In short

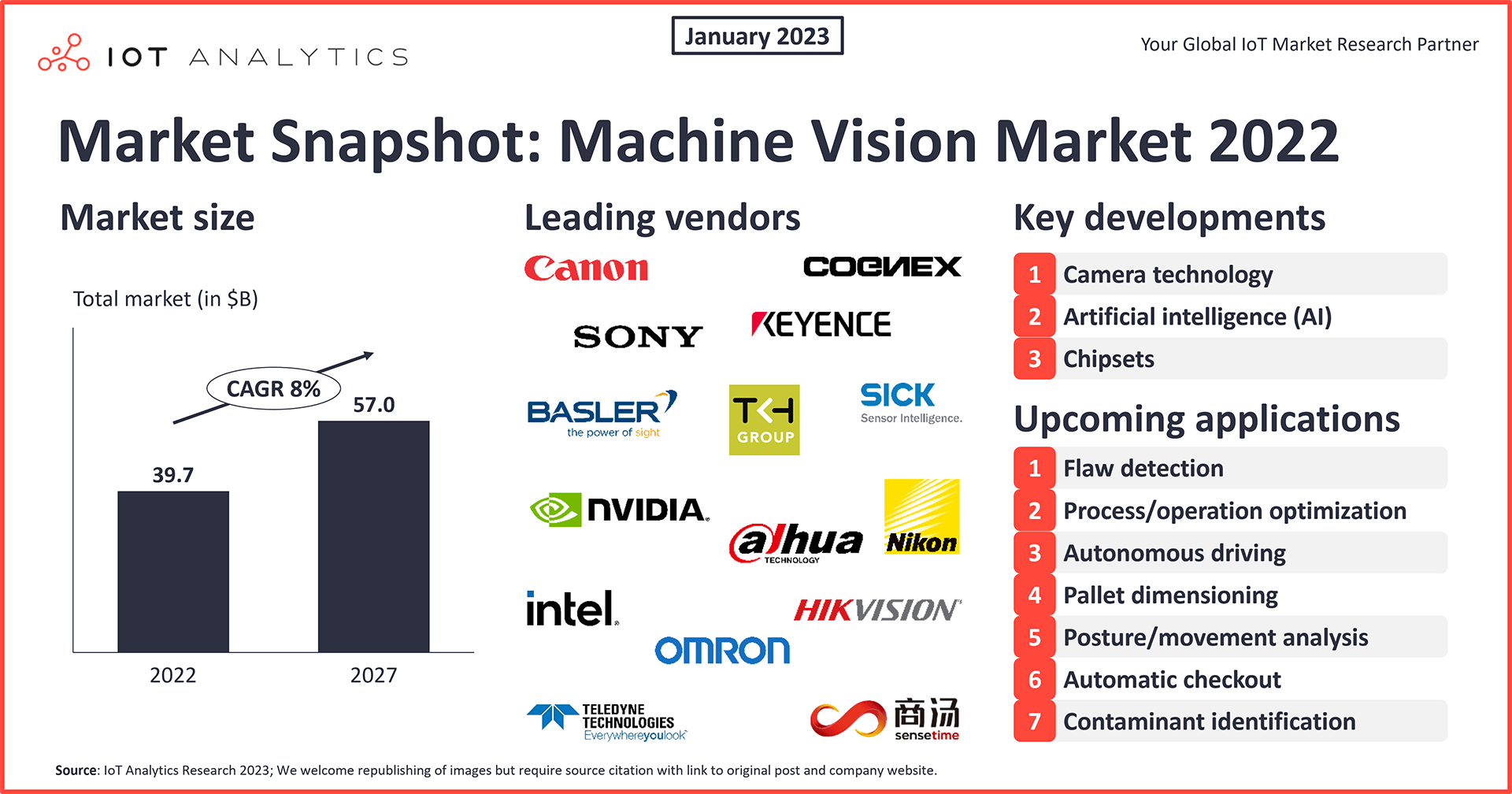

- New research on the machine vision (MV) market shows that advancements in cameras, AI, and chipsets are boosting the use of machine vision applications.

