In short

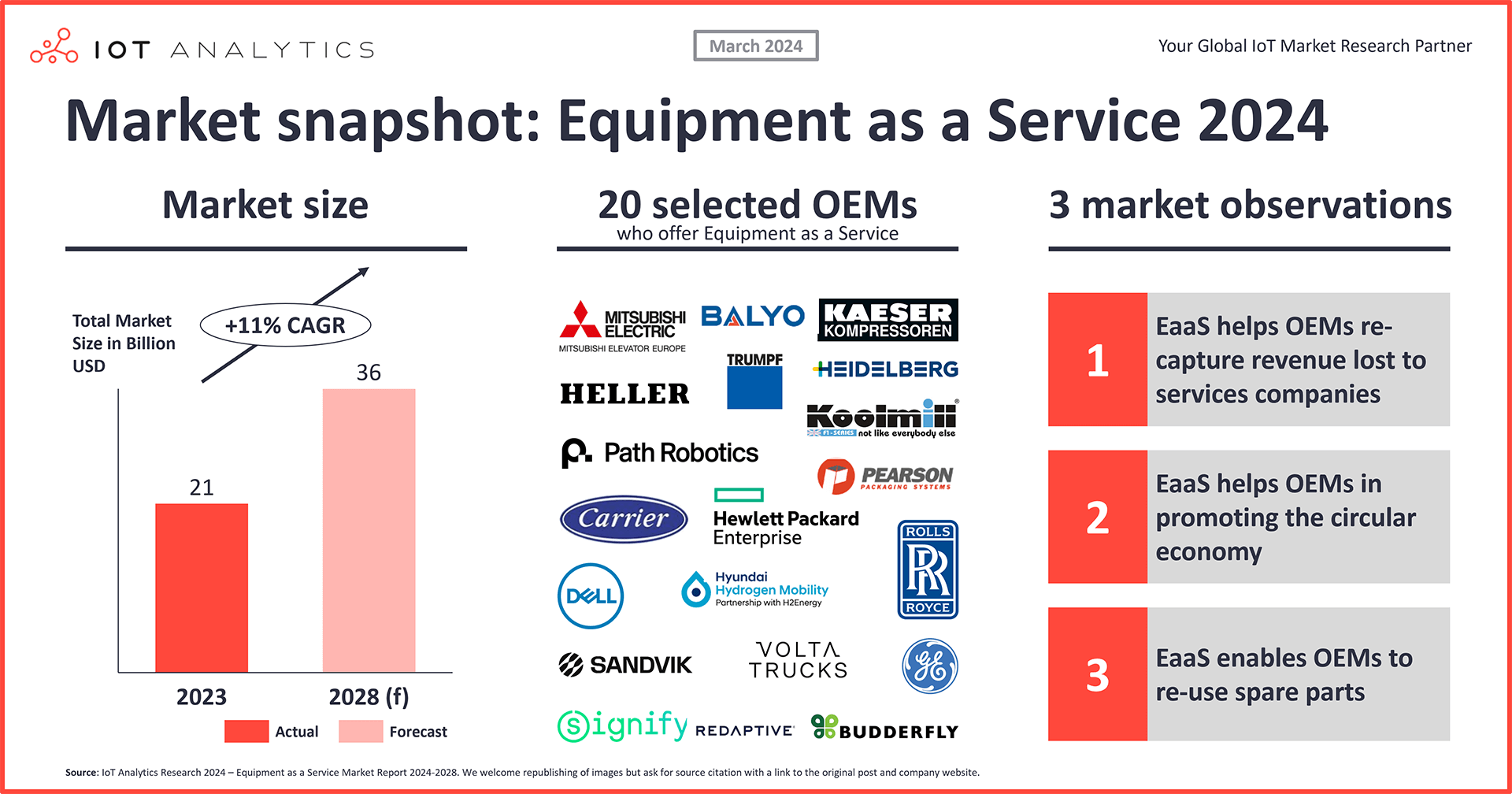

- According to the latest 147-page Equipment as a Service Market Report 2024–2028, the total equipment-as-a-service (EaaS) market reached $21.2 billion.

- Despite initial optimism, EaaS adoption has been slower than anticipated in the past 4 years, with less than 1% of equipment sales in 2023 being executed under EaaS contracts.

- While widespread adoption has not yet occurred, there are pockets of success (e.g., in the lighting and robotics industry), with research showing continued OEM interest in the model and a belief that customers will be willing to accept the model.

