In short

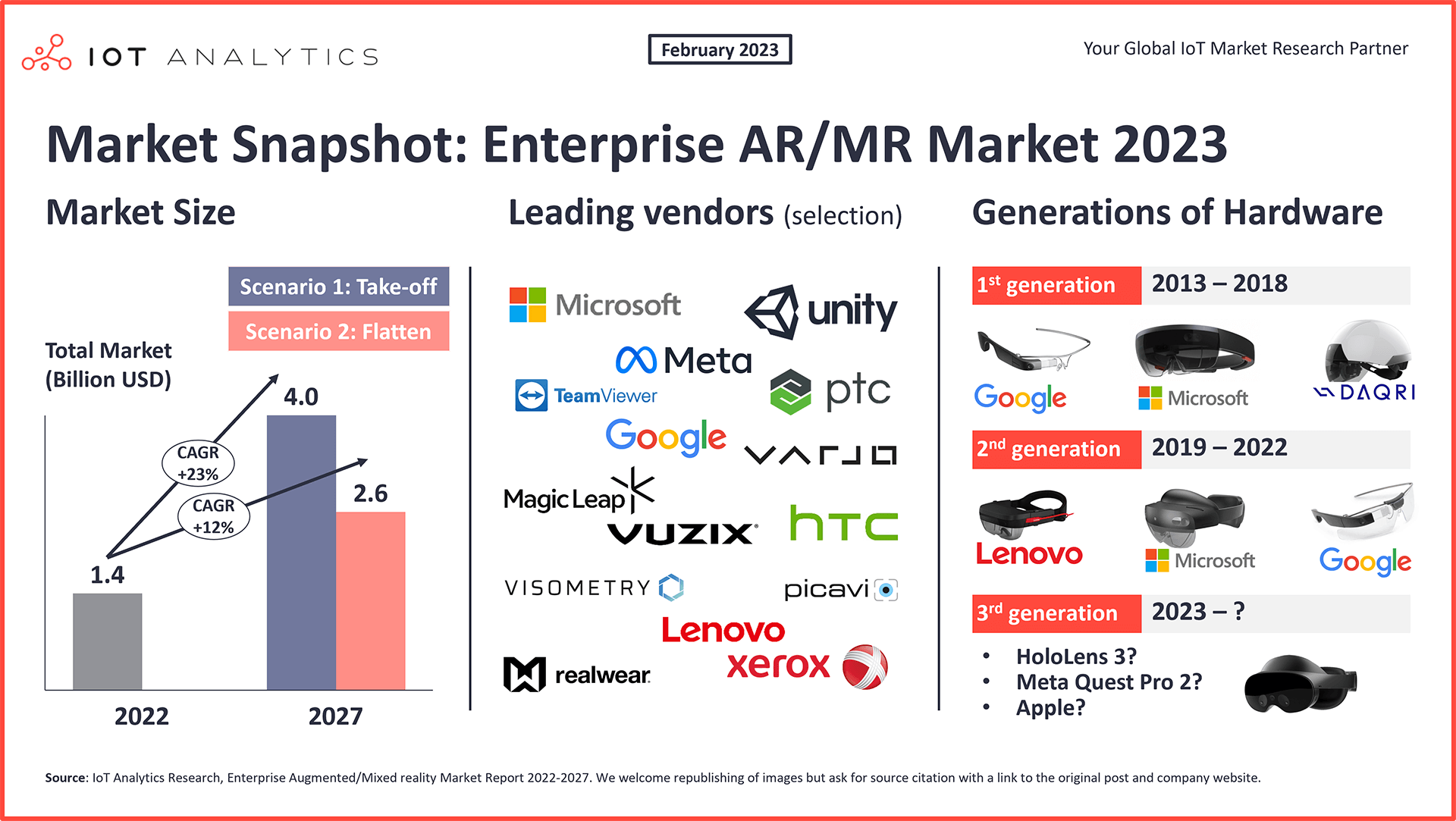

- The enterprise augmented reality (AR)/mixed reality (MR) market is at an inflection point, according to new research from IoT Analytics.