- Among the 39 use cases analysed, 7 have been flagged as particularly interesting, including flaw detection, autonomous driving, and contaminant identification.

Why it matters

- Vendors need to invest in the evolving technology and form the right partnerships as the ecosystem broadens.

- Adopters need to potentially re-evaluate their possibilities now. MV is becoming powerful, and its return on investment is proven. Quality inspection is a popular starting point.

Click on the button to load the content from .

Introduction: Machine vision—a key Industry 4.0 technology

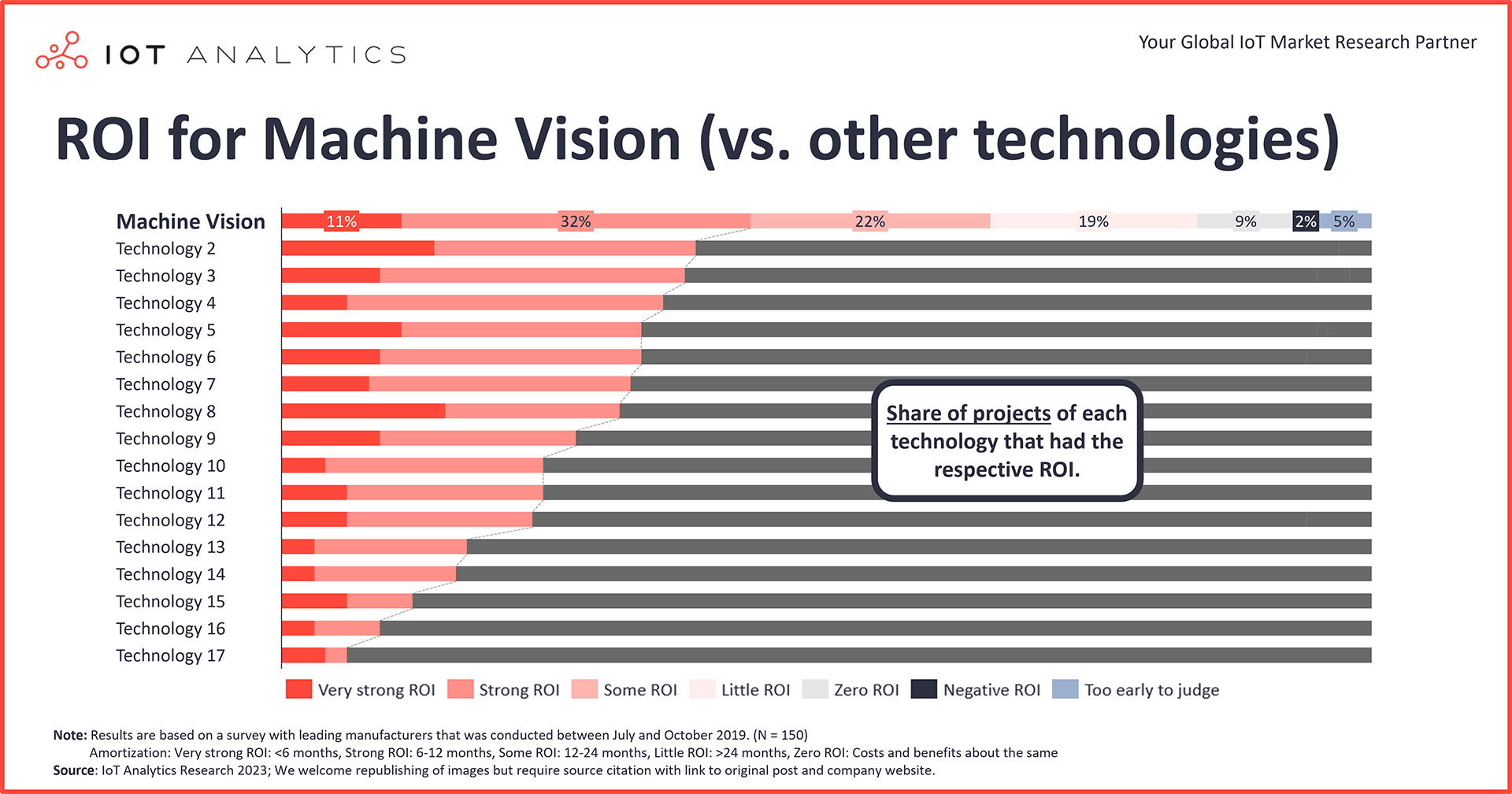

Machine vision (MV) has the highest return on investment (ROI) and quickest amortization time of all Industry 4.0 technologies:

- 2020/2021 market research: Our research and survey data with various Industry 4.0 adopters highlighted this for both 2020 (see Industry 4.0 Adoption Report 2020) and 2021 (IoT Use Case Adoption Report 2021). Average machine vision project amortization is 16.8 months, or ~20% faster than the overall industry average* of 17 Industry 4.0 technologies (20.1 months).

- 2022 market research: Research in 2022 showed that machine vision is expected to experience continued strong investment inflows in the coming years (see Industry 4.0 Adoption Report 2022).

- Latest market research: Our latest research, the 239-page Machine Vision Market Report 2022–2027 goes into much further depth on this important Industry 4.0 topic.

*The industry average does not include projects that have a negative ROI and never reach break-even. For machine vision, this number is also among the lowest of all Industry 4.0 technologies.

Related adopter quote