Why it matters

- For OEMs: A few OEMs claim to be very successful with the EaaS business model. Understanding why the model works for them and not for others can help clarify an OEM’s future strategy.

- For potential buyers of EaaS: Flexibility is a key paradigm for the factory of the future. EaaS can support the pursuit of flexibility since it does not tie manufacturers to specific, expensive pieces of equipment and can help keep costs relative to demand.

Are we in the decade of equipment as a service?

In 2020, IoT Analytics questioned whether we were witnessing the start of the machine-outcome decade (the 2020s), where assets are not purchased as capital expenditures (CapEx) but, instead, are paid for on an outcome basis as operational expenses (OpEx). Moving from CapEx to OpEx helps companies with limited access to capital access equipment without a large upfront investment, and assets with unpredictable usage could be more cost-effective since the companies would only pay for what they use.

This move could be seen as a natural evolution of the broader subscription economy, which has seen major inroads for customer services, such as music, video, and even home printer ink. The subscription economy has even entered the enterprise world, with software as a service (SaaS) as a prime example.

At that time, a revenue source innovation for this transactional approach—coined as equipment as a service, or EaaS—appeared to be gaining steam in adoption, according to IoT Analytics’ 2020 report on the EaaS market.

Our view in 2020: Strong momentum, technological maturity, and a desire to adopt

In 2020, when we first looked at the EaaS market, it looked to be on track to produce high growth by 2026. Here are 4 views we had back then:

- IoT technology had reached sufficient maturity to support EaaS. Sensors were affordable and versatile, allowing for cost-effective continuous data collection. Further, reliable and secure wireless connectivity options like cellular and low-power, wide-area networks (LPWAN) were widely available. Cloud platforms and data analytics had matured by this point, enabling efficient data storage, processing, and analysis.

- Plenty of EaaS innovators. Of the 39 companies previously reported as selling EaaS in 2020, 26 had started within the previous three years.

- Willingness to adopt. Survey data from a 2020 smart manufacturing adoption report showed that many manufacturers supported the concept of EaaS and would prefer to pay for outcomes, not assets.

- The aerospace engine industry sets an example. In 1997,UK-basedaerospace company Rolls-Royce pioneered EaaS with its TotalCare service—where customers pay by the usage hour of its engines. In 2023, approximately 70% of its revenue in the civil aerospace segment comes from services.

Our view in 2024: Much slower adoption than anticipated, though selected pockets of success

According to our latest research on the topic—the 147-page Equipment as a Service Market Report 2024–2028—the concepts of “equipment as a service” and “pay-per-use” have not taken off as much as expected, even though the greater subscription economy has.

Are we in the decade of EaaS? No. Not yet.

While it appears that we are in the decade of enterprise software outcome economy, specifically software-as-a-service (SaaS), propelled in part by the COVID-19 pandemic and the dawning of B2B software marketplaces, the pay-per-use model has not largely spilled over to physical equipment such as machines and other devices.

According to IoT Analytics’ estimates, the adoption of “as-a-service” models is less than 1%—meaning that less than 1% of equipment sales in 2023 (machines, electronics, electrical equipment, etc.) was achieved with EaaS contracts.

IoT Analytics believes the potential to enter the decade of EaaS still exists, albeit after “as a service” becomes more prevalent (and accepted) in the broader economy. Nonetheless, it needs to be stated that the research found several companies that doubled down on the concept of EaaS in previous years (examples below), and some industries appear to be moving ahead (examples also below).

The 2024 EaaS market report, among other things, delves into factors that have limited the market’s growth and highlights industries that have enjoyed higher EaaS adoption rates, some of which will be spotlighted below.

This article is based on insights from:

Equipment as a Service Market Report 2024–2028

Download a sample to learn about the in-depth data that are part of the report.

Already a subscriber? Browse your reports here →

Research findings: The current state of equipment as a service

At the end of 2023, the total EaaS market reached $21.2 billion, with a global adoption rate of <1%. The latest research anticipates market growth at 11% CAGR from 2023 until 2028.

While mass adoption has yet to happen, the research identified 56 companies that adopted EaaS between 2020 and 2024, adding to the 39 companies identified in the previous report.

However, clearly, there has yet to be widespread adoption following the hype around the topic in 2020 based on success stories from early adopters, like German machinery manufacturers Kaeser Compressors and Heidelberger Druckmaschinen.

