In short

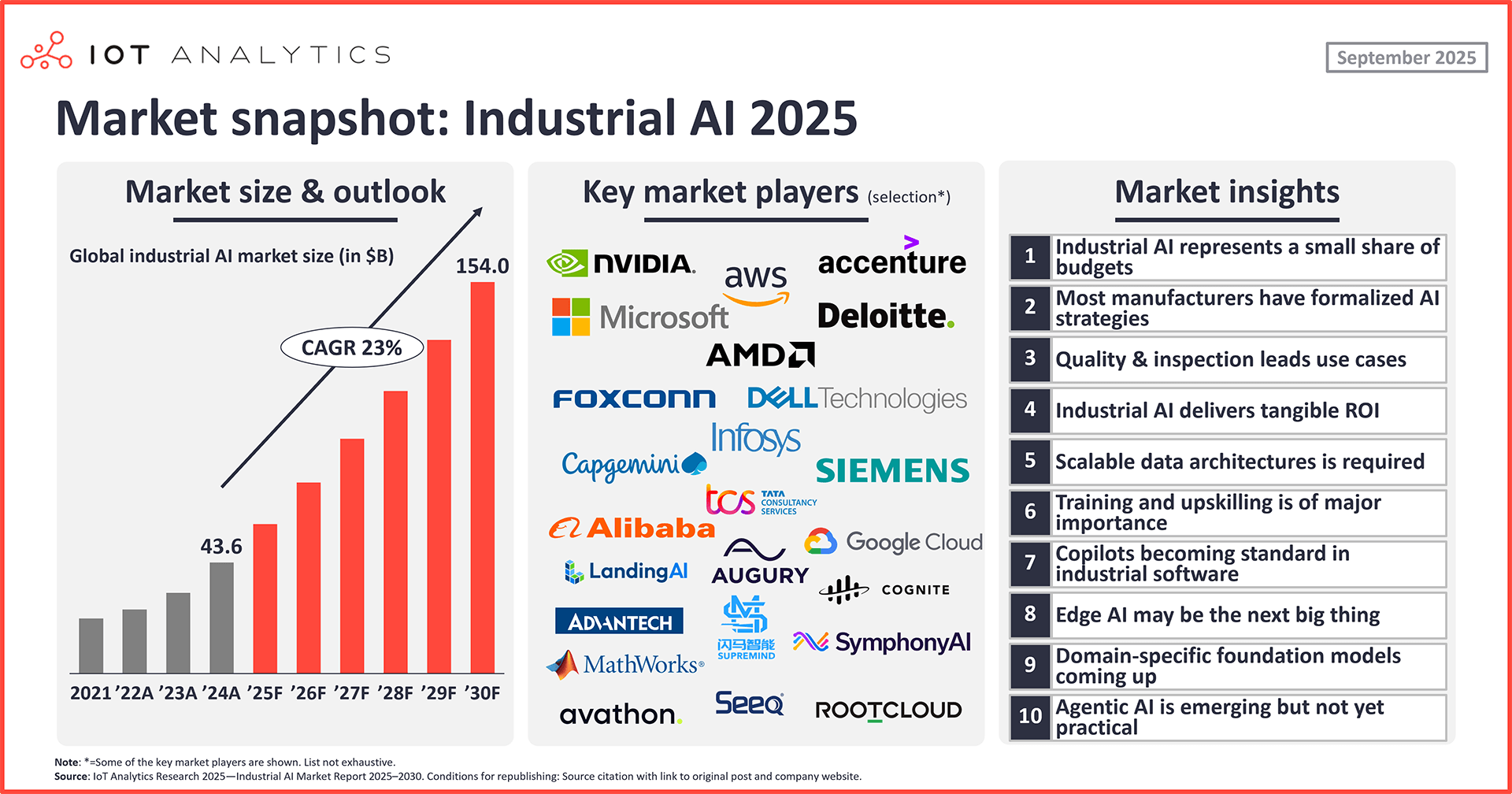

- The global industrial AI market reached $43.6 billion in 2024 and is expected to grow at a CAGR of 23% to $153.9 billion by 2030, according to the Industrial AI Market Report 2025–2030 (published August 2025).

- Although Industrial AI spending today only represents 0.1% of revenue, most manufacturers now have a CEO-driven AI strategy with several industrial AI focus areas emerging: industrial data management/architectures, AI for quality & inspection, edge AI, industrial copilots, and employee training and upskilling, along with the first trials of agentic AI.

Why it matters

- For industrial AI vendors: The market is highly dynamic, and vendors need to stay on top of the latest developments.

- For industrial AI adopters: Learning about current trends and how peers are applying AI to their operations can help companies make sound technology investment decisions.