“In our latest project involving the implementation of an AI-based machine vision system for quality inspection of car assemblies, we achieved amortization in half a year.”

Executive at German automotive supplier (2022)

What is machine vision?

MV is the combination of different technologies and methods to automate the extraction of image information for providing operational guidance/key data for machines to execute a given task, in industrial and non-industrial settings.

The continuous reports of high ROI are, among other things, a consequence of recent technological developments, particularly in the fields of:

- Camera technology

- Artificial intelligence (AI)

- Chipsets

These advancements enhance typical machine vision benefits such as saving costs, increasing competitiveness, or improving product quality. These technology shifts also affect the landscape of the 39 machine vision applications we identified in our research.

Related quote

“[…] Nowadays, we see that we can do things that were impossible a few years ago.”

Product Marketing Manager at a German MV solutions provider

This article highlights a number of existing machine vision applications that benefit strongly from these developments (e.g., flaw detection) and new use cases (e.g., process/operation optimization and pallet dimensioning).

Three notable machine vision technology shifts

Machine vision technology has been around for more than 30 years, but recent technology shifts have given a new boost to its adoption.

Key technology shift #1: Advanced cameras

Cameras with resolutions of more than 45 megapixels are not only (in many cases) now superior to the human eye, but they can also capture objects at extremely high speed and without distortion.