Factors contributing to slow equipment-as-a-service adoption

Let us now examine the contributing factors identified in the report, including factors from the OEM point of view, the impacts of the COVID-19 pandemic, and the underperformance of some key market segments.

1. The OEM angle: Equipment as a service is not the first thing on the agenda

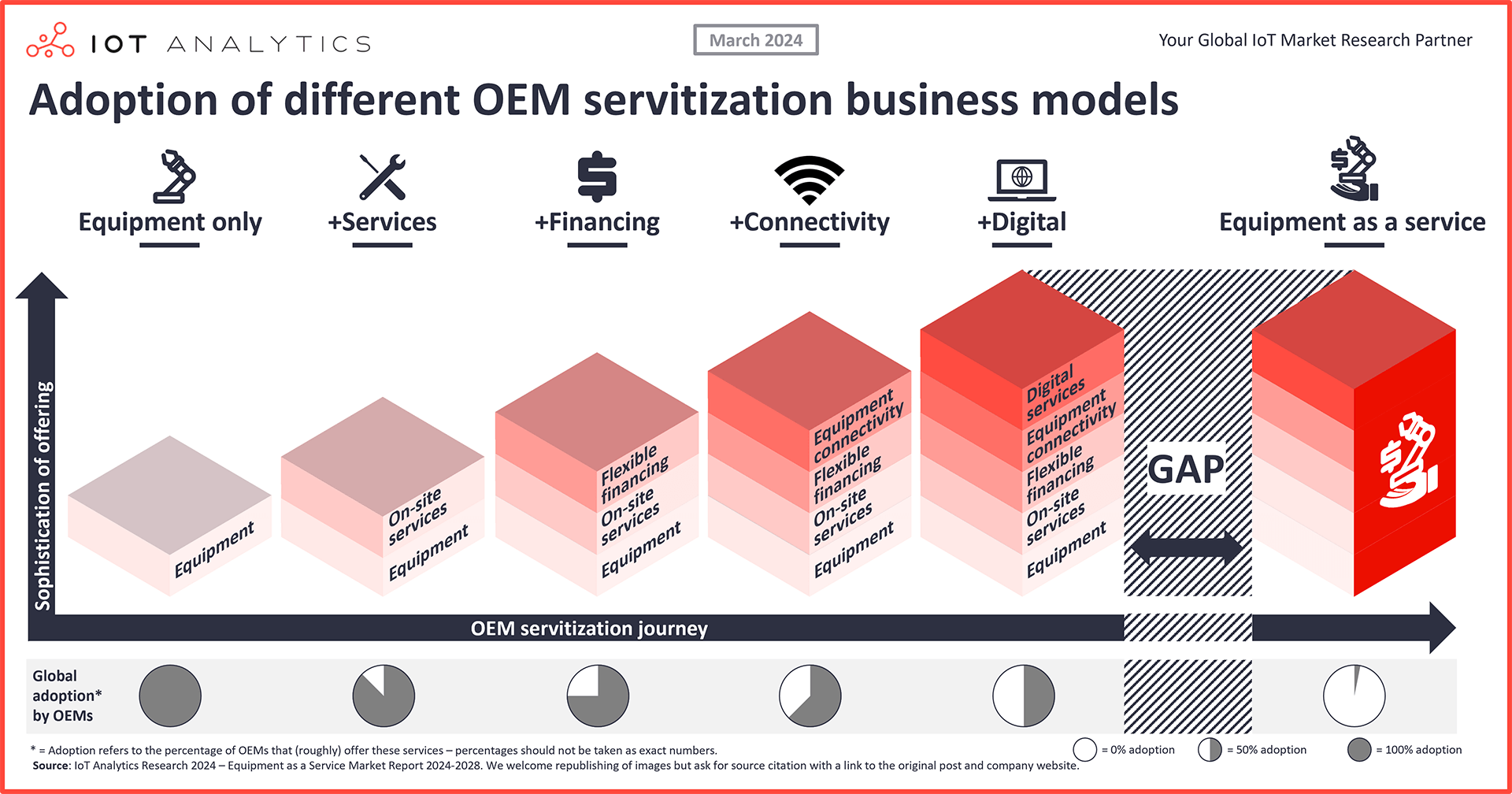

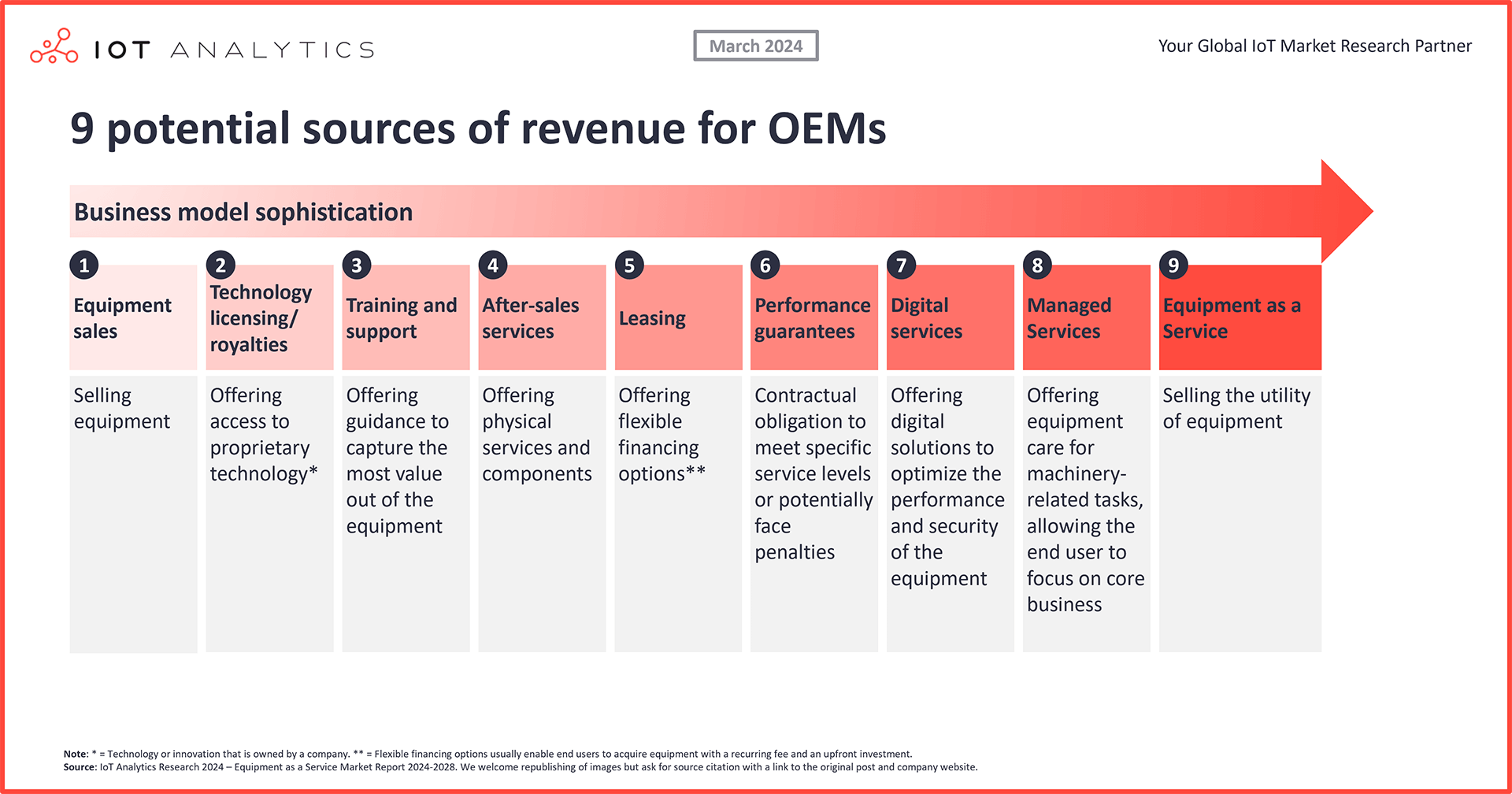

As highlighted in IoT Analytics’ February 2024 report on IoT commercialization and business model adoption, selling equipment as a service is just one of nine revenue source innovations—and the most sophisticated one at that. EaaS requires digital infrastructure on the part of the customers, recurring billing management, financing capabilities, and enough customer education (e.g., understanding the value of moving from CapEx to OpEx, leading to more resiliency).

Already, many OEMs have been slow to adopt revenue source innovations of lesser sophistication (such as selling digital software and services) since the related revenue streams have not been meaningful enough to the company’s top and bottom lines. Trying to move up to EaaS’s level of sophistication would hardly interest companies facing this struggle.