- In 2023, key product announcements from the likes of Microsoft, Google, and Apple are likely to set the tone for the market in the coming years and will play a key role whether the industrial metaverse becomes a reality.

Why it matters

- Enterprise AR/MR hardware is thought to be a game-changing technology that could even replace smartphones at some point in the future. So far, the technology has not lived up to its promise.

- The next (third) generation of AR devices may provide an opportunity for wider adoption of the technology.

Celebrating 10 years of commercial AR hardware

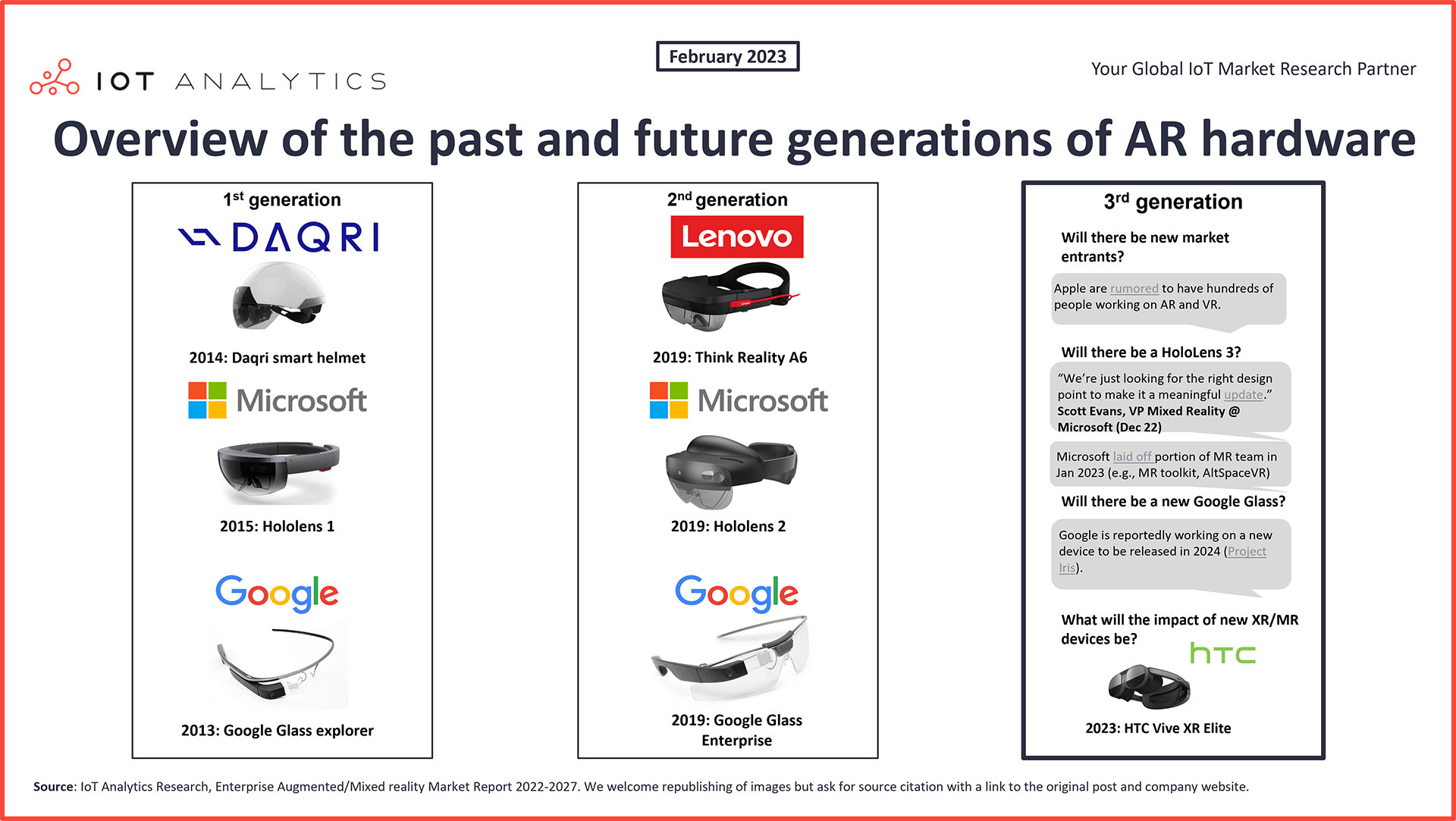

2023 marks the 10-year anniversary of Google’s infamous Google Glass launch, which rocked the tech world in 2013 and started the era of commercial AR headsets. In those 10 years, we have seen two generations of AR headsets, but adoption has lagged behind expectations.

The first generation of AR devices: 2013-2018

Although marketed as commercially ready, the first generation of AR devices were often perceived as prototypes by users and came with performance limitations (e.g., they were heavy and clunky because of the size of the processors and batteries necessary to run AR software). This generation included the Google Glass Explorer and the Daqri smart helmet (marketed as “the world’s most advanced sensor package”). In 2016, Microsoft entered the AR market with the HoloLens 1 (marketed as “the world’s first fully untethered holographic computer”) and the ambition to become a market leader in the space.

The second generation of AR devices: 2019 – today

By 2019, some of the technologies had evolved to the degree that vendors felt ready to launch the second generation of AR devices, aimed at resolving the pain points of the first generation and achieving more widespread adoption. In 2019, Lenovo launched its first AR glasses, the Think Reality A6. The device proved to be meaningfully lighter than the HoloLens 1, with 380 g (0.83 lbs.) for the Think Reality A6 vs. 579 g (1.2 lbs.) for the HoloLens 1. Lenovo also equipped its device with Qualcomm Snapdragon 845 Mobile XR, a processor dedicated to AR use. In addition, the company included new waveguide technology developed by Israel-based company Lumus. In 2019, Microsoft followed by announcing the second generation of its HoloLens, also using the Qualcomm (Snapdragon 850) and making the device smaller with lower power consumption. The same year, Google launched a second version of its Google Glass.

The role of augmented reality in the industrial metaverse

For the metaverse to become a reality, AR plays an important role.

What is the metaverse?