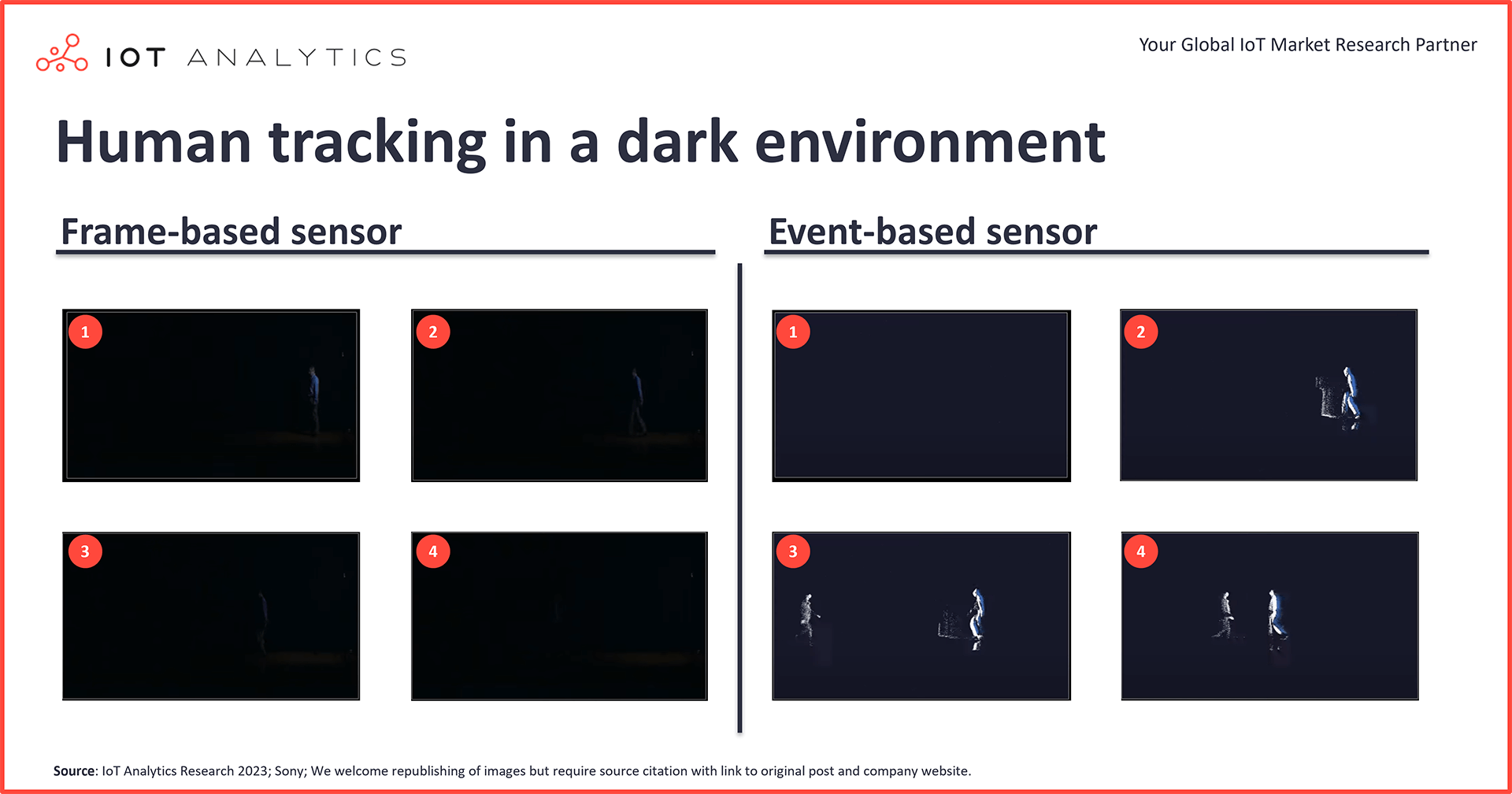

However, there are also other innovations happening behind the scenes that may not be as apparent to the user. One such advancement is the introduction of “event-based vision sensors.”

Event-based vision sensors:

Similar to how the optic nerve processes information, event-based vision sensors capture images by detecting only luminance changes (i.e., changes in brightness) of each pixel. In contrast to traditional frame-based vision sensors, this allows for much darker environments or harsher weather conditions (e.g., suitable for autonomous driving).

Key technology shift #2: Better decision-making with AI

The move from rule-based machine vision (decision-making based on pre-determined parameters) to AI-based machine vision (decision-making based on the output of the applicable MV model) is an impactful one.

Rule-based MV is “rigid” and suitable only for quantifiable, clear, and very specific characteristics (e.g., a scratch on a product is horizontal and 30 mm in length). It answers a yes/no question.

On the contrary, AI-based MV can provide accurate results for nonquantifiable characteristics, discern defects in a wider range of backgrounds and lighting settings, and work flexibly with variations in product appearance and types of defects (e.g., dents or discoloration). Deep learning, a more sophisticated and powerful subset of AI, is also becoming more and more adopted in machine vision applications.