2. The macro angle: The COVID-19 pandemic impacted major equipment-as-a-service segments negatively

At the outset, the COVID-19 pandemic made a reasonable case for equipment-as-a-service, as it led to unpredictable demand and supply patterns, benefiting those companies who pay for what they use. However, some of the largest initial adopters of equipment as a service—aviation jet engines being a key example—suffered during those years. In early 2020, aviation was a major contributor to EaaS adoption rates, particularly Rolls-Royce, with its jet-engine-as-a-service program, TotalCare.

Since a service like TotalCare requires flight hours to drive usage time revenue, the sudden decrease in travel in 2020 impacted the bottom line of jet engine manufacturers. In early 2020, Rolls-Royce planned to deliver 450 engines that year, but this was greatly reduced by mid-2020. By March 2021, Rolls-Royce reported a loss of approximately $5.6 billion due to the “severe impact” of COVID-19 on the aviation industry, and even in 2023, its service revenue was still down 11% compared to 2019.

3. Industry angle: Key industries did not adopt as expected

The 2020 EaaS market report identified several “high-potential” industries that would help drive EaaS adoption and market growth. However, contrary to our forecast, these industries have not (yet) experienced widespread adoption of EaaS.

Take, for example, the compressor segment of the machinery industry. The 2020 EaaS market report identified one EaaS adopter and six others with plans to adopt the EaaS model, indicating significant market growth potential. However, research for the updated 2024 EaaS market report identified only two compressor OEMs selling true equipment as a service in 2024: Kaeser Compressors and Atlas Copco. Even then, EaaS only comprised a single-digit percentage of their annual revenues.

Where equipment as a service is enjoying increased adoption

According to the 2024 EaaS market report, one of the segments that has seen rather strong adoption has been the electrical lighting equipment as a service subsegment. Additionally, in the new robotics-as-a-service (RaaS) market, 8 companies have launched RaaS after 2021 (out of 24 companies selling RaaS in total).

Based on the common factors identified among companies successfully selling EaaS, the report lists nine key factors that affect the success of EaaS in a given industry. Three of those 9 factors, which we highlight within the RaaS industry below, are:

- Ease of measuring ROI

- Preference for OpEx

- Equipment complexity

Spotlight on Robotics as a Service: Three vendors and how they align with EaaS success factors

The following are 3 of a total of 24 companies identified in our research that have found success with robotics as a service (RaaS):

1. Path Robotics – Welding as a service

Managing to simplify the ✅Ease of measuring ROI

Path Robotics, a US-based manufacturer of picking- and welding-type robots, has been actively selling robots as a service for a decade. The company directly contrasts its robots with a new employee rather than positioning them as a machinery investment, selling this as an instant return on investment and stating, “Think of [the Path Robotics solution] as your new 12-month labor contract.”

As an example of this selling point, the average salary for a welder in the US is approximately $46,302, with an average rate of $22 per hour. If the hourly usage rate for a welding robot were the same, but a company only uses it for 100 hours per month (versus the ~160 hours per month for the welder’s salary), the company would only pay $26,400 per year.

2. Pio – Picking and placing as a service

Targeting customers with ✅Preference for OpEx

Pio, a Norway-based manufacturer of automated storage and retrieval systems, targets customers with limited resources who cannot afford large upfront investments into robotics-based warehousing automation. The customers pay for the grid and bin systems (“cubes”), and Pio provides robots and charges based on per order line the customer ships.

3. Rapid Robotics – Risk-free robotics as a service

Making it easier for customers to handle ✅Equipment complexity

Rapid Robotics, a US-based manufacturer of multi-purpose robots, notes that conventional robotics automation is “too complex” and aims to simplify automation for customers who do not have sufficient knowledge to deploy robotics on their own. It offers pre-trained robots designed for specific tasks and can be set up for new tasks within 60 seconds without needing an automation expert.

EaaS outlook

The potential for the decade of EaaS still exists, but the time for large-scale adoption has yet to arrive. Surveys for the 2024 EaaS market report and other IoT Analytics’ enterprise-level market reports indicate a willingness by OEMs to adopt EaaS and a belief that customers would prefer the option, especially in the high-interest rate environment that has defined the post-pandemic economy.