In this article

- Introduction: The Industrial AI market outlook

- Insight 1: Industrial AI today represents a small share of manufacturing budgets

- Insight 2: Most large manufacturers now have formalized CEO-driven AI strategies

- Insight 3: Quality & inspection leads industrial AI use cases

- Insight 4: Industrial AI delivers tangible ROI

- Insight 5: Large-scale Industrial AI requires scalable data architectures

- Insight 6: Training and upskilling for AI is of major importance

- Insight 7: Copilots becoming standard features in industrial software

- Insight 8: Edge AI may be the next big thing in industrial AI

- Insight 9: Domain-specific industrial foundation models coming up

- Insight 10: Agentic AI is emerging but not yet practical

- Industrial AI market outlook and competitive landscape (Insights+ exclusive)

- Industrial AI market outlook 2024–2030 (Insights+ exclusive)

- Industrial AI competitive landscape (Insights+ exclusive)

- Up-and-coming industrial AI startups (Insights+ exclusive)

Introduction: The Industrial AI market outlook.

Industrial AI, a fast-growing market opportunity. In 2024, the global industrial AI market reached $43.6 billion, according to the 399-page Industrial AI Market Report 2025–2030 (published August 2025). The market is forecasted to grow at a CAGR of 23% until 2030, reaching $153.9 billion, driven by a renewed push for AI initiatives in industry following the advent of generative AI (GenAI) in 2022.

Industrial AI operates under different rules than consumer AI. Whereas GenAI dominates consumer and office adoption for text and images, most industrial value comes from sensor time-series, machine vision, and simulations that must run reliably at the edge and integrate with OT systems. As a result, explainability, safety, and payback discipline drive what gets deployed.

Below, the IoT Analytics team shares 10 insights in industrial AI based on the analysis in the report.

Insights from this article are derived from

Industrial AI Market Report 2025-2030

A 400-page report on the current state of the industrial AI market, including detailed market sizing, forecasts, vendor market shares, key trends, use cases, adoption statistics, and more.

Already a subscriber? View your reports and trackers here →

Insight 1: Industrial AI today represents a small share of manufacturing budgets

US manufacturers, on average, invest just 0.1% of revenue into AI. The average US manufacturer in 2024 made $30.5 million in revenue. Based on the market data in the report, these manufacturers spent over $10 billion on industrial AI in 2024, which translates to an average of roughly $40,000 per manufacturer. This represents approximately 0.1% of the average US manufacturer’s revenue, 3% of average R&D spending ($1.56 million), and 7% of average IT spending ($610,000). The relative share of AI spending is unevenly allocated, with larger companies spending more on AI than smaller companies.

Due to skill gaps and system complexity in AI, a significant portion of industrial AI spending is allocated to consulting and system integration services. Standing out as the top-earning AI services vendor is Ireland-based Accenture, which announced a $3 billion investment over 3 years in December 2023. The company completed over 2,000 GenAI projects alone in its fiscal year 2025 (which ended on August 31, 2025). Other companies with strong industrial AI offerings in a fragmented services market include India-based Infosys and UK-based Deloitte.

Insight 2: Most large manufacturers now have formalized CEO-driven AI strategies

Companies no longer treating AI as isolated pilots. In 2021, AI was largely viewed as an experimental or supporting capability rather than a central driver of organizational strategy. According to IoT Analytics research at that time, AI did not rank among the top 3 priorities for manufacturers, with many companies treating AI initiatives as isolated pilots rather than coordinated programs. By 2025, however, most leading manufacturers have developed dedicated AI strategies in their corporate roadmaps. These strategies are no longer ad-hoc exploratory projects but instead are vision-driven, supported by governance frameworks, performance targets, and integration with broader business objectives. This marks a significant cultural and structural shift, elevating AI from a peripheral technology investment to a top-of-mind discussion point for CEOs during corporate earnings calls.

The report shares several deep dives into company AI adoption strategies. A notable example is Toyota, a Japan-based automotive manufacturer. Since the mid-20th century, Toyota has been regarded as the benchmark for modern manufacturing, driven by the principles of the Toyota Production System. In FY2025, Toyota committed 1.7 trillion yen ($10.6 billion USD) to AI and software-centered vehicles, with key emphasis on the human element of AI. Toyota’s Smart Factory vision is for AI to augment humans, i.e., to extend and retain human expertise by empowering workers to develop ML models themselves, capturing design know-how from engineers, and flagging issues in real time to help ensure worker safety and boost productivity.

Insight 3: Quality & inspection leads industrial AI use cases

Quality & inspection vision use cases far ahead of GenAI-based use cases. GenAI-based use cases are far from being the leading use cases of AI in industry. Of the 48 industrial AI use cases analyzed in the report, automated optical inspection has emerged as the leading one with a share of approximately 11%. For comparison, all GenAI-based use cases combined currently account for less than 5% of the market, with coding being the largest at 1%.