Key technology shift #3: More powerful hardware with AI chips

The advances of AI go hand-in-hand with advances in chipsets. The latest generation of chips is more powerful and suited for processing images and running AI-based computer vision algorithms.These advances have helped reduce deep learning training times from weeks to hours.

Many smart camera machine vision systems are now packed with powerful AI chips, e.g., the NEON-2000-JNX series from ADLINK has the Nvidia Jetson Xavier NX module built in.

7 of the top upcoming machine vision applications

Here are seven machine vision applications that (according to our market research) are seeing a boost thanks to the aforementioned recent improvements in cameras, AI, and chipsets.

Upcoming machine vision application #1: Flaw detection

Flaw detection is a machine vision use case that is mostly deployed in quality inspection processes of manufacturing operations. In the past, non-AI machine vision required a database with images of all possible flaws for the system to successfully recognize a defect. Today’s MV technologies, however, can discern that something is “off” without requiring specific images for that defect (i.e., anomaly detection).

Example:

Fujitsu tested such a solution at its Nagano plant in Japan, which manufactures electronic equipment. The company says it achieved a 25% reduction in the number of hours required to inspect printed circuit boards. It achieved this efficiency improvement by training an AI to generate normal images through repairing abnormal areas in thousands of simulated images with defects (e.g., shape, size, and color abnormalities). Initially, the training images have no defects. In the next step, simulated defects are added (e.g., shape, size, and color abnormalities). The AI is then trained to remove that defect and restore the image to its original form. The accuracy is measured by comparing the initial and “restored” image. This way, when the AI is less accurate with a particular type of anomaly, the first step can generate more such anomalies, therefore precisely targeting and improving the AI’s weaknesses.

Upcoming machine vision application #2: Process/operation optimization

Another (mostly) manufacturing-related machine vision use case is process/operation optimization. The combination of better cameras and AI allows for new ways to achieve a specific result. Robots, for example, can now work on more complicated tasks with higher precision and efficiency than a human. The result is that with MV technology, robots (or other machinery) can do things that were previously performed in a different fashion.

Example:

A case in point is a new rubber grinding solution developed by the Fraunhofer-Institute for Design Engineering Mechatronics (IEM). Using a Mitsubishi Electric robotic arm, an optical laser scanner, and a control system equipped with AI software, the company developed a new AI grinding system—the RoboGrinder—that automates the process of grinding complex rubber-like materials, which was previously not feasible. According to the team, the new approach results in eliminating up to 40% of a typical rubber grinding process.

Upcoming machine vision application #3: Autonomous driving

Machine vision plays a crucial role in the quest to develop fully autonomous vehicles. There are six levels of autonomous driving, ranging from 0 (fully manual) to 5 (fully automated). Most (commercial) vehicles today offer driving assistance at levels 1 or 2, and only a few offer a level 3 option. To reach level 4 or 5, there is a leap that needs to be made when it comes to the technologies used in the vehicles. Very sophisticated MV camera systems and AI-powered computing are part of this technological leap.

Example:

The Google Waymo One autonomous ride-hailing service is an example of a commercially available level 4 autonomous vehicle. Each car is equipped with the Waymo Driver system, which is a complex MV system consisting of five LiDARs, four radars, 29 cameras, and AI software that collects sensor data and calculates the most optimal route in real time. The solution has already collected over 20 million miles of real-world driving experience.

Upcoming machine vision application #4: Pallet dimensioning

One of the key upcoming machine vision use cases in the logistics vertical is pallet dimensioning. Novel 3D time-of-flight* camera technology makes it possible to measure the dimensions of loaded pallets, thereby eliminating the time spent doing manual measurements and minimizing potential charges from carriers due to inaccurate dimensional weights.

Example:

Product packaging company DS Smith partnered with machine vision company Neadvance and sensor/process instrumentation company SICK to pilot a pallet dimensioning solution. A camera is mounted at the end of the production conveyor belt and takes a 3D snapshot of all pallets before they are picked up. This data is essential to both manufacturers and carriers, as it accurately provides the dimensions and volumetric load of pallets. Manufacturers can use this information to optimize production over time, while carriers can use it to ensure the freight is moved safely and efficiently with the right equipment. The expected result is an increase in the accuracy and reliability of stock data for finished goods and wooden pallets, and a decrease in accessorial charges.