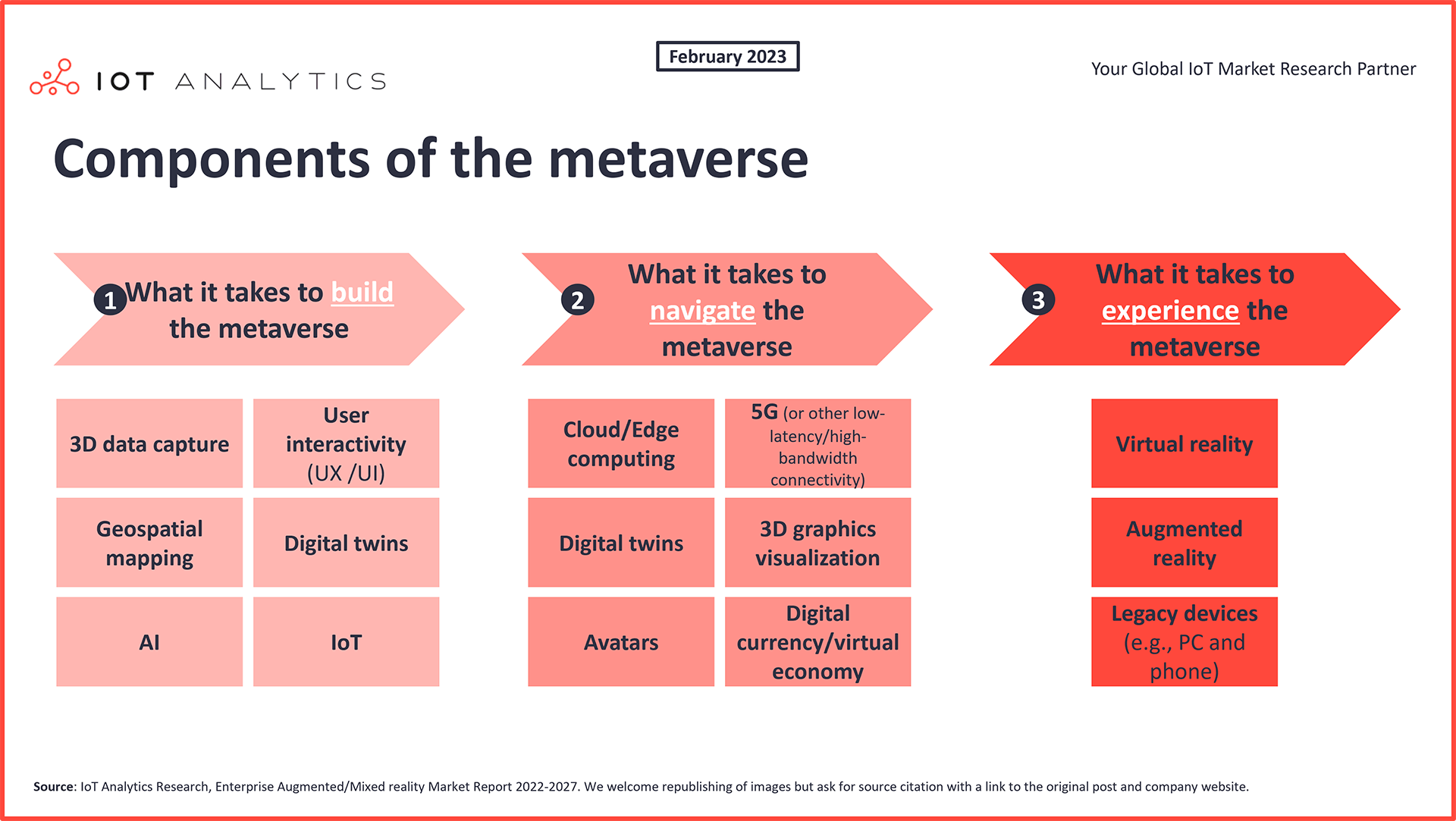

The metaverse is generally understood to be an integrated network of (3D) virtual shared worlds created by the convergence of various technologies such as digital twin, IoT, cloud computing, 5G, artificial intelligence, virtual reality (VR), and AR.

Companies have slightly different interpretations of what the metaverse is and, consequently, use different terms to refer to these virtual shared worlds (e.g., Magic Leap refers to it as the Magicverse, while NVIDIA uses the term Omniverse). Several companies have recently announced their industrial metaverse strategies (as opposed to the consumer metaverse). Nvidia, Siemens, and Microsoft are some of the most outspoken companies using the term in their official communication (e.g., in January 2022, Siemens and NVIDIA announced that they will collaborate and connect their respective metaverse products [Siemens Xcelerator and NVIDIA Omniverse] to enable the industrial metaverse).

The different technologies used for the metaverse can be split depending on their role in enabling enterprises to build, navigate, and experience the metaverse.

- What does it take to build the metaverse? A set of technologies and methods enabling the design and creation of digital shared spaces (e.g., 3D data capture technology or digital twin technology)

- What does it take to navigate the metaverse? A set of technologies and methods providing the data transmission and computing infrastructure to run and update virtual scenarios. They also enable the virtualization of human identity and the generation of virtual assets.

- What does it take to experience the metaverse? A set of technologies enabling enterprises to access, interact with, and immerse into virtual shared scenarios.