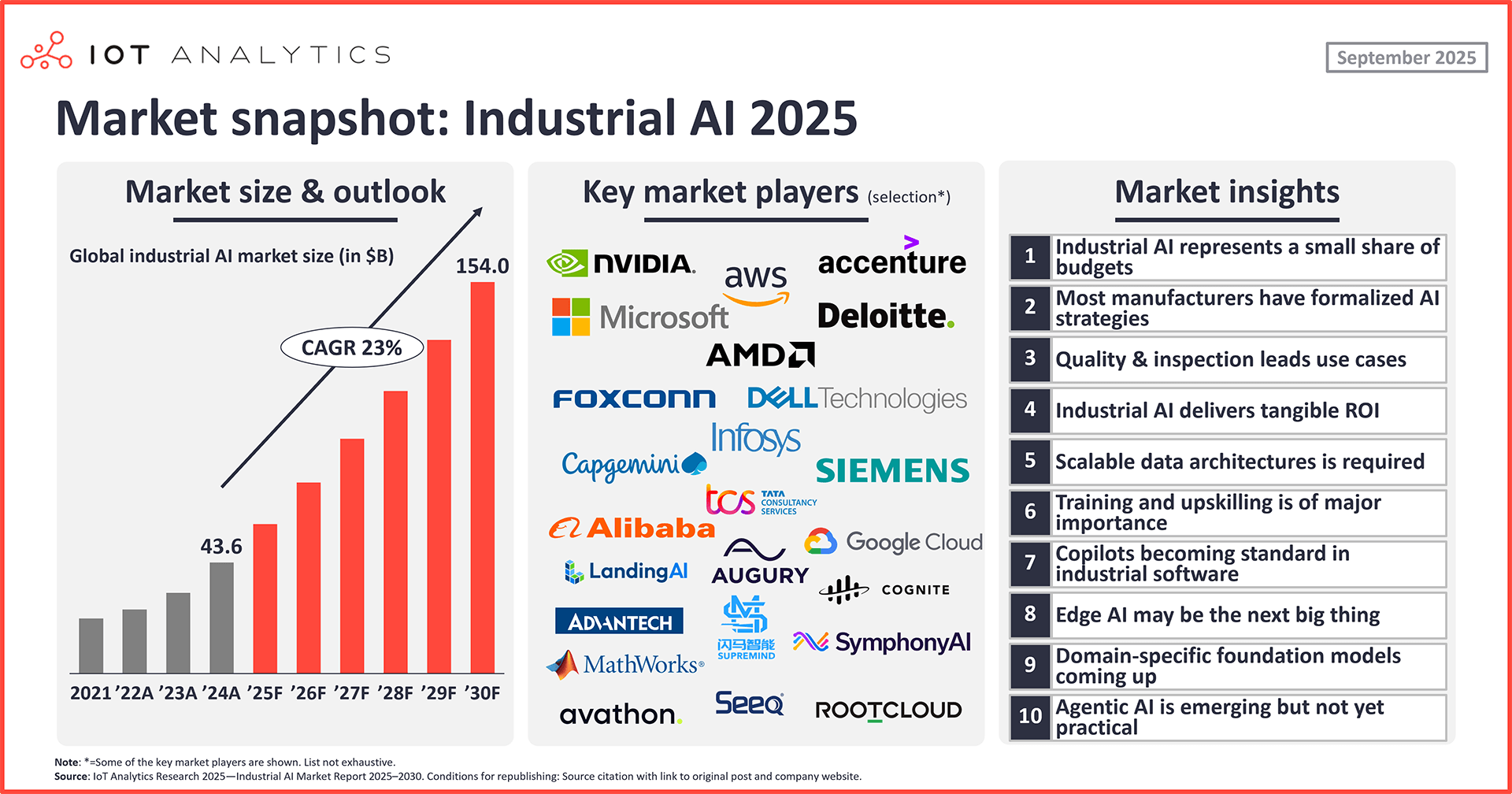

Taiwan-based electronics manufacturing company Pegatron is a notable example of an automated optical inspection implementation, which is covered in the research. Pegatron built its automated optical inspection tool, PEGA AI, using US-based semiconductor NVIDIA’s Omniverse Replicator, Isaac Sim, and Metropolis to improve defect detection accuracy to a reported 99.8% and 4x improvement in throughput.

Insight 4: Industrial AI delivers tangible ROI

Companies seeing 9-digits in savings and value gained. While the financial community grapples with the question of whether we are in an AI bubble, and some outlets report 95% failure rates for enterprise AI pilots, many industrial AI projects have already proven their value through measurable cost savings, uptime improvements, and quality gains in recent years. In fact, in 2023, IoT Analytics noted that machine vision had the highest ROI and quickest amortization time of all Industry 4.0 technologies at that time, with AI-assisted flaw detection and process/operations optimization as the top rising machine vision applications at the time.