Upcoming machine vision application #5: Body posture/movement analysis

Machine vision is also enabling several new applications in healthcare. Advances in the precision and quality of cameras has enabled body posture and movement analysis. It is now possible to identify the position and orientation of the bones and joints using just a camera and no additional equipment (e.g., worn sensors/accessories). Workspace ergonomics, healthcare practices such as orthopedics, and general gesture interaction can benefit from this machine vision application.

Example:

Taking advantage of the new USB 3.0 industrial cameras from German camera manufacturer IDS, biomedical solution company DIERS developed a solution that enables fast, high-resolution optical measurement of the human back, spine, and pelvis. By continuously recording the light projected by a device onto a patient’s back using the camera, computer software can generate an accurate representation of the spine curvature. This solution helps orthopedic surgeons detect imbalances in the muscular system or postural defects.

Upcoming machine vision application #6: Automatic checkout

Machine vision is set to improve the automatic checkout experience in retail stores. By using MV-based solutions, the time needed for checkout can be significantly reduced.

Example:

US-based start-up Mashgin has developed a machine vision solution that allows for the visual scanning of products instead of having to search for a barcode. Customers such as Texas-based DK stores report as much as a 34% increase in transactions thanks to the reduction in waiting lines enabled by the automatic checkout solution.

Upcoming machine vision application #7: Contaminant identification

The identification of contaminants in products is an important part of quality assessment in the food industry, but the process is difficult to solve with a traditional MV approach since it is highly qualitative and would require a database of every possible contaminant combination. However, by leveraging AI, discolorations, foreign objects, and other such abnormalities in processed foods can be effectively identified.

Example:

Frozen food company Apetito tested and deployed an automated qualitative assessment solution in more than 20 production lines, thus making sure that the processed foods division could successfully detect all contaminants in the raw ingredients.

Conclusion and outlook

The three technology advances described in this article are driving new and improved applications using machine vision technology. IoT Analytics expects the market for machine vision to grow at a CAGR of 8% from 2022 to 2027 (already factoring in a difficult 2023 for technology markets). As with many technology fields today, the highest growth is expected in the software that benefits from the progress of AI. Our research shows that ~60% of the 313 machine vision vendors we identified already offer specific MV software. We expect the seven use cases above to become much more common in the following years—and we also expect many other use cases to appear that we did not discuss in this article. MV is an exciting technology, and we are yet to see the height of its power.

Are you interested in learning more about the Machine Vision market?

IoT Analytics is a leading global provider of market insights and strategic business intelligence for the Internet of Things (IoT), AI, Cloud, Edge, and Industry 4.0.

Machine Vision Market Report 2022-2027

A 239-page report examining machine vision in industrial and non-industrial settings, including technology stack, market size & outlook, competitive landscape, use case analysis, end user insights, and trends & challenges.

Click on the button to load the content from .

Related publications

You may be interested in the following publications:

- Digital Supply Chain Market Report 2022-2027

- IoT Sensors Market Report 2022-2027

- Industry 4.0 Adoption Report 2022

- Industrial Software Landscape 2022–2027

Related articles

You may also be interested in the following recent articles:

- 8 key technologies transforming the future of global supply chains

- 5 IoT sensor technologies to watch

- The rise of Industry 4.0 in 5 stats

- The top 10 industrial software companies

Related market data

You may be interested in the following IoT market data products:

- Global Cellular IoT Module and Chipset Tracker and Forecast

- Global IoT Enterprise Spending Dashboard

Are you interested in continued IoT coverage and updates?

Subscribe to our newsletter and follow us on LinkedIn and Twitter to stay up-to-date on the latest trends shaping the IoT markets. For complete enterprise IoT coverage with access to all of IoT Analytics’ paid content & reports including dedicated analyst time check out Enterprise subscription.