early on to gather opinion and ideas can help reduce friction and avoid damaging politics in smart city project design.

Further Information

This article builds upon IoT-Analytics’ experience in smart city IoT projects. It also heavily relies on several IoT-Analytics’ reports.

If you are interested in smart city IoT projects, the insights discussed in this article are based on details in the following reports:

If you want to expand your knowledge and understanding of LPWAN technologies and their role in smart city IoT projects, you can also look at the following report:

For a detailed analysis of IoT platforms and the IoT platform vendor landscape, please refer to the following reports:

Finally, if you are interested in continued IoT coverage and updates (such as this one), subscribe to our newsletter and follow us on Linkedin and Twitter to stay up-to-date on the latest trends shaping the IoT markets. For complete enterprise IoT coverage (Entire Subscription) with access to all of IoT Analytics’ paid content and reports including dedicated analyst time.