Augmented Reality and the metaverse: AR is not equal to the metaverse, but it is one of the key technologies enabling individuals and enterprises to experience the metaverse. In contrast to legacy devices, AR enables a unique metaverse experience as it couples real and virtual environments in the human field of view, allowing real-time interactions and providing 3D visualizations of objects. In that way, AR technology is a cornerstone for a truly immersive metaverse experience.

Waiting for the next technological breakthrough in AR

The current generation of augmented reality hardware has been received with mixed feedback, and its adoption is lagging behind ambitions (according to our data, less than one in six enterprises have rolled out the technology in some form).

On the one hand, some enterprise adopters we came across during our research raved about the use in industrial settings (see quote below); on the other hand, complaints about certain aspects of the hardware persist, most recently evidenced by the US army, with some reports saying that AR technology made soldiers worse at their job.

“The feedback from users has been 10 out of 10. We have gotten hardly any negative feedback from the hundreds and hundreds of users that we have put our HoloLenses on.”

Michael Hinckley, Manager Digital Manufacturing @ Northrop Grumman

Of the 11 use cases we identified in the Enterprise Augmented/Mixed Reality Market Report 2022–2027, the following two were among the more successful:

- Remote field assistance. Using AR/MR to virtually guide users remotely to conduct operational tasks they have not performed before (e.g., aided by an expert in a different, remote location). Companies such as Boeing and Xerox have adopted this use case.

- Operations guidance. Using AR/MR alongside traditional processes to provide real-time guidance to workers and visually assist them in conducting tasks. Companies such as Plant Vision in the agriculture industry or Medivis in the healthcare industry have successfully implemented this use case in their operations and given positive feedback on their experience.

In general, however, many potential adopters—and even some of the early proponents of the technology—are waiting for the technology to improve and costs to come down. Key pain points include the weight of the devices, limited battery life or computing capacity, dizziness when using the devices, and a limited field of view.

“AR glasses will be one of the hardest technical challenges of the decade.”

Marc Zuckerberg, CEO @ Meta

In some cases, it is also a matter of willingness to change from legacy systems to new technology.

“AR technology is an invaluable tool for today’s changing workforce. But the legacy knowledge databases currently deployed by large multinationals will be a drag on the projected growth of this sector. I do expect a tipping point as the continued changing demographics of the workforce will demand better and more engaging tools.”

Chris Hoemeke, Global Account Manager at Rockwell Automation

While customers wait for better AR/MR devices and the industrial metaverse to become the immersive experience companies are claiming it will be, rumors of market pull-outs and new entrants are spreading. While Apple is thought to be entering the space in 2023 with a new device, manufacturers such as Microsoft and Google could pull the plug on their AR/MR programs or hit the pause button.

- Microsoft: According to interviews with 20 former and current employees, the company is rumored to have given up on developing the HoloLens 3. The inventor of the HoloLens, Alex Kipman, openly denied such rumors on Twitter in February 2022 but left Microsoft later that year. In January 2023, Microsoft also announced it is laying off 10,000 employees, with the MR team impacted.

- Google: The AR glasses pioneer retired its first generation of Google Glass only two years after its introduction and has yet to communicate on the success of the second generation. There are rumors of “Project Iris,” which would see a potential new Google Glass released in 2024.

While the public is left to speculate on the future of AR devices, the reality is that, to a large degree, enterprises are not yet fully satisfied with the current technology and expect a breakthrough for widespread AR/MR adoption.

“In my view, it will take at least another two generations of Microsoft HoloLens until the headsets are so lightweight and comfortable that our workers can use them full time or a large portion of their time.“

Head of Digitization @ major automotive OEM

A wildcard in the mix are new Mixed Reality devices from traditional VR makers, such as the new Meta Quest Pro, HTC’s Vive XR Elite, or Varjos’ XR3. These MR devices, which only started hitting the market in late 2022, are an evolution of VR headsets with cameras. This new feature is defined as full-color passthrough. The passthrough feature provides a real-time and perceptually comfortable 3D visualization of the physical world in the hardware via front-facing cameras.