For example, France-based automotive manufacturer Renault SA’s then-CEO Luca de Meo reported €270 million in savings on energy and maintenance in a single year by deploying predictive maintenance AI tools during the company’s Q4 2023 earnings call in February 2024. Meanwhile, US-based pulp and paper company Georgia-Pacific reported hundreds of millions of dollars in annual value capture through its AI projects, including a GenAI-based document generation tool called ChatGP, an AI-powered chatbot for real-time guidance and alerts for operators, and an AI-powered vision system for automated defect detection.

Insight 5: Large-scale Industrial AI requires scalable data architectures

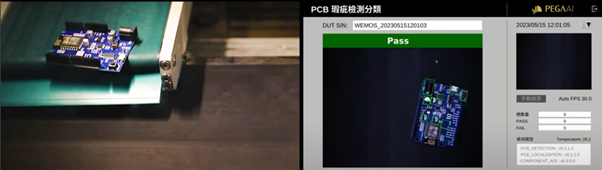

Renewed interest in industrial AI is changing how manufacturers approach data management. Traditional industrial environments have long struggled with fragmented data systems (e.g., siloed SCADA networks, MES deployments, and data historians). However, with AI solutions increasingly relying on structured, high-context, and real-time data, manufacturers are being compelled to modernize their approach to managing and preparing information. The analysis in the report shows that firms are no longer treating data management as an IT function, nor as a byproduct of OT installations. Instead, industrial data management is becoming an increasingly strategic pillar of digital transformation in its own right.

One of the most notable developments is the rise of industrial DataOps, now the fastest-growing industrial software segment. According to IoT Analytics’ Industrial Connectivity Market Report 2024–2028 (published in July 2024), the market for industrial DataOps is expected to grow at 49% CAGR until 2028, as companies embrace DataOps tools for their ability to clean, contextualize, and orchestrate operational data flows. DataOps platform vendors are also now adding capabilities like deploying language models to edge devices, such as US-based Litmus’s Litmus Edge platform, which supports locally hosted small language models like Microsoft Phi and Llama, and support for agentic AI workflows that rely on dynamic data access, such as Norway-based Cognite’s Atlas AI, which offers a low-code agent composer for creating tailored AI agents.

At the same time, manufacturers are rethinking their data storage architectures by breaking down legacy silos and creating unified data lakes, also known as lakehouses. This enables data lineage, shared context, and elastic compute resources, all of which are essential for consistent AI applications across functions. A leading EMEA-based aerospace & defense company that IoT Analytics spoke to, for example, has been working toward consolidating all of its functional data into one (or two) single source(s) of truth. To help with standardizing its data, it has leveraged Siemens’ Teamcenter (PLM), Opcenter (MES), and InsightsHub (Industrial Operations Solution).

Insight 6: Training and upskilling for AI is of major importance

Upskilling emerging as corporate priority. According to a survey conducted by US-based ERP software company Rootstock Software, “Lack of internal expertise or knowledge” is the top barrier to AI adoption for manufacturers (45% of respondents cited it). In response to this barrier, 60% of respondents reported that they were actively investing in the training and upskilling of existing employees, while 46% stated that they aimed to hire new employees with the necessary digital skills.

The industrial AI market reports several examples of companies placing heavy emphasis on employee upskilling for AI. A notable example is Toyota. On May 22, 2025, Toyota Motor Corporation, along with 4 other Toyota Group companies (AISIN Corporation, DENSO Corporation, Toyota Tsusho Corporation, and Woven by Toyota, Inc.), launched the Toyota Software Academy to strengthen AI and software-centered human resource development. As part of the academy, Toyota will offer approximately 100 training courses, where participants can learn practical knowledge in areas such as AI, data security, and vehicle regulations. Moreover, the company will bring together high-level AI and software professionals, providing employees with opportunities to learn from one another and explore various career paths.

Insight 7: Copilots becoming standard features in industrial software

GenAI getting adopted across the value chain. According to IoT Analytics’ repository of 530 GenAI projects across all sectors, customer support activities had the highest share of Generative AI projects, including issue resolution (35% of projects), inquiry handling (34%), and post-sale support (19%). Activities also seeing relatively high shares of AI projects were marketing (content creation, at 17%) and IT (software development/coding support, at 15%).

In the manufacturing sector, issue resolution and coding support have become particularly important. Applications like these have helped GenAI go from not being mentioned at all in IoT Analytics’ 2021 edition of the industrial AI market report to becoming a leading industrial AI development.

GenAI poised to comprise quarter of industrial AI projects. IoT Analytics estimates that GenAI accounted for 6% of industrial AI projects in 2024, a notable increase from just 1% in 2023. This share is projected to rise to around 1/4 of all industrial AI use cases by 2030. Common use cases for GenAI in industry include operations and service support (e.g., documentation querying and troubleshooting) and code generation for OT and embedded assets. However, GenAI is also increasingly used across the entire manufacturing value chain, including in R&D (e.g., for product discovery), design (e.g., generative design), engineering (e.g., for gathering requirements), and in field service (e.g., for guided maintenance).