However, as mentioned, acceptance of EaaS will likely come if “as a service” is more prevalent and accepted in the broader economy. Consumers have generally accepted the subscription-based system of entertainment and equipment utilization, and SaaS helped drive the broader subscription-based economy due largely to the COVID-19 pandemic. However, there appear to be limits to the acceptance of this model, and consumers have been pushing back.

US-based computer and printer manufacturer HP has faced consumer backlash in its practice of securing its subscription service. Doubling down in January 2024, HP CEO Enrique Lores stated clearly that HP’s long-term objective is to make printing a subscription—in the same fashion as Heidelberger Druckmaschinen.

Additionally, a May 2023 study from US-based automotive services company Cox Automotive suggests automakers could face challenges adopting subscription-type features (or “features on demand”). While 41% of survey respondents indicated interest in the model, 58% expect the approach to be too expensive, and there are concerns over privacy and data security. Even during the drafting of this article, criticism of subscription-based car services entered the spotlight as the CEO of Textio, Jensen Harris, mocked the requirement of an online account to operate a Tesla after Tesla CEO Elon Musk complained about needing to have a Microsoft account to access Windows on a new PC on X (formerly Twitter), which also requires a paid subscription to access all its features.

Examples such as these do not necessarily indicate a tapping on the breaks of subscription-based models in the broader economy. However, they do highlight that the models still need time to become more commonplace in various industries.

There is also a potential disrupter to the decade of EaaS: AI. The sudden explosion of generative AI has brought much attention to AI overall, and AI has started enabling companies to rely more on their own resources for maintenance, a significant selling point of EaaS. If companies can leverage AI for in-house operations, the selling point for EaaS can become moot in that regard. This has a ways to go before directly competing with the EaaS value proposition, but AI’s potential impact cannot be ignored.

Even still, lighthouse EaaS projects continue to pop up, with notable recent launches from Carrier, Pio, Mitsubishi, and others. And as these projects show demonstrable success, others will likely dip their toes into adopting an EaaS model. Further, the research found that sustainability was a driving factor for EaaS consideration and adoption. In 2020, Mitsubishi introduced its M-use model for elevator leasing, where Mitsubishi will dismantle elevators at the end of their use cycles and reuse them elsewhere where possible. If the elevator is at the end of its life cycle, Mitsubishi recycles the components to be used again.

To learn more about these and other projects or to dive deep into the EaaS market and EaaS success factors, read IoT Analytics’ 147-page Equipment as a Service Market Report 2024–2028.

3 questions OEMs should ask themselves now

Three questions that OEM executives should ask themselves based on the insights in this article, with more considerations found in the full report:

- Offering EaaS: Given the slower-than-expected growth of the EaaS market and the modest increase in adoption rates, should we offer EaaS? Further, do the 9 customer adoption success factors apply in our industry?

- Technical complexity: How prepared is our company to handle the complexities of EaaS, including the necessary digital infrastructure, recurring billing management, and customer education?

- Competitive landscape: Which of our competitors offers EaaS, and what can we learn from their successes or failures in this area?

More information and further reading

Are you interested in learning more about equipment as a service?

Equipment as a Service Market Report 2024–2028

Comprehensive 147-page analysis on OEMs’ transition to pay-per-use models. Includes market forecasts, vendor analyses, adoption drivers, case studies, key trends, and challenges.

Related publications

You may also be interested in the following reports:

- IoT Commercialization & Business Model Adoption Report 2024

- Industrial IoT & Industry 4.0 Case Study Report 2023

- Predictive Maintenance & Asset Performance Market Report 2023–2028

- IoT Gateway Market Report 2023–2027

Related articles

You may also be interested in the following articles:

- How to create a successful IoT business model—Insights from successful OEMs

- Industry 4.0 check-in: 5 learnings from ongoing digital transformation initiatives

- The rise of B2B software marketplaces: A shifting paradigm for enterprise procurement

- The vital role of industrial IoT gateways in bridging IT and OT

Related dashboard and trackers

You may also be interested in the following dashboards and trackers:

- Global IoT Enterprise Spending Dashboard

- Global Cellular IoT Module and Chipset Market Tracker & Forecast

- Global Cellular IoT Connectivity Tracker & Forecast

- Global Cellular IoT eSIM Module & iSIM Chipset Tracker

Subscribe to our newsletter and follow us on LinkedIn and Twitter to stay up-to-date on the latest trends shaping the IoT markets. For complete enterprise IoT coverage with access to all of IoT Analytics’ paid content & reports including dedicated analyst time check out Enterprise subscription.