Two scenarios for the mixed and augmented reality market beyond 2023

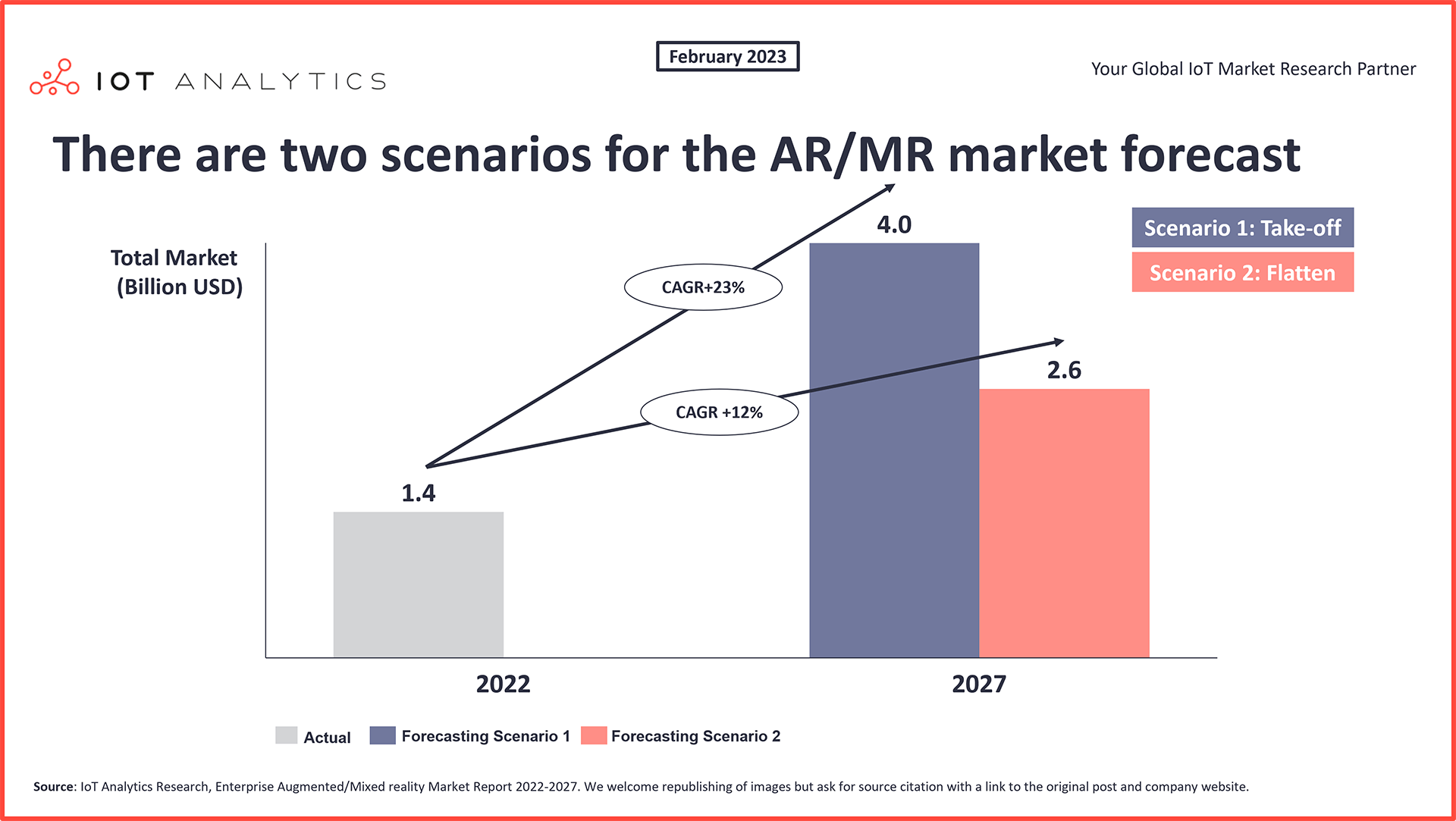

With end-users hungry for augmented reality technology improvements and the metaverse becoming increasingly real, 2023 is likely to be a make-or-break year for AR. We see two potential scenarios where the $1.4 billion enterprise AR/MR market will go from here:

Scenario 1: Take-off

AR/MR adoption may see a boost if manufacturers manage to introduce AR devices with major technology breakthroughs (see further below) and the promise of a significant reduction in costs going forward.