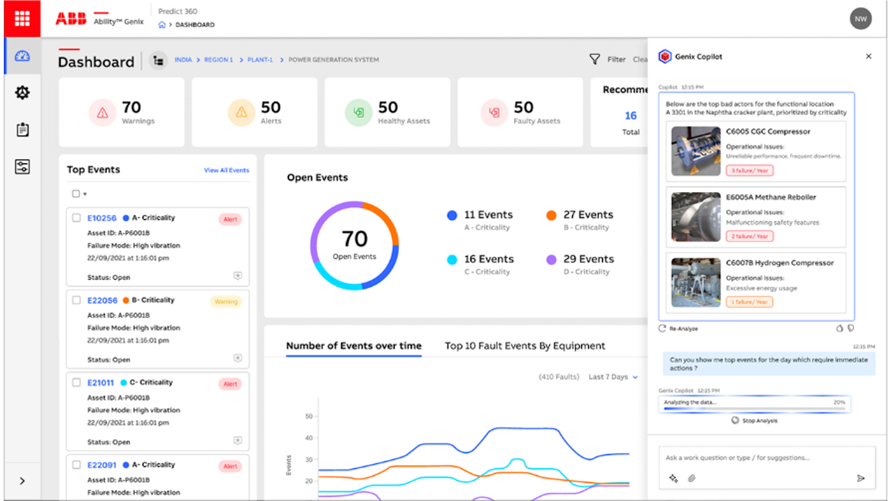

At this point, the rollouts of GenAI in manufacturing have largely been driven by industrial software vendors in the form of copilots featured within industrial software. These copilots are primarily designed to assist and collaborate with humans, offering recommendations, insights, or support while maintaining human control over final decisions. Examples of copilot integrations from leading and upcoming industrial software vendors include:

- Siemens‘ (Germany) Engineering Copilot TIA, which helps PLC engineers generate SCL code (Note: Siemens has more than a dozen other copilots in use across its manufacturing software portfolio)

- Rockwell Automation‘s (US) Copilot, which includes FactoryTalk Design Studio for PLC code generation and error descriptions

- ABB‘s (Switzerland) Genix Copilot, developed in collaboration with US-based software and technology company Microsoft, for natural language insights, troubleshooting, and documentation querying

- Tulip‘s Frontline Copilot for production data analysis

Insight 8: Edge AI may be the next big thing in industrial AI

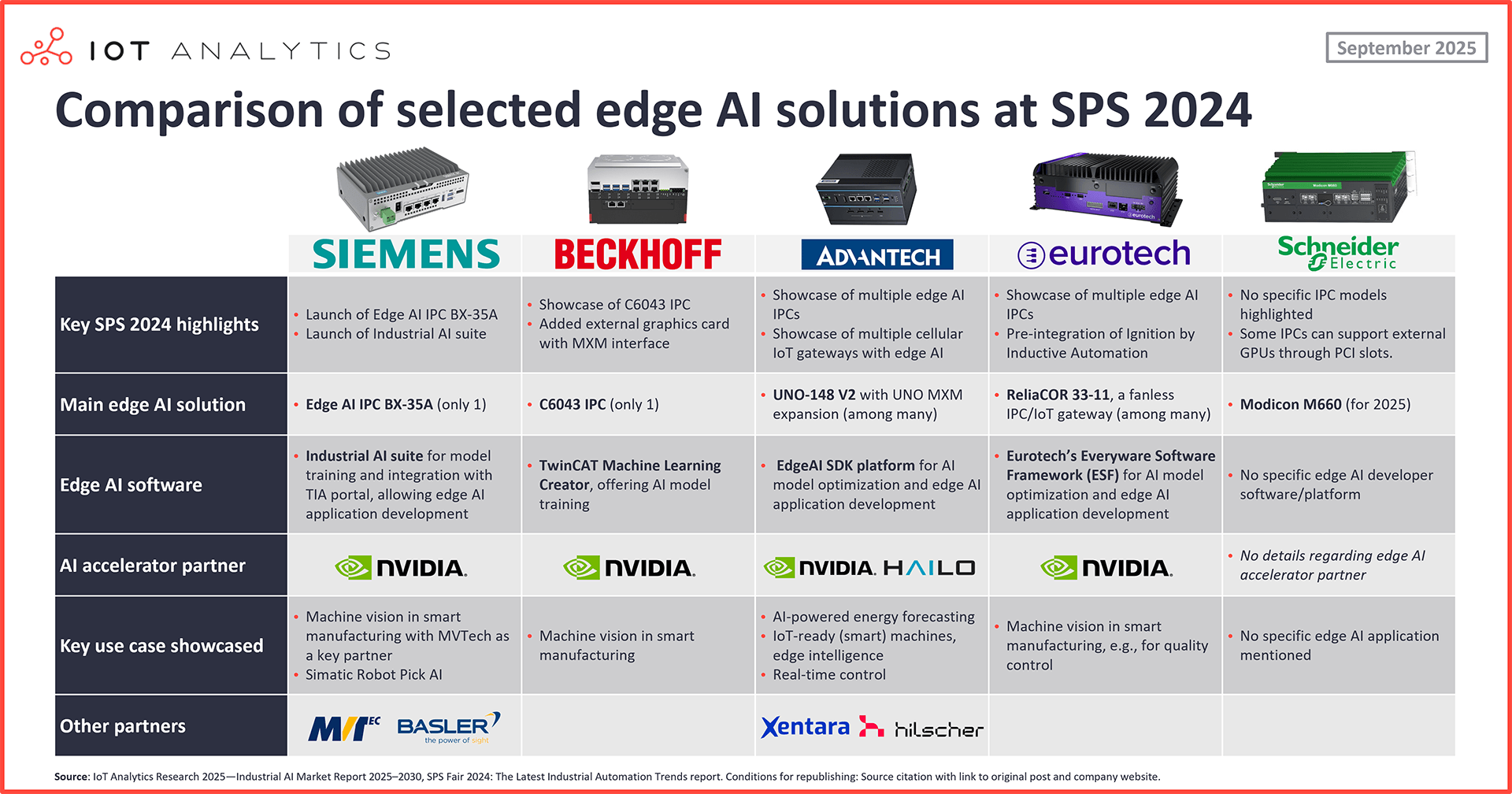

Manufacturers shift focus to edge AI adoption. As manufacturers adopt artificial intelligence to optimize operations, a significant emphasis is placed on centralized, cloud-based models. However, rising data costs, latency-sensitive applications, and security considerations are shifting attention toward processing some of the AI workloads close to machines and production lines and using dedicated edge AI hardware for it. 2 notable technological developments over the past few years have helped make edge AI a realizable goal for many manufacturers: 1) Maturation of dedicated edge computing hardware and 2) dedicated edge AI software platforms.

a) Maturation of dedicated edge computing hardware

NVIDIA’s Jetson platform has matured into the de facto standard for AI computing at the industrial edge. When it first launched in 2014, the original NVIDIA Jetson TK1 offered just 0.33–0.36 tera floating point operations per second (TFLOPs) of AI performance (enough for basic embedded vision tasks). The real breakthrough came with the Jetson AGX Orin, released in 2021, which increased AI performance to 5.3 TFLOPS, a 16x improvement in less than a decade. This exponential performance growth has enabled the execution of complex AI workloads (e.g., real-time video analytics, deep learning inference, and sensor fusion) directly on-device, without relying on the cloud. As a result, industrial automation vendors, industrial PC manufacturers, robotics OEMs, and smart camera makers have begun embedding Jetson modules into their systems, recognizing their value in latency-sensitive, compute-heavy environments.

b) Dedicated edge AI software platforms

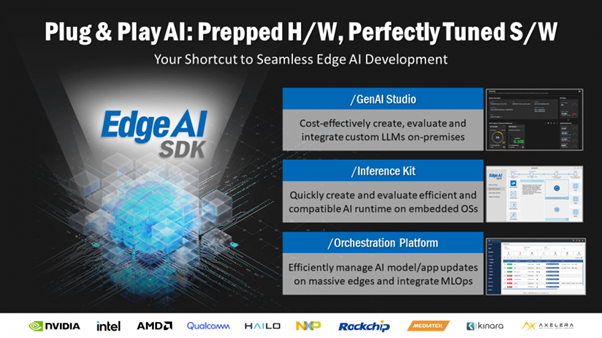

Vendors launching unified edge AI platforms. To streamline the deployment and training of AI models on these edge devices, semiconductor and hardware vendors have launched new edge AI software platforms that enable their customers to develop AI applications, optimize model performance for constrained devices, and manage updates across distributed industrial assets.

On the semiconductor side, some of the new unified development environments from vendors include:

- Infineon DEEPCRAFT: In October 2024, Germany-based Infineon launched DEEPCRAFT Edge AI development suite, designed to streamline the deployment of AI on its microcontroller platforms, such as PSoC, AURIX, XMC, and TRAVEO.

- Qualcomm AI Hub Edge Impulse integration: In March 2025, US-based Qualcomm acquired US-based edge AI platform provider Edge Impulse to unify edge AI model development, optimization, and deployment within its IoT and embedded ecosystem. One of the first demonstrations of this integration combined Edge Impulse’s data-centric model training pipeline with Qualcomm’s AI Hub and RB3 Gen 2 developer kits—offering a streamlined path from sensor data to deployed AI.

- STMicroelectronics’ STM32Cube.AI: In January 2019, Switzerland-based STMicroelectronics launched STM32Cube.AI, a toolchain that supports models from TensorFlow, PyTorch, Keras, and ONNX and applies graph optimization, quantization, and memory tuning for embedded deployment.

These platforms offer full-stack edge AI toolchains for model training, quantization, deployment, and over-the-air updates.