Scenario 2: Flatten

AR/MR adoption may cool down significantly if manufacturers continue to produce expensive devices that remain clunky, uncomfortable, and with limited battery life.

Where to expect AR technology innovation

In our research, we identified seven key augmented reality hardware technology innovation areas that are currently being developed and whose progress will define the future of the market.

One of these seven developments is optics, and a promising innovation in optics is waveguide technology. This technology is defined by a clear, thin piece of glass on which virtual lights are bent and combined with natural light. Waveguides direct light into the eye and create the virtual images seen by the wearer overlaid onto the environment. Using the latest waveguide technology allows for image projection on glasses that range from sub-nanometers to a few nanometers thick while keeping the same image quality.

In January 2023, Israel-based Lumus launched the Lumus Z-lens (and optical engine architecture) based on waveguide technology with the purpose of using it for smart eyewear. The new architecture is supposedly 50% smaller than its previous generation while maintaining the same level of image quality.

Other technology areas, such as batteries or processors, have also seen recent improvements that point to the “take-off” scenario potentially becoming reality.

Conclusion and outlook

We think that the likelihood of a take-off market is there, given the potential of Apple announcing an AR device as soon as spring 2023 and a number of positive recent technology developments.

What it means to companies in the AR ecosystem?

A technological breakthrough may mean a shift in competitive dynamics. We have seen a number of software companies in recent years developing vendor-neutral AR software platforms (e.g., PTC Vuforia) and end-user focused applications (e.g., Xerox CareAR). It is important for them to ensure they position themselves as a preferred and compatible partner with whoever leads the AR hardware revolution.

What it means to companies looking to adopt AR?

End users looking to implement AR/MR as part of their digitization should not be scared by negative reports in the press about shortcomings of the technology. There are plenty of example of companies that have successfully and happily adopted augmented reality in some form. However, they should be aware of the limitations of the current technology and ensure they are ready to switch hardware when/if the manufacturers deliver on their promise of a lighter, more efficient, and cheaper device that enables a truly immersive industrial metaverse experience.

Are you interested in learning more about the MR/AR market?

IoT Analytics is a leading global provider of market insights and strategic business intelligence for the Internet of Things (IoT), AI, Cloud, Edge, and Industry 4.0.

Enterprise Augmented/Mixed Reality Market Report 2022–2027

164–page report examining augmented and mixed reality in enterprise settings incl. definition, disambiguation, market size & outlook, market segmentation, competitive landscape, case studies, technological developments, trends.

Click on the button to load the content from .

Related publications

You may be interested in the following publications:

- Digital Supply Chain Market Report 2022-2027

- Industry 4.0 Adoption Report 2022

- Industrial Software Landscape 2022–2027

- IoT Semiconductor Market Report 2020-2025

Related articles

You may also be interested in the following recent articles:

- 8 key technologies transforming the future of global supply chains

- The rise of Industry 4.0 in 5 stats

- The top 10 industrial software companies

- The rise of the IoT semiconductor

Related market data

You may be interested in the following IoT market data products:

- Global Cellular IoT Module and Chipset Tracker and Forecast

- Global IoT Enterprise Spending Dashboard

Are you interested in continued IoT coverage and updates?

Subscribe to our newsletter and follow us on LinkedIn and Twitter to stay up-to-date on the latest trends shaping the IoT markets. For complete enterprise IoT coverage with access to all of IoT Analytics’ paid content & reports including dedicated analyst time check out Enterprise subscription.