On the hardware side, some of the new software platforms/offerings include:

- Advantech Edge AI SDK: In December 2023, Taiwan-based industrial computing systems provider Advantech released its Edge AI SDK, a platform aimed at simplifying model deployment across various chipsets. The Edge AI SDK functions as a sub-segment of the broader Edge Hub capability within Advantech’s WISE-Edge platform. The initial release of the SDK primarily focused on machine vision applications (e.g., object detection), but subsequent updates have introduced more cross-platform support and GenAI Studio, added in January 2025 and aiming to simplify the development of large language models (LLMs) on-premises by combining model fine-tuning and inference into a single workflow.

- Beckhoff TwinCAT Machine Learning Creator. At Hannover Messe 2025, Germany-based industrial automation company Beckhoff Automation showcased its TwinCAT Machine Learning Creator, which helps users create and deploy machine learning models directly into the company’s TwinCAT 3 runtime, tightly coupled with PLC control systems.

Insight 9: Domain-specific industrial foundation models coming up

Will industrial foundation models understand the language of “manufacturers”? Some manufacturers who have tried to build assistants and copilots with market-leading LLMs from the likes of OpenAI, Google, or Anthropic have seen limited understanding of these models in industrial environments. Since many of the valuable industrial data points that are required to train an LLM do not reside on the public internet, some industrial technology vendors have started to build purpose-built industrial foundation models (IFMs) that aim to “speak the language of engineering,” and are trained on domain-specific data (such as CAD files or machine failure codes), ontologies, and workflows across design, production, maintenance, and operations rather than using general-purpose models.

Examples include:

- Siemens IFM: In April 2025, industrial automation leader Siemens launched its multimodal Industrial Foundation Model (built in collaboration with Microsoft), which was trained on CAD/CAE files, sensor time-series, and automation code.

- Google Gemini Robotics: In March 2025, Google released the cloud version of its Gemini Robotics platform, which integrates Gemini multimodal models into robotic agents, aiming to enable robots to interpret, reason, and act in complex physical environments, like industrial spaces. An on-device version of Gemini Robotics was released in June 2025.

- NVIDIA Robotics Foundation Model: In March 2025, NVIDIA released its Isaac GR00T N1 for robotics, a vision-language-action (VLA) foundation model tailored to humanoid robots. In August 2025, NVIDIA further unveiled new NVIDIA Omniverse libraries and its NVIDIA Cosmos world foundation models aimed at accelerating the development and deployment of robotic and physical AI systems.

- Figure AI Vision-Language-Action Model: In February 2025, US-based AI robotics company Figure AI launched the Helix VLA model, which the company claims to unify perception, language understanding, and continuous high-rate control, letting multiple humanoid robots cooperate on unfamiliar manipulation tasks without task-specific retraining.

- NXAI TiRex: In May 2025, Austria-based AI research and development company NXAI released TiRex, its first time-series foundation model based on the xLSTM architecture, designed for high efficiency with only 35 million parameters. The company reports that TiRex achieves state-of-the-art accuracy in both short- and long-term forecasting while enabling zero-shot predictions without retraining.

Insight 10: Agentic AI is emerging but not yet practical.

Agentic AI holds potential for industry use. Emerging from GenAI, agentic AI has grown as a key topic of interest, also in the industrial sector. Agentic AI refers to a software system that executes entire workflows based on an AI model, often by orchestrating multiple individual AI agents.

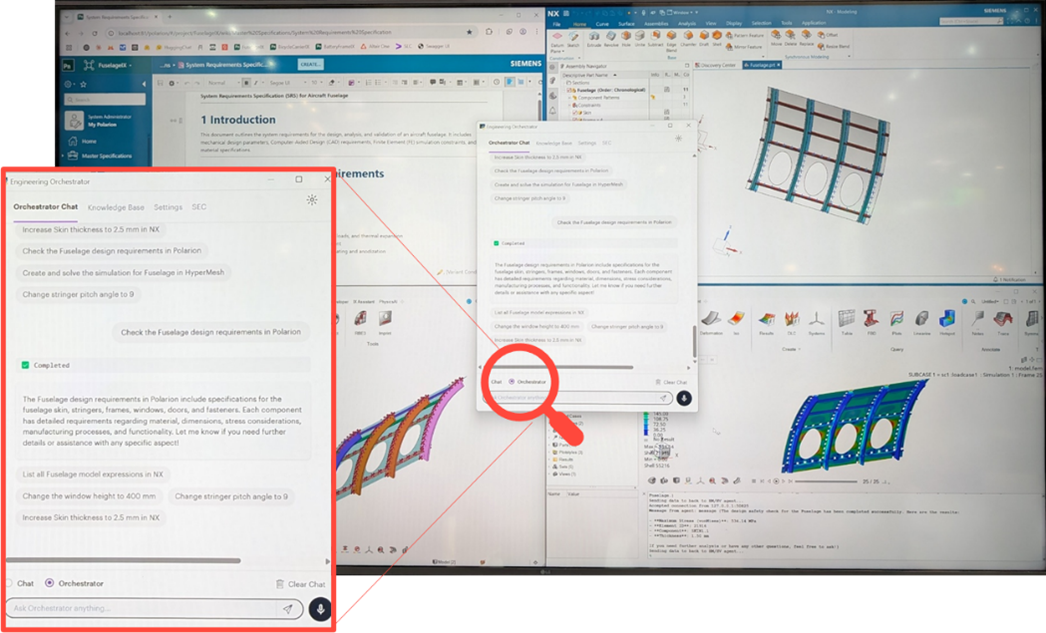

While many industrial software vendors began prominently featuring the term agentic AI in their messaging in 2025, deployment is still in its infancy. At Hannover Messe 2025, most of the showcases that IoT Analytics observed demonstrated only basic orchestration capabilities. One promising showcase was Accenture’s Engineering Orchestrator, which enables users to modify engineering designs using natural language. The agentic engineering chatbot serves as a control layer on top of existing tools, interpreting user prompts and executing design changes across multiple tools (e.g., Siemens NX and Altair HyperMesh) in parallel.

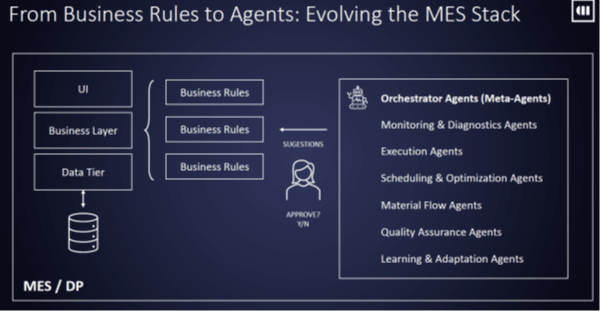

However, many vendors are framing agentic AI as a long-term opportunity, with meaningful deployments expected after 2025. One example is Portugal-based MES vendor Critical Manufacturing, which envisions AI agents coordinating scheduling, quality, and maintenance actions in near real time.

Critical Manufacturing envisions an agentic MES that enables dynamic, data-driven decision-making by replacing static rules with autonomous AI agents that can adapt, learn, and optimize production in real time.

“Agents [can autonomously] reschedule tasks, adapt to disruptions, and optimize production on the fly.”

Francisco Lobo, CEO, Critical Manufacturing (June 2025 at the MES & Industry 4.0 Summit)

Model Context Protocol (MCP) as orchestration frontrunner. Coinciding with this rise is MCP, a potential orchestration standard for agentic AI, standardizing how applications provide context to LLMs. US-based AI company Anthropic first released MCP in November 2024, and leading technology companies like Microsoft, OpenAI, and Google have since adopted it.

“In the last 6 months, with MCP, we have seen the world’s fastest technology standardization right in front of our eyes.”

Joe Bohman, EVP PLM products at Siemens (July 2025 at Siemens Realize Live)

Industrial AI market outlook and competitive landscape (Insights+)

The Industrial AI Market Report 2025–2030 classifies the Industrial AI market into 5 segments:

Access key market data for $99/month per user

The Insights+ Subscription unlocks exclusive facts & figures. You will gain access to:

- Additional analyses derived directly from our reports, databases, and trackers

- An extended version of each research article not available to the public

Full report access not included. For enterprise offerings, please contact sales: sales@iot-analytics.com

Disclosure

Companies mentioned in this article—along with their products—are used as examples to showcase market developments. No company paid or received preferential treatment in this article, and it is at the discretion of the analyst to select which examples are used. IoT Analytics makes efforts to vary the companies and products mentioned to help shine attention to the numerous IoT and related technology market players.

It is worth noting that IoT Analytics may have commercial relationships with some companies mentioned in its articles, as some companies license IoT Analytics market research. However, for confidentiality, IoT Analytics cannot disclose individual relationships. Please contact compliance@iot-analytics.com for any questions or concerns on this front.

More information and further reading

Related publications

You may also be interested in the following reports:

- Digital and ESG Regulations Outlook 2025-2030

- Digital & AI in Industrial Robotics Insights Report 2025

- IoT Platforms Market Report 2025-2030

- Generative AI Market Report 2025-2030

- Data Management and Analytics Market Report 2024–2030

Related articles

You may also be interested in the following articles:

- 2025 regulatory landscape: 40+ digital & ESG laws to have on the radar

- The top 10 enterprise generative AI applications – Based on 530 real-world projects

- State of enterprise IoT in 2025: Market recovery, AI integration, and upcoming regulations

- The leading generative AI companies

Sign up for our research newsletter and follow us on LinkedIn to stay up-to-date on the latest trends shaping the IoT markets. For complete enterprise IoT coverage with access to all of IoT Analytics’ paid content & reports, including dedicated analyst time, check out the Enterprise subscription.